Tradesight Recap Report for 8/3/22

Overview

The markets gapped up and did nothing for 90 minutes, then drifted higher into lunch, then did nothing on 4.4 billion NASDAQ shares.

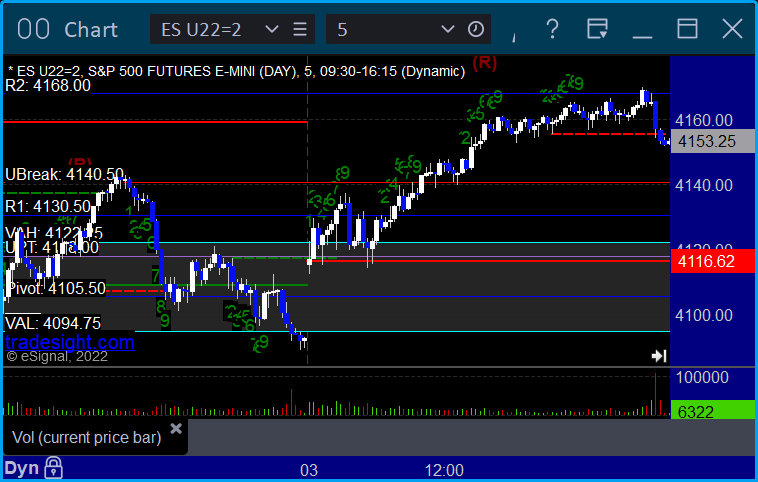

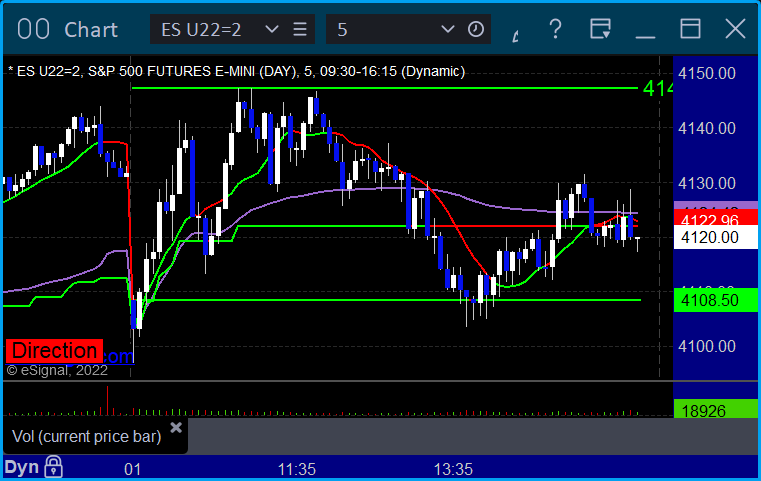

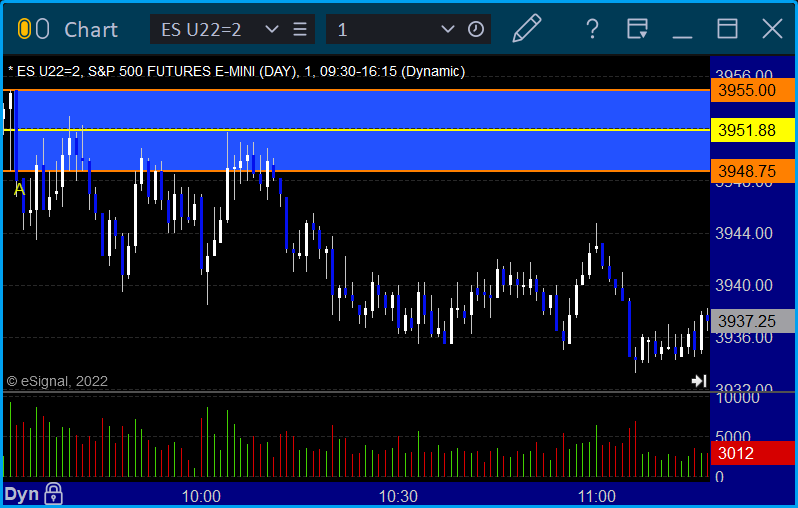

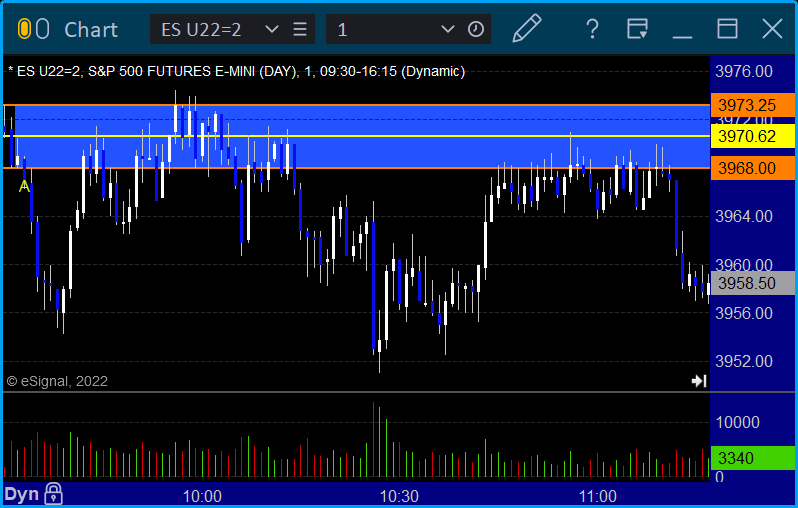

ES with Levels:

ES with Market Directional:

Futures:

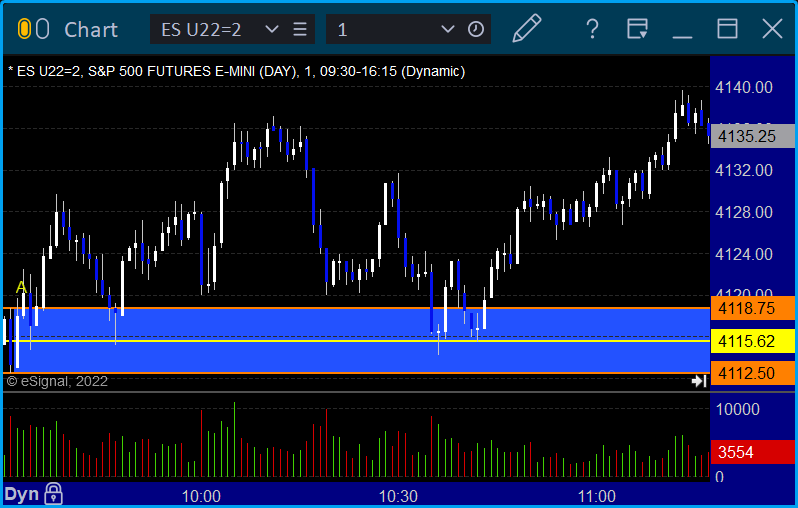

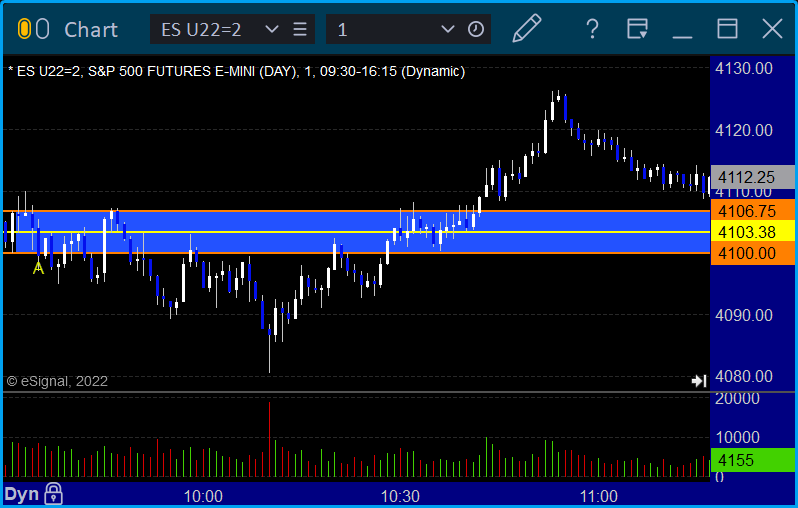

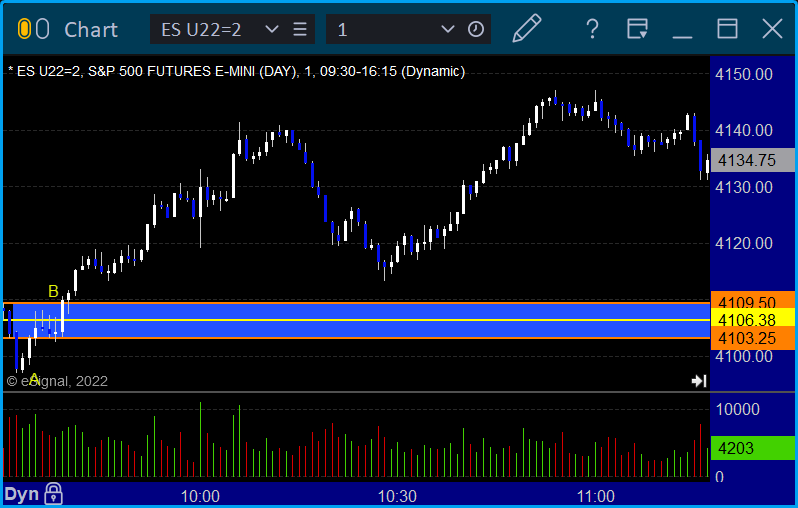

ES Opening Range Play triggered long at A and stopped under the midpoint:

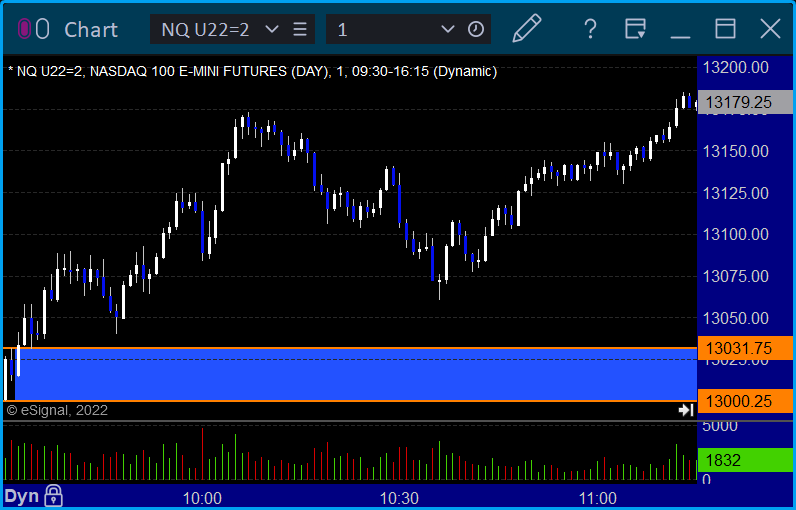

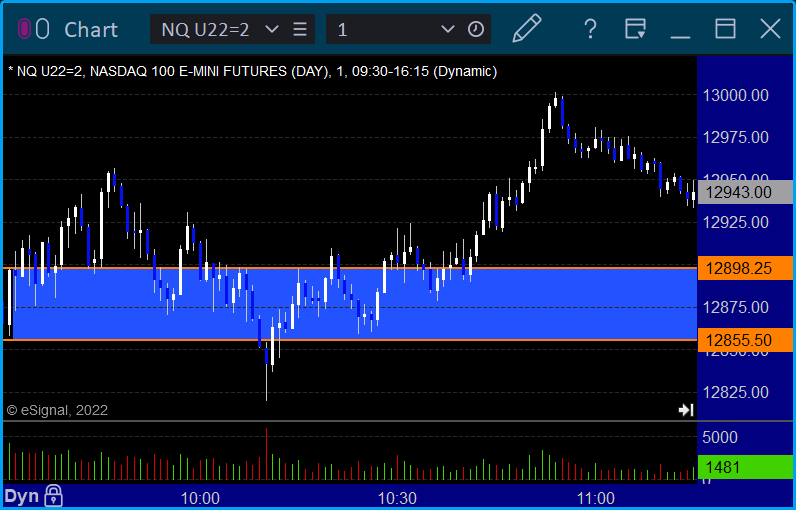

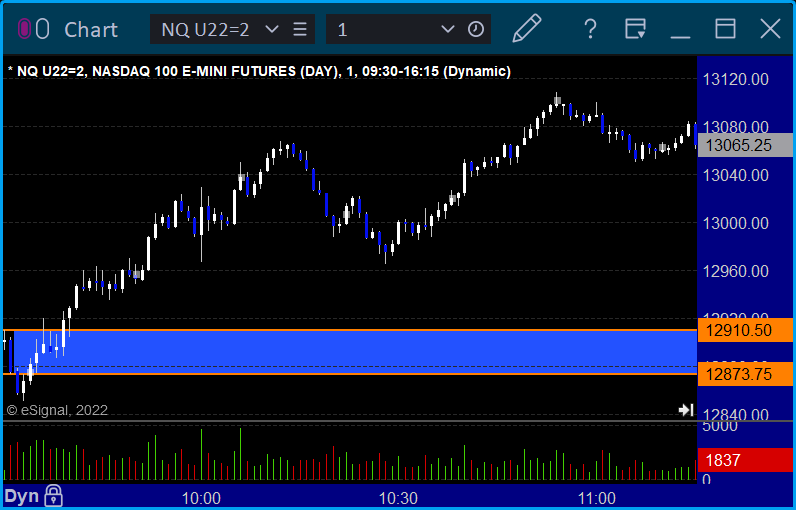

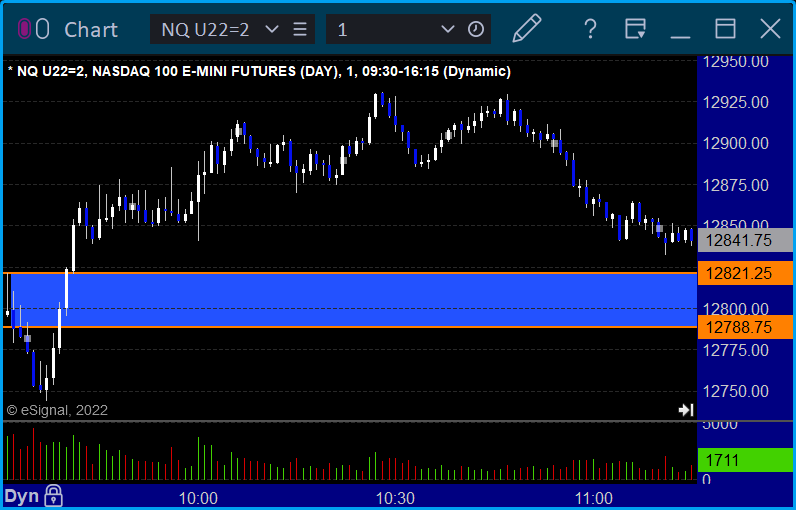

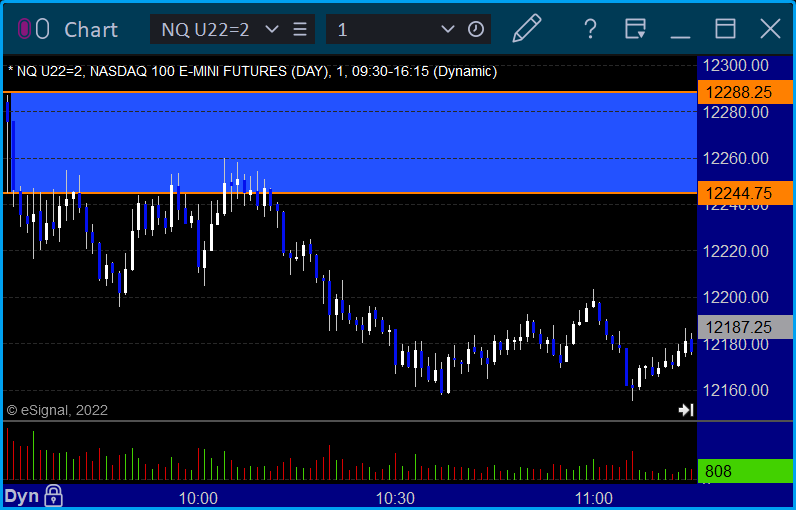

NQ Opening Range Play:

Results: -18 ticks

Forex:

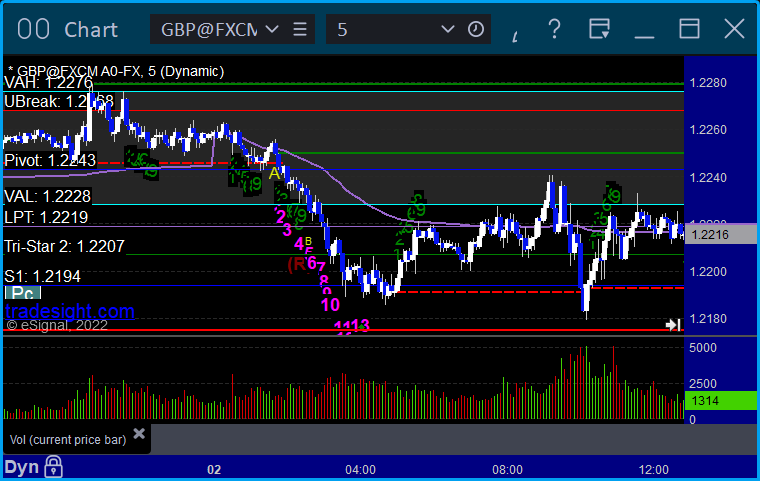

GBPUSD second half of the prior day's trade stopped, no new triggers:

Results: +20 pips

Stocks:

Yet another boring but green day.

From the Tradesight Plus Report, no calls.

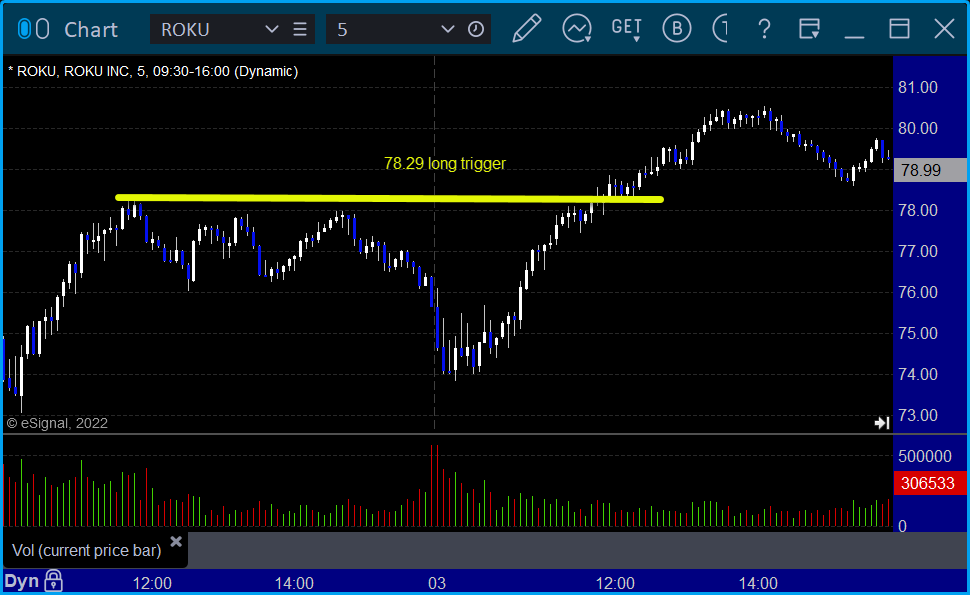

From the Tradesight Plus Twitter feed, Rich's ROKU triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 8/2/22

Overview

The markets gapped down, went lower, then rallied to fill the gap, went higher, and then sold off on the lows in a narrow range on 4.8 billion NASDAQ shares.

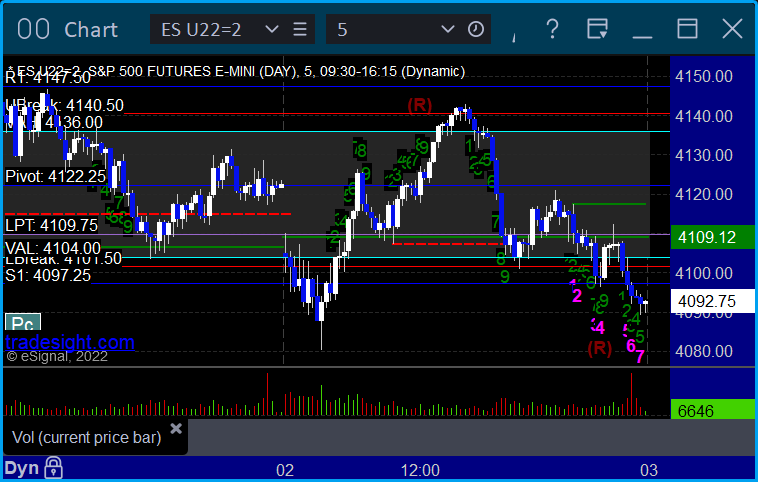

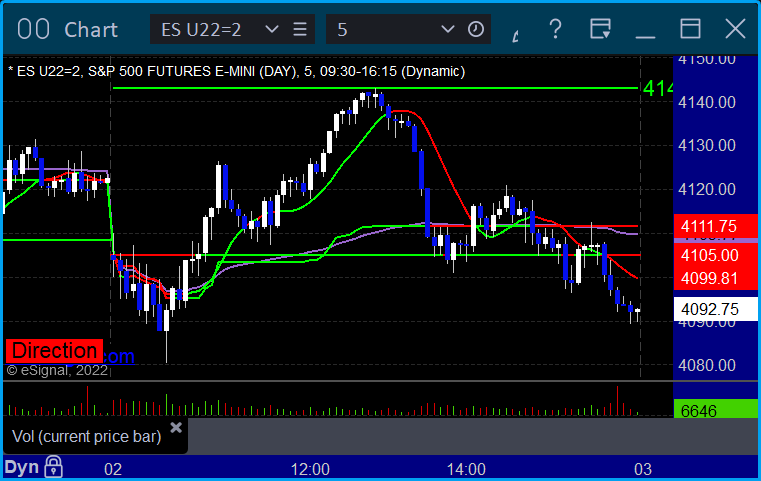

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial:

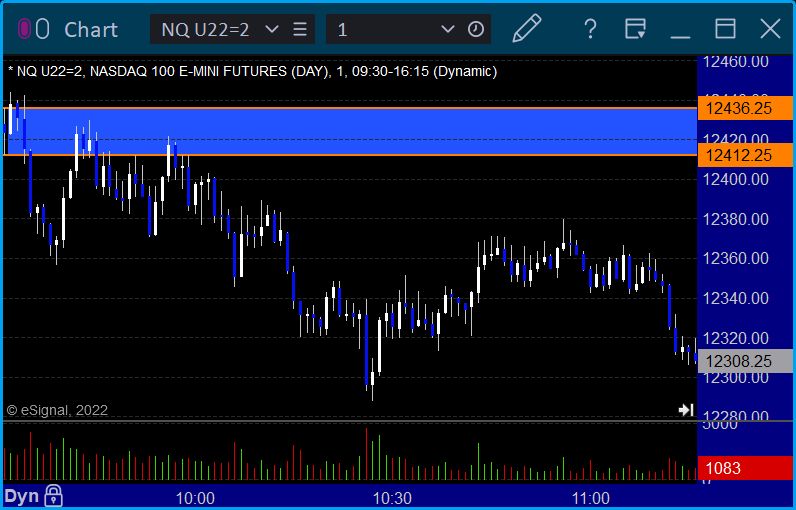

NQ Opening Range Play:

Results: +4 ticks

Forex:

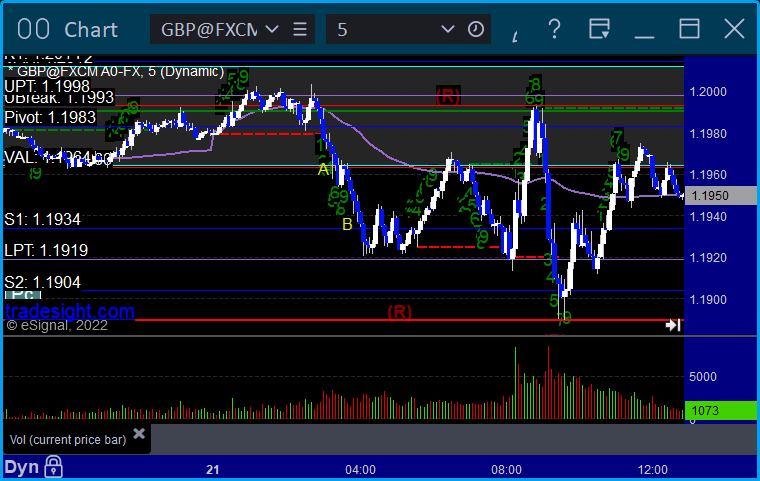

GBPUSD triggered short at A, hit first target at B, still holding second half with a stop over the entry:

Results: trade not complete

Stocks:

Another dull but green day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's CDNS triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 8/1/22

Overview

Markets gapped down, came back up to fill, then just went mostly flat for the rest of the day on 4.3 billion NASDAQ shares.

