Forex Calls Recap for 8/21/14

A new trade that was basically flat and we finally stopped the second half of the trade from two days ago 60 pips in the money. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

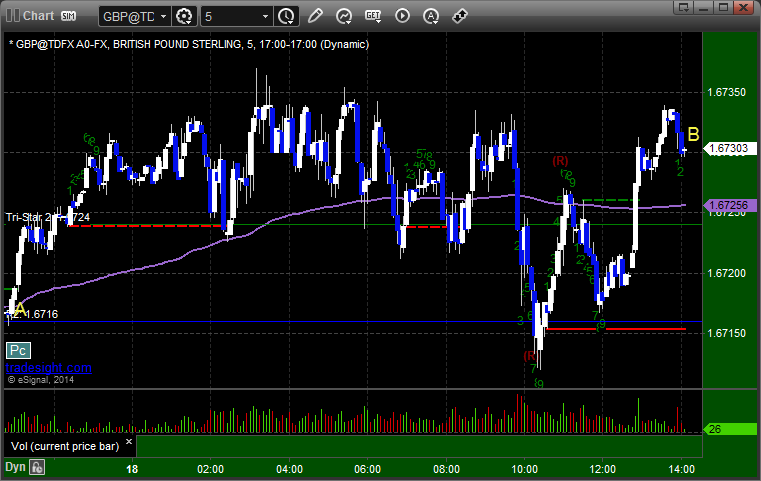

EURUSD:

Came into the session still short from 1.3340 from two days ago and put our stop over the Pivot. This was also our new long entry, so we closed and reversed at A, but it went nowhere and ended up closing at B even on the new trade:

Stock Picks Recap for 8/20/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AAPL triggered long (with market support) and didn't work, tried again later and did better:

From the Messenger/Tradesight_st Twitter Feed, no calls, which is pretty rare.

In total, that's 1 trades triggering with market support, and it didn't work.

Futures Calls Recap for 8/20/14

A small winner in another dead session which I ended up closing out to lock in the gain after the market was dead on no volume. See ES section below. NASDAQ volume closed at a "worst day yet" level of 1.38 billion shares.

Net ticks: +3 ticks.

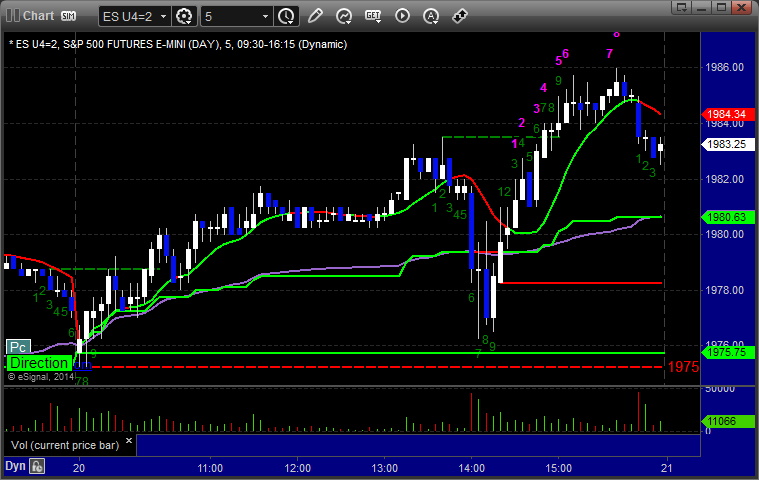

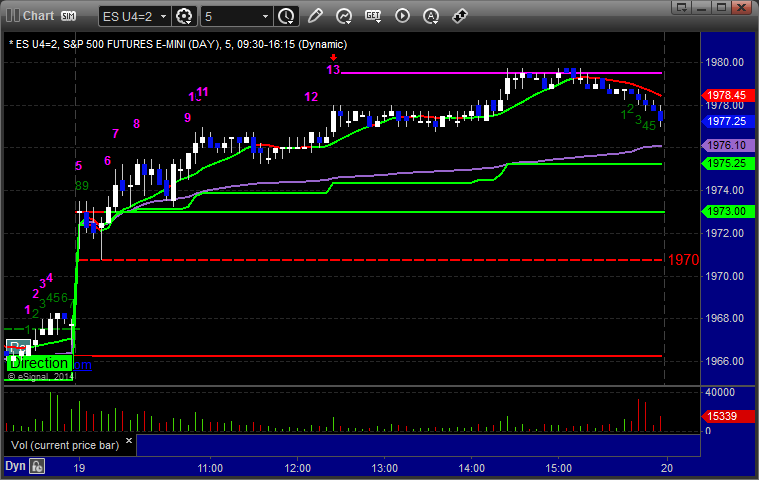

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1976.75. After 20 minutes of doing nothing, I closed the whole thing 3 ticks in the money:

Forex Calls Recap for 8/20/14

A new winner, a new loser, and our EURUSD short from the last session continues to work further. See EURUSD and GBPUSD sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

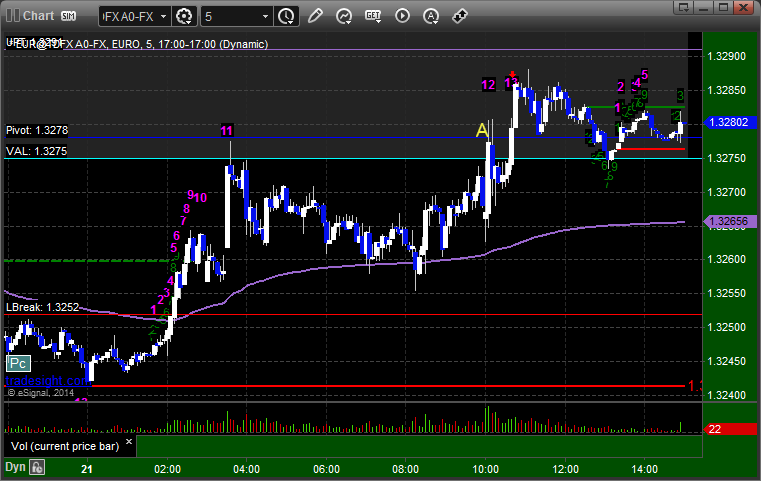

EURUSD:

We continue to hold the second half of our short in the EURUSD from the prior session, now well in the money with a stop over S2 (A):

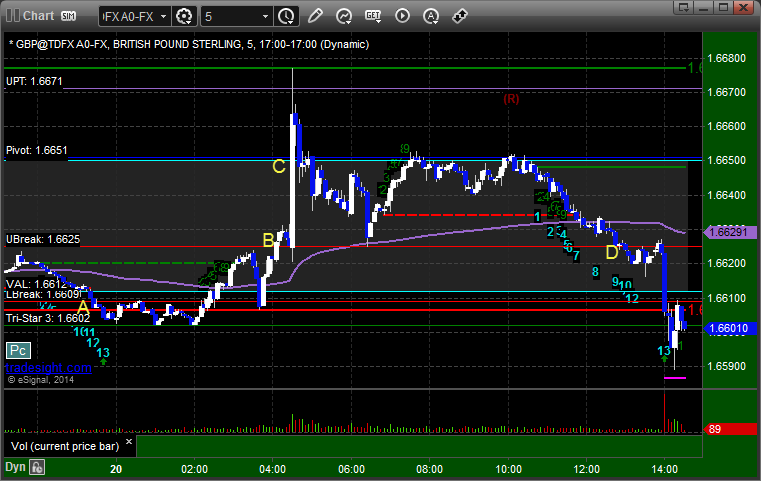

GBPUSD:

Triggered short at A, stopped. Triggered long at B, hit first target at C, and stopped the second half under the entry at D:

Stock Picks Recap for 8/19/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SWIR triggered long (without market support due to opening 5 minutes) and worked:

MOVE triggered long (without market support due to opening 5 minutes) and worked enough for a partial, but I didn't take this one, the offer was really above the trigger at the open:

From the Messenger/Tradesight_st Twitter Feed, GILD triggered short (with market support) and worked:

In total, that's 1 trades triggering with market support, and it worked, but it wasn't the one I stuck with (SWIR was).

Futures Calls Recap for 8/19/14

One winner in another horribly light volume session that gapped up and just drifted higher. See the ES section below.

Net ticks: +2.5 ticks.

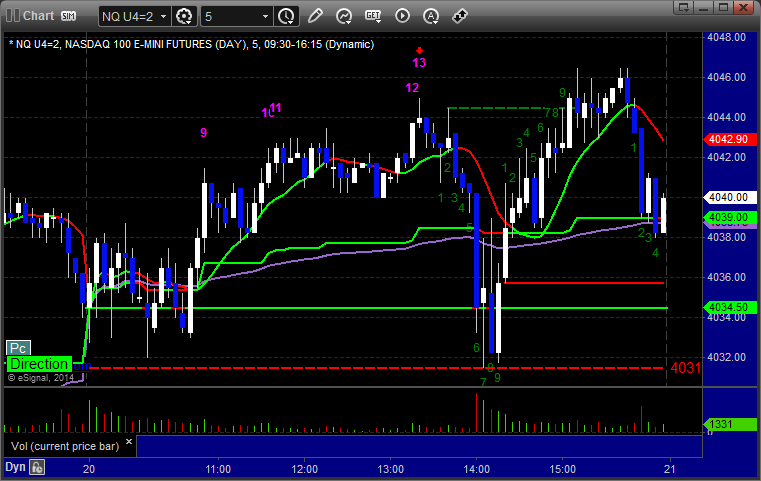

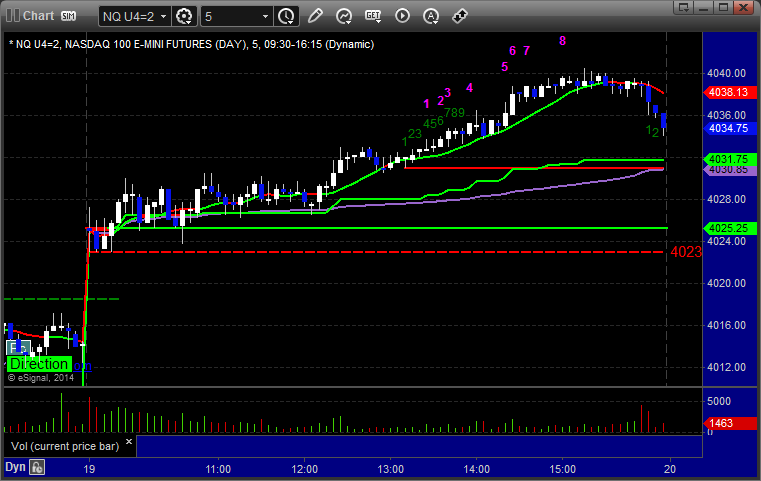

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1974.00, hit first target for 6 ticks, and stopped the second half under the entry:

Forex Calls Recap for 8/19/14

A winner for the session, and things finally did move a little bit. See the EURUSD section below.

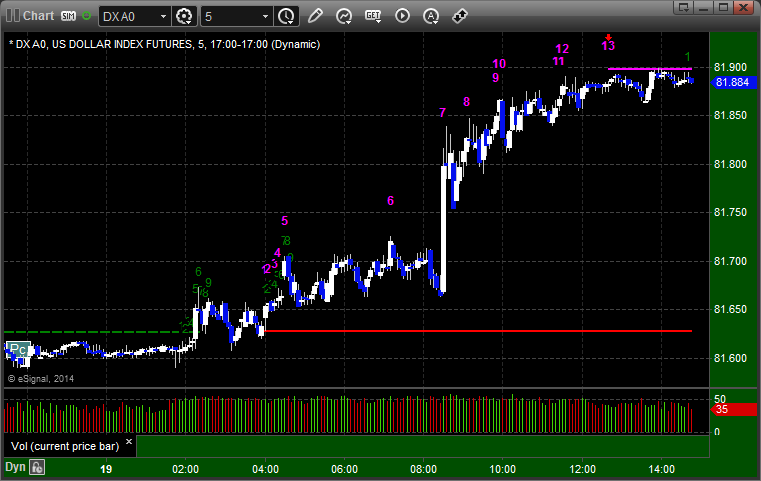

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over S2:

Stock Picks Recap for 8/18/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SNSS triggered long (I had special instructions in the report to take it even in the first 5 minutes, which is when it went) and worked:

PFPT triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered long (with market support) and worked:

LNKD triggered long (with market support) and didn't work, literally flat-lined for 90 minutes after:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

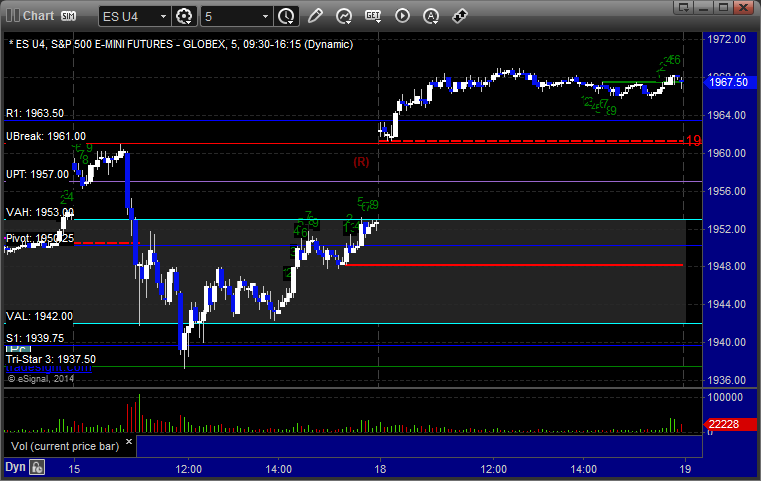

Futures Calls Recap for 8/18/14

This could end up being the slowest week of the year with people on summer vacation. The markets gapped up to start the week, and the ES broke through R1 and never touched another level. The last 5 hours of the day traded in a 3 point ES range. NASDAQ volume closed at 1.2 billion shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 8/18/14

Another fairly boring session with a small winner in the GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A (actually even before the chart starts) and never got to R3, closing out 15 pips in the money at B: