Forex Calls Recap for 8/7/14

Horrible range, and it took tries to get to a measly 20 pip first target on the EURUSD. See that section below. Tonight's levels spacing will be even worse based on these ranges.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and stopped. Put it back in and triggered short at B, hit first target (small as it was) at C, and closed at D:

Stock Picks Recap for 8/6/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Again, I tried to keep everyone in the Lab focused on the TSLA call as it was the cleanest setup.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered long (with market support) and worked great:

His DISH triggered long (with market support) and worked enough for a partial:

His HLF triggered short (without market support) and didn't work:

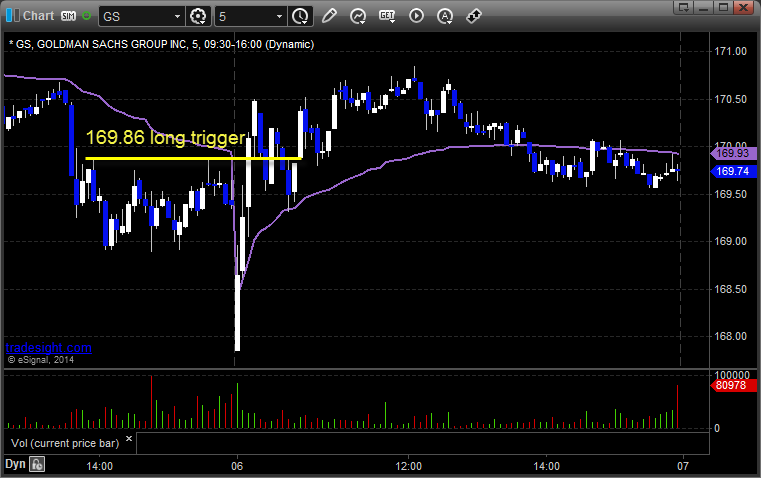

His GS triggered long (with market support) and worked enough for a partial:

His GLD triggered short (ETF, so no market support needed) and never went enough in either direction to count, closed at the trigger:

WYNN triggered long (with market support) and didn't work:

NFLX triggered long (with market support) and we will say that it stopped because it didn't hit +1 before it hit -1, but ultimately it worked great if you went again:

Rich's REGN triggered long (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.

Futures Calls Recap for 8/6/14

We gapped down and got some Value Area plays, with the ES call in particular working a bit. Ultimately crossed the Value Area and could have made more, but our stop was raised and got hit. NASDAQ volume closed at 1.7 billion and the markets closed fairly flat.

Net ticks: +10 ticks.

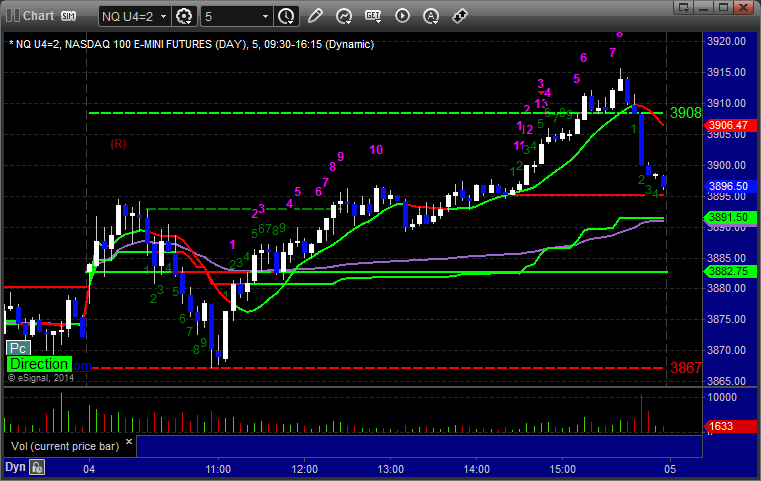

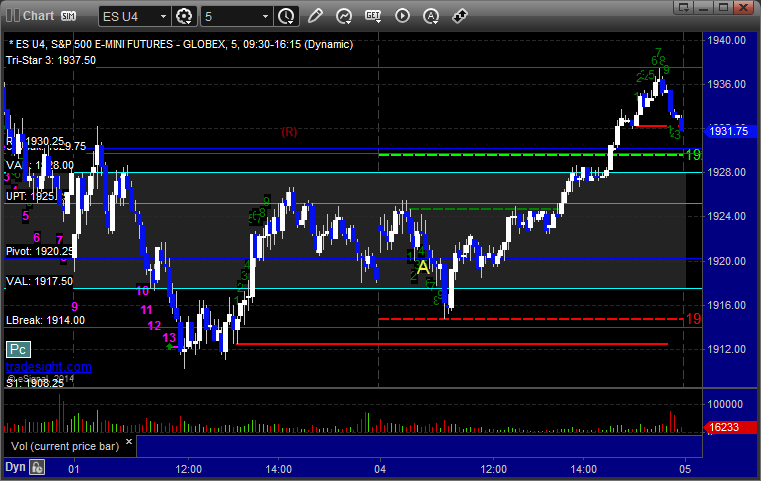

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Our call triggered long into the Value Area at A at 1907.75, hit first target for 6 ticks, raised stop twice and stopped at 1911.25 at B:

Forex Calls Recap for 8/6/14

A stop out for the session as narrow ranges continue. See the EURUSD section below.

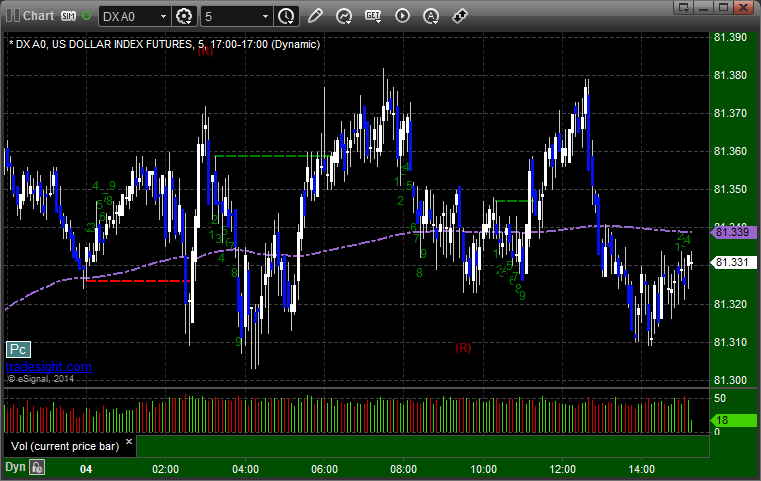

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and stopped:

Stock Picks Recap for 8/5/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FITB gapped under the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, FSLR triggered long (without market support) and worked enough for a partial:

LNKD triggered long (with market support) and worked:

NTAP triggered long (with market support) and worked:

Rich's HLF triggered short (with market support) and worked enough for a partial:

His AAPL triggered short (with market support) and worked enough for a partial:

His GOOG triggered short (with market support) and didn't work:

His WFM triggered long (without market support) and worked:

His APA triggered short (with market support) and worked:

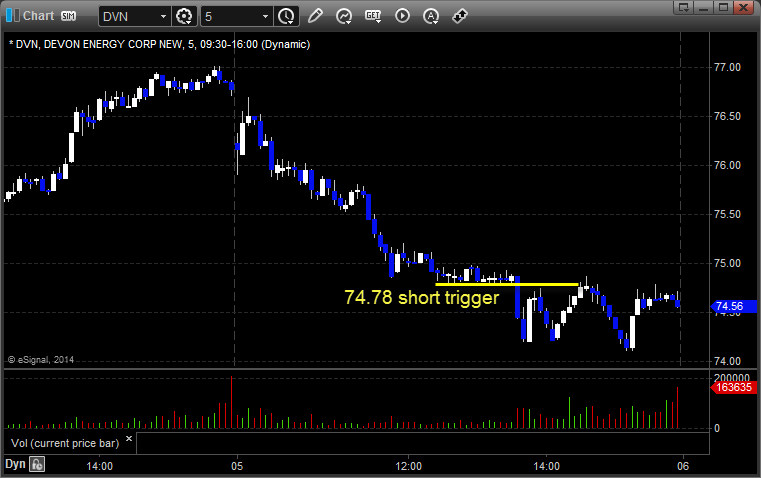

His DVN triggered short (with market support) and worked:

His SLB triggered short (with market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

Futures Calls Recap for 8/5/14

A loser and 2 small winner2 on the ES in a session that gapped around, tried both ways, and never filled the gaps on 1.7 billion NASDAQ shares.

Net ticks: -2 ticks.

