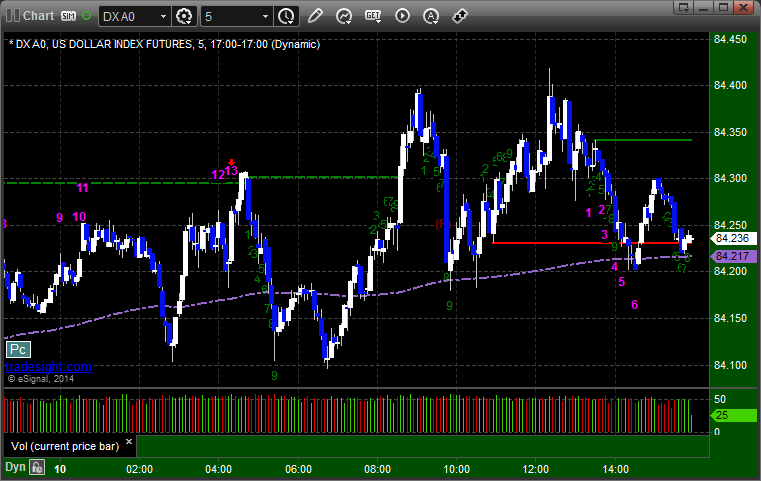

Forex Calls Recap for 9/11/14

No triggers for the session as we went back to narrow ranges on the pairs and the EURUSD never got to our long trigger.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 9/10/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PCAR triggered short (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and worked:

His GLD triggered long (ETF, so no market support needed) and worked enough for a partial:

His VXX triggered long (ETF, so no market support needed) and worked:

His FEYE triggered long (with market support) and worked:

His CAT triggered short (with market support) and didn't work:

GILD triggered long (just barely without market support) and worked:

Rich's PCLN triggered long (with market support) and worked:

His TSO triggered short (without market support) and didn't work:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

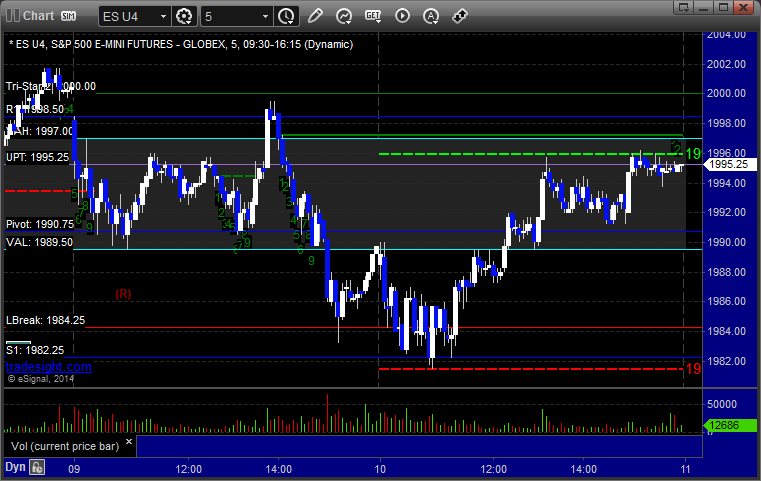

Futures Calls Recap for 9/10/14

Small winner in the ES on a session that wasn't very exciting. NASDAQ volume was 1.67 billion shares.

Net ticks: +2.5 ticks.

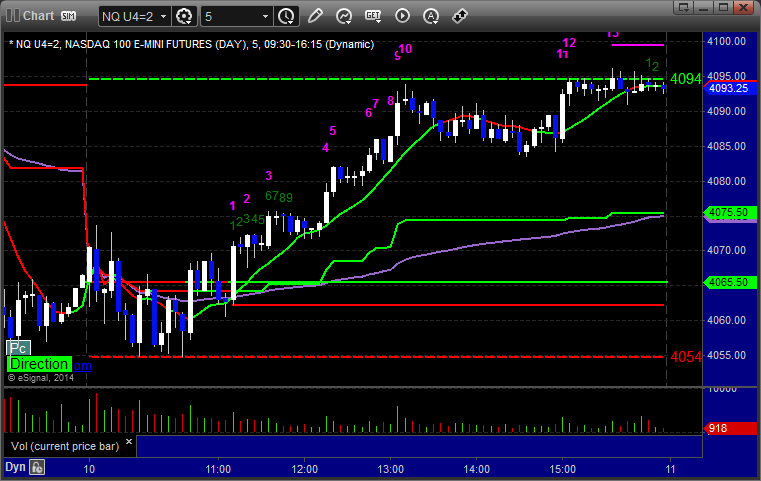

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1984.00, hit first target for 6 ticks, stopped second half over entry. Bounced fast, so you have to adjust the stop as soon as the first target hits:

Forex Calls Recap for 9/10/14

Not much for the triggers despite four calls. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, did nothing, closed at B:

Trading AAPL on the Apple Watch News Announcement

This video will show you how Tradesight used our technical tools like Unlock iPhone 6 to trade the announcement of the new Apple Phone profitably:

https://www.youtube.com/watch?v=_9pcMgQTJCM

Stock Picks Recap for 9/9/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PTCT triggered long (without market support due to opening 5 minutes) and only worked enough for a quick partial:

CREE triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered long (with market support) and didn't work:

His GS triggered short (with market support) and worked:

BIDU triggered short (with market support) and worked:

Rich's AMGN triggered short (with market support) and didn't work:

AMZN triggered short (with market support) and worked great:

Rich's AAPL triggered long (with market support) and worked:

His GMCR triggered short (with market support) and worked a little, never went against and ran out of time:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

Futures Calls Recap for 9/9/14

The first loser in a while and a small winner for the session. See ES and NQ sections below. NASDAQ volume closed at 1.8 billion shares. The markets gapped down and the ES never quite filled. The session was narrow, mostly watching the AAPL announcement, until late, and then sold off a bit.

Net ticks: -4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1991.75 and stopped:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at A at 4077.50, hit first target for 6 ticks, and stopped second half over the entry:

Forex Calls Recap for 9/9/14

A partial loser, a new tiny winner (they washed), and we locked in the gains from yesterday's short. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Came into the session still short the second half of the prior day's play (and in the money). If you follow our order staggering rules, 2 out of 3 pieces of the EURUSD short triggered at A and stopped. The long triggered at B (and stopped us out of the second half of the prior day's trade), and didn't go far, so I closed at C:

Stock Picks Recap for 9/8/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, KLIC triggered long (with market support) and came within a penny of a partial, should have closed it when futures rolled, but without a note in the Twitter feed, we will count it as a loser:

From the Messenger/Tradesight_st Twitter Feed, TSLA triggered long (with market support) and worked:

Rich's PCLN triggered short (without market support) and worked enough for a partial:

His REGN triggered short (without market support) and didn't work:

His TWTR triggered long (with market support) and didn't work over lunch:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not. Always interesting to get that math on a day that I was actually green.

Futures Calls Recap for 9/8/14

Couple of calls and nothing triggered, which is probably for the best. There was a short over lunch on the ES that would have worked. The markets gapped down, filled the gaps, and then drifted lower over lunch before rebounding to...you guessed it...the VWAP. NASDAQ volume was 1.5 billion shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES: