Stock Picks Recap for 8/15/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PNNT triggered long (without market support) and never went a nickel either way, so doesn't count:

From the Messenger/Tradesight_st Twitter Feed, nothing triggered.

In total, that's 0 trades triggering with market support, only on options expiration in August. That's despite having 9 calls.

Futures Calls Recap for 8/15/14

That's about right. The markets gapped up for expiration Friday and were doing about what you'd expect (nothing) for over an hour. It would have been a complete waste of a session as expected except then Ukraine attacked a Russian envoy and the market tanked hard, filling the gap and more, before recovering to the VWAP for the close on 1.6 billion NASDAQ shares.

Net ticks: -7 ticks.

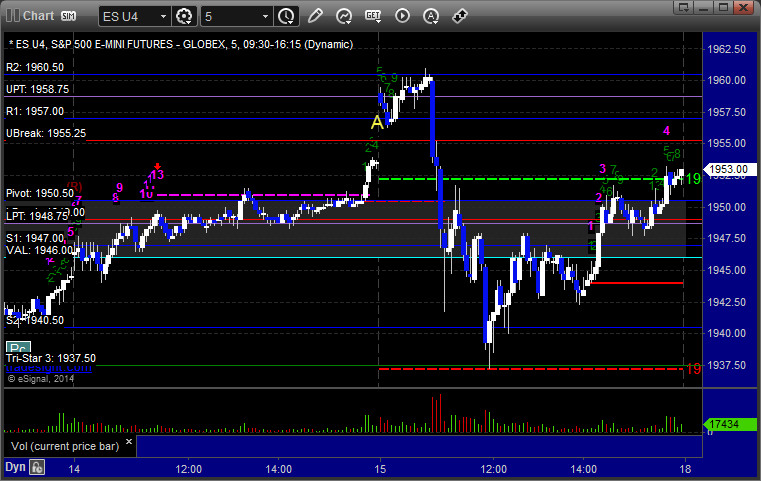

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1956.75 and stopped for 7 ticks. We did not put it back in because it was expiration Friday, but with the news out of Ukraine, the retrigger would have been a huge winner:

Forex Calls Recap for 8/15/14

That's a fitting end to the week for options expiration. Our EURUSD long triggered and did little for hours, and we were able to close it at the entry level for end of session. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered long at A, never hit first target or stop, closed at B:

Stock Picks Recap for 8/14/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SGEN triggered long (with market support) and worked enough for a partial, though I closed it out of boredom:

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered long (without market support due to opening 5 minutes) and worked:

TWTR triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked, but I made the most money on the other one (BIDU).

Futures Calls Recap for 8/14/14

Pretty much what we expected after options unraveling Wednesday, which was not much. Volume was light at 1.3 billion NASDAQ shares. The ES did set up a Value Area play, so we posted it. See that section below.

Net ticks: -7 ticks.

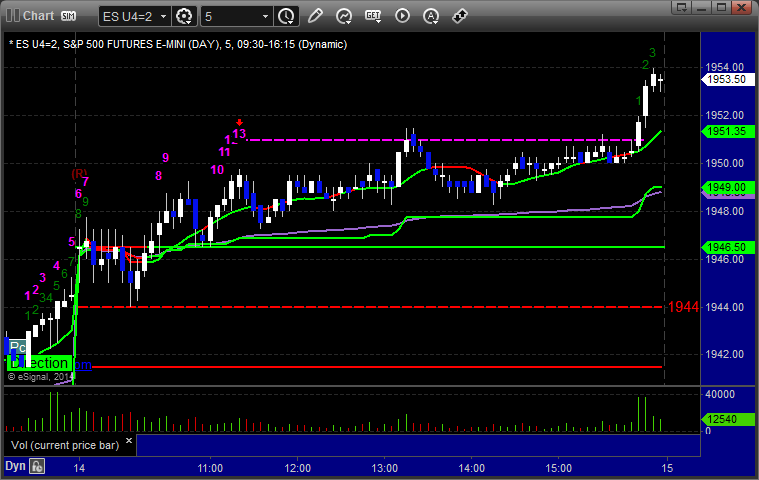

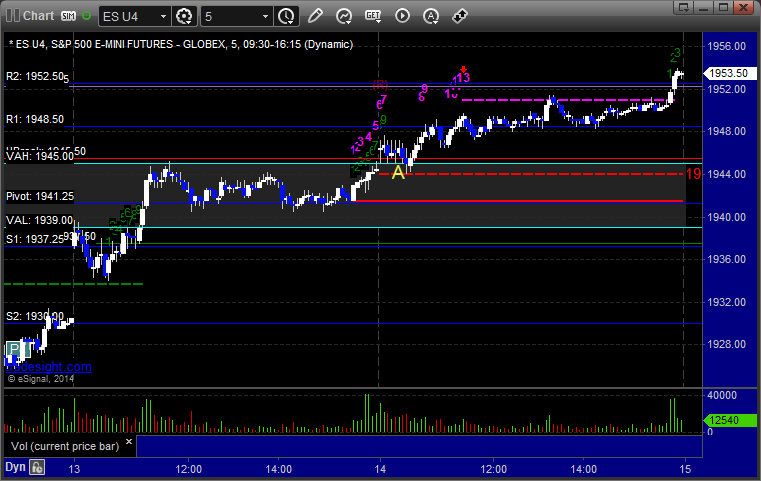

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

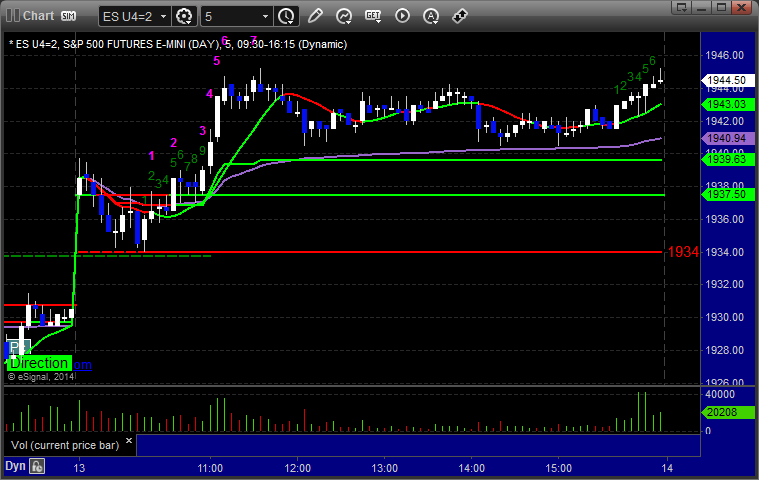

ES:

The boring action for the first 40 minutes was right on top of the Value Area, so we went short breaking into it at A, but it only reached down to fill the gap and bounced:

Forex Calls Recap for 8/14/14

Two triggers close together, and both triggered. See GBPUSD section below. Very narrow action yet again.

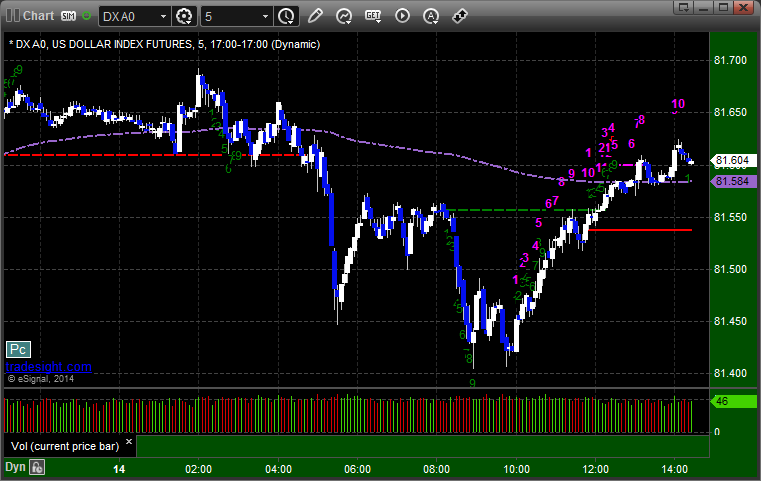

Here's a look at the US Dollar Index intraday with our market directional lines:

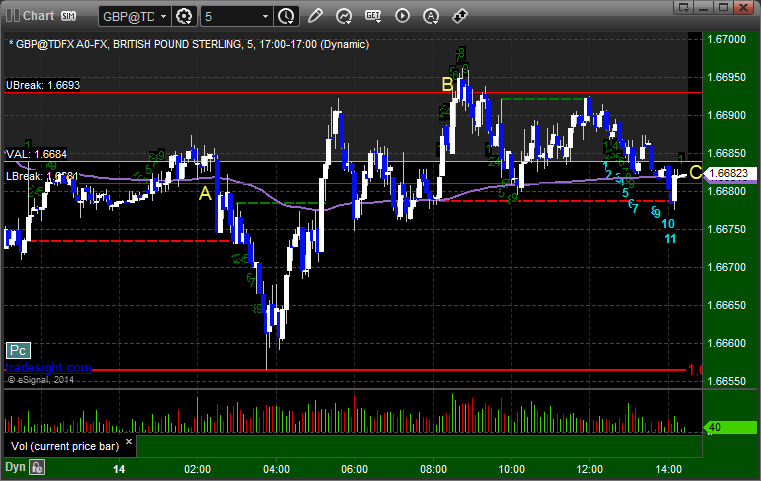

GBPUSD:

Triggered short at A and stopped. Triggered long at B and closed at C for 10 pips loss at end of session:

Stock Picks Recap for 8/13/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Market direction was dead flat for the first 15 minutes, so some of the "market directional" info is just by the book using the tool, but it was really flat.

From the report, MDRX triggered short (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered long (with market support) and didn't work on the first try:

SHLD triggered short (with market support) and worked enough for a partial:

GILD triggered long (with market support) but I closed it flat in the Twitter feed when futures rolled to lows:

Rich's AMZN triggered long (with market support) and worked enough for a partial:

Rich's BIIB triggered long (with market support) and worked:

His EOG triggered short (with market support) and didn't work:

Rich's TRLA triggered long (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.

Futures Calls Recap for 8/13/14

A small winner on the ES and that was it for options unraveling. We gapped up, made some money heading back into the gap, but we didn't fill it, and then the market curled up after the first 60 minutes and options unraveled to the upside. This now leaves us with not much to do until Friday, which was what we were expecting for August expiration. NASDAQ volume was 1.45 billion shares.

Net ticks: +2 ticks.

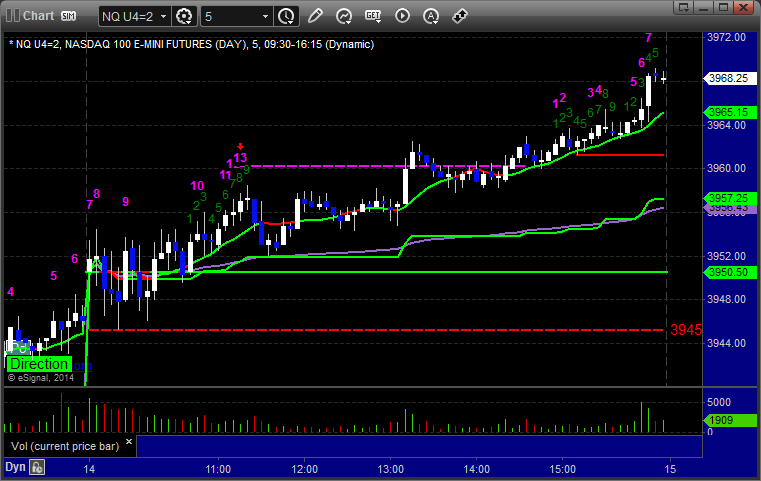

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

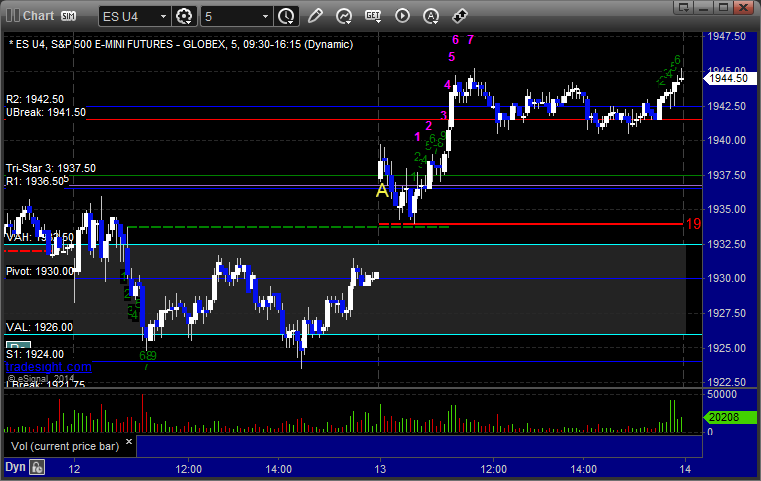

ES:

Triggered short at A at 1936.25, hit first target for 6 ticks, and stopped second half over the entry:

Forex Calls Recap for 8/13/14

You'd like to think with the spikes that you'll see in the charts below that we finally got a decent move in the Forex markets, but it's still just 70 pips of range on the EURUSD. We had a loser and then a winner in the move. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, second half stopped under entry:

Stock Picks Recap for 8/12/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, OVTI triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (with market support) and worked enough for a partial:

His AMZN triggered long (with market support) and worked:

His GOOG triggered short (actually with market support as well) and worked enough for a partial:

In total, that's 4 trades triggering with market support, all 4 of them worked, although nothing huge.