Tradesight Recap Report for 8/10/21

Overview

The market opened flat, tried to push up, came back, closed even, not much action again on 3.9 billion NASDAQ shares.

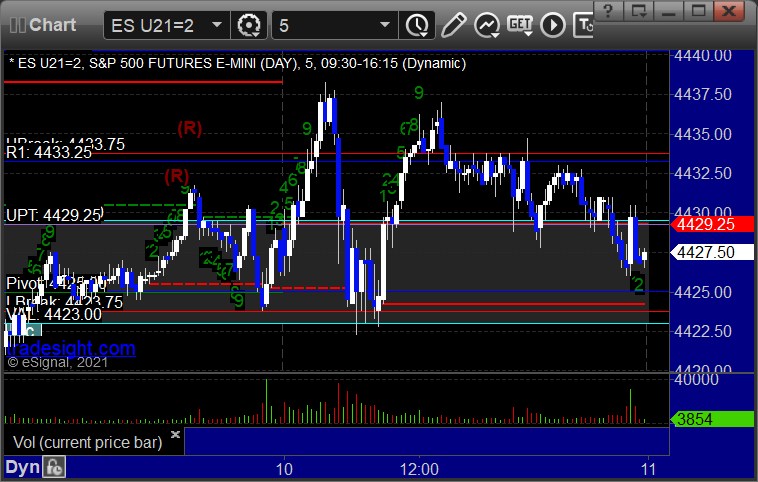

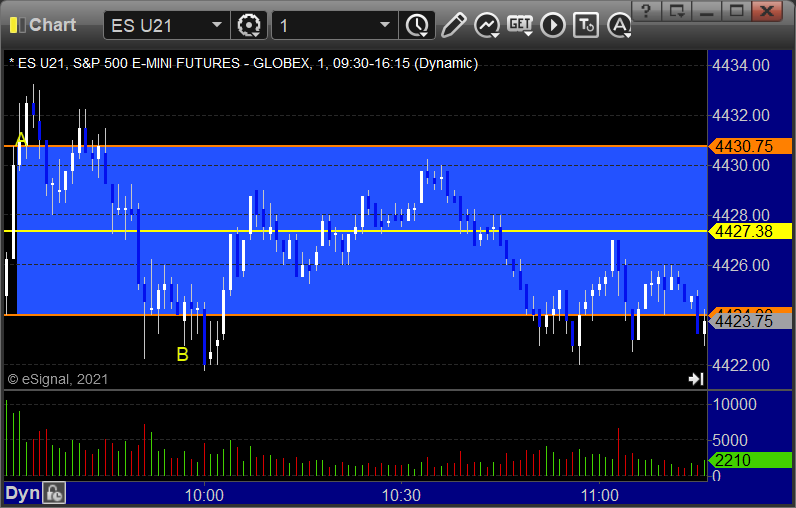

ES with Levels:

ES with Market Directional:

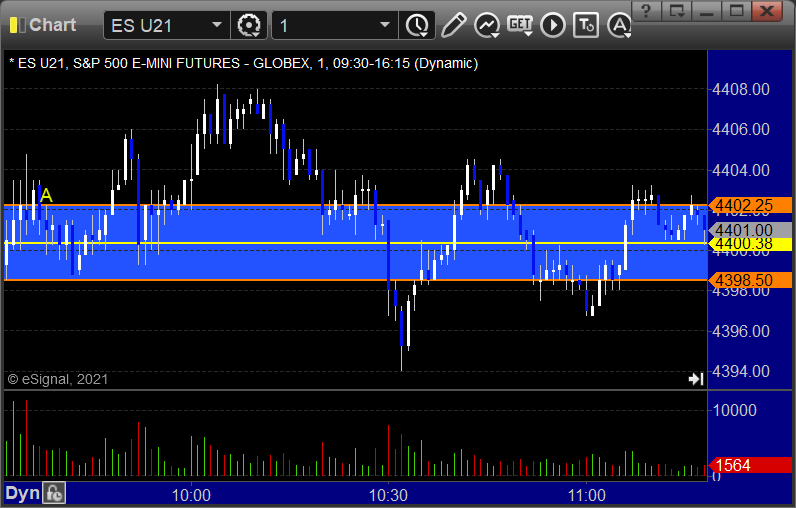

Futures:

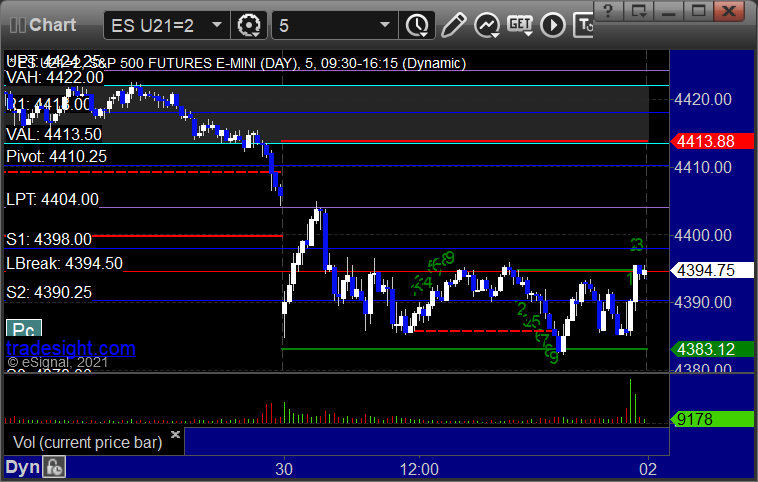

ES Opening Range Play triggered long at A and worked:

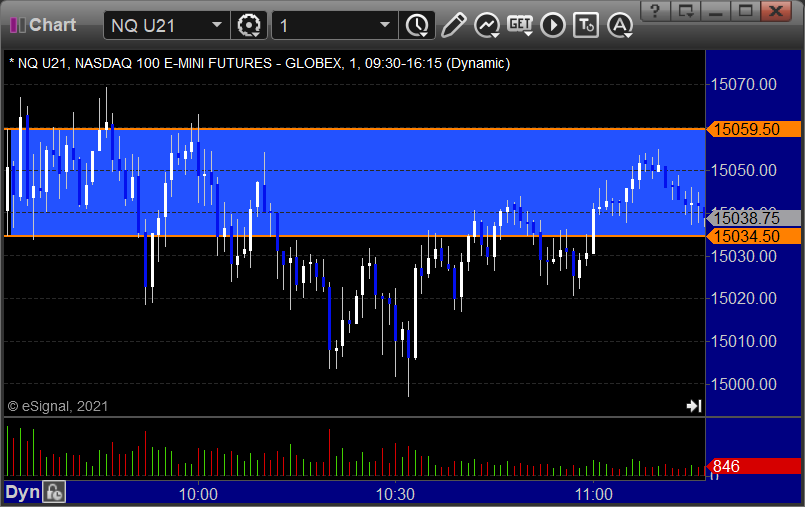

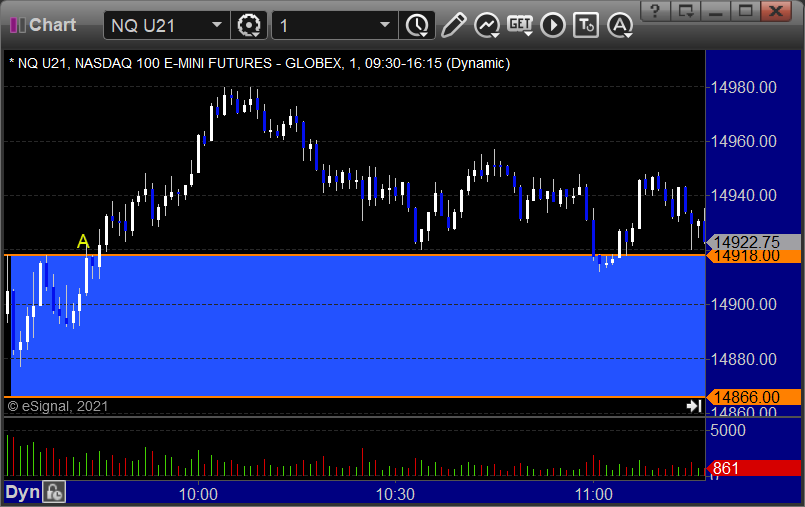

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +6.5 ticks

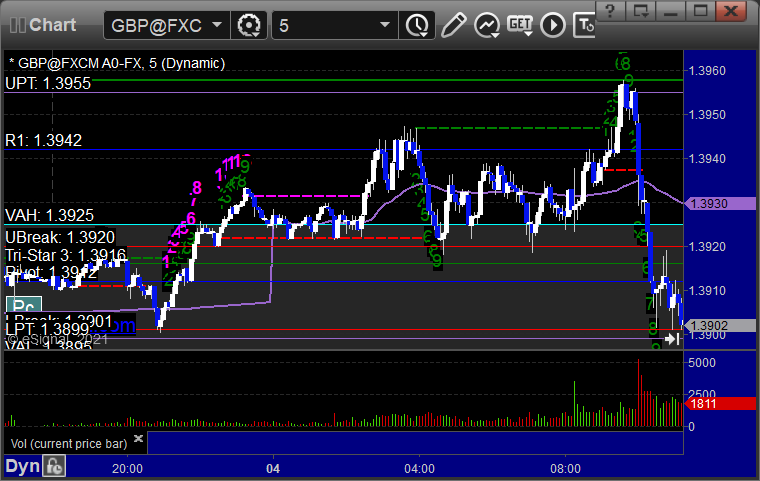

Forex:

No calls because the Levels spacing was horrible.

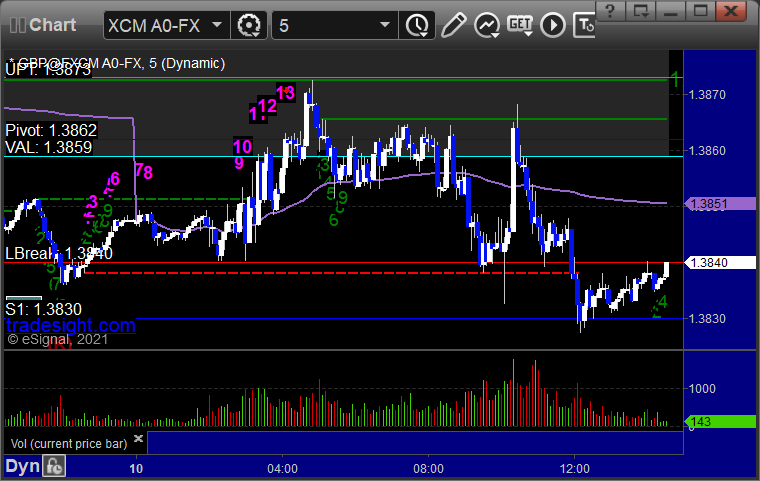

GBPUSD:

Results: +0 pips

Stocks:

Not too much given the dull action.

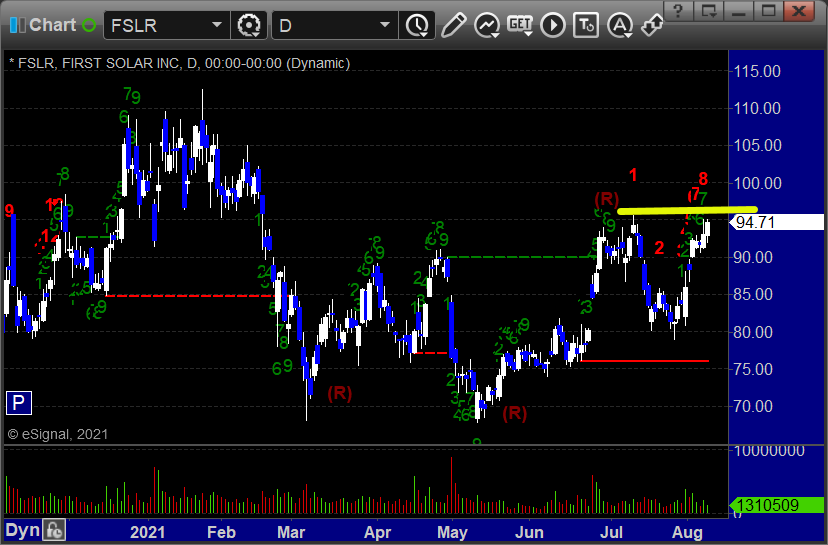

From the Tradesight Plus Report, FSLR triggered long (with market support) and we closed it for a small loss after the markets tanked:

From the Tradesight Plus Twitter feed, LYFT triggered long (with market support) and worked:

LULU triggered short (with market support) and we closed it even late in the day:

That’s 3 triggers with market support, 1x of them worked and 1 didn’t and 1 was breakeven.

Tradesight Plus Report for 8-10-21

Opening comments posted to YouTube. Still waiting for some real action.

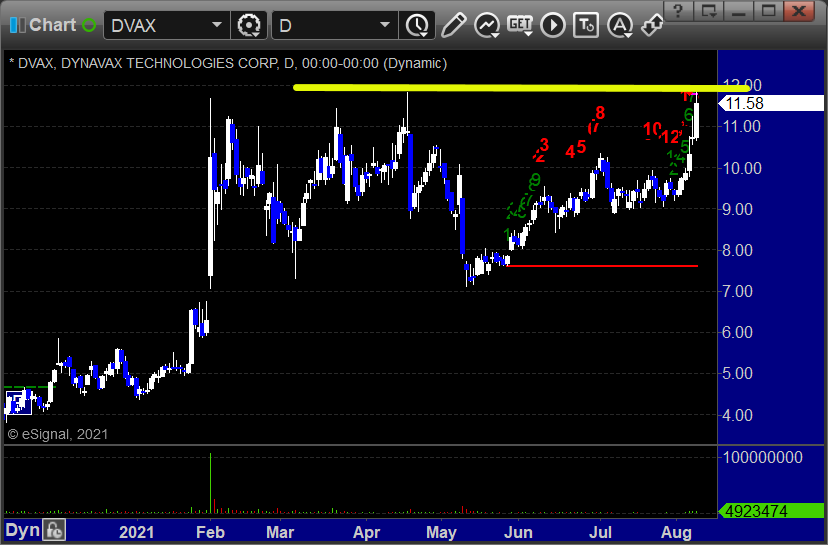

Longs only, in order of best chart construction, starting with DVAX > 11.90:

VXRT > 11.11:

FSLR > 95.64:

Tradesight Recap Report for 8/9/21

Overview

A big day in our trading mostly because of the Opening Range Plays on the ES. Markets gapped up small, dropped a bit, and then hung out mostly flat all day on 4.1 billion NASDAQ shares.

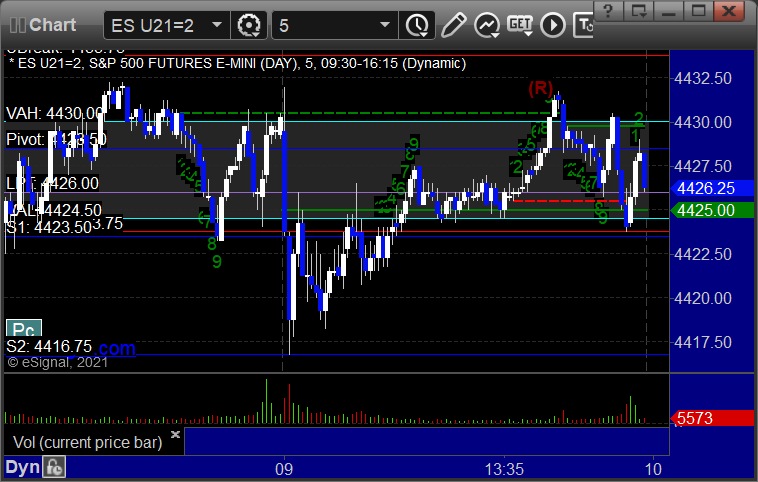

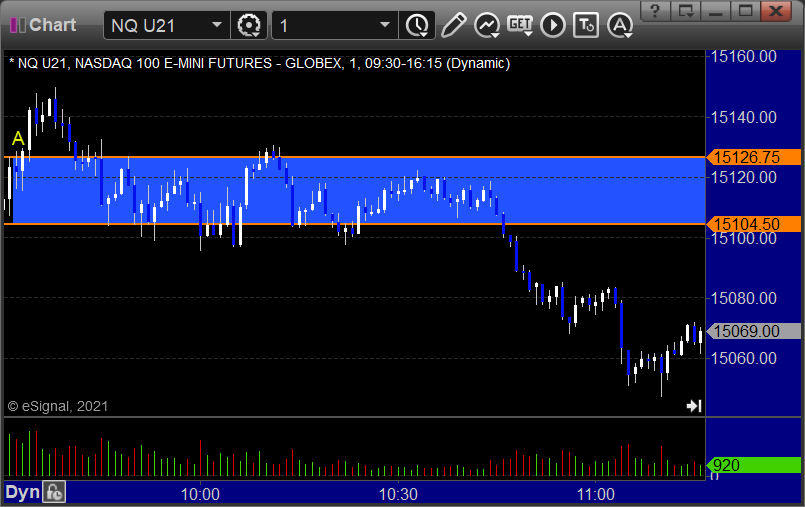

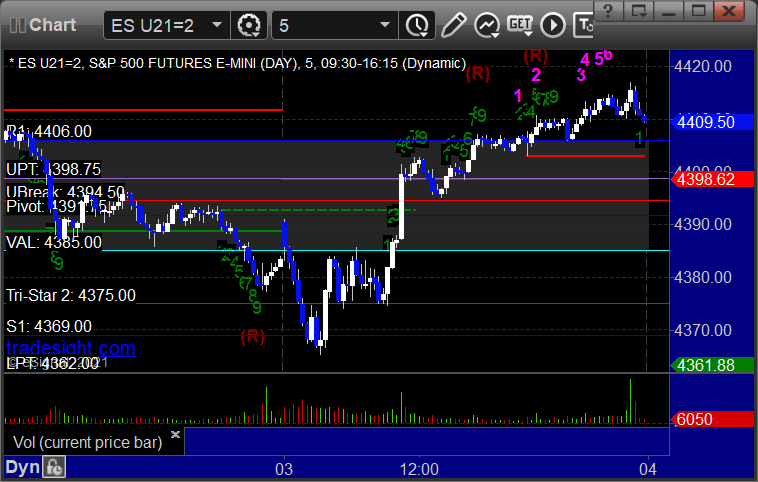

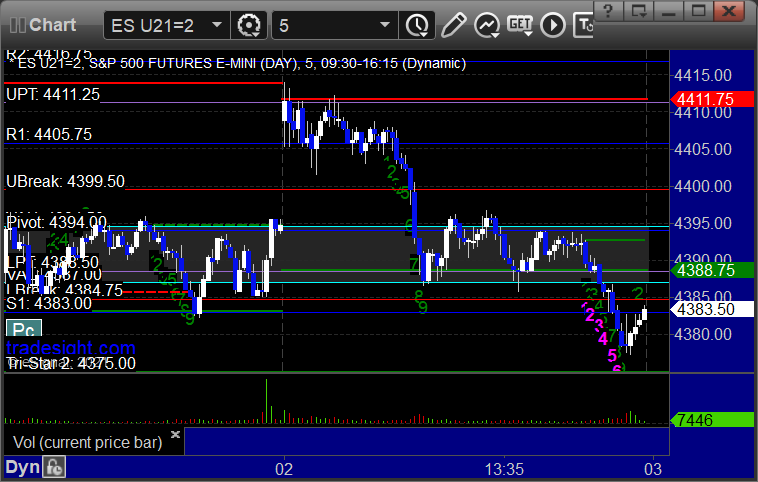

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked great:

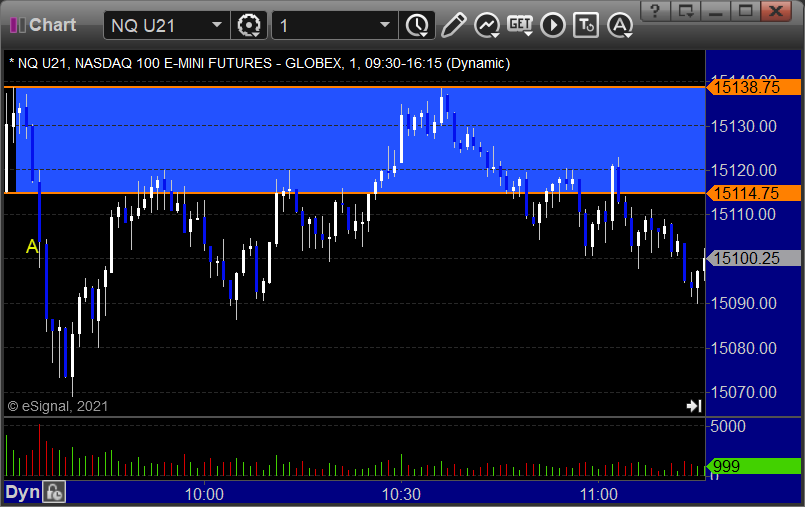

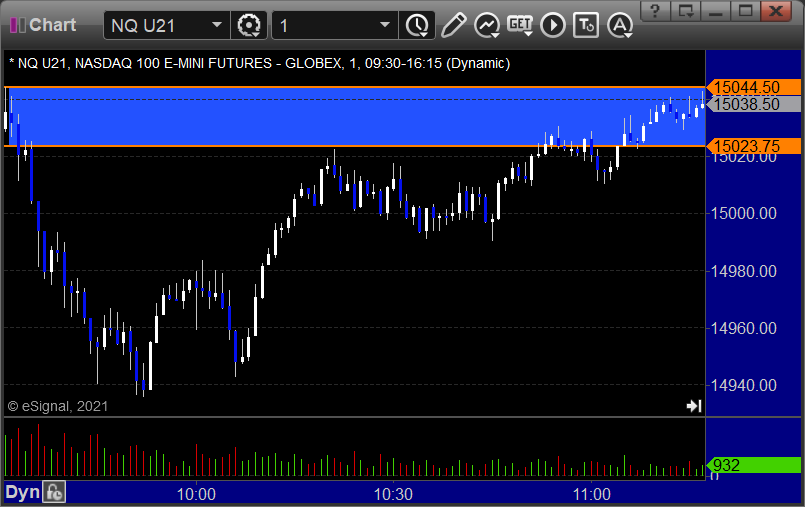

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +18.5 ticks

Forex:

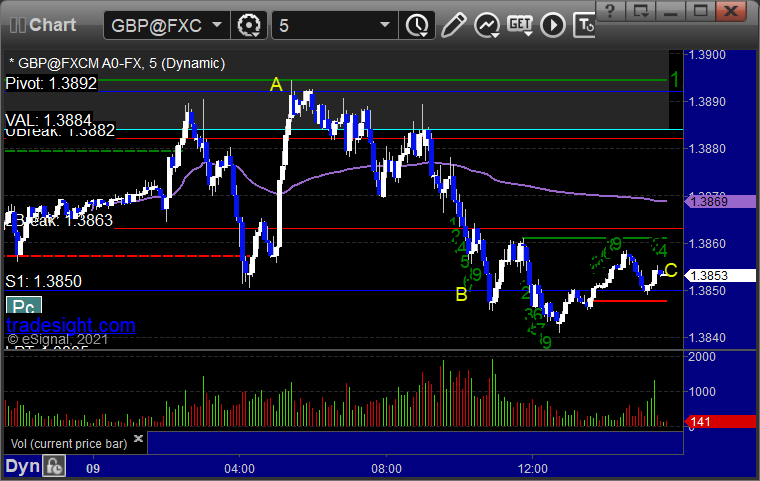

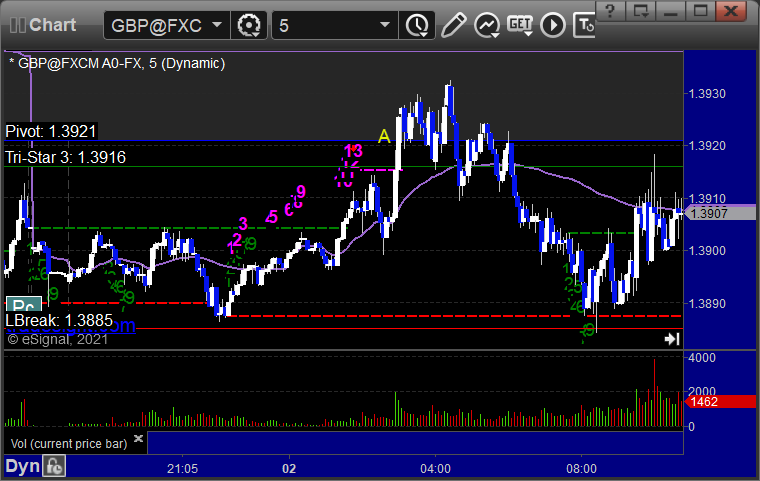

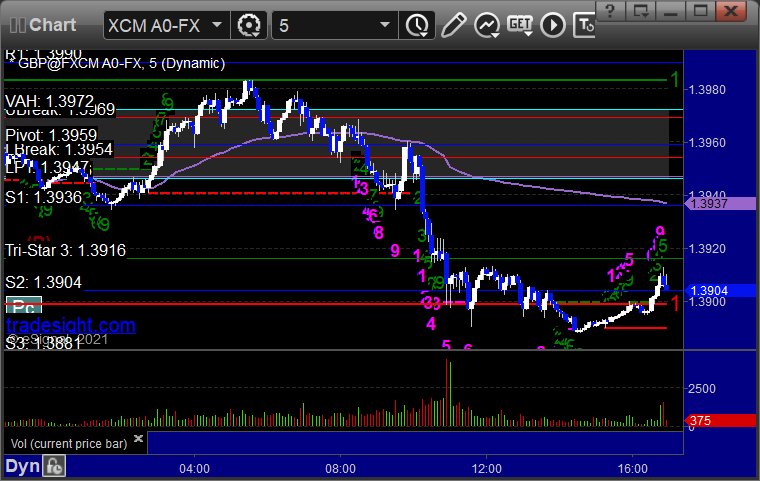

GBPUSD triggered long at A and stopped, triggered short at B, closed at C for a 5 pips loss:

Results: -30 pips

Stocks:

Not much of a day given the flat action.

From the Tradesight Plus Report:

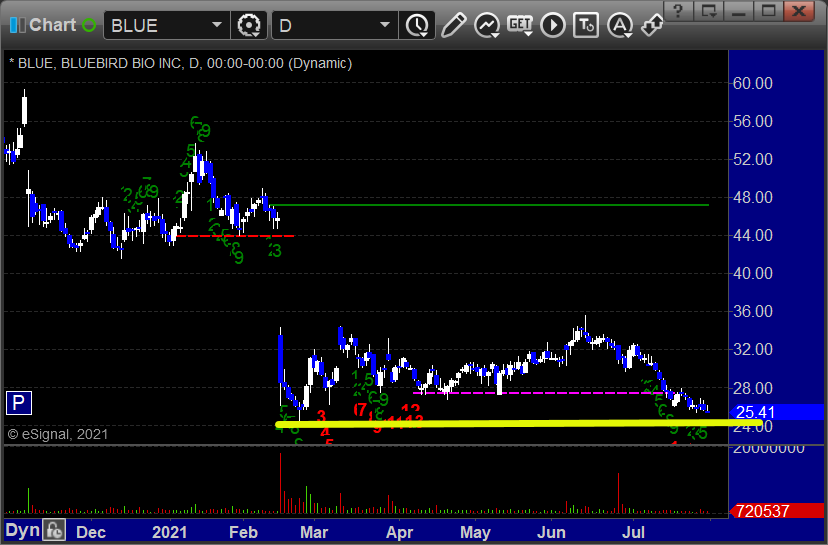

BLUE gapped under.

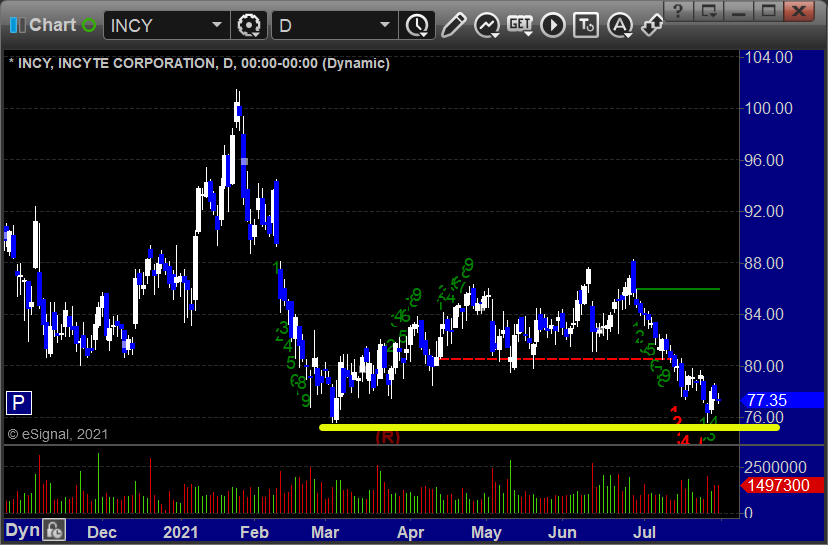

INCY triggered short (with market support) and worked a little:

From the Tradesight Plus Twitter feed, nothing triggered.

That’s 1 trigger with market support, and it worked a little.

Tradesight Recap Report for 8/6/21

Overview

The ES gapped up and was dead flat, spent almost the whole day inside the range of the opening 5 minute candle, and closed in the Opening Range. NASDAQ gapped down and went lower early, but then recovered to the midpoint and sat dead flat on 4.1 billion NASDAQ shares. Waste of a day.

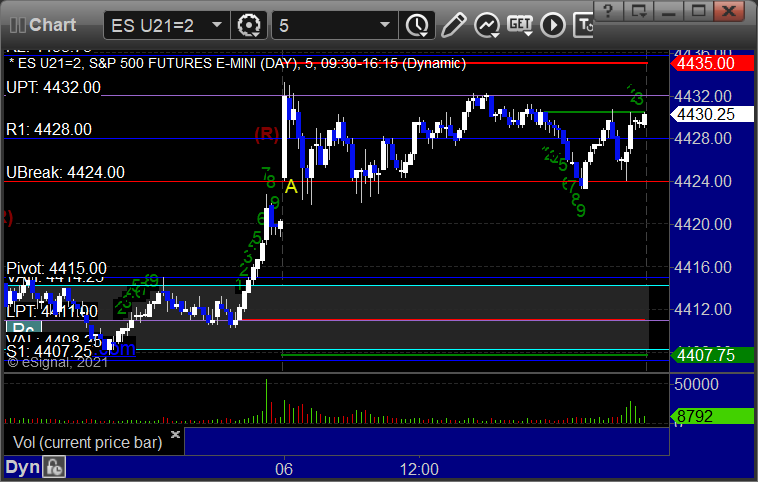

ES with Levels:

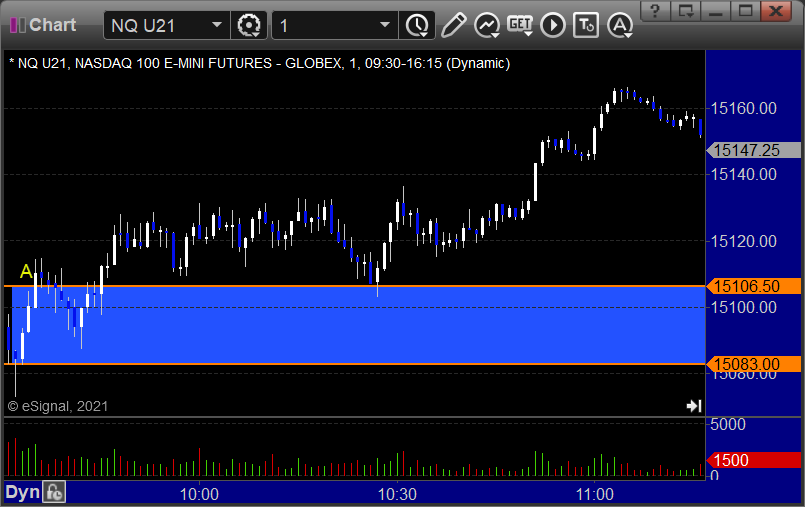

NQ with Levels since it was completely different than the ES:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B, but too far out of range to take:

NQ Opening Range Play triggers were too far out of range to take:

Results: +4 ticks

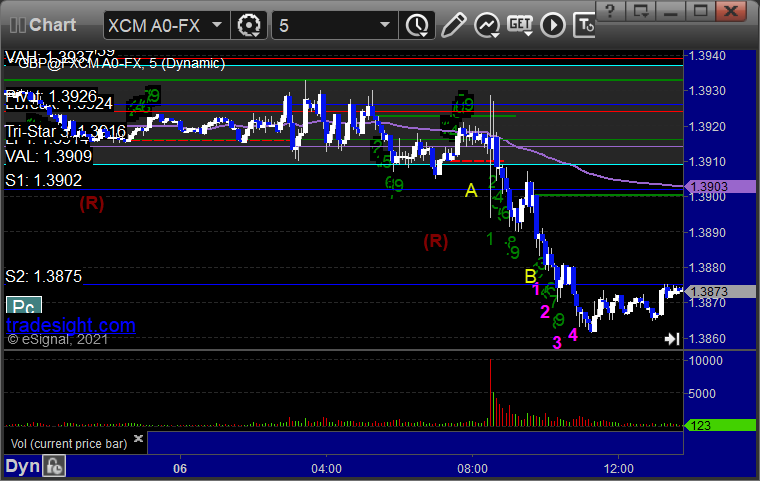

Forex:

GBPUSD triggered short at A, hit first target at B, closed second half for end of week:

Results: +25 pips

Stocks:

From the report, nothing triggered.

From the Twitter feed, Rich's MRNA triggered short (with market support) and worked:

His COIN triggered long (with market support) and didn't work:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 8/5/21

Overview

Another boring day as we wrap up Core Earnings Boredom Season. Markets gapped up a little and did almost nothing all day until a rally in the last 30 minutes on 4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +6.5 ticks

Forex:

We went very small size ahead of the data, and the trigger actually happened on the news spike.

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

From the report, EHTH triggered short (without market support) and didn't work:

From the Twitter feed,

Rich's AMED triggered short (without market support) and didn't work:

His WYNN triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 8/4/21

Overview

The markets gapped down small and stayed dead flat all day on 3.9 billion shares as we get near the end of Core Earnings. Very dead action.

ES with Levels:

ES with Market Directional:

Futures:

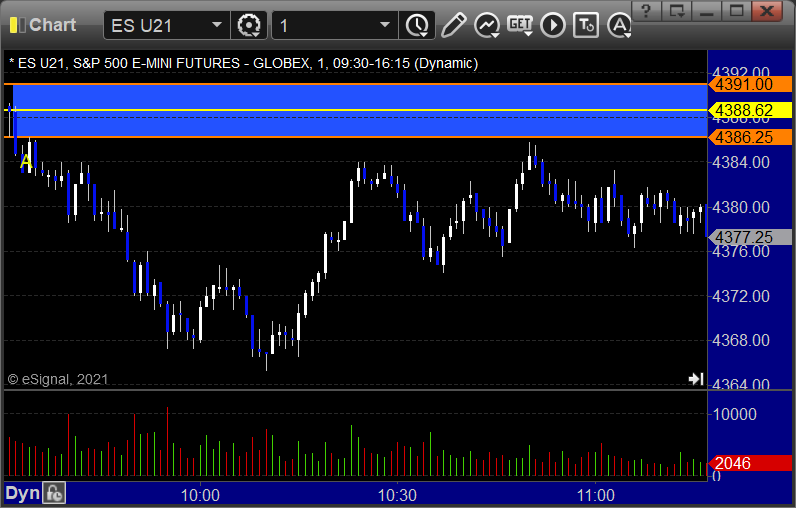

ES Opening Range Play triggered long at A and worked a little:

NQ Opening Range Play:

Results: +2.5 ticks

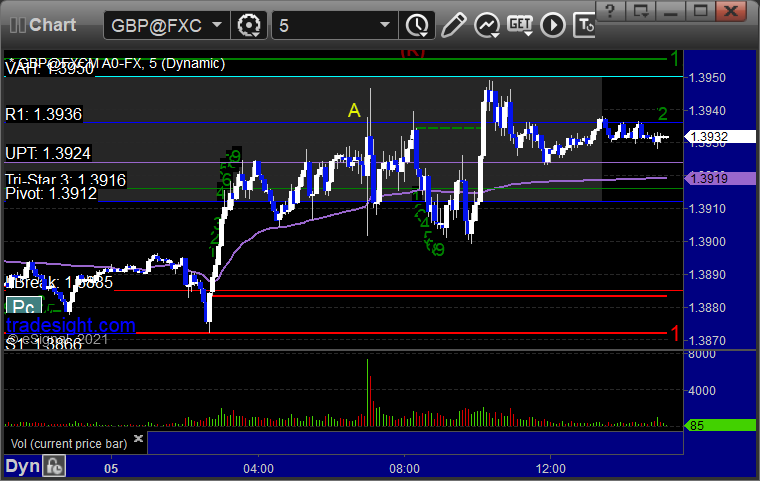

Forex:

GBPUSD triggered long over R1 and stopped:

Results: -25 pips

Stocks:

No triggers from the report.

No triggers from the Twitter feed.

That’s 0 triggers with market support.

Tradesight Recap Report for 8/3/21

Overview

The markets opened flat, pushed down, then recovered all day and closed positive on 3.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +6.5 ticks

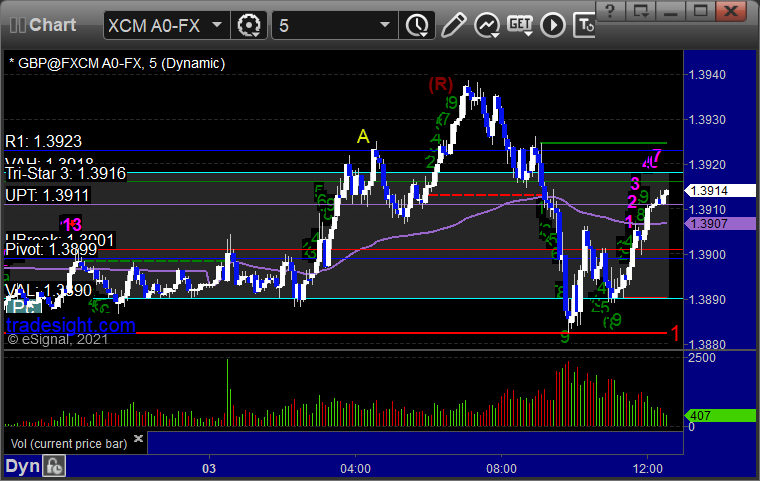

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

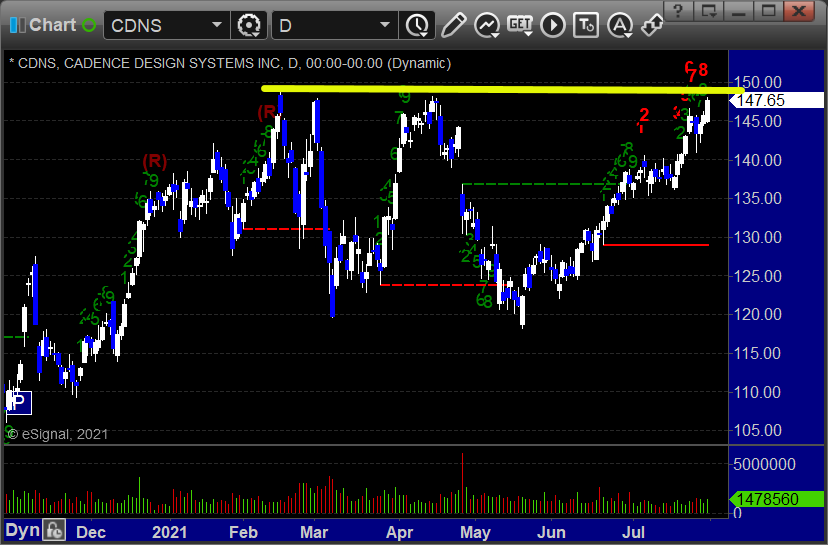

From the report, CDNS triggered long (without market support) and didn't work:

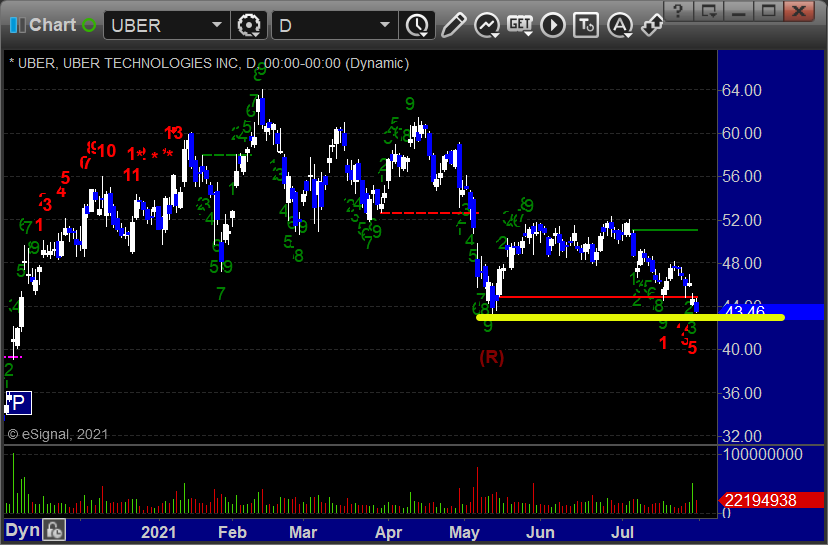

UBER triggered short (without market support due to opening 5 minutes) and worked:

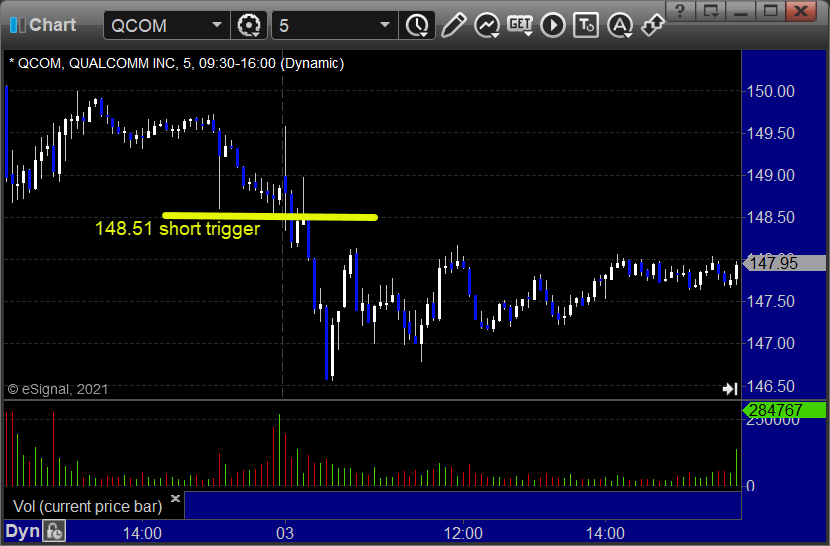

From the Twitter feed, Rich's QCOM triggered short (with market support) and worked:

AMZN triggered short (with market support) and didn't work:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 8/2/21

Overview

The markets gapped up and filled (separately, each on its own time) on 3.7 billion NASDAQ shares, which is light. We closed very flat, which is unexciting.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and worked:

NQ Opening Range Play:

Results: +9 ticks

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

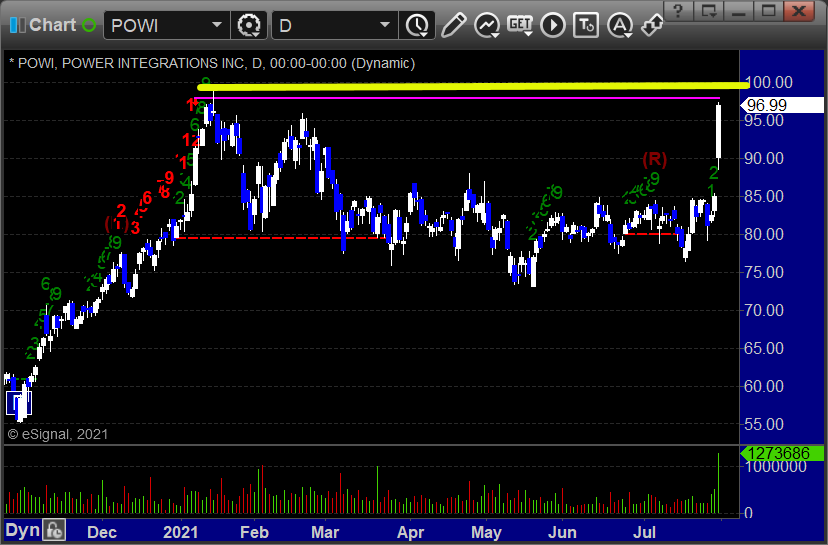

From the report, POWI triggered long (with market support) and worked enough for a partial:

From the Twitter feed, Rich's MRNA triggered short (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Plus Report for 8-2-21

Opening comments posted to YouTube. We are still in the second half of the Core Eight Days of Earnings, so watch for gaps and late-day rumor-moving.

Longs first in the order of best chart construction, starting with CDNS > 149.06:

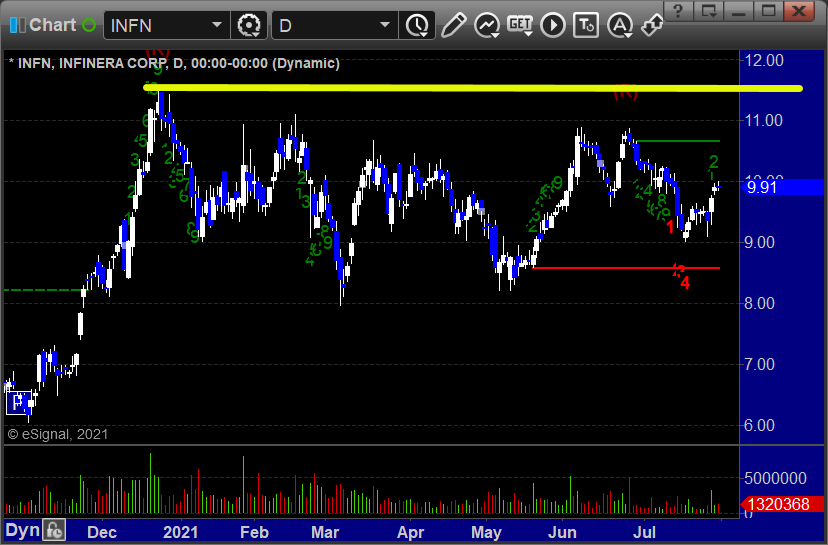

INFN > 11.51:

VRAY > 7.36:

POWI > 99.05:

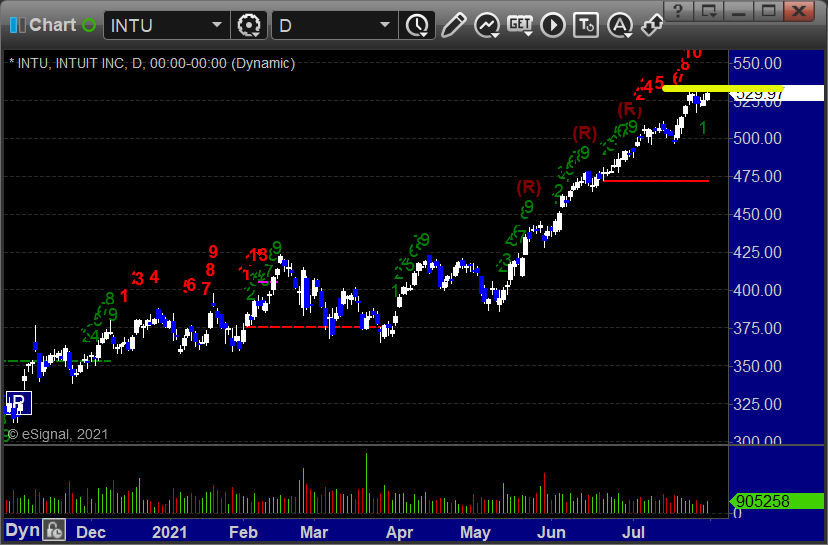

INTU > 532.33:

On the short side, BLUE < 24.24:

EHTH < 48.58:

INCY < 75.52:

UBER < 43.17:

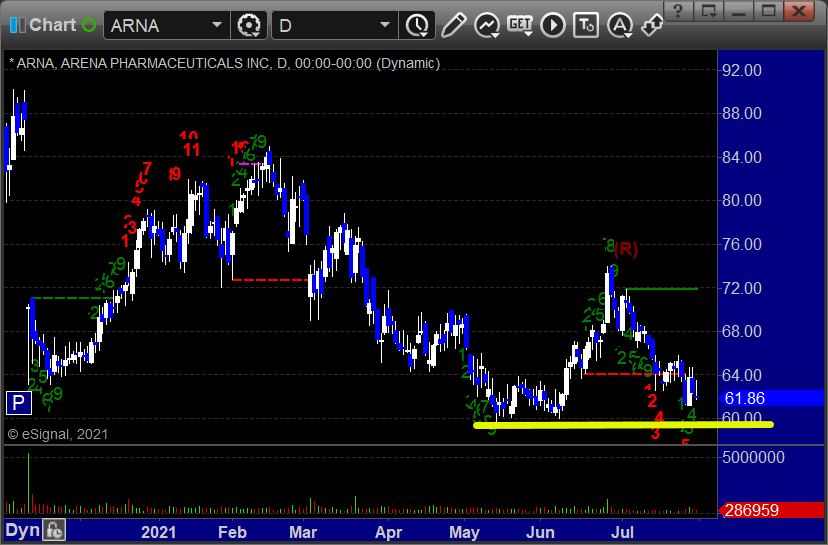

ARNA < 59.55:

Tradesight Recap Report for 7/30/21

Overview

The markets gapped down, filled, and then just sat all day as expected for end of month in July on a Friday on 3.6 billion NASDAQ shares, which is weak volume.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A, hit first target quickly, stopped second half quickly:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +4 ticks

Forex:

GBPUSD, we stopped out of the second half of the prior day's trade in the money:

Results: +35 pips

Stocks:

Nothing triggered off of the report.

From the Twitter feed, nothing triggered.

No shocker for end of July Friday statement printing day.

That’s 0 triggers with market support.