Tradesight Plus Report for 3-22-21

Not much in the scans. Let's see how it goes.

No longs.

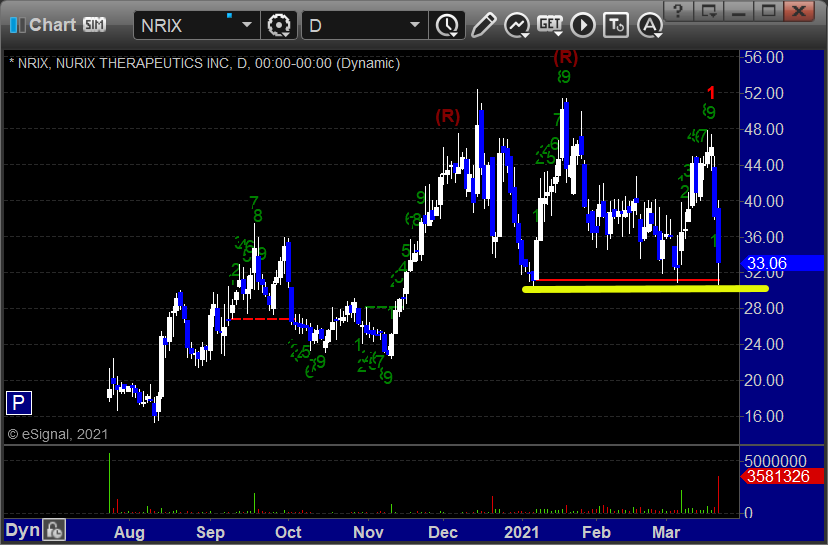

Shorts only, just one, NRIX < 30.25:

Tradesight Recap Report for 3/19/21

Overview

The markets gapped down and sent a bit lower but they recovered and closed right where they opened, which is the usual for triple expiration on 7.6 billion NASDAQ shares, which, the extra volume is just expiration volume.

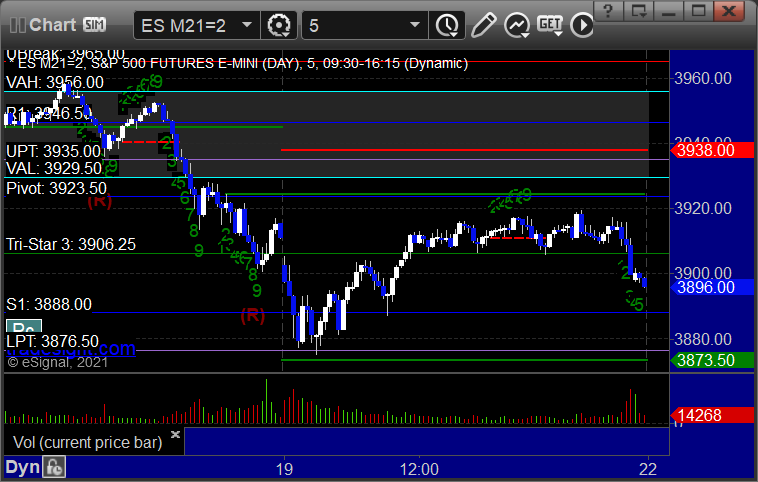

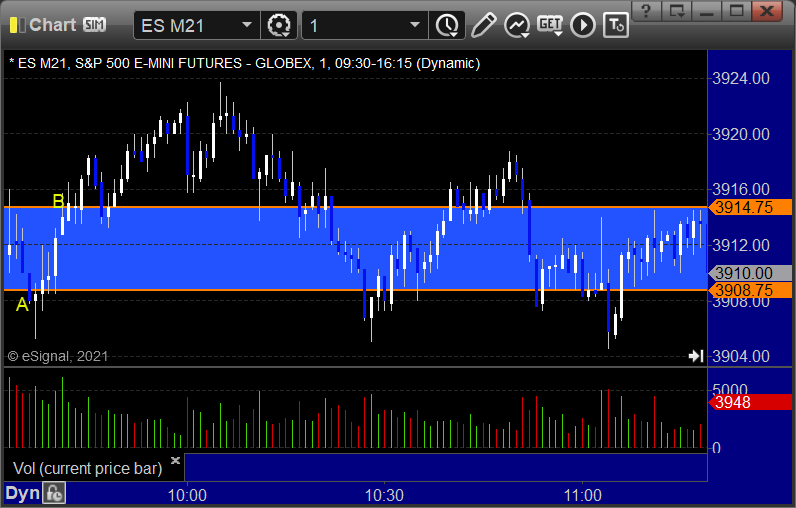

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial:

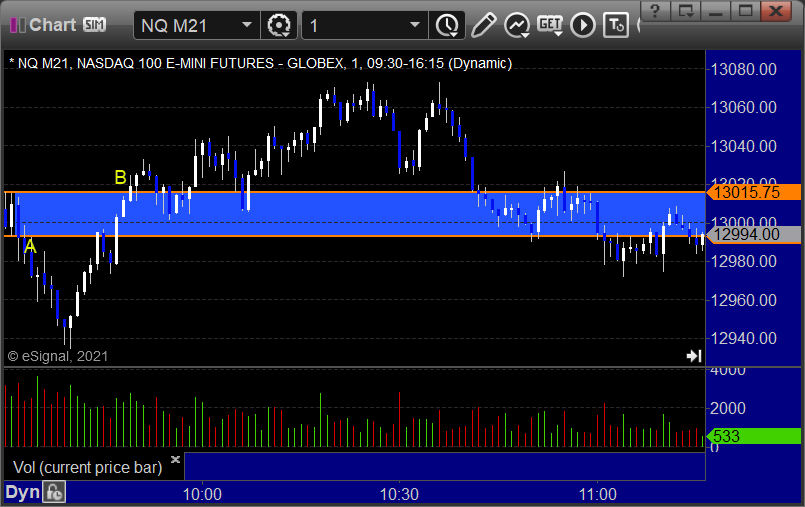

NQ Opening Range Play triggered long at A and short at B, both too far out of range to take:

Results: +4 ticks

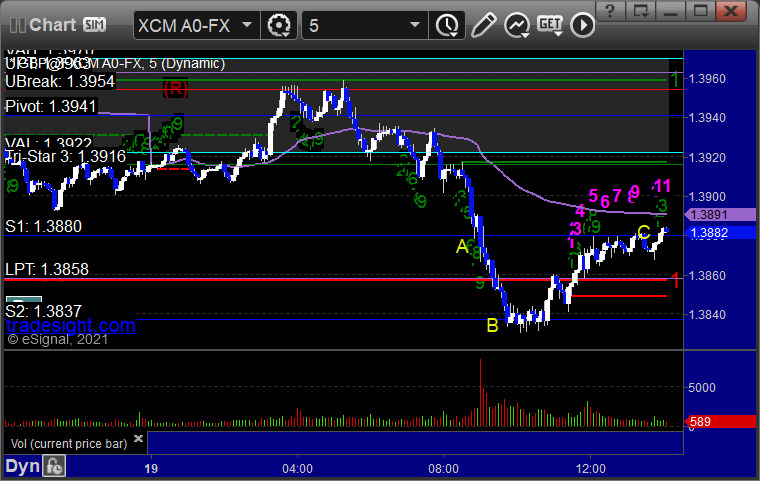

Forex:

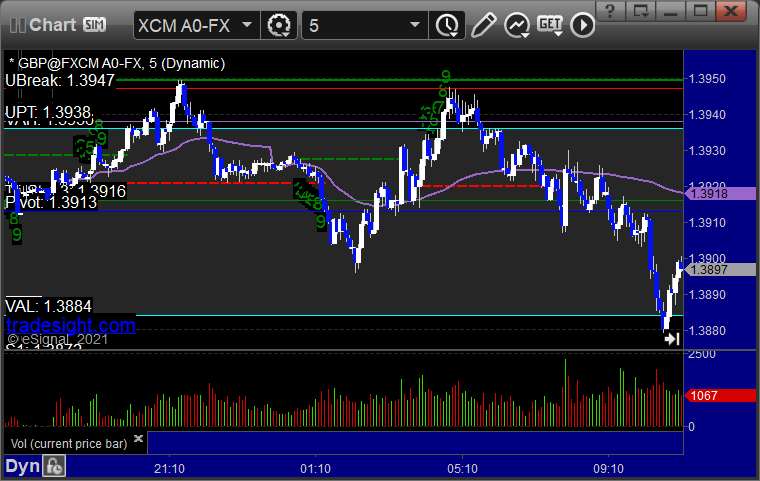

GBPUSD triggered short at A, hit first target at B, closed second half over entry at C:

Results: +20 pips

Stocks:

Triple expiration Friday, not exciting as expected.

No triggers from the report.

From the Twitter feed, several calls, but just one trigger on triple expiration Friday (common).

Rich's FB triggered long (without market support) and worked:

That's 0 trades with market support.

That's 0 trades with market support.

Tradesight Recap Report for 3/18/21

Overview

The markets gapped down, went flat for two hours, tried to rally heading into lunch, topped out, then sold off a bit in the afternoon on 5.6 billion NASDAQ shares.

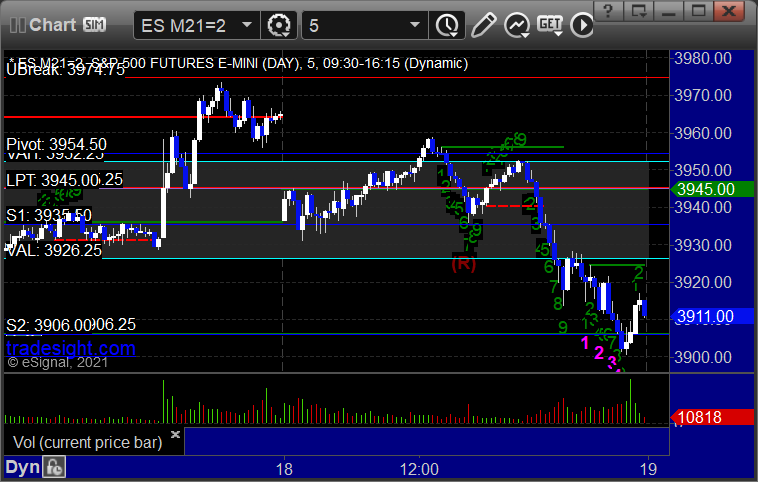

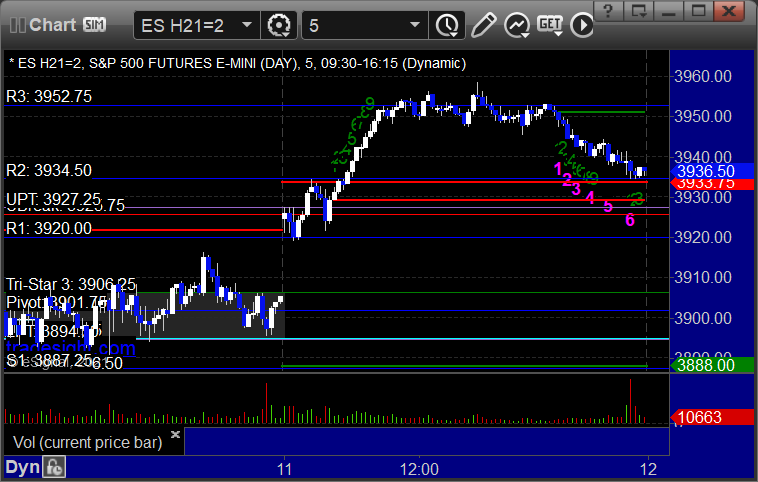

ES with Levels:

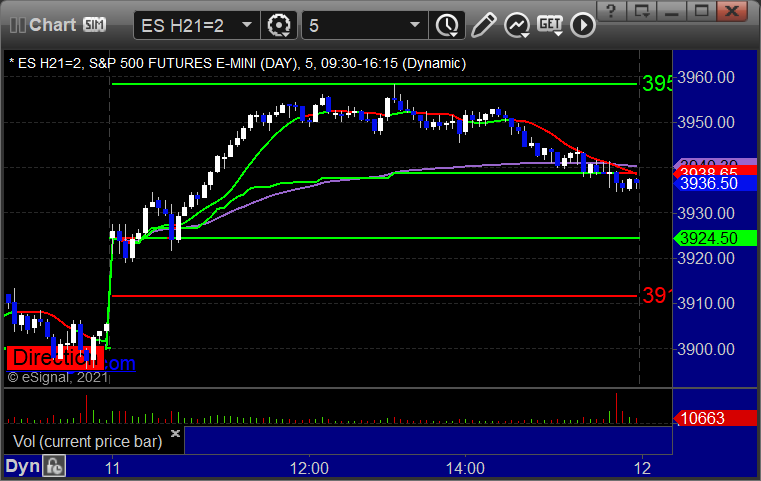

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and worked enough for a partial:

NQ Opening Range Play triggered long at A and short at B, but both too far out of range to take:

Results: +8 ticks

Forex:

No calls, and they would have been a loss either way, so safe play as we head into triple expiration.

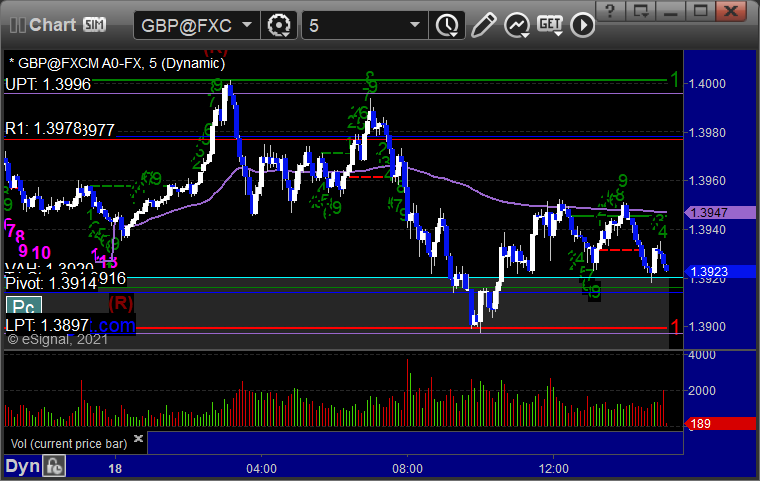

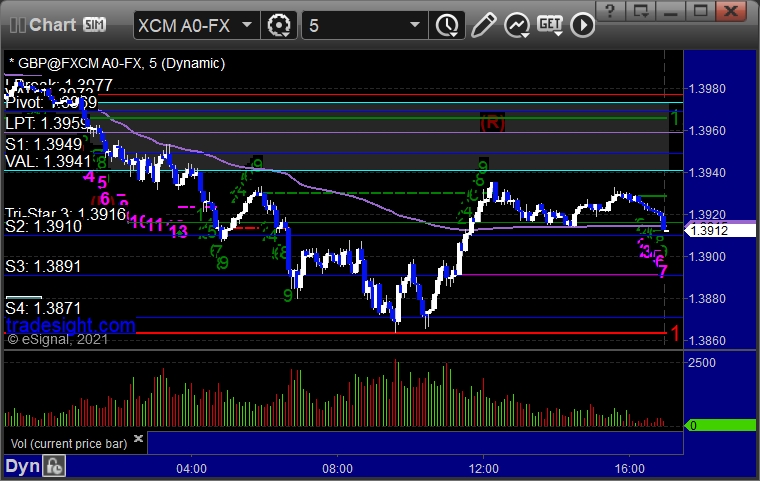

GBPUSD:

Results: +0 pips

Stocks:

From the report, TAOP triggered long (without market support due to opening 5 minutes) and worked:

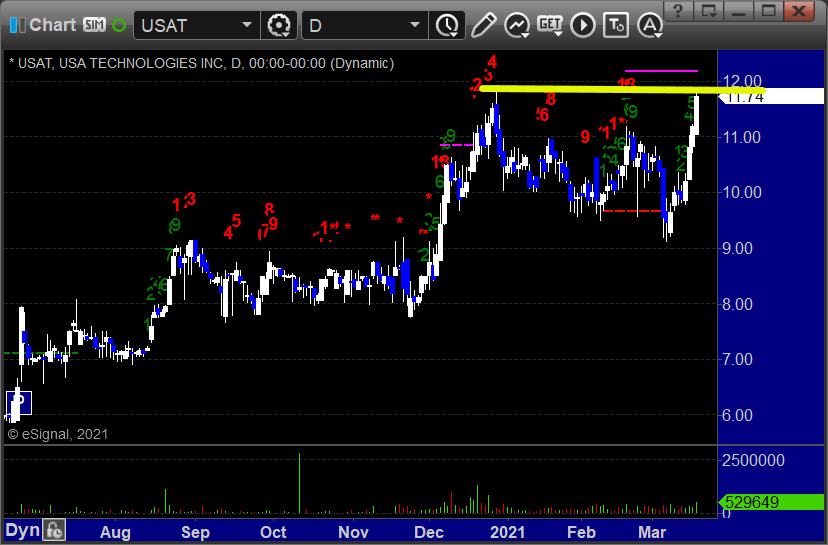

USAT triggered long (with market support) and worked:

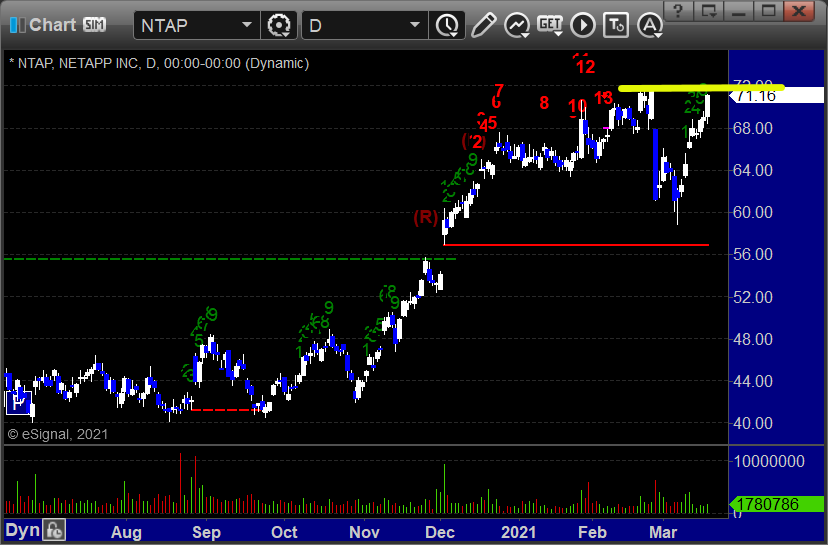

NTAP triggered long (with market support) and didn't work:

From the Twitter Feed,

Rich's PLUG triggered long (without market support due to opening 5 minutes) and didn't work:

His SOXL triggered long (with market support) and didn't work:

KSS triggered long (with market support) and worked great:

GILD had a Comber 13 sell signal on the 15 minute chart and a Seeker 13 sell signal on the 30 minute chart at the same time at A and worked:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Plus Report for 3-18-21

So with the Fed behind us, options unraveling potentially still ahead of us, and triple expiration (waste of time) Friday, let's get something going for Thursday.

Longs only, in order of chart construction.

TAOP > 14.48:

USAT > 11.85:

NTAP > 71.68:

No shorts found.

Tradesight Recap Report for 3/17/21

Overview

The markets gapped down and sat all day until the Fed announcement, and then everything popped up to fill the gaps and more, with the S&P closing around even after all of that. Was that options unraveling? No way to know. NASDAQ volume was 5 billion shares at the close, so down a bit.

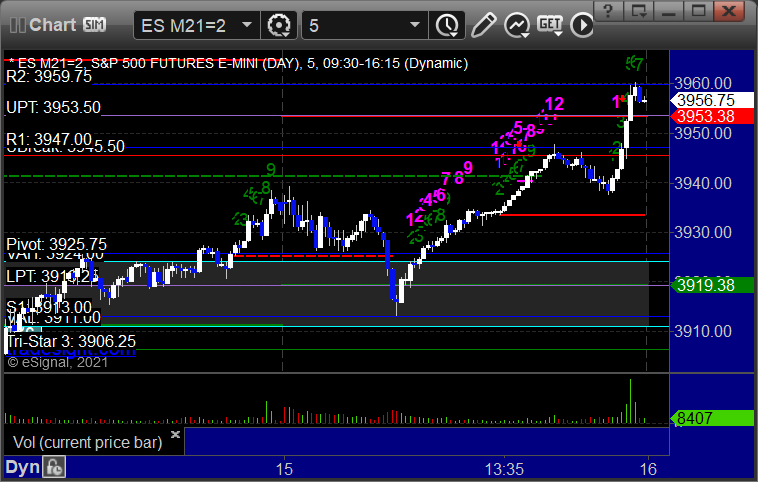

ES with Levels:

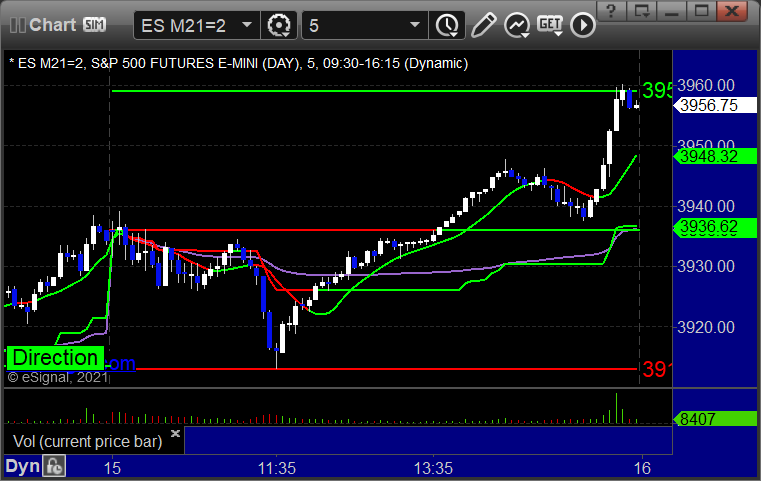

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked, triggered long at B and worked:

NQ Opening Range Play triggered short at A and long at B, both worked, but both just slightly too far out of range to take:

Results: +11.5 ticks

Forex:

GBPUSD triggered short at A, closed for about 10 pips ahead of the Fed announcement at B, which was a smart move:

Results: +5 pips

Stocks:

No calls in the report for the Fed meeting.

From the Twitter feed, Rich's CRWD triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

AMGN triggered long (with market support) and worked great:

Rich's X triggered long (without market support) and didn't work:

His BABA triggered long (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 3/16/21

Overview

The markets gapped down and didn't do much all day on 5.1 billion NASDAQ shares as we wait for the Fed announcement on Wednesday.

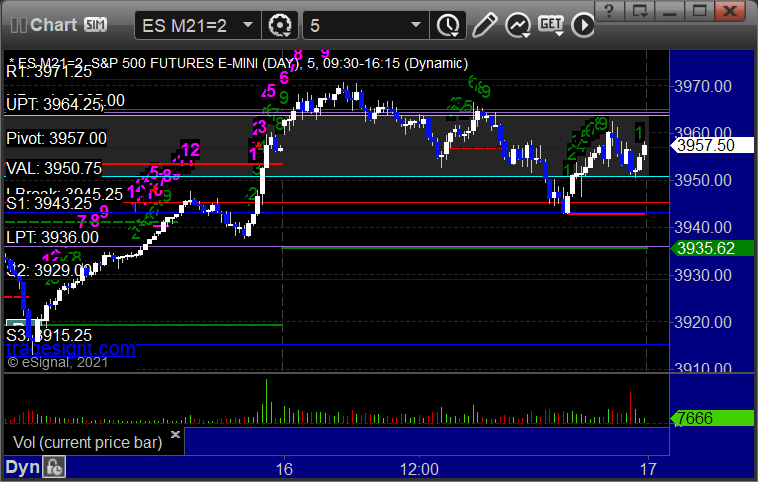

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +6 ticks

Forex:

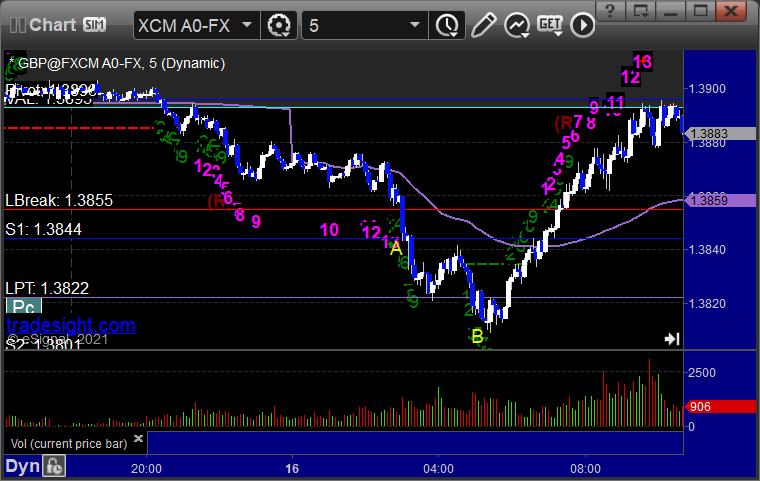

GBPUSD triggered short at A, hit first target at B, stopped second half over entry:

Results: +15 pips

Stocks:

Not too much to do with the markets focused on the Fed meeting tomorrow.

Rich's FB triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 3/15/21

Overview

The markets opened flat, went lower, came back, and rallied in the afternoon on 5.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and stopped under the midpoint:

NQ Opening Range Play:

Results: -4 ticks

Forex:

GBPUSD, nothing triggered for the session:

Results: +0 pips

Stocks:

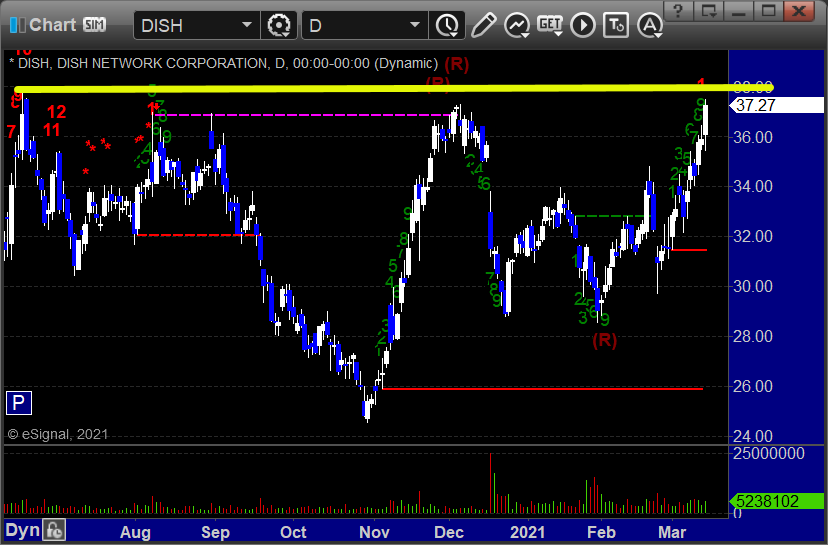

From the report, DISH triggered long (with market support) and worked:

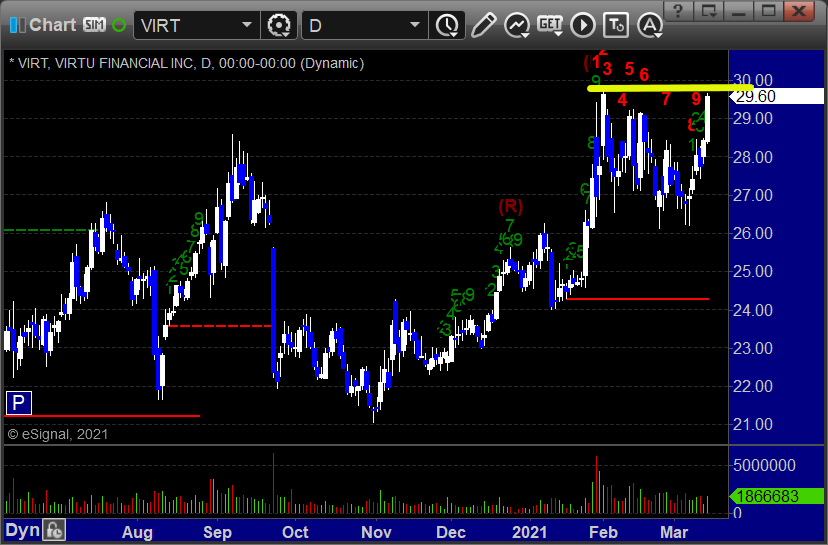

VIRT gapped over, no play.

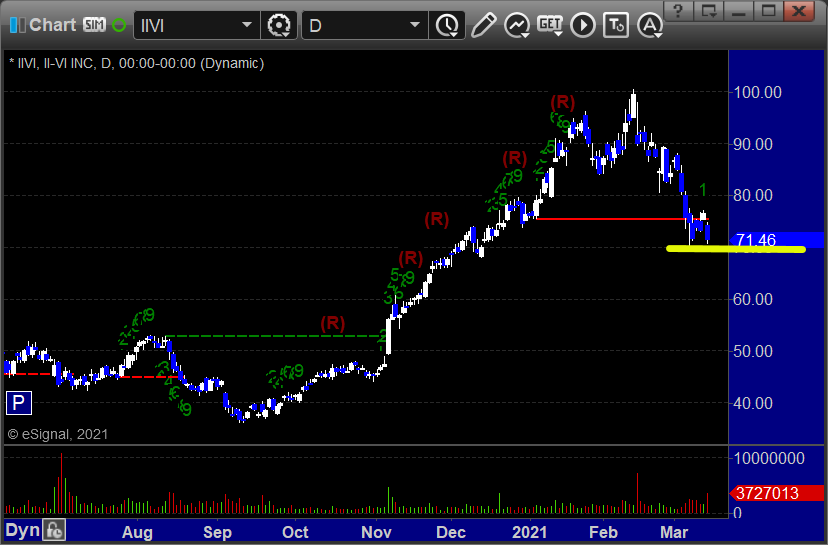

IIVI triggered short (with market support) and didn't work:

From the Twitter feed, Rich's GS triggered short (with market support) and worked:

His FAS triggered short (ETF, so no market support needed) and worked:

His KRE triggered short (with market support) and worked:

That’s 5 triggers with market support, 4 of them worked and 1 didn’t.

Tradesight Plus Report for 3-15-21

Opening comments for the week are posted to YouTube. Triple expiration week. Let's do it.

Long ideas, starting with DISH > 37.89, long base breakout:

VIRT > 29.76, high-range base breakout:

IIVI < 6964, short base breakdown:

Tradesight Recap Report for 3/12/21

Overview

For the second half of quarterly contract roll, the markets gapped down, went lower, came back, and closed about where they opened, which is normal for the wasted quarterly Friday on 5.4 billion NASDAQ shares.

ES June contract with March contract levels:

ES with market directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked enough for a partial:

NQ Opening Range Play triggered short at A and long at B, both too far out of range to take:

Results: +8 ticks

Forex:

GBPUSD, no calls, locked in a gain from the prior session:

Results: +20 pips

Stocks:

From the report, EVOP triggered long (with market support) at a non-ideal time and worked:

From the Twitter feed, Rich's MU triggered short (with market support) and didn't work:

ADBE triggered long (with market support) and didn't work:

Rich's FDX triggered long (with market support) and didn't work:

That’s 4 triggers with market support, 1 of them worked and 3 didn’t. Welcome to futures contract roll.

Tradesight Recap Report for 3/11/21

Overview

The markets gapped up and went higher, flattened out over lunch, and then just drifted back down in the afternoon on 4.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take, triggered short at B and worked enough for a partial:

NQ Opening Range Play:

Results: +4 ticks

Forex:

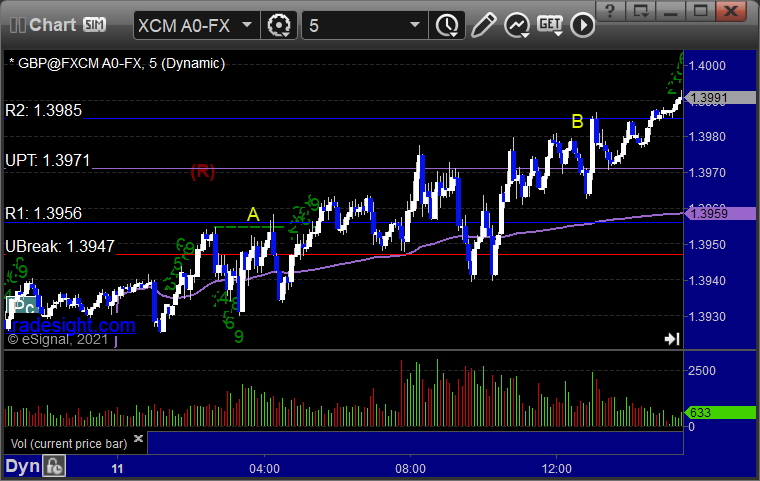

GBPUSD triggered long at A, hit first target at B, still holding second half with a stop under R1:

Results: Trade not yet complete

Stocks:

From the report, no triggers.

From the Twitter feed, COST triggered long (with market support) and didn't work:

Rich's AVGO triggered short (with market support) and worked enough for a partial:

His PENN triggered long (with market support) and worked:

That’s 3 triggers with market support, 2 of them worked and 1 didn’t.