Stock Picks Recap for 9/2/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TTWO triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, LNKD triggered long (with market support) and I closed it for a gain in the Twitter feed when the futures plunged to lows:

Rich's WLP triggered short (with market support) and didn't work:

His WYNN triggered short (with market support) and worked great:

His BIDU triggered long (without market support) and worked:

His REGN triggered short (with market support) and worked:

His EMES triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not. And we're back to work.

Futures Calls Recap for 9/2/14

A small winner to start the month in the NQ. See that section below. Volume was much improved in the markets, which traded 1.8 billion shares, up big from the last two weeks of summer nonsense. The markets gapped up, filled, went lower with two or three sell programs (the first in more than two weeks) and recovered to the VWAP late.

Net ticks: +2.5 ticks.

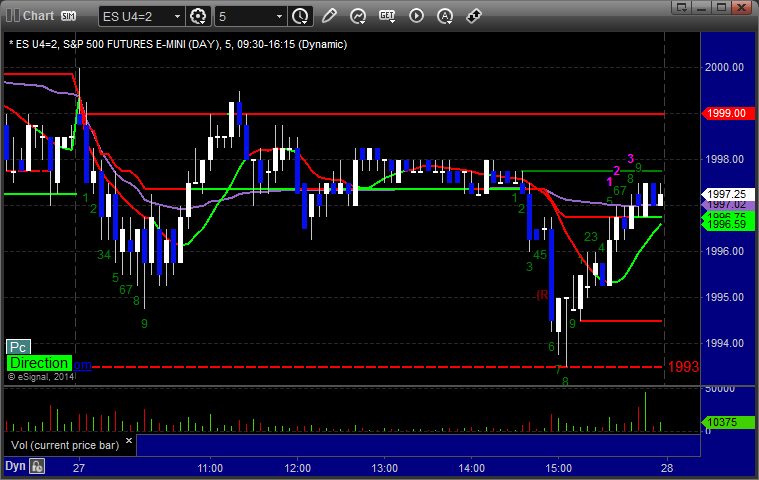

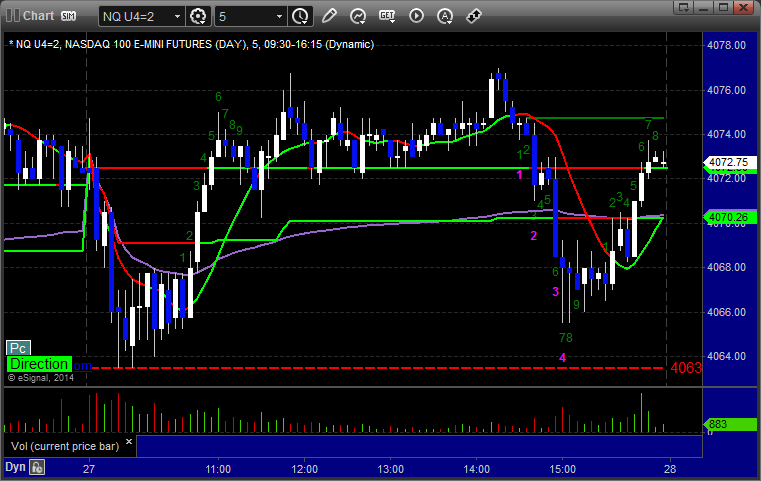

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 4083.00, hit first target for 6 ticks, and stopped second half over the entry:

Forex Calls Recap for 9/2/14

Well, the EURUSD stuck in a 25 pip range overnight, so neither of our calls triggered. Meanwhile, the same calls on the GBPUSD would have worked great. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

