Tradesight Plus Report for 3-10-21

Opening comments for the rest of the week are posted to YouTube. Keep in mind that we are at quarterly futures contract roll, so expectations are low for Thursday and DEFINITELY for Friday.

No shorts founds.

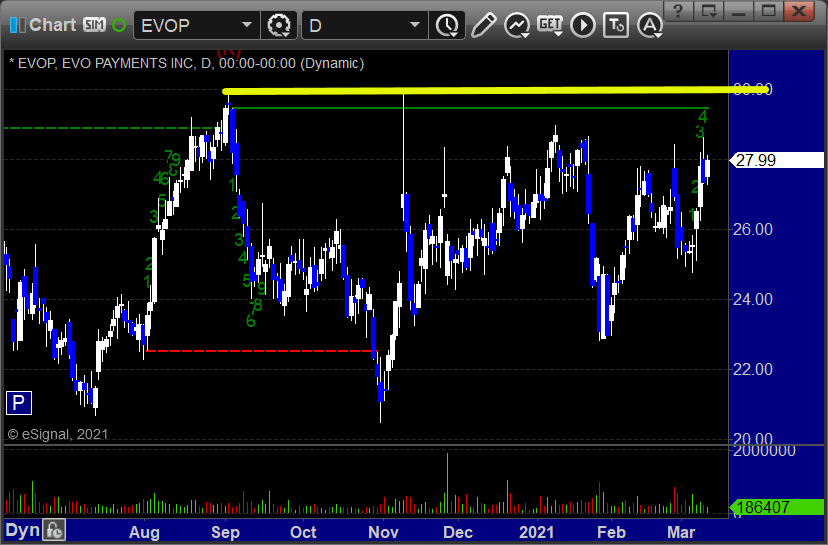

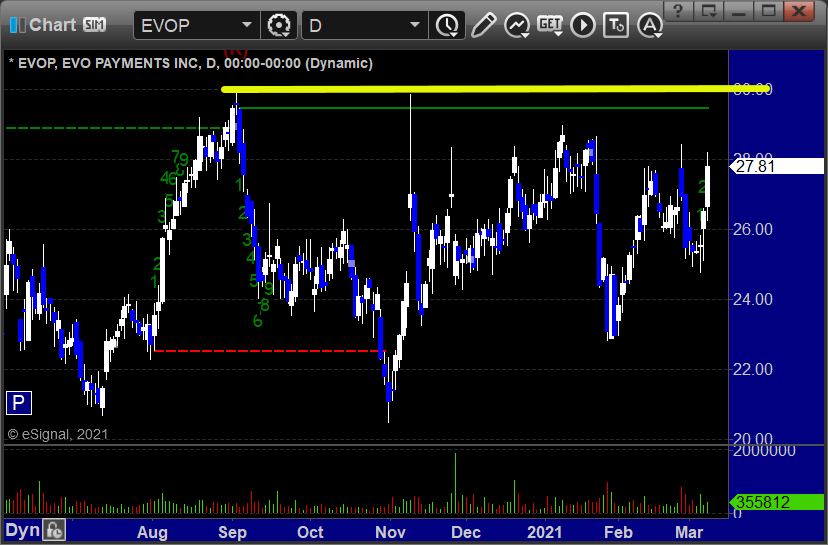

Longs first, in order of best chart construction, starting with EVOP > 30.00:

AVDL > 9.37:

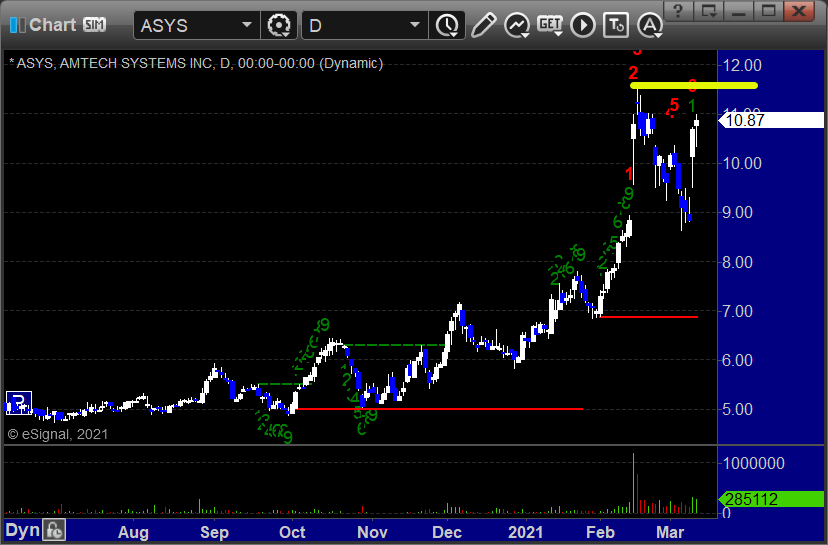

ASYS > 11.50:

Tradesight Recap Report for 3/10/21

Overview

The markets gapped up, pulled back a bit, and then it was not a great day on 6 billion NASDAQ shares.

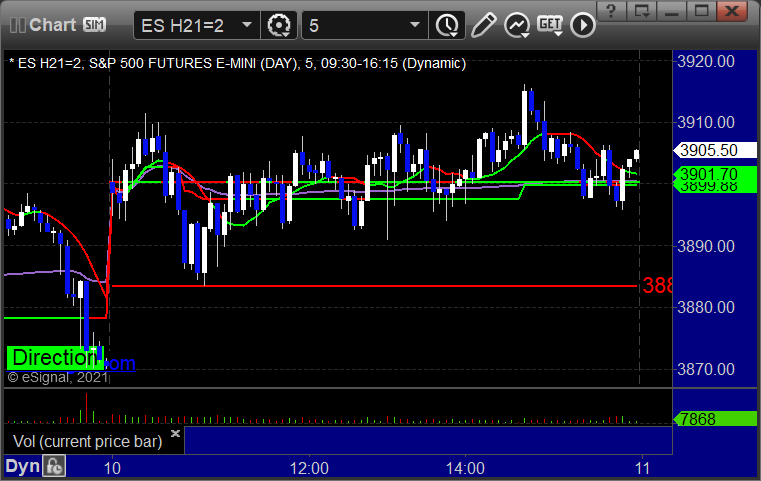

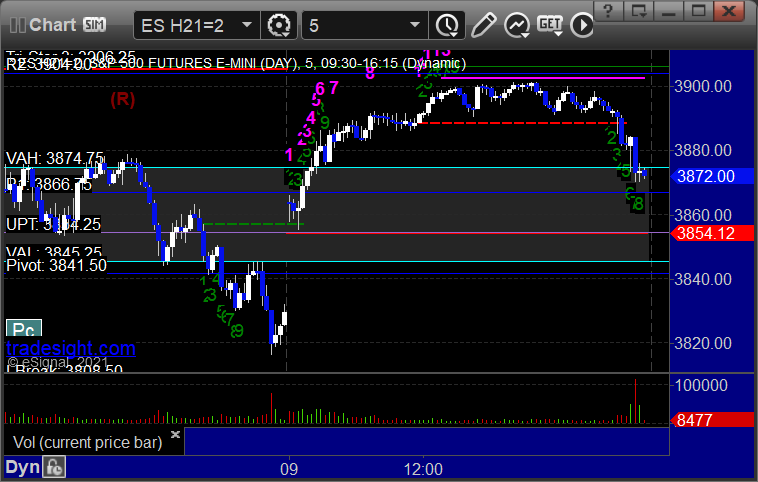

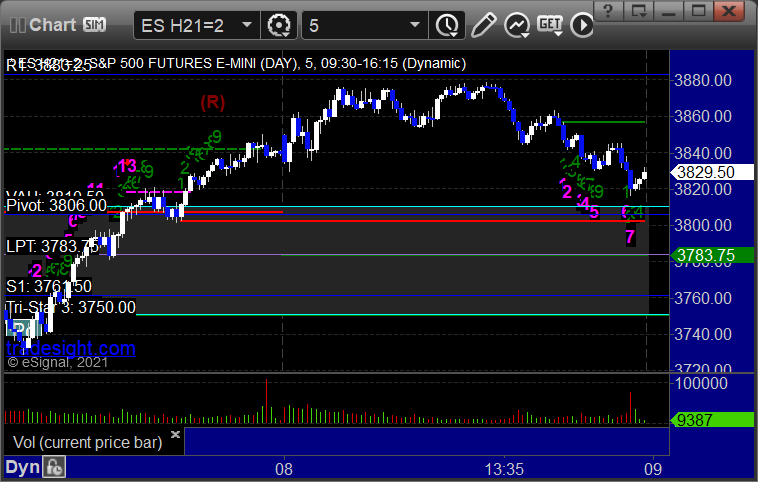

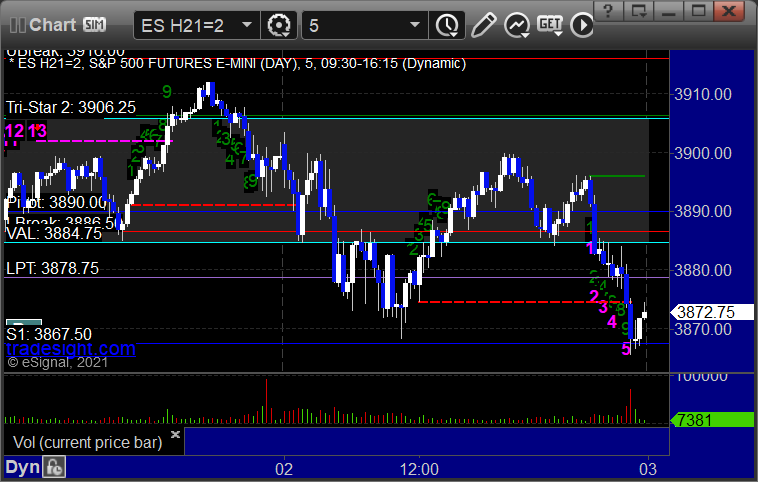

ES with Levels:

ES with market directional, a very flat day:

Futures:

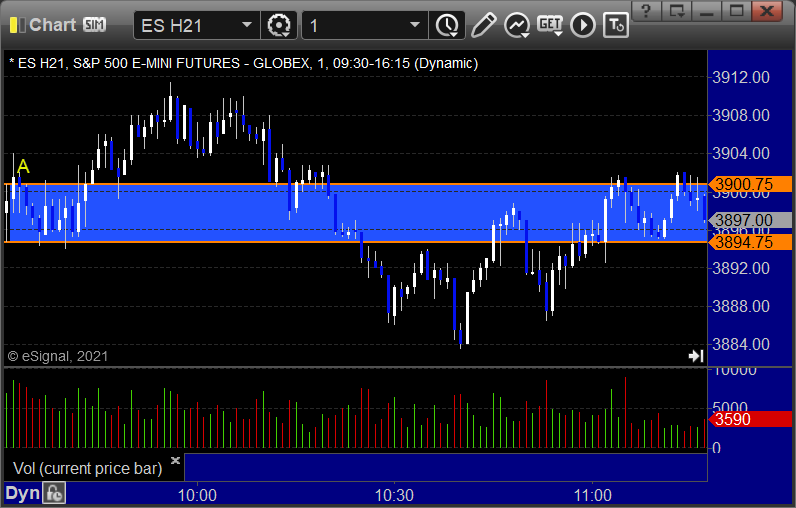

ES Opening Range Play triggered long at A and stopped under the midpoint:

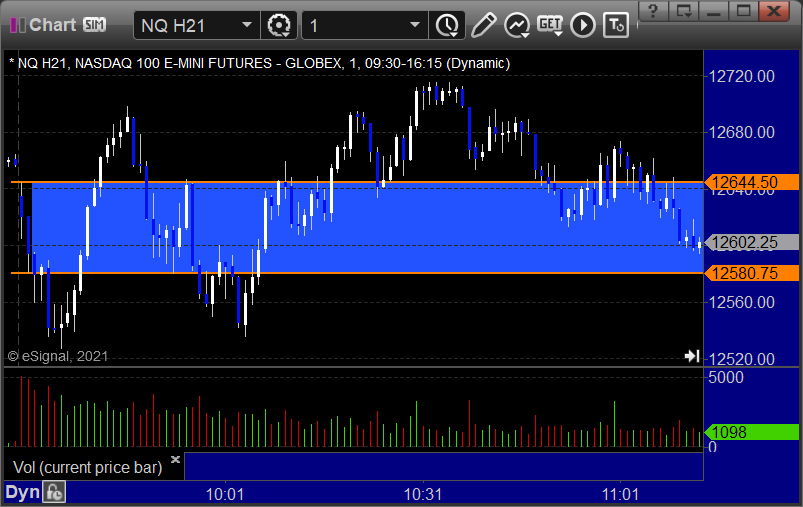

NQ Opening Range Play triggered short at A but too far out of range to take:

We called NQ short under A with a partial for 10 points and a final exit for 41.5 points:

Results: +37.5 ticks

Forex:

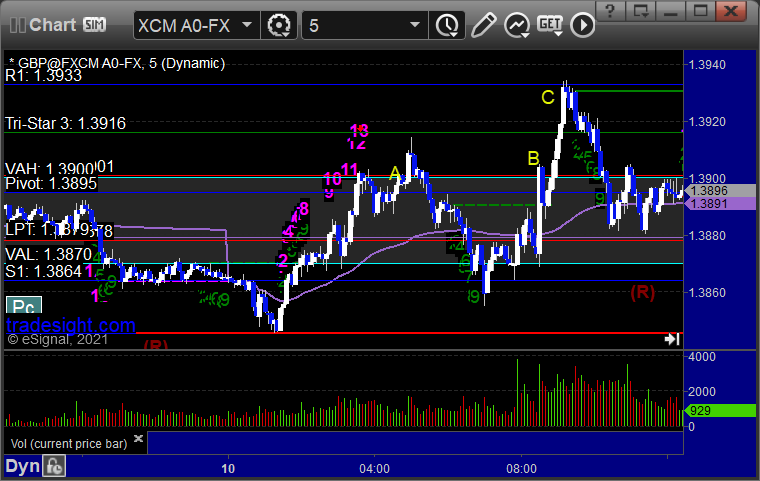

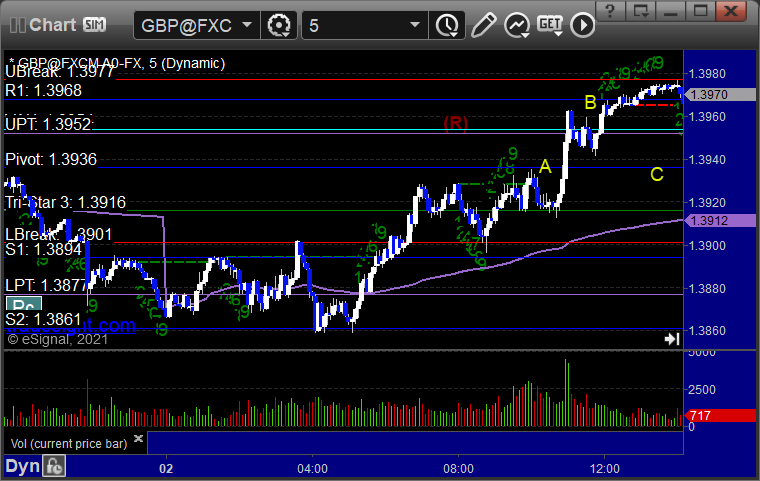

GBPUSD triggered long at A and stopped, triggered long again at B, hit first target at C, stopped second half under the entry:

Results: -5 pips

Stocks:

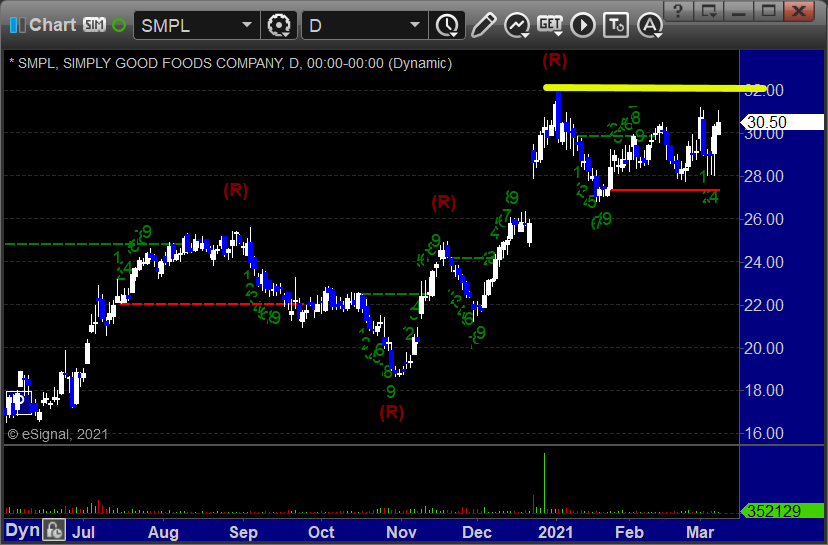

SMPL triggered in the opening 5 minutes, no play.

From the Twitter feed,

GS triggered long (with market support) and worked:

Rich's X triggered long (with market support) and didn't work:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 3/9/21

Overview

Markets gapped up HUGE, erasing most of the prior day's losses, and recovered even more on 6.6 billion NASDAQ shares by the close.

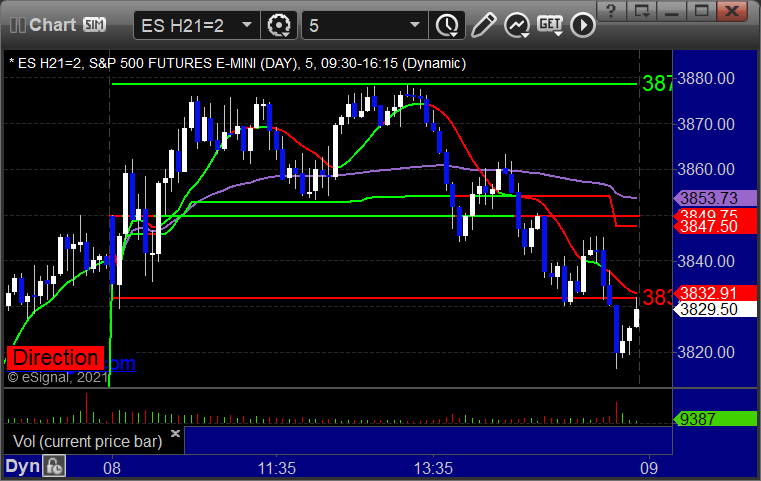

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and stopped over the midpoint, triggered long at B but too far out of range to take:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: -15 ticks

Forex:

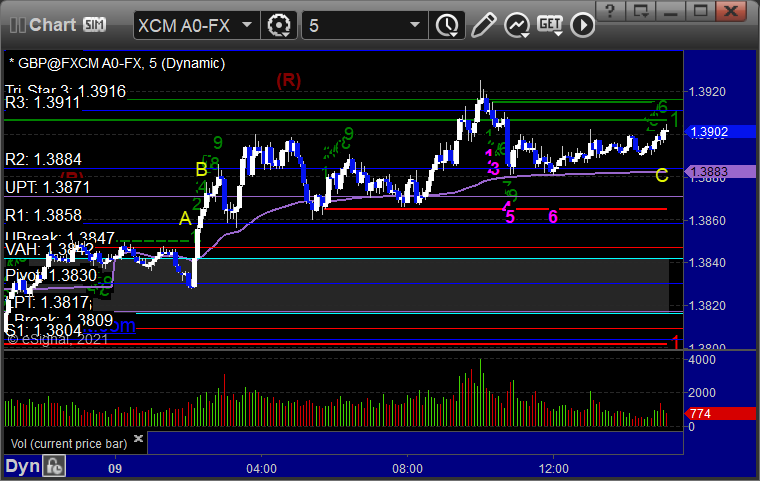

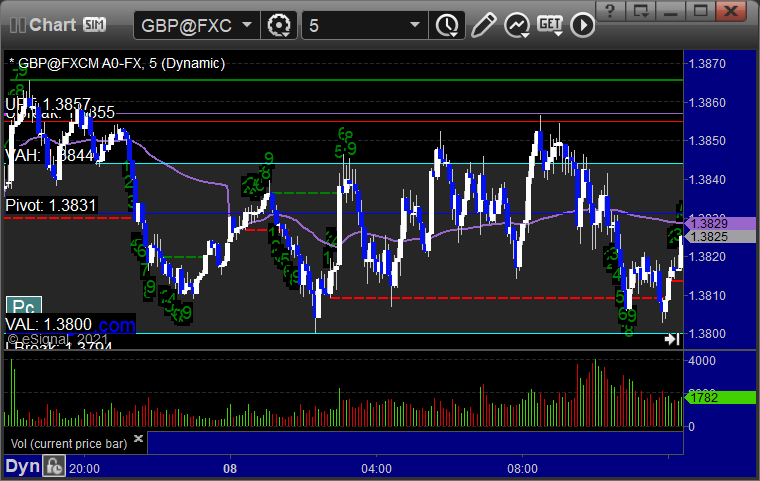

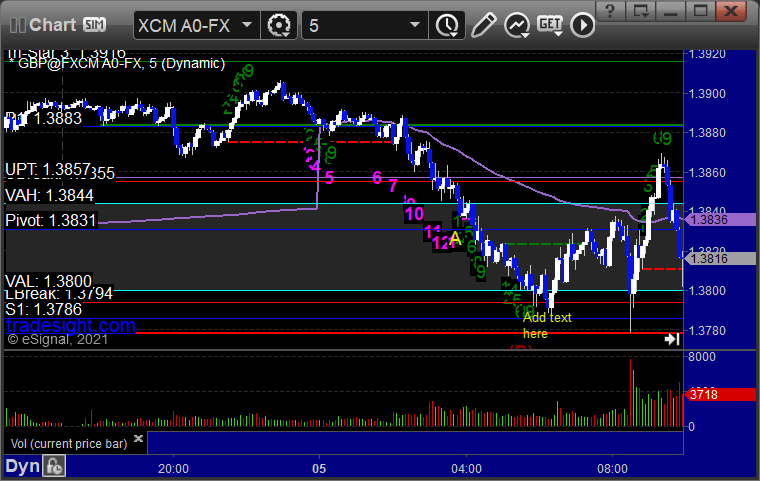

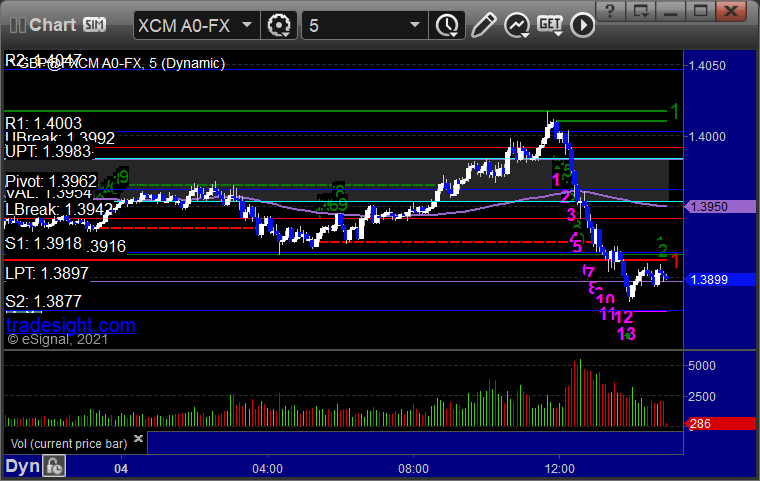

GBPUSD, triggered long at A, hit first target at B, still holding second half with a stop under R2 at C:

Results: Trade Not Yet Closed

Stocks:

Not a super exciting day.

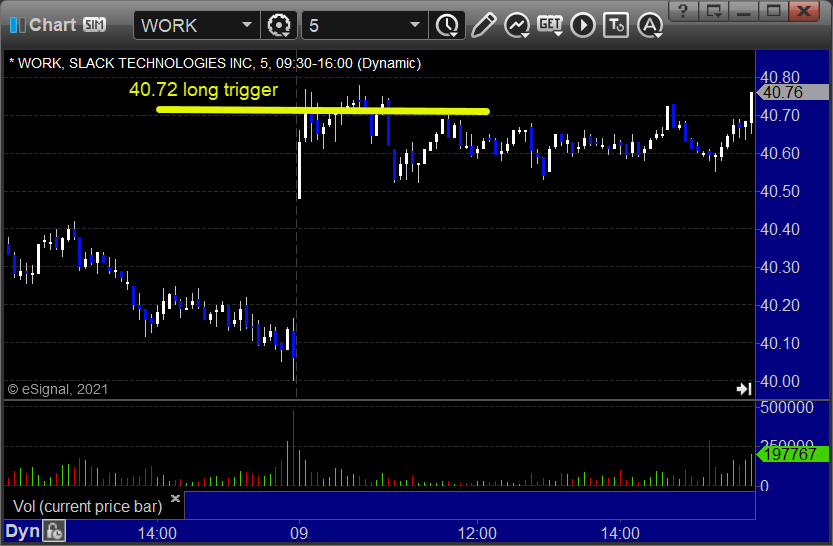

Rich's WORK triggered long (with market support) and didn't do anything either way, closed even:

His AAPL triggered long (with market support) and worked:

His QCOM triggered long (with market support) and worked:

That’s 3 triggers with market support, 2 of them worked and 1 did nothing either way.

Tradesight Plus Report for 3-9-21

Opening comments posted to YouTube. Two new longs is all I found.

EVOP > 30.00:

SMPL > 32.03:

Tradesight Recap Report for 3/8/21

Overview

The markets kind of opened flat, filled gaps early, the ES went higher and the NQs lower, and then we sold off late in the day on 6 billion NASDAQ shares.

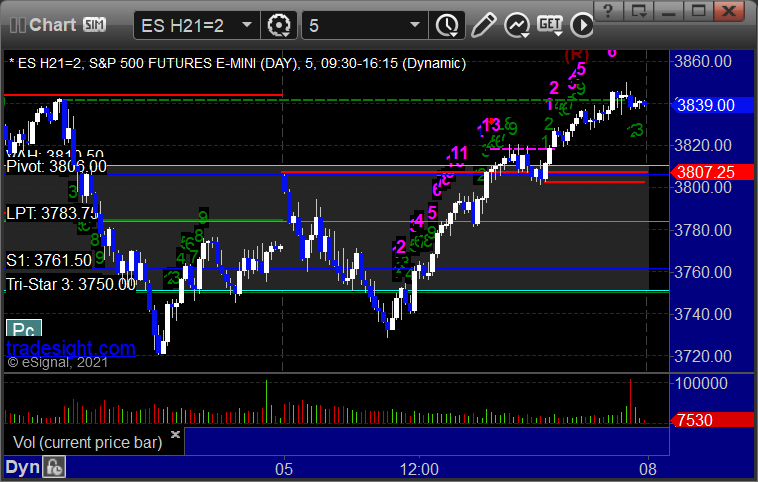

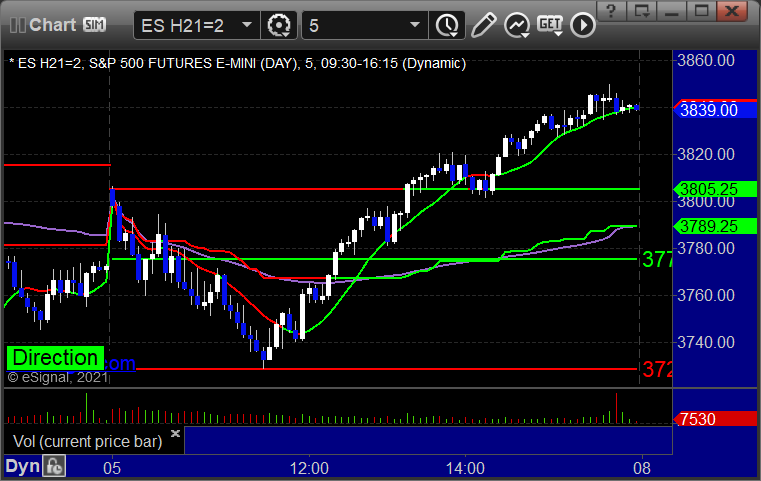

ES with Levels:

NQ with Levels (very different look):

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and you should have taken it, but under the precise rules we won't count it, triggered long at B but too far out of range to take:

NQ Opening Range Play all triggers were too far out of range to take:

Results: +0 ticks

Forex:

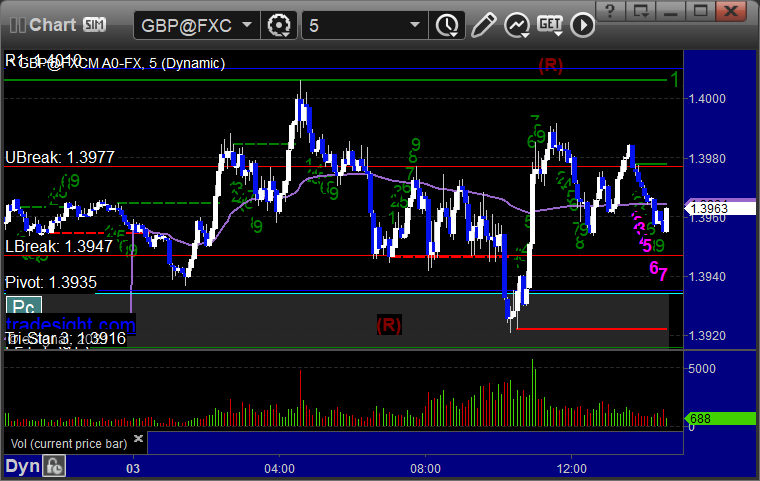

Amazingly, neither GBPUSD call triggered, so here's the chart:

Results: +0 pips

Stocks:

From the report, PVAC gapped over, no play.

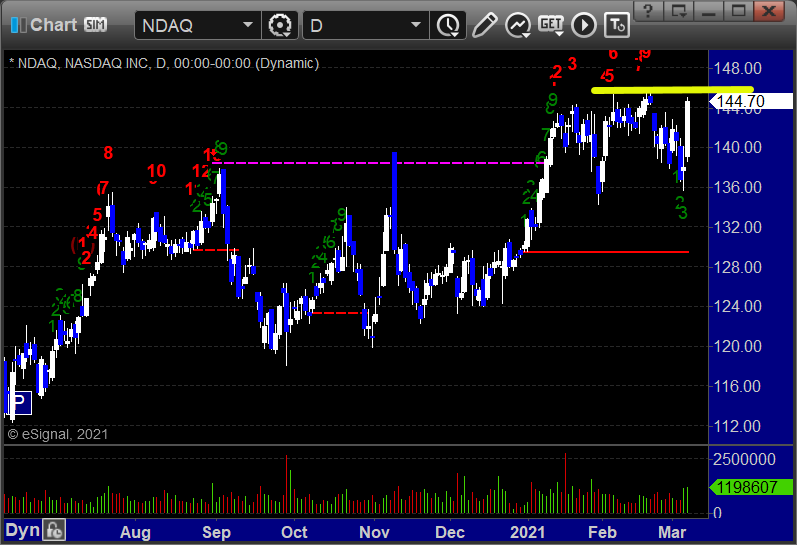

NDAQ triggered long (with market support) and worked:

CNSL triggered long (with market support) and worked:

From the Twitter feed,

BABA triggered short (with market support) and worked a little:

That’s 3 triggers with market support, all of them worked.

Tradesight Plus Report for 3-8-21

Opening comments for the wee are posted to YouTube. The main thing to remember this week is that quarterly futures contract roll is Thursday to Friday.

Longs only, starting with PVAC > 19.09:

NDAQ > 145.83:

CNSL > 6.24:

Tradesight Recap Report for 3/5/21

Overview

The markets gapped up, filled, and then went higher on 7.7 billion NASDAQ shares.

Futures:

ES Opening Range Play the trigger at A was too far out of range to take:

NQ Opening Range Play the trigger at A was too far out of range to take:

Results: +0 ticks

Forex:

GBPUSD triggered short at A, hit first target at B, stopped second half over entry:

Results: +20 pips

Stocks:

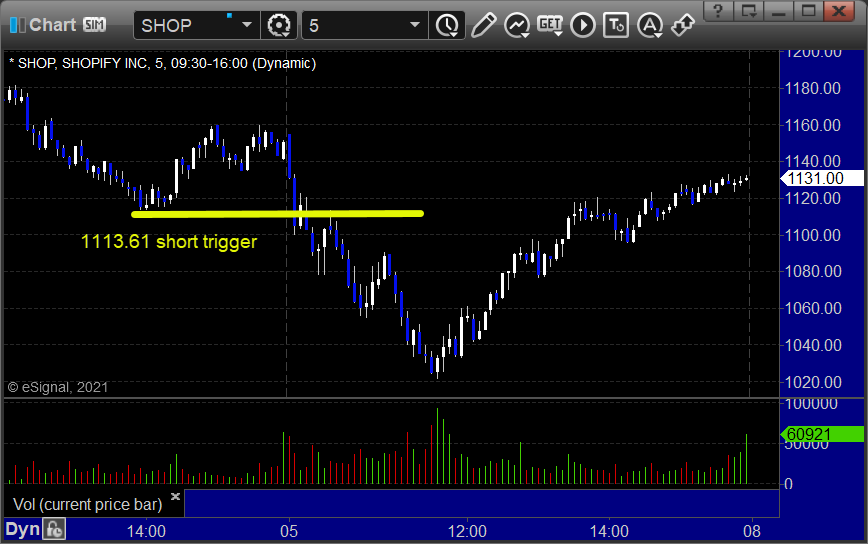

Rich's SHOP triggered short (with market support) and worked:

FSLR triggered short (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 3/4/21

Overview

The markets opened flat and didn't do much early, then sold off on 7.2 billion NASDAQ shares.

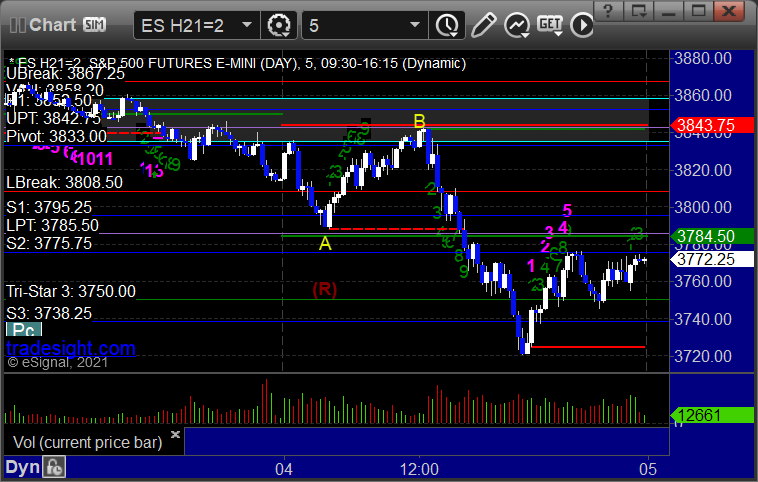

ES with Levels:

ES with Market Direction:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take, triggered short at B and worked enough for a partial:

NQ Opening Range Play both triggers were too far out of range to take:

Results: +4 ticks.

Forex:

GBPUSD, no triggers during the normal time frame:

Results: +0 pips

Stocks:

An interesting day. Nothing off the report triggered.

Rich's AAPL triggered long (with market support) and didn't work:

His XLNX triggered short (with market support) and worked:

His XONE triggered short (with market support) and didn't work:

His NFLX triggered short (with market support) and didn't work:

NTAP triggered short (with market support) and worked:

That’s 5 triggers with market support, 2 of them worked and 3 didn’t.

Tradesight Recap Report for 3/3/21

Overview

The markets gapped down slightly and proceeded lower on 5.5 billion NASDAQ shares.

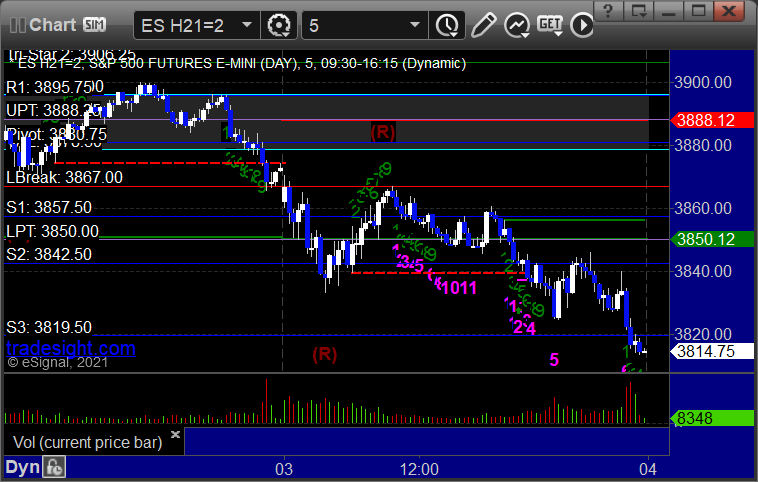

ES with Levels:

ES with market directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take, triggered short at B and worked enough for a partial:

NQ Opening Range Play triggered short too far out of range to take:

Results: +4 ticks

Forex:

No calls for the tight Levels spacing, but here's the GBPUSD:

Results: +0 pips

Stocks:

Nothing from the report triggered.

LULU triggered short (with market support) and we can maybe say it didn't work the first time on the sweep and then worked, although if you used a $3 stop, it worked:

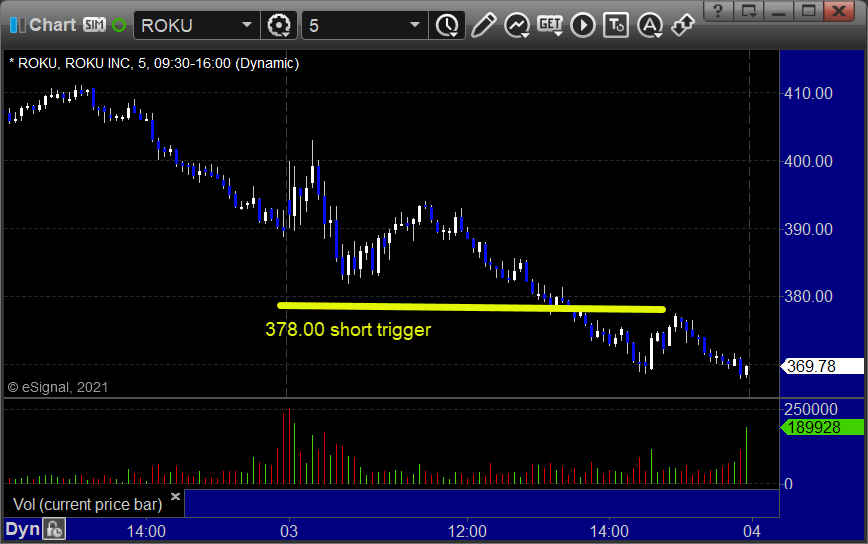

ROKU triggered short (with market support) and worked:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 3/2/21

Overview

The markets gapped down a little, drifted lower, came back, and then closed at the lows on just 4.9 billion NASDAQ shares.

ES with Levels:

ES with market direction:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +0 ticks

Forex:

GBPUSD triggered long at A, hit first target at B, still holding second half with a stop under Pivot at C:

Results: nothing yet as trade is not complete

Stocks:

From the report, APPS triggered long (without market support due to opening 5 minutes) and worked.

MIK triggered long (without market support) and worked:

COST triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

That’s 1 trigger with market support, and it worked.