Futures Calls Recap for 9/16/14

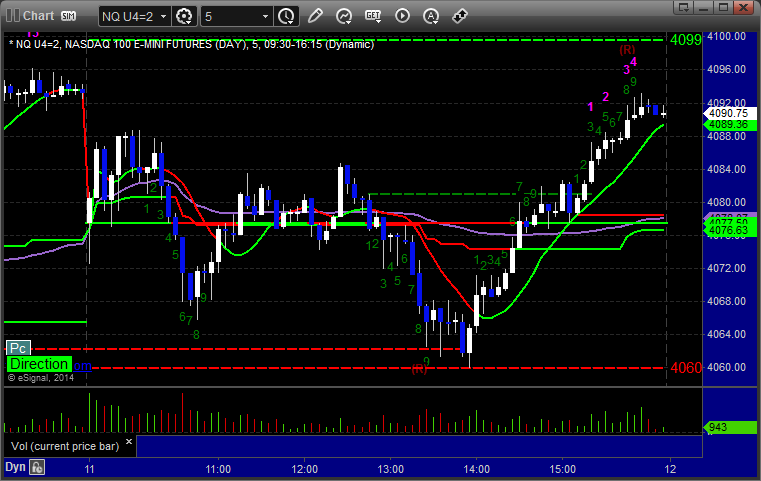

A perfect Value Area play on the NQ worked great. The call didn't make it to the Twitter feed/Messenger in time, but it worked and we called it in the room as it was going. See that section below.

Net ticks: +0 ticks (because the official call wasn't posted).

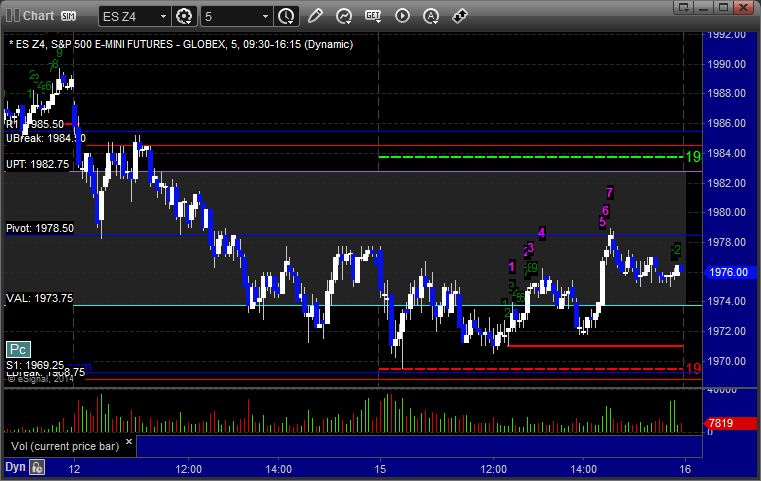

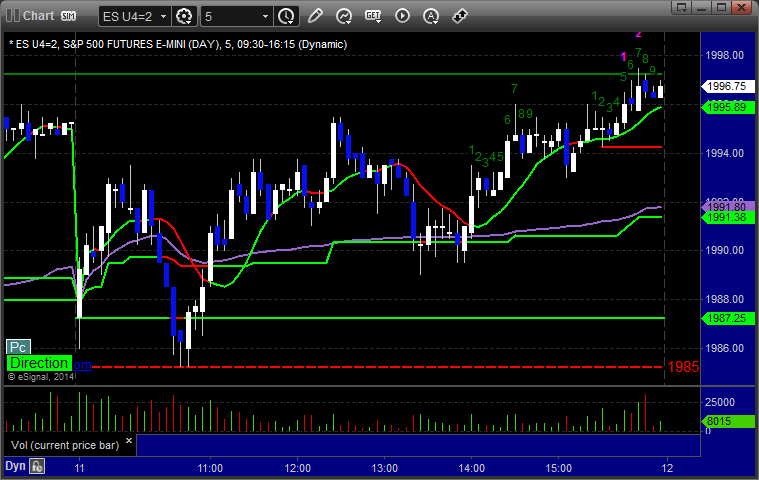

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Note the clean Value Area move from A to B for 30 ticks:

Forex Calls Recap for 9/16/14

Two triggers, one loser and one flat trade. See EURUSD section below. Fed announcement tomorrow.

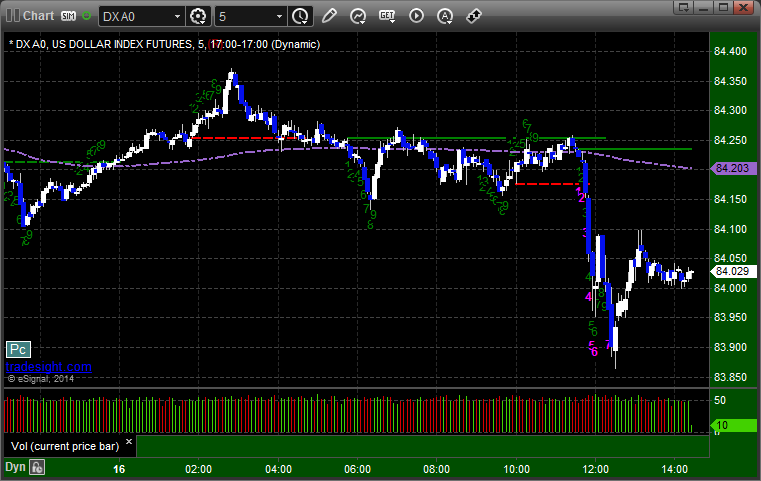

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped. Triggered long at B, just missed first target at C, closed at D:

Stock Picks Recap for 9/15/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered short (with market support) and worked great:

Rich's TQQQ triggered short (ETF, so no market support needed) and worked great:

GS triggered long (with market support) and worked:

Rich's AMZN triggered short (with market support) and worked enough for a partial:

His APA triggered long (without market support) and worked a little:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 9/15/14

None of our calls triggered as the ES opened flat and headed lower but covered 90% of the range of the day in the first 20 minutes. Volume looked good early and closed at 1.8 billion shares. The NASDAQ side was much weaker.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 9/15/14

A winner to start the week using the EURUSD "magic" number of 1.2939 as the trigger. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, stopped second half over entry at C:

Stock Picks Recap for 9/12/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's LNKD triggered short (with market support) and didn't work:

GS triggered long (without market support) and worked:

Mark's JPM triggered long (with market support) and didn't work:

Rich's AMGN triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, none of them worked. Typical non-technical action on a quarterly futures contract roll session with light volume.

Futures Calls Recap for 9/12/14

We were waiting on a nice setup over the Pivot on the ES to trigger into the gap for the fill, but it never did, which isn't completely surprising on a Friday of quarterly contract roll. NASDAQ volume closed at 1.5 billion shares. Next week is triple expiration.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 9/12/14

No triggers for the end of the week and a dull session. But, if things aren't moving, I'd rather have nothing trigger anyway, as it obviously would have stopped out. This is not unexpected for futures contract quarterly roll, which is now out of the way. We head into triple expiration next week.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Stock Picks Recap for 9/11/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ISIL and DYAX were triggering right at the close.

ANAC triggered long (with market support) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's GS triggered long (with market support) and technically worked (never went enough against for a stop) but you would have had to have a lot of patience:

His FEYE triggered long (with market support) and worked:

His GPRO triggered short (without market support) and worked:

His QIHU triggered short (with market support) and worked:

His MDVN triggered short (without market support) and worked:

His PXD triggered long (with market support) and worked:

His SCOK triggered long (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, all 6 of them worked.

Futures Calls Recap for 9/11/14

We are in the process of rolling our futures contracts to the December (Z4) today, which usually means that tomorrow (first full day on the contract) will see lighter volume and more drifting (plus it is a Friday anyway). Today, we had one winner just to a first target using the LPT on the ES. Markets gapped down and eventually filled, and the ES (see chart below with Levels) was essentially inside the Value Area exactly all session.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1988.25, hit first target for 6 ticks, stopped second half over the entry: