Tradesight Recap Report for 5/10/21

Overview

The markets opened flat to lower and the NASDAQ was much weaker all day. We finally sold off late on 4.8 billion NASDAQ shares.

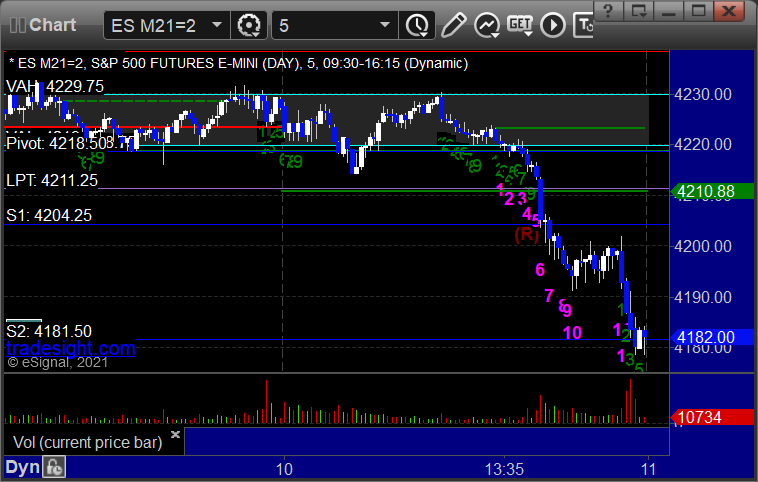

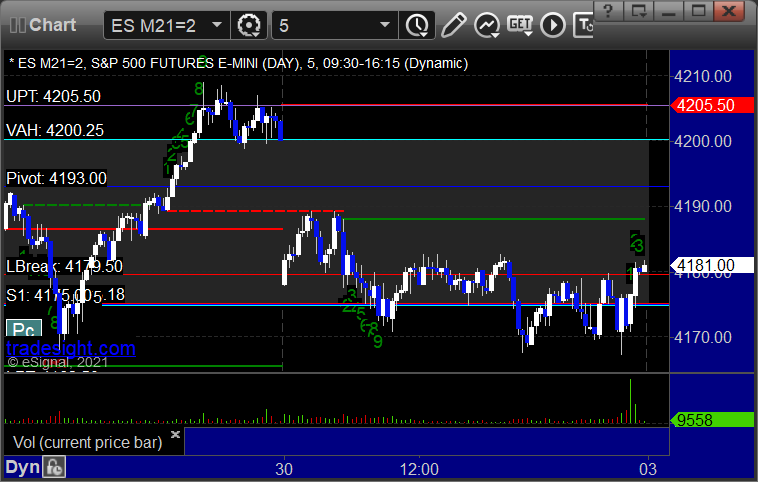

ES with Levels:

ES with Market Directional:

Futures:

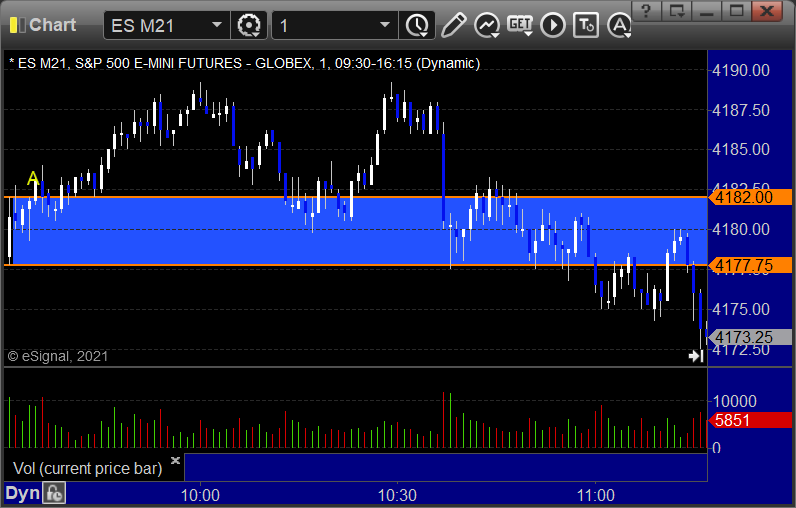

ES Opening Range Play triggered short at A and worked:

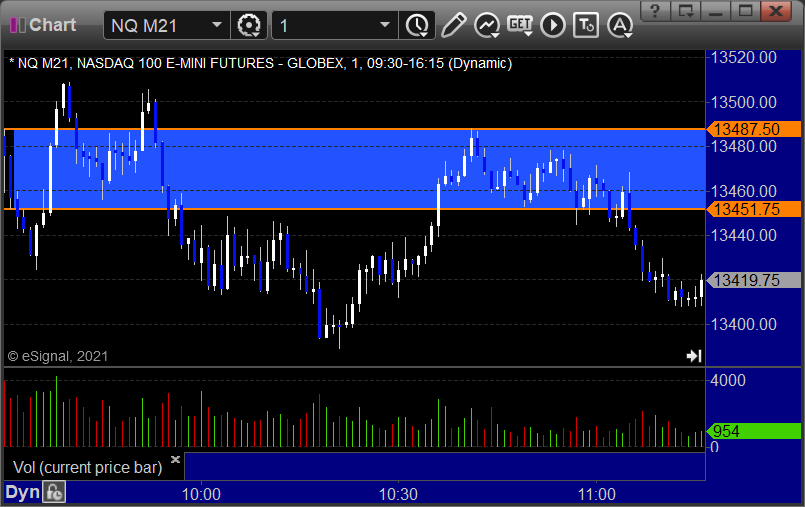

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +8.5 ticks

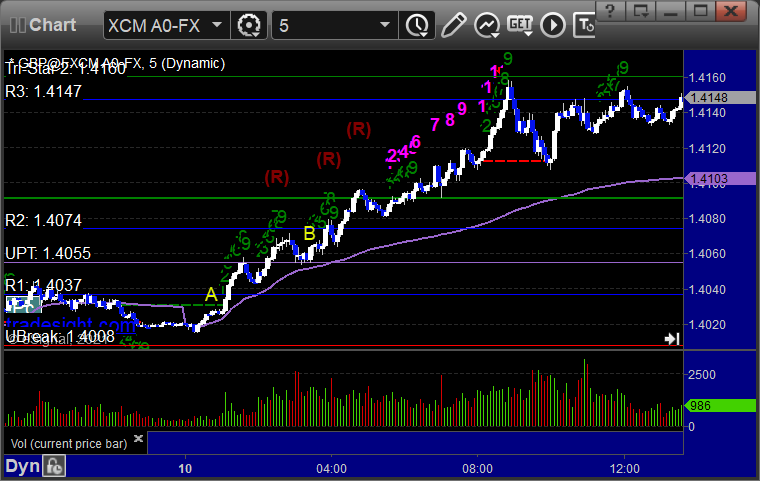

Forex:

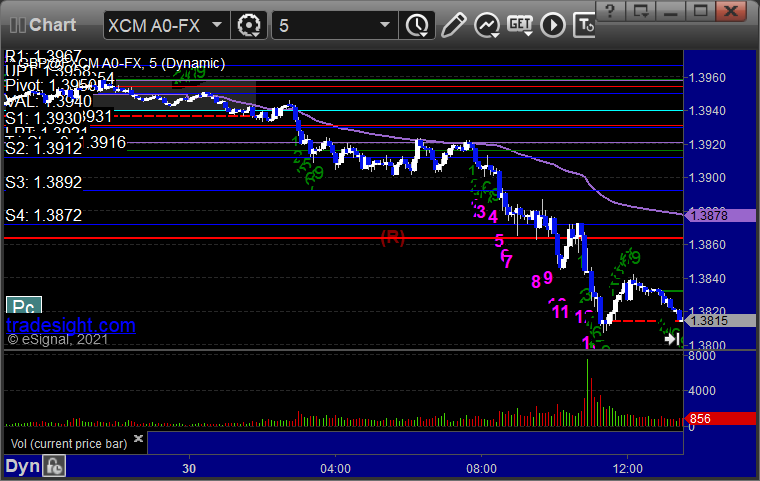

GBPUSD triggered long at A, hit first target at B, still holding second half:

Results: No final results as the trade is still working and well in the money

Stocks:

From the report, nothing triggered.

From the Twitter feed, Rich's SPOT triggered short (with market support) and worked enough for a partial:

COST triggered short (with market support) and worked:

UBER triggered short (with market support) and didn't work:

Rich's MU triggered short (with market support) and worked:

That’s 4 triggers with market support, 3 of them worked and 1 didn’t.

Tradesight Recap Report for 5/7/21

Overview

Markets gapped up a little and pushed higher for an hour and then went dead flat for the rest of Friday on 4.8 billion NASDAQ shares.

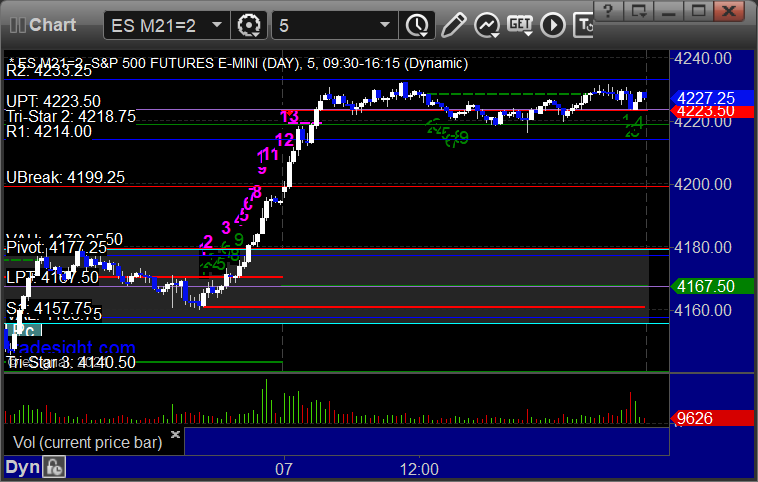

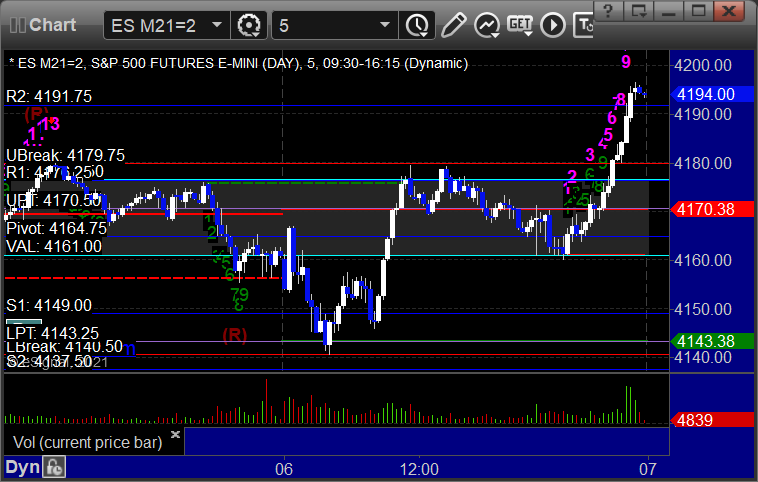

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play:

Results: +20 ticks

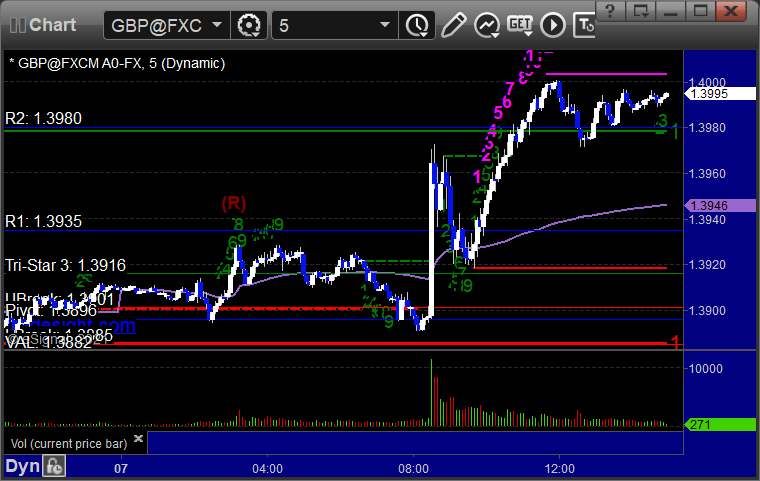

Forex:

GBPUSD triggered long at A, hit first target at B, closed for end of week:

Results: +40 pips

Stocks:

Nothing triggered from the daily picks.

From the Twitter Feed, Rich's DKNG triggered short (without market support) and didn't do enough either way to count:

His CAT triggered long (with market support) and didn't do enough either way to count:

That’s 1 trigger with market support and it didn't do enough either way.

Tradesight Recap Report for 5/6/21

Overview

The markets opened flat, went lower, reversed into lunch, came out of lunch flat, and then rallied very late on 4.9 billion NASDAQ shares.

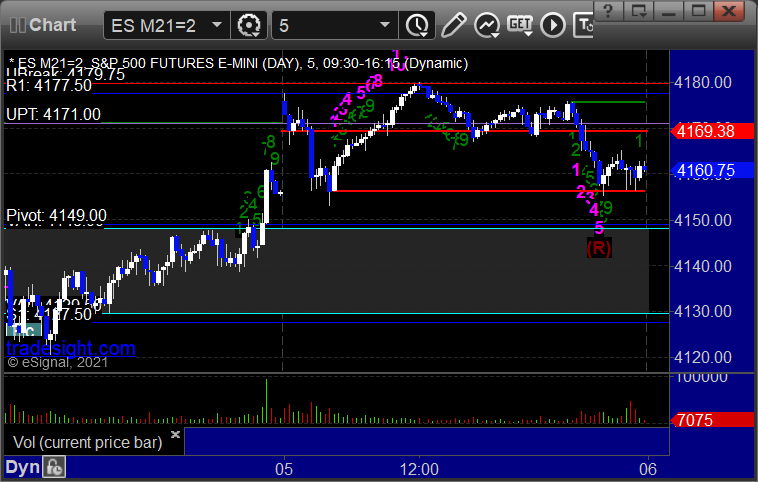

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked enough for a partial:

NQ Opening Range Play:

Results: +8 ticks

Forex:

No calls, and that was a good thing.

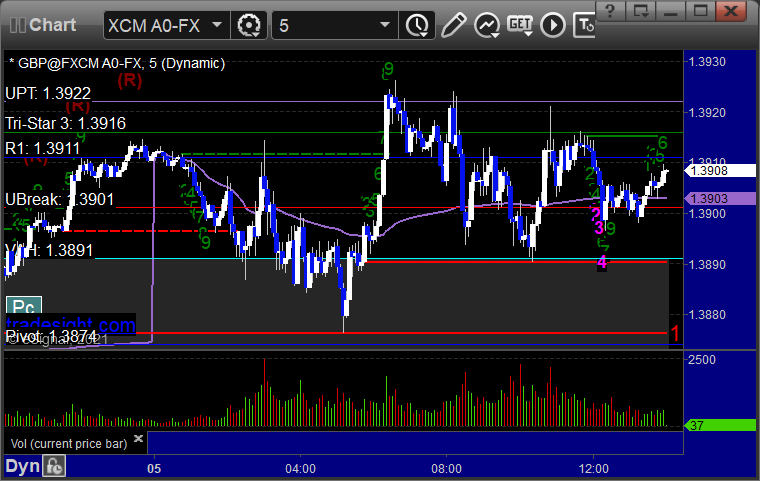

GBPUSD:

Results: +0 pips

Stocks:

ROKU triggered short (with market support) and worked huge:

Rich's VXX triggered long (ETF, so no market support needed) and worked enough for a partial:

His SHOP triggered short (with market support) and didn't work:

That’s 3 triggers with market support, 2 of them worked and 1 didn’t.

Tradesight Recap Report for 5/5/21

Overview

The markets gapped up, filled, pushed back to highs, and then came down and closed around even on 4.2 billion NASDAQ shares.

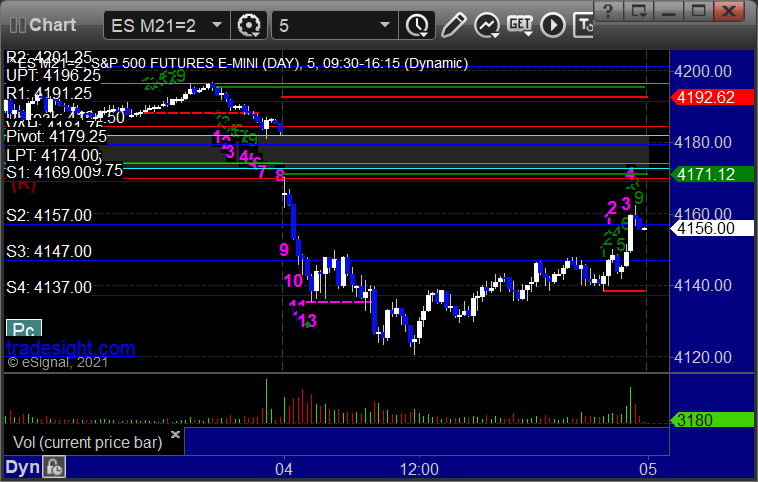

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play:

Results: +9.5 ticks

Forex:

No triggers for the session.

GBPUSD:

Results: +0 pips

Stocks:

A nice session.

GS triggered long (with market support) and worked huge:

Rich's NTES triggered short (with market support) and worked a little:

His APA triggered long (with market support) and didn't work:

That’s 3 triggers with market support, 2 of them worked and 1 didn’t.

Tradesight Recap Report for 5/4/21

Overview

Finally, a solid day of trading as the markets broke to the downside, which we were looking for after the TRIN reading that we got last Friday. NASDAQ volume was 5.5 billion shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A (barely) and then (barely) stopped over the midpoint before working great:

NQ Opening Range Play triggered too far out of range to take:

Results: -19 ticks

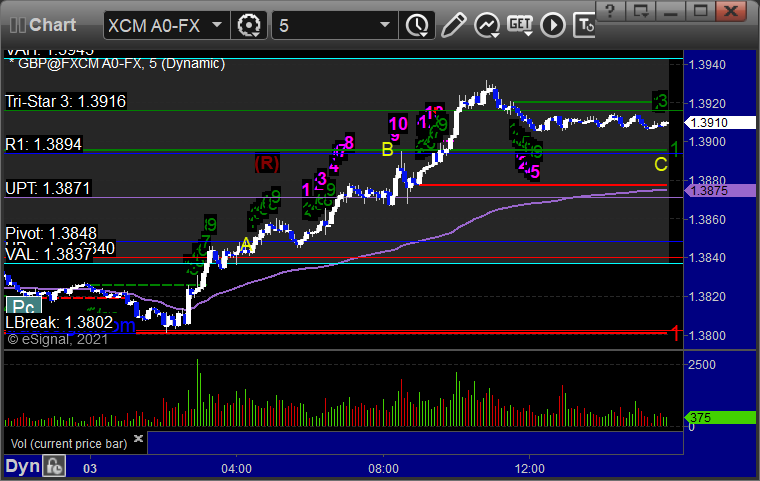

Forex:

Not much action, one stop out.

GBPUSD, triggered short at A and stopped:

Results: -25 pips

Stocks:

A huge day. Nothing off of the report triggered.

From the Twitter feed, FB gapped under the trigger, no play.

ZM triggered short (with market support) and worked:

ROKU triggered short (with market support) and worked:

LYFT triggered short (with market support) and worked enough for a partial:

ATVI triggered short (with market support) and worked:

Rich's OSTK triggered short (with market support) and worked:

That’s 5 triggers with market support, all of them worked.

Tradesight Recap Report for 5/3/21

Overview

The markets gapped up, the NASDAQ filled, the ES was flat all day, and there was a minor negative bias on 4.7 billion NASDAQ shares.

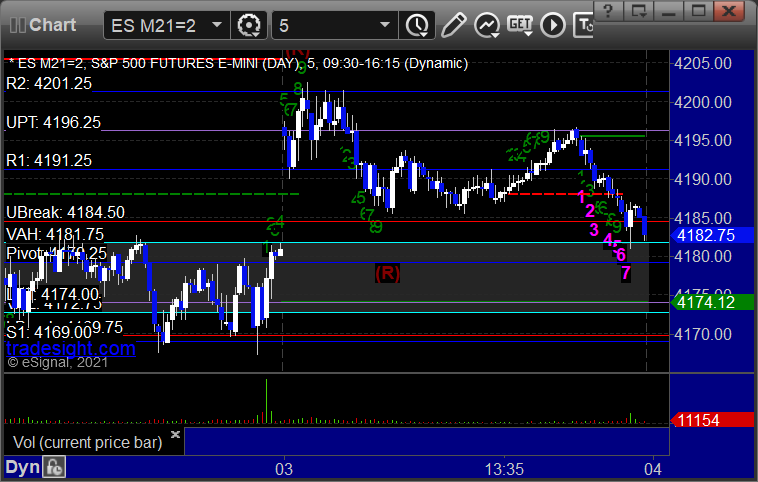

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked, triggered long at B and worked enough for a partial:

NQ Opening Range Play:

Results: =13 ticks

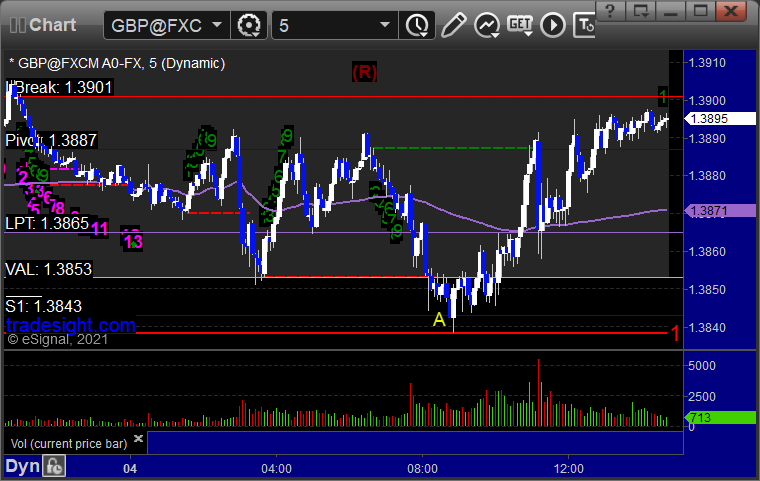

Forex:

GBPUSD triggered long at A, hit first target at B, still holding second half with a stop under R1 at C:

Results: still pending, trade has not closed out

Stocks:

Not a very exciting day.

From the report, OCGN triggered long (without market support due to opening 5 minutes) and worked:

From the Twitter feed, Rich's ROKU triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Plus Report for 5-3-21

Opening comments posted to YouTube. Let's hope (obviously) for a better week. Not sure it can get any worse.

Scans only turned up a couple but they look nice. Nothing on the short side.

OCGN > 14.05:

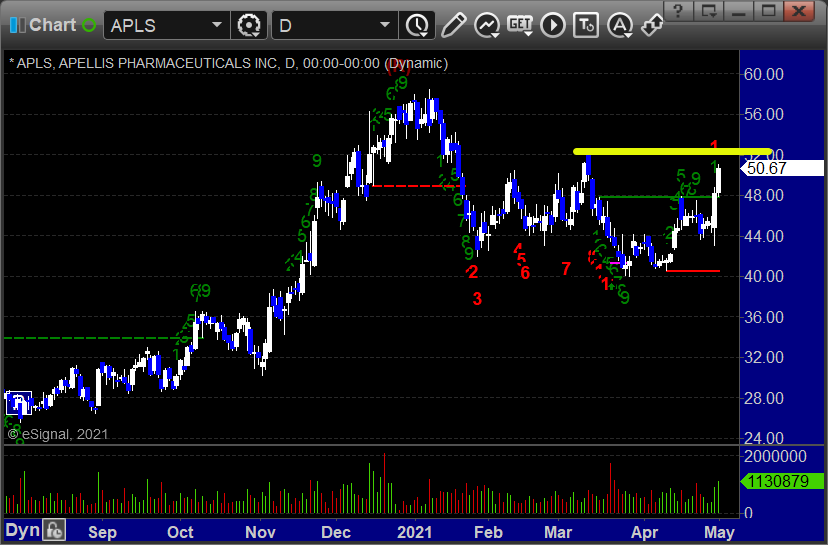

APLS > 52.26:

Tradesight Recap Report for 4/30/21

Overview

The markets gapped down and went flat all day, literally closing where they opened for end of month statement printing on 4.8 billion NASDAQ shares.

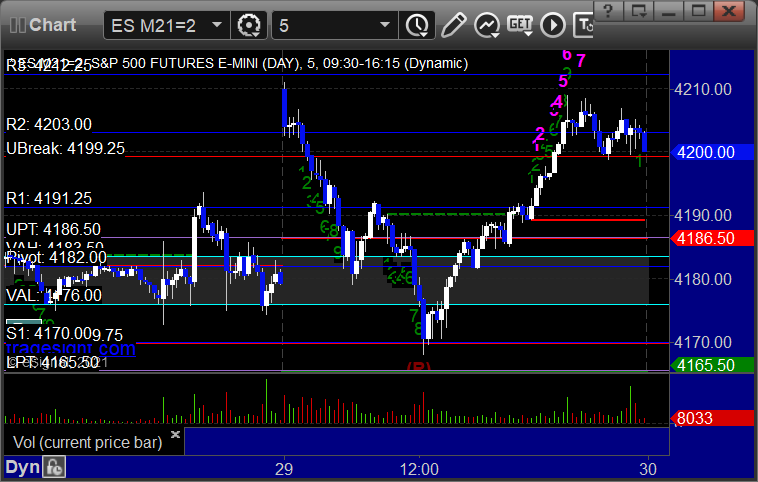

ES with Levels:

ES with market directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +9.5 ticks

Forex:

GBPUSD, no calls with the horrible Levels spacing:

Results: +0 pips

Stocks:

Wrapping up one of the single worst (in terms of boredom, not losses) trading weeks I have experienced, nothing triggered at all.

That’s 0 triggers with market support.

Tradesight Plus Report for 4-30-21

No YouTube Preview for a Friday (especially end of month), but let's discuss. Things were starting to look good yesterday and then ended up being nothing. The 10-day TRIN under 0.85 suggests a market decline. It is doubtful that it starts on a month-ending Friday, so I have low expectations for Friday. Having said that, it can start whenever, and most important, I would look to next week for action to begin so we can continue what has started up twice in the last two weeks.

As expected since we went nowhere Thursday, nothing much came up in the scans.

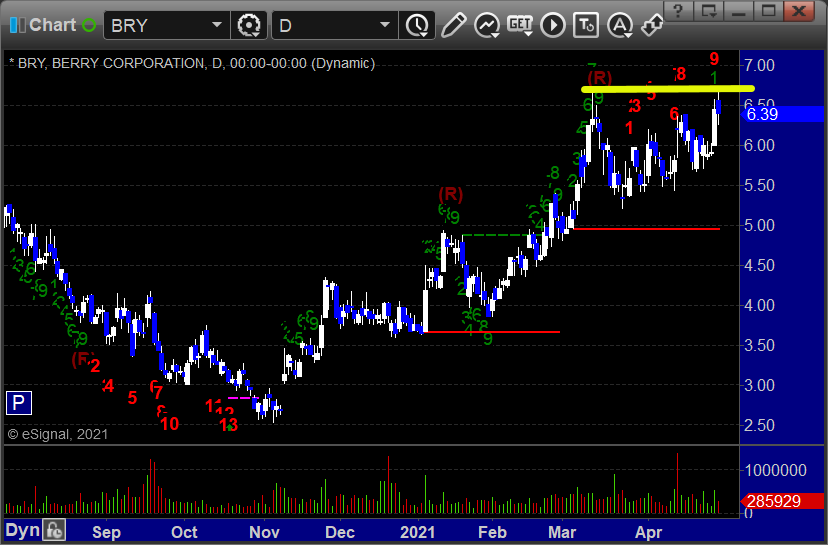

BRY > 6.70:

Tradesight Recap Report for 4/29/21

Overview

Thursday was a day that was looking really great early and then turned into a nothing burger. Markets gapped up on earnings, sold back off into the range we have been stuck in, but looked to finally have the momentum to breakdown. Instead, we bottomed heading into lunch, came back up, and then rallied back to the open. The main point to take away as we wrap up earnings for the season after the close and then print statement Friday is that the 10-day moving average of the TRIN is now 0.82, which is a sell signal on the broad market. So if we had kept dropping into the close, we would have been in a really great shape for some huge trades going forward. That doesn't really mean the drop won't happen, it just means that we are waiting for it to start instead of completing Thursday with that move in motion. NASDAQ volume was 4.8 billion shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked but too far out of range to take unfortunately or it would have been a nice winner:

NQ Opening Range Play triggered short at A and worked:

Results: +0 ticks

Forex:

No triggers for the session.

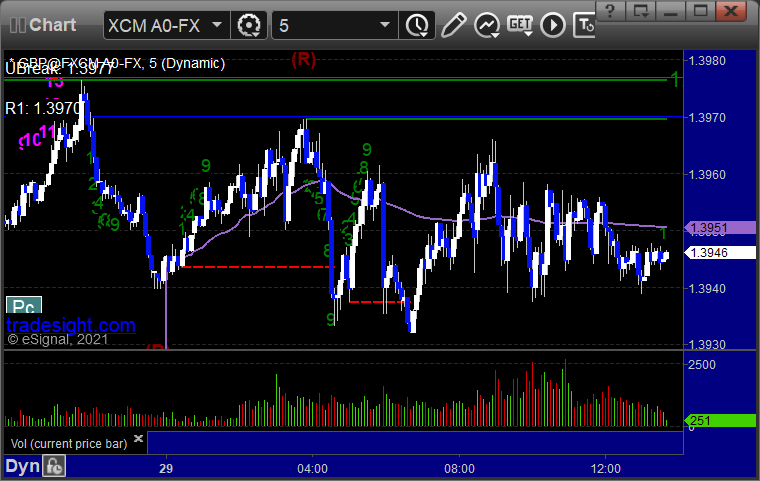

GBPUSD:

Results: +0 pips

Stocks:

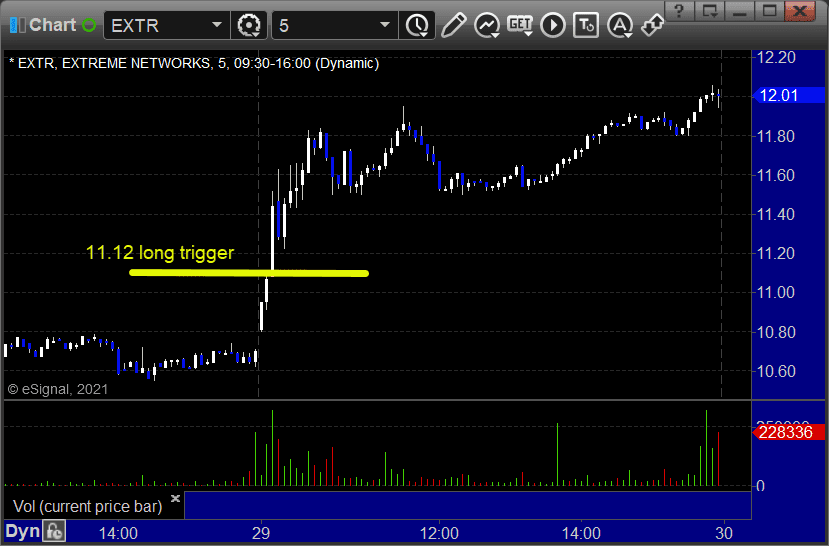

From the report, EXTR triggered long (with market support) and worked:

AMZN gapped over, no play.

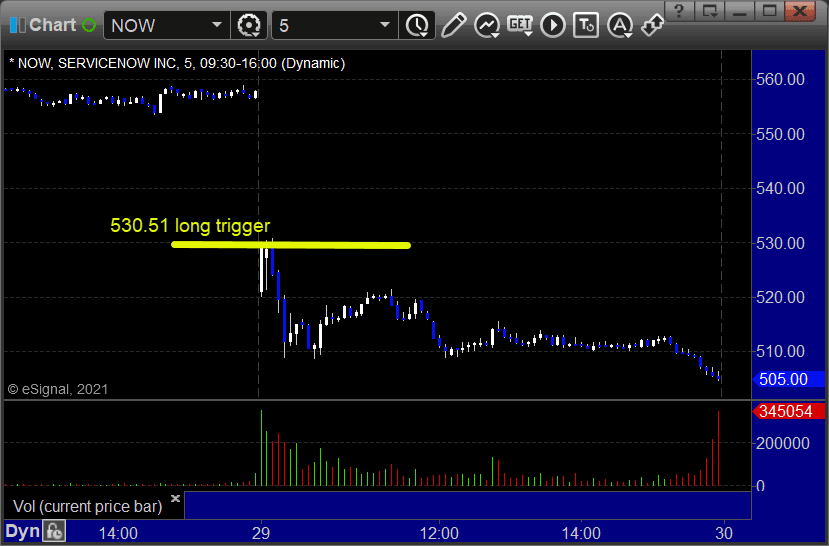

From the Twitter feed, Rich's NOW triggered long (with market support) and didn't work:

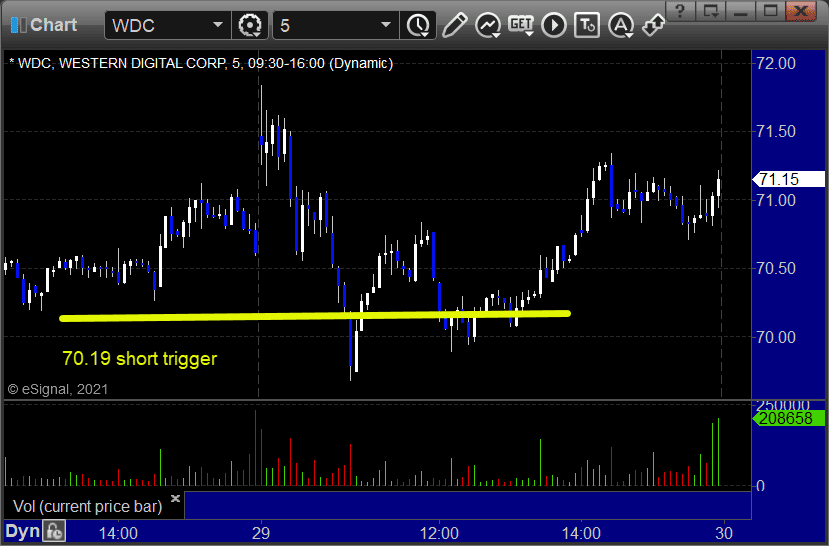

WDC triggered short (with market support) and didn't work:

INTU triggered short (with market support) and worked enough for a partial:

NFLX triggered short (with market support) and didn't work:

That’s 5 triggers with market support, 2 of them worked and 3 didn’t.