Tradesight Recap Report for 4/19/21

Overview

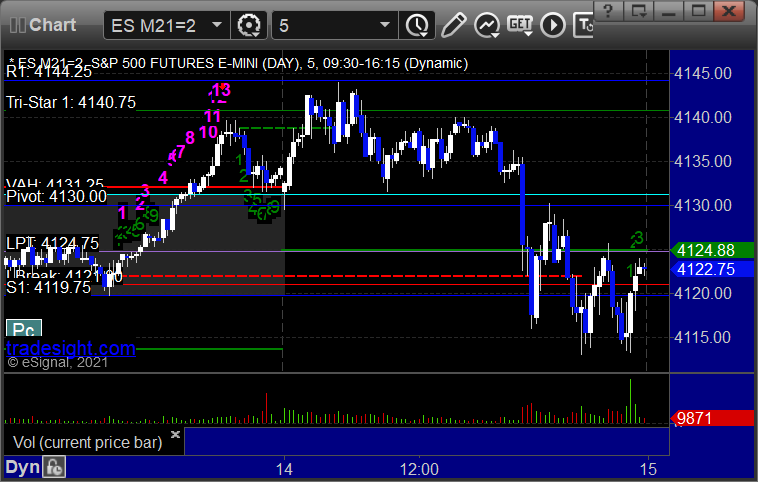

The markets gapped down, tried to fill but couldn't quite get there, we warned everyone that the internals were bad, and then everything tanked on 4.3 billion NASDAQ shares.

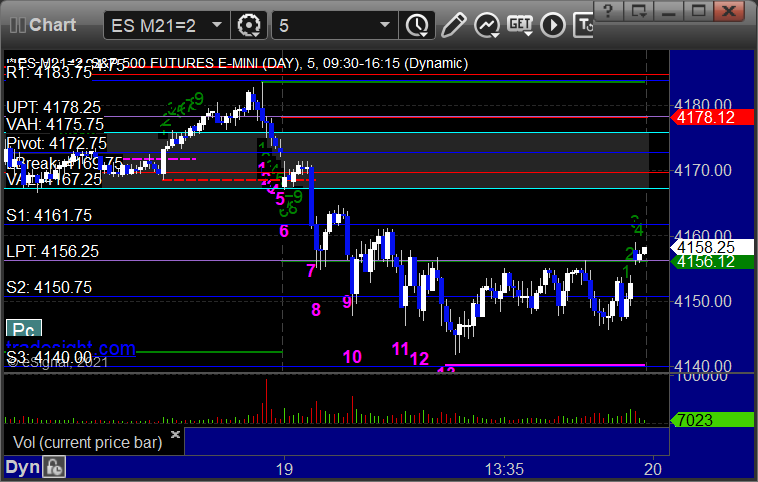

ES with Levels, note the 13 buy signal at the low:

ES with market directional:

Futures:

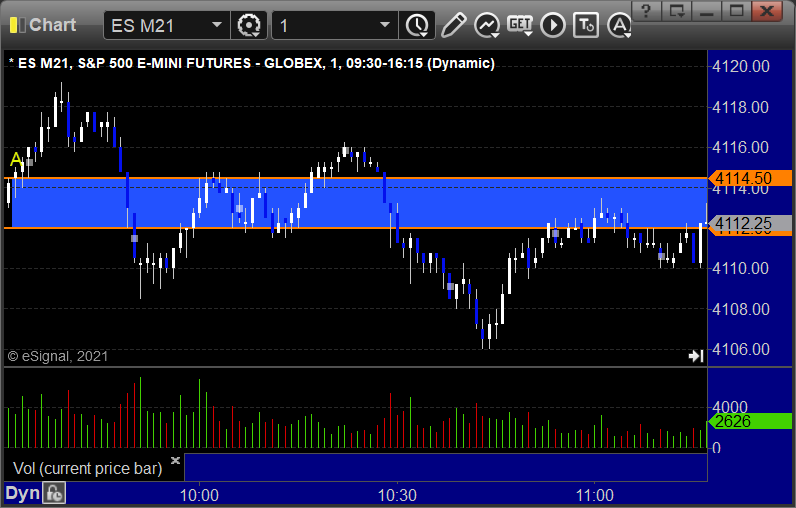

ES Opening Range Play triggered long at A and stopped under the midpoint, triggered short at B and worked:

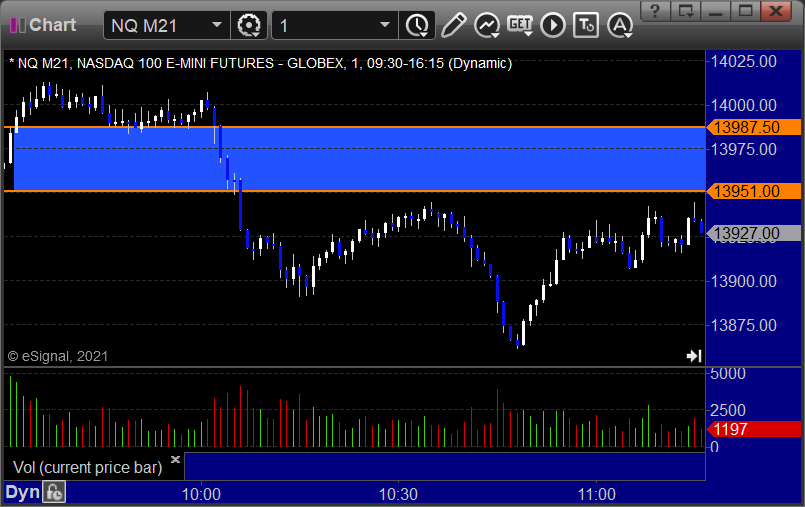

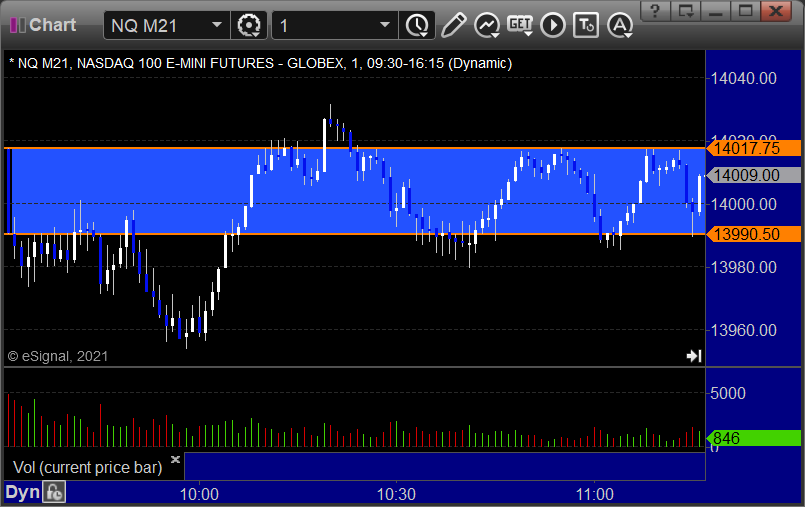

NQ Opening Range Play triggers were out of range:

Results: +5 ticks

Forex:

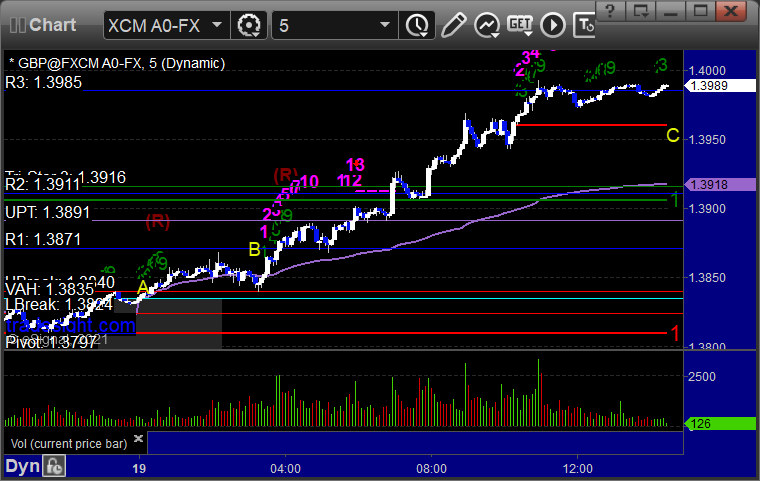

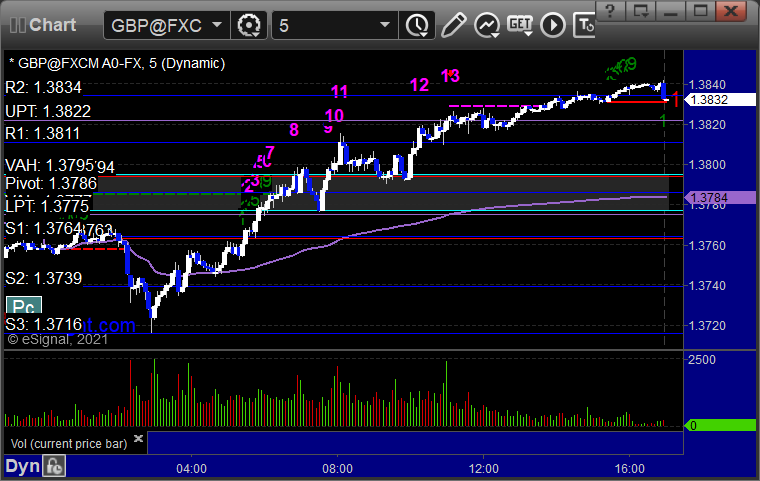

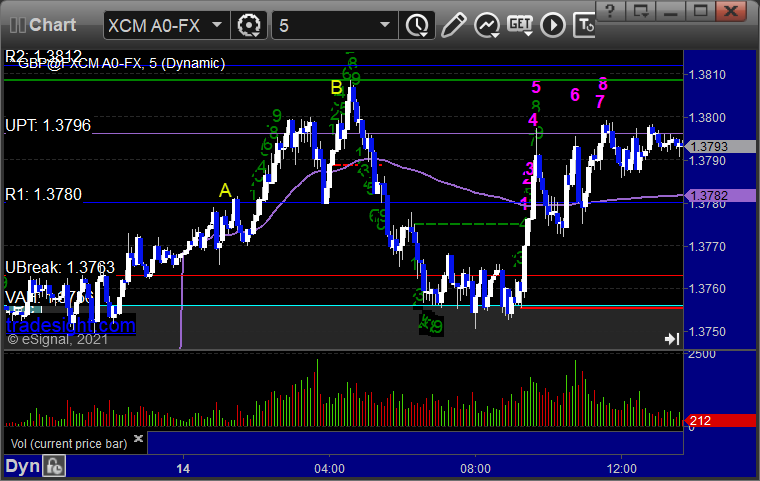

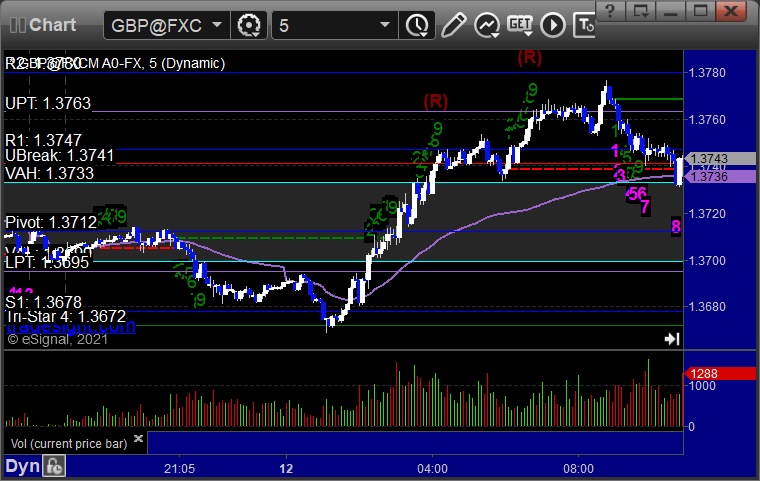

GBPUSD triggered long at A, hit first target at B, and worked great, still holding second half with a stop under C:

Results: Trade is still running over 150 pips in the money, no final result yet.

Stocks:

The early action looked positive but then they pulled the rug.

Rich's AAPL triggered long (with market support) and didn't work:

His GOOGL triggered long (with market support) and worked enough for a partial:

AMZN triggered long (with market support) and didn't work:

WDC triggered short (with market support) and worked:

Rich's ETSY triggered short (with market support) and worked:

ROKU triggered short (with market support) and worked:

That’s 6 triggers with market support, 4 of them worked and 2 didn’t.

Tradesight Plus Report for 4-19-21

Start of a new week as we head into the Core Eight Days of Earnings. The big story to start will likely be the drop in the cryptos. Opening comments posted to YouTube.

Longs first, in order of best construction, starting with CRIS > 13.44:

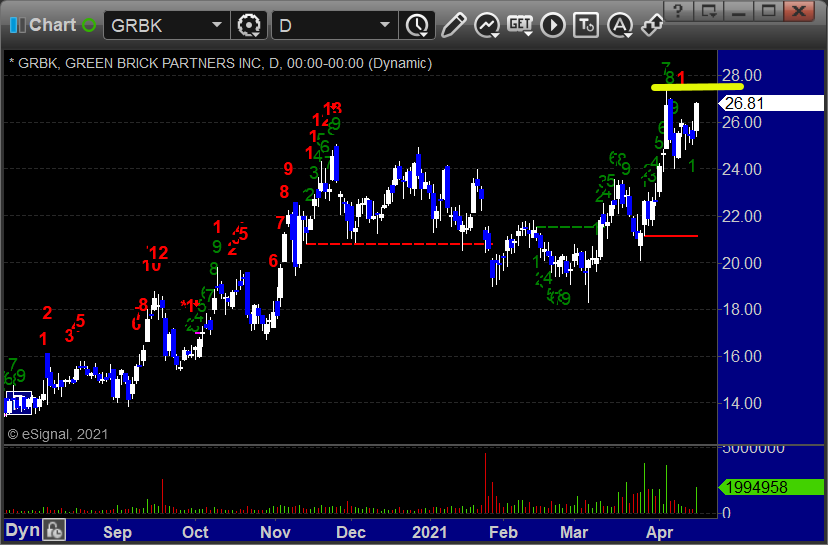

GRBK > 27.40:

Shorts, just one, VSPR < 10.01:

Tradesight Recap Report for 4/16/21

Overview

The markets gapped up, went dead flat, and then closed exactly where they opened for options expiration on 4.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play way to wide to take:

We also called an ES short into the Value Area, worked to the first target for 8 ticks and stopped over the entry.

Results: +10.5 ticks

Forex:

Two winners for the session.

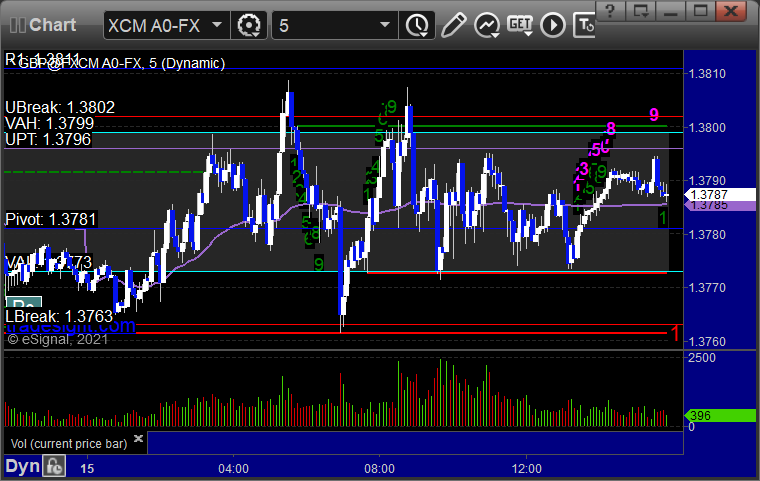

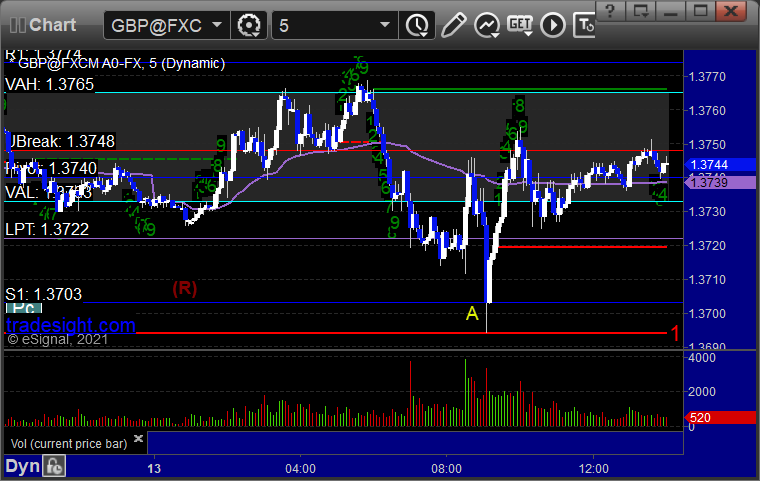

GBPUSD triggered short at A, hit first target at B, second half stopped over the entry, then triggered long at C, hit first target at D, should have closed second half for end of week:

Results: +30 pips

Stocks:

Options expiration was boring.

From the report, nothing triggered.

From the Twitter feed, Rich's SFIX triggered short (with market support) and worked enough for a partial:

AAPL triggered short (with market support) and worked enough for a partial:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 4/15/21

Overview

The markets gapped up and went a little higher and closed there on 4.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional (note the 13 sell signal for the high):

Futures:

ES Opening Range Play, triggered long at A and stopped:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: -12 ticks

Forex:

Opening for forex pairs:

GBPUSD, nothing triggered:

Results: +17 pips

Stocks:

What an expiration day!

GOOGL triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Plus Report for 4-15-21

Keep in mind that usually this is Tax Day, but this year, everyone gets an extra month, so we shall see what that means.

It's likely this is the last Plus report of the week since Friday is expiration. YouTube preview for the rest of the week posted.

Anything from prior reports is no longer valid, and I only have one here that matters, so it's just this and then whatever we put in the Twitter feed through the close Friday.

Longs only, just one, CRIS > 13.44:

No shorts found. Really sad.

Tradesight Recap Report for 4/14/21

Overview

Wednesday was the day COIN went public, and the markets clearly waited for it. Then it opened, shot higher, and plunged over 100 points and the market slipped with it on 4.1 billion NASDAQ shares.

ES with Levels, note the PERFECT Value Area Plays:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +11.5 ticks

Forex:

GBPUSD triggered long at A, hit first target barely at B, stopped second half under the entry:

Results: +10 pips

Stocks:

A few triggers. From the report, SUPN triggered long (with market support) and didn't work, didn't really do anything either way:

From the Twitter feed, Rich's VIAC triggered long (with market support) and worked enough for a partial:

His DISCA triggered long (with market support) and didn't work:

His BKNG triggered long (with market support) and worked enough for a partial:

That’s 34 triggers with market support, 2 of them worked and 2 didn’t.

Tradesight Plus Report for 4-14-21

Opening comments posted to YouTube. Just a few trades have come up.

Longs first, starting with SUPN > 31.99:

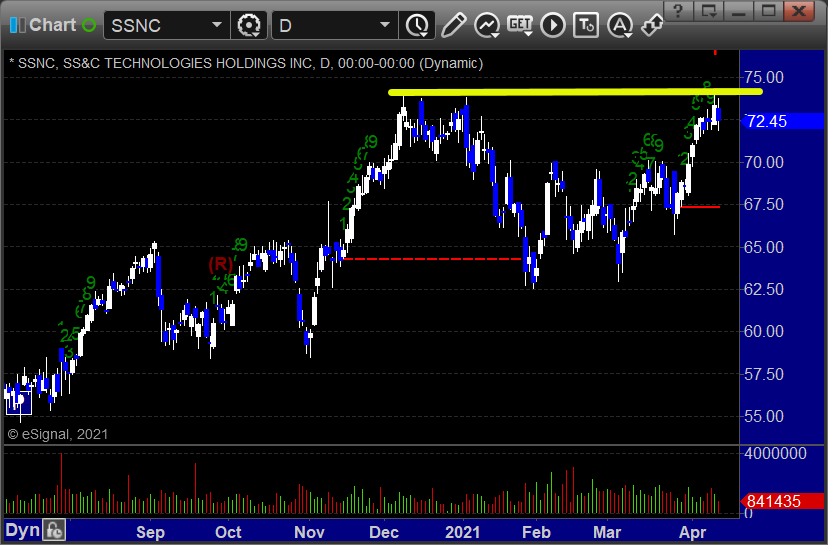

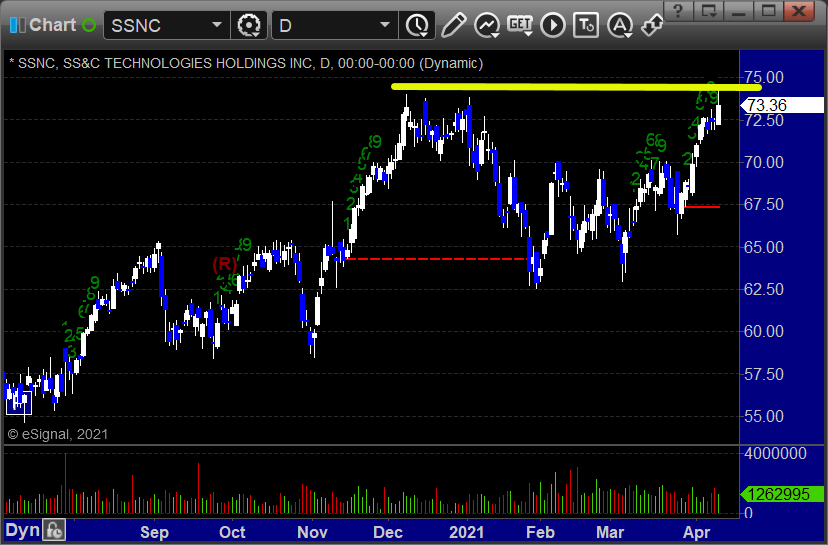

SSNC> 74.29:

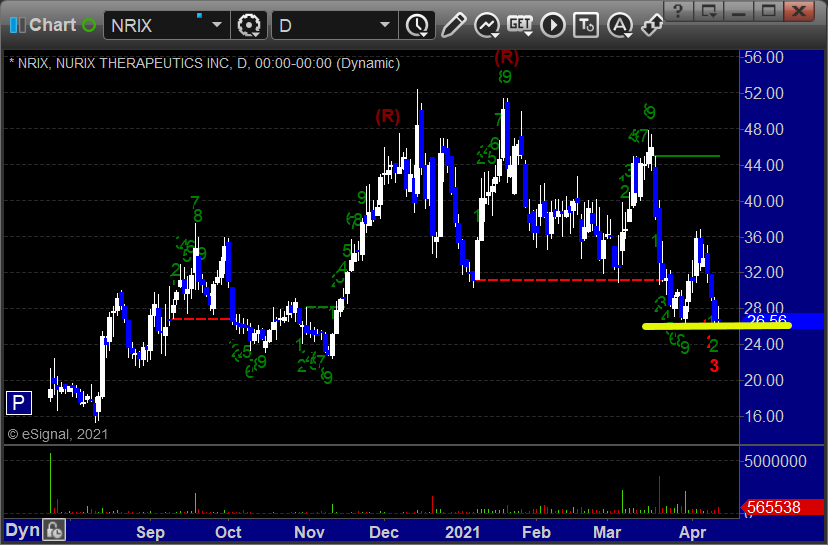

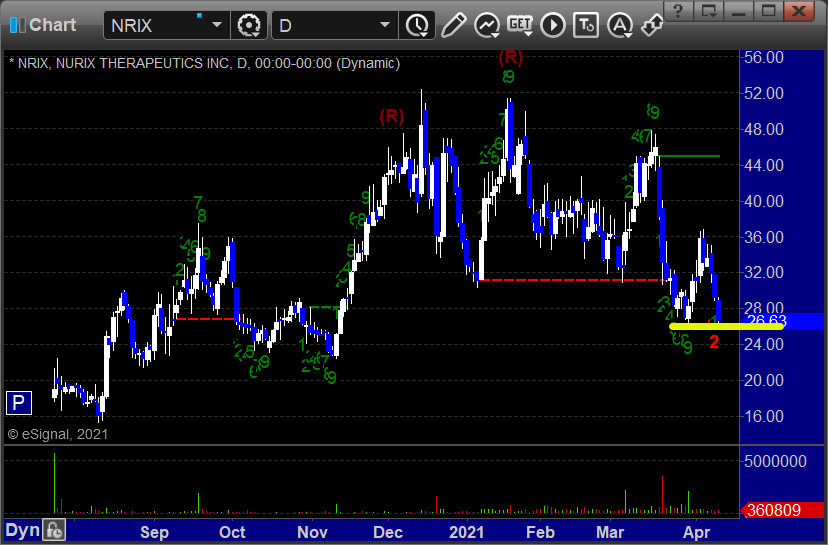

Shorts next, NRIX < 25.96:

Tradesight Recap Report for 4/13/21

Overview

The markets opened flat (NASDAQ gapped up) and didn't do much early, rose in the afternoon, and we did well on 4.2 billion NASDAQ shares.

Futures:

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: -3 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

From the report, ADBE triggered long (without market support due to opening 5 minutes) and worked big:

From the Twitter feed, Rich's OSTK triggered long (with market support) and worked:

NVDA triggered long (with market support) and worked a bit, the day ended:

Rich's AAPL triggered long (without market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Plus Report for 4-13-21

Not much new in the scans after the markets did nothing on Monday, but we do have a couple at least.

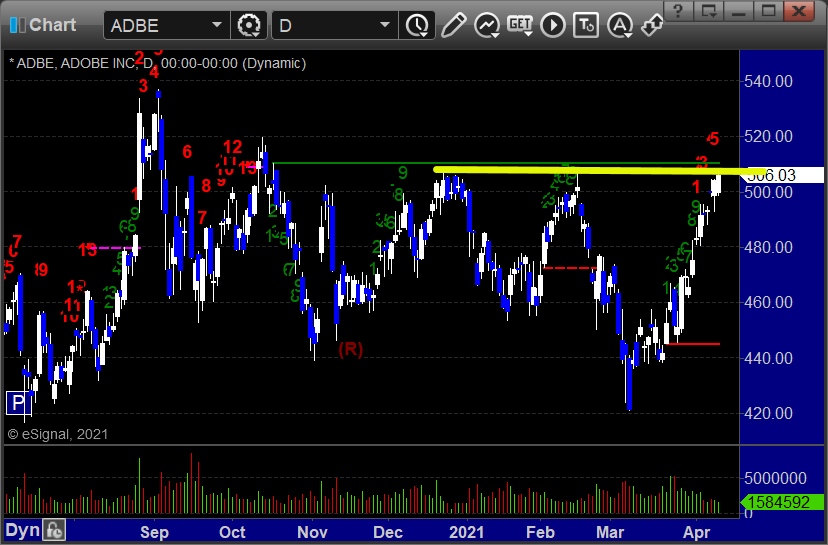

Longs first, in order of best chart construction, starting with ADBE > 506.92:

SSNC > 74.29:

And one short, NRIX < 25.96:

Tradesight Recap Report for 4/12/21

Overview

The markets gapped down a very little and did nothing all day, S&P literally closed down less than a point, on 4.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked, triggered short at B and worked:

NQ Opening Range Play:

Results: +14 ticks

Forex:

GBPUSD triggered long at A and stopped under entry at B:

Results: +10 pips

Stocks:

Nothing actually triggered. Such a bad day again. Wow.

That’s 0 triggers with market support.