Futures Calls Recap for 8/12/14

Another dull session that basically just served to reach down and fill the ES gap from the prior session. Volume was only 1.35 billion NASDAQ shares. See the ER for our calls.

Net ticks: -4.5 ticks.

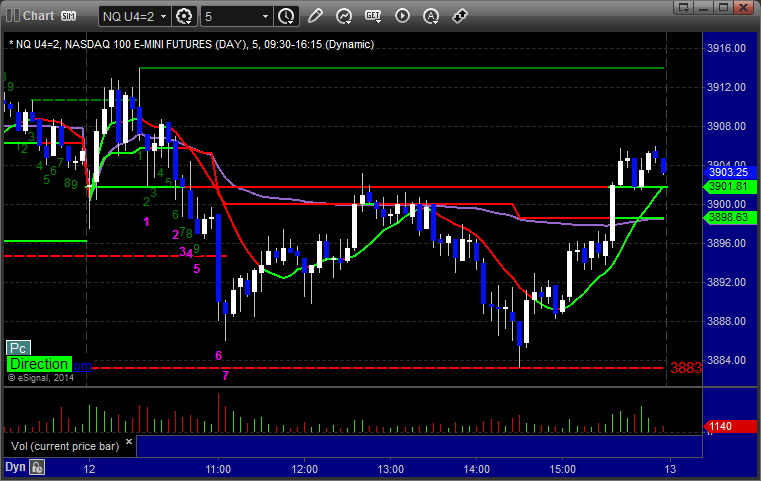

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

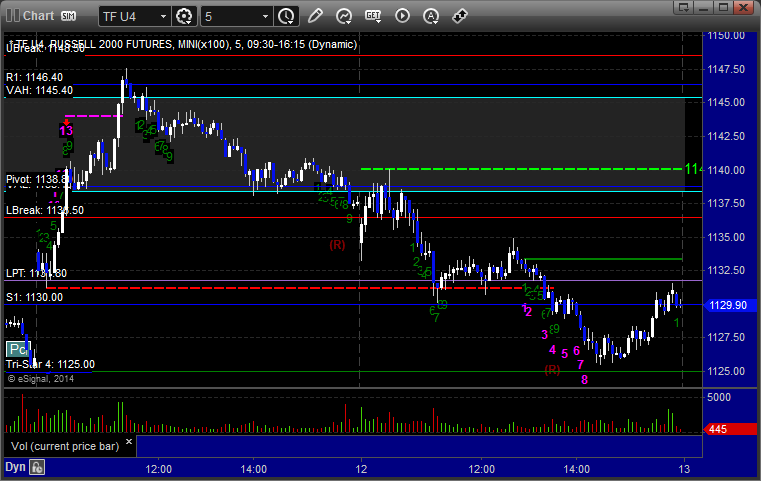

ER:

We had a nice setup here with the Value Area and the Pivot lined up together that never quite got going. It triggered long at A at 1138.90 and stopped for 8 ticks, and then we put it back in and it triggered again, hit first target for 8 ticks, and stopped the second half under the entry:

Forex Calls Recap for 8/12/14

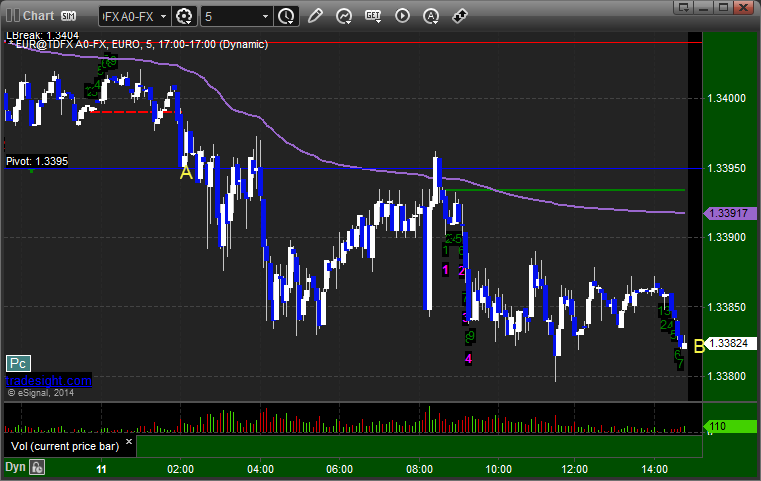

Those Levels were sure tightly spaced based on the prior day's action. The EURUSD trade triggered short and actually moved a bit but didn't quite get to the first target before reversing, and we closed for a small loss. Hopefully, this will widen the Levels spacing for tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, never hit the first target, and closed at B 5 pips over the entry:

Stock Picks Recap for 8/11/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CVLT triggered long (without market support due to opening 5 minutes) and didn't work, worked later with market support after filling the gap:

JCOM triggered long (with market support) and worked:

MCRL triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's QIHU triggered long (with market support) and worked:

His TSLA triggered long (with market support) and worked:

FSLR triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, all 5 of them worked

Futures Calls Recap for 8/11/14

A very light volume session (1.3 billion NASDAQ shares traded) to start the week. The markets gapped up and just held the gaps in very narrow range. One stop out in the ES, see that section below.

Net ticks: -7 ticks.

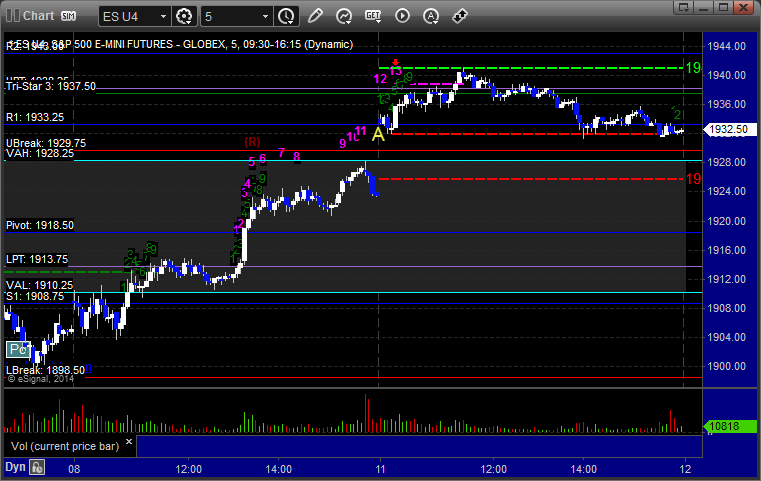

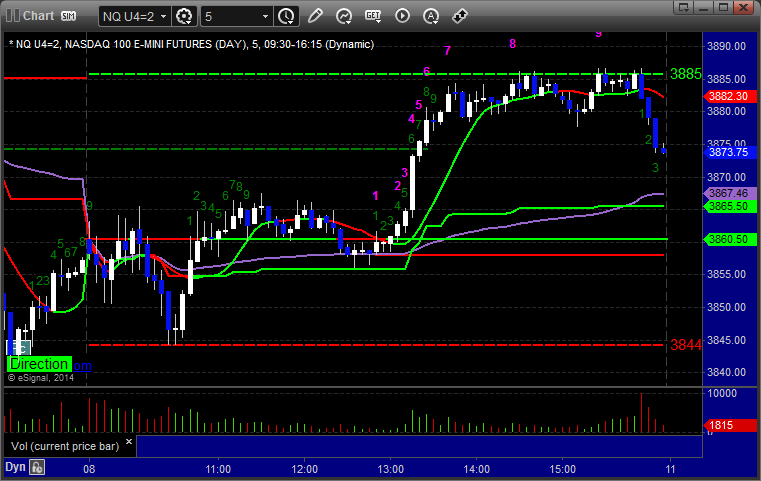

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1933.00 and stopped:

Forex Calls Recap for 8/11/14

Typically, when the EURUSD trades 25 pips from high to low in a session, none of our calls trigger, much less make money. In this case, we did make a little, but there wasn't much to do. See the EURUSD section below.

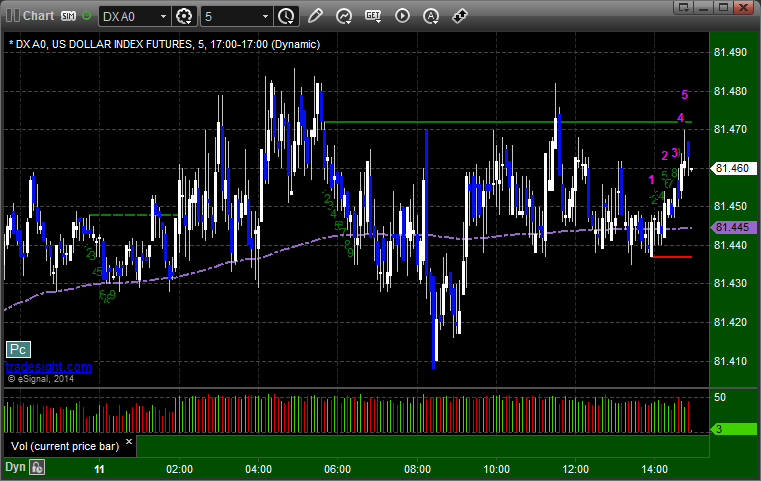

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, never did much, closed at B for 10 pips:

Stock Picks Recap for 8/8/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, JACK triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered long (with market support) and worked:

In total, that's 1 trade triggering with market support, and it worked.

Futures Calls Recap for 8/8/14

The markets closed out the week with another light volume session, although we did get an upward move over lunch. NASDAQ volume closed at 1.6 billion shares. See the ES section below for the trade recaps.

Net ticks: -4.5 ticks.

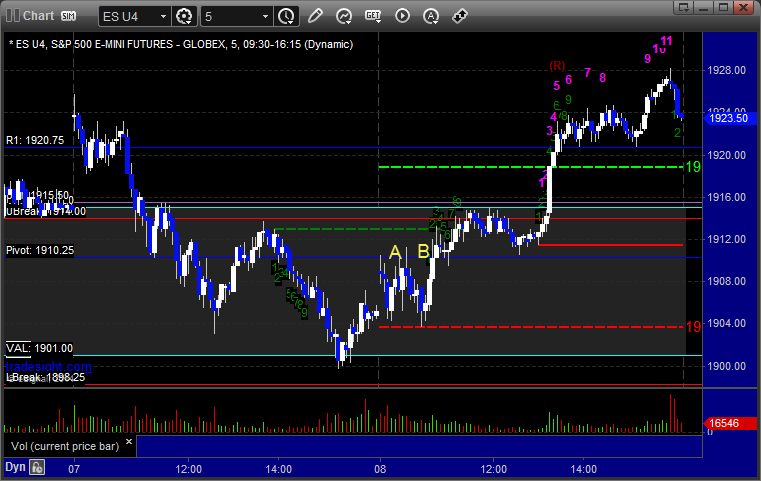

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1910.75 and stopped. Put it back in and triggered at B, hit first target for 6 ticks, and stopped second half under the entry:

Forex Calls Recap for 8/8/14

A winner to close out the week, although still a very narrow trading session. See the EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

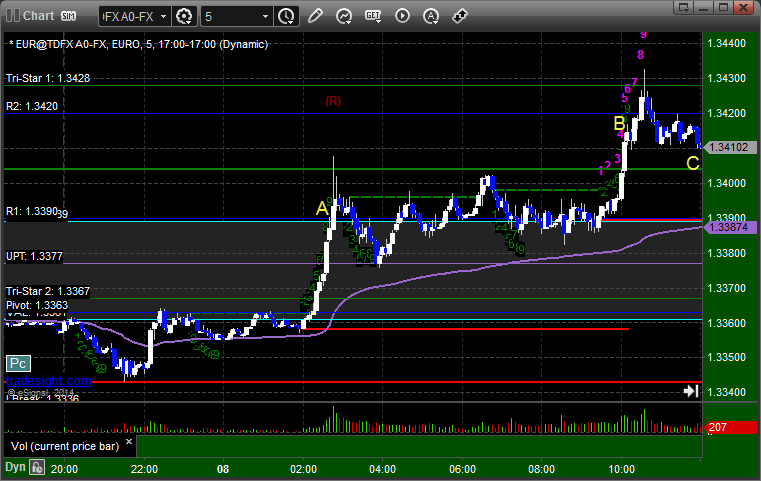

EURUSD:

Triggered long at A, hit first target at B, and closed the remainder at C for end of week:

Stock Picks Recap for 8/7/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, INSM triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's UA triggered long (without market support) and didn't work:

His NFLX triggered long (without market support) and worked great:

His WYNN triggered short (with market support) and worked:

His THOR triggered short (with market support) and didn't go enough either way to count, closed at the trigger:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 8/7/14

A loser on the YM and a winner on the ES for a mixed session. The markets were completely dead early after a gap up and then finally sold off on what looked like some sort of news. Volume was weak early and closed at 1.6 billion NASDAQ shares.

Net ticks: -0.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1918.00, hit first target for 6 ticks, lowered stop twice and stopped 13 ticks in the money at 1914.75:

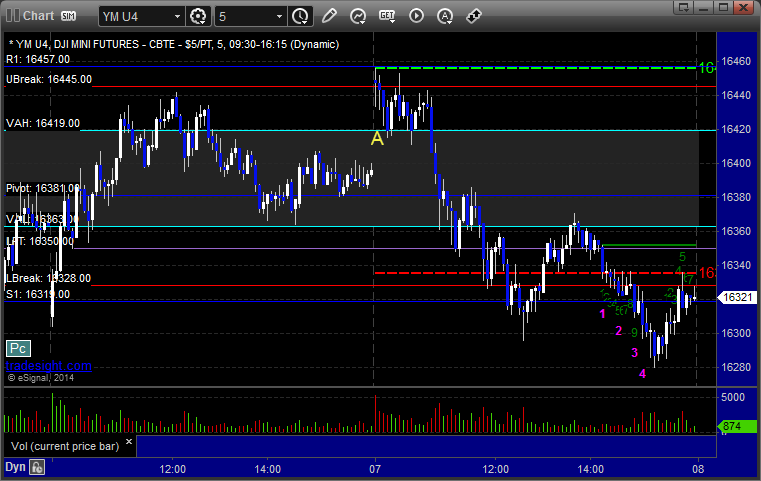

YM:

Triggered short at A at 16418 and stopped for ten ticks: