Stock Picks Recap for 9/19/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, APOL triggered short (with market support) and didn't work (worst day for that great setup to trigger is triple expiration):

SGMO triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TQQQ triggered short (ETF, so no market support needed) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 9/19/14

Wasn't expecting much for triple expiration, but we did get a gap up, which should lead to some sort of call for filling the gap, and we got it (we even got a separate Value Area Play on the ES that set up perfect). See the ES section below.

Net ticks: +2 ticks.

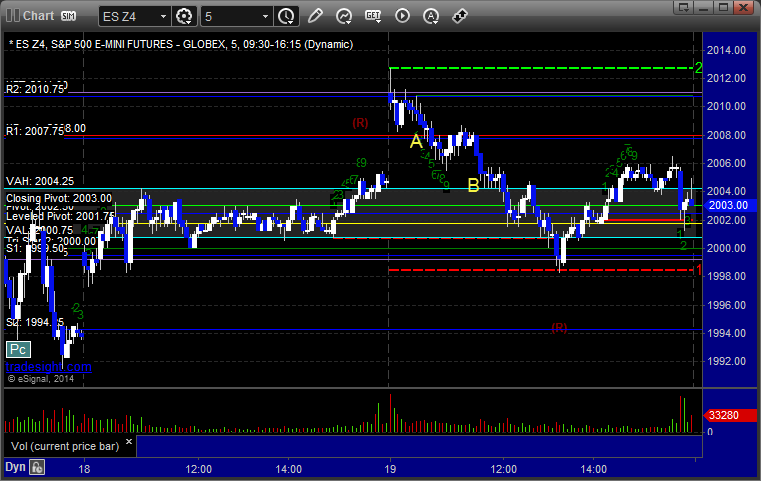

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 2007.50, hit first target for 6 ticks, and stopped the second half at 2008.00 unfortunately before it worked much further. Note the Value Area play at B that set up and worked great too:

Forex Calls Recap for 9/19/14

Nice winner to end the week in the EURUSD. The GBPUSD action ended up less exciting than expected. The financial markets really were factoring in a No vote out of Scotland.

See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered short at A, hit first target at B, closed second half for 55 pips at C for end of week:

Stock Picks Recap for 9/18/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AKAM triggered long (with market support) and worked great:

PMCS triggered long (without market support due to opening 5 minutes (although it gave you plenty more time to take it)) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's NUS triggered long (without market support due to opening 5 minutes) and worked:

His TBT triggered long (ETF, so no market support needed) and worked enough for a partial:

His FDX triggered short (technically with market support on the one spike of the day where the market direction went red for a second) and eventually worked enough for a partial:

TWTR triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 9/18/14

Not a very exciting session as the market is now in triple expiration mode completely. Barely moved at all after gapping up. We had a nice ES Value Area setup that failed and then set the trigger later but didn't trigger again. See that section below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1998.00 and stopped. Set the trigger again at B but didn't trigger. Mark's call triggered long at C at 2004.50 in the afternoon, but the market was already dead and we closed it at the entry:

Forex Calls Recap for 9/18/14

Well, it has been a while since we got some decent movement in a pair and would have had a nice winner, but it barely stopped out on us first before working. Still, improved range is a good sign for the future. See GBPUSD below.

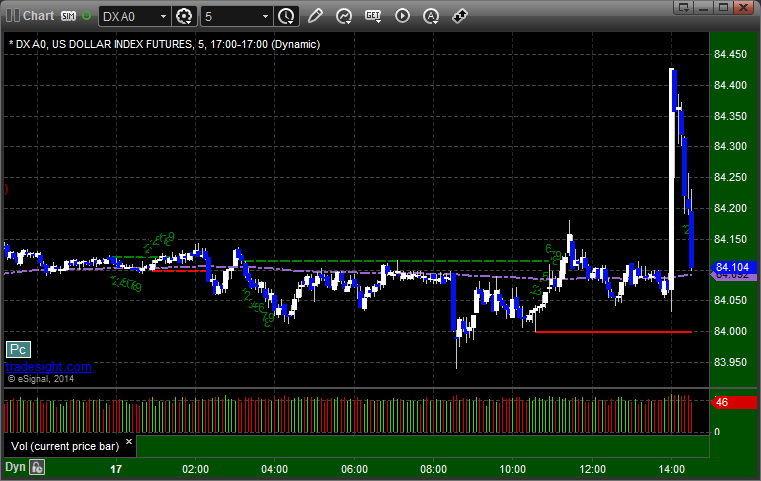

Here's a look at the US Dollar Index intraday with our market directional lines:

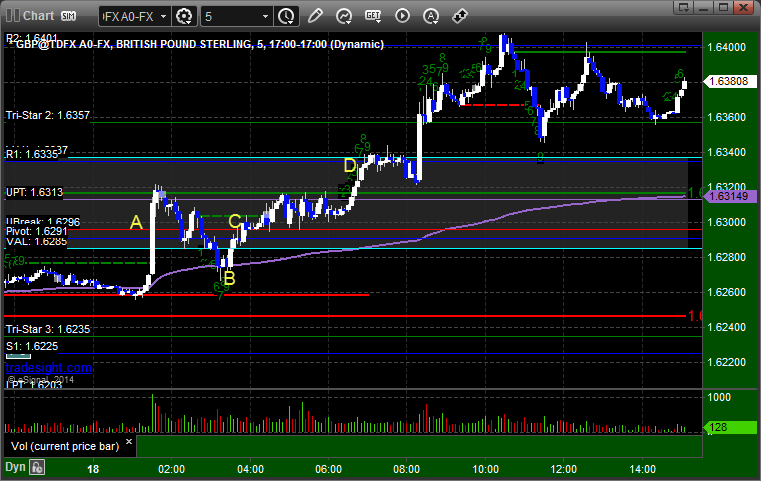

GBPUSD:

Triggered long at A and just barely stopped at B before proceeding to go again through C (if you were awake) and hit first target at D:

Stock Picks Recap for 9/17/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AKAM triggered long (with market support, right at the high) and didn't work:

MLNX triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TWTR triggered long (with market support) and worked enough for a partial:

GOOG triggered long (without market support) and worked:

Rich's LOW triggered long (with market support) and worked:

His CMG triggered short (with market support) and worked:

PCLN triggered long (with market support) and worked enough for a partial:

Mark's AAL triggered short (with market support) and worked:

Rich's afternoon PCLN triggered long (with market support) and worked:

His NUS triggered long (with market support) and worked:

FEYE triggered long (with market support) and worked:

In total, that's 10 trades triggering with market support, and 9 of them worked, 1 did not. Great day.

Futures Calls Recap for 9/17/14

A stop out and then a winner to the first target on a trigger on a spike after the Fed announcement. See the ES section below. Overall, it was a slower session as expected waiting for the Fed. Should have a chance at some action tomorrow, and then Friday should be slow for expiration.

Net ticks: -4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1996.50 and stopped. It triggered again after the Fed, hit first target for 6 ticks, and stopped second half under the entry:

Forex Calls Recap for 9/17/14

A clean winner on the GBPUSD and then we stopped out of the second half in the money ahead of the Fed announcement, which caused the usual wild swing. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

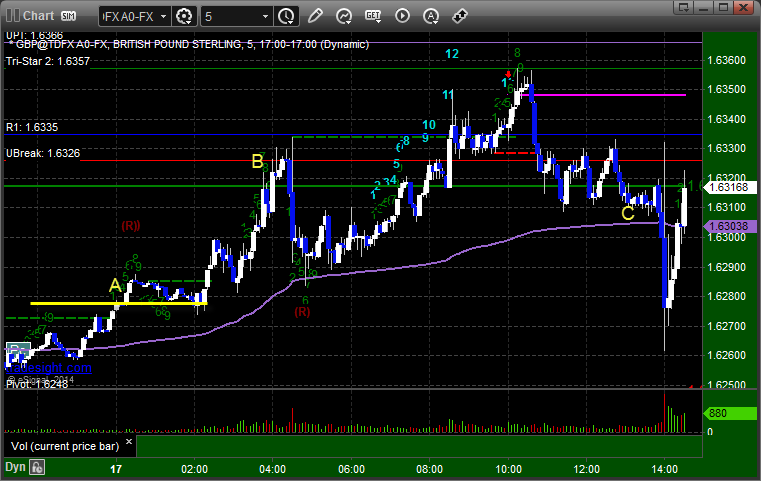

GBPUSD:

Triggered long at A, hit first target at B, stopped second half at C ahead of the Fed announcement:

Stock Picks Recap for 9/16/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SOHU gapped past the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's PCLN triggered (without market support due to opening 5 minutes) and worked:

His PXD triggered long (with market support) and worked:

TWTR triggered long (with market support) and worked enough for a partial:

In total, that's 2 trades triggering with market support, both of them worked.