Tradesight Recap Report for 7/20/21

Overview

The markets gapped up slightly and rallied on 4.5 billion NASDAQ shares.

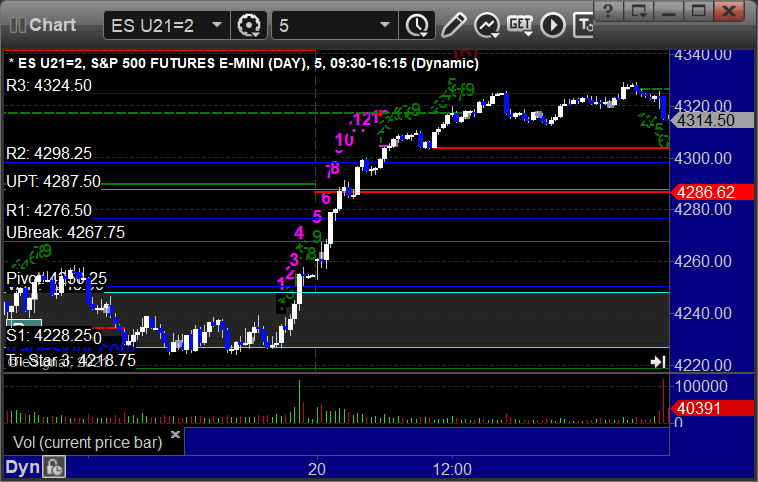

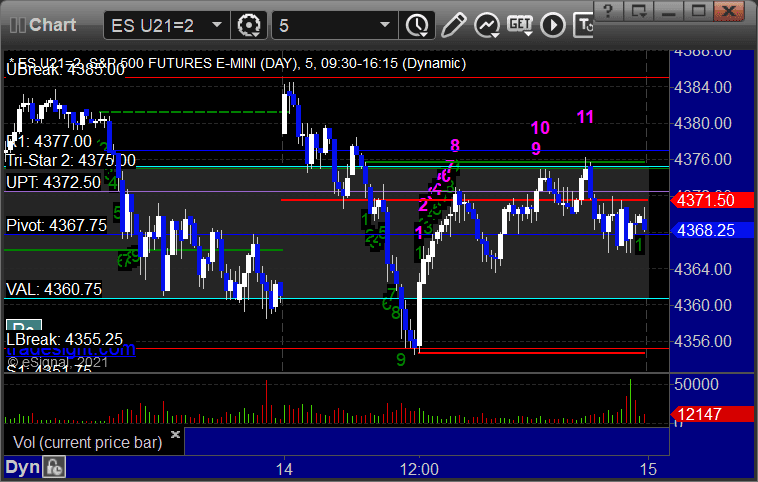

ES with Levels:

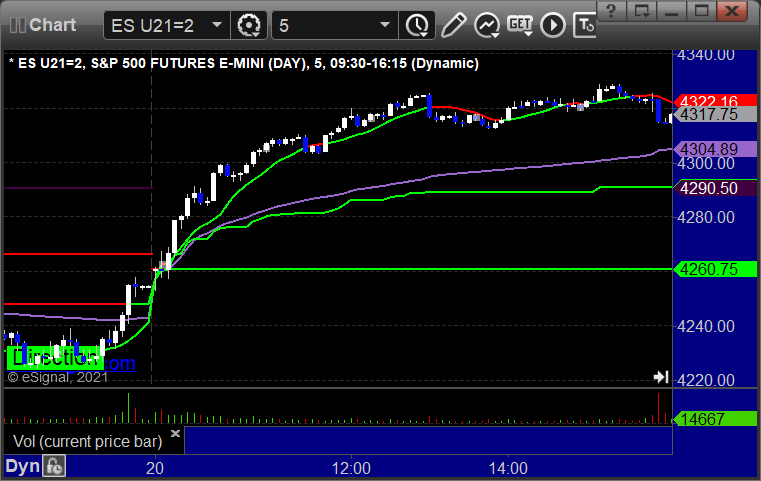

ES with Market Directional:

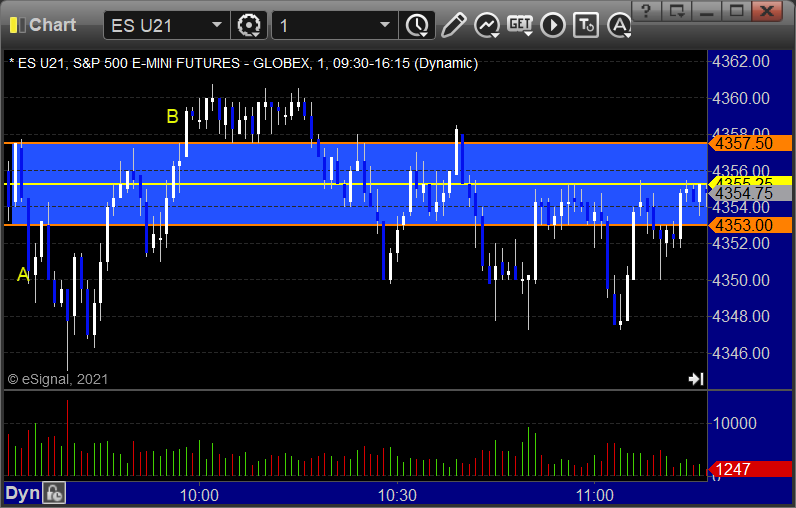

Futures:

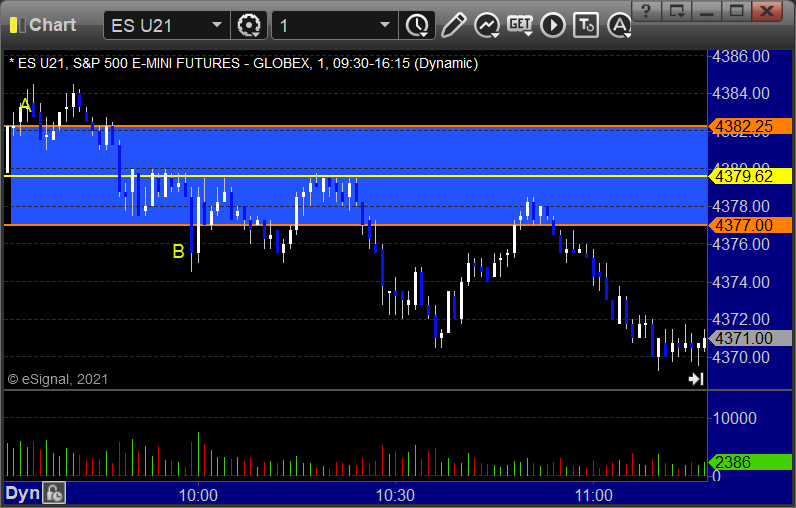

ES Opening Range Play triggered short at A and stopped, triggered long at B but too far out of range to take:

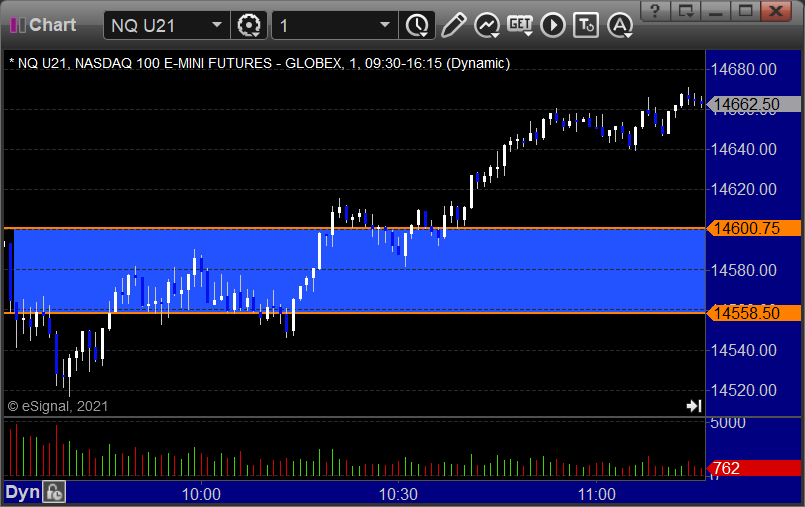

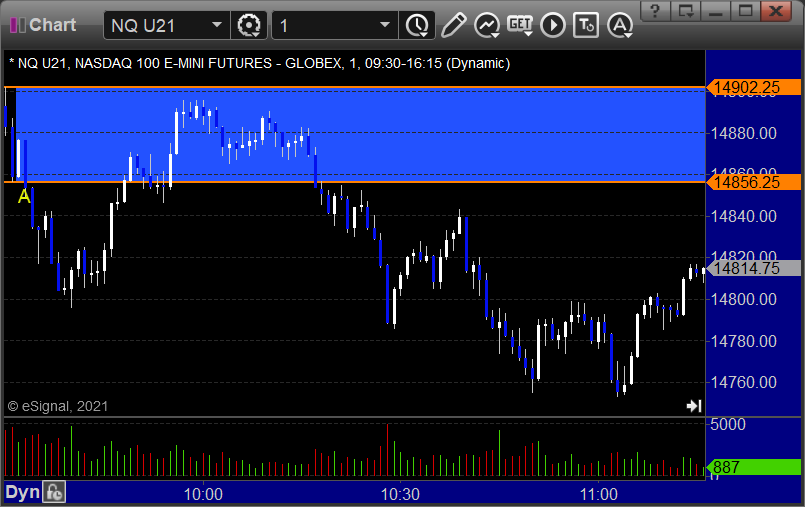

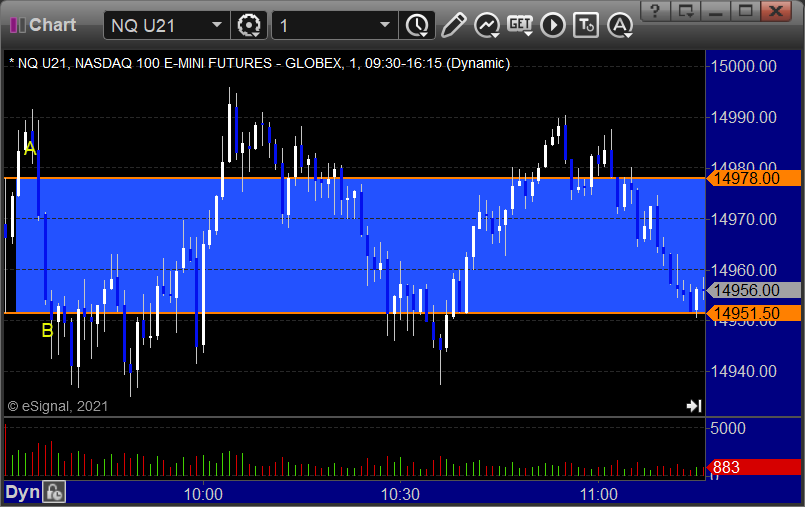

NQ Opening Range Play:

Results: -13 ticks

Forex:

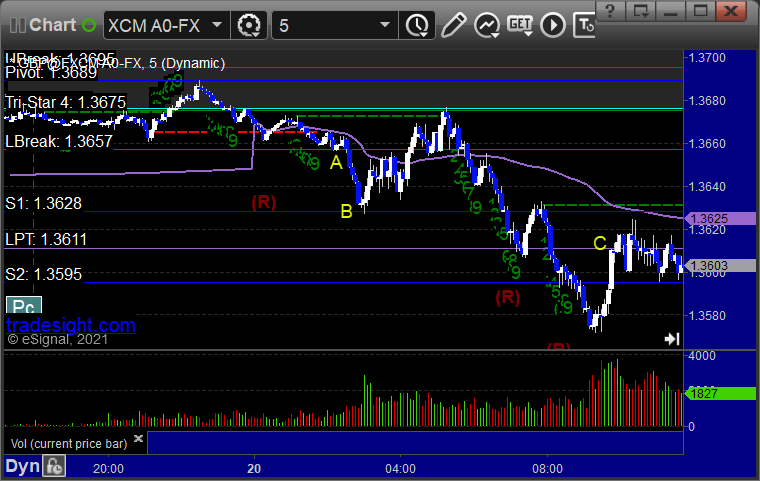

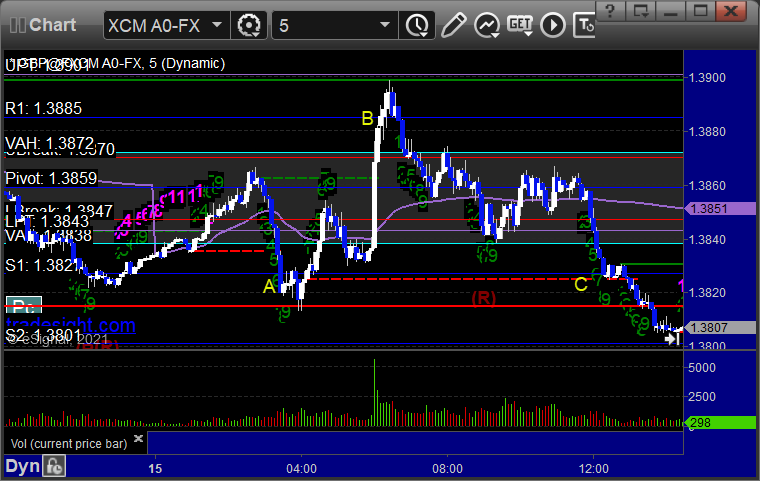

GBPUSD triggered short at A, hit first target at B, stopped out of second half at C:

Results: +40 pips

Stocks:

Quite a disappointing day since we rallied hard without warning.

From the Tradesight Plus Report, nothing triggered.

From the Twitter Feed, Rich's AMGN triggered long (with market support) and didn't work:

That’s 1 trigger with market support, and it didn't work.

Tradesight Recap Report for 7/19/21

Overview

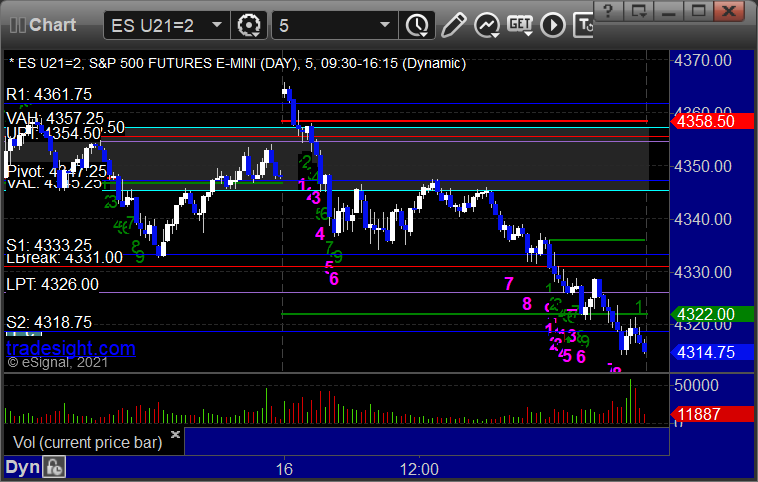

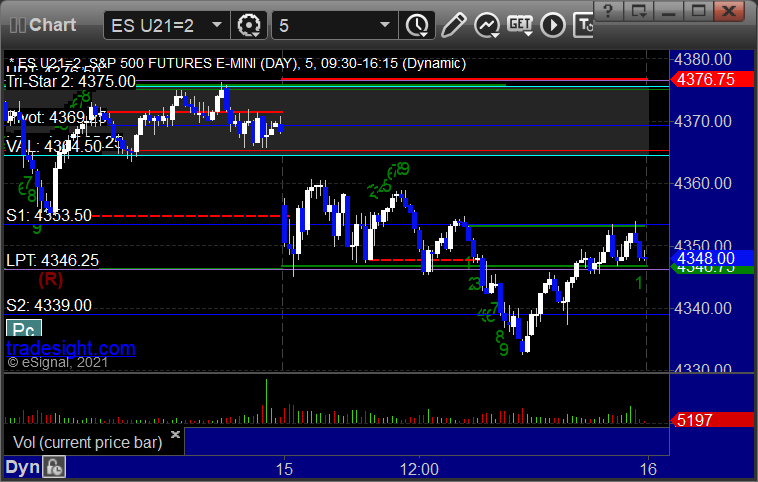

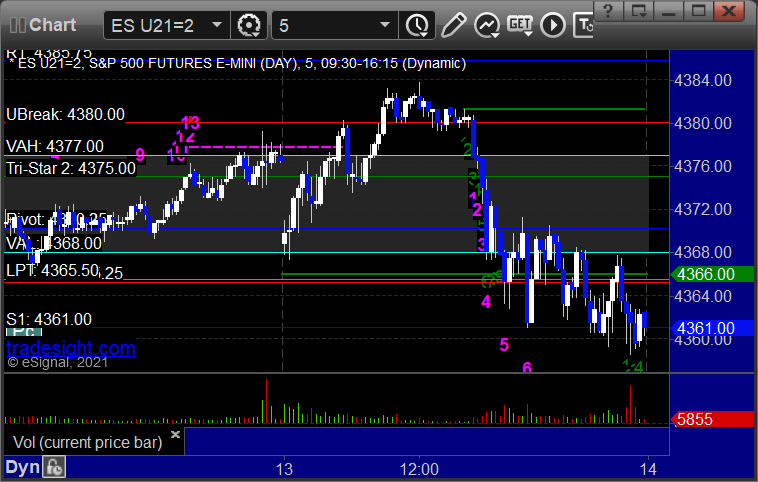

The markets gapped down and went lower but then recovered almost to the starting point of the day on 4.5 billion NASDAQ shares. Mostly, it was the biggest waste of the day possible, as the futures OR plays were too far out of range to take and really no other futures trades lined up except for the ES 13 Comber buy signal on the 5 minute chart against the Average Daily Range. Forex worked and continues. Stocks barely mattered as we closed where we opened. Waste of a day.

ES with Levels:

ES with Market Directional:

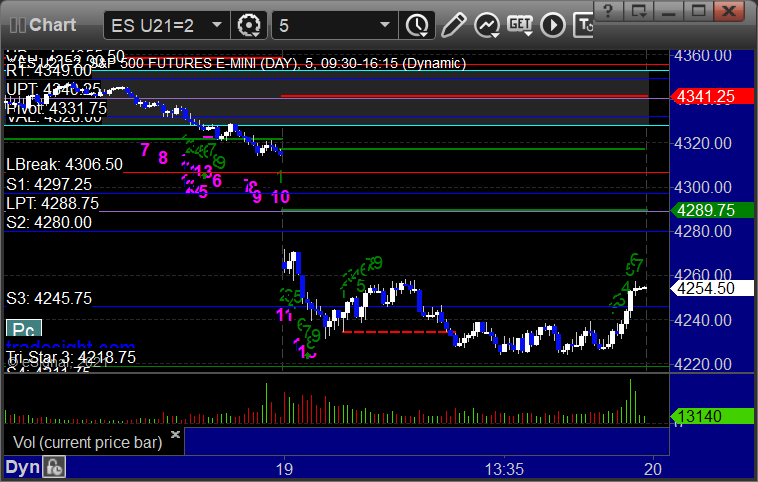

Futures:

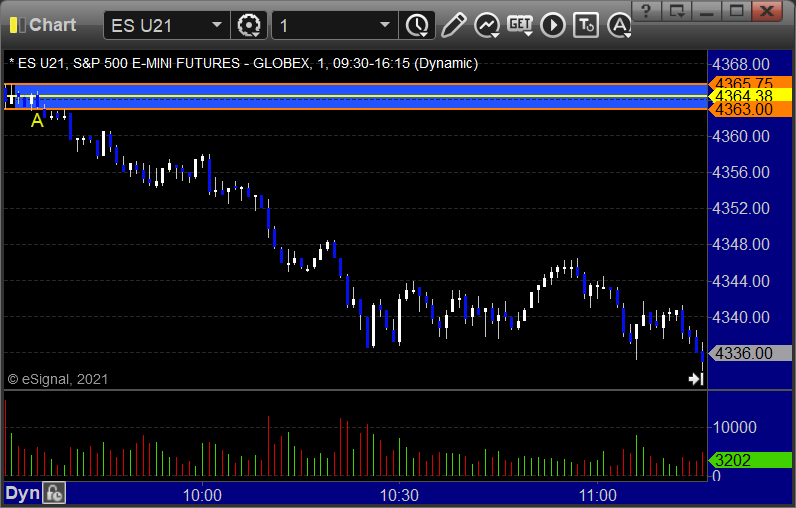

ES Opening Range Play triggered short at A but too far out of range to take:

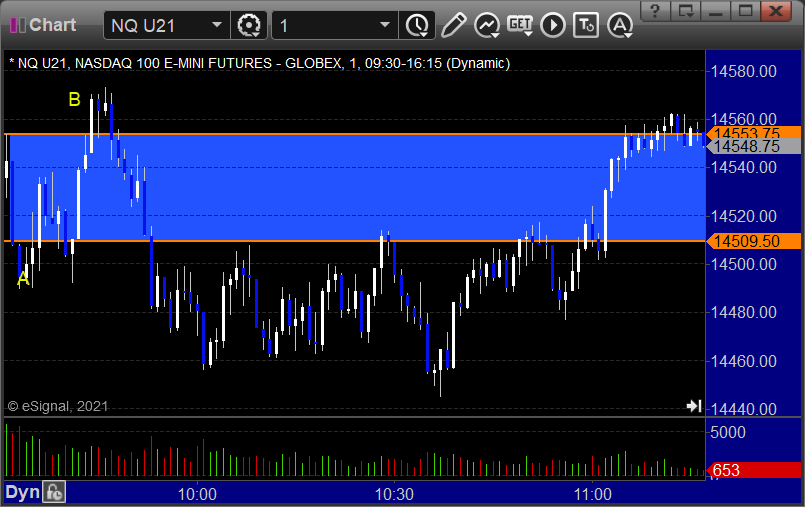

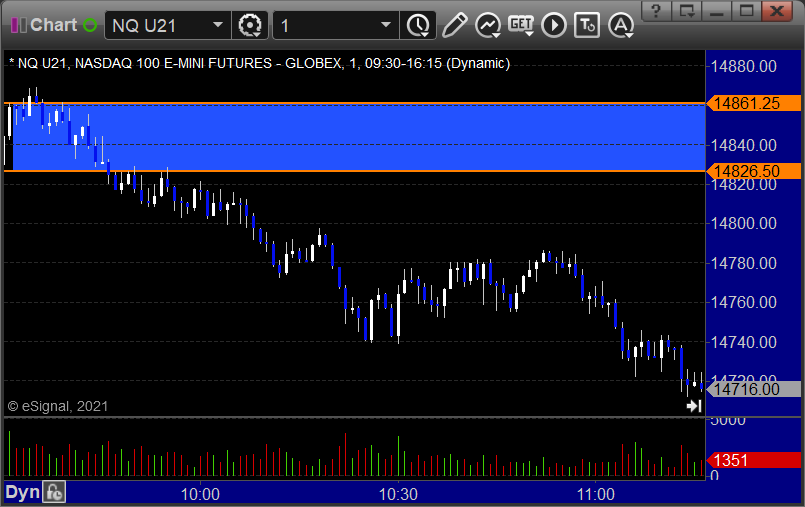

NQ Opening Range Play triggered short at A and long at B and both were too far out of range to take:

Results: +0 ticks

Forex:

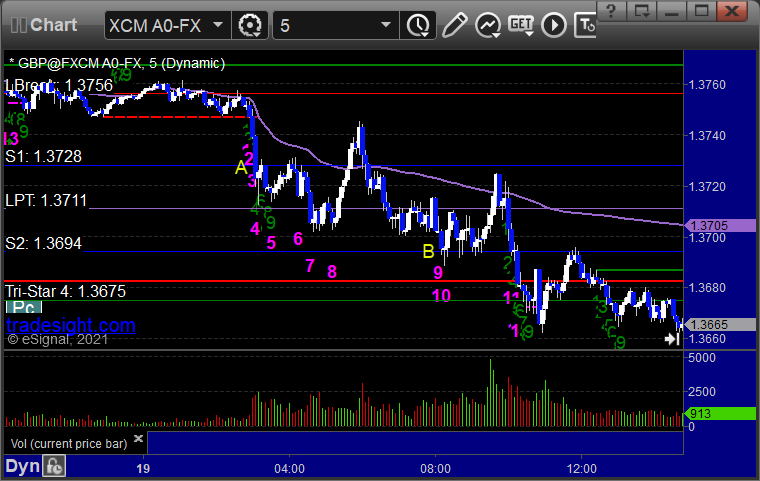

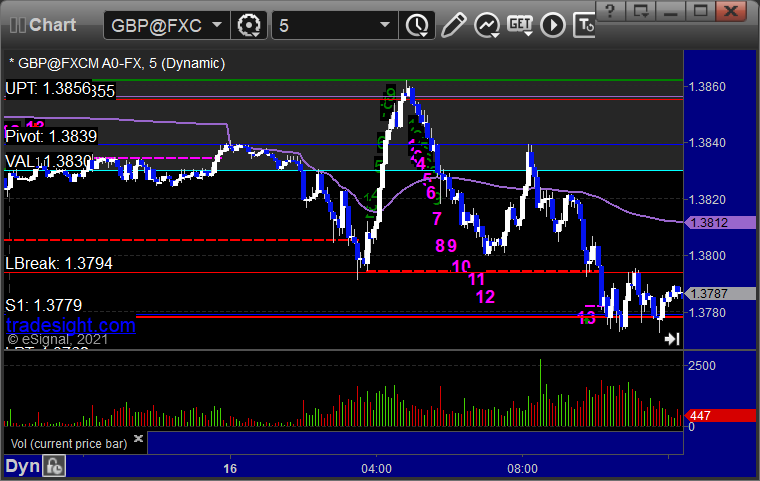

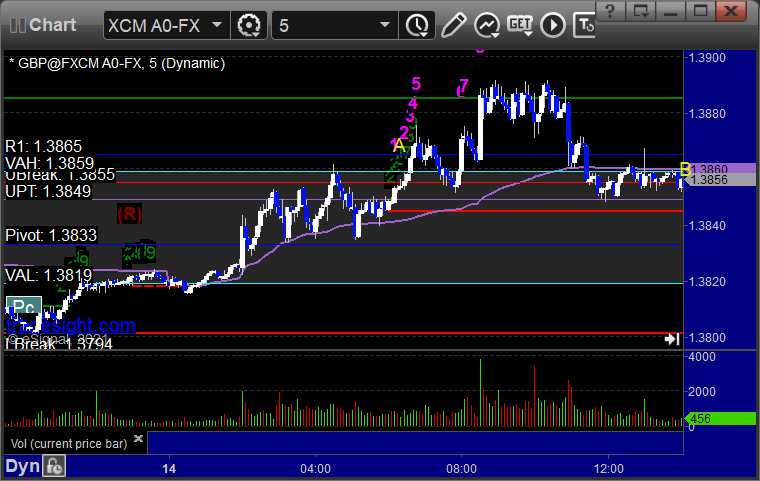

GBPUSD triggered short at A, hit first target at B, still holding second half with a stop over S2:

Results: no results since the trade is still open.

Stocks:

From the Tradesight Plus report, several shorts gapped under the triggers, so no plays.

From the Twitter feed, Rich's KLAC triggered long (without market support) and worked:

YELP triggered long (with market support) and worked enough for a partial:

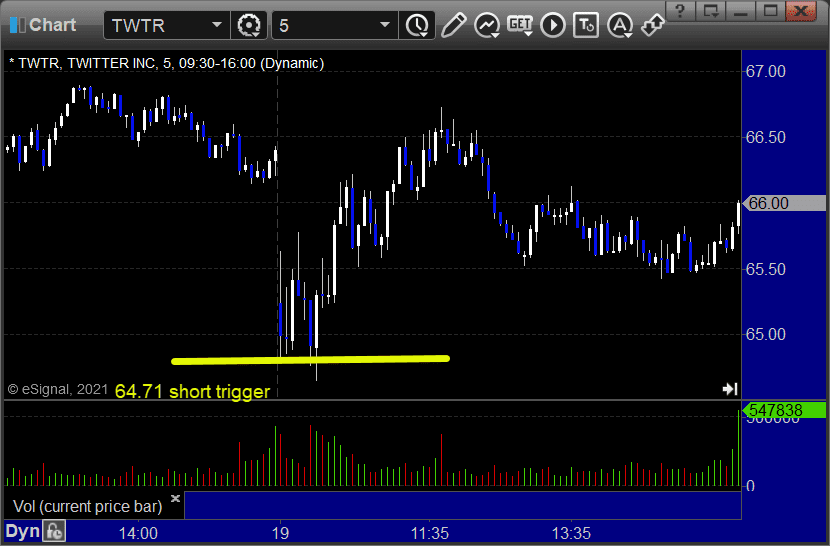

TWTR triggered short (with market support) and didn't work:

That’s 2 triggers with market support, one worked and one didn't.

Tradesight Plus Report for 7-19-21

Opening comments for the week are posted to YouTube. There are a lot of charts forming good downside construction, so let's see if we start to get some action like we did Thursday.

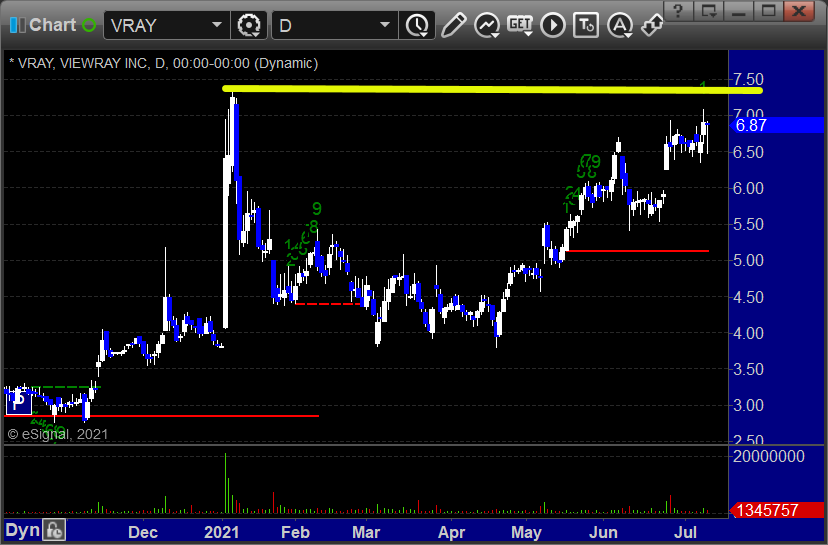

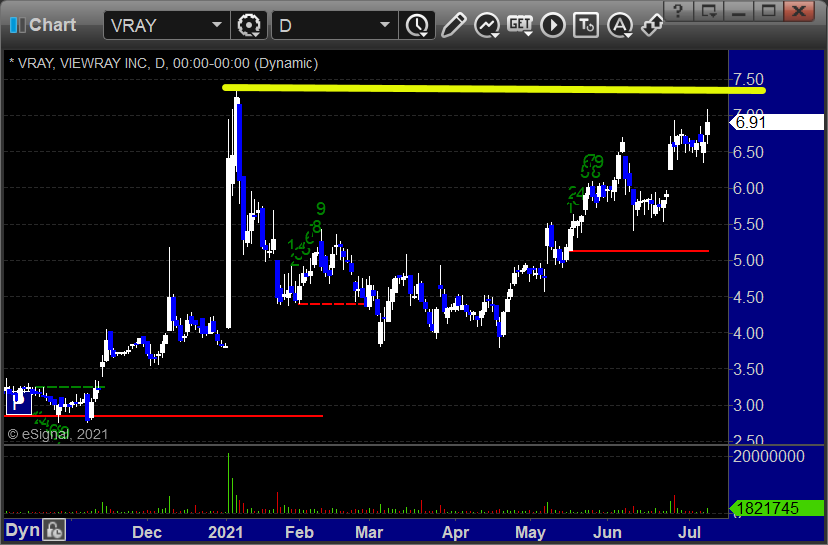

Longs first, in order of best construction, starting with VRAY > 7.36:

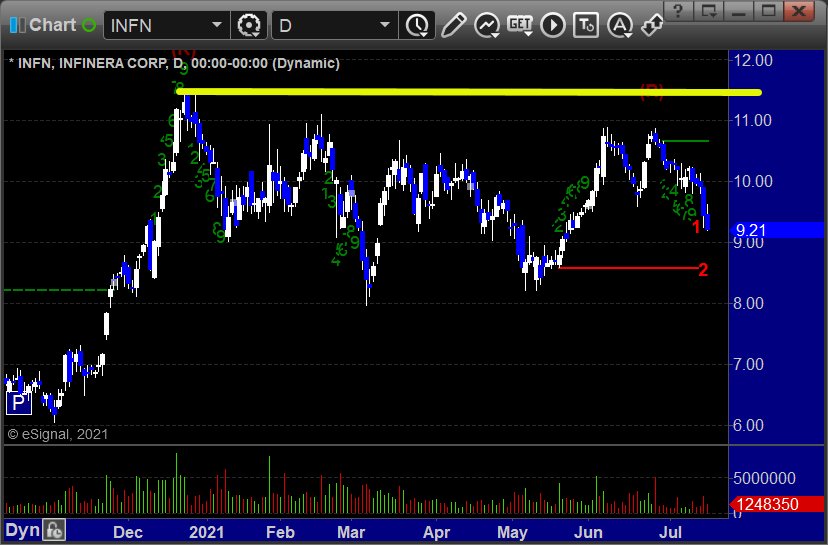

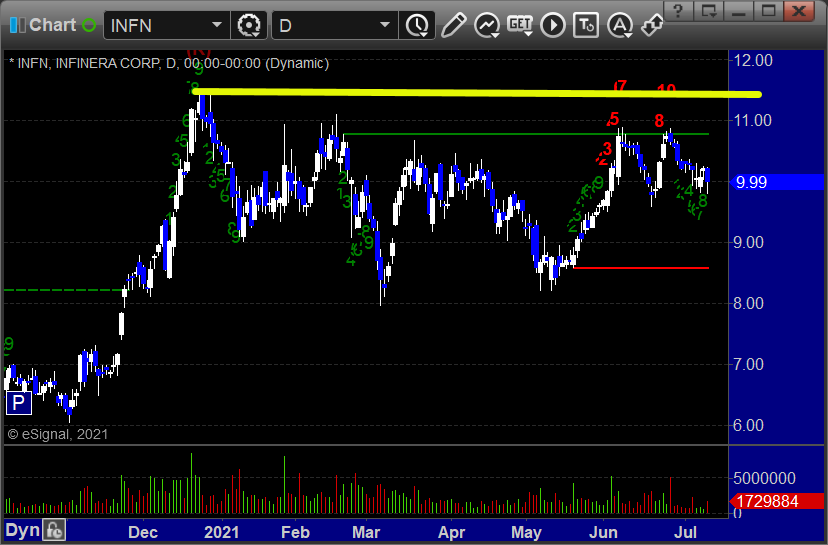

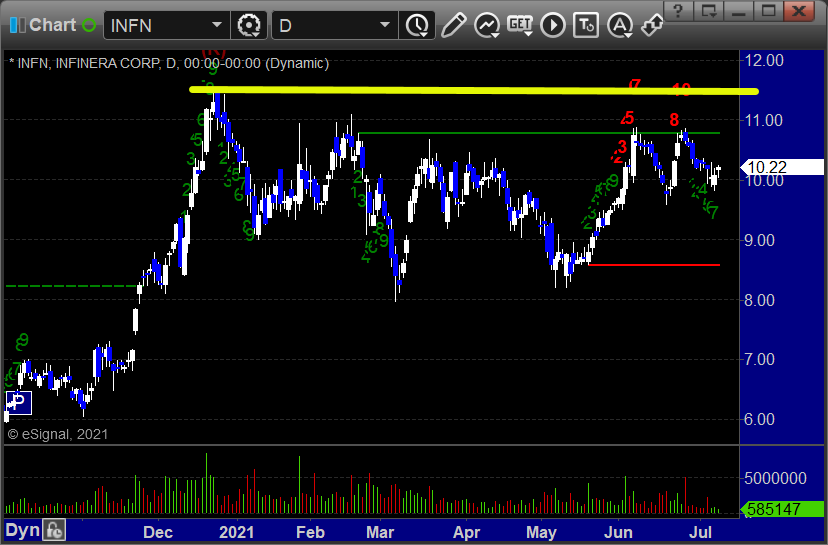

INFN > 11.51:

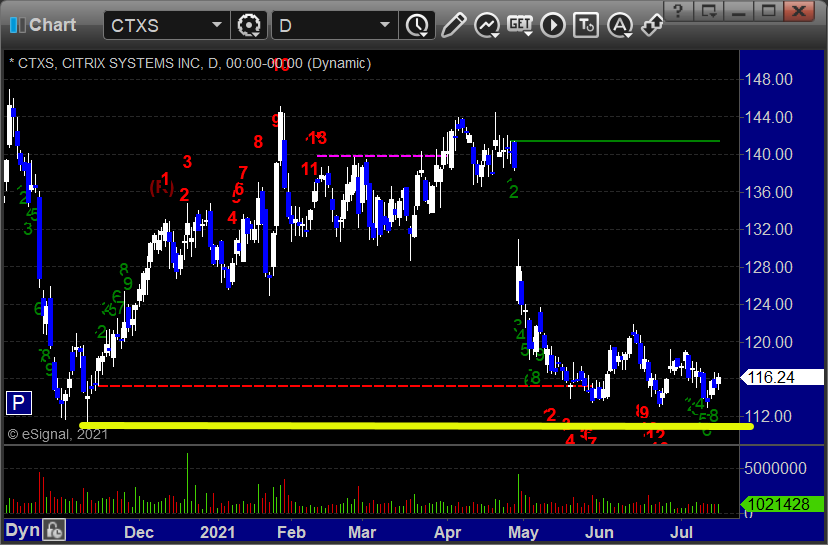

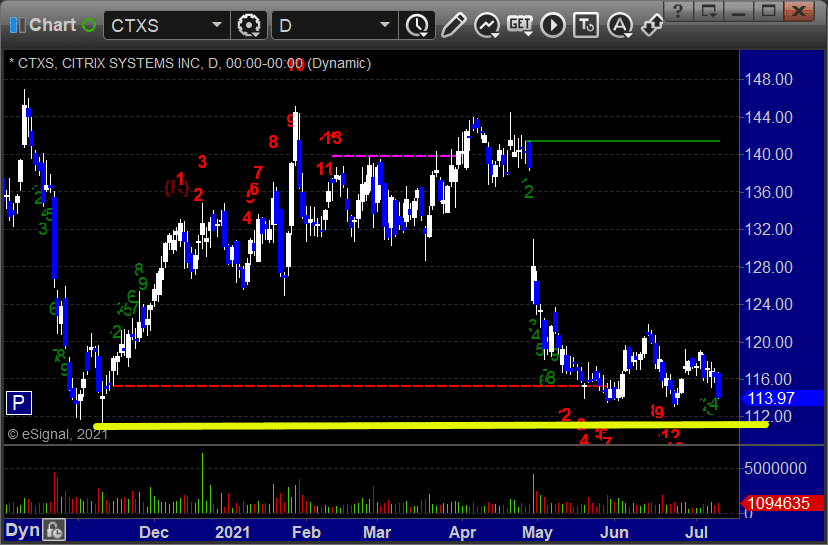

Shorts next, CTXS < 111.26:

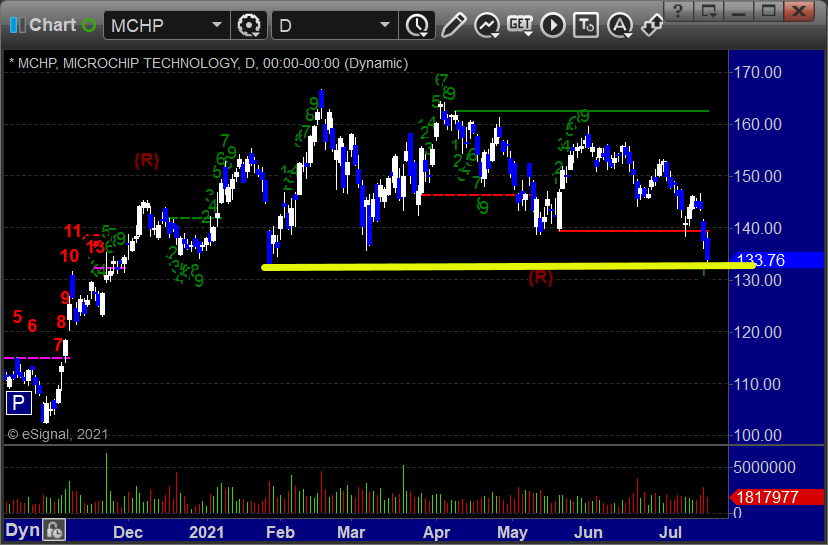

MCHP < 132.54:

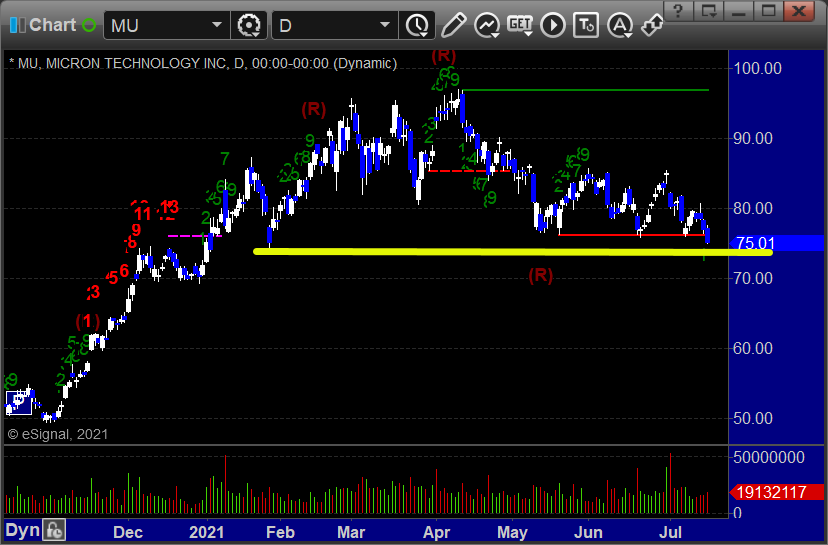

MU < 74.33:

VUZI < 12.74:

Tradesight Recap Report for 7/16/21

Overview

The markets gapped up, filled, went flat through lunch, then sold off a little in the afternoon, but not much was expected for options expiration in July in the summer. NASDAQ volume was 4 billion shares, which is light for the new normal but worse for what was options expiration (usually extra volume for no reason). Made money on futures, forex never triggered, no stock triggers, so a small green day as expected for options expiration in July.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play:

NQ Opening Range Play:

Results: +7.5 ticks

Forex:

GBPUSD:

Results: +0 pips

Stocks:

From the report, nothing triggered.

From the Twitter feed, nothing triggered.

That’s 0 triggers with market support, which is sort of normal for options expiration per Module 10. Great week though.

Tradesight Recap Report for 7/15/21

Overview

The markets gapped down, stayed flat for hours, finally headed lower over lunch, but then came back to where they started for the close on 3.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked, triggered long at B and stopped under the midpoint:

NQ Opening Range Play:

Results: -12.5 ticks

Forex:

GBPUSD triggered short at A and stopped, triggered long at B and stopped, triggered short again at C and worked:

Results: -15 pips

Stocks:

What a great day for stocks finally.

From the report, nothing triggered again.

From the Twitter feed, ATVI triggered short (with market support) and worked:

WYNN triggered short (with market support) and worked:

Rich's NVDA triggered short (with market support) and worked great:

His AAPL triggered short (with market support) and didn't work:

That’s 4 triggers with market support, 3 of them worked and 1 didn’t.

Tradesight Recap Report for 7/14/21

Overview

The markets gapped up, then sold off sharply, then rebounded back to the midpoint on a weak 3.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

NQ Opening Range Play:

Results: -7.5 ticks

Forex:

GBPUSD triggered long at A and closed for a couple of pip loss for end of session:

Results: -5 pips

Stocks:

From the report, nothing triggered.

From the Twitter feed, Rich's GME triggered short (with market support) and worked great:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 7/13/21

Overview

The markets opened down a little and rallied, then came back down on 4.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

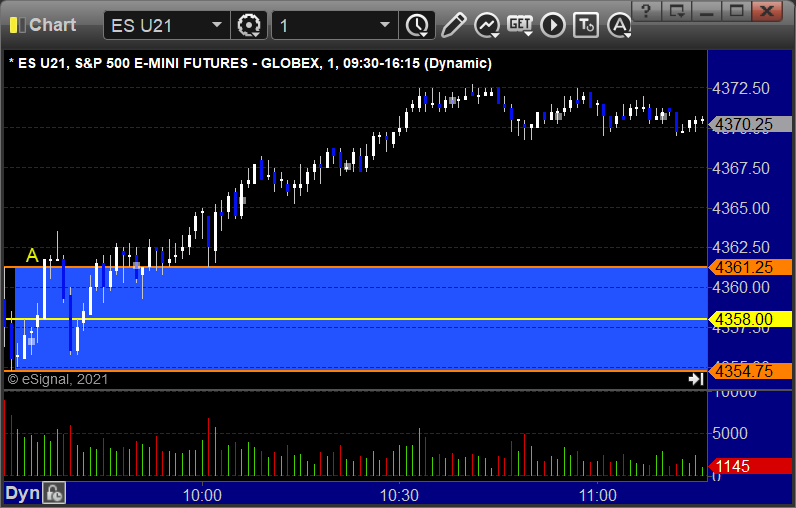

ES Opening Range Play triggered long at A and worked:

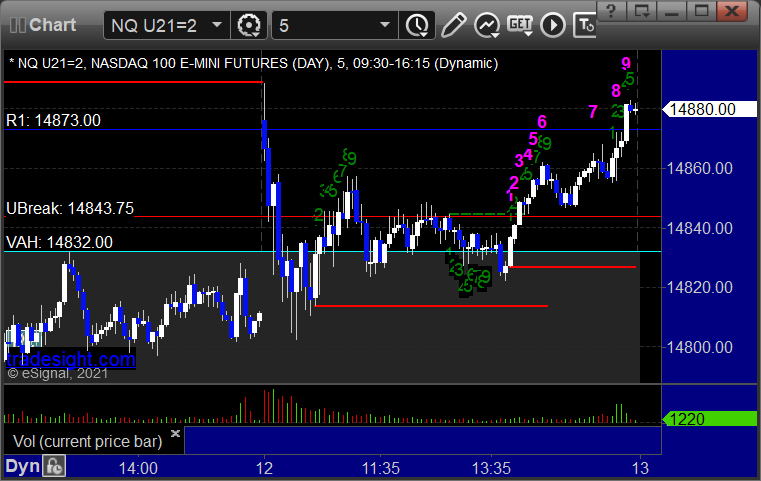

NQ Opening Range Play:

Results: +6 ticks

Forex:

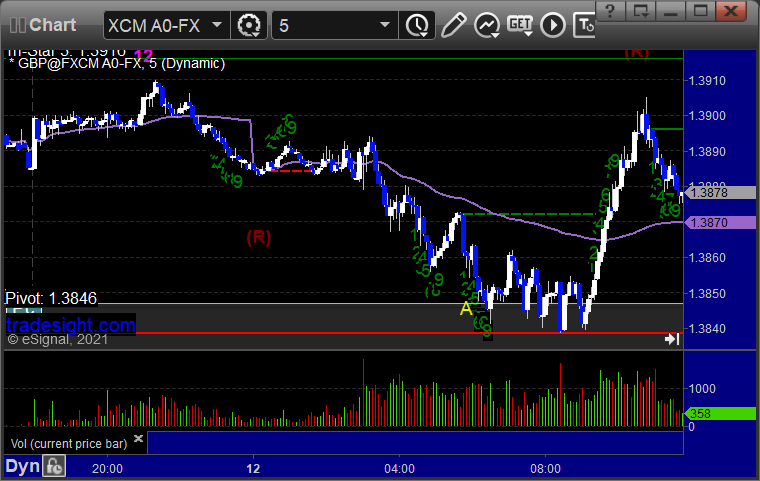

GBPUSD triggered short at A, hit first target at B, stopped second half over the entry at C:

Results: +10 pips

Stocks:

A nice day. From the report, nothing triggered.

From the Twitter feed, Rich's TLT triggered short (ETF, so no market support needed) and worked:

His SNOW triggered long (with market support) and worked enough for a partial:

His ZM triggered short (without market support due to opening 5 minutes) and didn't work:

That’s 2 triggers with market support, both of them worked.

Tradesight Plus Report for 7-13-21

Opening comments posted to YouTube. We are heading into earnings season shortly, but options expiration first. Let's see what we get.

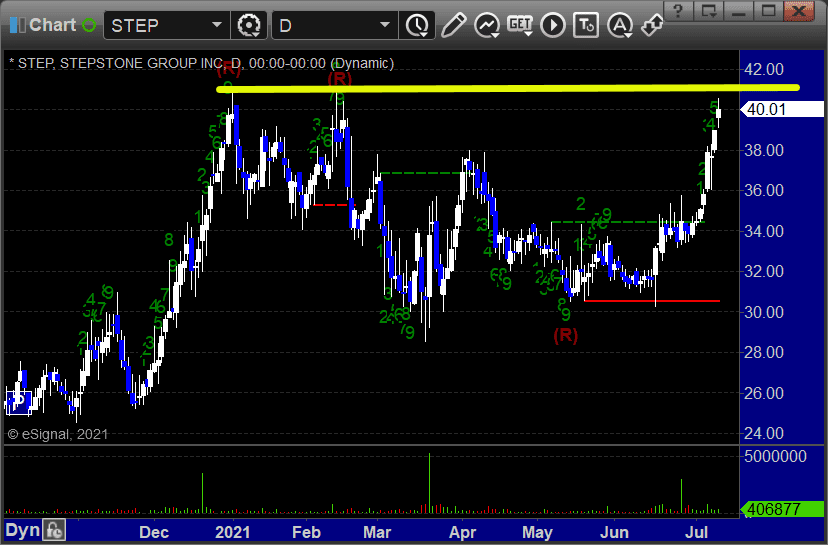

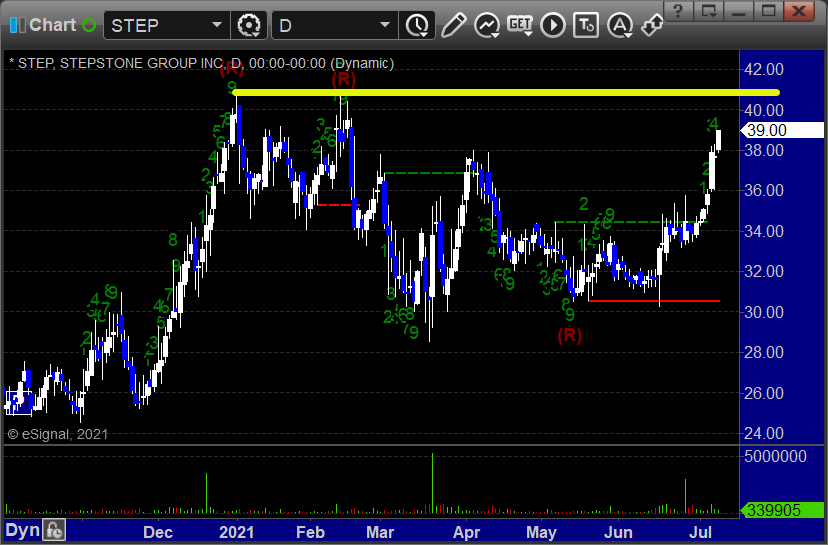

Longs first, in the order of best chart construction, starting with STEP > 41.00:

VRAY > 7.36:

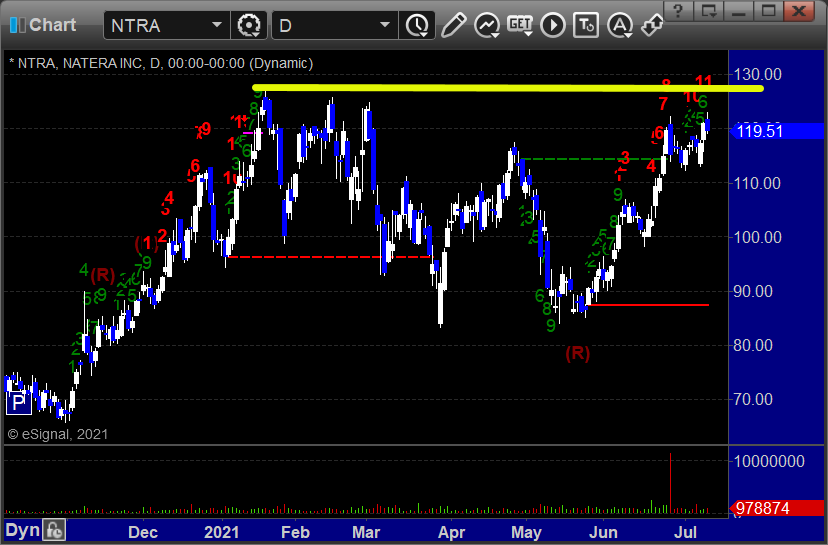

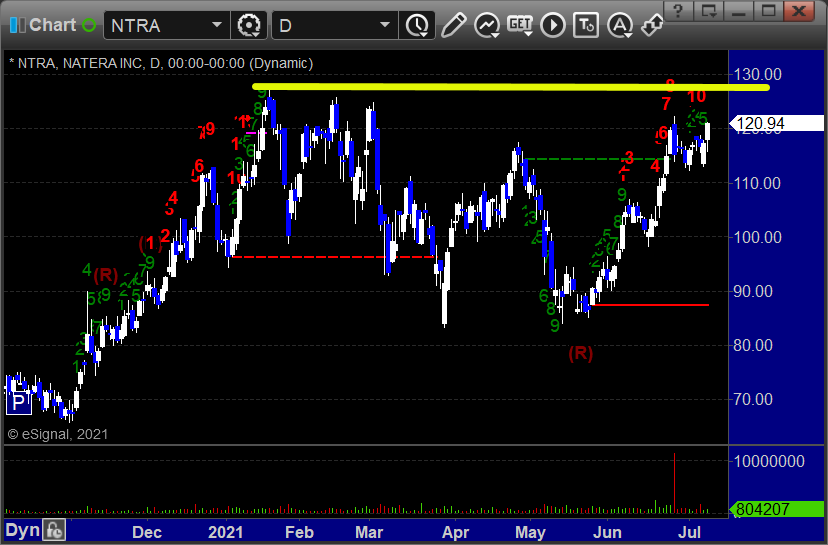

NTRA > 127.19:

NTRA > 127.19:

INFN > 11.51:

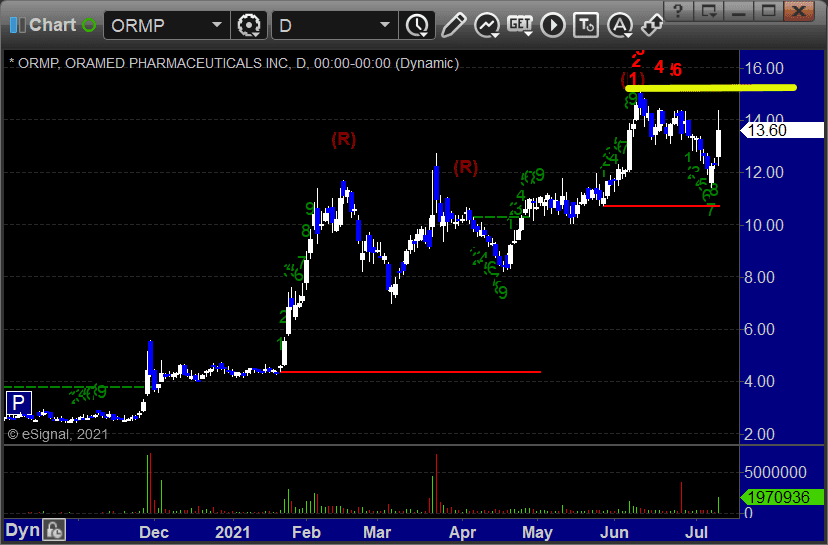

ORMP > 14.70:

Shorts next, just one, CTXS < 111.26:

Tradesight Recap Report for 7/12/21

Overview

The markets opened mixed and traded mixed, the NQ closed inside the Opening Range, so no action, and the ES drifted higher on 3.8 billion NASDAQ shares, which is light. Negative day in futures and forex, nothing triggered correctly in stocks.

ES with Levels:

NQ with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped under the midpoint:

NQ Opening Range Play:

Results: -16 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

From the report, nothing triggered.

From the Twitter feed, PTON triggered short (without market support) and didn't work:

That’s 0 triggers with market support.

Tradesight Plus Report for 7-12-21

Opening comments for the week posted to YouTube. This is options expiration week for July (usually a non-event in the summer). Several nice patterns came up in my screens.

Longs only, in order of best chart construction, starting with STEP > 41.00:

NTRA > 127.19:

VRAY > 7.36:

INFN > 11.51:

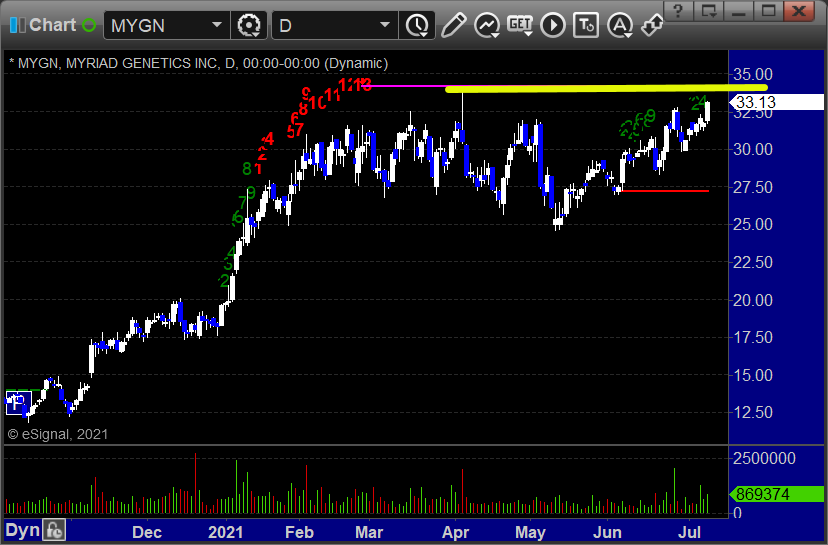

MYGN > 33.97: