Futures Calls Recap for 8/26/14

Neither trade call triggered as the markets gapped up, drifted higher, but never covered half of average daily range on 1.27 billion NASDAQ shares. See charts below. Not good for the rest of the week.

Net ticks: +0 ticks.

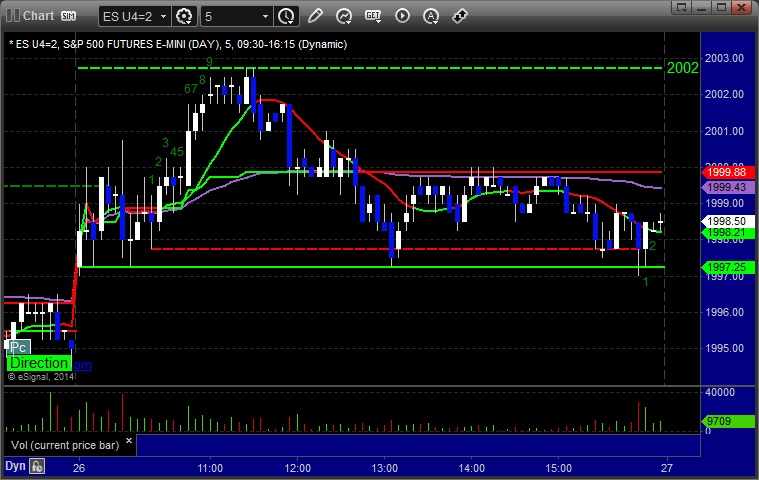

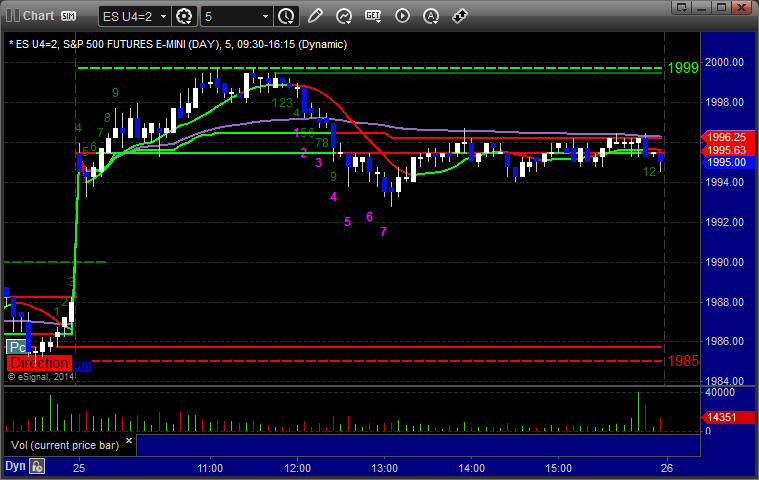

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

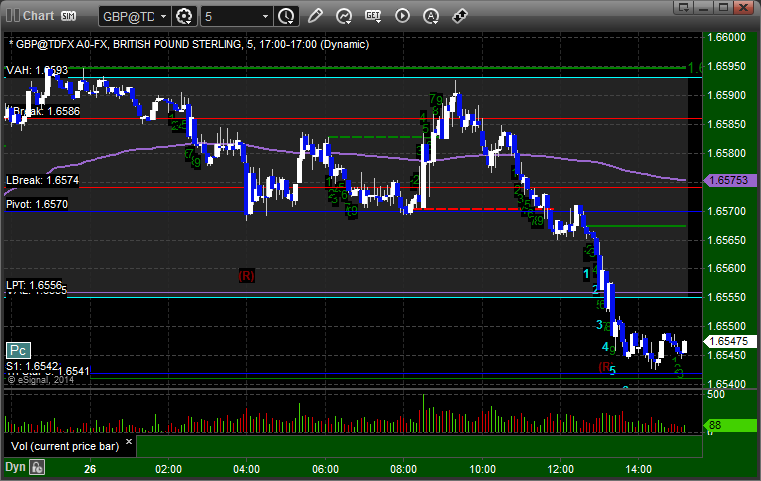

Forex Calls Recap for 8/26/14

Ranges were so bad again (50 pips on the GBPUSD, 45 on the EURUSD) that nothing triggered at all today.

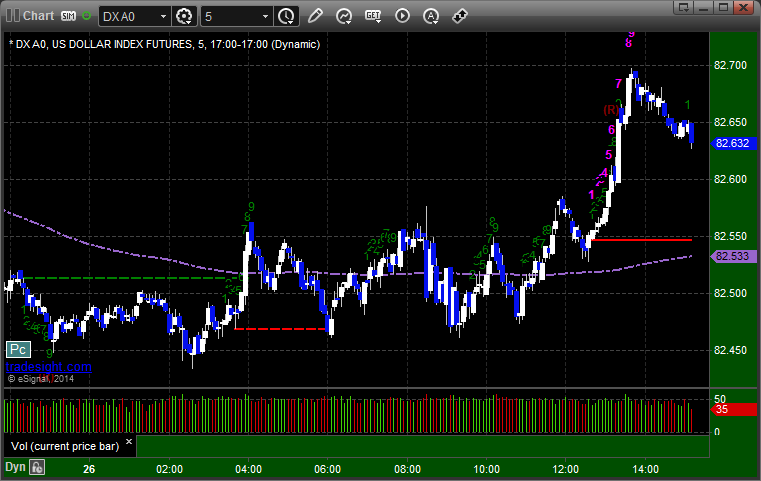

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stock Picks Recap for 8/25/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AMSG gapped over, no play.

INFN triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's QIHU triggered short (with market support) and worked:

His INTU triggered short (without market support) and worked:

His SINA triggered short (without market support) and didn't work:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 8/25/14

Monday and Tuesday will basically tell you whether Wednesday and Thursday have a chance to be interesting this week (Friday won't be either way), and Monday so far says that things won't be. Volume was light early but didn't come back at all in the afternoon and closed at 1.28 billion NASDAQ shares. The ES was glued to the VWAP/midpoint area the whole session. Mark had one call that stopped that he did not re-enter. Trading is very dangerous this week as we wrap up summer. See ES section below.

Net ticks: -7 ticks.

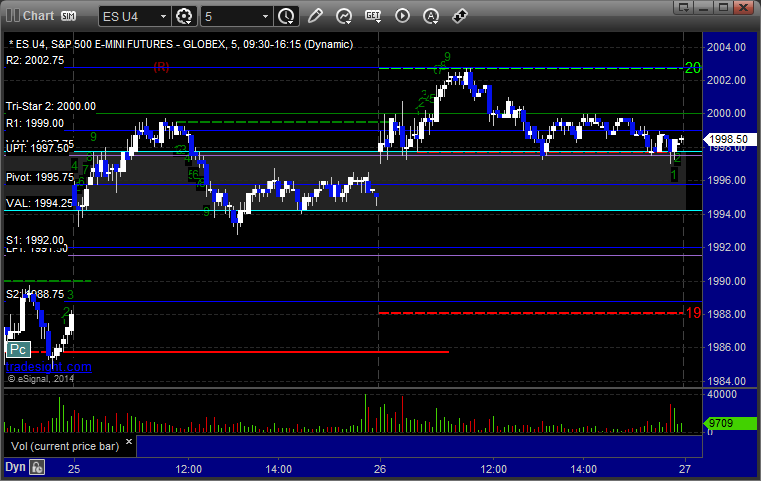

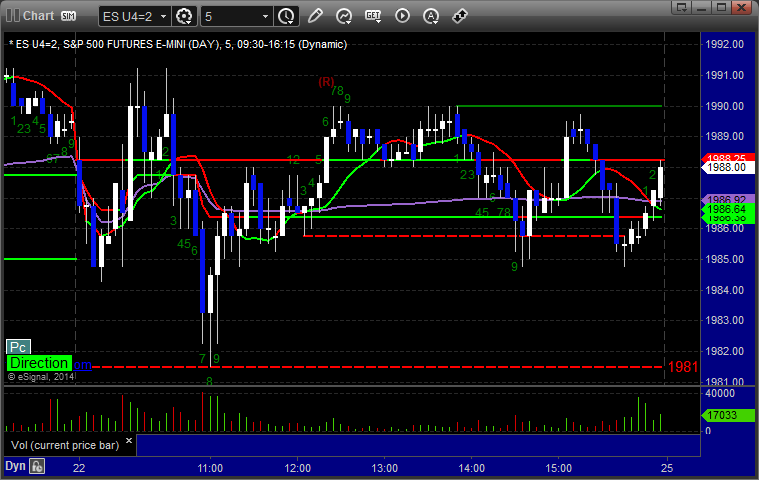

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1997.00 and stopped:

Forex Calls Recap for 8/25/14

Wow, a gap in the EURUSD to start the week, and then it stuck in a 35-pip range and couldn't even fill the gap. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

After the gap down, I made new calls. The long triggered at A and stopped:

Stock Picks Recap for 8/22/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered short (with market support) and didn't work, triggered again later and worked, but there was no point in any of this:

TSLA triggered short (with market support) and didn't work:

In total, that's 2 trades triggering with market support, neither of them worked, as expected.

Futures Calls Recap for 8/22/14

No official calls for the day as the NASDAQ traded 1.2 billion shares, the lowest volume day of the year as expected. Mark did point out the ES short under LBreak in the Lab, and that would have worked just enough for our 6 ticks, but no official calls.

Net ticks: +0 ticks.

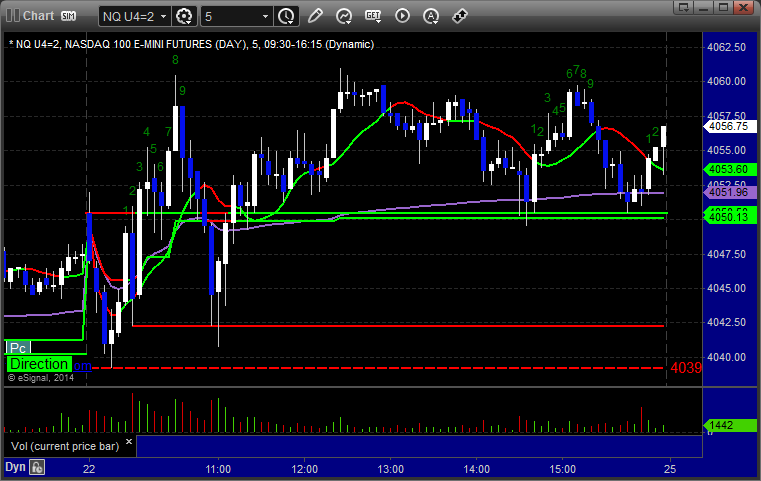

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 8/22/14

A winner and a loser to wrap the narrow week. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Have a look at the EURUSD in particular.

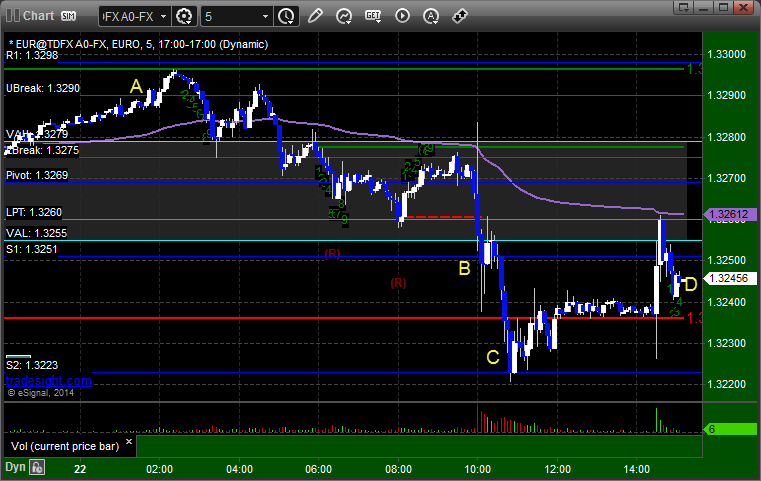

EURUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, closed second half at D:

Stock Picks Recap for 8/21/14

A fairly flat opening in the markets. The ES reached down and the low of the day was Wednesday's close to the tick (gap fill), and then we drifted higher in an 8-point total range on 1.3 billion NASDAQ shares, the lightest trading session of the year.

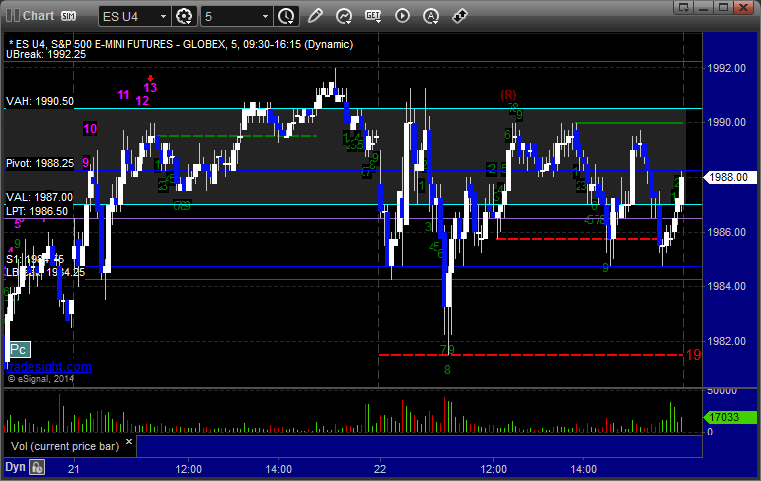

ES with Tradesight Levels:

NQ with Tradesight Levels:

Results:

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered, which is great when the market is this dead. Our top pick, PDLI, did come up to the trigger exactly.

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered long (with market support) and didn't work:

Futures Calls Recap for 8/21/14

Another light day as expected, although volume dropped off even more here, closing at barely 1.3 billion NASDAQ shares. Doesn't bode well for Friday. One small winner, see the ES section below.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1986.75, hit first target for 6 ticks, stopped second half under the entry: