Tradesight Recap Report for 5/19/21

Overview

The markets gapped down and recovered most of it on 4.1 billion NASDAQ shares.

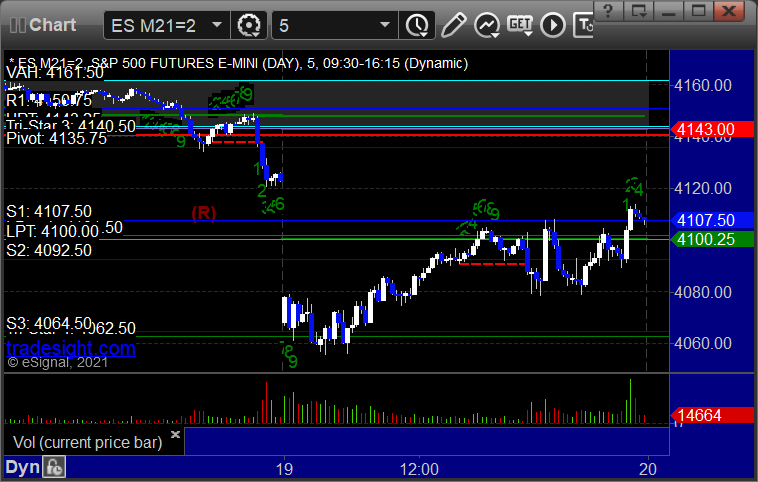

ES with Levels:

ES with Market Directional:

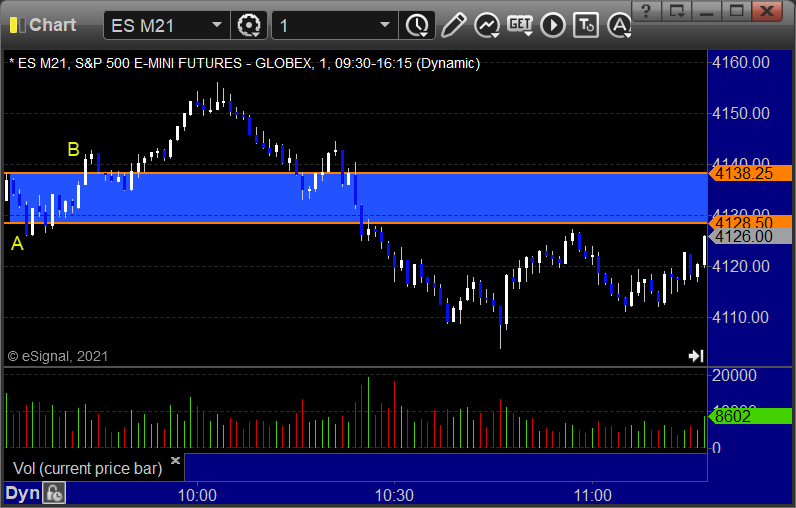

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and worked enough for a partial:

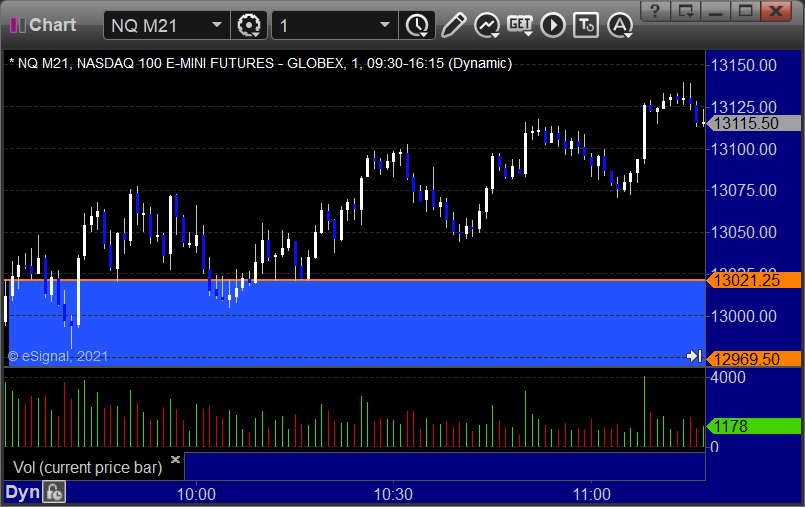

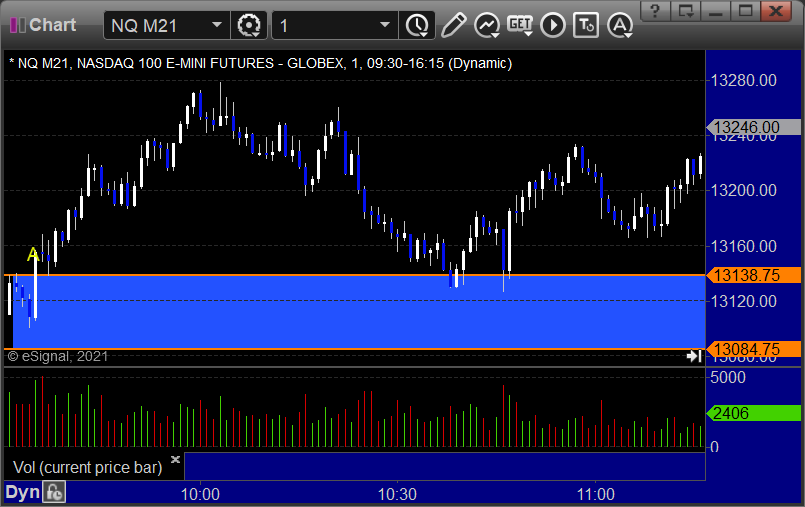

NQ Opening Range Play:

Results: +8 ticks

Forex:

No calls for the session as the levels were too tightly bunched together.

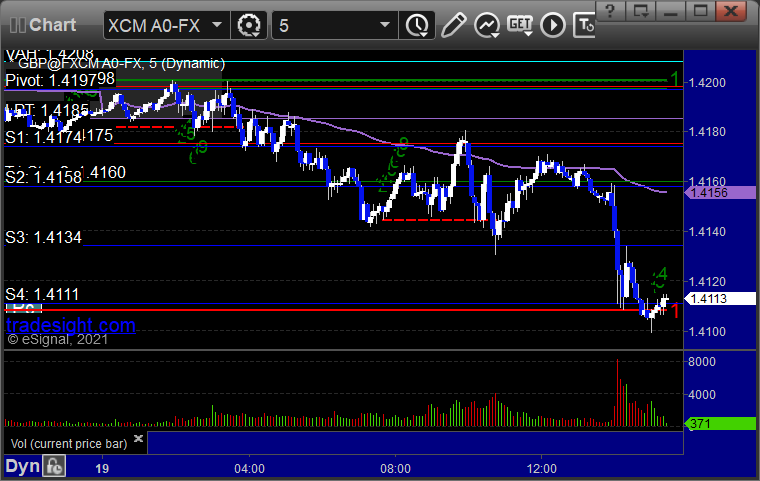

GBPUSD:

Results: +0 pips

Stocks:

From the report, no triggers.

From the Twitter feed, TXN triggered long (with market support) and worked, but we closed it for a smaller gain because the futures broke to lows:

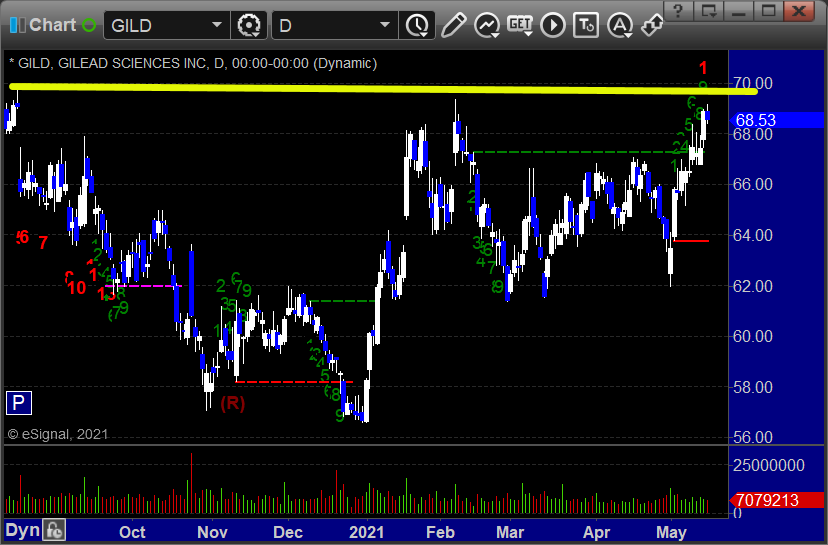

GILD triggered long (with market support) and didn't go enough in either direction to count:

That’s 2 triggers with market support, 1 of them worked and 1 was neutral.

Tradesight Plus Report for 5-19-21

Opening comments posted to YouTube. Options expiration is this week, which means option unravel could be Wednesday.

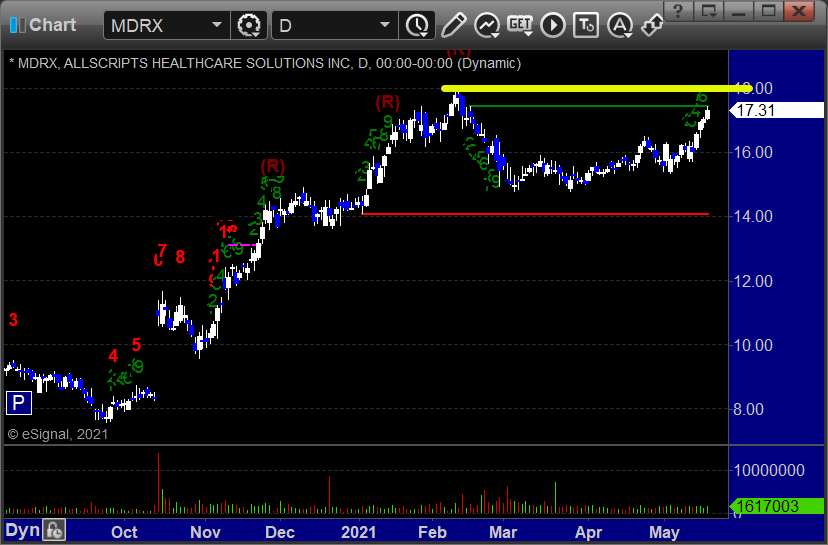

Longs only, starting with MDRX > 17.96:

PRTK > 8.75:

BOWX > 13.93:

Call the rest from the tape.

Tradesight Recap Report for 5/18/21

Overview

Markets opened flat and just drifted most of the day, dipped a little after lunch, came back, and then sold off sharply in the last 15 minutes on 4 billion NASDAQ shares.

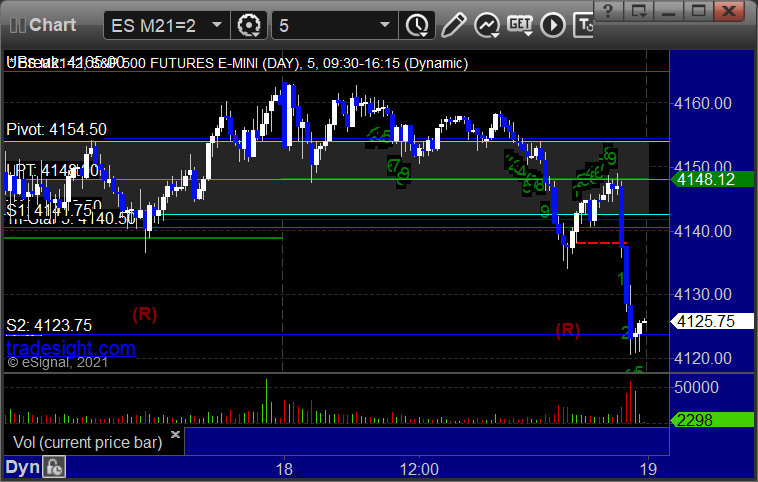

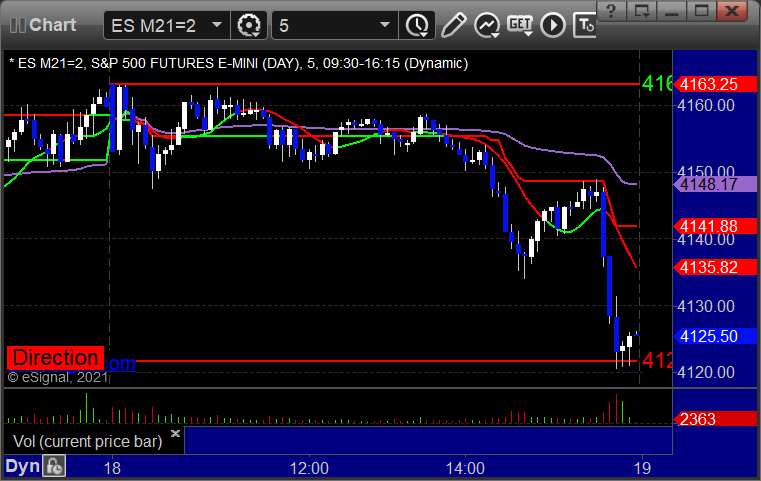

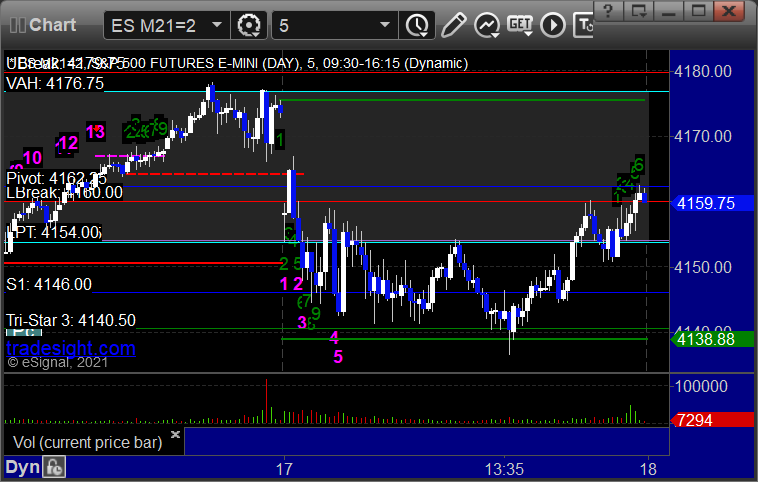

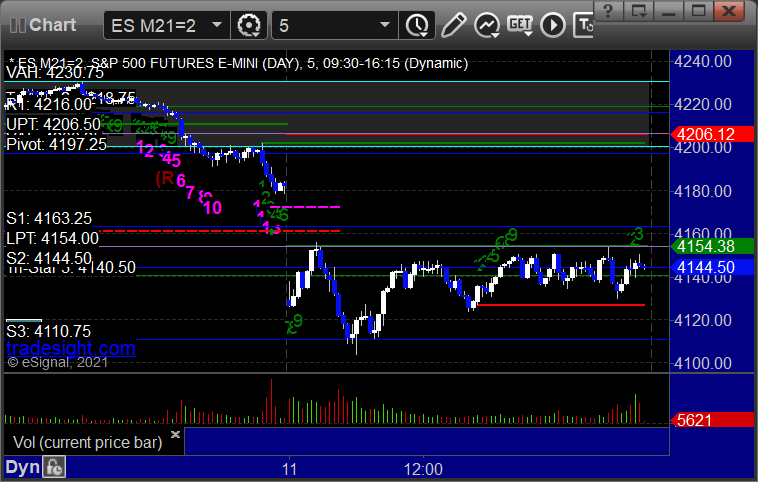

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked:

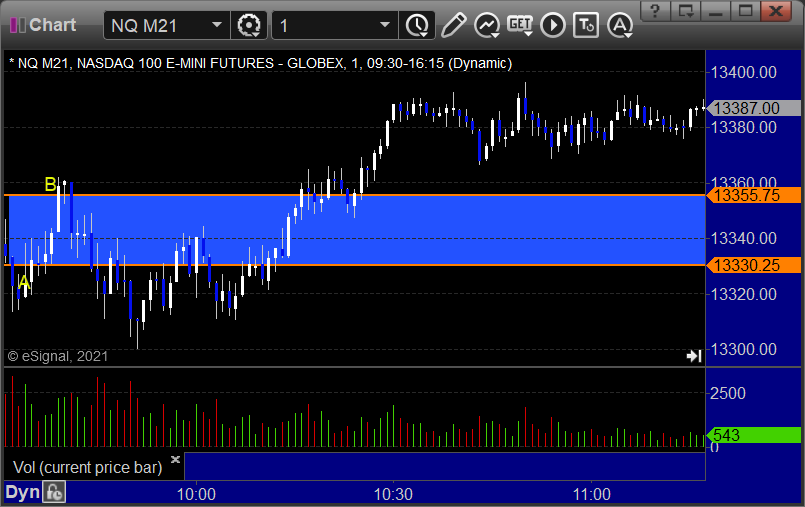

NQ Opening Range Play:

Results: +6.5 ticks

Forex:

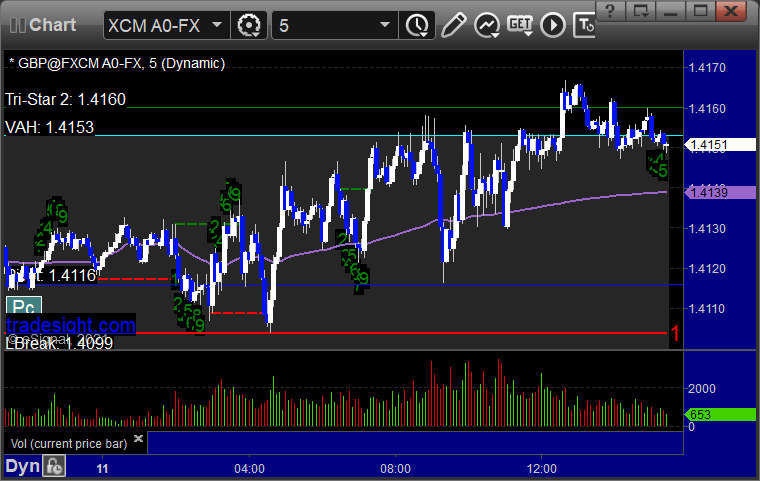

GBPUSD triggered long at A, never hit the first target, closed even:

Results: +0 pips

Stocks:

Another fairly dull session and not much triggered.

EMKR triggered long (with market support) and literally didn't do anything, so can't be counted again:

Rich's NVAX triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 5/17/21

Overview

A boring session. Markets gapped down a little and were flat all session on 4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

NQ Opening Range Play:

Results: +13 ticks

Forex:

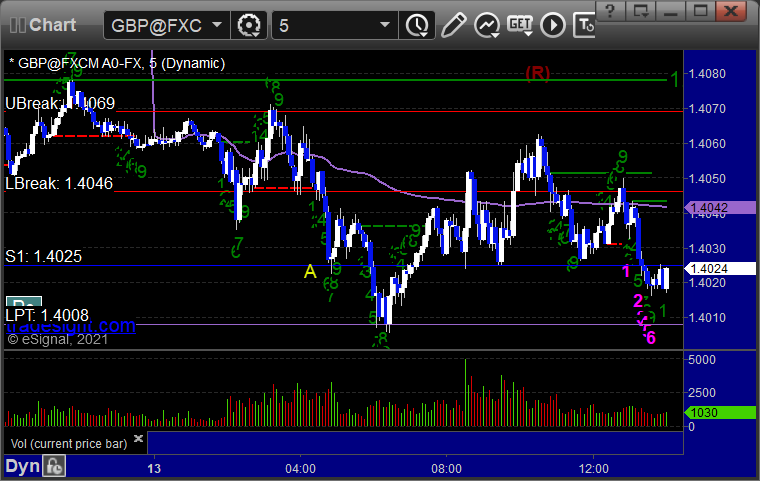

GBPUSD, no triggers:

Results: +0 pips

Stocks:

From the report, EMKR triggered long (without market support) and didn't go enough either way to count:

From the Twitter feed, Rich's PANW triggered long (with market support) and didn't work:

His DIS triggered short (with market support) and didn't work:

That’s 2 triggers with market support, and neither worked.

Tradesight Plus Report for 5-17-21

Opening comments posted to YouTube. Full size Monday. Let's see how this goes.

Longs first, starting with GILD > 69.75:

EMKR > 8.20:

Tradesight Recap Report for 5/14/21

Overview

The markets gapped up and just kept going in creepy stair-step fashion with small candles and not great action on 4 billion NASDAQ shares, which is light.

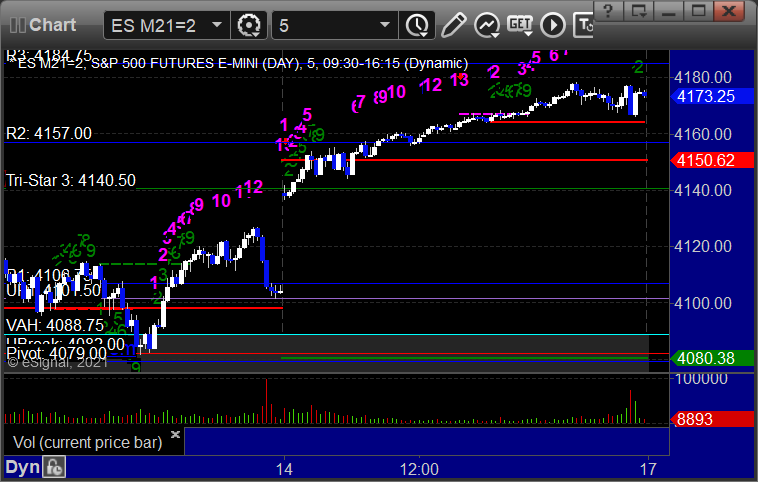

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and short at B but too far out of range to take:

Results: +6 ticks

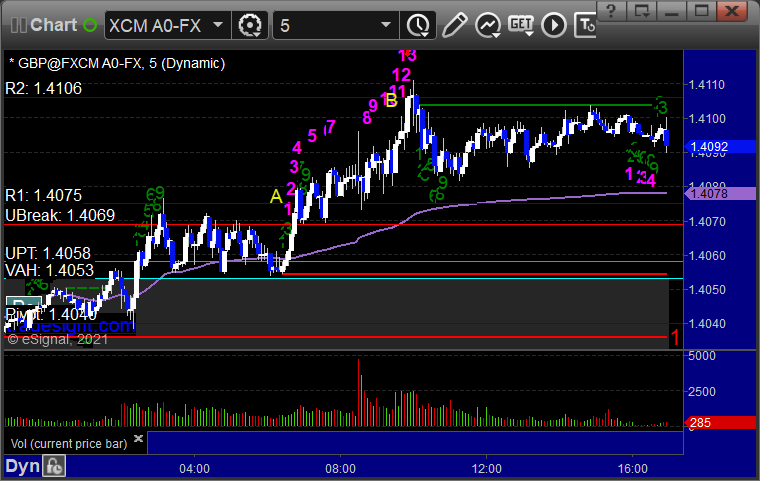

Forex:

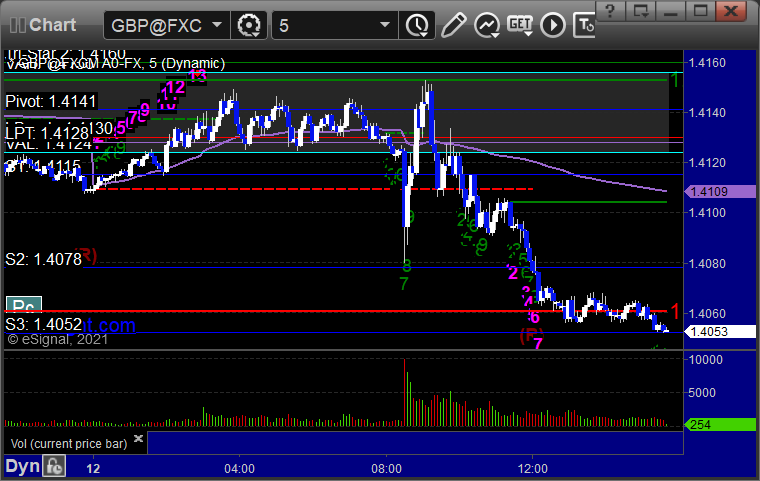

GBPUSD triggered long at A, hit first target at B (note the Comber 13 sell signal at the top) and closed at end of the day for end of week:

Results: +25 pips

Stocks:

Several calls, nothing triggered.

That’s 0 triggers with market support.

Tradesight Recap Report for 5/13/21

Overview

The markets gapped up, went higher early, came back over lunch to the lows, and then pushed up in the afternoon until a sell off at the close on 4.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +0 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Not many triggers. Nothing off of the daily charts.

AAPL triggered short (with market support) and didn't work:

Rich's SNOW triggered short (with market support0 and worked:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 5/12/21

Overview

The markets gapped down and went lower on 4.7 billion NASDAQ shares. Good day for us in stocks, but not much in futures or forex.

ES with Levels:

ES with Market Directional:

Futures:

Neither OR was valid because the ORs were too wide.

ES Opening Range Play:

NQ Opening Range Play:

Results: +0 ticks

Forex:

No calls for the session, and that was a good thing.

GBPUSD:

Results: +0 pips

Stocks:

From the report, no triggers.

From the Twitter feed, Rich's JNJ triggered short (without market support due to opening 5 minutes) and didn't work:

His VLO triggered long (without market support due to opening 5 minutes) and worked:

WDC triggered short (with market support) and worked:

TTWO triggered short (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 5/11/21

Overview

The markets gapped down, which ruined the plan, bounced back to key resistance, rolled over, and then broke to lows but didn't go far and the rest of the day was a bust on 4.7 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and long at B but both were too far out of range to take:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +0 ticks

Forex:

GBPUSD, the trade from the prior day continues, but nothing new triggered:

Results: Trade from prior day still not completed

Stocks:

From the report, nothing triggered.

From the Twitter feed, Rich's FSLY triggered long (with market support) and worked:

His MRNA triggered long (with market support) and worked enough for a partial:

GS triggered short (with market support) and worked a little eventually:

That’s 3 triggers with market support, all of them worked.

Tradesight Plus Report for 5-11-21

Just a couple of picks from the daily scans, but we will likely call more in the room. I'm hoping the gap down isn't too big so we have a way to get short.

Long side, just EMKR > 8.20:

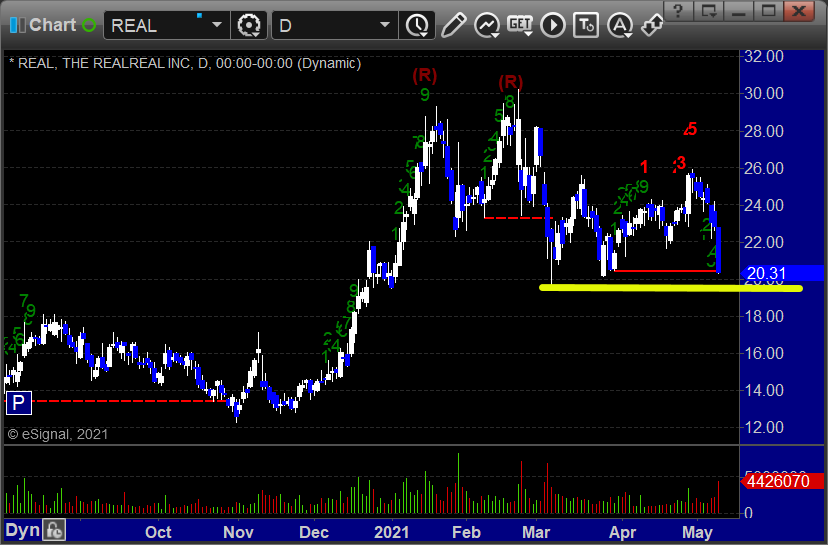

Short side, REAL < 19.63: