Tradesight Plus Report for 5-31-21

Opening comments for the (short) week are posted to YouTube.

Hard to say what the week brings after last week's disappointment.

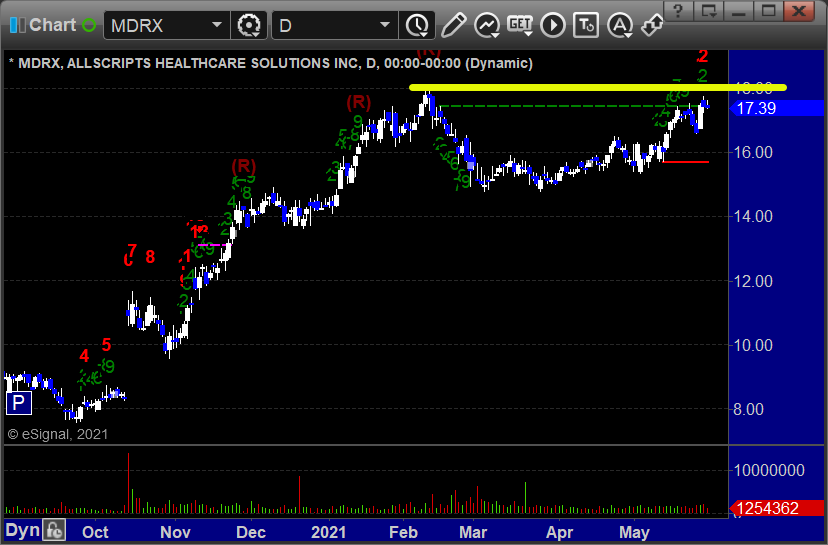

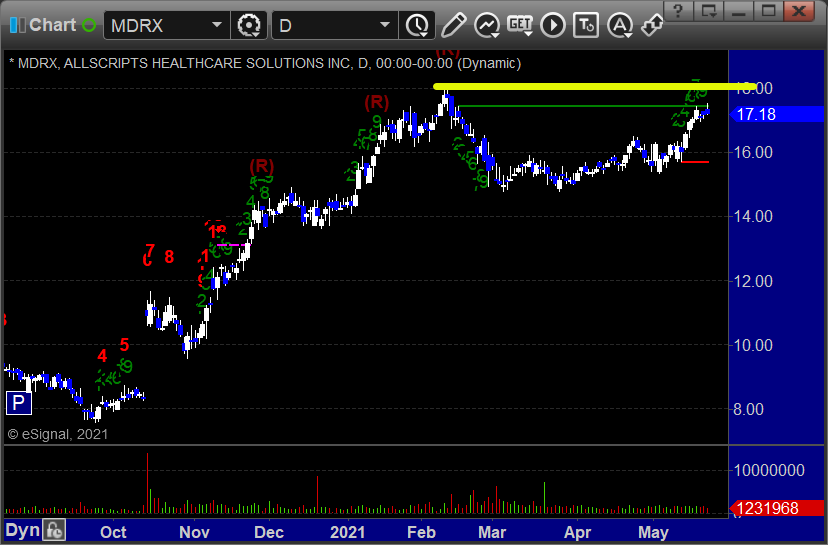

Longs only, starting with MDRX > 17.96:

PRTK > 8.75:

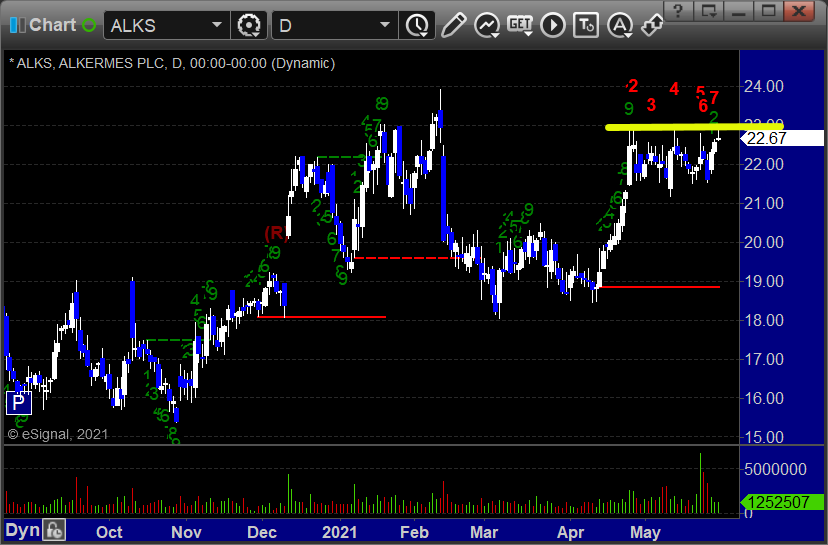

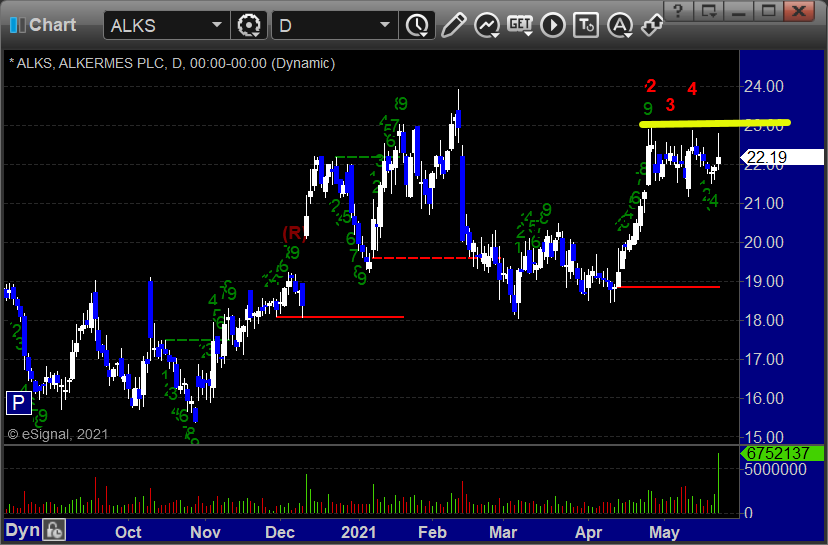

ALKS > 22.98:

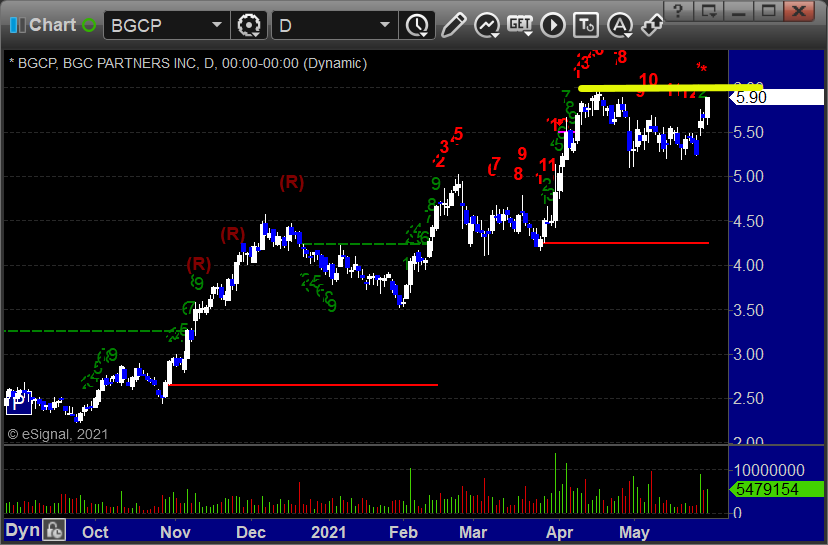

BGCP > 5.98:

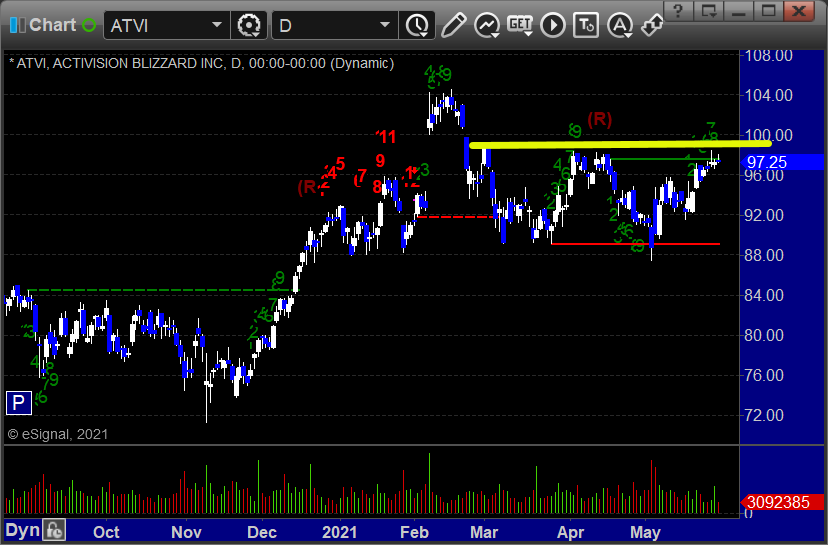

ATVI > 98.99:

Tradesight Recap Report for 5/28/21

Overview

The markets gapped up small, filled the ES early, and then went flat all day for end of May statement printing ahead of a long Holiday weekend on 4.4 billion NASDAQ shares.

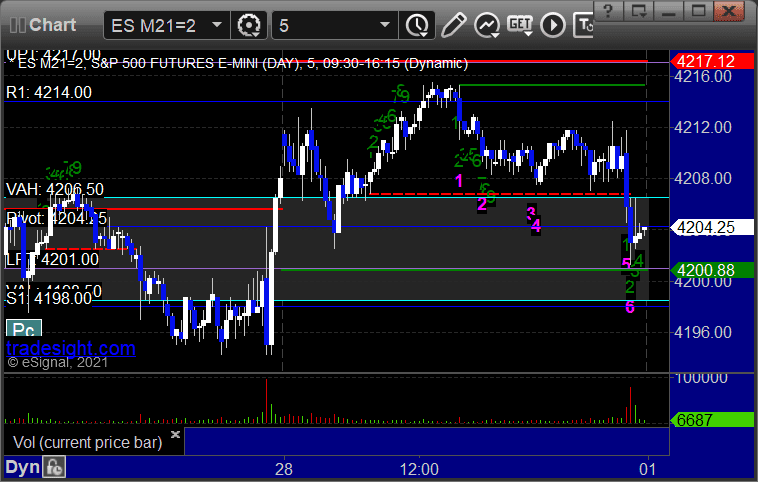

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial:

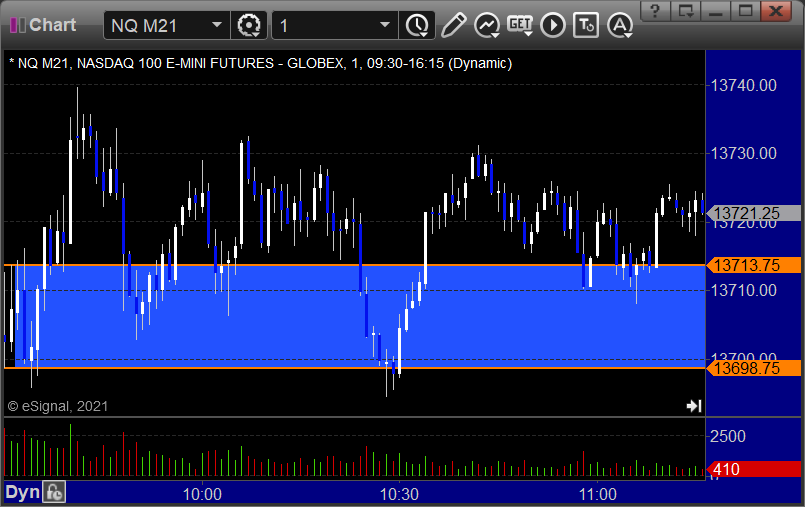

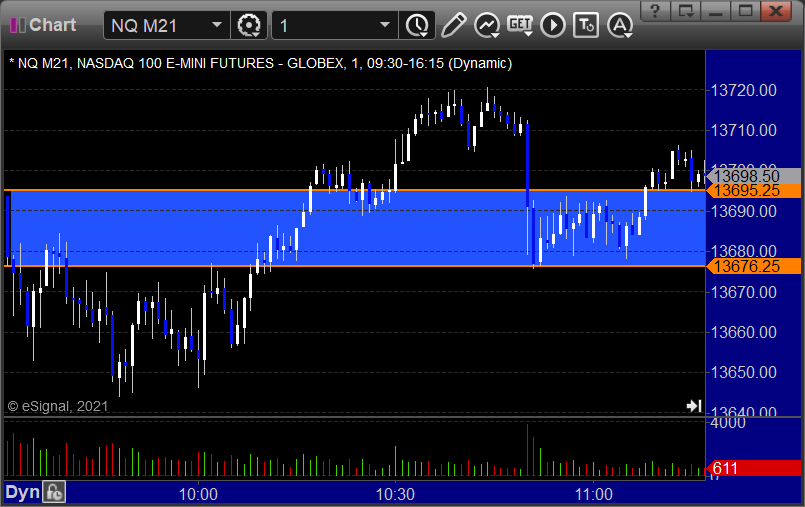

NQ Opening Range Play, long trigger was out of range:

Results: +4 ticks

Forex:

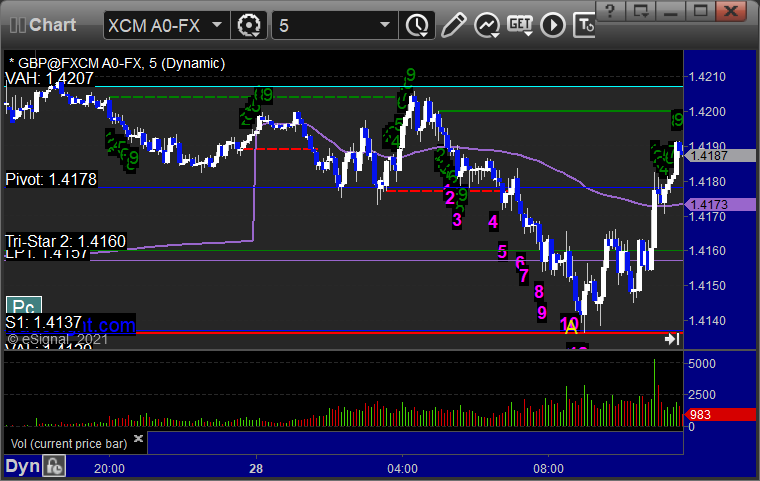

GBPUSD, no new triggers, but we stopped out of the prior day's play in the money:

Results: +30 pips from prior day's trade completing

Stocks:

From the report, nothing triggered.

From the Twitter feed, no calls for end of month Friday leading into the 3-day Memorial Weekend.

That’s 0 triggers with market support.

Tradesight Recap Report for 5/27/21

Overview

The markets gapped up small and basically filled late in the day on 4.1 billion NASDAQ shares.

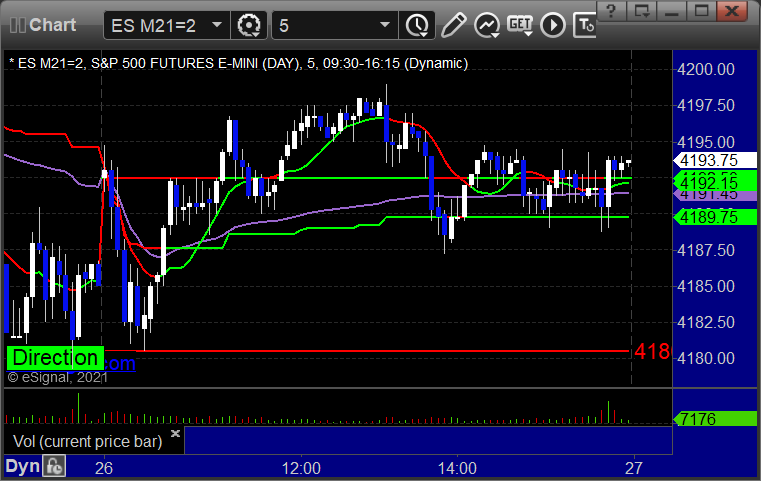

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped, triggered short at B and stopped:

NQ Opening Range Play triggered out of range:

Results: -27 ticks

Forex:

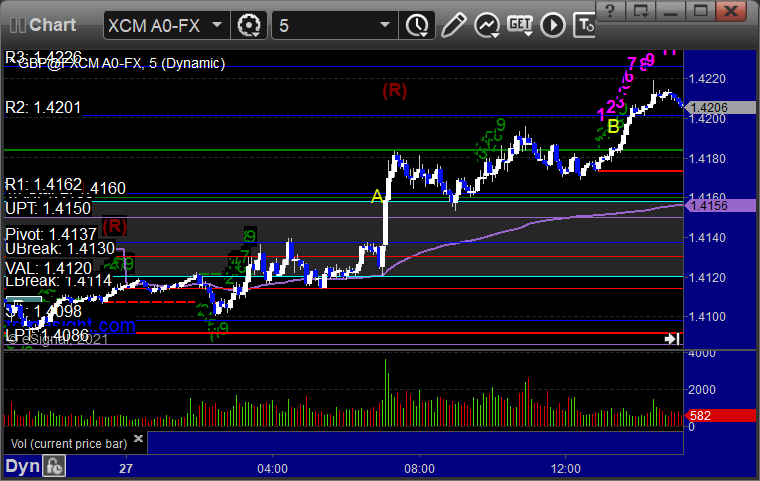

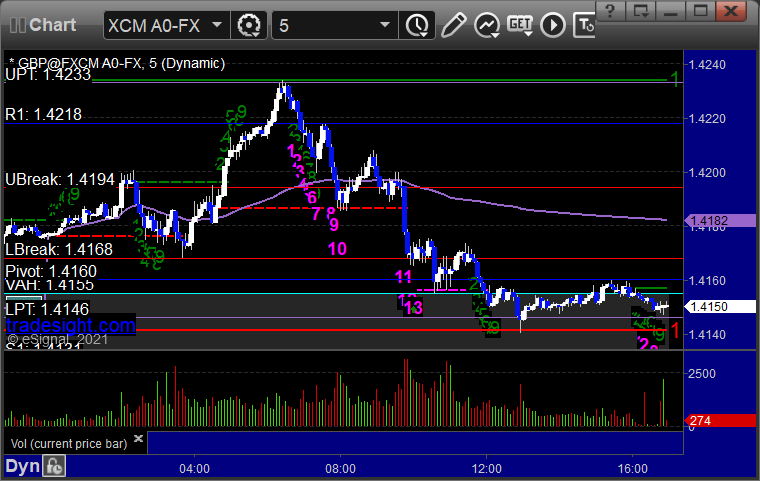

GBPUSD:

Results: unknown because the trade hasn't close out yet, will be a gain

Stocks:

We are in a dead week ahead of a 3-day weekend and statements printing for the month.

From the report, nothing triggered.

From the Twitter feed, Rich's AMZN triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 5/26/21

Overview

The market gapped up small, ES filled, NQ almost filled, and then we came back up and went DEAD FLAT on 4.3 billion NASDAQ shares.

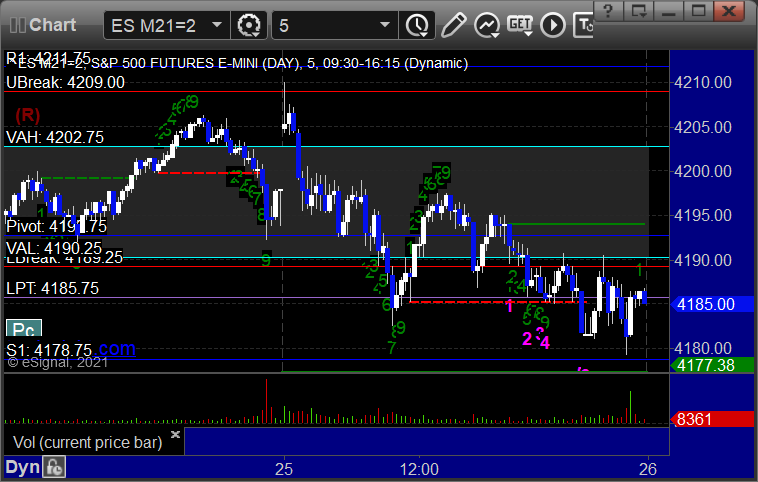

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +3.5 ticks

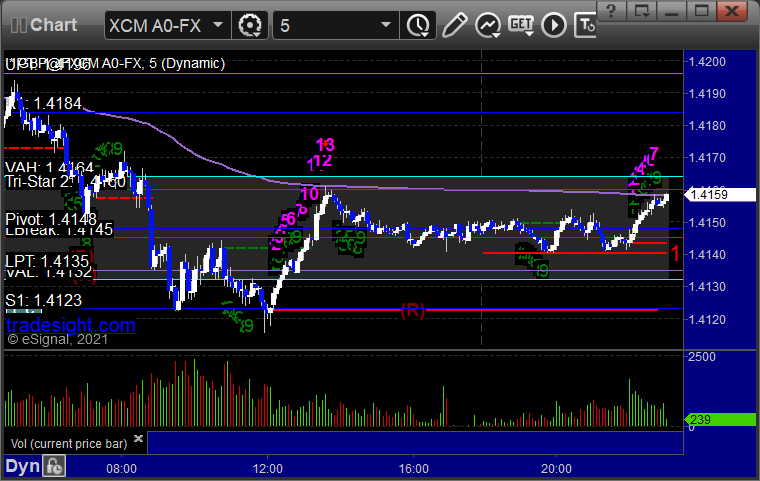

Forex:

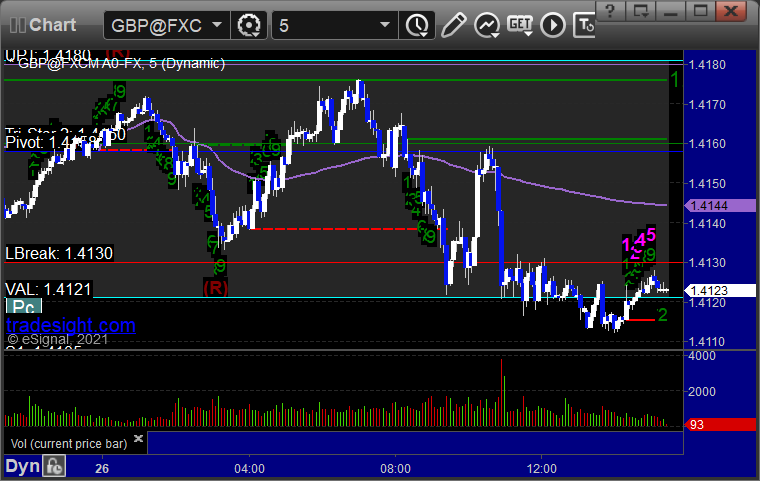

GBPUSD, nothing triggered:

Results: +0 pips

Stocks:

From the report, WRAP triggered long (with market support) and worked:

Rich's JPM triggered short (with market support) and didn't work:

ATVI triggered long (with market support) and didn't work:

Rich's DIS triggered long (without market support) and didn't do much either way:

That’s 3 triggers with market support, 1 of them worked and 2 didn’t. Waste of a day.

Tradesight Recap Report for 5/25/21

Overview

The markets gapped up, filled the gap, crossed the Value Area, and closed lower on 4 billion NASDAQ shares.

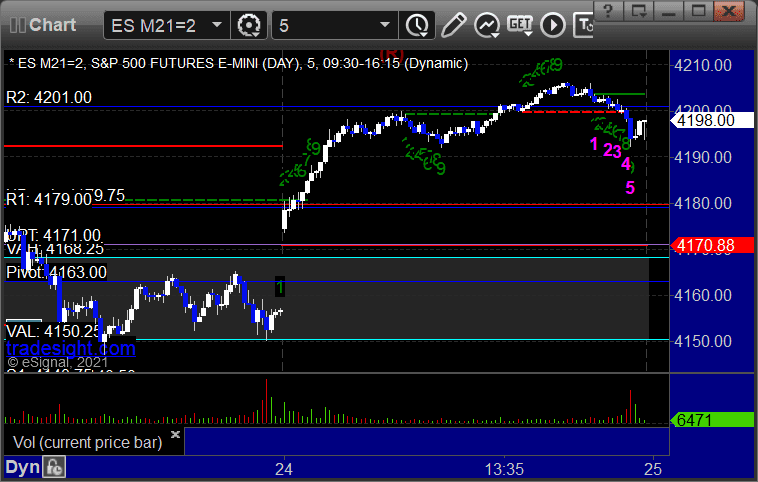

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

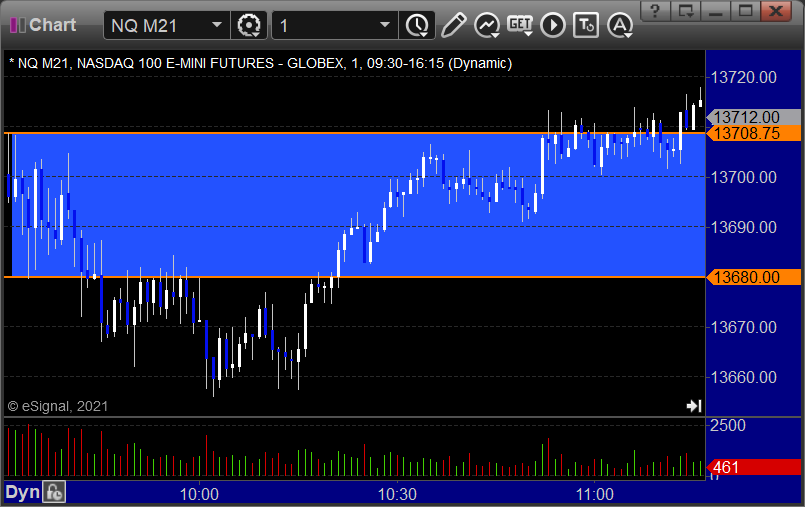

NQ Opening Range Play:

Results: 2.5 ticks

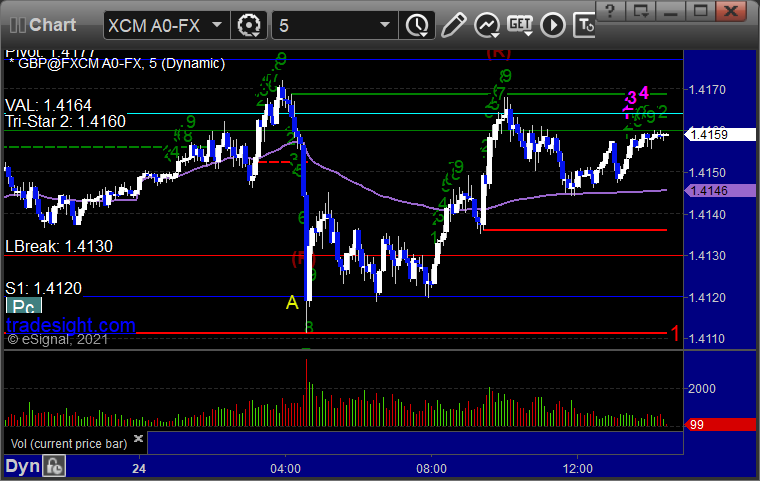

Forex:

GBPUSD, nothing triggered, amazing:

Results: +0 pips

Stocks:

Nothing triggered from the report.

From the Twitter feed, LULU triggered long (without market support) and worked a little:

NTES triggered short (with market support) and didn't work:

TTWO triggered short (with market support) and didn't work:

That’s 2 triggers with market support, none of them worked.

Tradesight Recap Report for 5/24/21

Overview

The markets gapped up, pushed higher for about an hour and then the rest of the day was dead, but NASDAQ volume was only 3.5 billion shares due to the European Holiday. Not a great day.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play:

Results: +9 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Not too much with the Holiday in Europe.

From the report, nothing triggered.

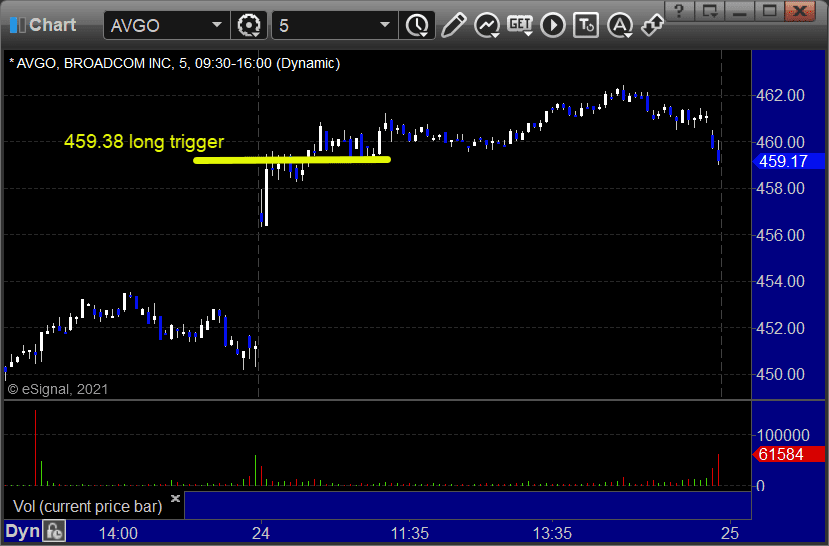

From the Twitter feed, Rich's AVGO triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Plus Report for 5-24-21

Opening comments for the week posted to YouTube. Europe on Holiday Monday and then Friday we lead into our long weekend here in the US with Memorial Day the Monday after.

Longs first, starting with MDRX > 17.96:

PRTK > 8.75:

BOWX > 13.93:

WRAP > 7.37:

ALKS > 22.98:

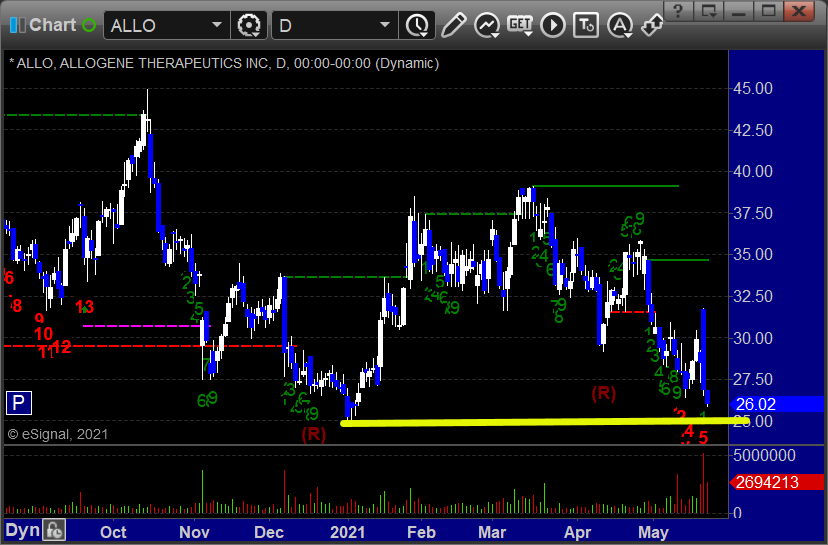

Shorts next, just one, ALLO < 24.85:

Tradesight Recap Report for 5/21/21

Overview

The markets gapped up and spent the day drifting back to fill the gaps on 3.5 billion NASDAQ shares for options expiration Friday.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play:

Results: +11 ticks

Forex:

GBPUSD, no triggers:

Results: +0 pips

Stocks:

Several calls, nothing triggered for expiration.

That’s 0 triggers with market support.

Tradesight Recap Report for 5/20/21

Overview

The markets gapped up and went higher, although they basically closed where they were about two hours into the day. NASDAQ volume was 3.9 billion shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play:

Results: +6.5 ticks

Forex:

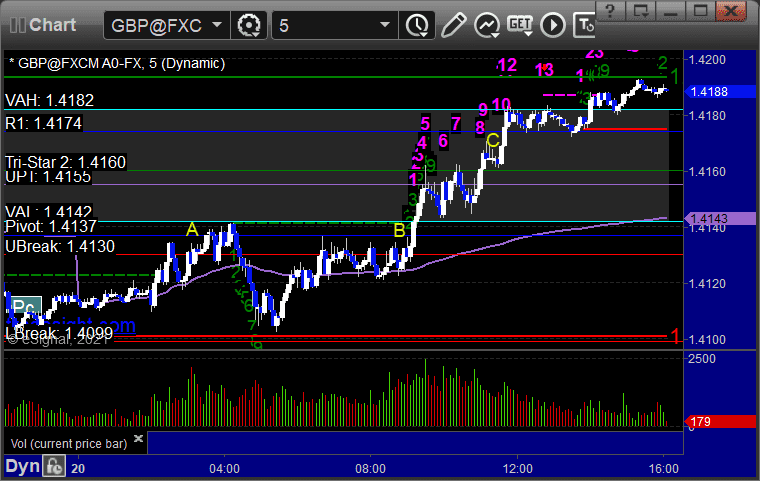

GBPUSD triggered long at A and stopped. Triggered long again at B, hit first target at C, still holding second half with a stop under UPT:

Results: No results yet as trade is still going

Stocks:

From the report, nothing triggered.

From the Twitter feed, Rich's DOCU triggered long (with market support) and worked:

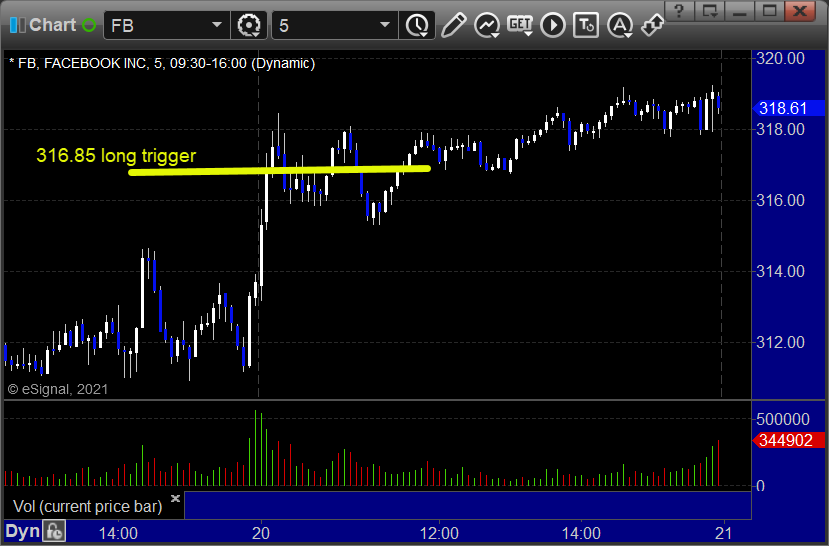

His FB triggered long (with market support) and worked:

His MU triggered long (with market support) and worked:

AMAT gapped over the trigger, no official play.

That’s 3 triggers with market support, all of them worked.

The New Tradesight Mentoring Course

As we said earlier in the year when we rolled out the new website and combined our services (stocks, futures, forex, and options) into one service and one price, we have been hard at work planning out the next version of the Tradesight Mentoring Course. I'm pleased to say that the planning is done and we will start recording modules this summer.

At Tradesight, we have always considered ourselves a Market Education company. We are not a trade calling service, although we do make calls in all of the asset classes. What we want is to teach people to become their own professional trader and think independently about how to approach the markets each day using all of the tools and analysis that we know works from nearly 30 years of experience from each of our analysts. We aren't here for you to just follow our trades. We want you to be able to spot your own, analyze the market, make good entry decisions, and manage the trades properly. We know from training over 1000 people directly for over a decade that the most successful traders understand all asset classes. In other words, understanding how to read a stock chart and analyze the market is good for trading stocks, but there are scenarios where using options instead of the stock itself is a better choice. Understanding futures gives you something else to trade that, once you understand how it works, also can help you make better decisions about your stock trading. Forex is sort of its own thing, but it is a good side tool for making money over the course of a year.

While we understand that for about $7.60 per trading day, we can do the market analysis for you and spot entry points in stocks, futures, etc., we are also thrilled when one of our students goes on to trade without us. We have helped many students become successful enough that they were able to start their own hedge funds. We consider this a sign of our success, not that they felt the need to follow our trades only or to chase our results, but that they became educated enough that they were able to use what we have taught them to build a successful career.

In the past, each of our programs (stocks, futures, forex) were separate. Many traders took them all. We also had an add-on course for options (which don't require an extended period of time to teach if you know how to spot stock setups). So now we are combining the course into one cohesive product. For those that only purchased one of the programs, you can add everything else for the difference in price between what you paid for one program and the new total price. You immediately get access to the existing course material for the other asset classes. So in other words, if you paid $3000 for the stock course, the new combined course costs $4500, so for the difference of $1500, you get the current futures, forex, and options material AND all of the new material.

But moving forward, we are redesigning everything so that they flow together. So in other words, we will teach chart patterns as they apply to all asset classes and indicators as they apply to all asset classes, but then have specific modules of the program that focus on certain things that are unique to stocks, futures, forex, and options. For example, for those that are familiar with our powerful Seeker and Comber tools, there is no need to teach them once for each asset class as they work the same on any chart. However, Opening Range trades in futures are still their own standalone thing.

So, we feel that we have developed a great order to train people about all of these things in a way that builds on each piece so that they can include all of the key asset classes along the way to expand their education and make them more successful instead of just learning about stocks, then maybe futures separately, then maybe forex. These assets all have things in common, and it is better to point those out along the way while also giving direct instruction where necessary on specific asset class information.

As we complete this new program, the modules will be available in the website after you login rather than separate links sent to you. So you can always login, go to the Course menu, and see the modules below. If you have only paid for the stock program so far, for example, you won't see any of the modules that are specific to futures, forex, or options, but you will get the broader overlap modules. But for all new students, the entire program will be available. As usual, we will only allow you to move along as we are convinced through our private one-on-one mentoring sessions that you understand the material that you have been given. And we will work with you through the weekly blotter review process to help you improve properly.

We wrote the current programs in 2014-5. We have learned a lot about the order that we teach things in and where it might be beneficial to traders to move some of that around, so that will happen.

This is not a short process. It takes a good amount of time to write each module and then record it properly. But, we will begin that process in June, and possibly roll out many of the early modules fairly quickly. I do expect it to take most of the rest of the year to finish everything that we have to record because there is so much in our program. Anyone who has paid for all of the programs so far will automatically get all of the new material as it becomes available with their continuing monthly subscription. This includes weekly private mentoring sessions.

We are excited to undertake this new endeavor for you, and we look forward to making you a successful trader on your own.

The Tradesight Team