Tradesight July 2014 Futures Results

Before we get to July’s numbers, here is a short reminder of the results from June. The full report from June can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for June 2014

Number of trades: 20

Number of losers: 8

Winning percentage: 60%

Net ticks: +35.5 ticks

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for July 2014

Number of trades: 24

Number of losers: 8

Winning percentage: 66.7%

Net ticks: +17.5 ticks

July was interesting. Our winning percentage was higher than usual, but the markets were so flat that a lot of the winners were small, only to our first targets, so we spent much of the month on the main calls trading winners and losers. The markets did start to move in the last week of the month though, and that's when things improved. Hopefully, we won't have too many months as flat as July. It was a great month to see how the system works and why movement matters.

Tradesight July 2014 Forex Results

Before we get to July’s numbers, here is a short reminder of the results from June. The full report from June can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for June 2014

Number of trades: 19

Number of losers: 6

Winning percentage: 68.4%

Worst losing streak: 3 in a row

Net pips: +90 pips

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for July 2014

Number of trades: 18

Number of losers: 8

Winning percentage: 55.5%

Worst losing streak: 3 in a row

Net pips: +60 pips

Once again, it was mostly an uninteresting month in the Forex markets, although this one was not a surprise as summer usually isn't. In fact, we did pick up a little speed for the last week as the US Dollar is approaching a 10-month breakout, so maybe things are finally about to get exciting, and that helped give us a couple of late month gains. Even though our winning percentage was in the range we like to see (50-60%), we didn't have many big winners because the pairs never moved much, so it was a lot of trading small winners and losers for small net gains, which is all part of the system when things are dull.

Stock Picks Recap for 8/1/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NFLX triggered short (with market support) and worked great:

VRTX triggered short (without market support due to opening 5 minutes) and didn't work, triggered later clean with market support and did work:

From the Messenger/Tradesight_st Twitter Feed, NTES triggered short (without market support) and worked great:

BIDU triggered short (with market support) and worked great:

We also had a room call on AMZN short that worked great.

In total, that's 2 trades triggering with market support, both of them worked great.

Futures Calls Recap for 8/1/14

We closed out the week and started the new month with a winning session in futures. See the ES section below. Markets gapped down and filled quickly. NASDAQ volume closed at 1.8 billion shares.

Net ticks: +6.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

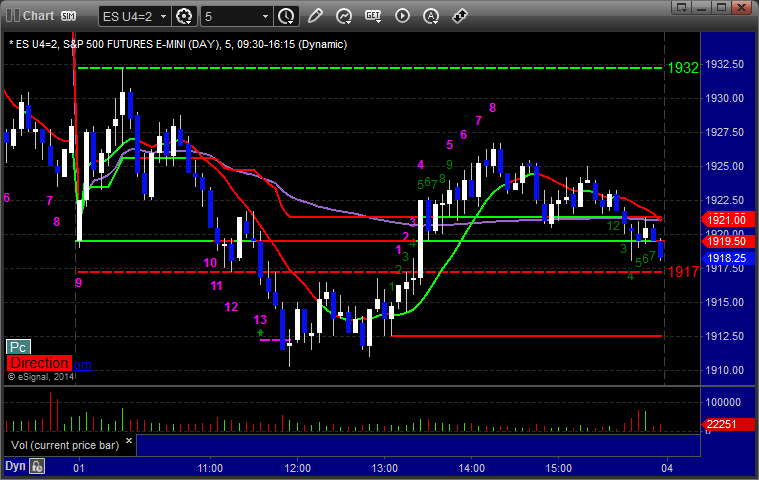

ES:

Triggered long at A at 1924.00, hit first target for 6 ticks, stopped second half for 7 ticks:

Forex Calls Recap for 8/1/14

A winner to close out the week and month of July officially. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. There will be some interesting things to discuss in the market preview for next week.

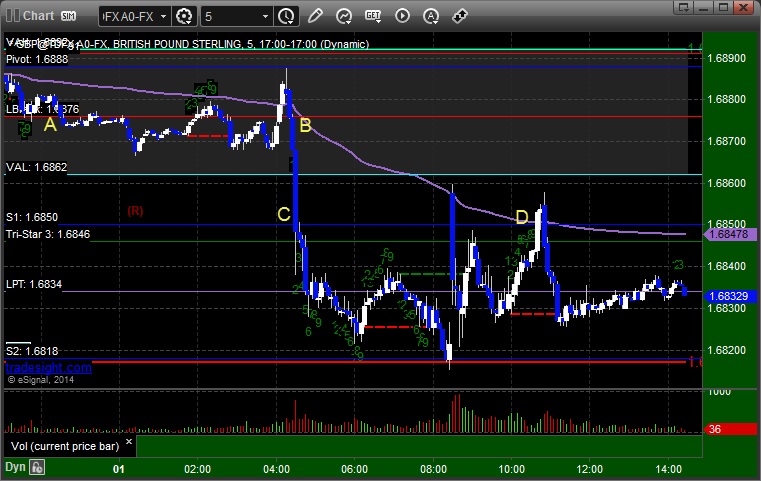

GBPUSD:

Triggered short at A (or B if you waited for the European session), hit first target at C, lowered stop in the morning and stopped at D:

Stock Picks Recap for 7/31/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

A nice day overall with good winners in FB and FOSL even though the other stuff didn't work, but we kept it all tight.

From the report, FOSL triggered short (with market support) and worked:

MDLZ gapped under the trigger, no play.

EXXI triggered short (with market support) and did not work, although in the Lab we closed it for a dime loss as it swept the trigger heading into lunch:

From the Messenger/Tradesight_st Twitter Feed, FB triggered short (with market support) and worked:

BIDU triggered long (with market support) and didn't work, although we retook it in the Lab on a second trigger than worked fine, but we only officially count the first trigger unless posted to the Messenger/Twitter feed:

EBAY triggered short (with market support) and didn't go enough in either direction to count, too late in day:

SNDK triggered short (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 2 of them worked, 3 did not.

Futures Calls Recap for 7/31/14

The markets gapped down big on news out of Argentina, Russia, and a general lack of action by Congress to help address the border issues before they head off for a 5 week vacation. The early action was too choppy, and any calls I was looking at would have stopped. Eventually, the market headed lower but never touched a level, so no official calls for the last day of the month.

Net ticks: +0 ticks.

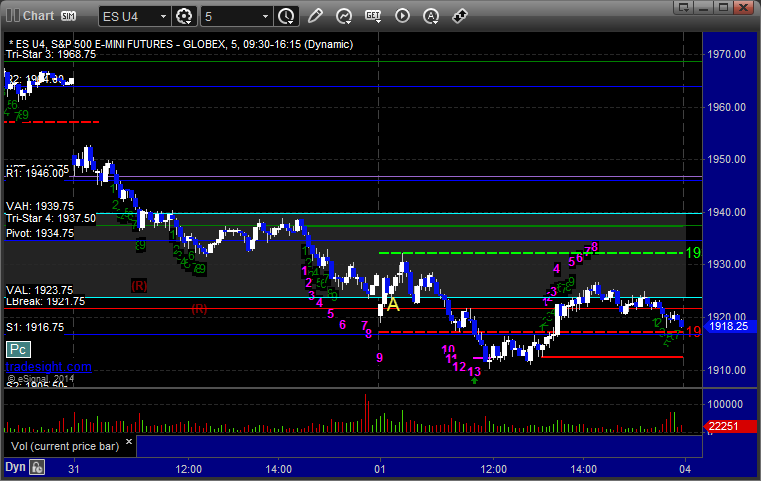

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 7/31/14

July ends with a whimper as we lost 10 pips on the GBPUSD. See that section below. Tonight's calls are still technically in July and count toward July's numbers, but starting this weekend, we are officially in August.

Here's a look at the US Dollar Index intraday with our market directional lines:

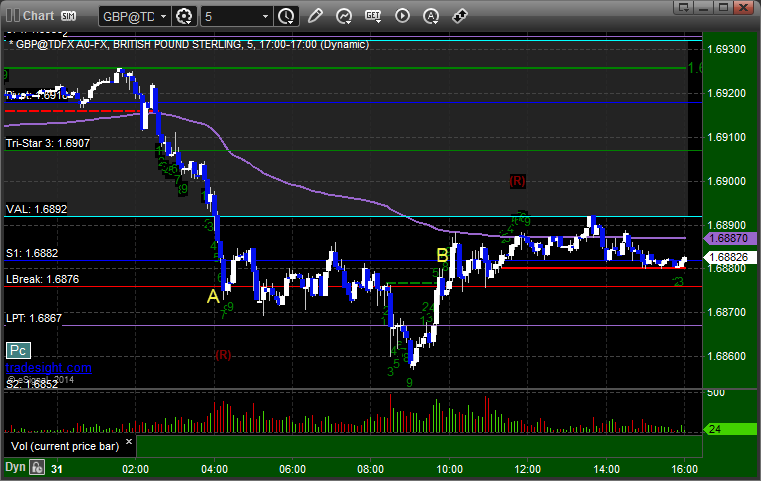

GBPUSD:

Triggered short at A, wasn't going anywhere, lowered the stop over S1 in the morning and stopped for 10 pips:

Stock Picks Recap for 7/30/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered, amazingly.

From the Messenger/Tradesight_st Twitter Feed, Mark's CHKP triggered long (without market support) and didn't work, would have been great if the market hadn't tanked:

WYNN triggered short (with market support) and worked:

NFLX triggered long (with market support only literally for that moment of the afternoon) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 7/30/14

The markets gapped up and the ES gave us a clean gap fill early. NASDAQ side never quite filled, and then the markets spiked up on the Fed before retreating to middle range for the last hour of play. NASDAQ volume closed weak at 1.65 billion shares. Tomorrow is end of month in the summer, so might not be too exciting. Note that the ES closed on the VWAP within a tick.

Net ticks: +5.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1971.00 and stopped for 7 ticks. Re-entered the trade on a re-trigger, hit first target for 6 ticks, and lowered stop twice and stopped final piece at 1966.25: