Tradesight Recap Report for 7/20/22

Overview

The markets opened flat, pushed higher, came back, and then drifted up midrange on 5.4 billion NASDAQ shares.

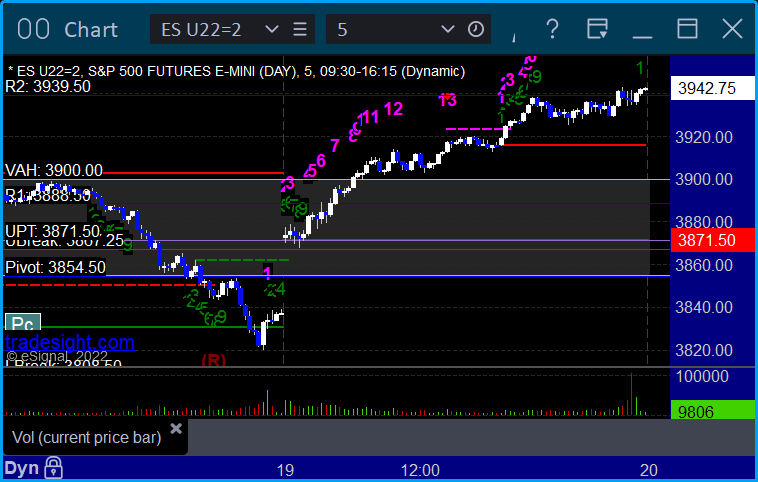

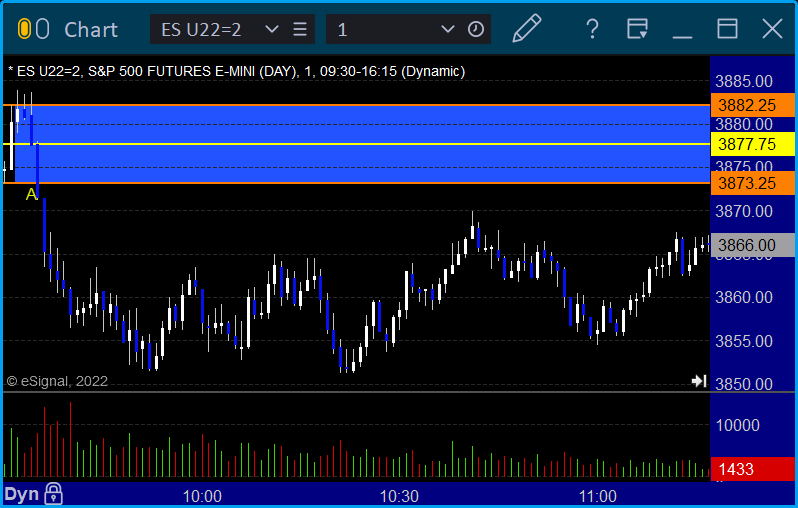

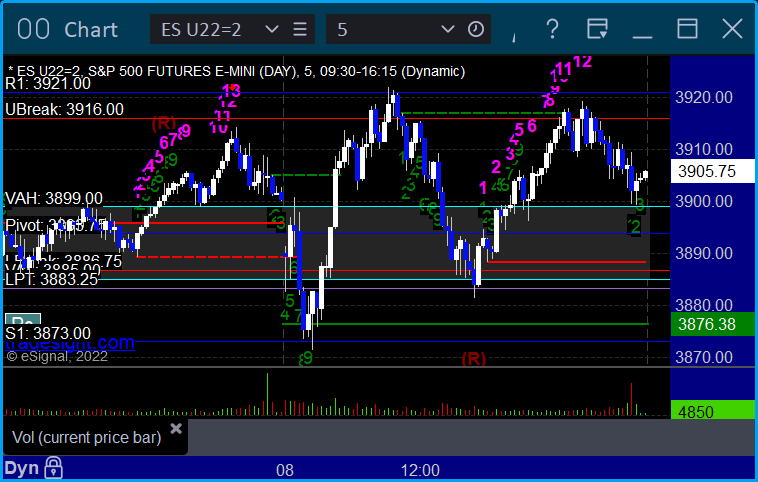

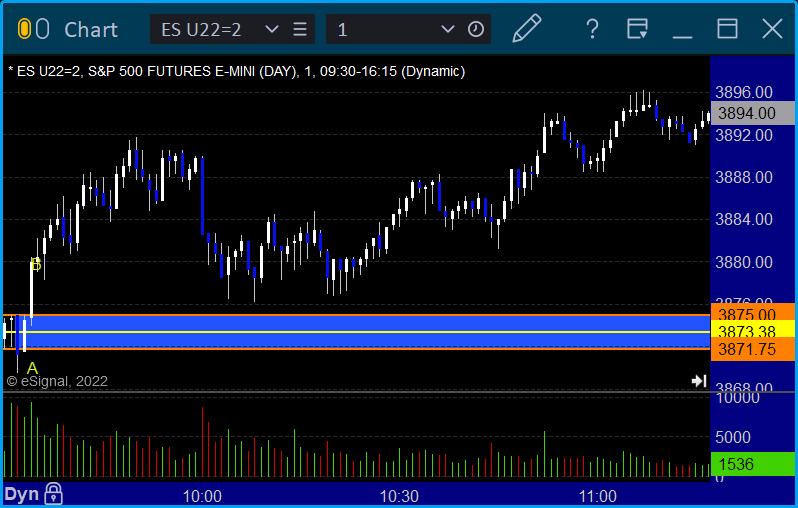

ES with Levels:

ES with Market Directional:

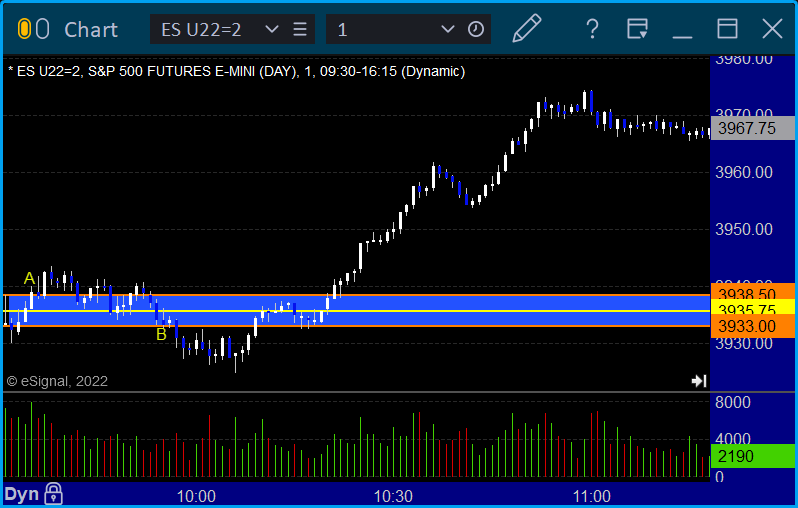

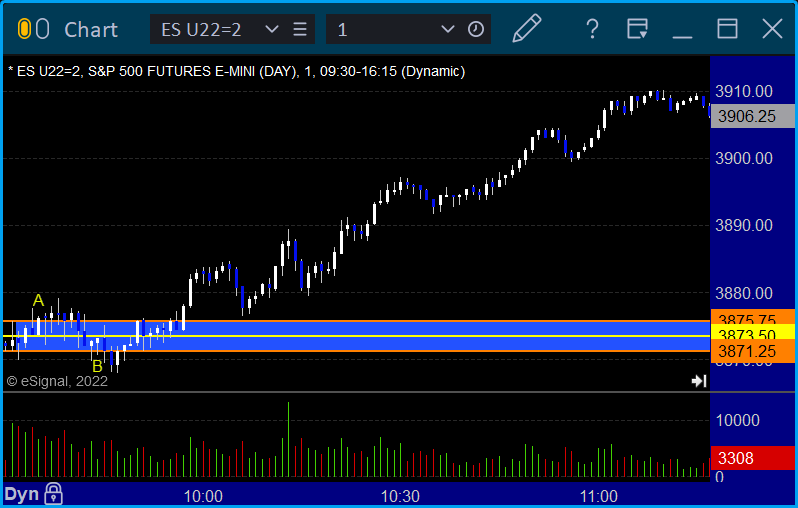

Futures:

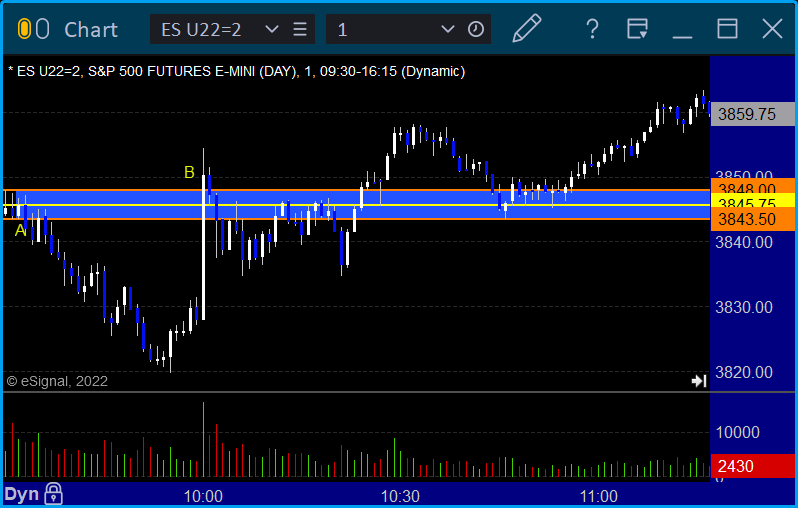

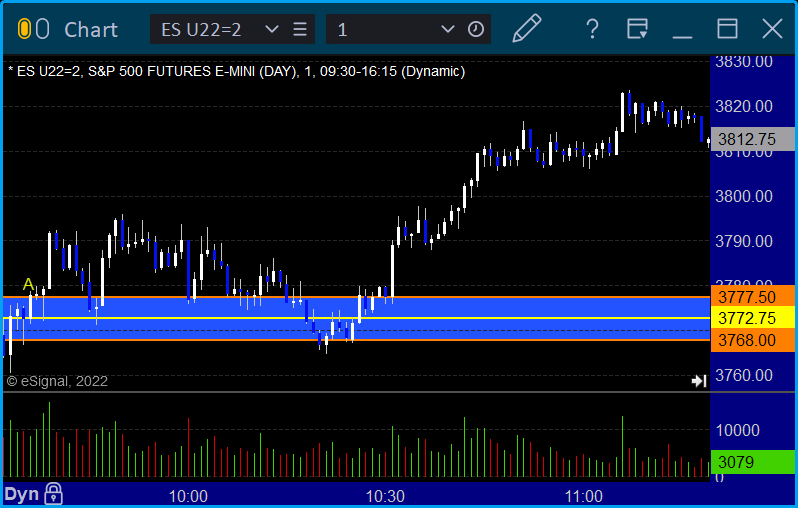

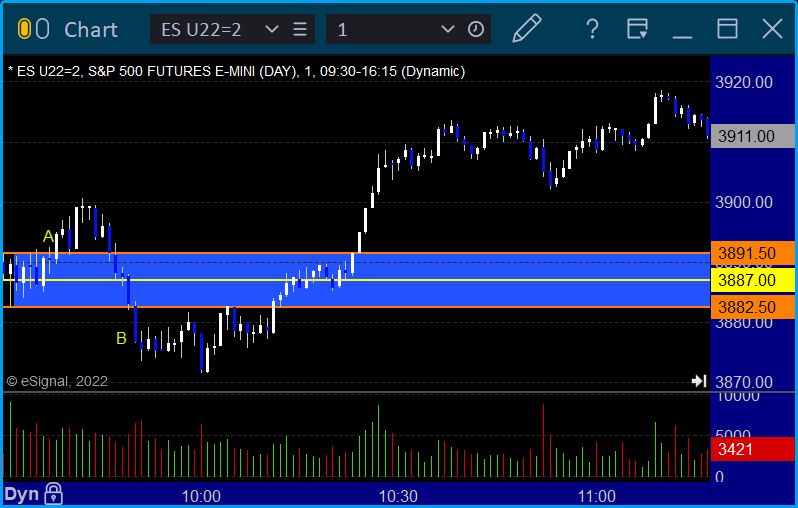

ES Opening Range Play triggered long at A and worked, triggered short at B and worked:

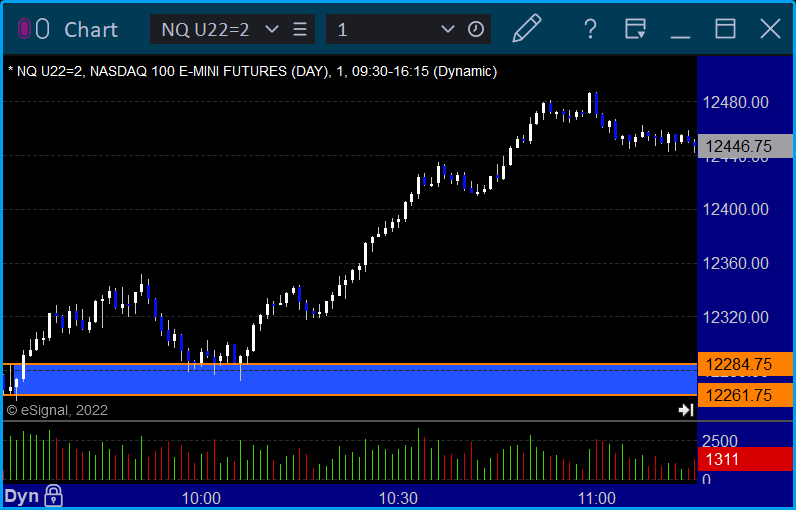

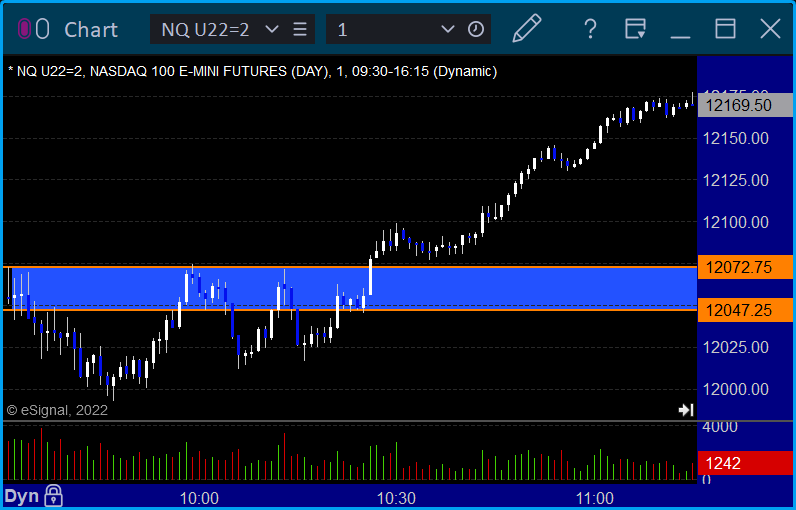

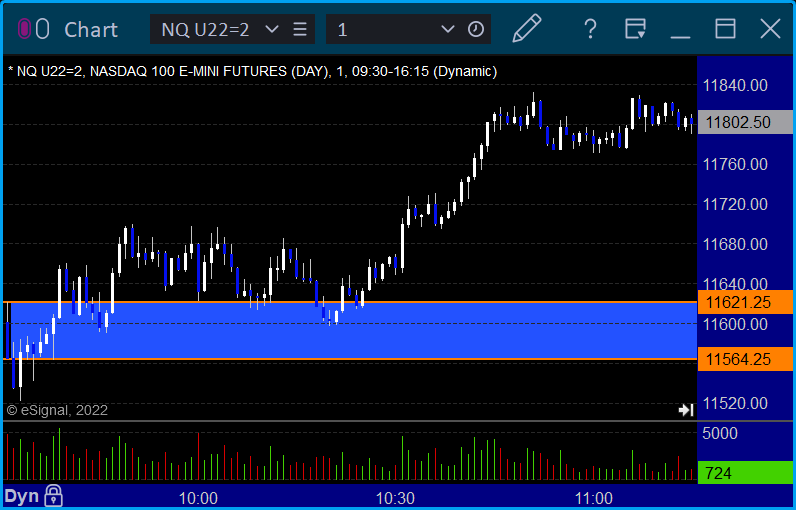

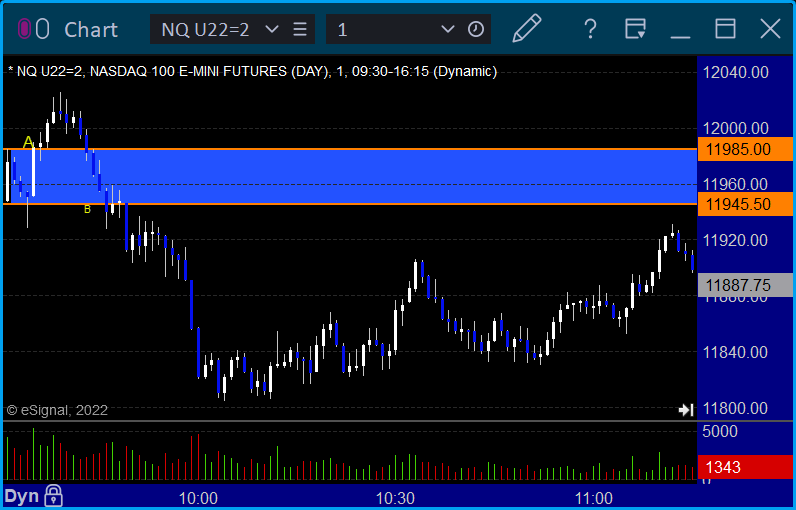

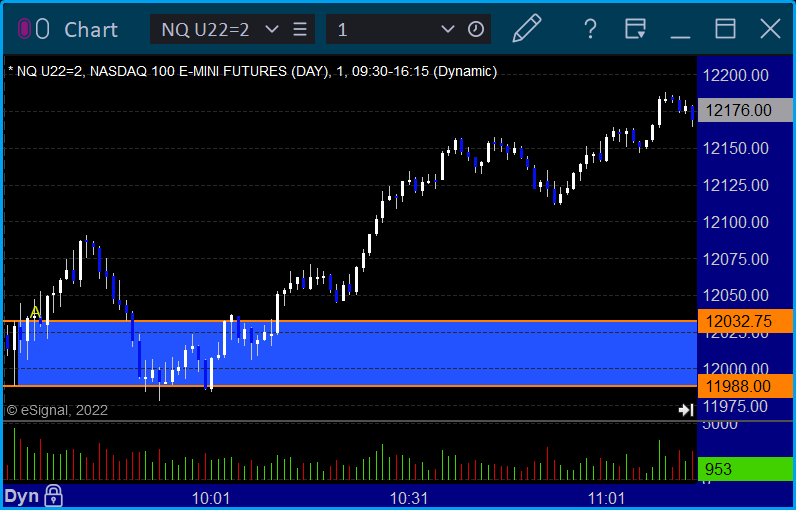

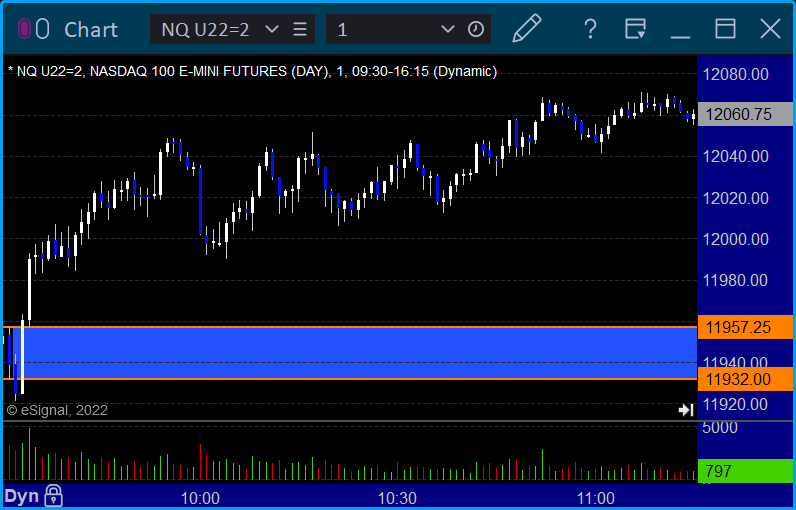

NQ Opening Range Play:

Results: +12 ticks

Forex:

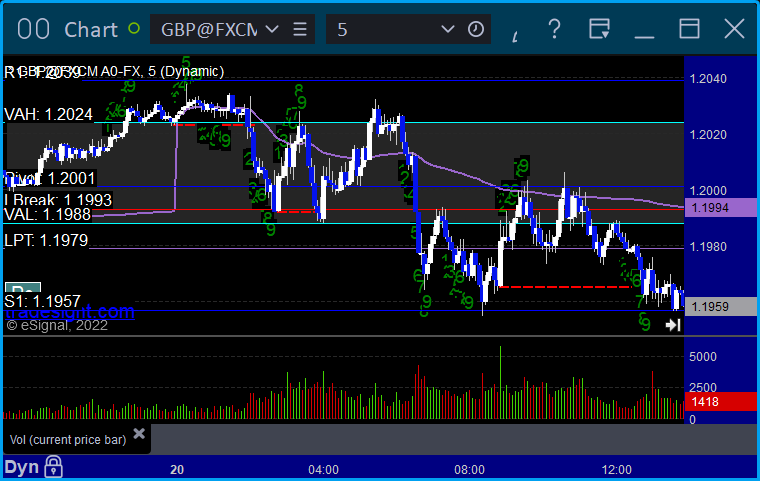

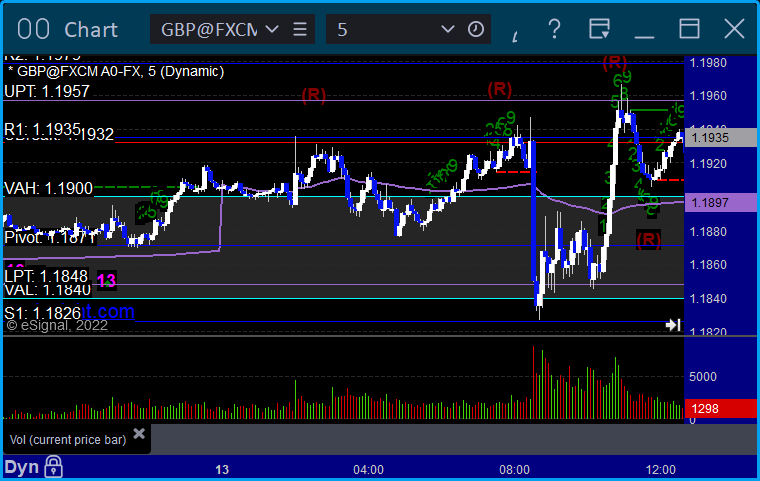

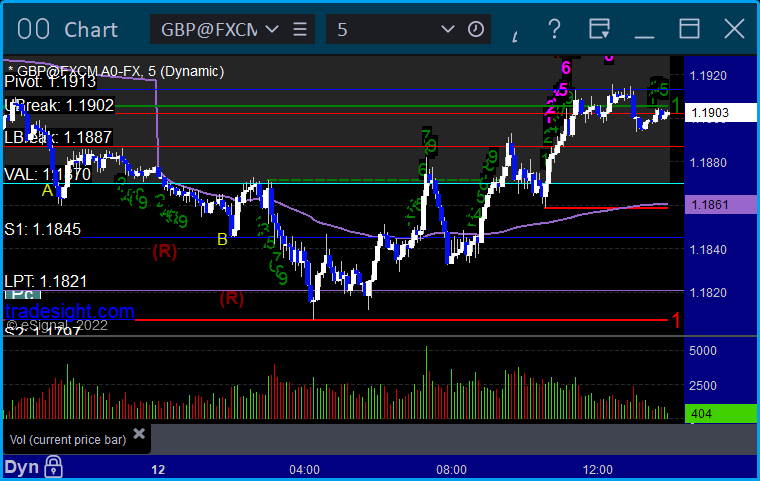

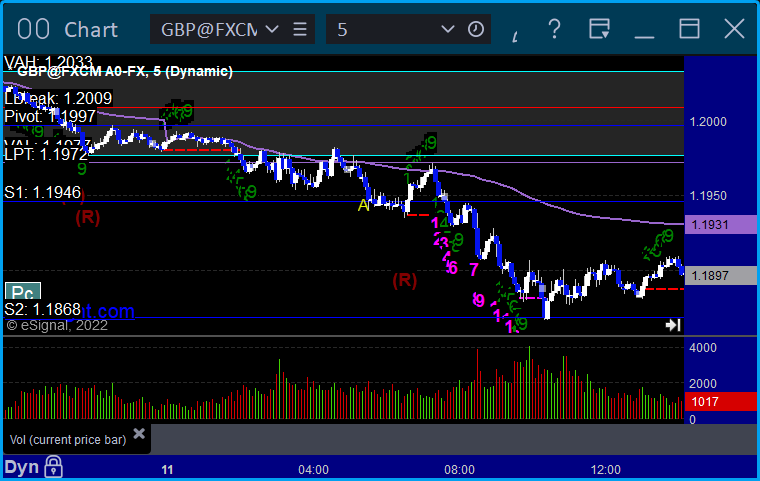

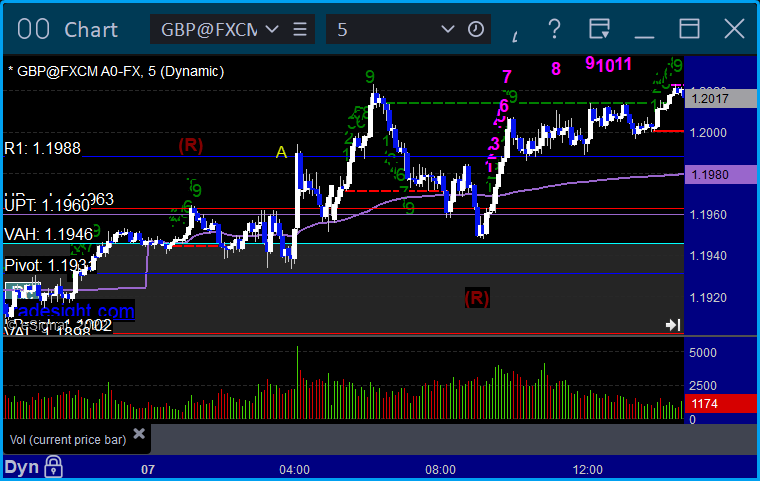

GBPUSD, no calls. Second half of the prior day's trade stopped:

Results: +20 pips

Stocks:

Another day of a couple of winners.

From the Tradesight Plus Report, no calls for summer doldrums.

From the Tradesight Plus Twitter feed, Rich's ADBE triggered long (with market support) and worked:

His CHF triggered long (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 7/19/22

Overview

The markets gapped up and ultimately drifted higher but still in summer doldrum mode on 5.2 billion NASDAQ shares.

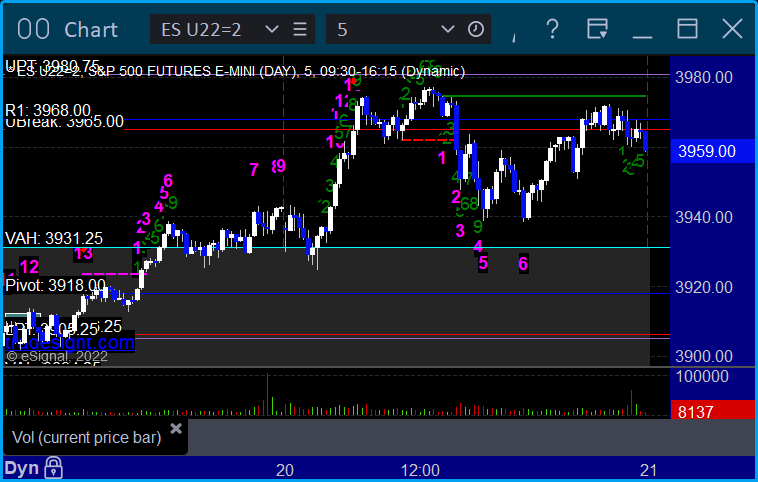

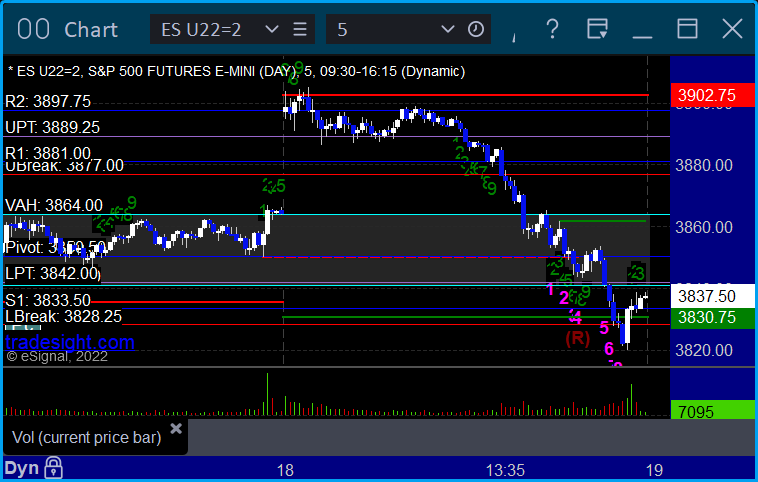

ES with Levels:

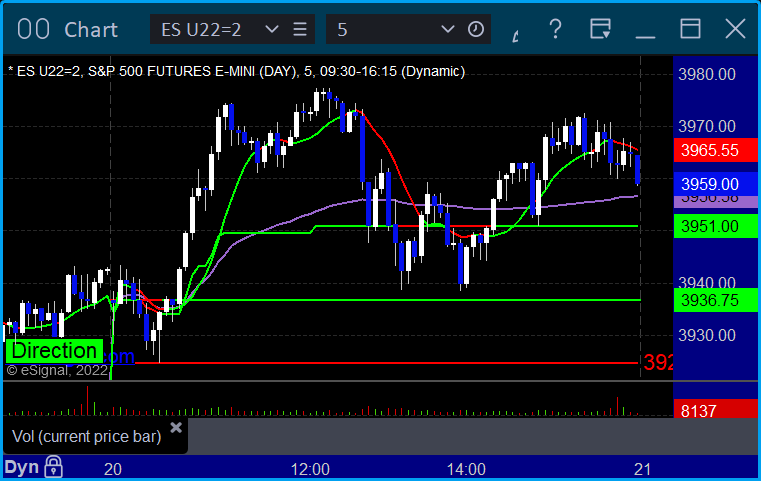

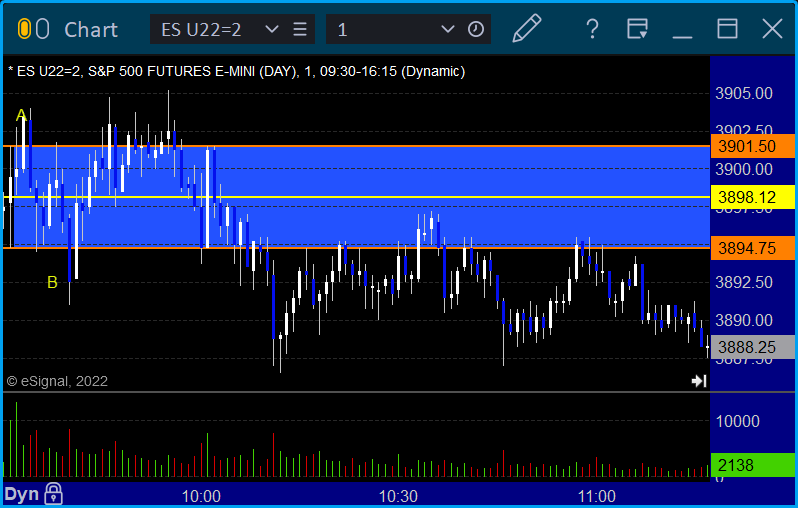

ES with Market Directional:

Futures:

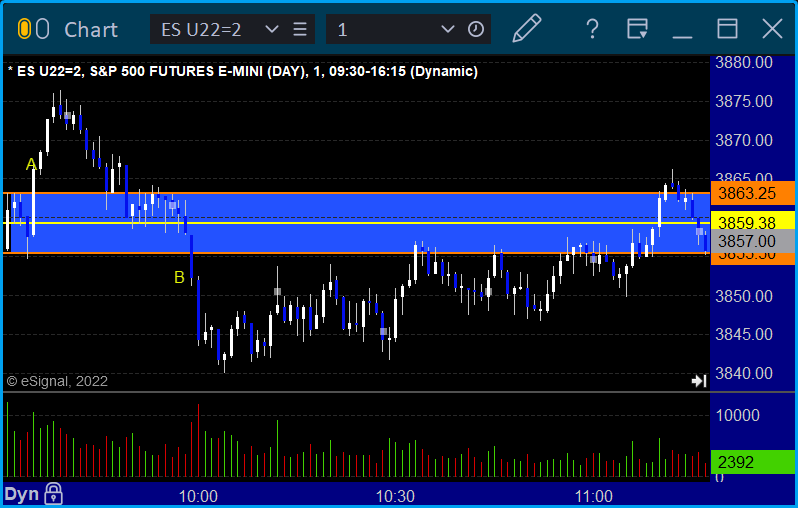

ES Opening Range Play triggered long at A and stopped, triggered short at B and stopped over the midpoint:

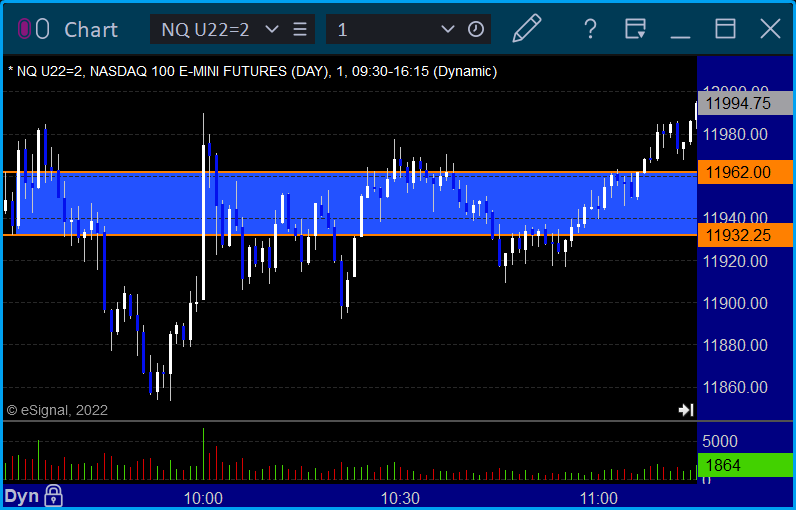

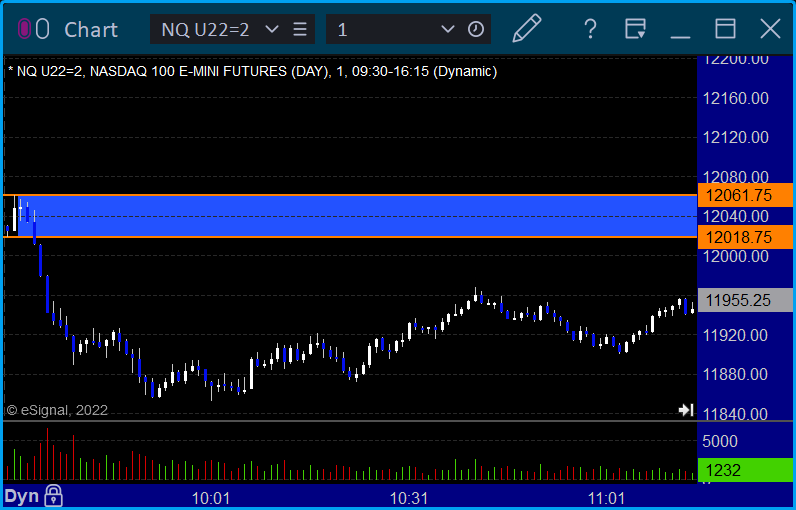

NQ Opening Range Play:

Results: -37 ticks

Forex:

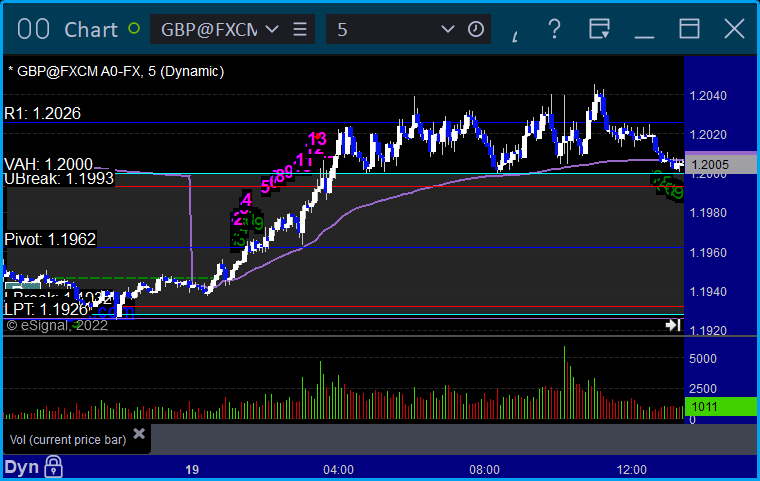

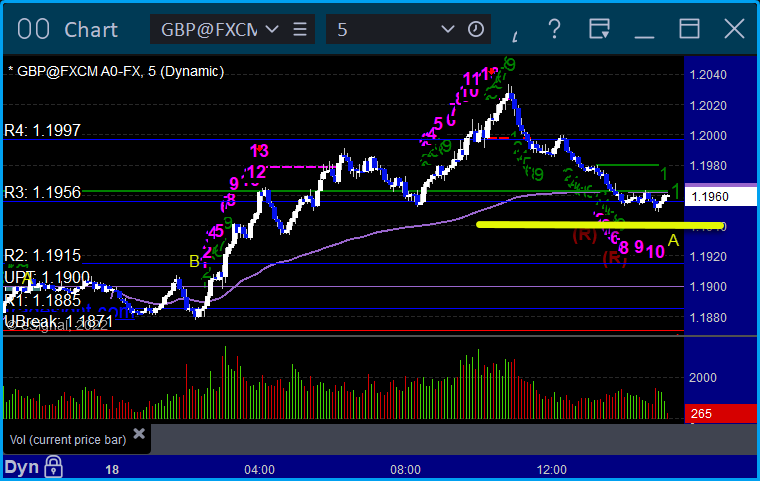

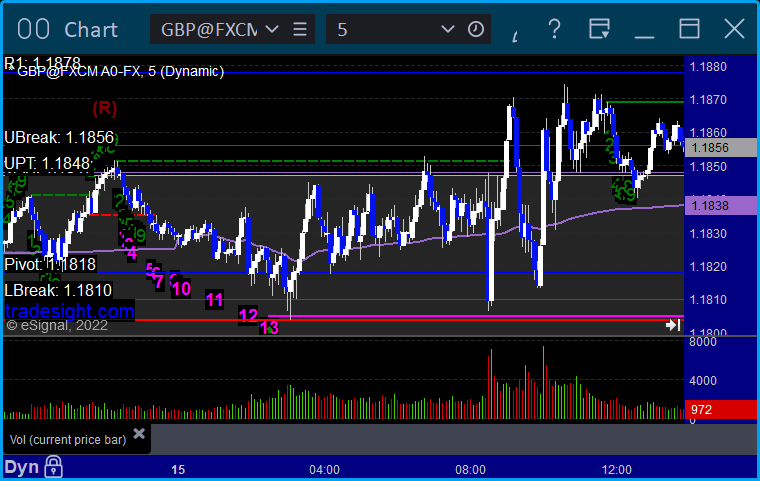

GBPUSD, triggered long at A, hit first target at R1, still holding second half:

Results: trade is still going.

Stocks:

A decent day.

From the Tradesight Plus Report, no calls.

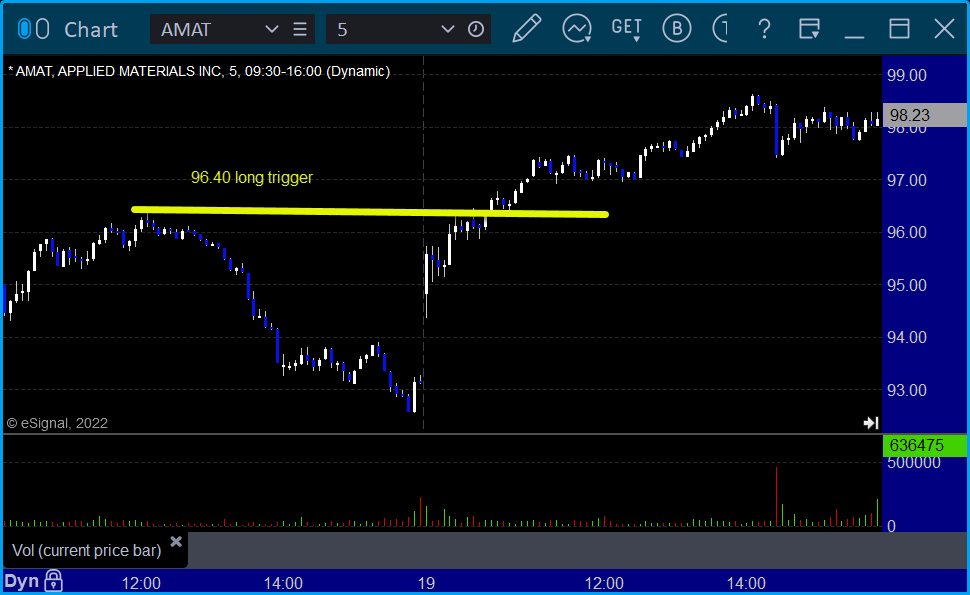

From the Tradesight Plus Twitter feed, Rich's AMAT triggered long (with market support) and worked:

His CLF triggered long (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 7/18/22

Overview

The markets gapped up and sat flat until late in the lunch hour, then dropped to fill the gap and more on 5 billion NASDAQ shares.

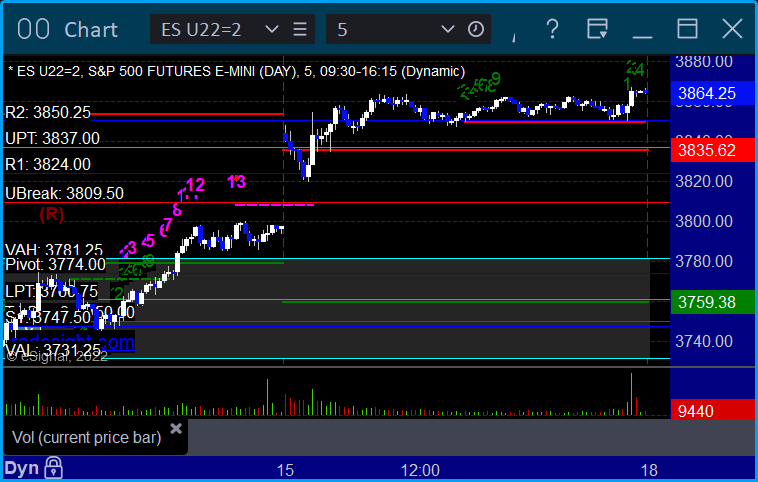

ES with Levels:

ES with Market Directional:

.Futures:

ES Opening Range Play triggered long at A and short at B, both exceeded the risk level by a little, so trader's choice, but not in range to count:

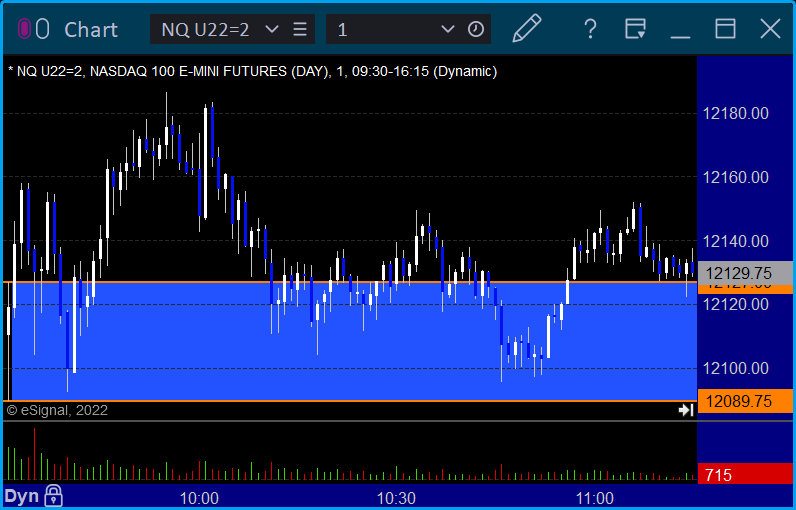

NQ Opening Range Play:

Results: +0 ticks

Forex:

A winner to start the week.

GBPUSD triggered long at A, hit first target at B, still holding second half:

Results: Trade still going

Stocks:

A very dull day as summer doldrums continues.

From the Tradesight Plus Report, no calls.

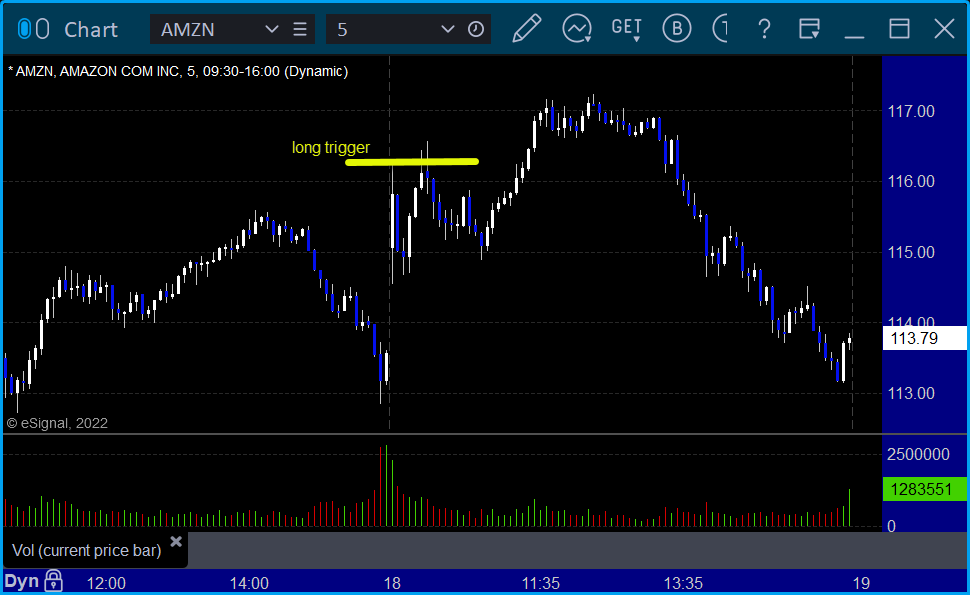

From the Tradesight Plus Twitter feed, Rich's AMZN triggered long (with market support) and didn't work:

Nothing else triggered that was called. That’s 1 trigger with market support, and it didn't work.

Tradesight Recap Report for 7/15/22

Overview

The markets gapped up, pulled back briefly, then went back to where they opened and basically sat flat the rest of the day for July options expiration Friday on 4.3 billion NASDAQ shares, which is light for an options expiration.

ES with Levels:

ES with Market Directional:

Futures:

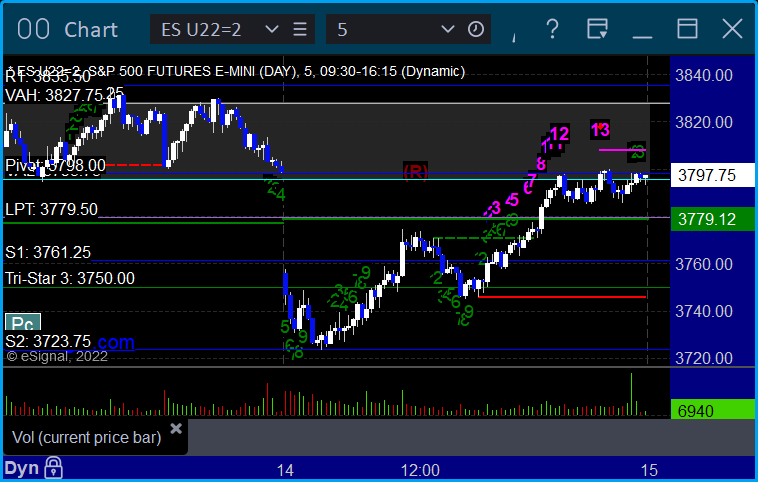

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B on a news spike if you took that and stopped under the midpoint:

NQ Opening Range Play:

Results: -15 ticks

Forex:

GBPUSD, no calls for options expiration Friday in July:

Results: +0 pips

Stocks:

I didn't expect much and got less.

From the Tradesight Plus Report, no calls for summer doldrums.

From the Tradesight Plus Twitter feed, no calls.

That’s 0 triggers with market support.

Tradesight Recap Report for 7/14/22

Overview

The markets gapped down and spent the whole day filling the gap on 4.3 billion NASDAQ shares.

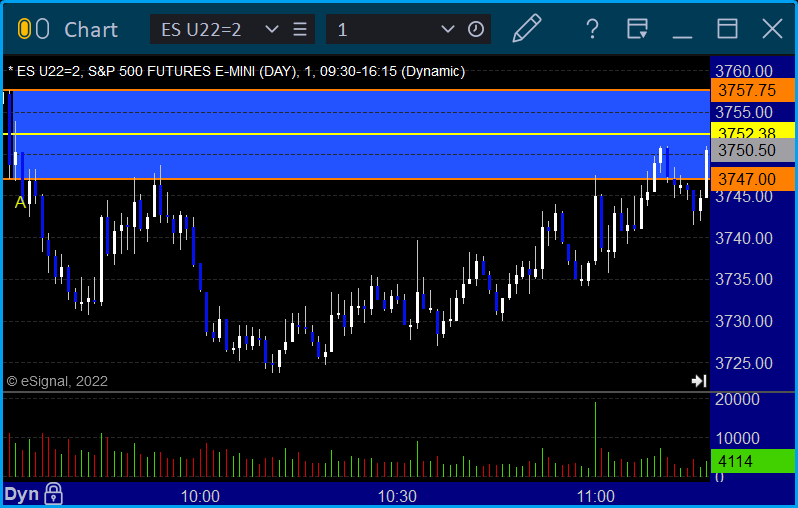

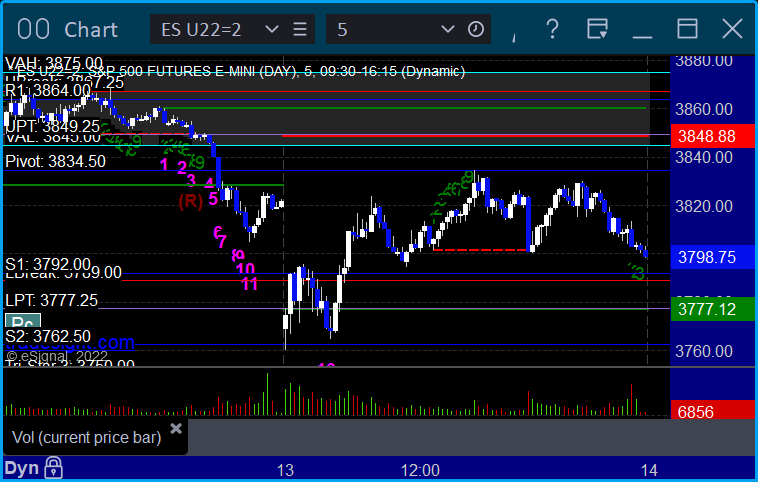

ES with Levels:

ES with Market Directional:

Futures:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

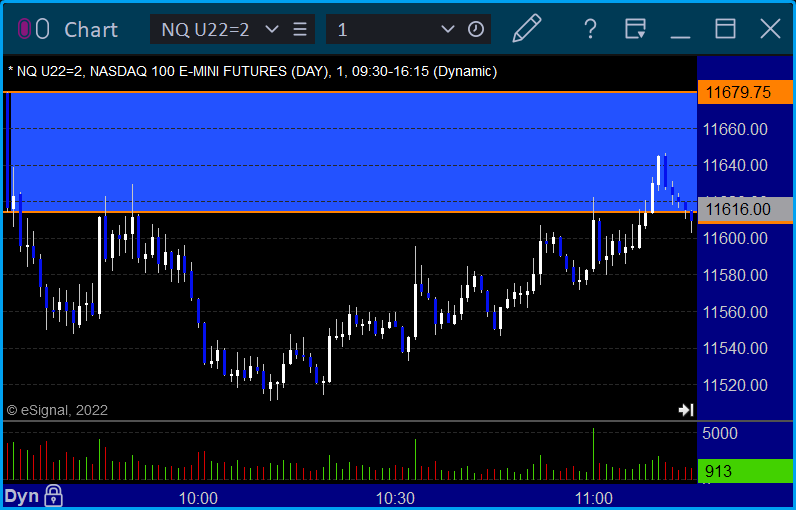

NQ Opening Range Play:

Results: +0 ticks

Forex:

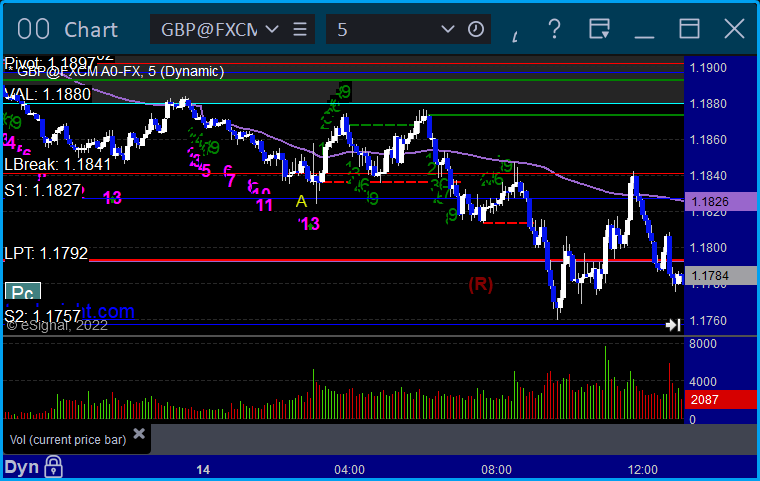

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

A boring day in the markets with options unravel done.

From the Tradesight Plus Report, no calls.

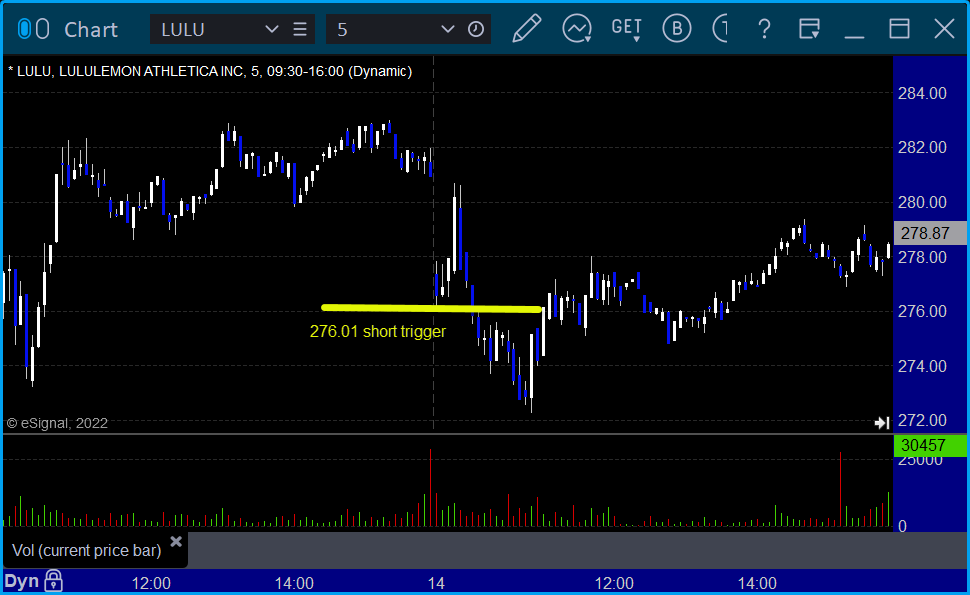

From the Tradesight Plus Twitter feed, LULU triggered short (with market support) and worked enough for a partial:

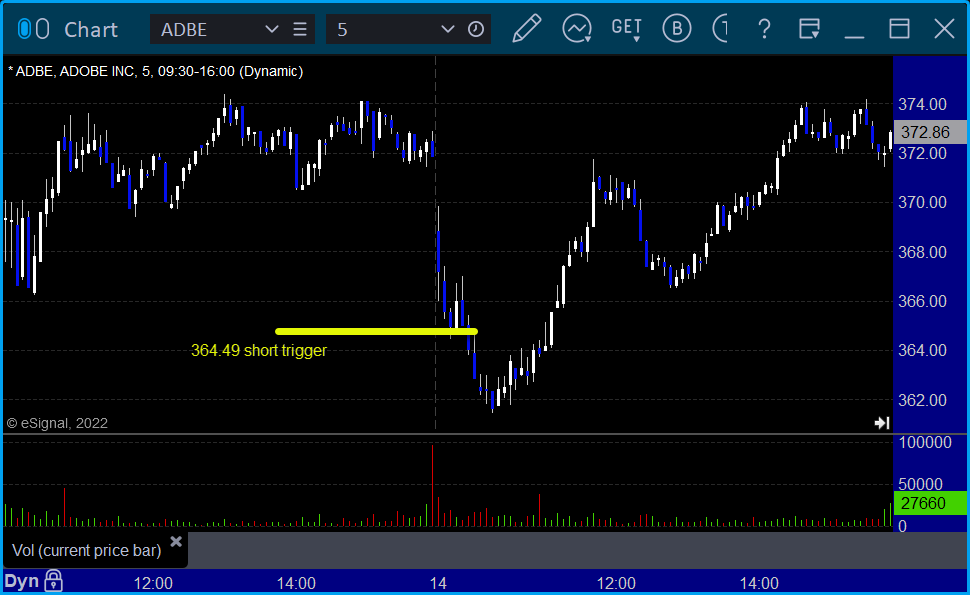

ADBE triggered short (with market support) and worked enough for a partial:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 7/13/22

Overview

The markets gapped down and fiddled around for an hour, then popped to fill the gap, then went flat all day. Welcome to summer doldrums even if that was options unravel. NASDAQ volume was 4.4 billion shares.

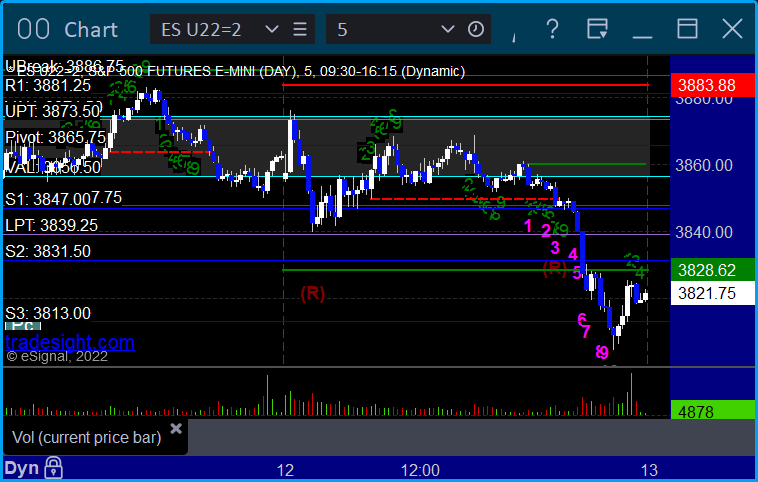

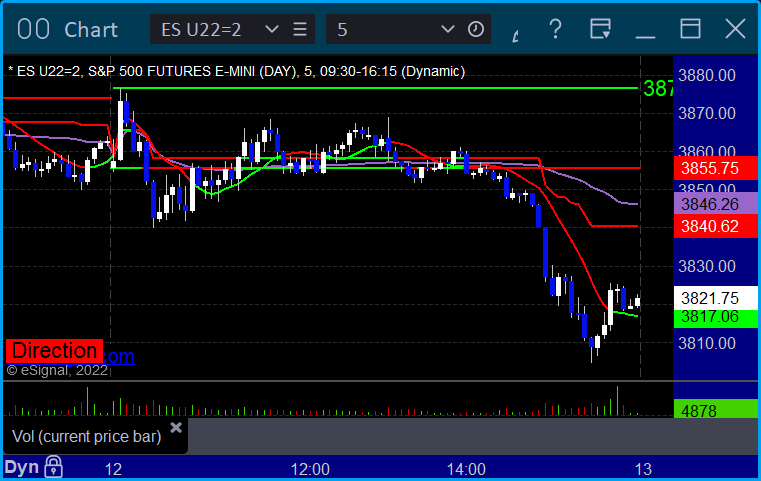

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD, no calls:

Results: +0 pips

Stocks:

A boring day and none of the calls triggered.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, nothing triggered.

That’s 0 triggers with market support.

Tradesight Recap Report for 7/12/22

Overview

The markets opened mixed, filled gaps and went dead flat all day until the last hour on 4.3 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and short at B, both too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD triggered short at A, hit first target at B, stopped second half over entry:

Results: +10 pips

Stocks, not much of a day until the last hour.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, no calls.

That’s 0 triggers with market support.

Tradesight Recap Report for 7/11/22

Overview

The markets gapped down and pushed lower for about 10 minutes and that was it for the day on 4.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD triggered short at A and barely stopped before working:

Results: -25 pips

Stocks:

Too boring for anything to trigger.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, no calls.

That’s 0 triggers with market support.

Tradesight Recap Report for 7/8/22

Overview

A summer Friday for sure. Markets gapped down and went lower, rebounded to fill the gap and more, dropped, came back, and closed even on 4.5 billion NASDAQ shares.

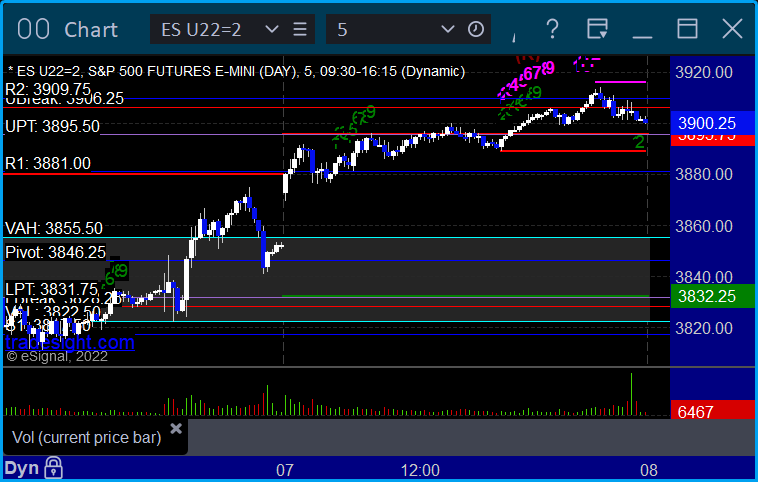

ES with Levels:

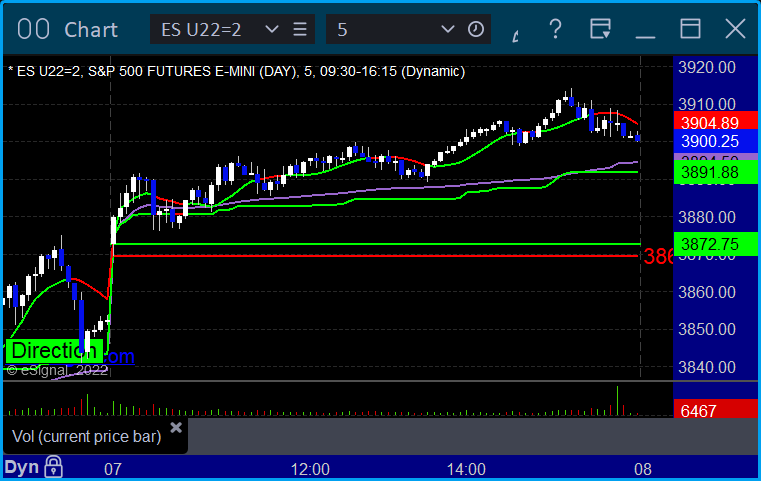

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and short at B, both too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex:

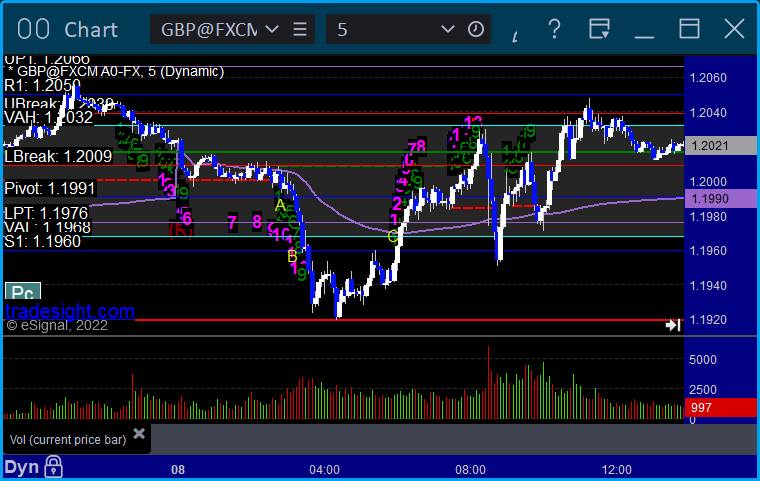

GBPUSD triggered short at A, hit first target at B, stopped second half at C in the money:

Results: +25 pips

Stocks:

A boring summer Friday but some gains.

From the Tradesight Plus Report, no calls.

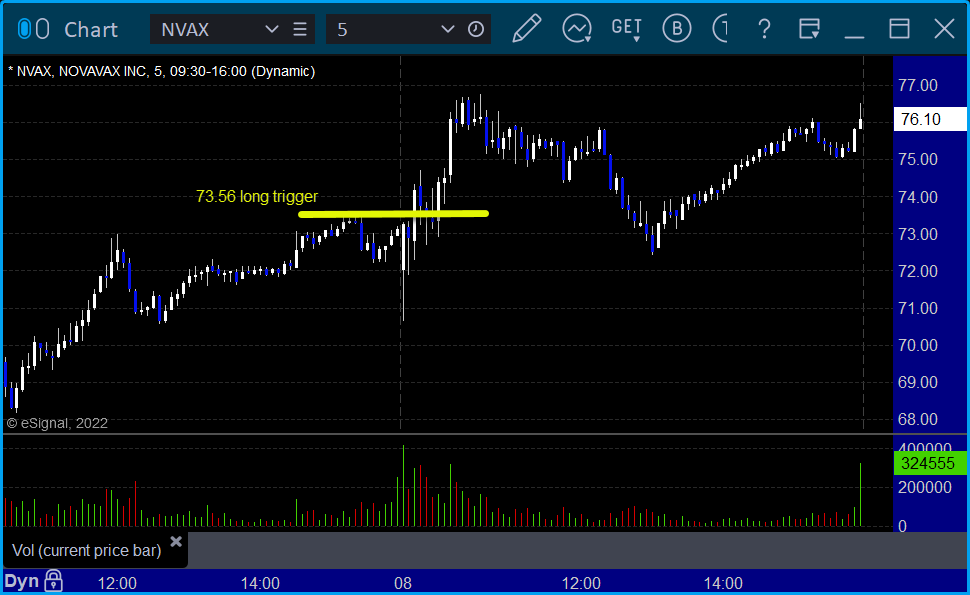

From the Tradesight Plus Twitter feed, Rich's NVAX triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 7/7/22

Overview

The markets gapped up and were mostly flat with an upward drift on 4.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and stopped, triggered long at B but too far out of range to take:

NQ Opening Range Play:

Results: -16 ticks

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

Not much of a day. Nothing triggered outside of the opening 5 minutes.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, no triggers.

That’s 0 triggers with market support.