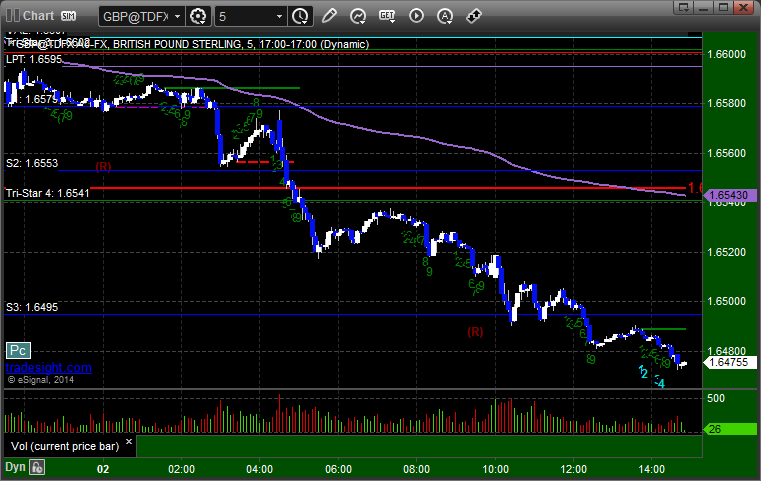

GBPUSD:

The short under S2 would have triggered here and still be working and 70 pips in the money:

Stock Picks Recap for 8/29/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ANAC triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, EBAY triggered short (with market support) but then I posted to close it at the entry when it didn't move at all for 20 minutes:

In total, that's 1 trades triggering with market support, and it worked (a little).

Futures Calls Recap for 8/29/14

NASDAQ volume barely passed 1 billion shares in the last few minutes of the day, as expected. No official calls. Back to work Tuesday.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 8/29/14

A small winner that didn't trigger until the US session to close out the week (and the month of August).

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

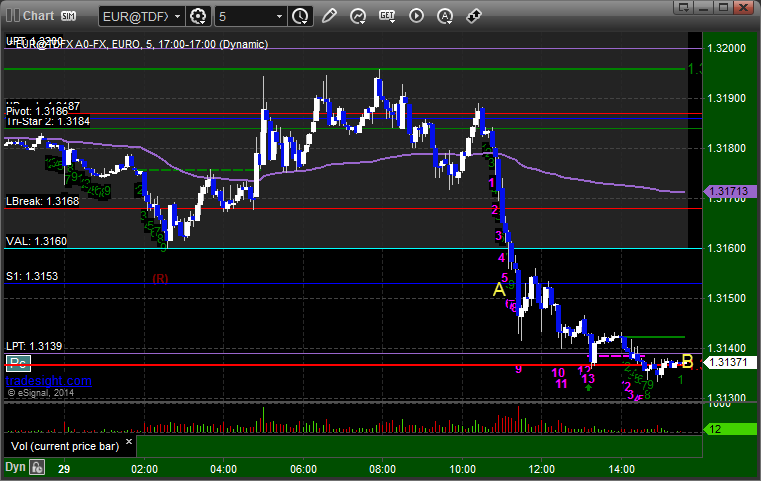

EURUSD:

Triggered short at A, never hit stop or first target, closed at B for 15 pips:

Stock Picks Recap for 8/27/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CHKP gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered short (with market support) and worked:

SINA triggered short (without market support) and worked:

In total, that's 1 trade triggering with market support, and it worked.

Futures Calls Recap for 8/27/14

No calls for the session as things were

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 8/27/14

No calls because the ranges have been so terrible that all of the Levels were too bunched together, and it turned out to be a good thing because nothing happened. All of the markets are dead right now, and we might just be stuck until after Labor Day this week when summer ends. Pretty common.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 8/26/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, KERX triggered long (with market support) and worked:

PDLI gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, NTAP triggered long (with market support) over lunch and didn't work:

Rich's GOOG triggered short (with market support) and worked enough for a partial:

His QIHU triggered short (without market support) and worked enough for a partial:

His V triggered long (with market support) and worked enough for a partial:

His VXX triggered long (ETF, so no market support needed) and didn't do enough either way to count, closed right at the trigger:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.