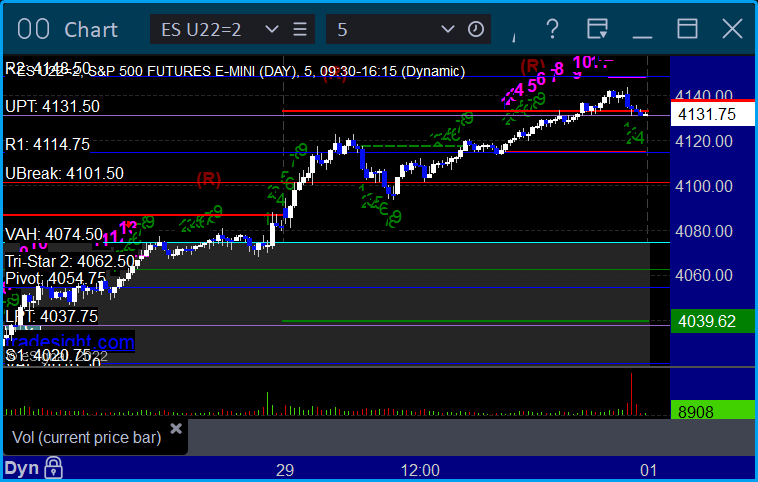

ES with Levels:

ES with Market Directional:

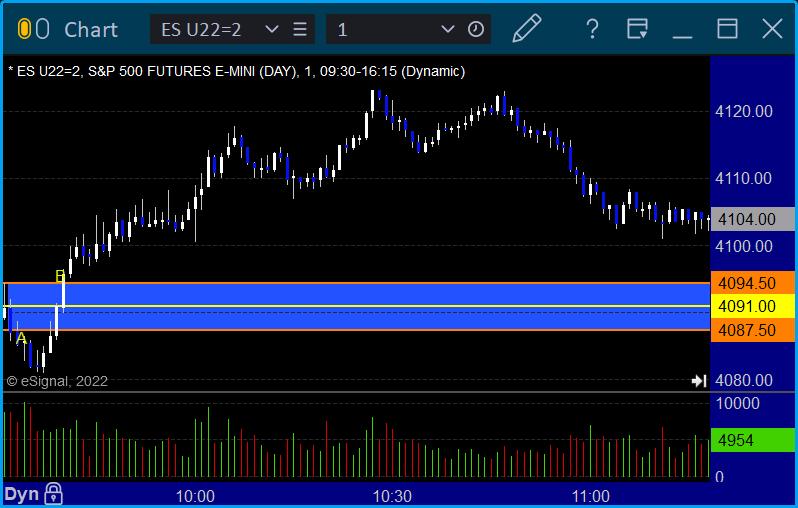

Futures:

ES Opening Range Play triggered short at A but too far out of range to take, triggered long at B and worked:

NQ Opening Range Play:

Results: +14.5 ticks

Forex:

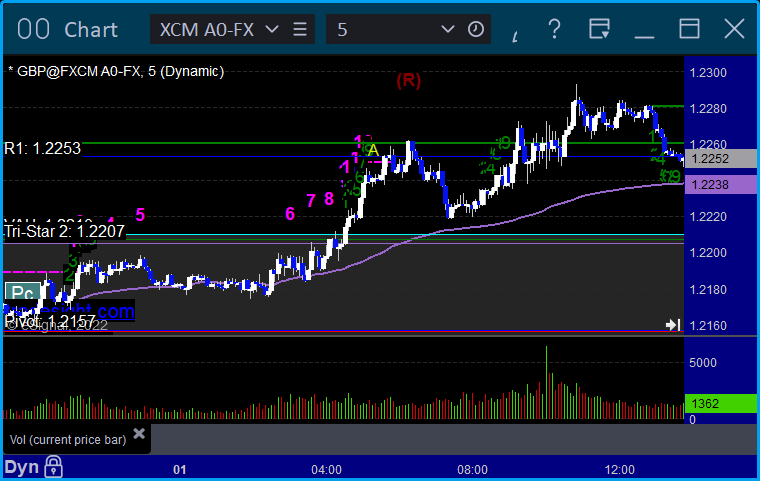

GBPUSD:

Results: -25 pips

Stocks:

Not much of a day, but a green one.

From the Tradesight Plus Report, no calls.

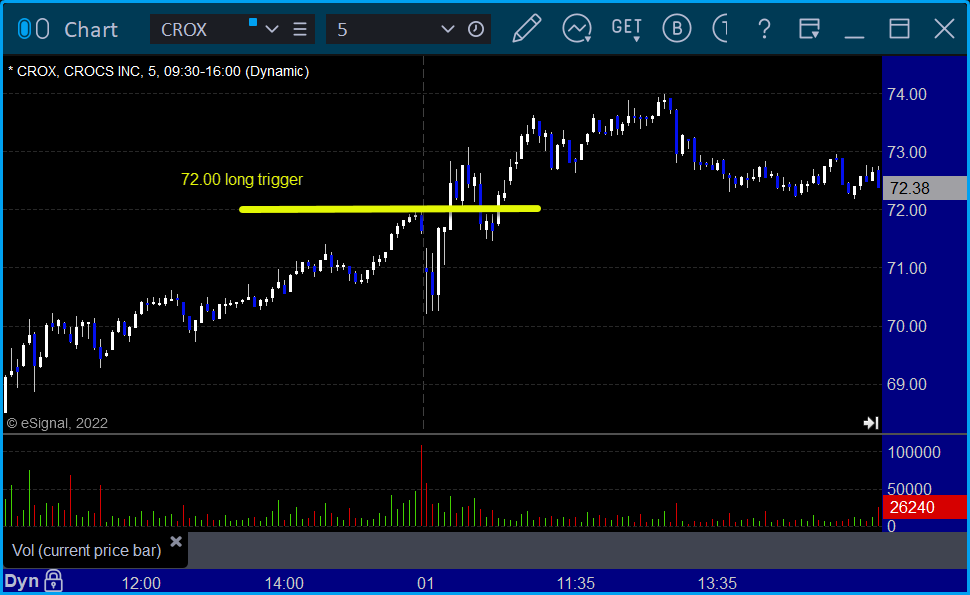

From the Tradesight Plus Twitter feed, Rich's CROX triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 7/29/22

Overview

The markets opened fairly flat and drifted higher on 4.9 billion NASDAQ shares for end of month.

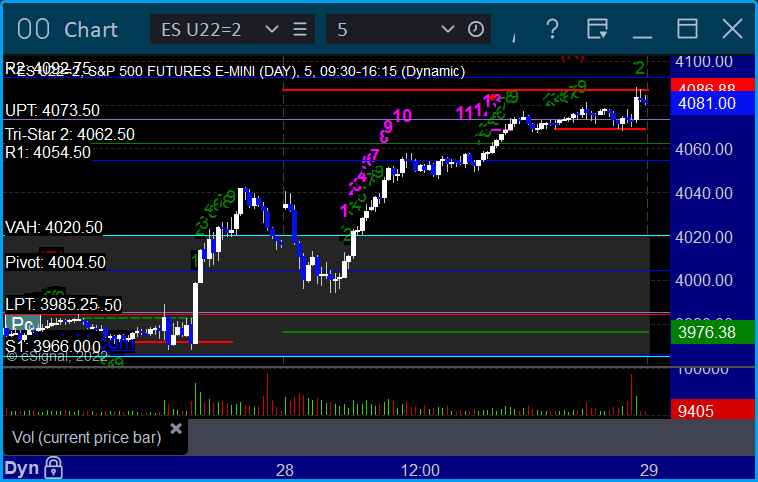

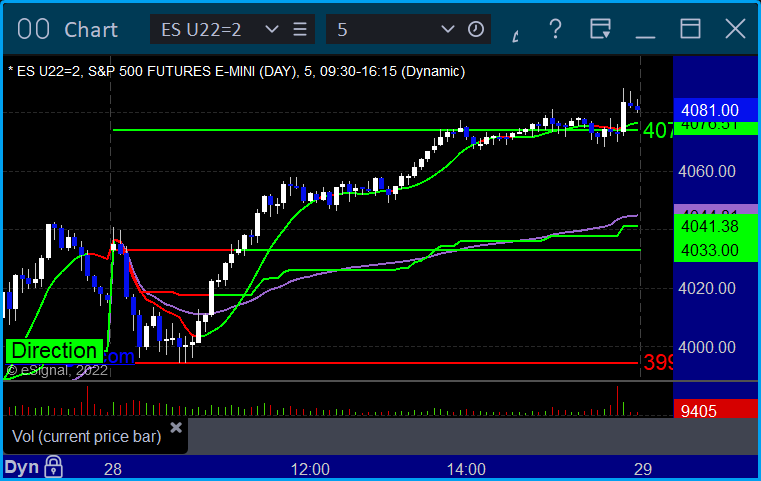

ES with Levels:

ES with Market Directional:

Futures:

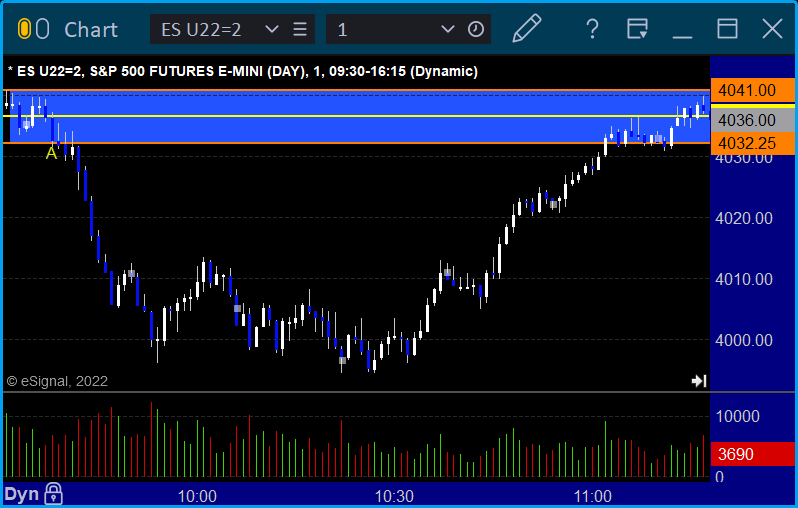

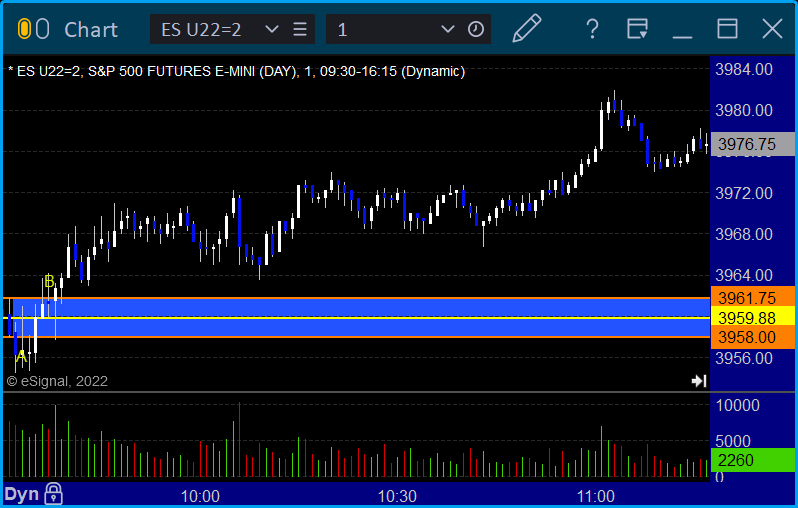

ES Opening Range Play triggered short at A and worked, triggered long at B and worked:

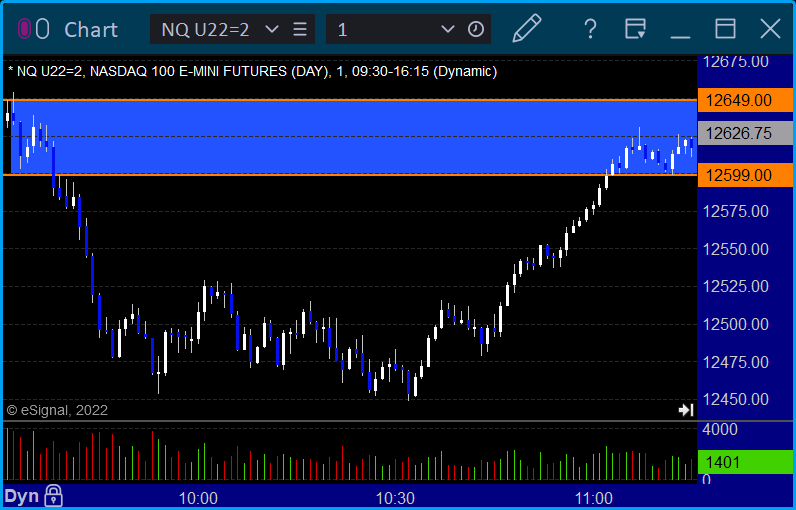

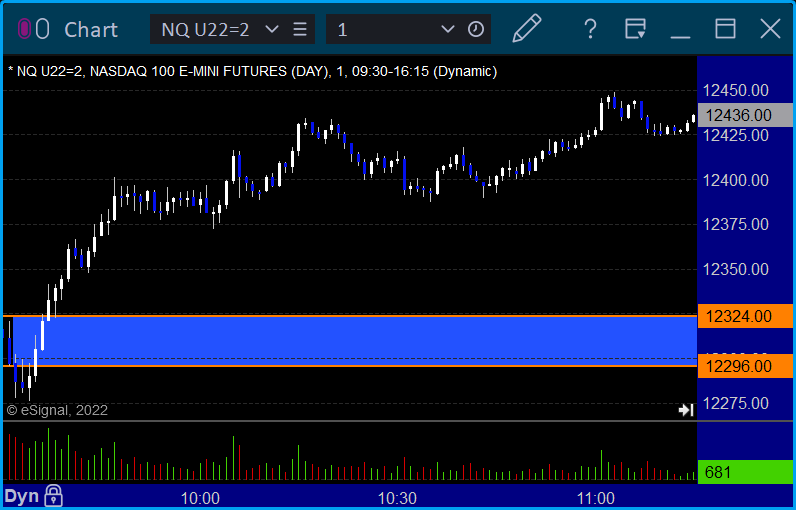

NQ Opening Range Play:

Results: +16.5 ticks

Forex:

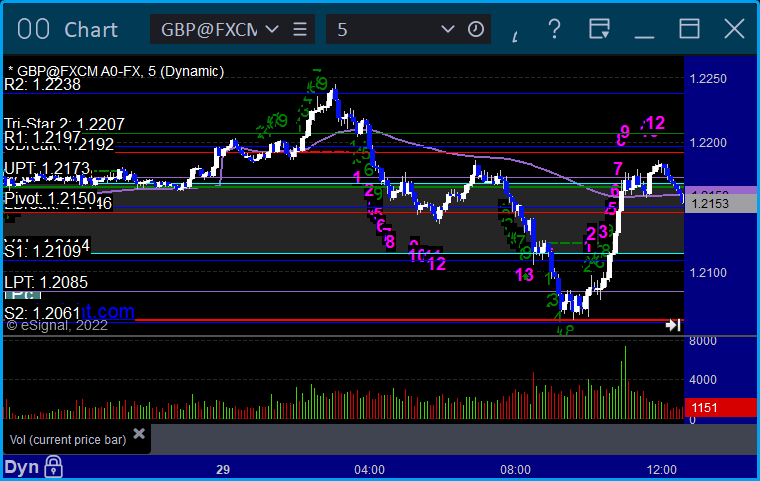

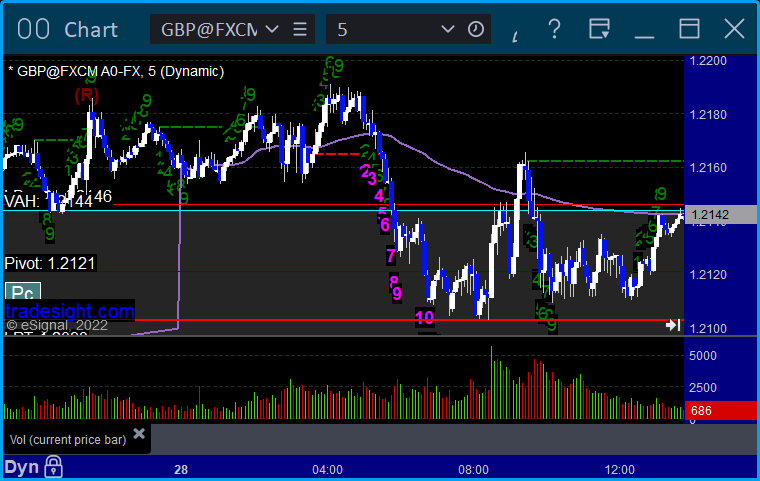

GBPUSD no calls for the end of month:

Results: +0 pips

Stocks:

Only one call but it worked.

From the Tradesight Plus Report, no calls.

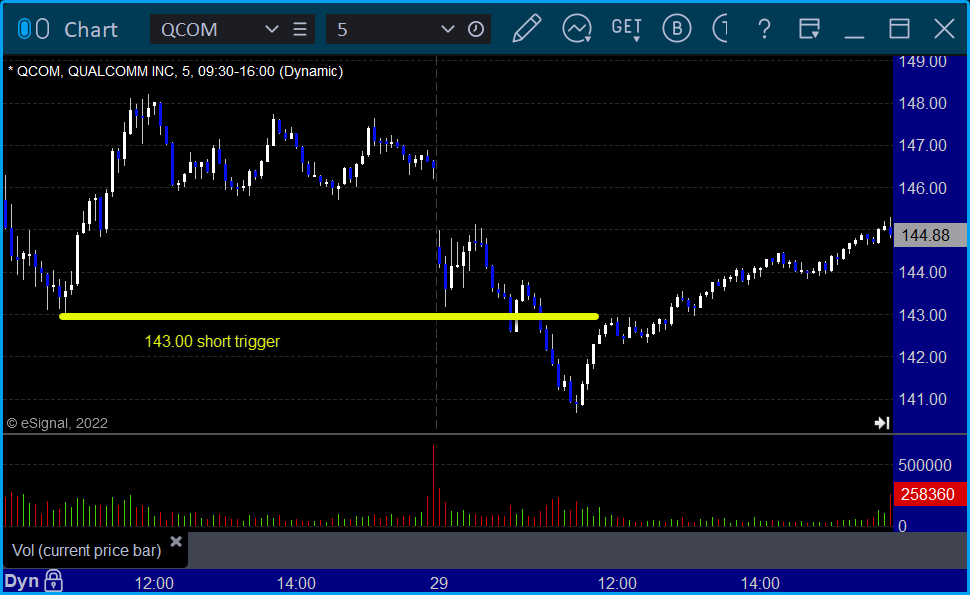

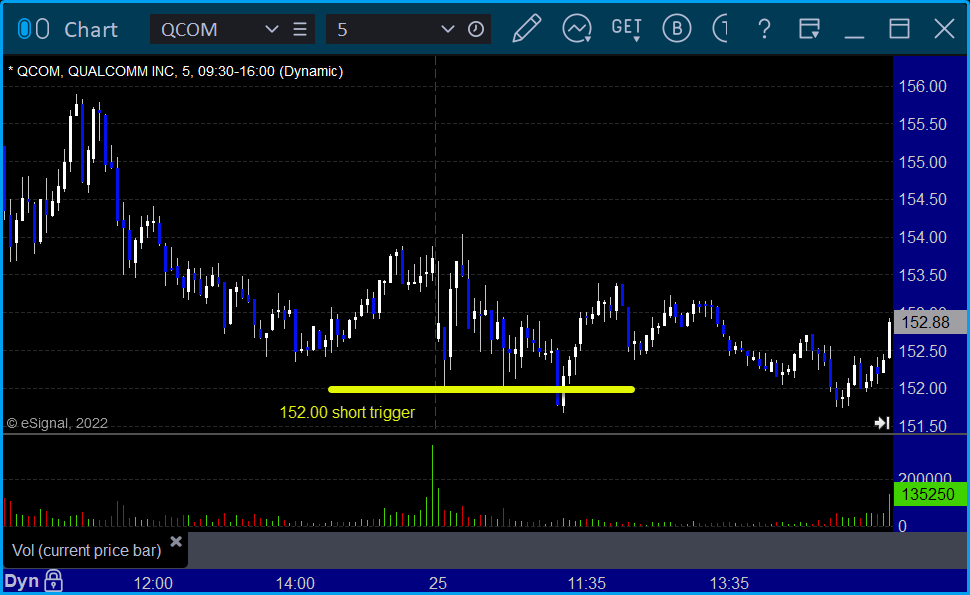

From the Tradesight Plus Twitter feed, Rich's QCOM triggered short (with market support) and worked:

That’s 1 trigger with market support and it worked.

Tradesight Recap Report for 7/28/22

Overview

The markets gapped up, filled, went a bit lower, then came back up and didn't do much in the afternoon for end of quarter on 4.7 billion NASDAQ shares.

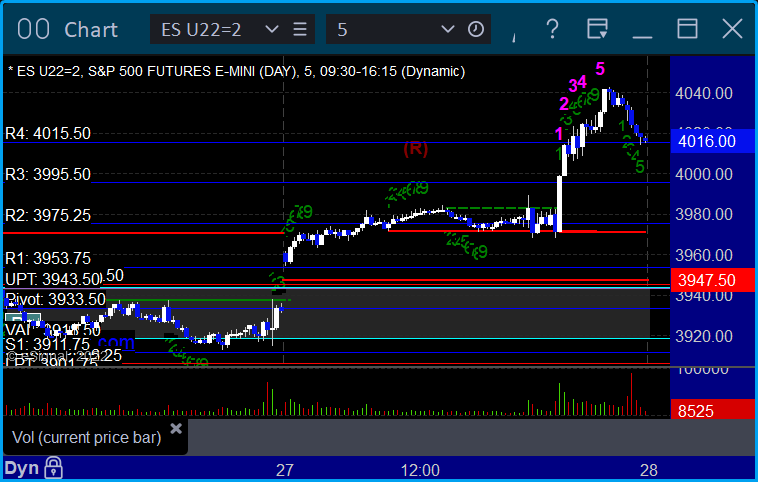

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked big:

NQ Opening Range Play:

Results: +44 ticks

Forex:

GBPUSD, no calls:

Results: +0 pips

Stocks:

A nice day again.

From the Tradesight Plus Report, no calls.

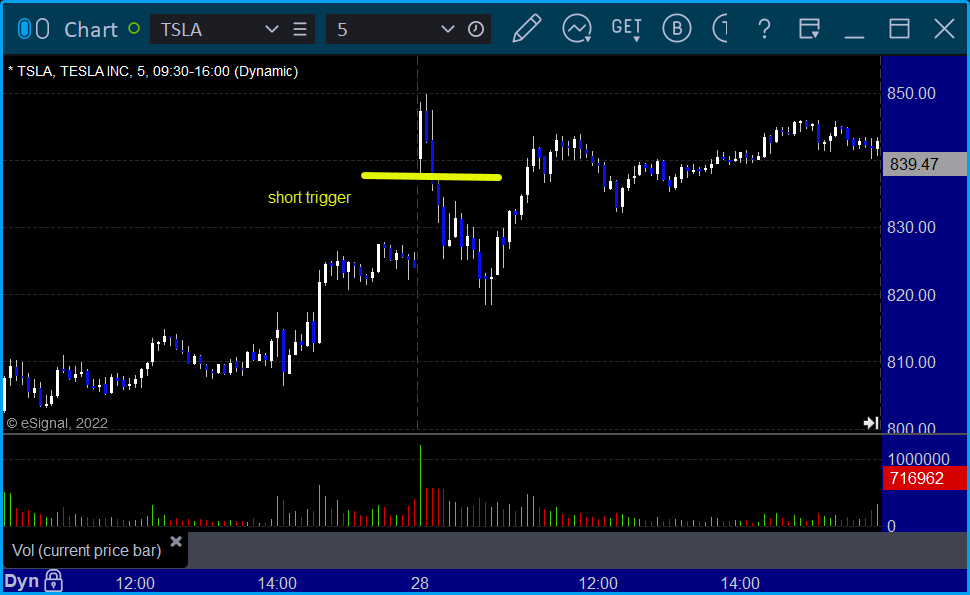

From the Tradesight Plus Twitter feed, Rich's TSLA triggered short (with market support) and worked:

His FAS triggered long (ETF, so no market support needed) and worked a little):

His INTU triggered long (with market support) and worked a little:

That’s 3 triggers with market support, all of them worked.

Tradesight Recap Report for 7/27/22

Overview

The markets gapped up and went dead flat while waiting for the Fed, then popped on the news and pulled back late on 4.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and stopped, triggered long at B and stopped:

NQ Opening Range Play:

Results: -28 ticks

Forex:

No calls ahead of the Fed.

GBPUSD:

Results: +0 pips

Stocks:

No trades. Nothing triggered until the last 30 minutes.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, no calls.

That’s 0 triggers with market support.

Tradesight Recap Report for 7/26/22

Overview

The markets gapped down and went lower until lunch, then started waiting for the Fed on 4.8 billion NASDAQ shares.

ES with Levels:

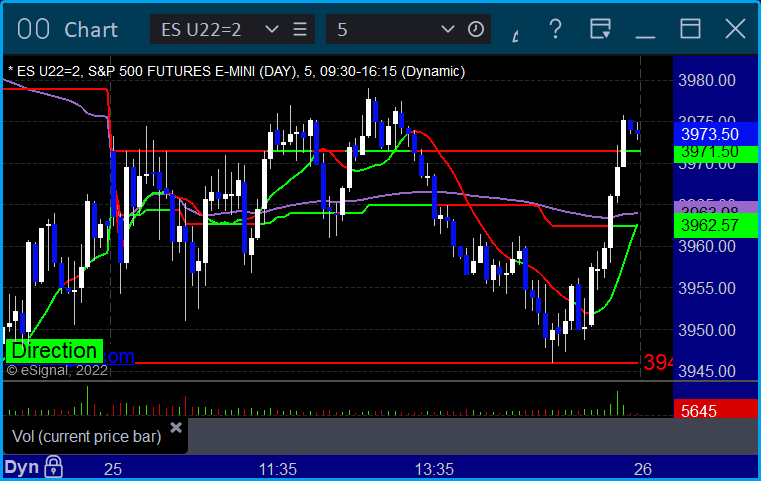

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play:

Results: +4 ticks

Forex:

Came into the session long the second half of the prior day's trade and stopped in the money.

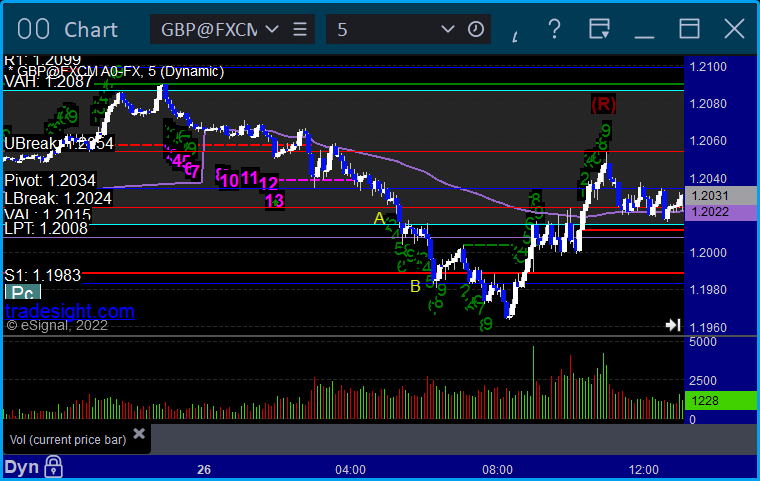

GBPUSD triggered short at A, hit first target at B, stopped second half over the entry:

Results: +50 pips

Stocks:

A good day on one stock.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's CRWD triggered short (with market support) and worked big:

His CAT triggered long (without market support) and didn't work:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 7/25/22

Overview

A dead flat day in the markets ahead of the Fed on 4.6 billion NASDAQ shares.

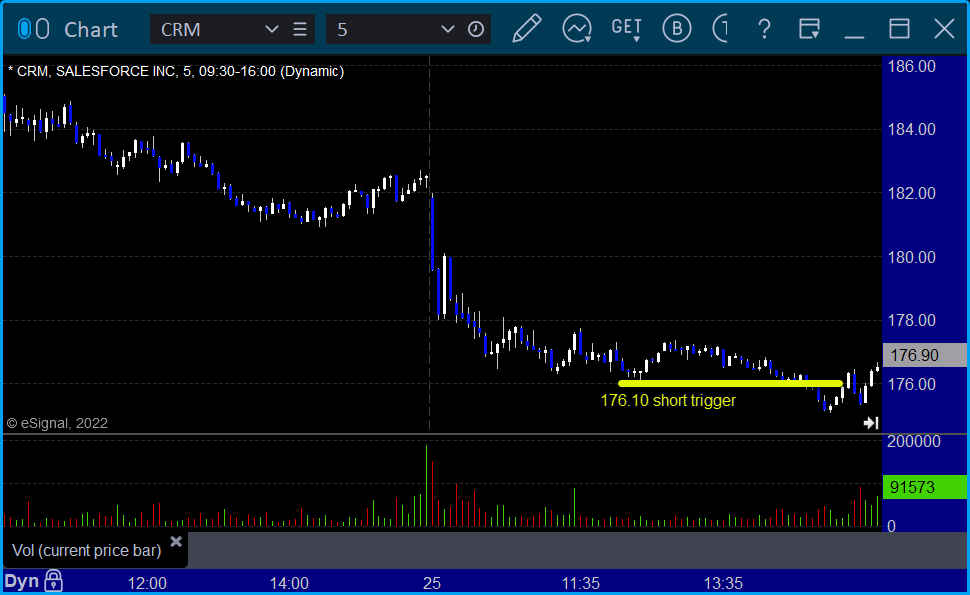

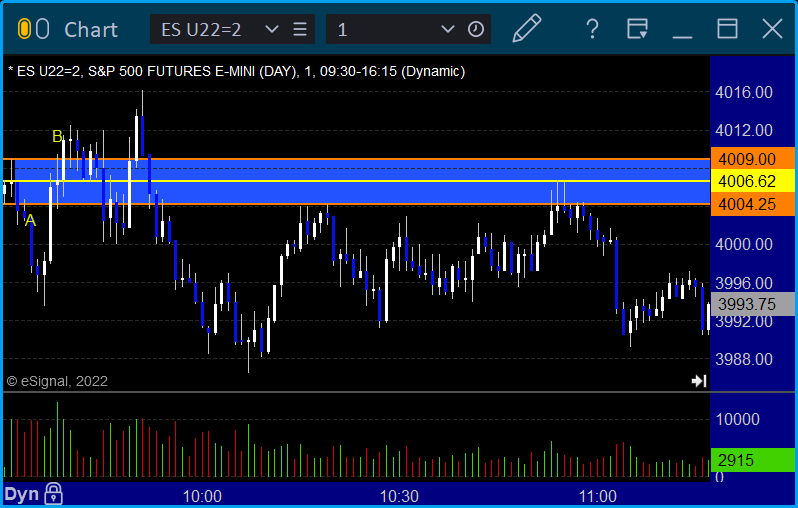

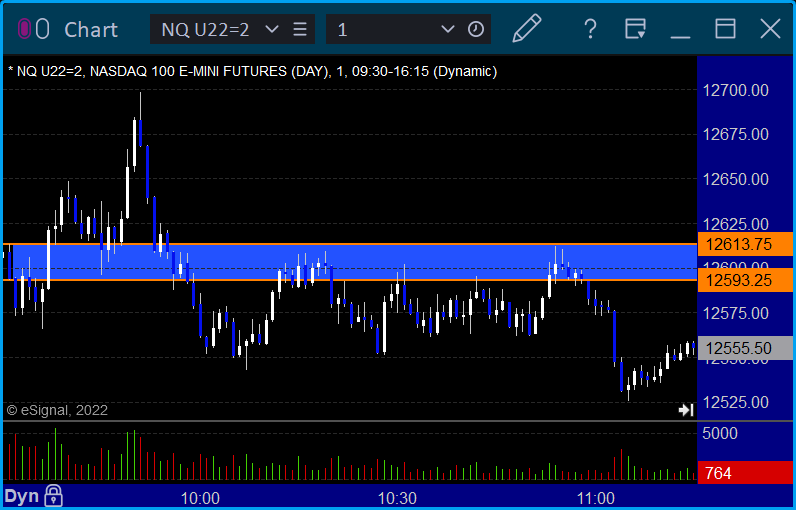

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play:

Results: +21.5 ticks

Forex:

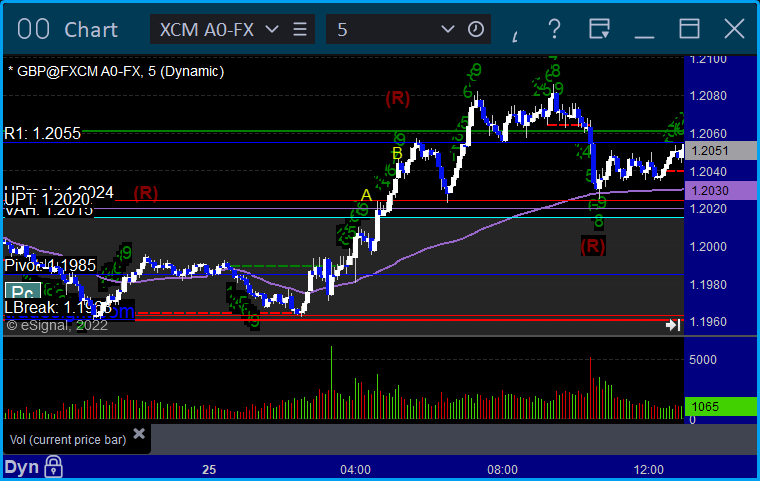

GBPUSD triggered long at A, hit first target at B, still holding second half:

Results: Trade not complete

Stocks:

Not a big day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's QCOM triggered short (without market support) and didn't work:

His META triggered short (with market support) and worked:

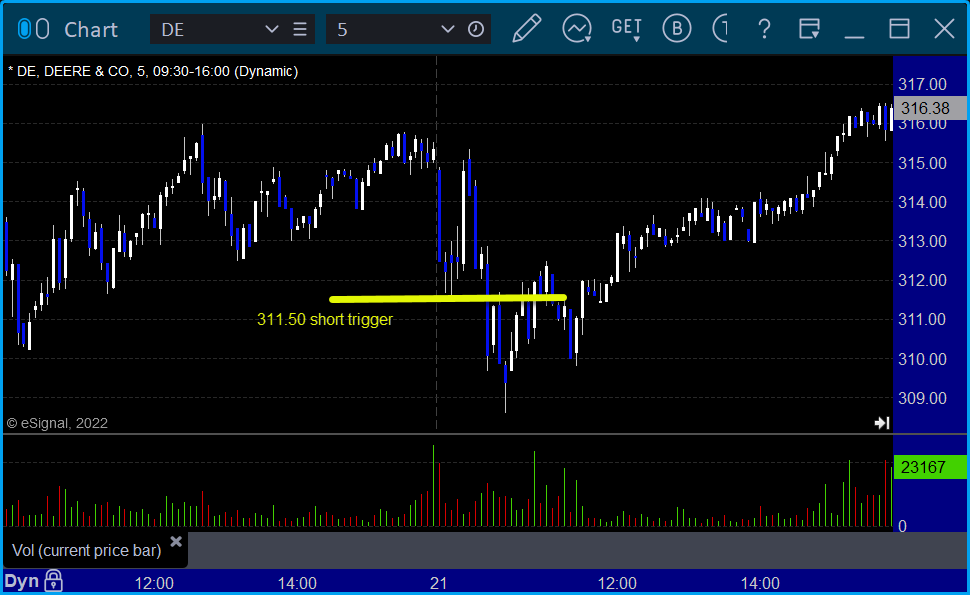

His DE triggered long (with market support) and worked:

His AMZN triggered short (with market support) and worked a little:

His CRM triggered short (with market support) and didn't do enough to count:

That’s 4 triggers with market support, 3 of them worked and 1 didn't do anything.

Tradesight Recap Report for 7/22/22

Overview

The markets opened flat and did nothing until lunch, then dipped a bit but that was it for a summer Friday during earnings season on 4.7 billion NASDAQ shares.

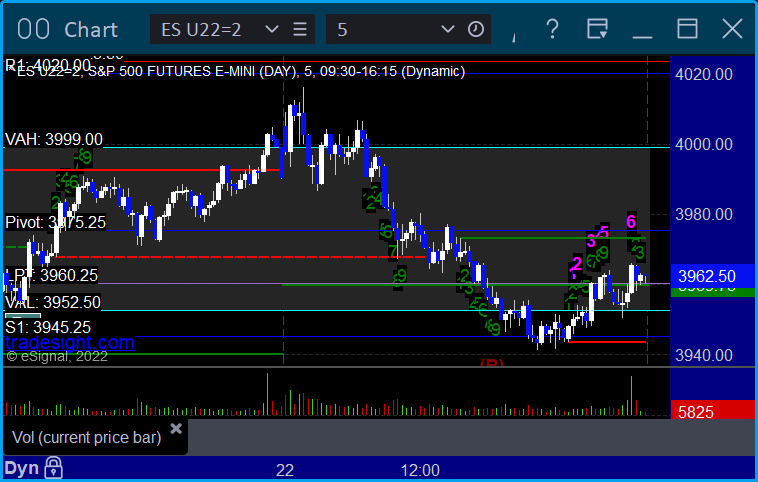

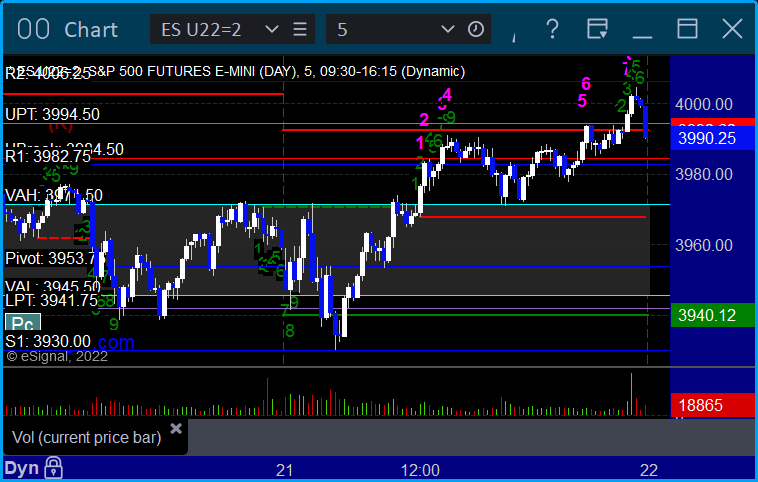

ES with Levels:

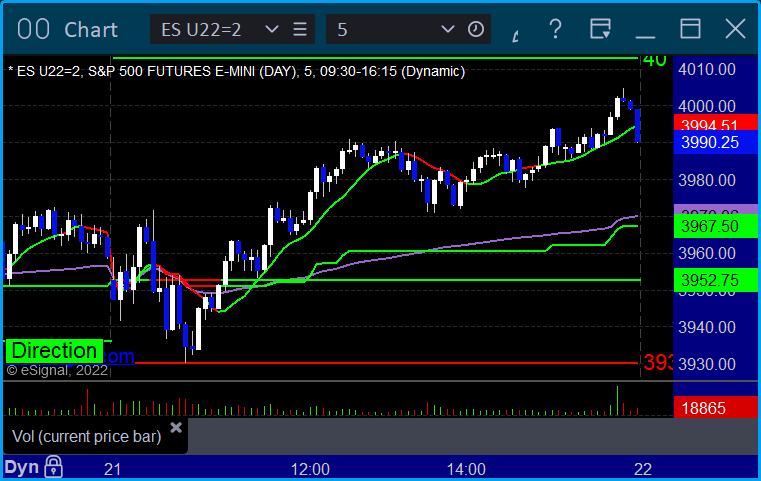

ES with Market Directional:

Futures:

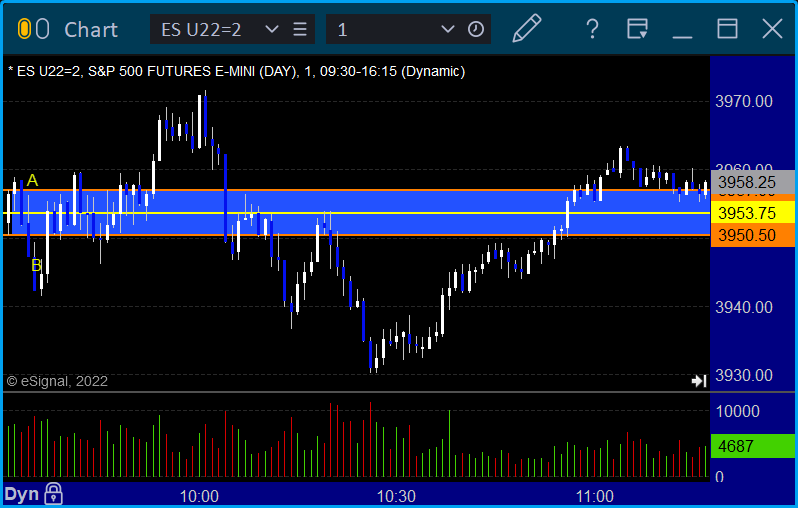

ES Opening Range Play triggered short at A and worked, triggered long at B and stopped:

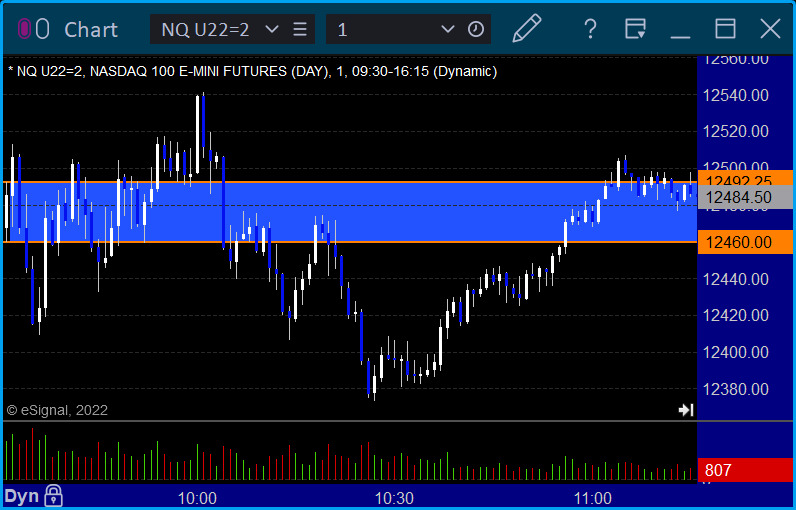

NQ Opening Range Play:

Results: -6 ticks

Forex:

GBPUSD triggered short at A and stopped, triggered long at B, hit first target at C, stopped second half under the entry for end of week:

Results: -5 pips

Stocks:

Not much of a day for a summer doldrum Friday between the core 2 weeks of earnings.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, no triggers.

That’s 0 triggers with market support.

Tradesight Recap Report for 7/21/22

Overview

A mostly dead day until a late rally on a light 4.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped, triggered short at B but too far out of range to take:

NQ Opening Range Play:

Results: -19 ticks

Forex:

GBPUSD triggered short at A, hit first target at B, second half stopped over the entry:

Results: +10 pips

Stocks:

Not much of a day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's DE triggered short (with market support) and worked enough for a partial:

That’s 1 trigger with market support, and it worked a little.