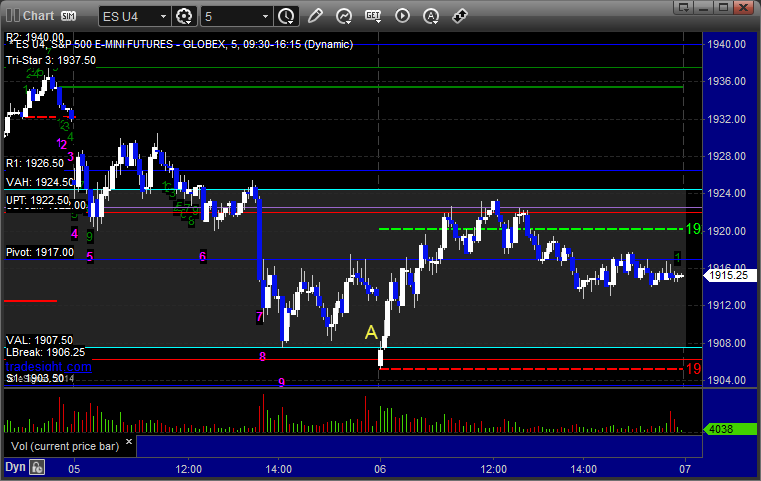

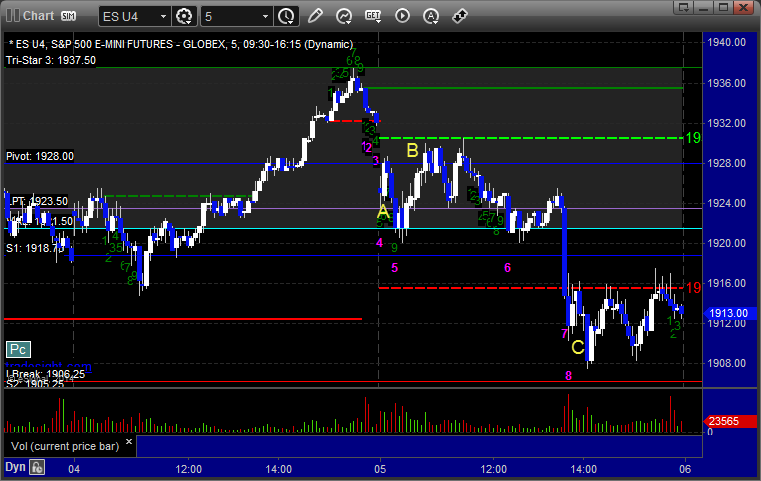

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1923.25, hit first target for 6 ticks, looked like it was going to continue and then reversed sharply and stopped the second half over the entry. Mark's call triggered long at 1929.00 at B and stopped. Rich's call triggered short at 1910.00 at C, hit first target for 6 ticks, and stopped second half over the entry:

Forex Calls Recap for 8/5/14

Well, the EURUSD moved, but our calls were in the GBPUSD for the session and nothing triggered, although we bounced right off of the short entry exactly. On to tomorrow...

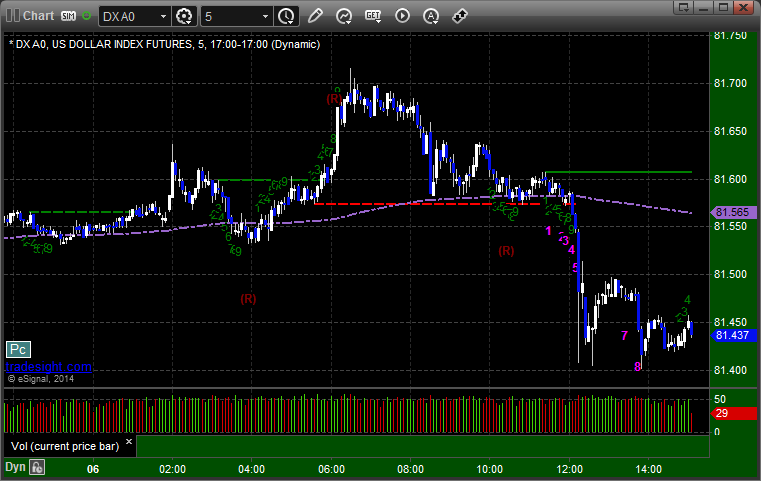

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 8/4/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BCRX triggered long (with market support) and went enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMGN triggered short (with market support) and worked:

His KORS triggered short (with market support) and worked:

His TSLA triggered long (with market support) and worked enough for a partial:

Mark's FB triggered long (with market support) and worked, very slowly:

BIIB triggered short (with market support) and didn't work:

Rich's VRTX triggered short (without market support) and didn't work:

His EXPE triggered long (with market support over lunch) and didn't work:

His AAL triggered short (with market support over lunch) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

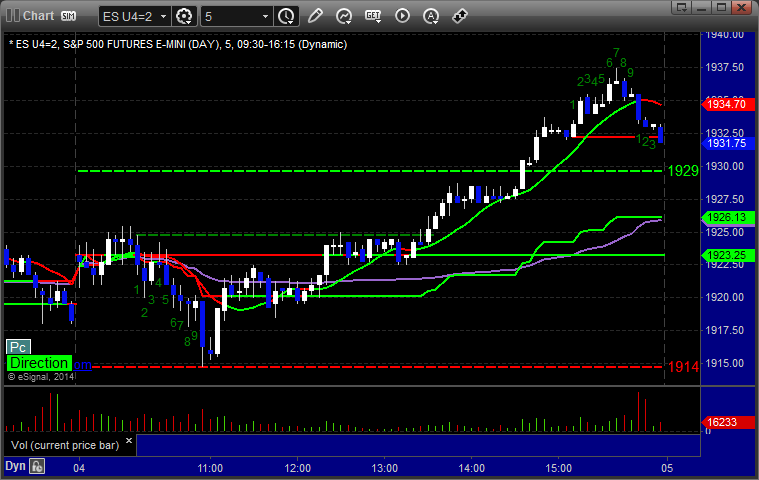

Futures Calls Recap for 8/4/14

A small winner for the session in the ES. Volume was horrible for the session, and the whole first half of the day was a narrow waste. The market did turn up in the afternoon, although still without volume. See the ES section below.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

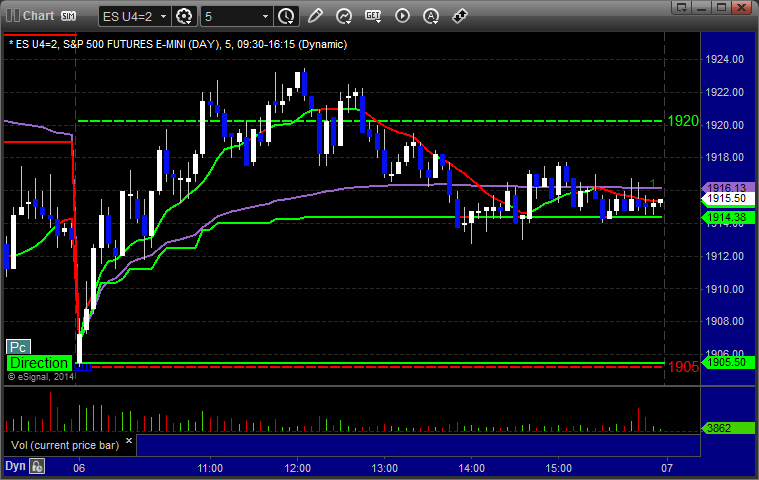

ES:

Triggered short at A at 1920.00, hit first target for 6 ticks and stopped second half over the entry:

Forex Calls Recap for 8/4/14

A dull overnight session, and then our trade finally triggered late in the US session, so I ended up closing it a couple of pips in the money. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

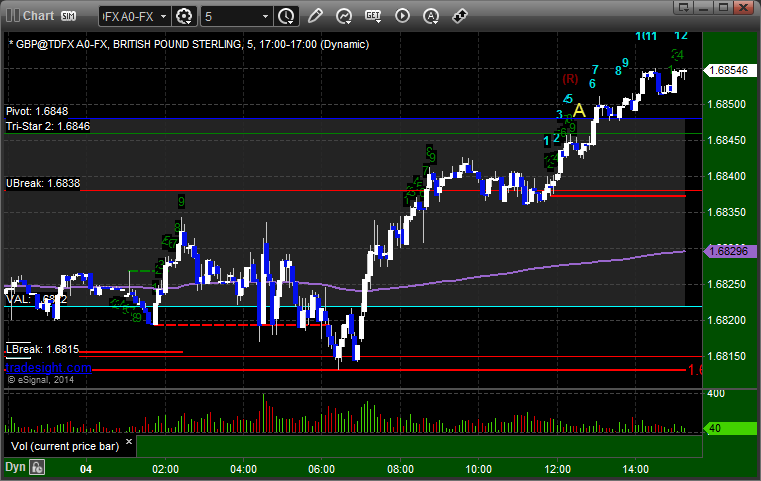

GBPUSD:

Triggered long at A late in the session and closed it at the end of the chart: