Tradesight Recap Report for 10/1/21

Overview

The markets gapped up a little, filled, headed lower for over an hour, then bottomed out for the day and rallied into the close on just 4.6 billion NASDAQ shares.

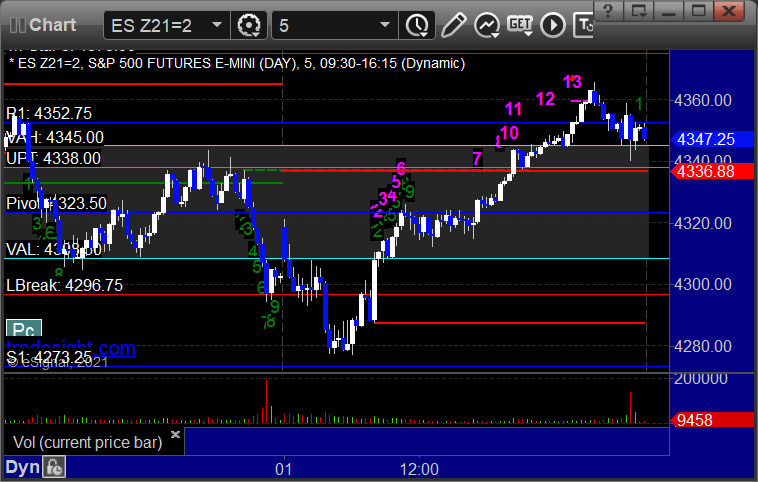

ES with Levels:

ES with Market Directional:

Futures:

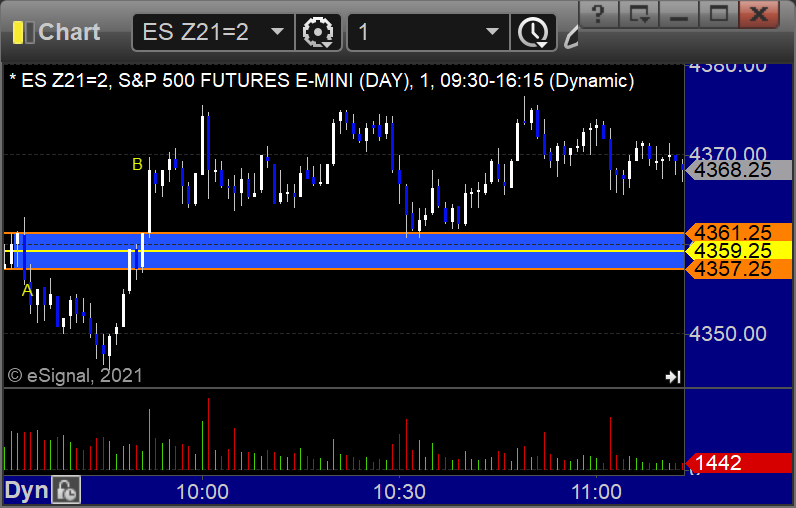

ES Opening Range Play triggered short at A and worked:

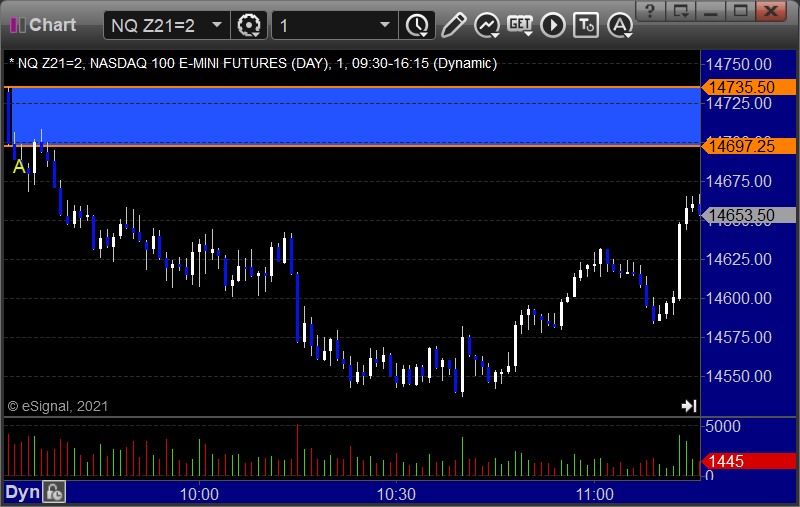

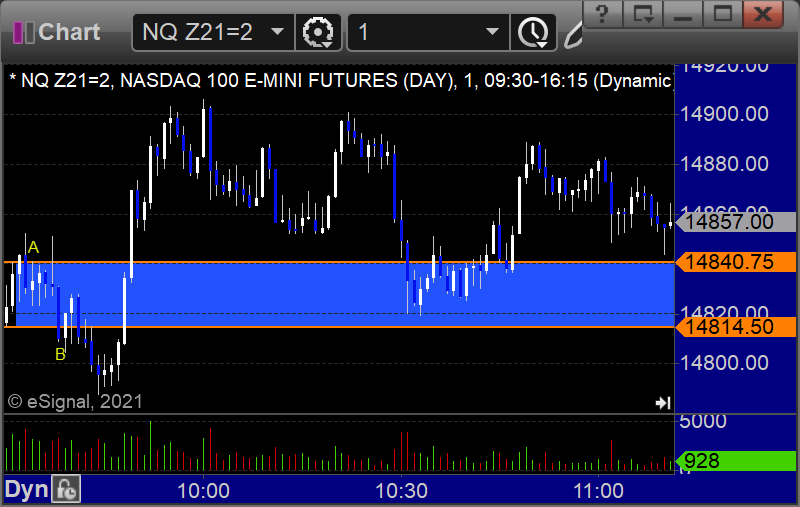

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +22 ticks

Forex:

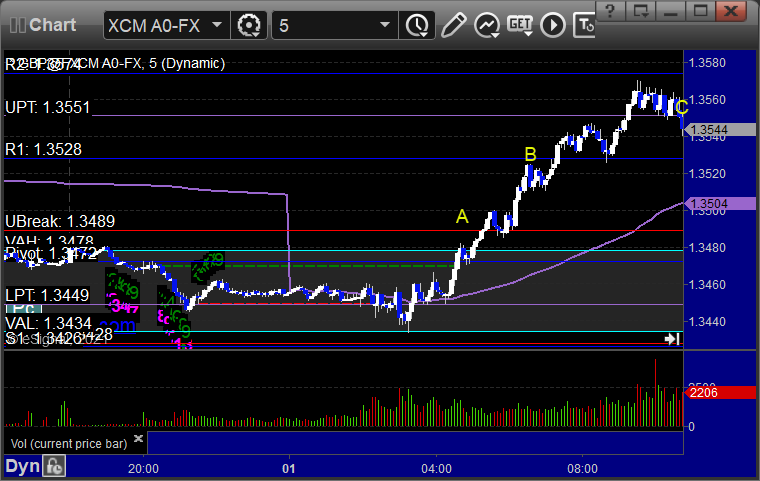

GBPUSD triggered long at A, hit first target at B, closed second half at C for end of week:

Results: +50 pips

Stocks:

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's VMW triggered long (with market support) and didn't do enough either way to count:

His AAPL triggered short (without market support due to opening 5 minutes) and worked:

His FB triggered long (with market support) and didn't go enough either way to count:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 9/30/21

Overview

The markets gapped up, filled, broke lower a lot over lunch and closed at the lows on 5.2 billion NASDAQ shares.

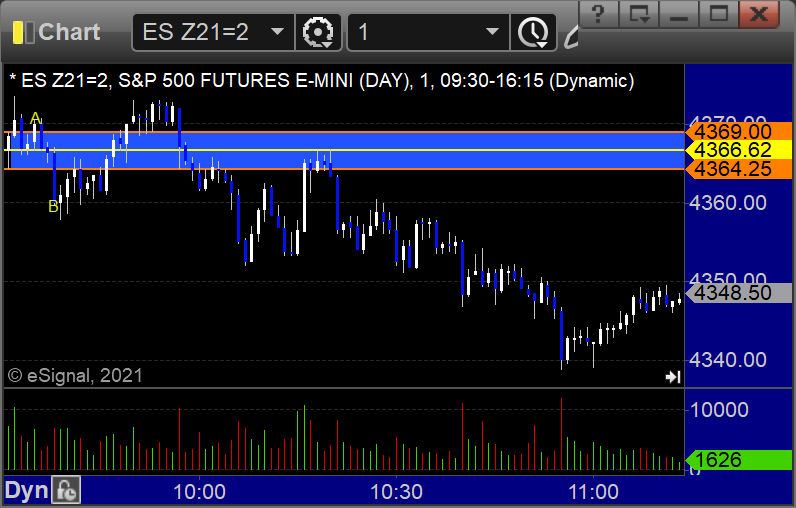

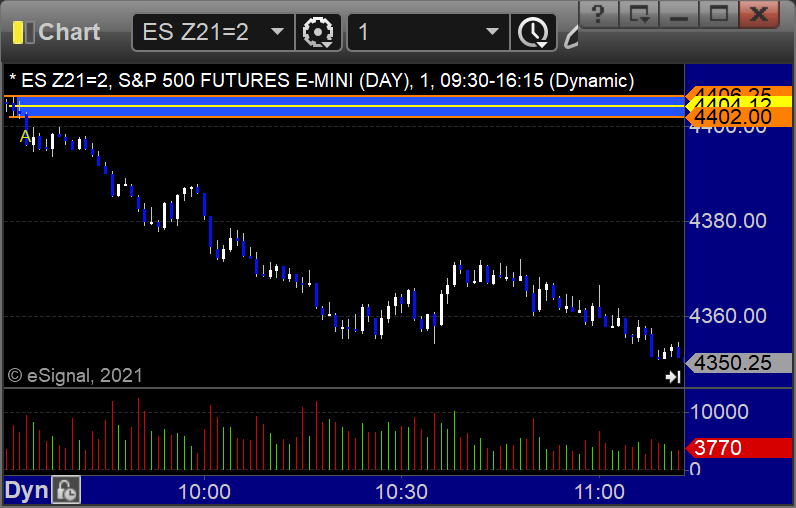

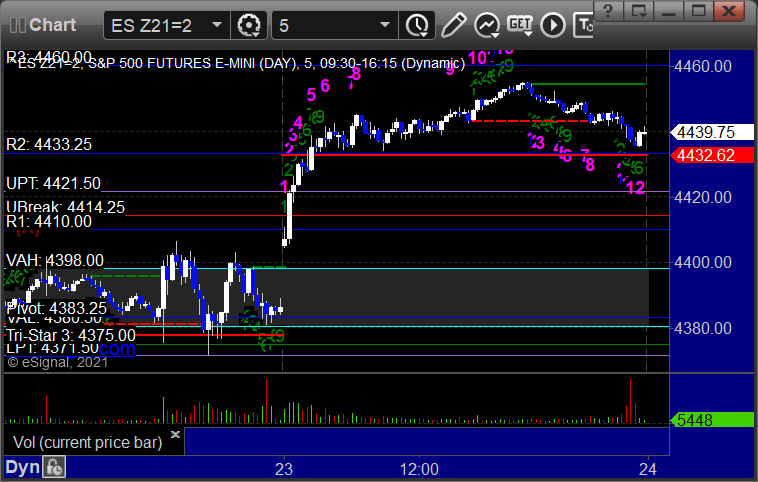

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped under the midpoint, triggered short at B but too far out of range to take:

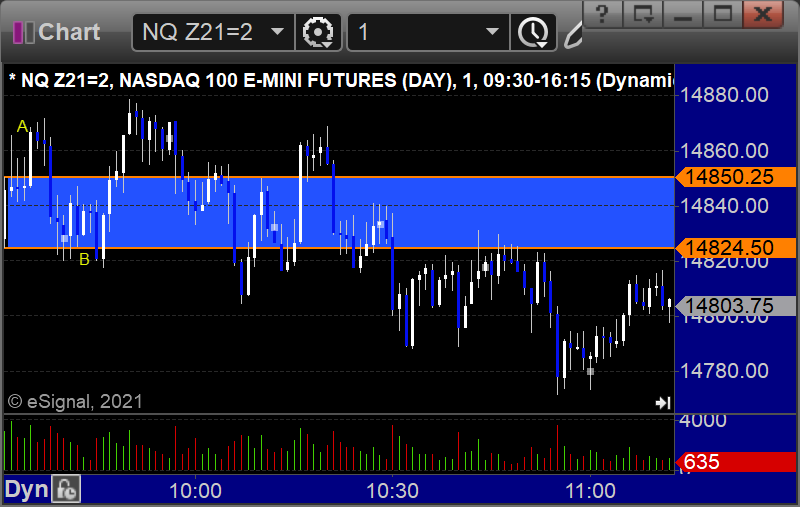

NQ Opening Range Play:

Results: -16 ticks

Forex:

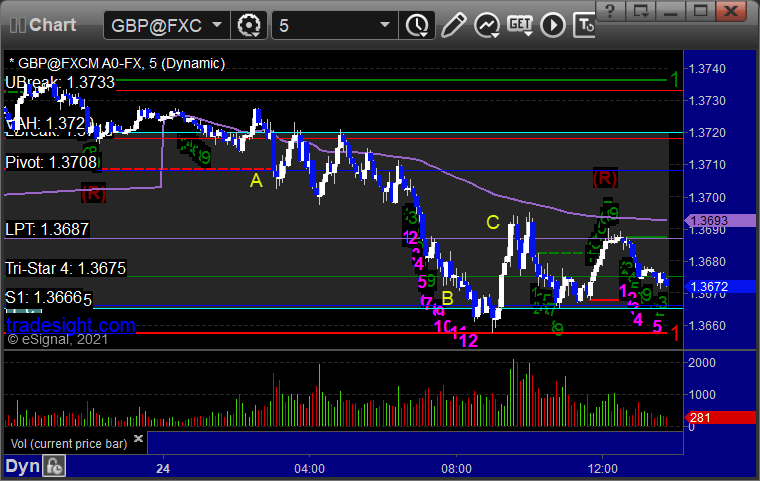

GBPUSD triggered short at A, hit first target at B, second half stopped over the entry:

Results: +10 pips

Stocks:

Not too exciting.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's SLB triggered short (without market support) and didn't work:

His JPM triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 9/29/21

Overview

The markets gapped up a little, filled the gap, and were dead all day on 4.9 billion NASDAQ shares.

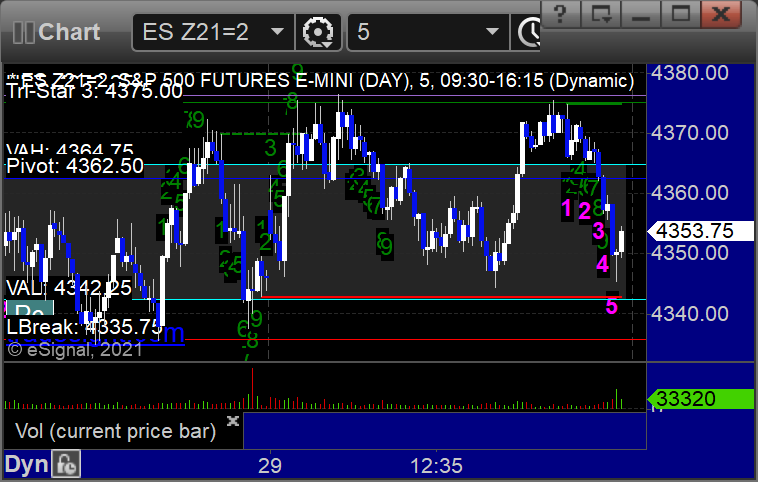

ES with Levels:

ES with Market Directional:

Futures:

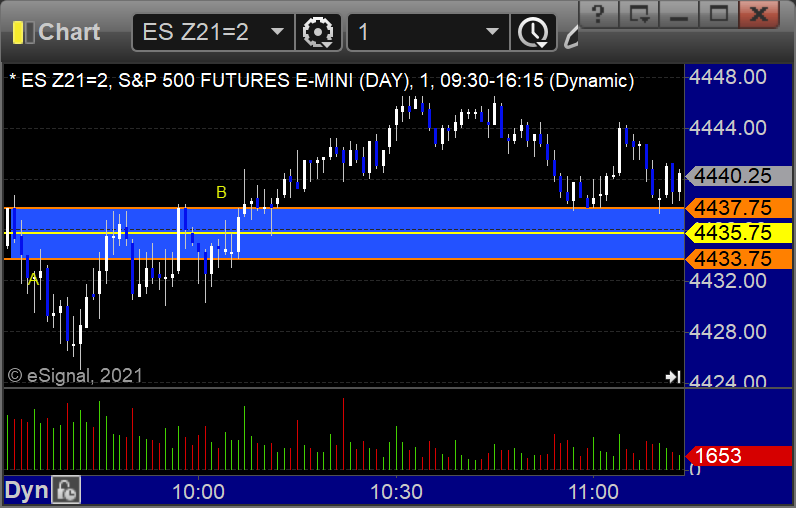

ES Opening Range Play triggered short at A and worked, triggered long at B but too far out of range to take:

NQ Opening Range Play:

Results: +4.5 ticks

Forex:

Closed out the second half of the prior day's trade in the money.

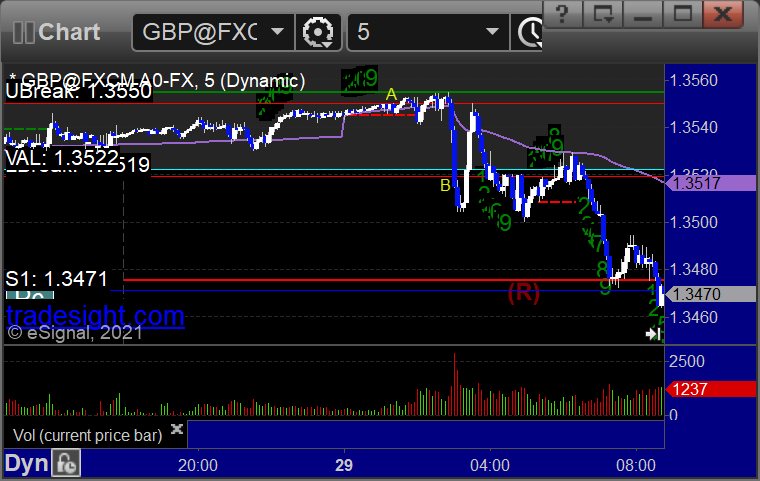

GBPUSD triggered long at A and stopped, triggered short at B and stopped:

Results: -20 pips

Stocks:

Not too exciting.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, NVDA triggered short (with market support) and worked:

Rich's QCOM triggered short (with market support) and worked:

That’s 2 triggers with market support, both of them worked a little.

Tradesight Recap Report for 9/28/21

Overview

The markets gapped down big and pushed lower until the start of lunch, then went flat for the rest of the session on 4.9 billion NASDAQ shares.

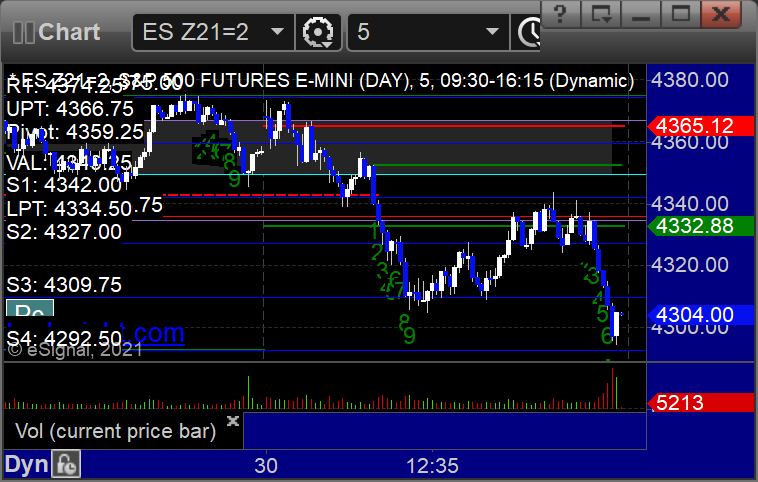

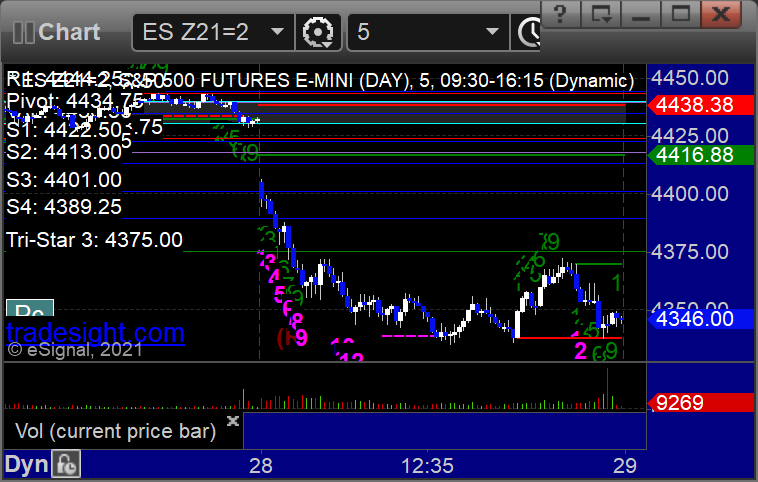

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short, but just barely too far out of range to take. Worked if you did take it:

NQ Opening Range Play triggered short, but way too far out of range to take:

Results: +0 ticks

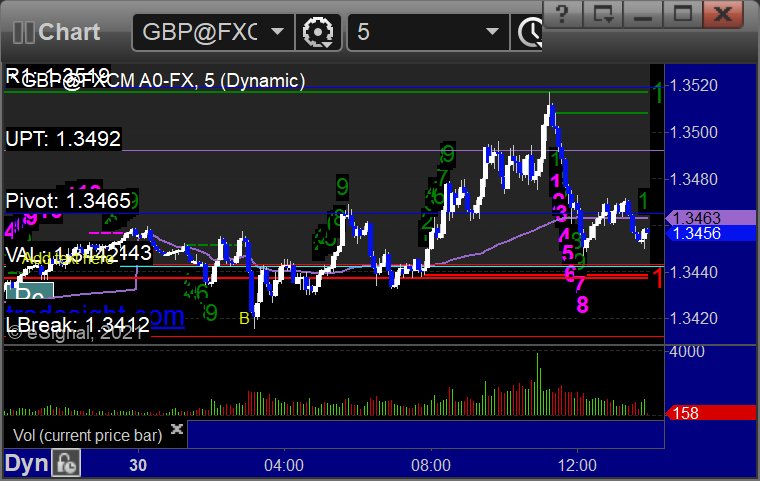

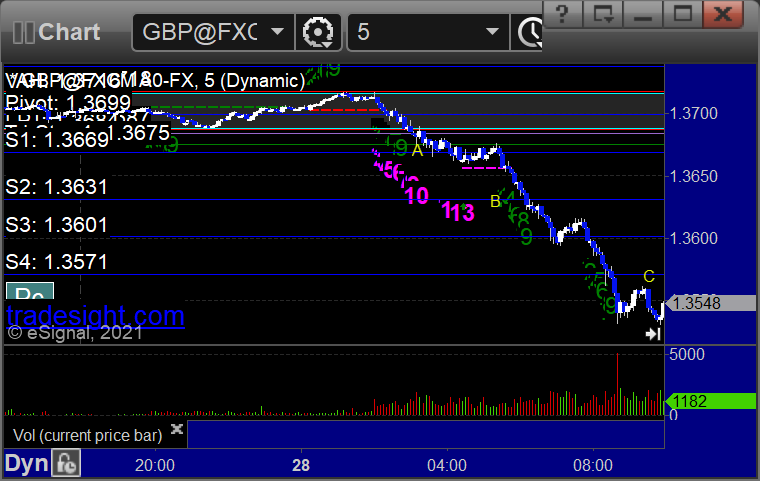

Forex, a nice winner for the session, still going:

GBPUSD triggered short at A, hit first target at B and kept going, still holding second half with a stop over S4 at C:

Results: unknown, trade is still going

Stocks:

A great call in COST, but the gap ruined most of the rest of the day for finding stuff.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, COST triggered short (with market support) and worked great:

That’s 1 trigger with market support, and it worked great.

Tradesight Recap Report for 9/27/21

Overview

Not a very exciting session. Forex was dead. The markets gapped down, the ES filled, the NASDAQ did not, but the action was narrow. NASDAQ volume was 4.4 billion shares.

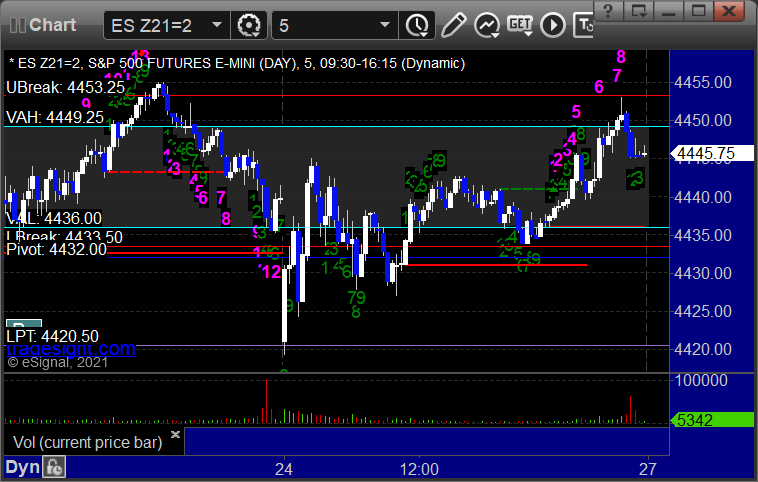

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked, triggered long at B and worked:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +19 ticks

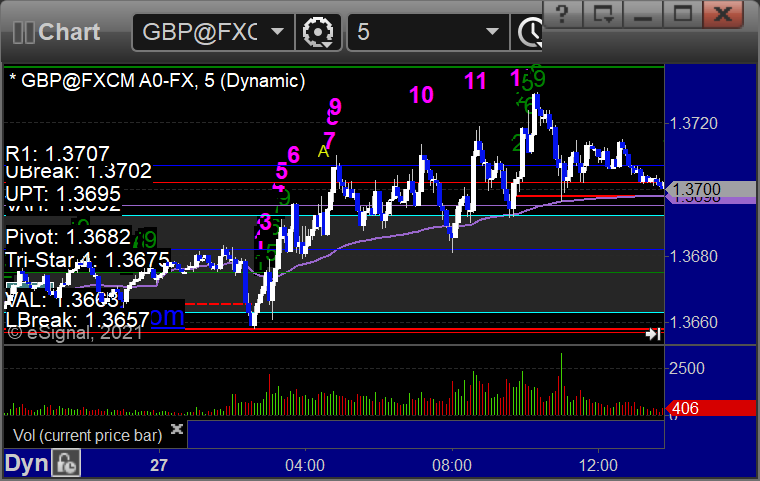

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

Not much action in the markets, but we had some winners.

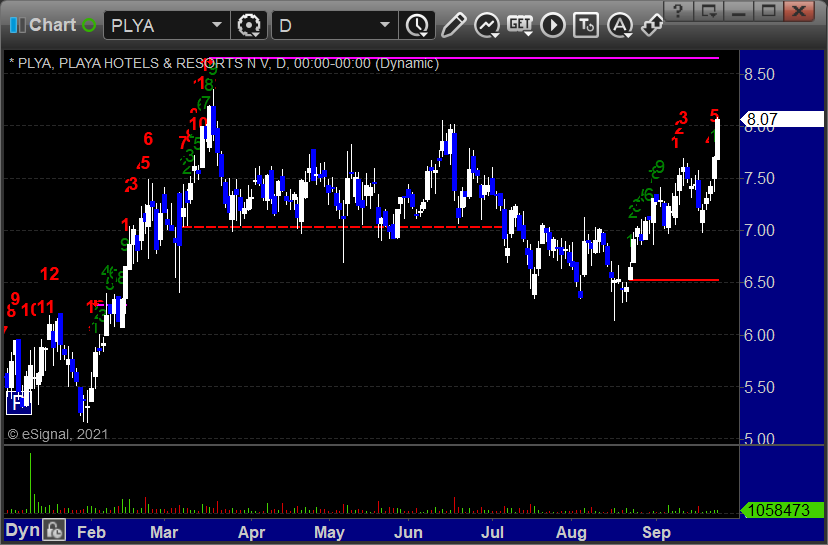

From the Tradesight Plus Report, PLYA triggered long (with market support) and worked:

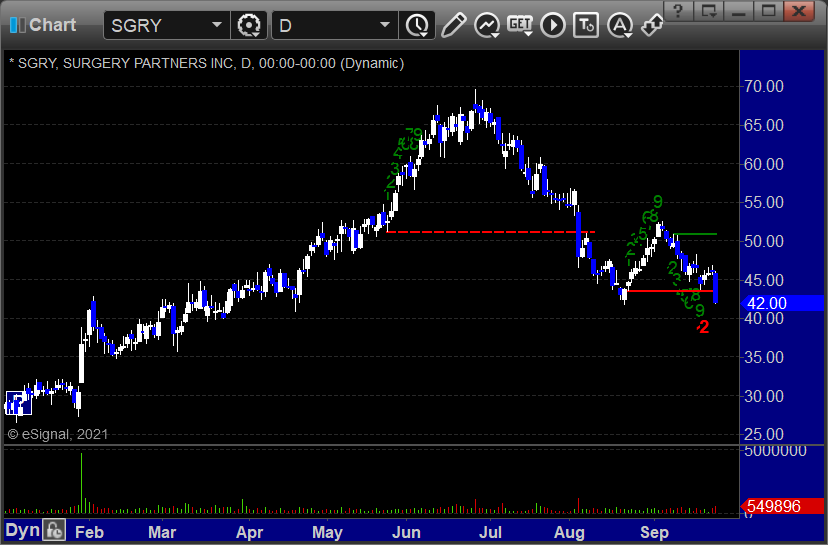

SGRY triggered in the opening 5 minute candle, no play.

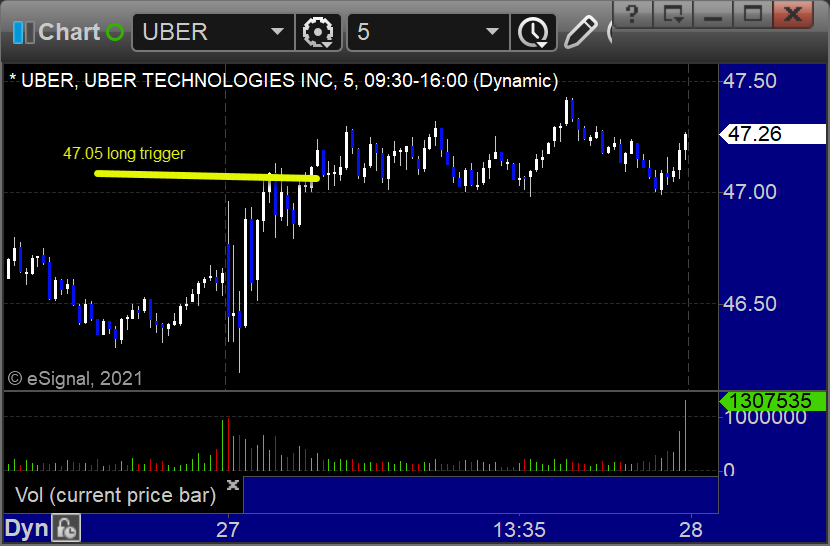

From the Tradesight Plus Twitter feed, Rich's UBER triggered long (with market support) and worked enough for a partial:

That’s 2 triggers with market support, both of them worked.

Tradesight Plus Report for 9-27-21

Opening comments are posted to YouTube. I would continue to focus on the downside overall with up days occasionally. I will be gone all week, so we will likely not have any more YouTube previews and maybe no Plus reports. We will build the recaps as we go or after I get back.

Longs first, in the order of best chart construction, starting with, starting with PLYA > 8.35:

PLXP > 21.50:

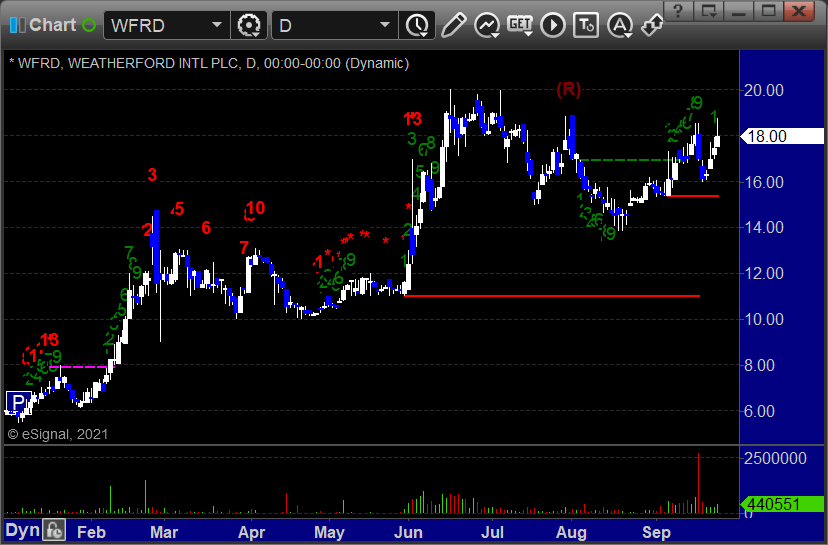

WFRD > 20.02:

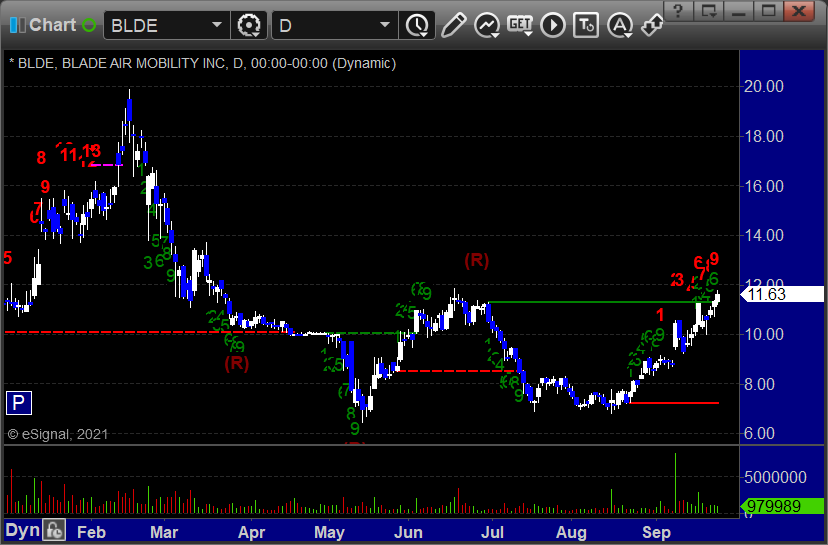

BLDE > 11.87:

Shorts next, just one, SGRY < 41.70:

Tradesight Recap Report for 9/24/21

Overview

The markets gapped down, bounced back so the ES filled early and went flat and then the NASDAQ filled late on 3.9 billion NASDAQ shares.

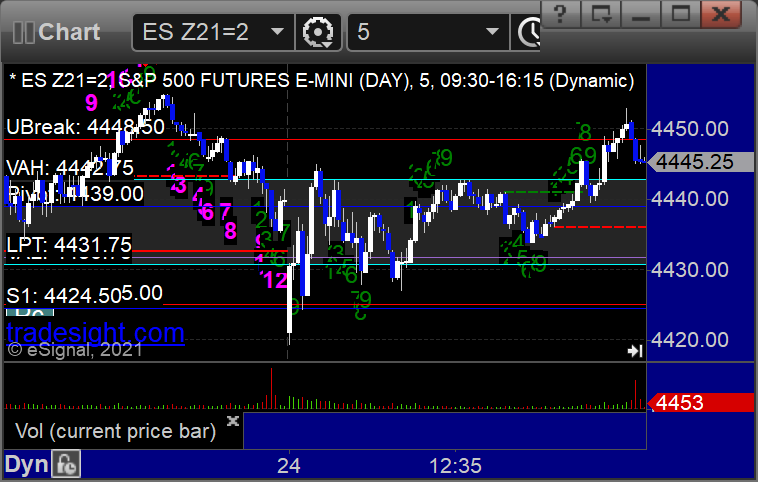

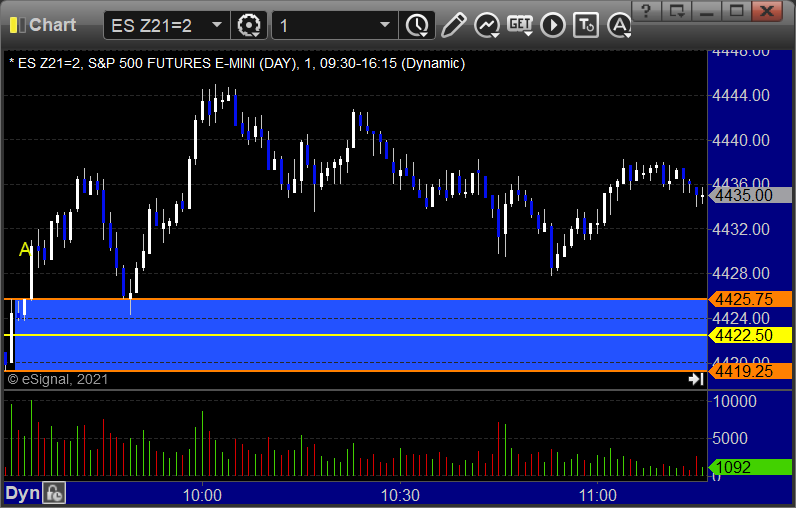

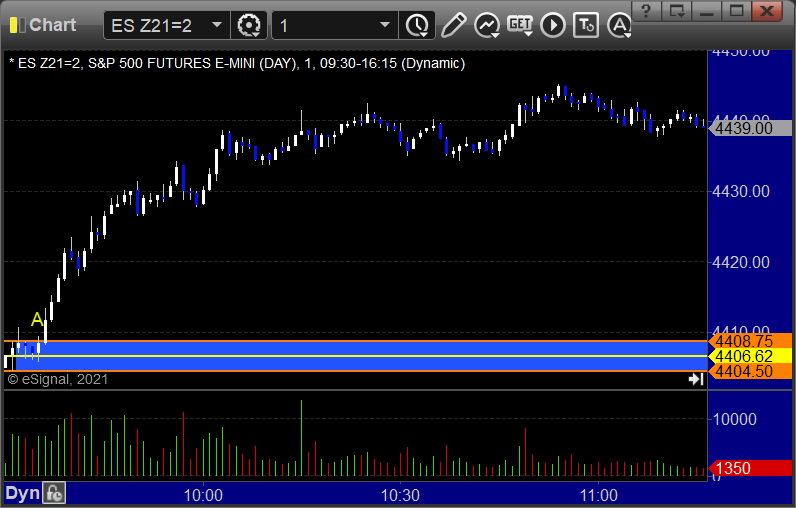

ES with Levels:

ES with Market Directional:

Futures:

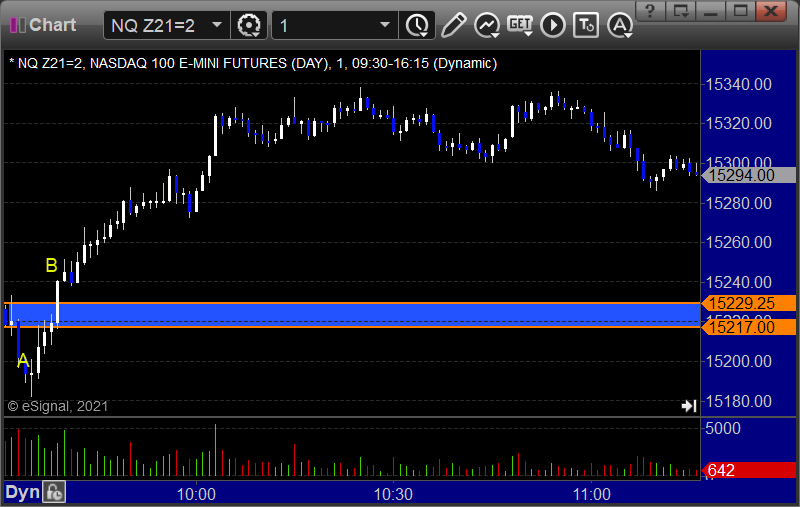

Futures:

ES Opening Range Play triggered long at A but too far out of range to take:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +0 ticks

Forex:

We closed out the second half of the prior day's trade for a win and then had a new trade.

GBPUSD triggered short at A, hit first target at B, stopped second half at C:

Results: +60 pips

Stocks:

An interesting day in the markets.

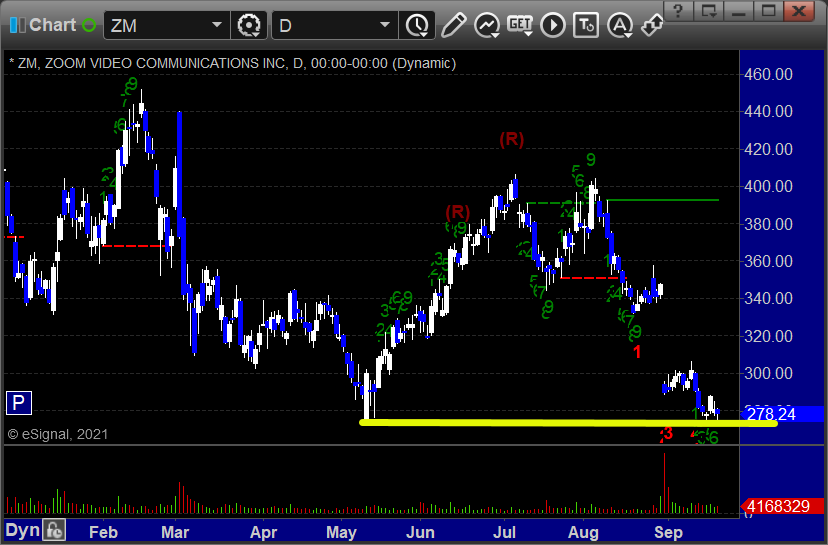

From the Tradesight Plus Report, ZM triggered short (without market support) and worked:

From the Tradesight Plus Twitter feed, Rich's JPM triggered long (without market support due to opening 5 minutes) and worked:

His KRE triggered long (with market support) and worked:

His AAPL triggered long (with market support) and didn't do enough to count either way:

That’s 1 trigger with market support, and it worked but so did ZM.

Tradesight Recap Report for 9/23/21

Overview

The markets gapped up, pushed higher, topped out after lunch, and came back to the midpoint on 4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked big:

NQ Opening Range Play, both triggers were out of range:

Results: +36 ticks

Forex:

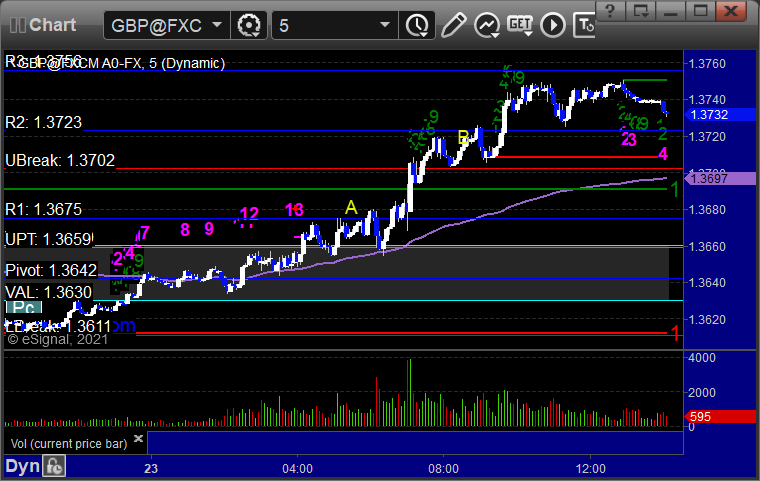

GBPUSD triggered long at A, hit first target at B, still holding second half with a stop under R2:

Results: none yet, trade not finished

Stocks, a big day:

From the Tradesight Plus Report, nothing triggered until very late in the day.

From the Tradesight Plus Twitter feed, Rich's MU triggered long (with market support) and didn't do anything:

His CAT triggered long (with market support) and worked:

His PXD triggered long (with market support) and worked:

That’s 3 triggers with market support, 2 of them worked and 1 didn’t do enough to count.

Tradesight Recap Report for 9/22/21

Overview

The markets gapped up, pulled back briefly, pushed up into lunch, and then shook both ways on the Fed announcement and closed exactly where they were at the time of the announcement on 4.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

NQ Opening Range Play, both triggers were out of range:

Results: +30.5 ticks

Forex:

GBPUSD triggered short at A, hit first target at B, stopped second half over the entry:

Results: +10 pips

Stocks:

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's DASH triggered short (without market support) and didn't work:

His GS triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Plus Report for 9-22-21

Opening comments posted to YouTube. Fed announcement at 2 pm EST is what the markets will focus on.

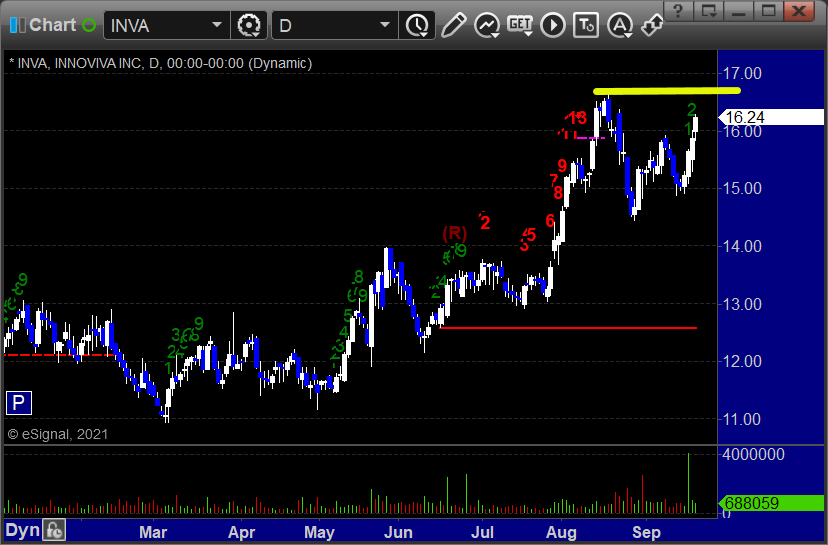

Longs first, in the order of best chart construction, starting with INVA > 16.72:

LIFE > 12.97:

On the short side, ZM < 273.20:

SUMO < 15.80: