Tradesight Recap Report for 6/18/21

Overview

The markets gapped down and went basically dead flat for triple expiration on 6.1 billion NASDAQ shares. Not much action.

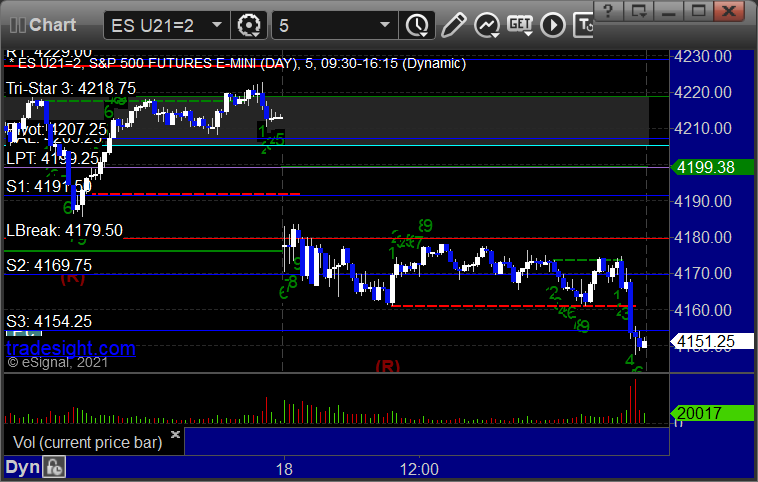

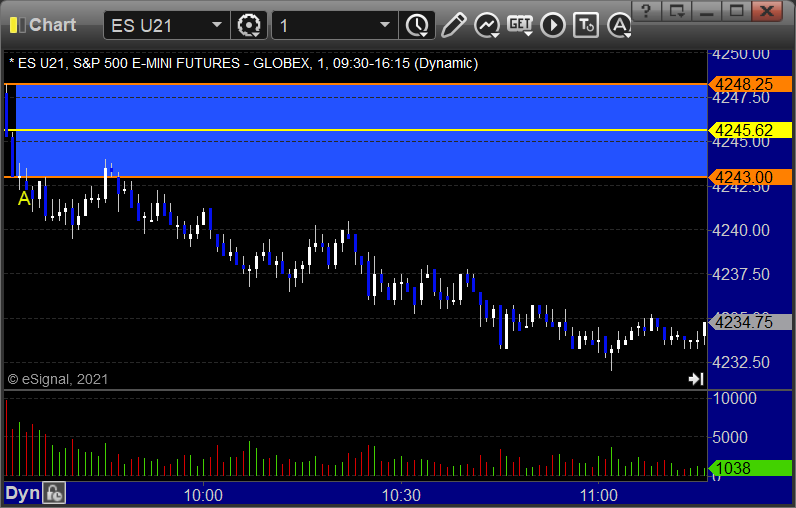

ES with Levels:

ES with Market Directional:

Futures:

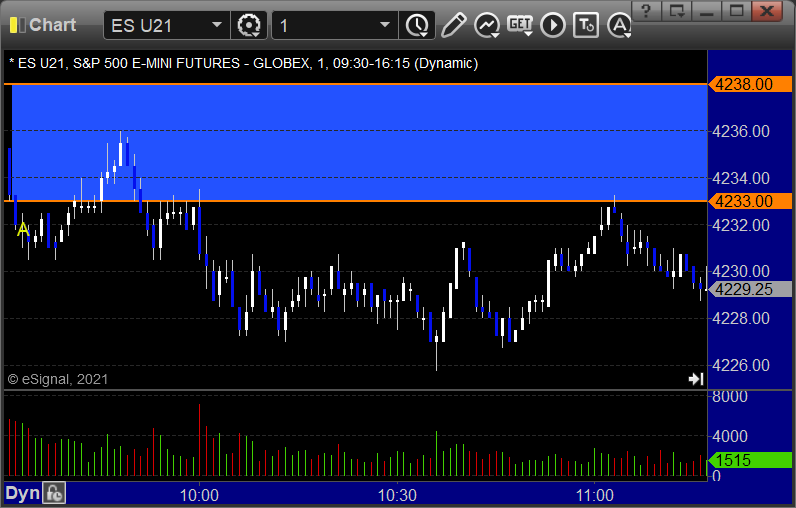

ES Opening Range Play triggered long at A but too far out of range to take, triggered short at B but too far out of range to take:

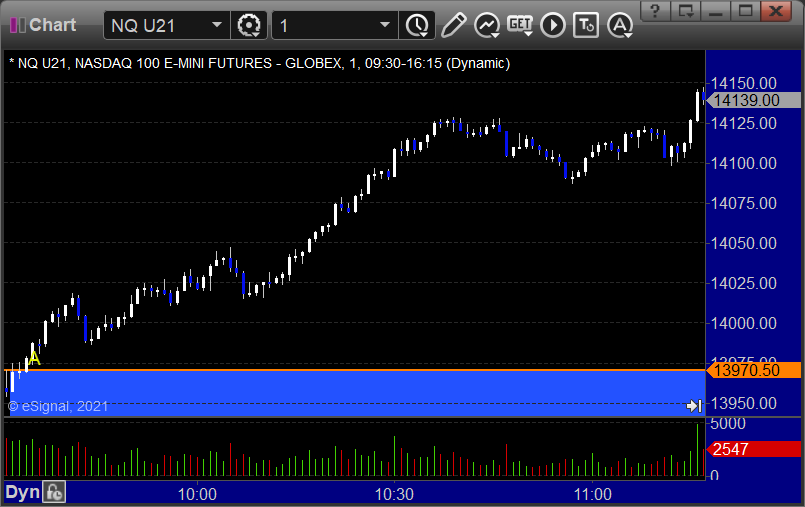

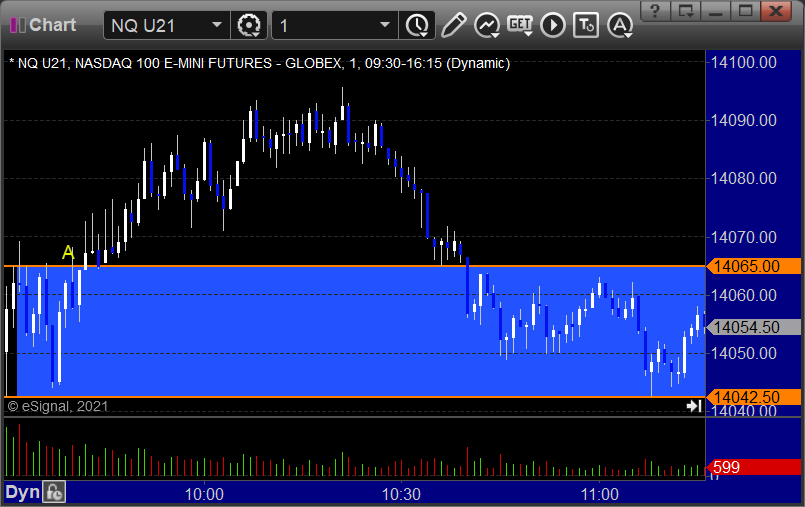

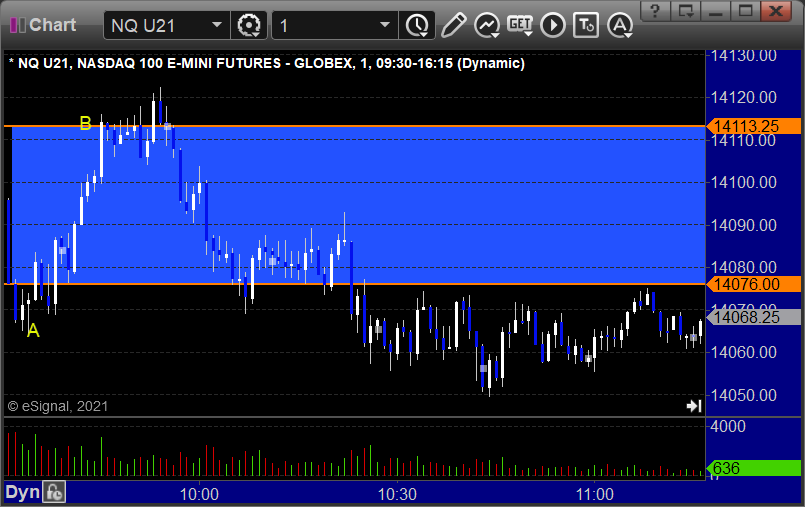

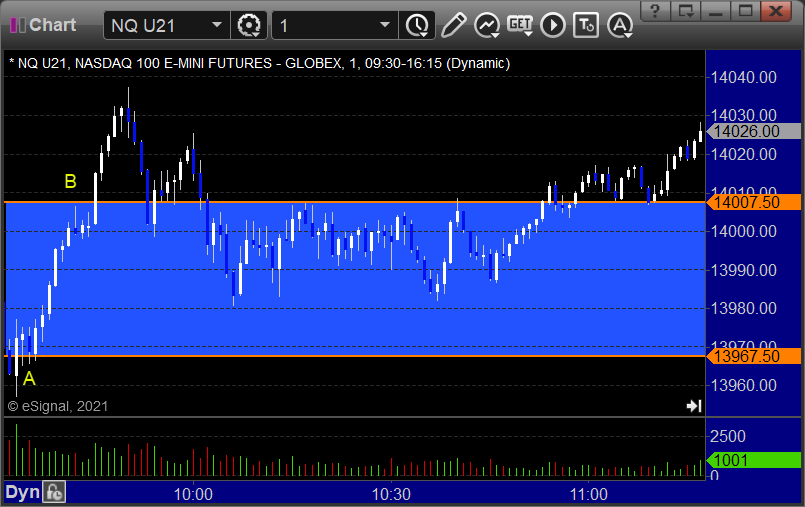

NQ Opening Range Play, truly amazing, the NQ never closed out of the OR until after 1 hour into the market, never seen that before:

Results: +0 ticks

Forex:

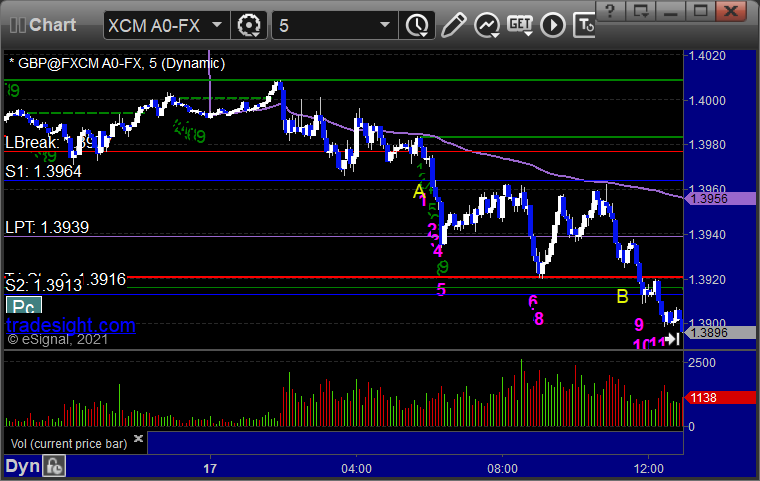

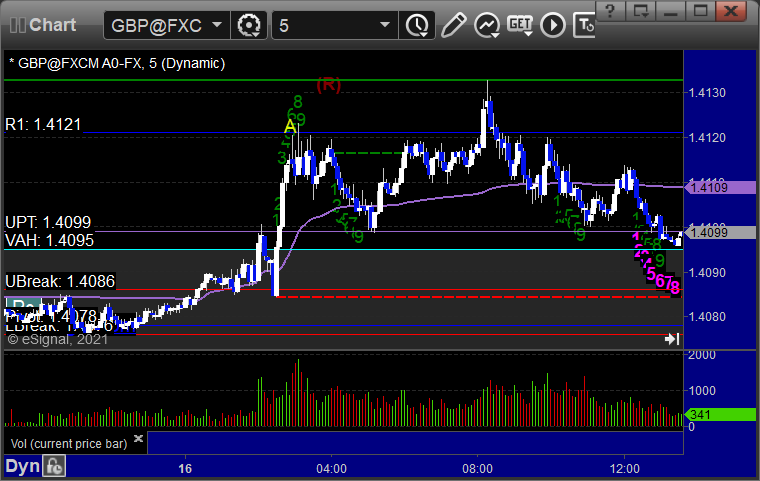

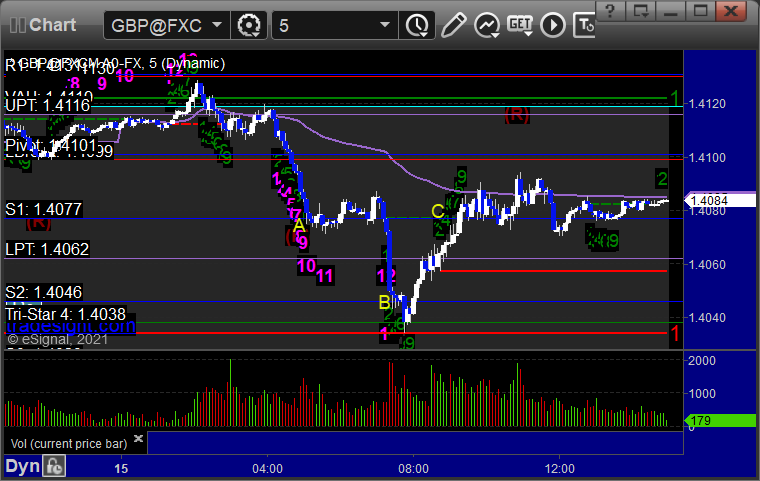

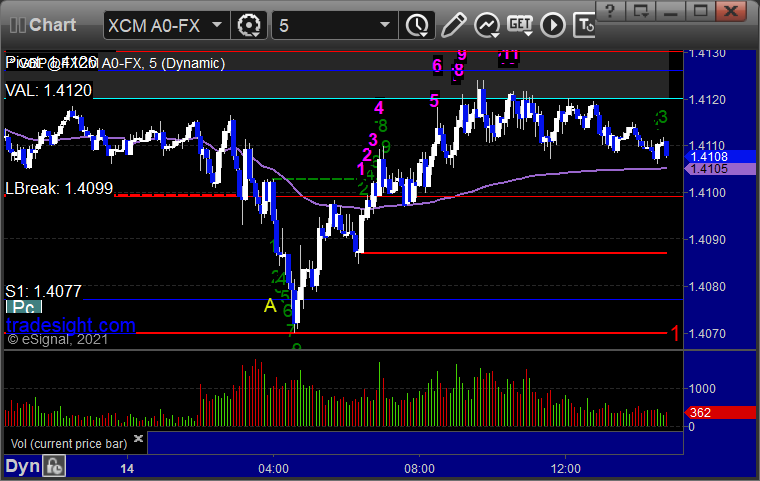

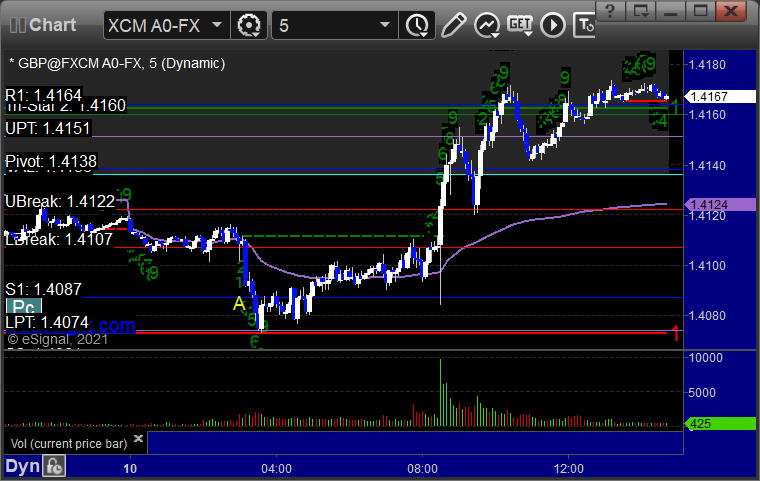

GBPUSD triggered short at A, hit first target at B, closed at end of chart for end of week:

Results: +55 pips

Stocks:

From the report, POWW triggered long (with market support) and didn't go enough either way to count:

From the Twitter Plus feed, Rich's TWLO triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 6/17/21

Overview

The markets opened flat and were mixed. ES was flat all day, Dow was down, and the NASDAQ was up a bit on 4.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

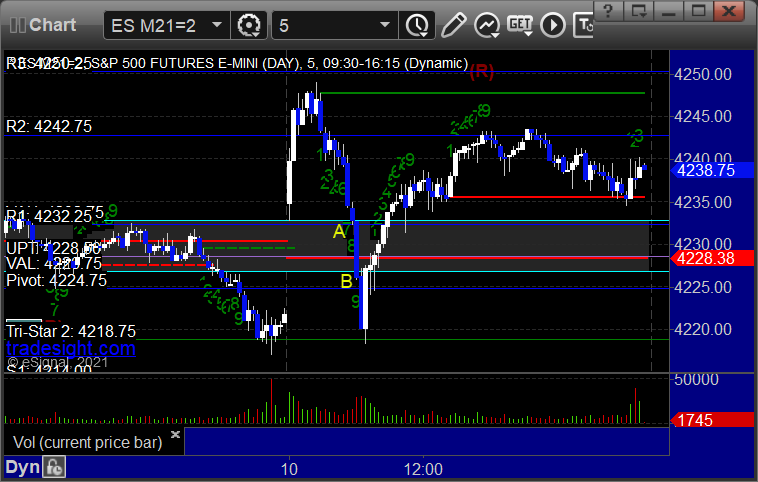

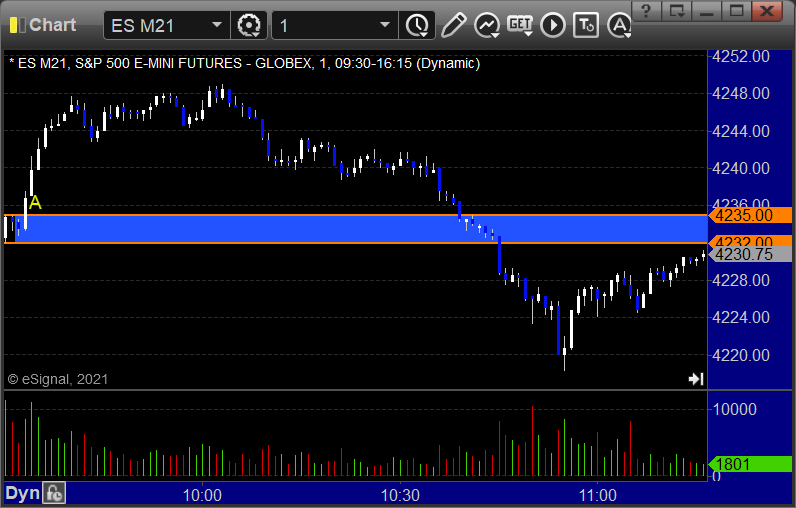

ES Opening Range Play triggered long at A and worked, triggered short at B and worked:

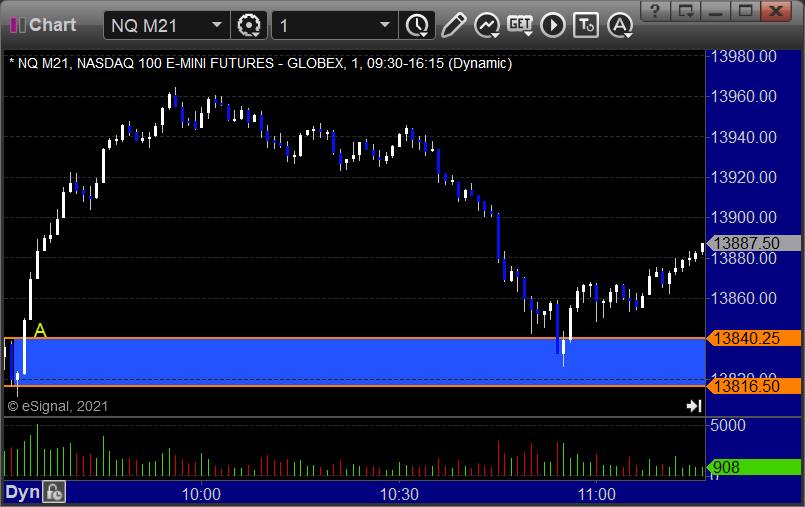

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +18.5 ticks

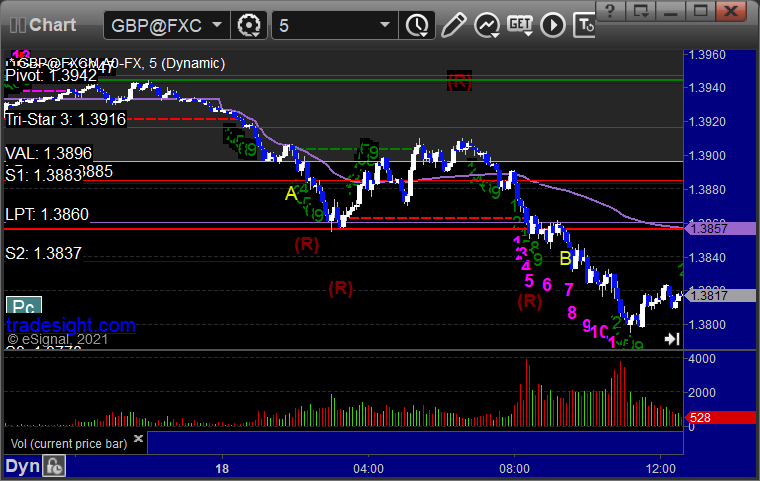

Forex:

GBPUSD triggered short at A, hit first target at B, still holding second half:

Results: pips

Results: pips

Results: Unknown, trade still going.

Stocks:

ZM triggered long (with market support) and worked enough for a partial:

That’s 1 trigger with market support, and it works.

Tradesight Recap Report for 6/16/21

Overview

The markets opened flat and did nothing until the Fed announcement, then dropped and came back on 4 billion NASDAQ shares.

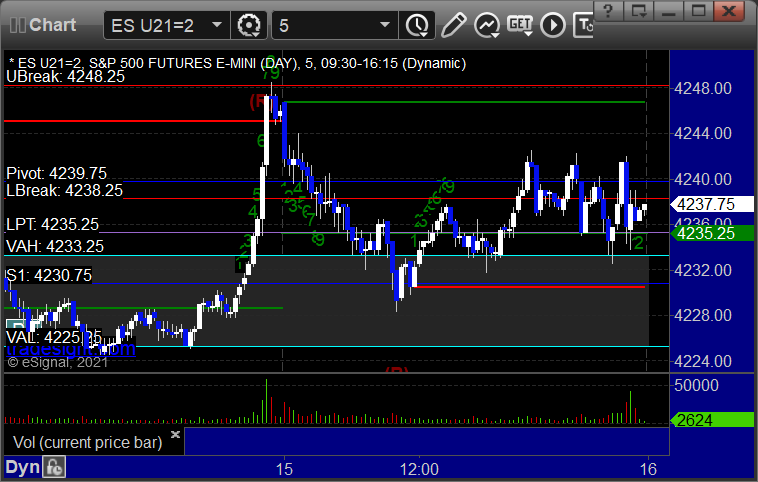

ES with Levels:

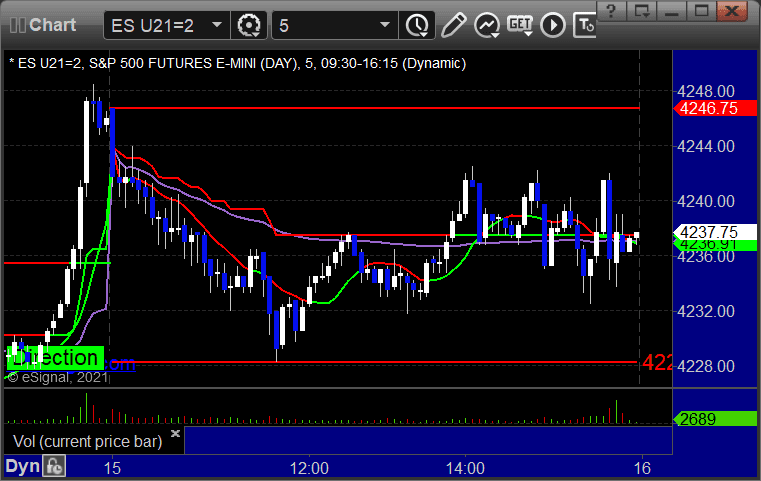

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and eventually worked:

NQ Opening Range Play:

Results: +6 ticks

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

From the report, nothing triggered.

From the Twitter Plus feed, Rich's DASH triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Plus Report for 6-16-21

Well, a lot of stocks came up in my scans, but not many were worth adding to the list. Keep in mind that we have a Fed announcement at 2 pm EST and then the Press Conference 30 minutes later.

Also keep in mind that if there is an options unraveling move waiting to happen, it could be Wednesday or Thursday.

Finally, opening comments posted to YouTube.

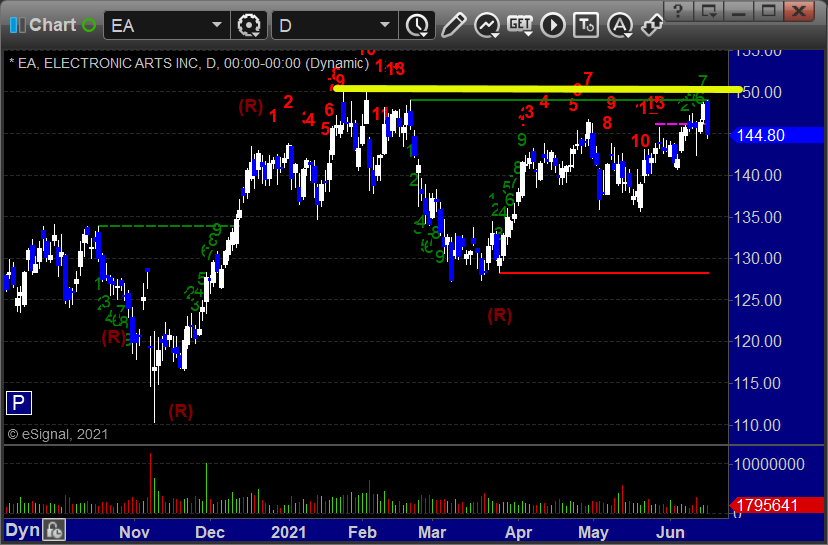

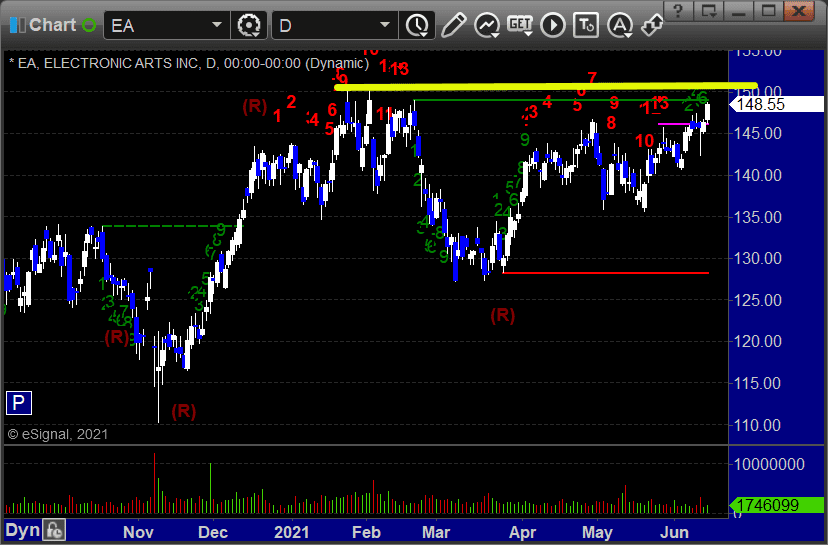

Longs first, in order of best chart construction, starting with EA > 150.30:

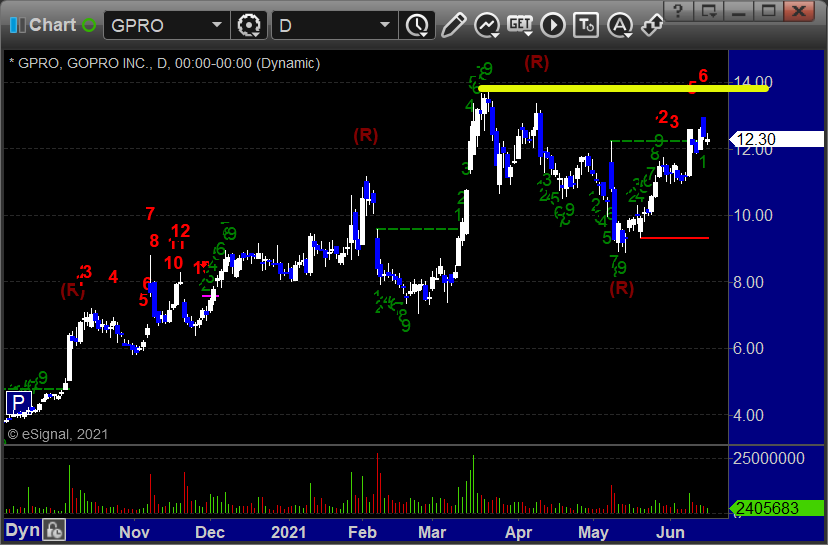

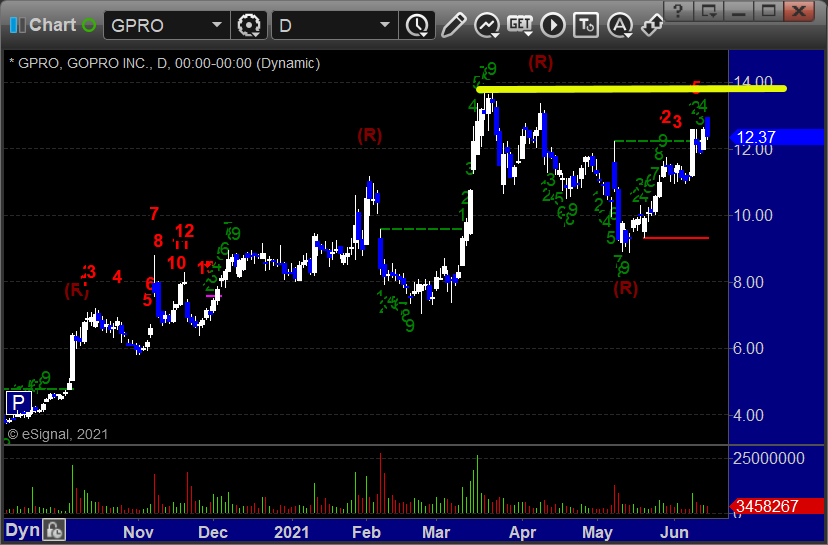

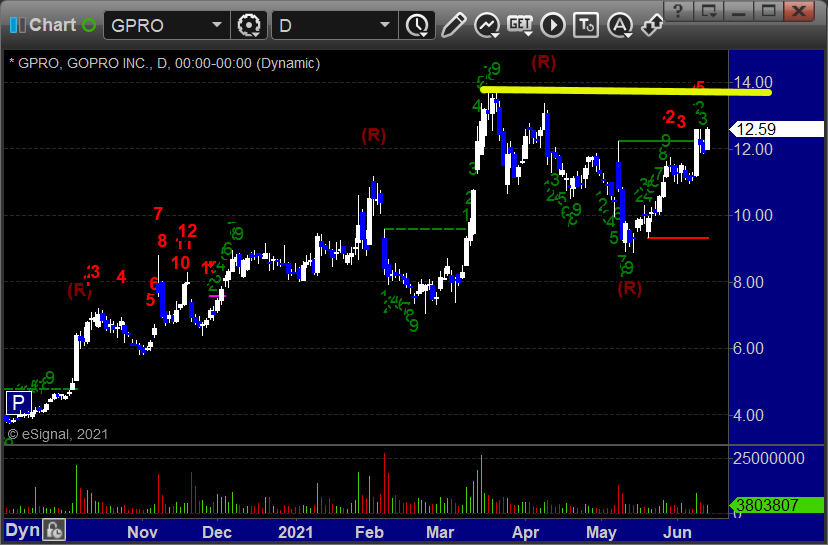

GPRO > 13.79:

POWW > 7.88:

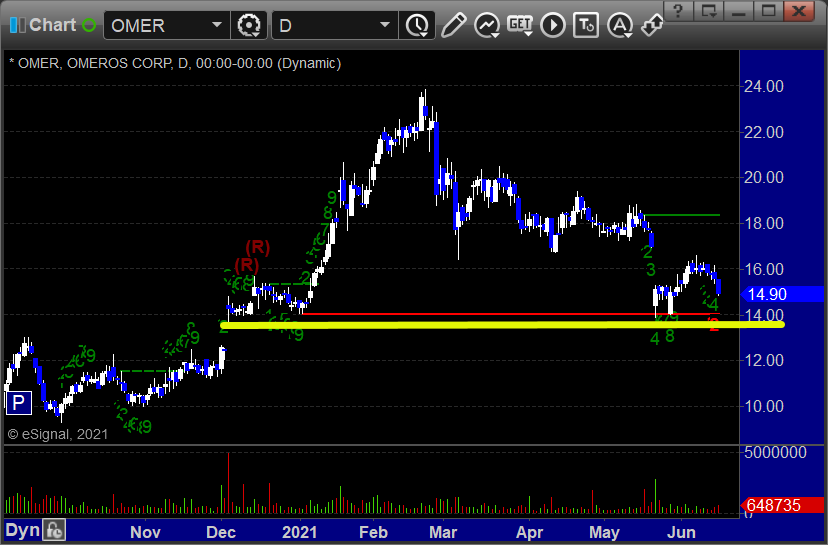

On the short side, OMER < 13.65:

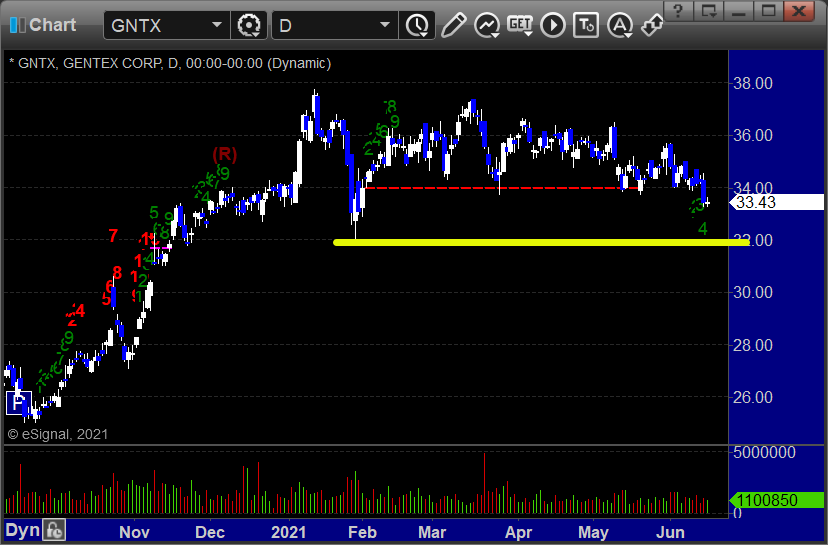

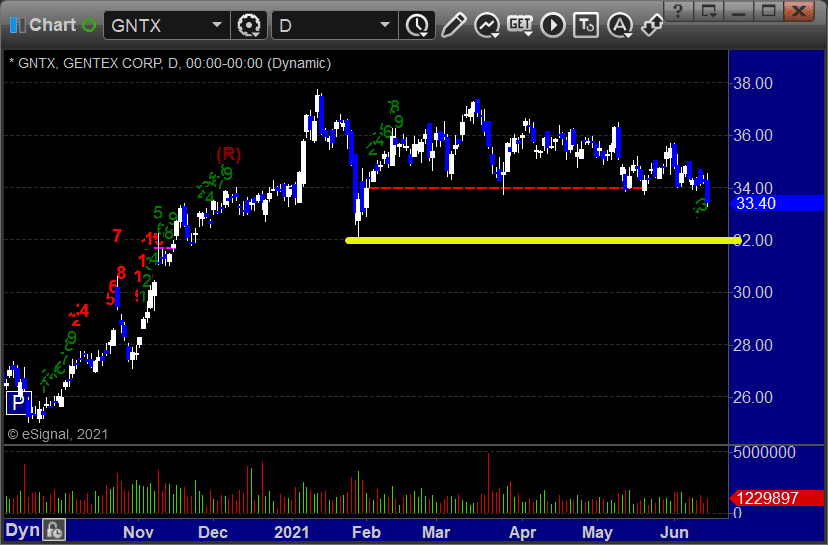

GNTX < 32.00:

Tradesight Recap Report for 6/15/21

Overview

The markets opened flat and drifted lower in the morning without much excitement and then went flat for the rest of the day on 4.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and long at B, both too far out of range to take:

Results: +4.5 ticks

Forex:

GBPUSD triggered short at A, hit first target at B, stopped second half over the entry at C:

Results: +10 pips

Stocks:

From the report, nothing triggered.

From the Twitter feed, no pattern plays triggered. The AVGO and FEYE Seeker sell signals both worked.

That’s 0 triggers with market support.

Tradesight Plus Report for 6-15-21

Opening comments for the session posted to YouTube. It was a weird session Monday with a split market and then a very late rally. Hopefully, Tuesday is clearer and more unified.

Longs first, in the order of best chart construction, starting with EA > 150.50:

GPRO > 13.79:

POWW > 7.88:

Shorts, just one, GNTX < 32.00:

Tradesight Recap Report for 6/14/21

Overview

The markets opened mostly flat and split, with the ES drifting down and the NASDAQ drifting up until the last hour when everything suddenly ran up on 4.3 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and stopped over the midpoint:

NQ Opening Range Play triggered short at A and long at B, both too far out of range to take:

Results: -13 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

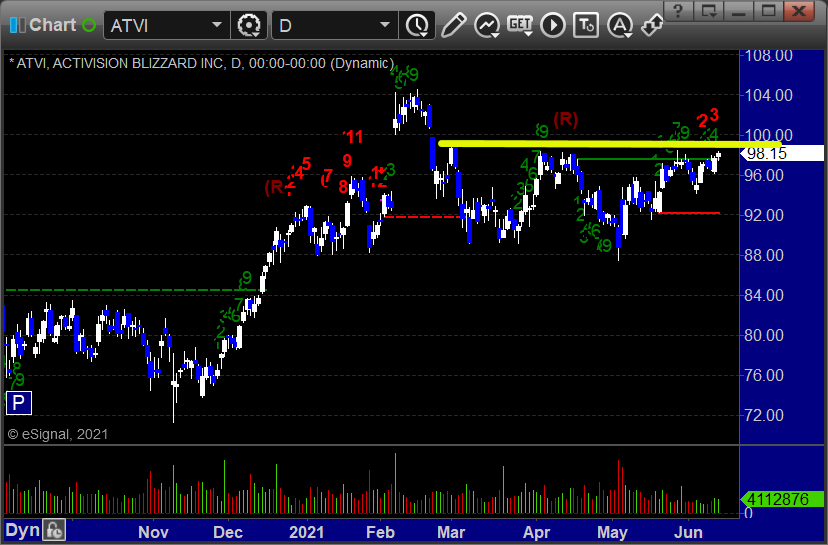

From the report, ATVI triggered long (without market support based on the trigger posted in the Plus report) and worked a little:

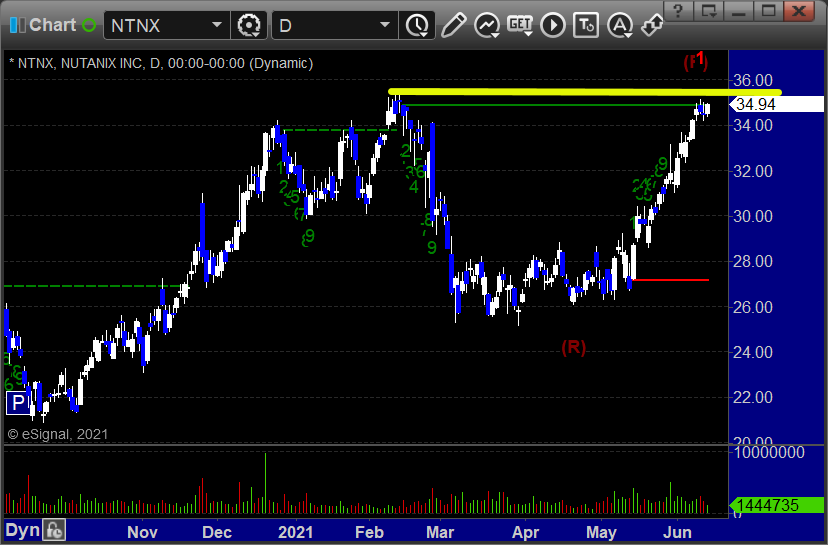

NTNX triggered long (without market support due to opening 5 minutes) and worked:

From the Twitter Plus feed, Rich's AMZN triggered long (with market support) and worked:

PYPL triggered long (without market support) and worked:

That’s 1 trigger with market support, and it worked, plus three others.

Tradesight Plus Report for 6-14-21

Opening comments posted to YouTube (or will be soon). I didn't find much new stuff after this last week, but we will certainly call it from the tape this week. Quarterly futures contract roll is behind us, but triple expiration is this week, so we shall see. Summer is here as well.

Longs only, in order of best chart construction, starting with ATVI > 98.92:

NTNX > 35.58:

GPRO > 13.79:

POWW > 7.88:

Tradesight Recap Report for 6/11/21

Overview

Pretty much as we expected for quarterly contract roll. The markets gapped up small, filled, and sat there all day until the last ten minutes on 4.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

First red day of the week on the Opening Range Plays.

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

NQ Opening Range Play, too big of a range to take:

Results: -7 ticks

Forex:

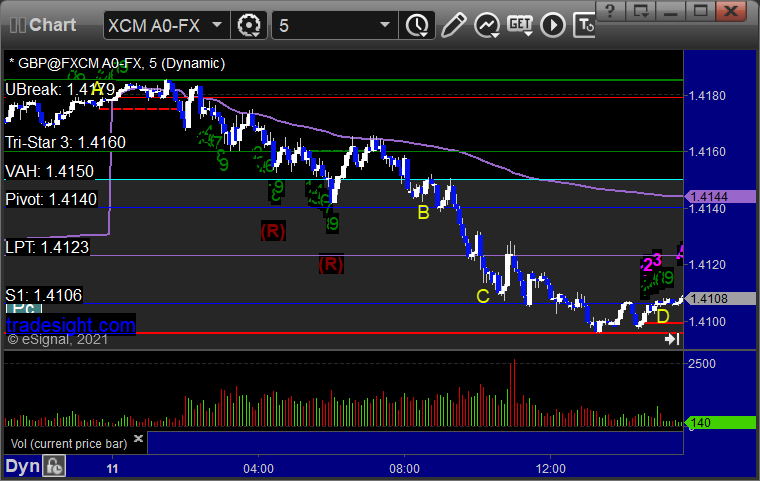

GBPUSD triggered long at A and stopped, triggered short at B, hit first target at C, closed second half at D for end of week:

Results: +10 pips

Stocks:

From the report, nothing triggered.

From the Twitter Plus feed, ADBE triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 6/10/21

Overview

The markets gapped up and pushed sharply higher out of the gate, then pulled back, broke the lows, and dropped to fill the gap, then bounced back to the middle of the range for the rest of the day on 4.8 billion NASDAQ shares.

ES with Levels (Value Area Play worked perfectly from A to B):

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked great:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +21.5 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

From the report, no triggers.

From the Twitter Plus feed, Rich's AMZN triggered long (without market support due to opening 5 minutes, but he also told everyone to just take it over the opening 5 minute candle if they waited, so with market support) and worked huge:

His BIIB triggered long (with market support) and worked:

His FEYE triggered long (with market support) and worked:

That’s 3 triggers with market support, all of them worked.