Forex Calls Recap for 9/8/14

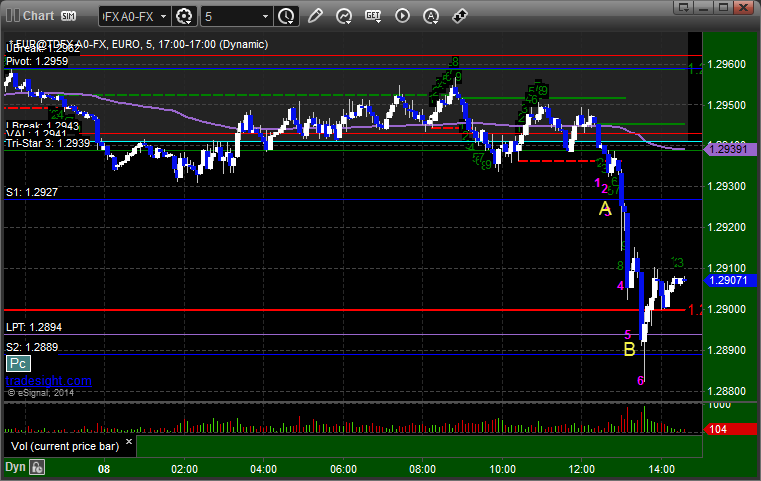

A late trigger on the EURUSD worked and we're still holding the second half.

See that section below.

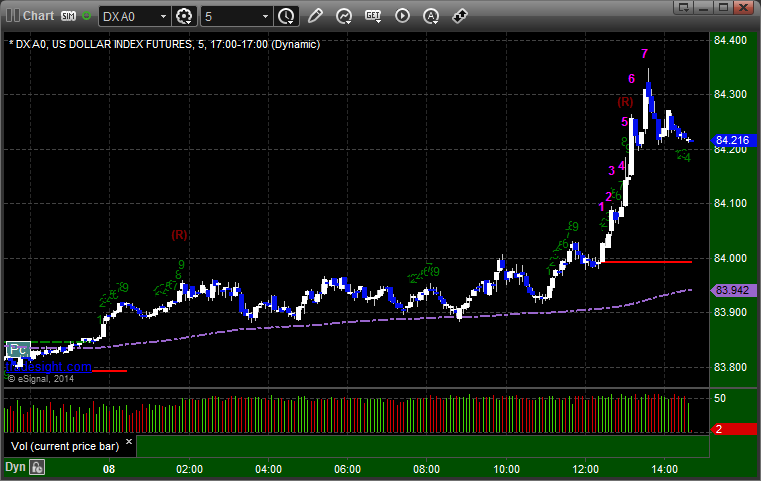

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over S1:

Stock Picks Recap for 9/5/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ALTR triggered long (without market support due to opening 5 minutes) and didn't work. It also triggered later in the day cleaner and worked a little:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (without market support due to opening 5 minutes) and didn't work:

His GOOG triggered long (with market support) and didn't work:

His TSLA triggered short (without market support due to opening 5 minutes) and worked great:

Several other calls, but nothing else triggered.

In total, that's 1 trade triggering with market support, it didn't work (we kept it to a small loss in the Lab when the futures tanked).

Futures Calls Recap for 9/5/14

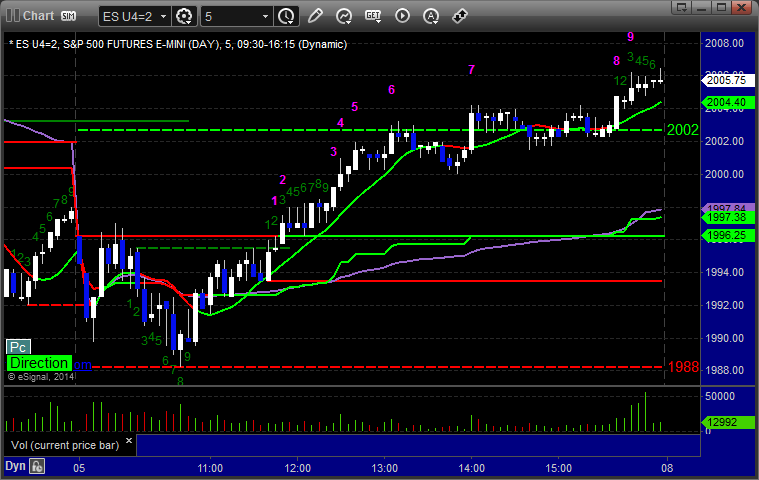

Some bumbling around early in the markets, but eventually, the ES broke into the Value Area and we had a winner. NASDAQ volume was the lightest of the week, but that's not a problem on Friday. Volume closed at 1.4 billion shares.

Net ticks: +13 ticks.

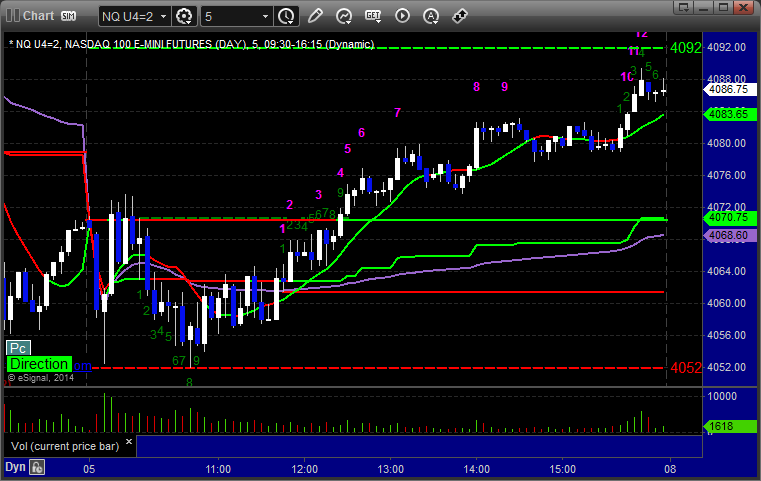

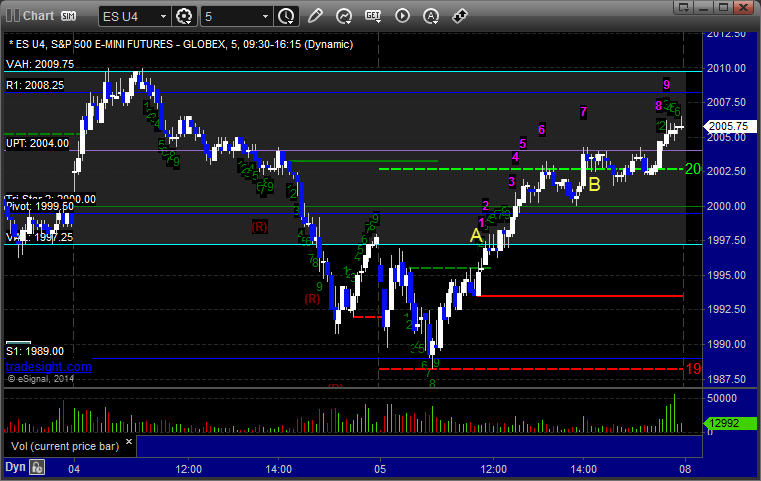

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1997.50, hit first target for 6 ticks, raised the stop and then just closed the final piece at 2002.50 at B:

Forex Calls Recap for 9/5/14

No triggers for the last day of the week as the pairs went back to narrow ranges.

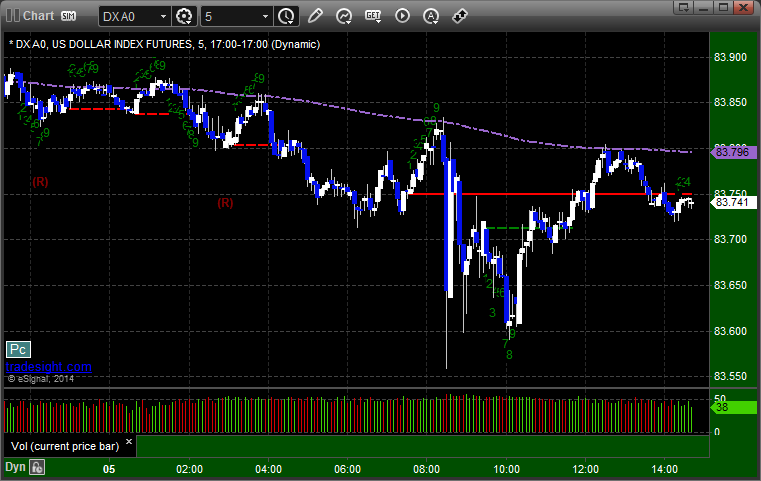

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Stock Picks Recap for 9/4/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FOXA triggered long (with market support) and did nothing for quite a while, I closed it slightly in the money in the Twitter feed/Messenger, which ended up being a good thing:

FSLR triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (with market support) and worked:

His PCLN triggered short (without market support) and worked great for over 20 points:

His ISNS triggered short (with market support) and worked:

GOOG triggered long (with market support) and worked:

Rich's VXX triggered short (ETF, so no market support needed) and didn't work, but gave you hours to close it out:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 9/4/14

A nice winner on the ES that triggered in the afternoon and ran well. See that section below. The markets gapped up, headed higher, and then rolled in the afternoon to fill the gaps on 1.6 billion NASDAQ shares.

Net ticks: +10.5 ticks.

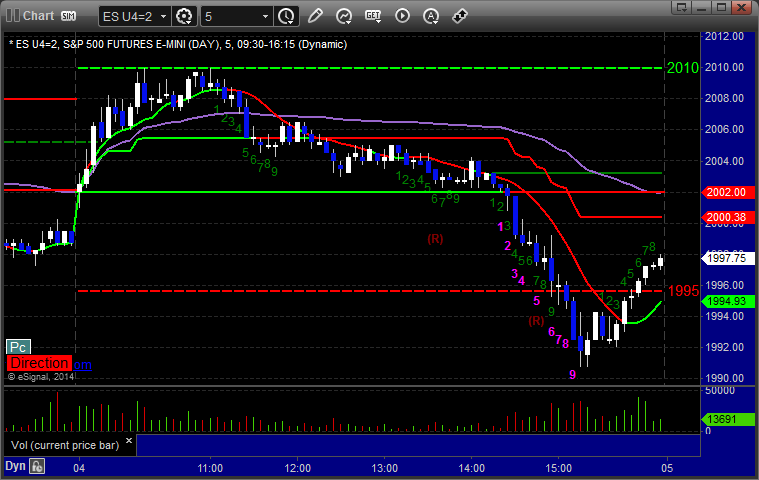

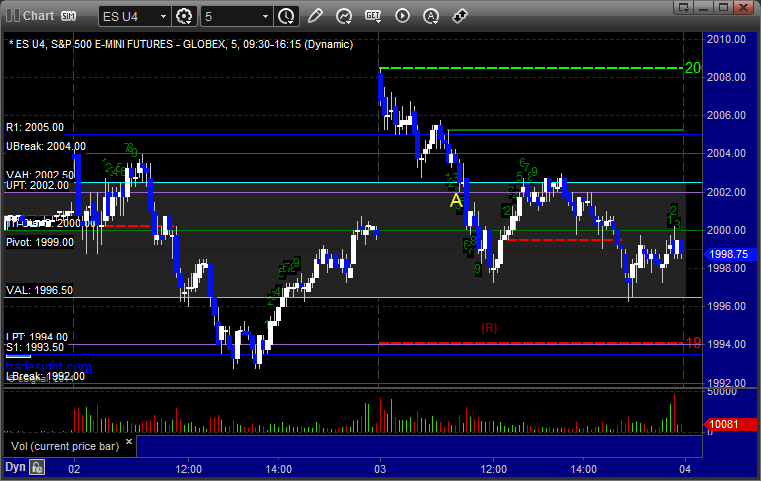

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 2001.00, hit first target for 6 ticks at the gap fill, and lowered stop twice and stopped just over VAL at 1998.25:

Forex Calls Recap for 9/4/14

Well, a winner that just missed being a huge winner when we stopped out on our lowered stop right before it dropped another 80 pips. Still, it's good to see ranges in Forex now that summer is behind us. See the GBPUSD section below.

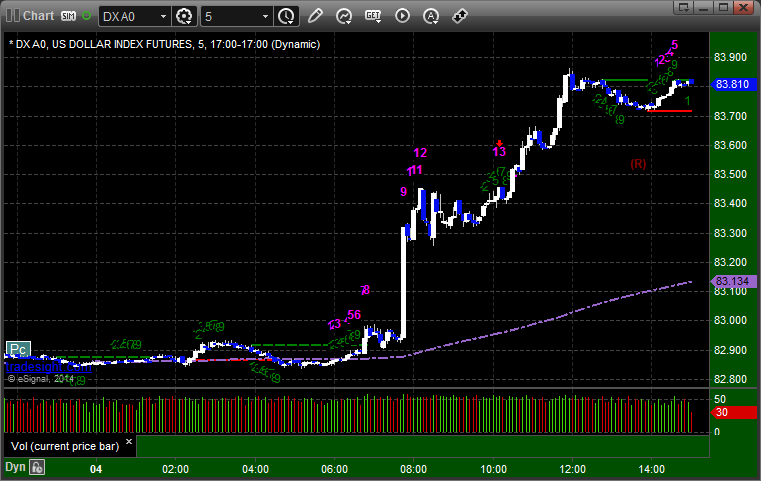

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, and barely stopped at C before making the big move:

Stock Picks Recap for 9/3/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SMCI triggered long (without market support due to opening 5 minutes) and didn't work:

IACI gapped over, no play.

WPRT triggered short (with market support) and worked a little, never really did much:

From the Messenger/Tradesight_st Twitter Feed, Rich's GS triggered long (without market support) and worked enough for a partial (market direction was exactly in the middle at the time):

His LULU triggered short (with market support) and worked:

SINA triggered short (with market support) and ultimately worked but took too long for me, I closed it even:

Rich's ATHM triggered long (without market support) and worked enough for a partial:

His LOW triggered long (without market support) and never went enough either way to count:

His PCLN triggered short (with market support) and worked:

In total, that's 3 trades triggering with market support, all 3 of them worked, although WPRT was a waste of time, and I took the GS where market direction was trying to go green at the time for a gain.

Futures Calls Recap for 9/3/14

A clean entry on the ES using the Value Area and the Pressure Threshold line worked. The markets gapped up and headed lower, closing on 1.73 billion NASDAQ shares. Ranges are definitely improving.

Net ticks: +6 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 2001.75, hit first target for 6 ticks, lowered stop twice and also stopped 6 ticks in the money:

Forex Calls Recap for 9/3/14

A loser and a small winner on the retrigger on the GBPUSD. See that section below. Not much for ranges again.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Triggered short again at B, never went far, closed at C for end of session: