Tradesight Recap Report for 7/9/21

Overview

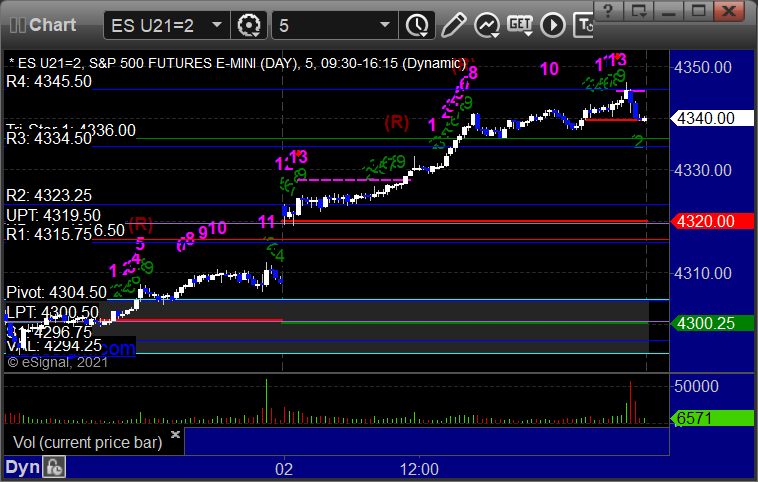

The markets gapped up and went higher and filled the gap from the prior day before flatlining on 3.8 billion NASDAQ shares.

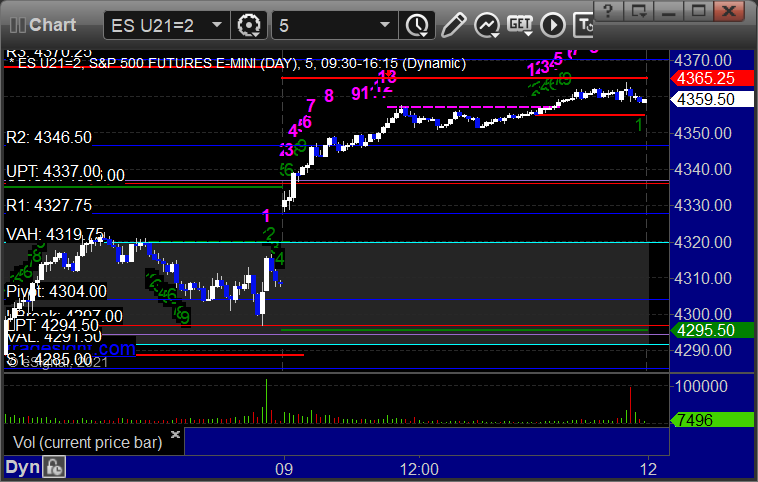

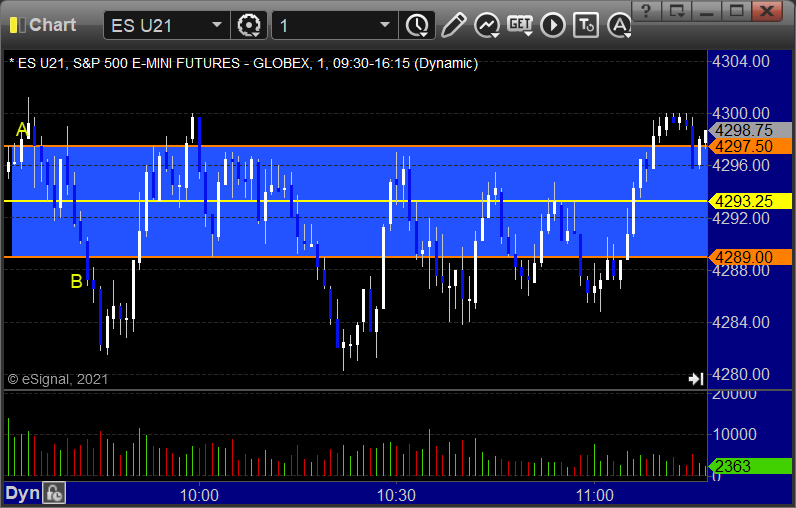

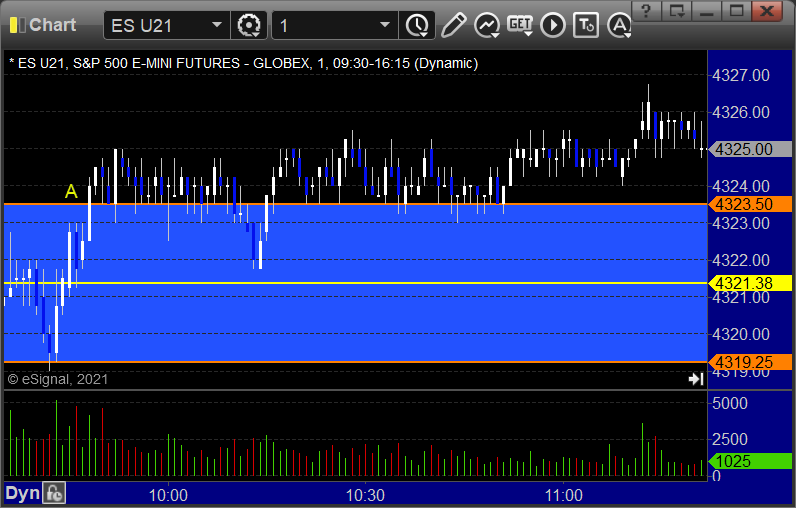

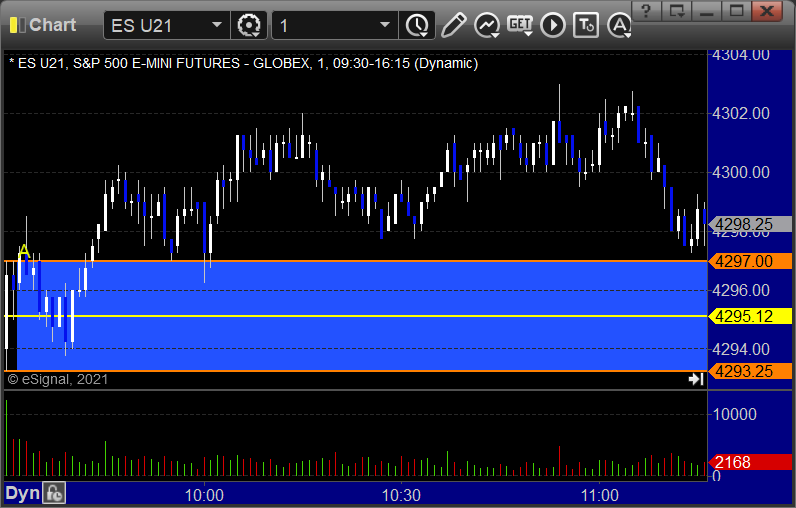

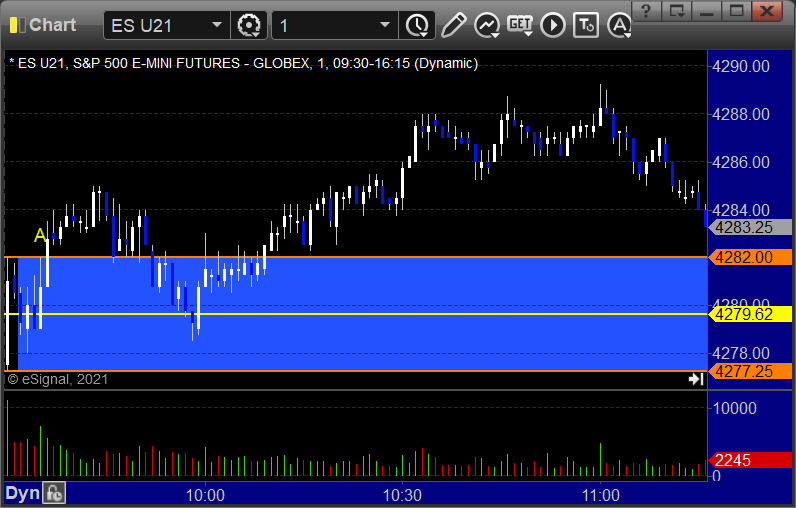

ES with Levels:

ES with Market Directional:

Futures:

Futures:

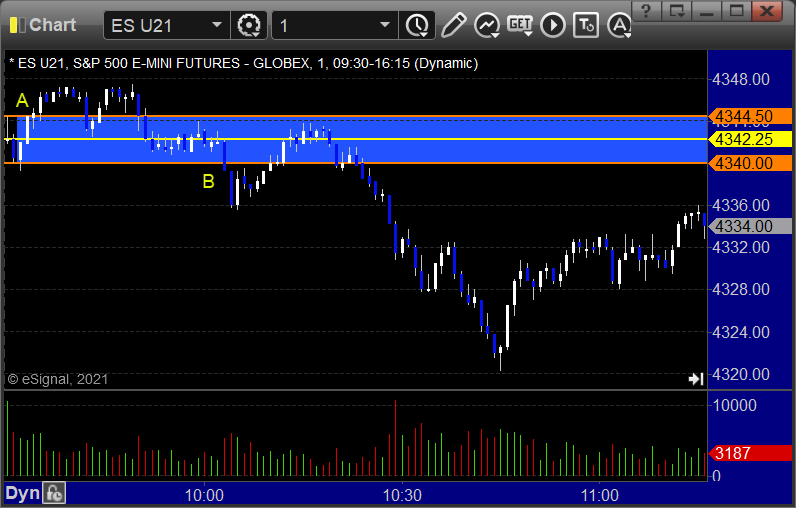

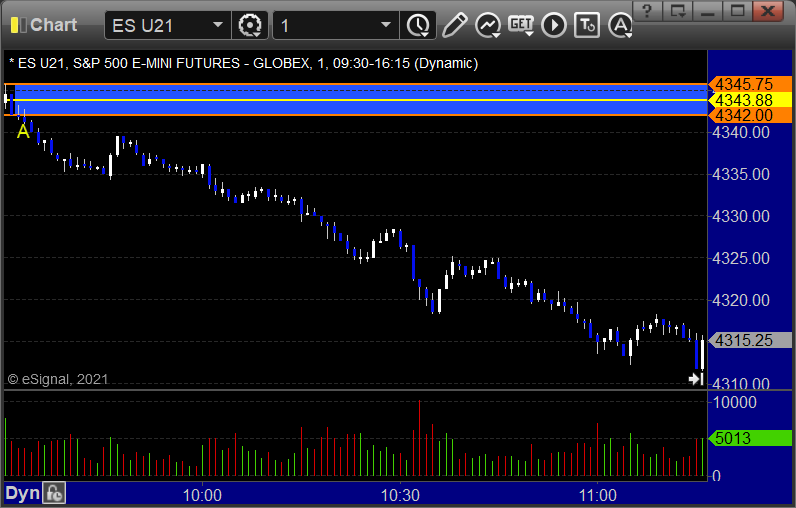

ES Opening Range Play triggered long at A and worked:

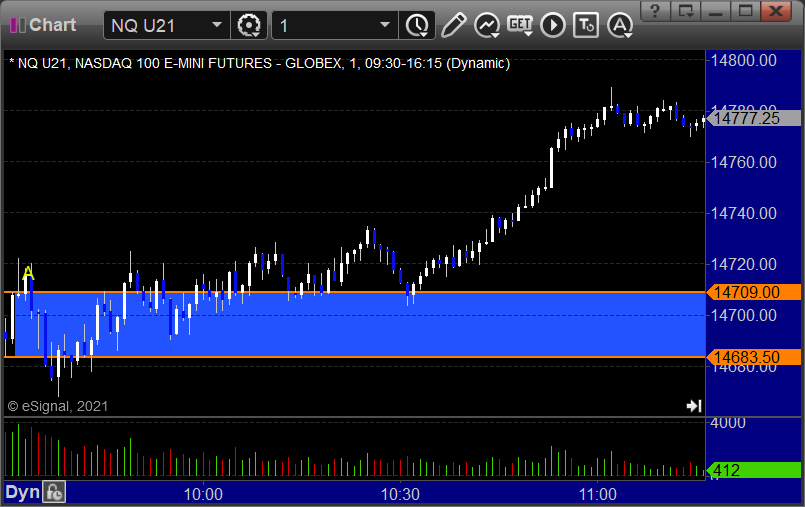

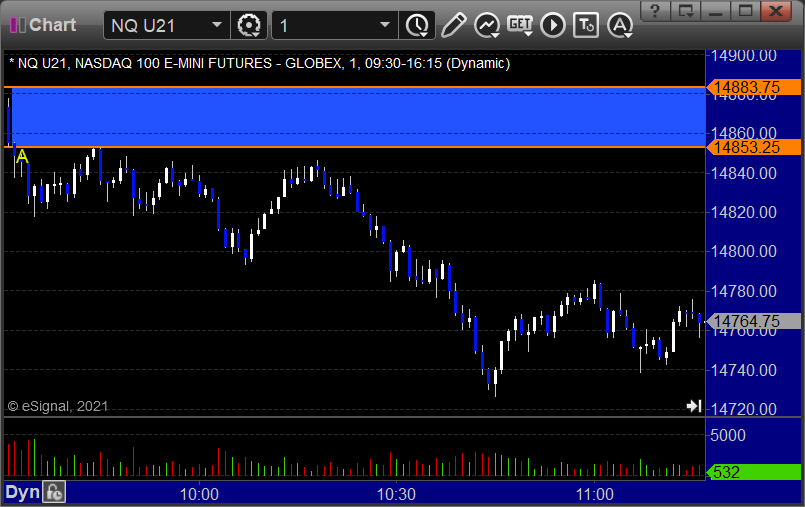

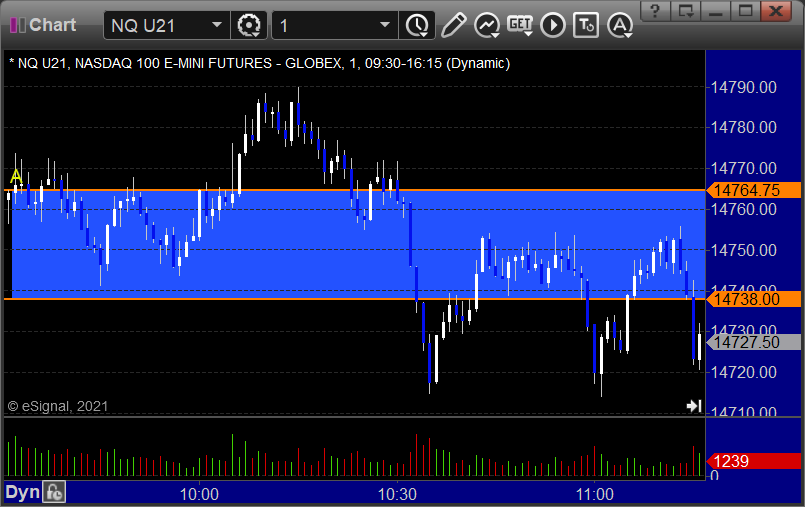

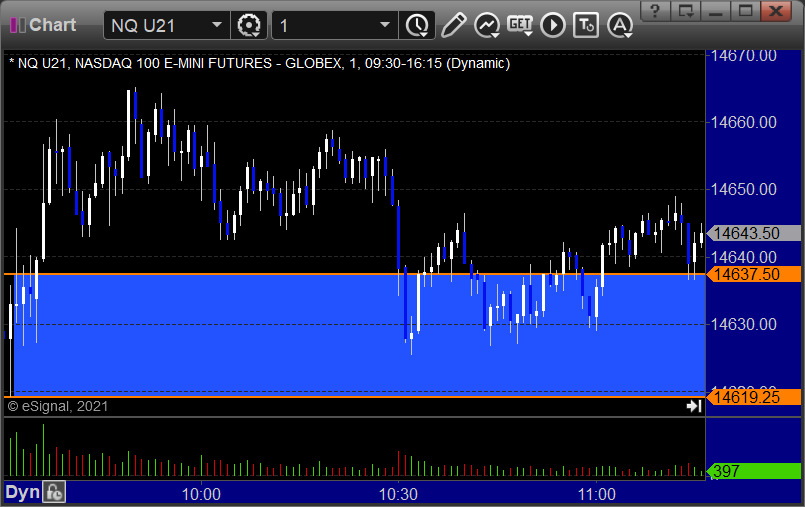

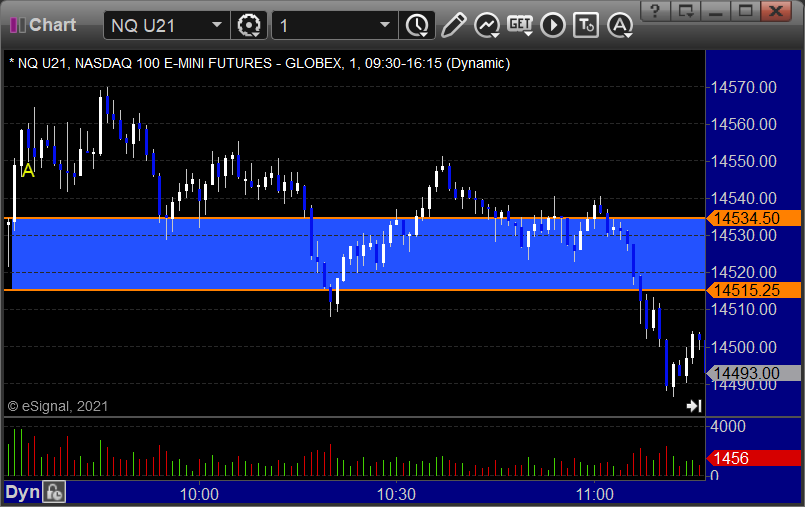

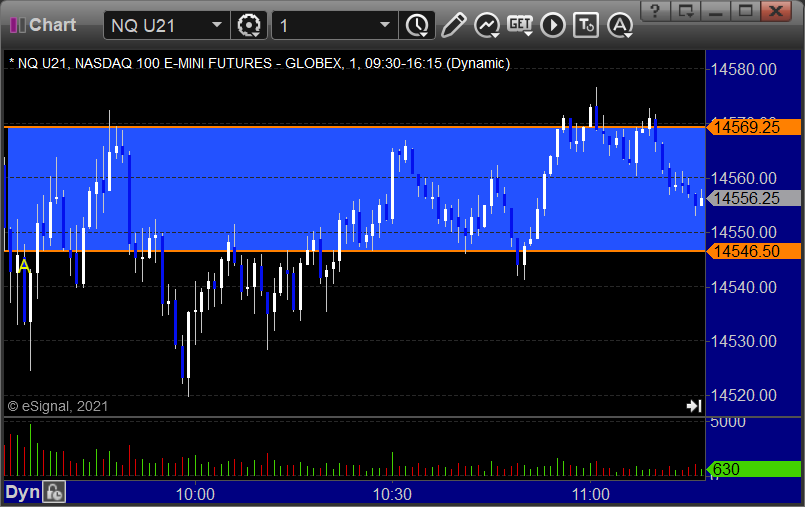

NQ Opening Range Play triggered long at A but too far out of range to take, same with the short:

Results: +11 ticks

Forex:

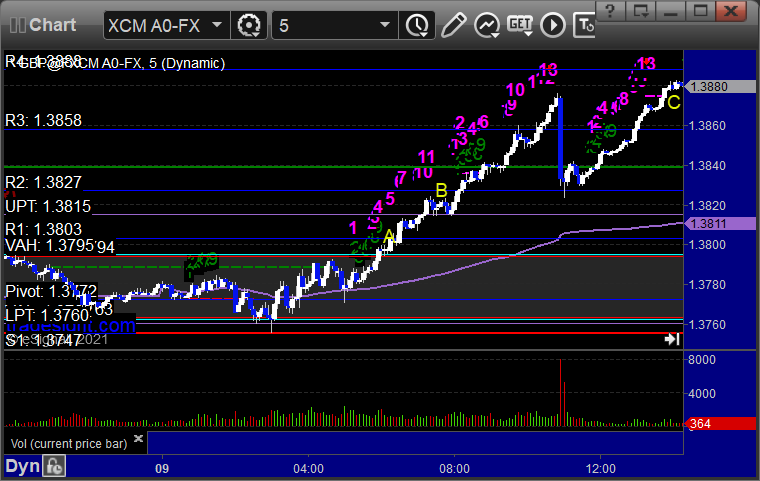

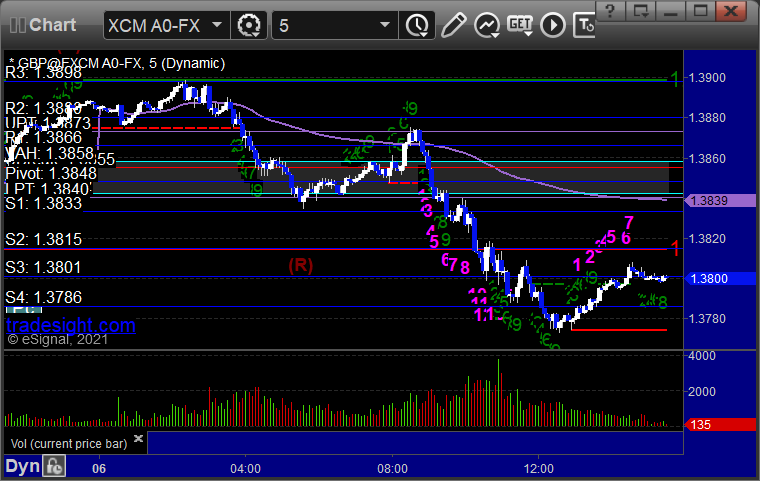

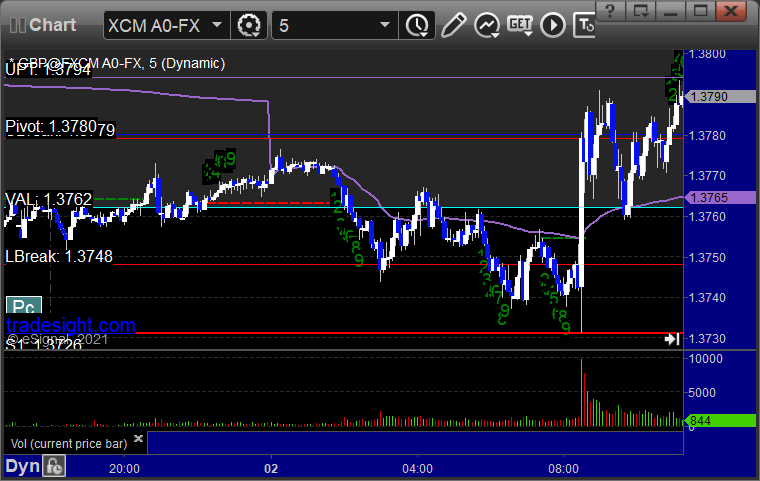

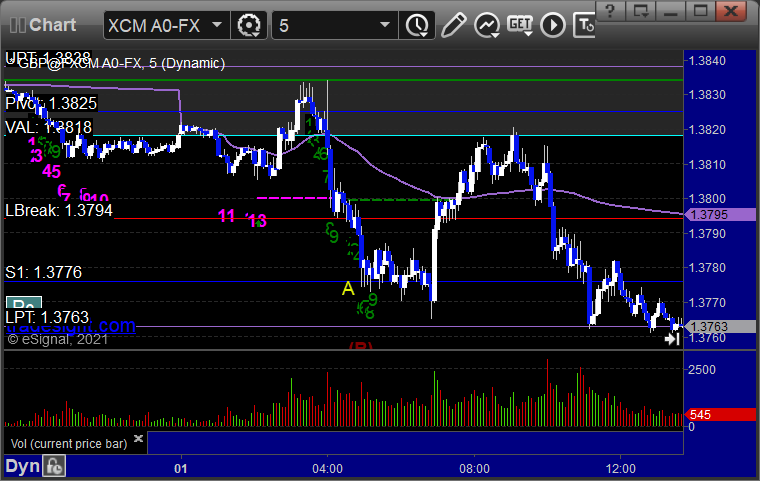

GBPUSD triggered long at A, hit first target at B, closed second half at C for end of week:

Results: +45 pips

Stocks:

Not a great day. Volume died off, but the opening 2 hours were awful.

From the report, nothing.

From the Twitter Plus feed,

Rich's LOW triggered long (with market support) and didn't work:

That’s 1 trigger with market support, and it didn't work.

Tradesight Recap Report for 7/8/21

Overview

The markets gapped down and were dead for the first two hours, then pushed up a bit on 4.1 billion NASDAQ shares.

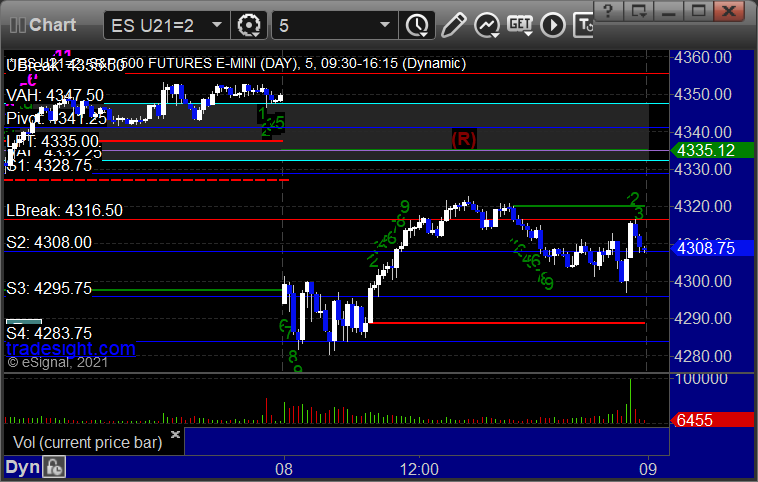

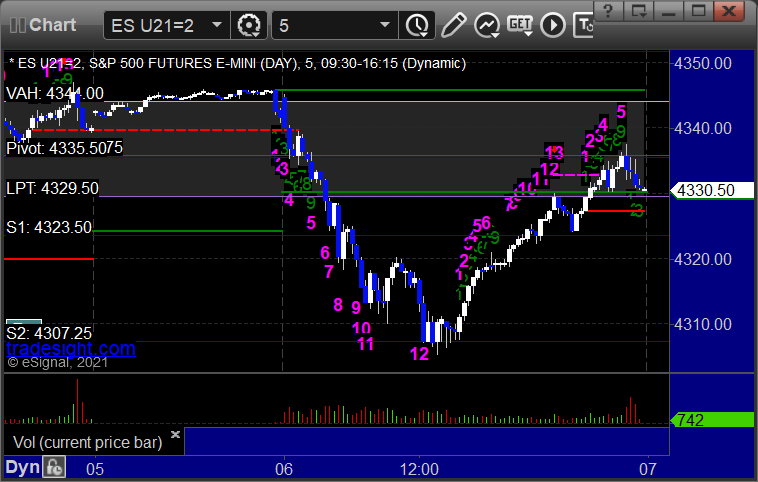

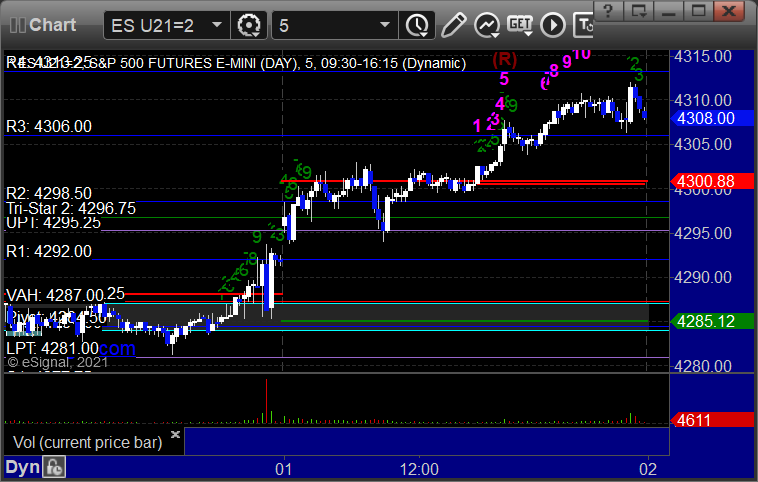

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B but too far out of range to take:

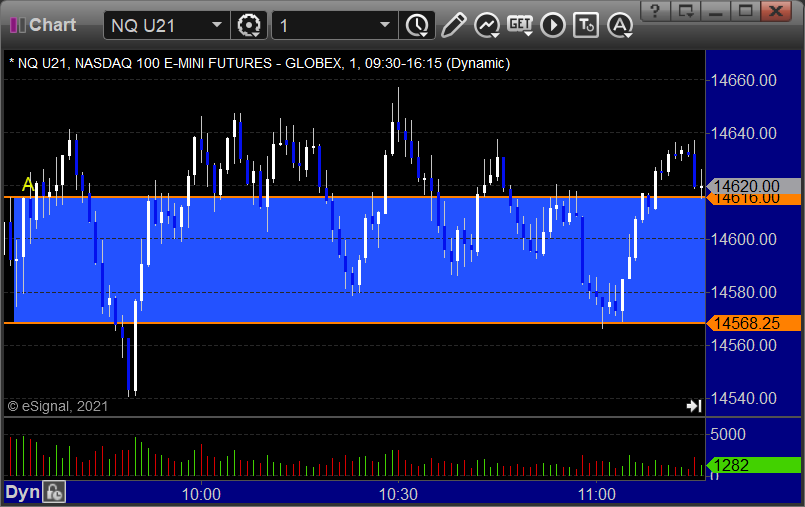

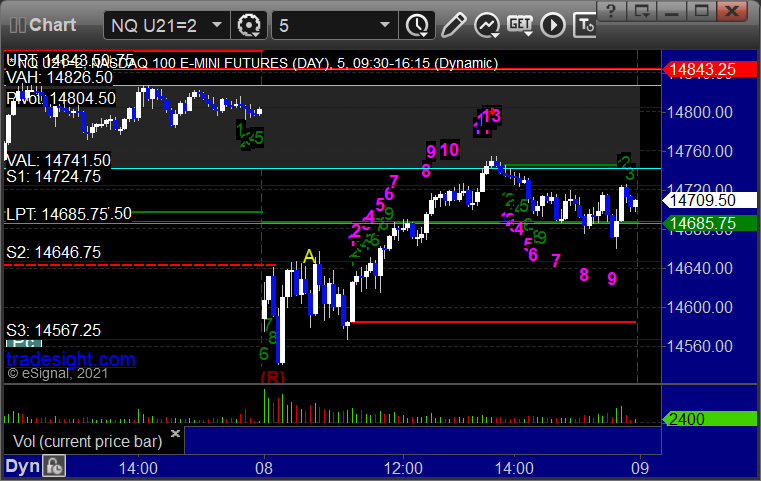

NQ Opening Range Play:

NQ call triggered long at A and stopped for 11 ticks:

Results: -7 ticks

Forex:

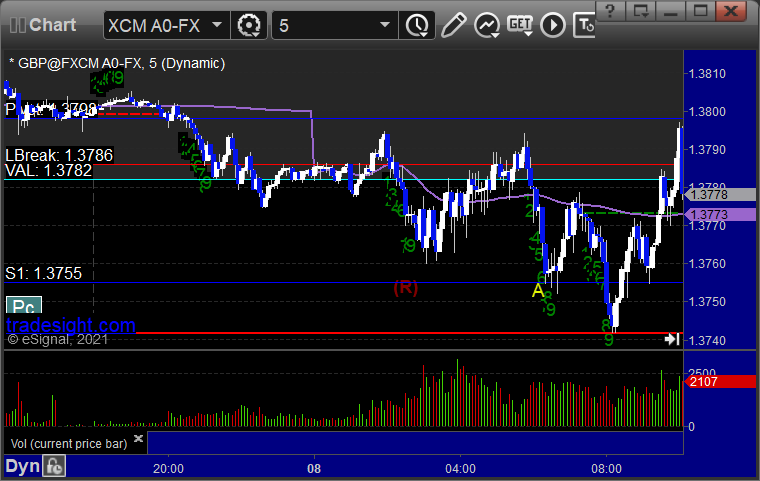

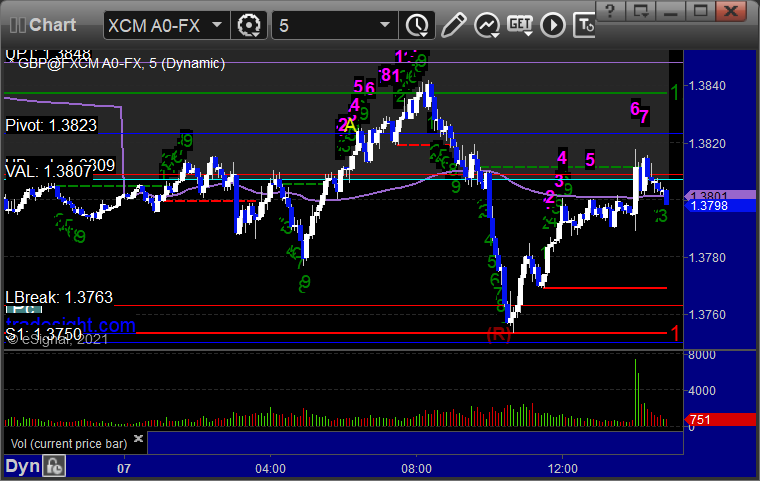

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Nothing from the report.

From the Twitter Plus feed, Rich's COST triggered long (with market support) and didn't go enough either way to count, closed slightly positive:

His AMC triggered short (with market support) and worked enough for a partial:

That’s 1 trigger with market support, and it worked enough for a partial.

Tradesight Plus Report for 7-8-21

Opening comments for the rest of the short week posted to YouTube. Note that next week is already options expiration for July.

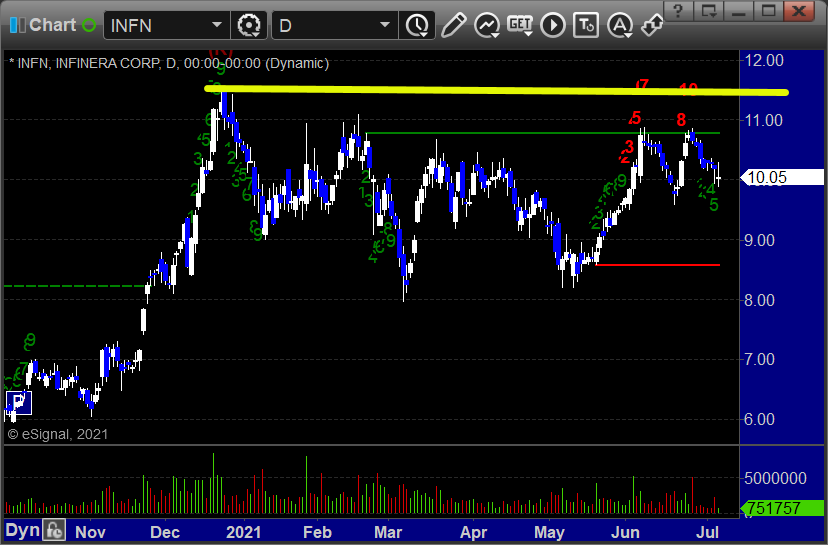

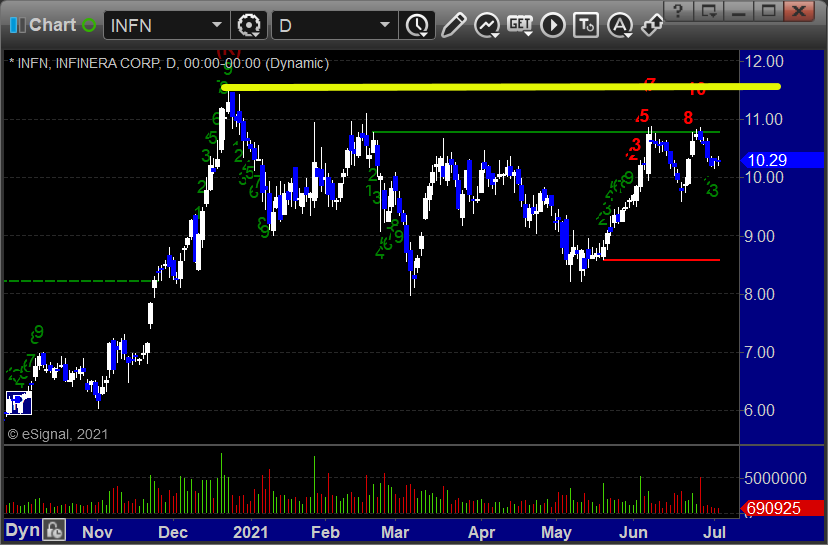

Longs only, in order of best chart construction, starting with INFN > 11.51:

BLFS > 47.99:

STEP > 41.00 (note the early entry over Wednesday's high that also works if it triggers clean):

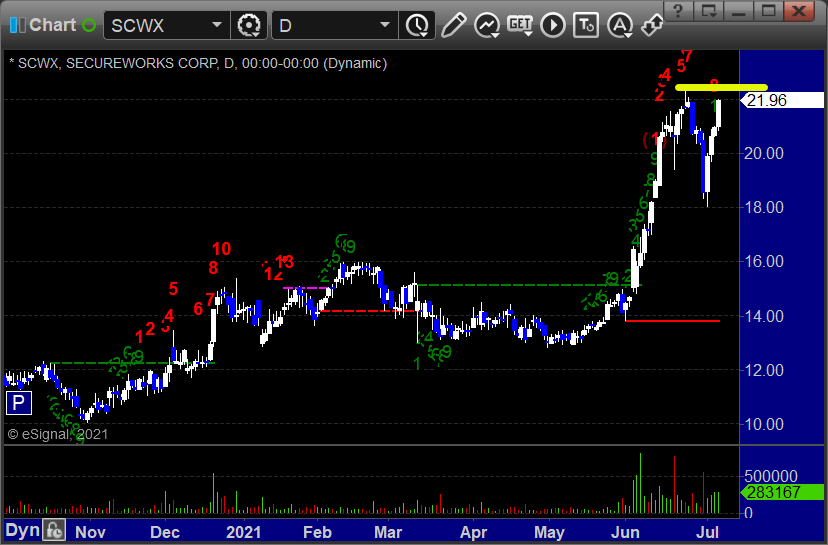

SCWX > 22.37:

Tradesight Recap Report for 7/7/21

Overview

The markets gapped up, sold off sharply and things were looking promising, and then we recovered back to the highs on 4.6 billion NASDAQ shares.

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked, triggered short at B and worked enough for a partial:

NQ Opening Range Play:

Results: +10.5 ticks

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

From the report, nothing triggered.

From the Twitter feed, PTON triggered long (with market support) and worked enough for a partial:

QCOM triggered short (with market support) and didn't go enough in either direction to count:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 7/6/21

Overview

The markets opened flat to higher, dipped in the middle of the day, and then came back to close slightly red on the ES and green on the NASDAQ side on 4.3 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play:

Results: +14 ticks

Forex:

No calls for the session with horrible Levels spacing on the GBPUSD:

Results: +0 pips

Stocks:

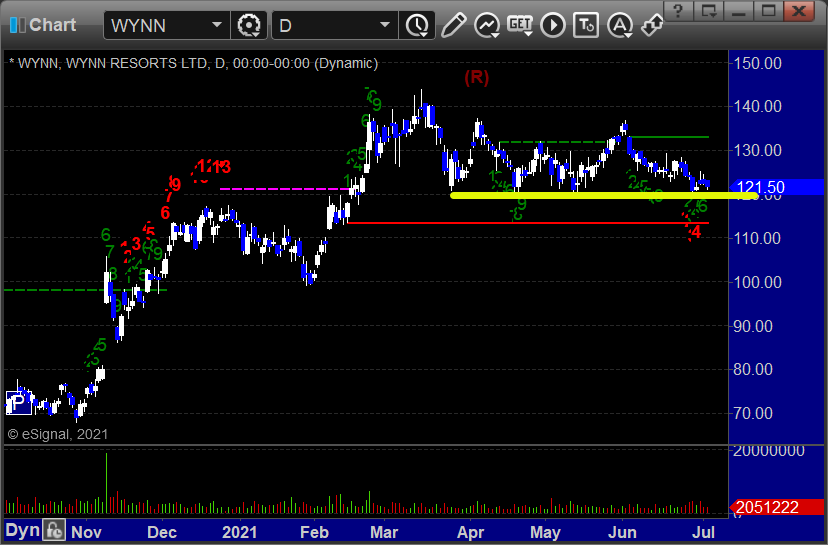

From the report, WYNN triggered short (with market support) and worked great:

From the Twitter feed, EBAY triggered short (with market support) and we closed for a tiny loss late in the day:

That’s 1 trigger with market support, and it worked.

Tradesight Plus Report for 7-6-21

Opening comments for the short week posted to YouTube. Let's see if they get things moving now that statements are printed and the Summer Holiday is over.

Longs first, in order of best construction, starting with INFN > 11.51:

CURI > 16.00, great cup and handle setup, not perfect because of the overhead not too far back:

On the short side, just WYNN < 119.74:

Tradesight Recap Report for 7/2/21

Overview

The market gapped up and went higher with not much excitement on 3.7 billion NASDAQ shares with everyone out for the long weekend.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and eventually worked:

NQ Opening Range Play:

Results: +6 ticks

Forex:

No calls, which was the right answer, as we head into the summer Holiday weekend.

GBPUSD:

Results: +0 pips

Stocks:

From the report, nothing triggered.

No calls in the Twitter feed given the Holiday environment.

That’s 0 triggers with market support.

Tradesight Recap Report for 7/1/21

Overview

The markets gapped mixed and did not too much. The NASDAQ was weaker and sat all day, while the ES inched higher on 4.4 billion NASDAQ shares.

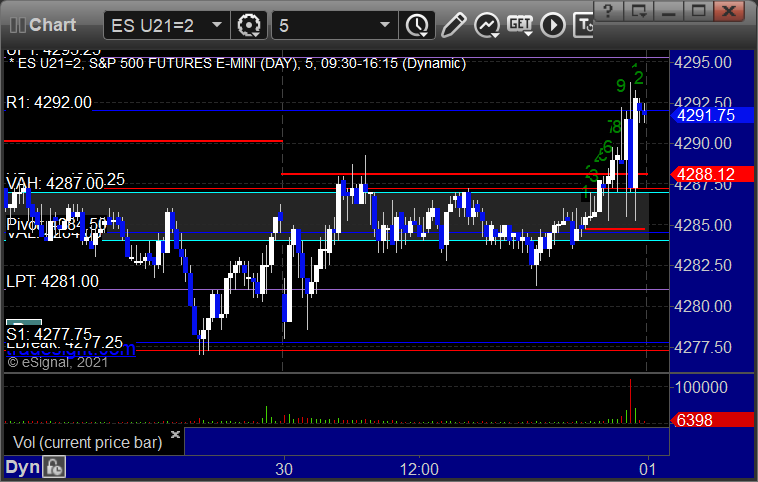

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +6.5 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

From the report, nothing triggered.

From the Tradesight Plus Twitter feed, AMGN triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 6/30/21

Overview

The markets gapped down small, ES filled, NQ never did, and we went nowhere on 4.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial:

NQ Opening Range Play:

Results: +4 ticks

Forex:

GBPUSD, no triggers:

Results: +0 pips

Stocks:

From the report, nothing triggered.

From the Tradesight Plus Twitter feed, some calls, but nothing triggered.

That’s 0 triggers with market support.

Tradesight Recap Report for 6/29/21

Overview

The markets gapped up and went dead flat until a small dip to fill the gap in the afternoon and closed where they opened on 4.9 billion NASDAQ shares as we close in on end of quarter.

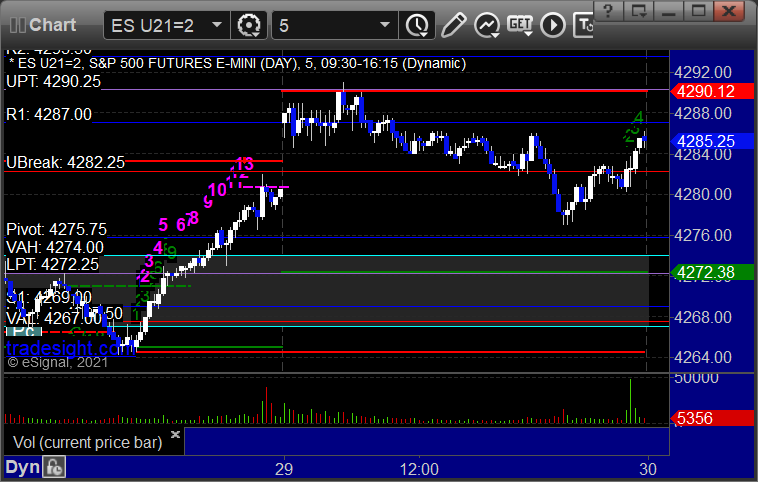

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play:

Results: +4.5 ticks

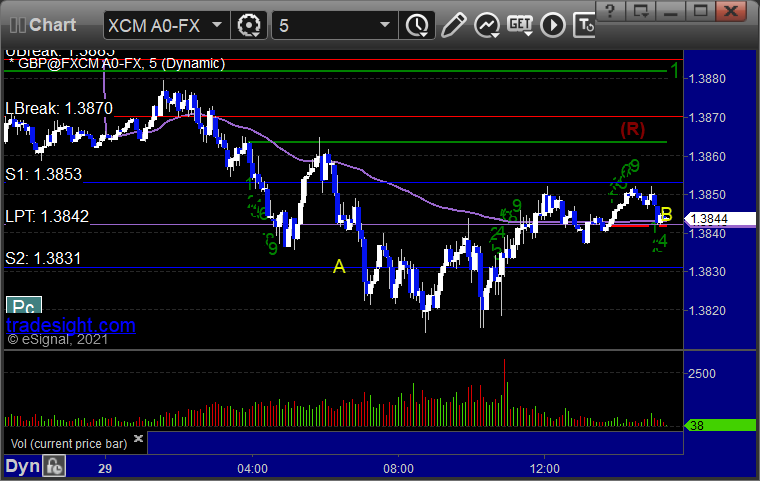

Forex:

GBPUSD triggered short at A and closed at B for a small loss at end of session:

Results: -10 pips

Stocks:

From the report, MDXG triggered long (with market support) and didn't work:

From the Twitter Plus feed, Rich's BIIB triggered long (with market support) and worked:

His KLAC triggered long (with market support) and didn't go enough either way to count:

That’s 2 triggers with market support, 1 of them worked and 1 did nothing.