Tradesight Plus Report for 4-29-21

Opening comments posted to YouTube. The biggest day of earnings is Thursday, especially after the close, and then we have month-end statements printing on Friday. The good news is the TRIN is likely to give us a broad market sell signal for next week.

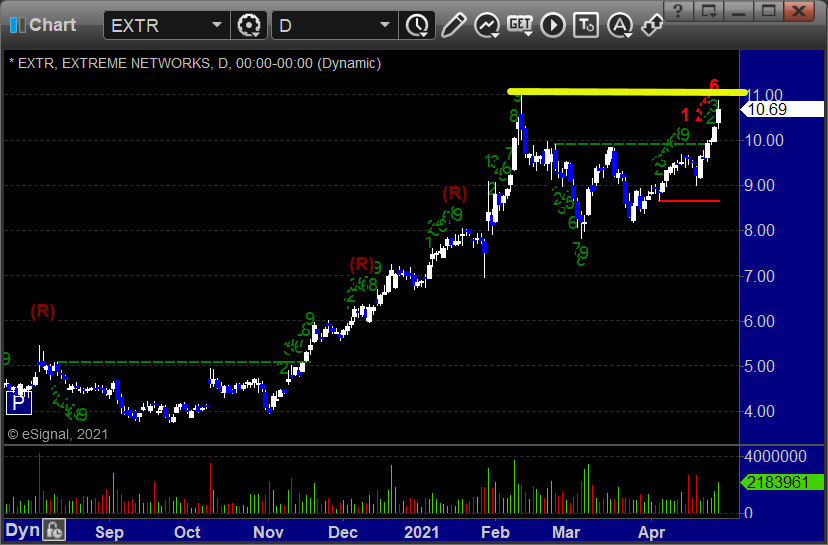

Longs only, in order of best chart construction, starting with EXTR > 11.12:

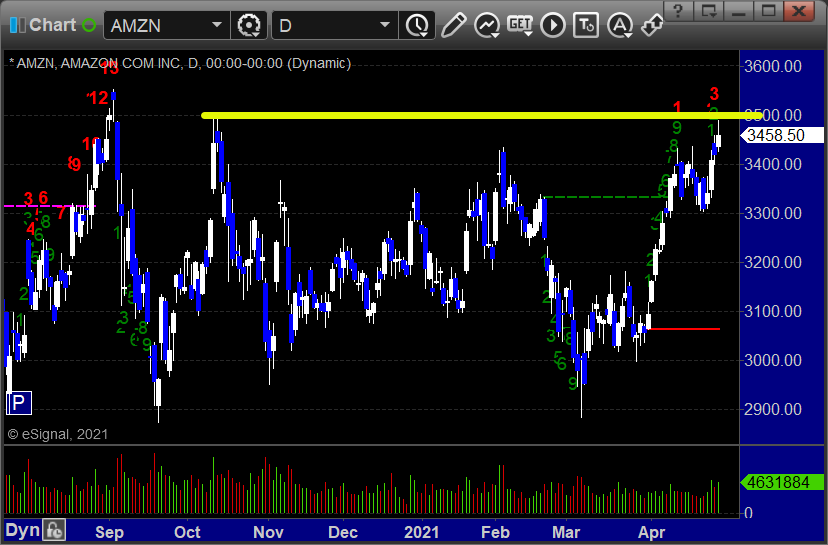

AMZN > 3496.24:

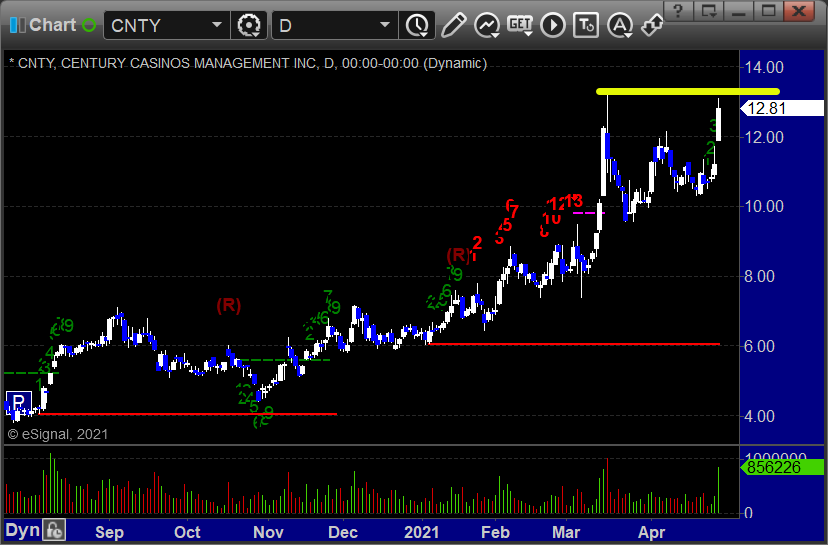

CNTY > 13.35:

Tradesight Recap Report for 4/28/21

Overview

As expected, an uneventful Fed meeting day, and then the market didn't get out of the range of the week even after that. We closed about where we opened on 4.5 billion NASDAQ shares. One more day of earnings and then the month end statements print on a Friday, but the 10-day TRIN closed under 0.85, which could be what we needed.

Futures:

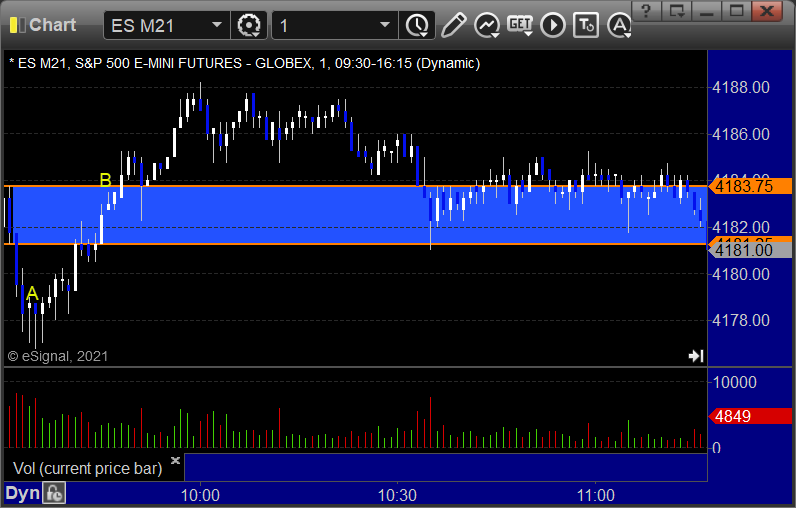

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

NQ Opening Range Play triggered short at A but too far out of range to take under the rules, triggered long at B and worked:

Results: +39 ticks

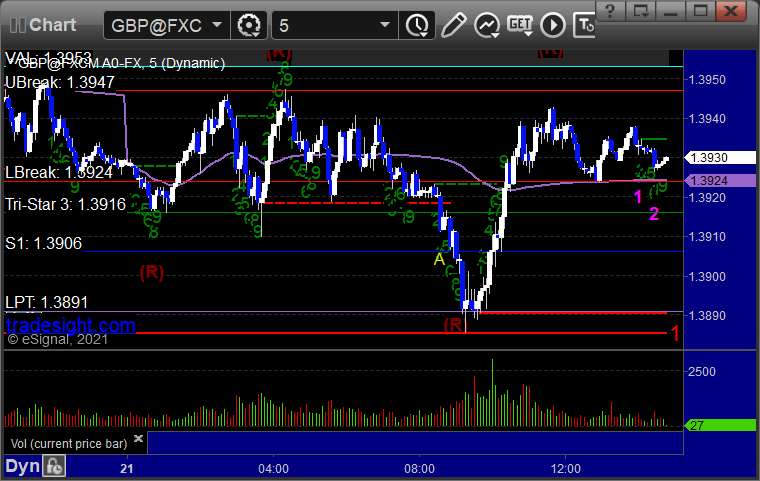

Forex:

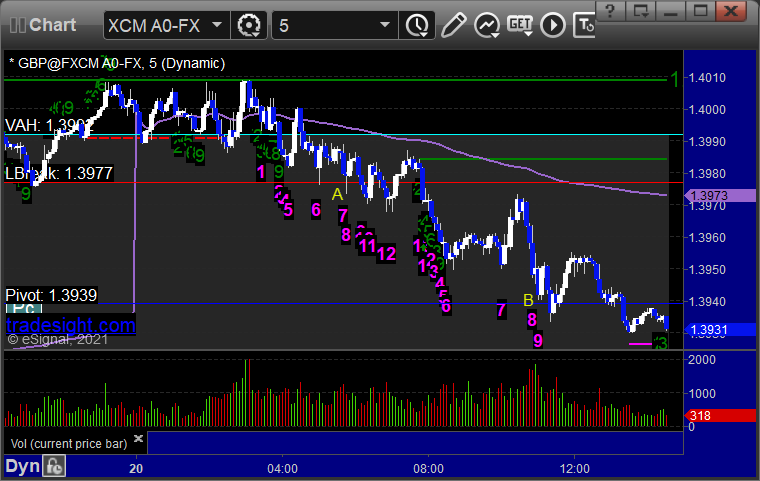

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Quite amazing to have no movement after three and a half days. Nothing triggered at all, even after the Fed announcement, which just shook both ways. Boring as heck week.

That’s 0 triggers with market support.

Tradesight Recap Report for 4/27/21

Overview

The markets opened close to flat and pushed a little lower (NASDAQ was weaker) for a little bit and then just sat dead flat all day as everyone waits for the Fed and earnings. NASDAQ volume was 4.5 billion shares.

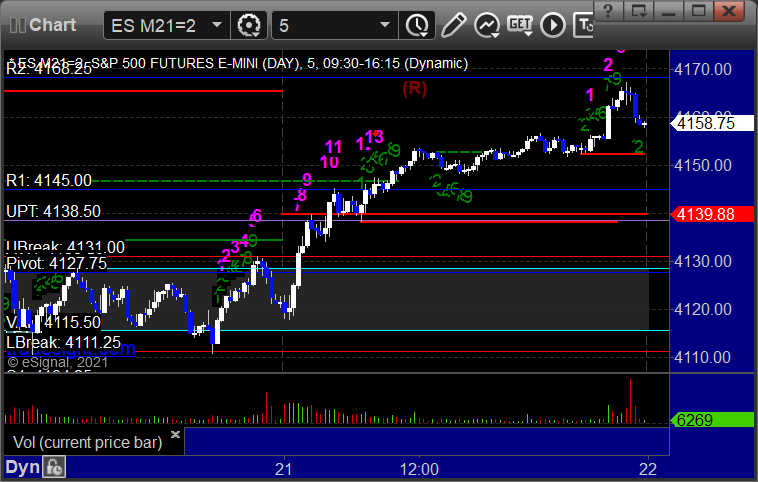

ES with Levels:

ES with Market Directional:

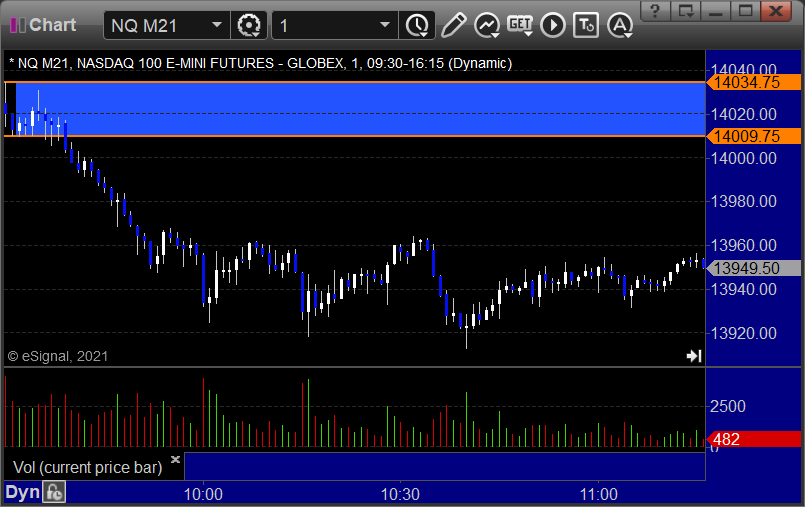

Futures:

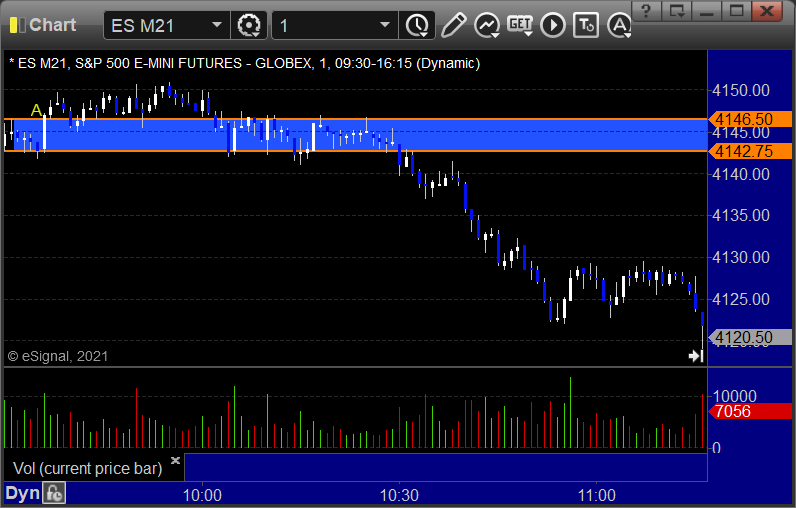

ES Opening Range Play triggered short at A and worked:

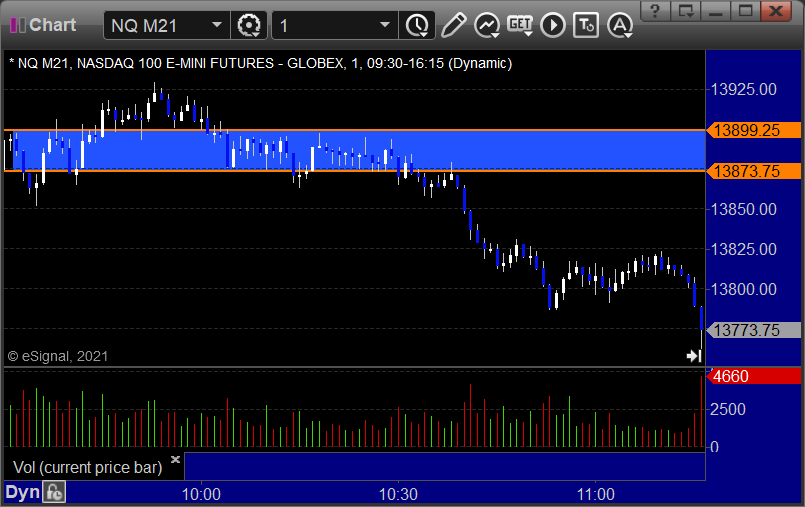

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +13 ticks

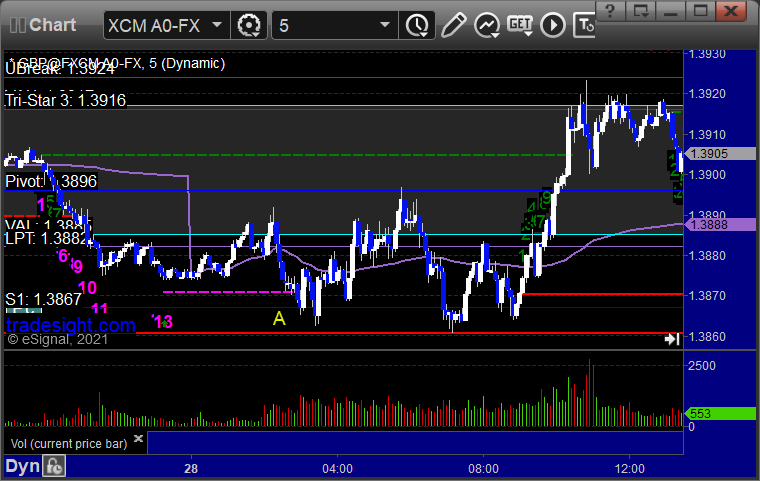

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

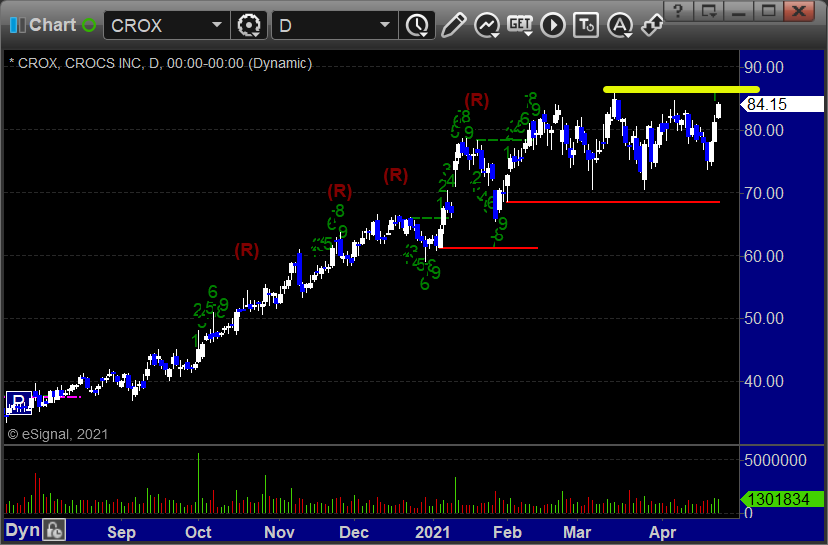

From the report, CROX gapped over, no play.

MXIM triggered long (without market support) and didn't work:

From the Twitter feed, PYPL triggered short (with market support) and didn't go enough in either direction to count:

That’s 0 triggers with market support, and one that didn't matter.

Tradesight Recap Report for 4/26/21

Overview

A super-boring day to start the week and one of the narrowest we have seen on 4.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked, triggered short at B and stopped:

NQ Opening Range Play:

Results: -7.5 ticks

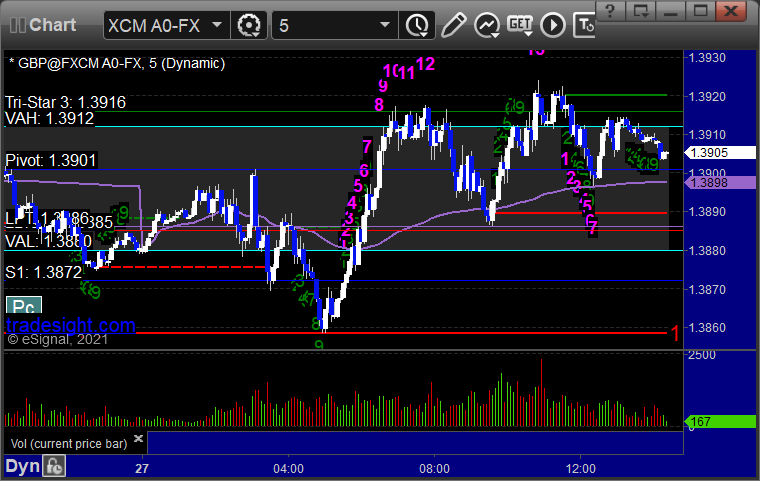

Forex:

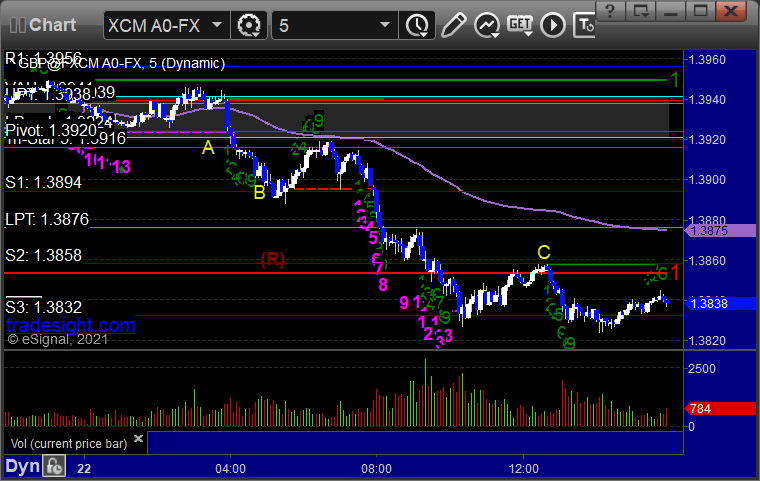

GBPUSD triggered long at A, hit first target at B, stopped second half under the entry, triggered short at C and stopped:

Results: -10 pips

Stocks:

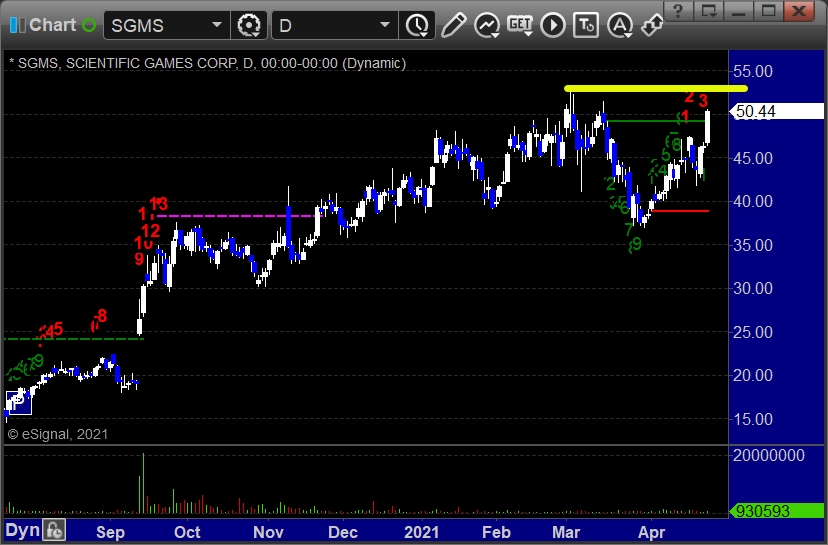

Truly amazing. SGMS gapped over. 6 other calls didn't trigger.

That’s 0 triggers with market support.

Tradesight Plus Report for 4-26-21

Opening comments posted to YouTube for the week. Remember that Friday is also end of month, so Friday should be slow for statement printing.

Longs only, in order of best construction, starting with MXIM > 98.44:

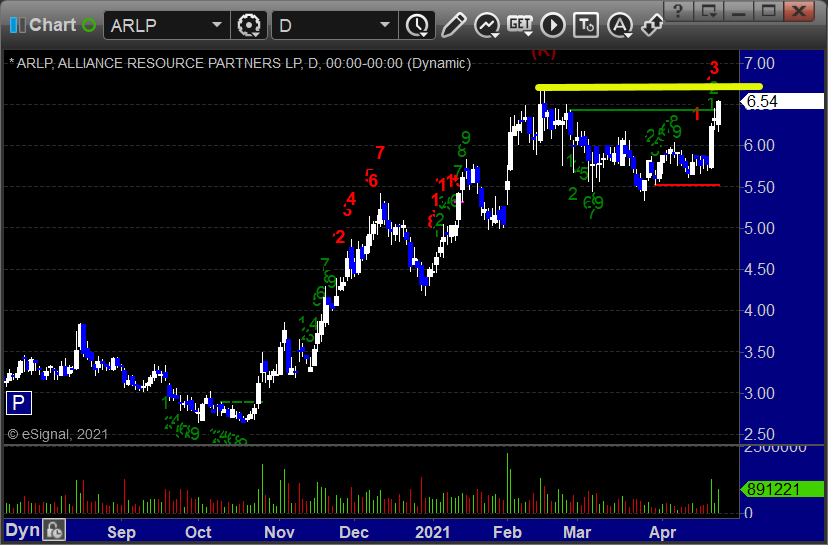

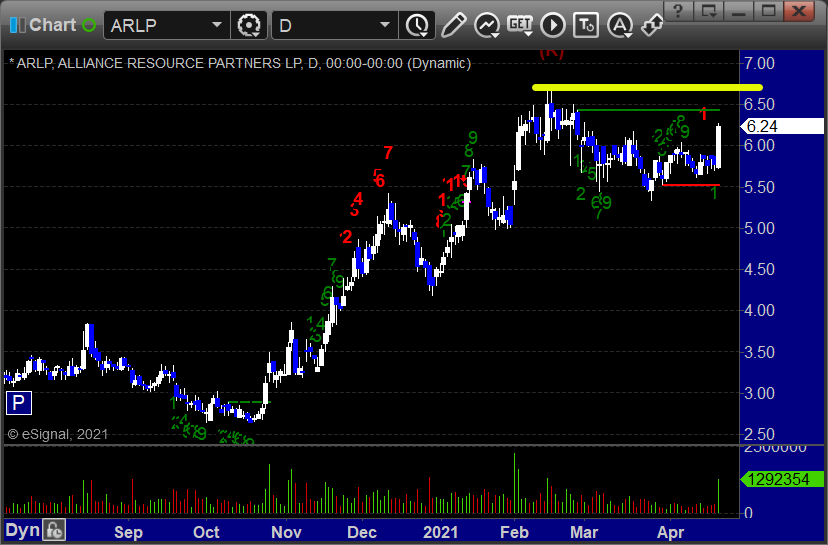

ARLP > 6.68:

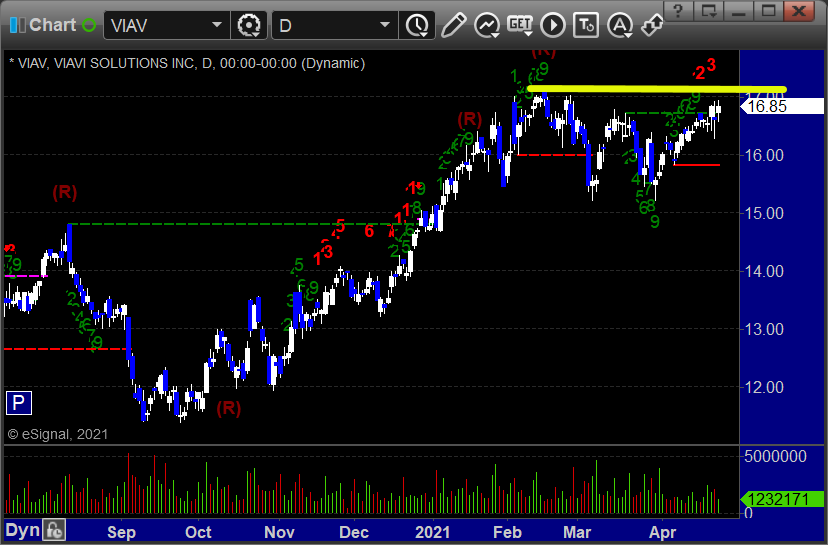

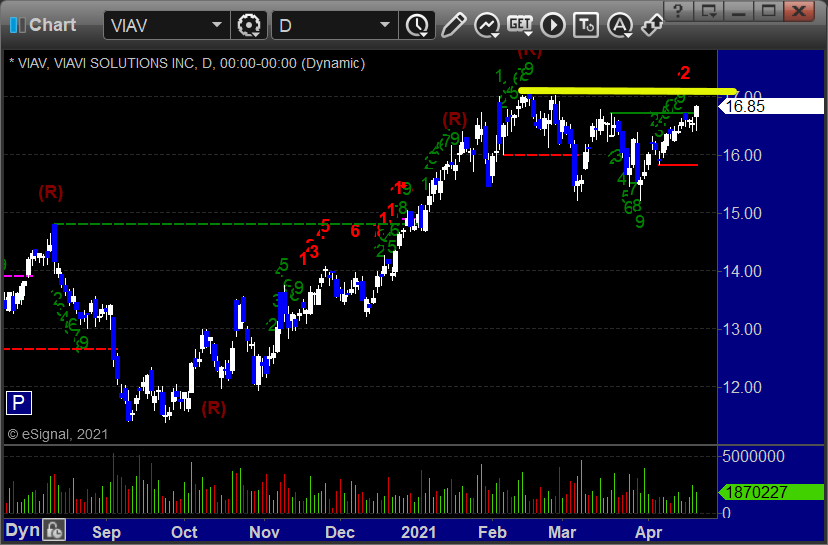

VIAV > 17.13:

CROX > 86.40:

SGMS > 51.16:

Tradesight Recap Report for 4/23/21

Overview

The markets gapped up a little, pushed higher, stalled out after the first 30 minutes, but then rallied and recovered all of the gains lost by the tax announcement the prior day (in other words, the markets don't care) on 4.3 billion NASDAQ shares.

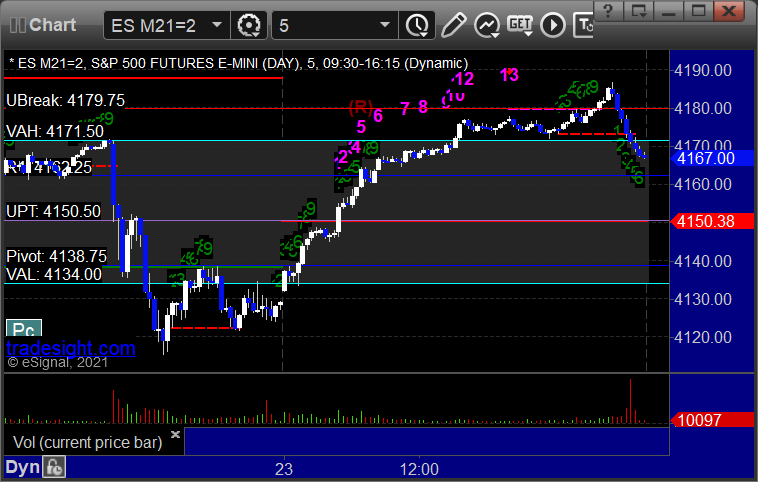

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play:

Results: +15 ticks

Forex:

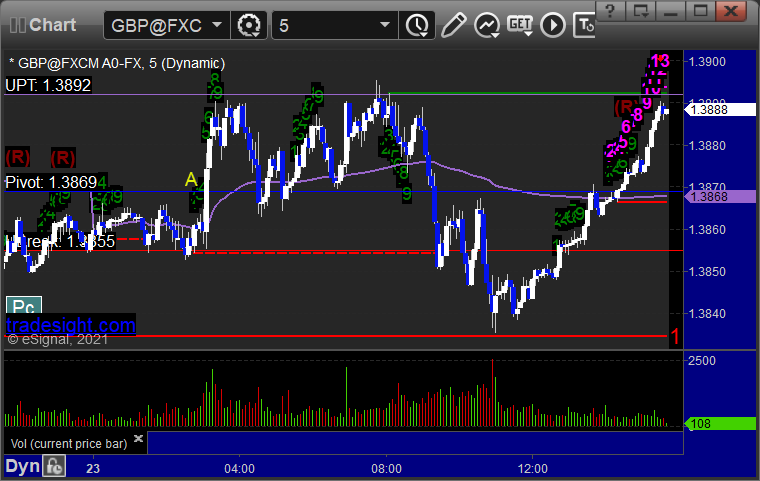

GBPUSD triggered short at A and stopped:

Results: +25 pips including yesterday's final gain and today's loss

Stocks:

Rich's FSLR triggered long (with market support) and didn't quite work:

That’s 1 trigger with market support, and it didn't work.

Tradesight Recap Report for 4/22/21

Overview

Markets basically opened flat, slightly rose early, and then tanked on news that the Fed wanted to tax crypto gains at 80%. Volume was 4 billion NASDAQ shares.

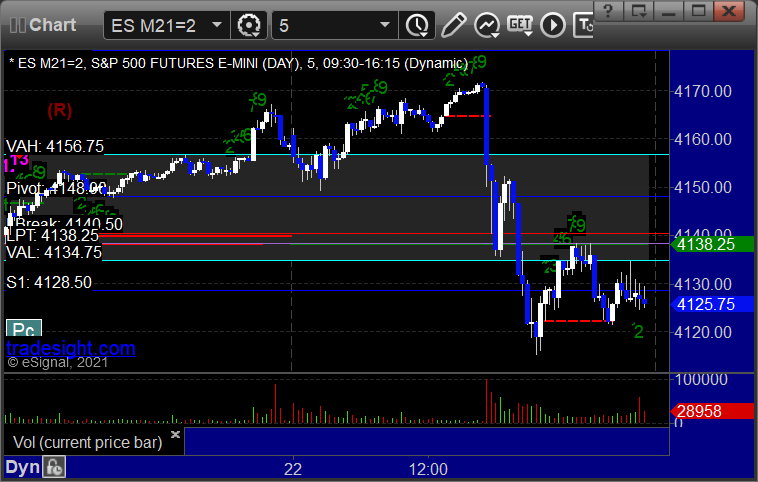

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +4 ticks

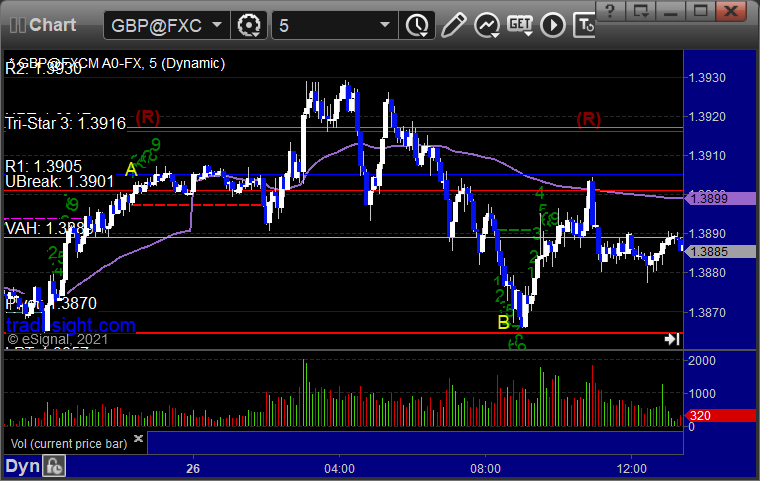

Forex:

GBPUSD triggered short at A, hit first target at B, still holding second half with a stop over C:

Results: Nothing yet, trade not complete

Stocks:

NFLX triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Plus Report for 4-22-21

Not a ton of picks, but there are a few to get us started and see what happens.

Opening comments posted to YouTube.

Longs first, in order of best chart construction, starting with VIAV > 17.13:

ARLP > 6.68:

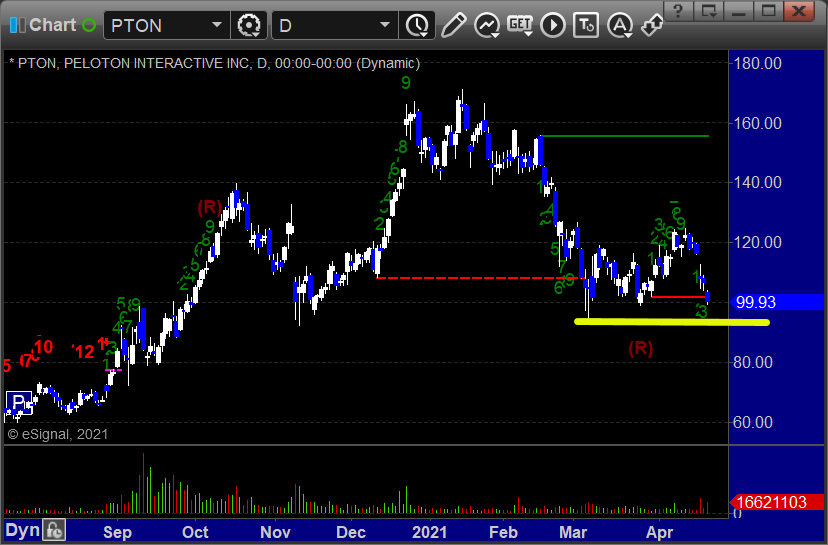

Shorts next, just one, PTON < 94.00:

Tradesight Recap Report for 4/21/21

Overview

Markets gapped down and then recovered all of the prior day's losses on 4.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked great:

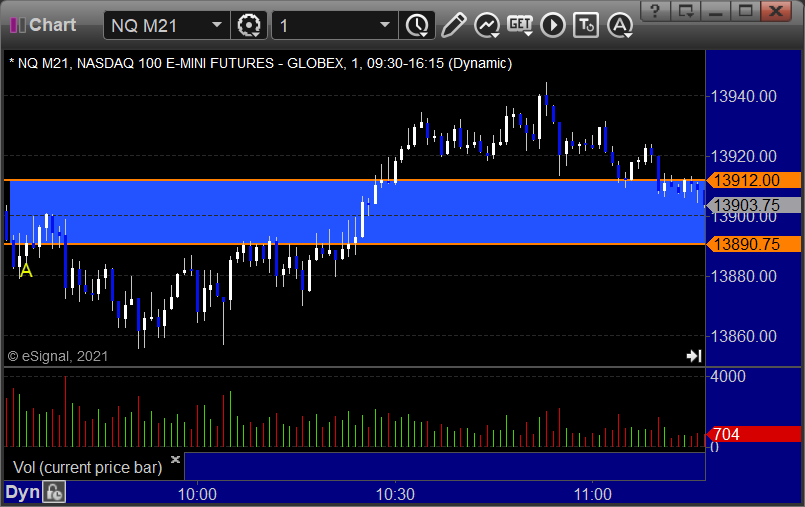

NQ Opening Range Play triggered both ways but too far out of range to take:

Results: +28.5 ticks

Forex:

GBPUSD:

Results: +25 pips (includes yesterday gain and today's loss)

Stocks:

Nothing from the report triggered.

From the Twitter feed, Rich's AMAT triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked great.

Tradesight Recap Report for 4/20/21

Overview

The markets gapped down a little, tried to fill, and then plunged until lunchtime, and that was about it on the day on 4.3 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long but too far out of range to take:

Results: +4 ticks

Forex:

We came into the session long the GBPUSD for the prior session, and the second half closed 140 pips in the money. Our new call worked.

GBPUSD triggered short at A, hit first target at B, still holding second half:

Results: +90 pips from prior day's trade, current trade is still active

Stocks:

GS triggered short (with market support) and worked:

NVDA triggered short (with market support) and worked great:

WYNN triggered short (with market support) and worked enough for a partial:

Rich's FB triggered short (with market support) and worked:

His JNJ triggered long (without market support) and didn't work:

That’s 4 triggers with market support, all of them worked.