Tradesight Recap Report for 2/19/21

Overview

Straight out of Module 10 from the course, a dead session for options expiration. NASDAQ volume was 6.7 billion shares. We gapped up small and stayed flat through most of the session. We were dead even until the last 15 minutes.

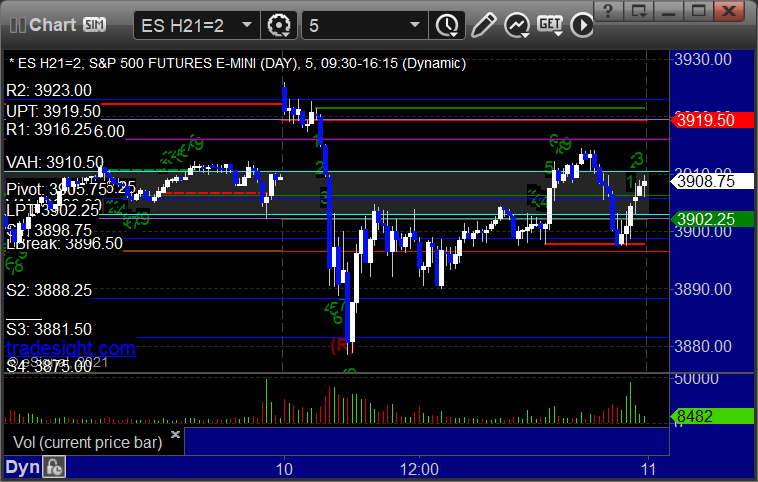

Here's the ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial:

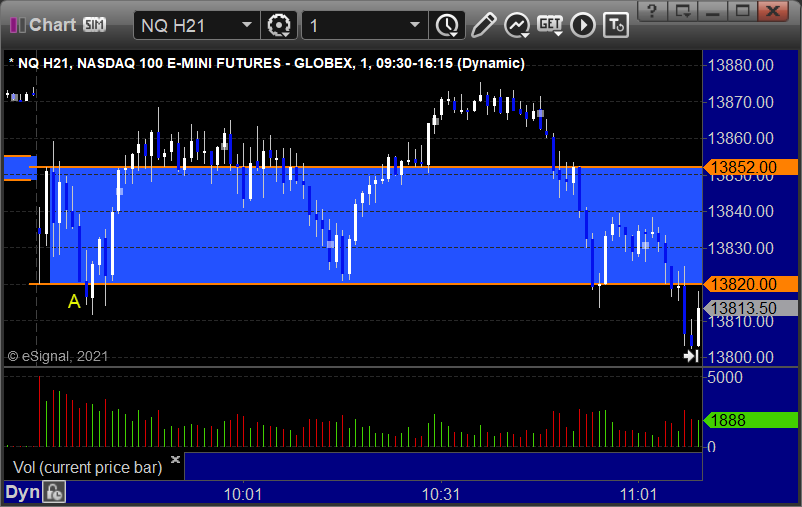

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +4 ticks

Forex:

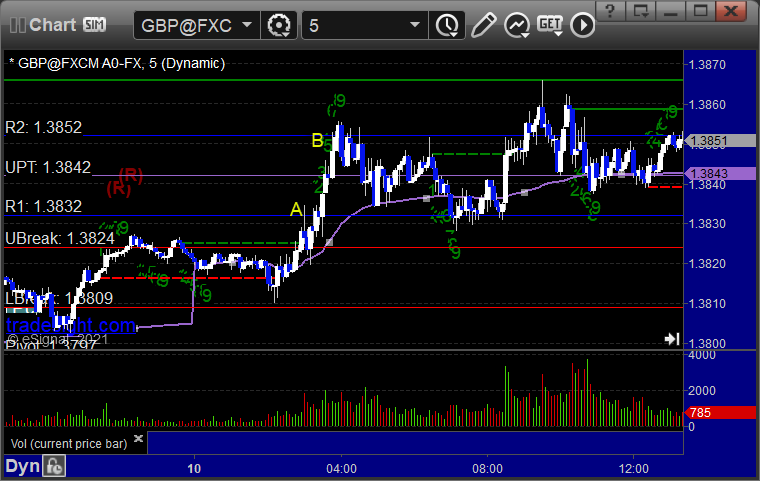

GBPUSD triggered long at A, hit first target at B, closed second half for end of week:

Results: +35 pips

Stocks:

From the report, nothing triggered.

Rich's SPOT triggered long (with market support) and didn't work:

That’s 1 trigger with market support, and it didn't work.

Tradesight Recap Report for 2/18/21

Overview

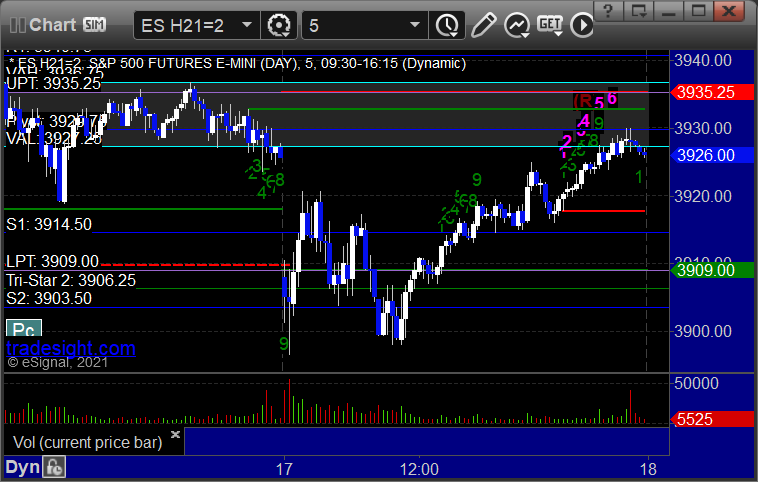

The markets gapped down, went lower, and eventually climbed up to almost fill the gap on 6.5 billion NASDAQ shares. Here's the ES with Levels:

And with market directional:

And with market directional:

Futures:

Futures:

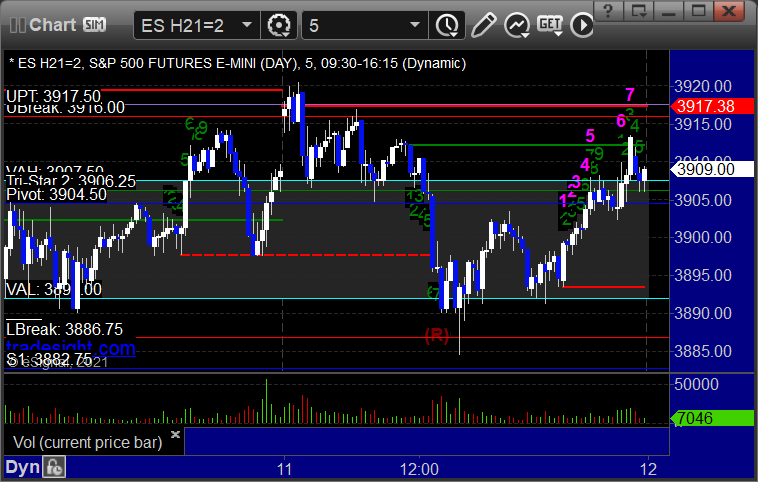

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and stopped over the midpoint:

NQ Opening Range Play triggered long at A and short at B, both too far out of range to take:

Results: -12 ticks

Forex:

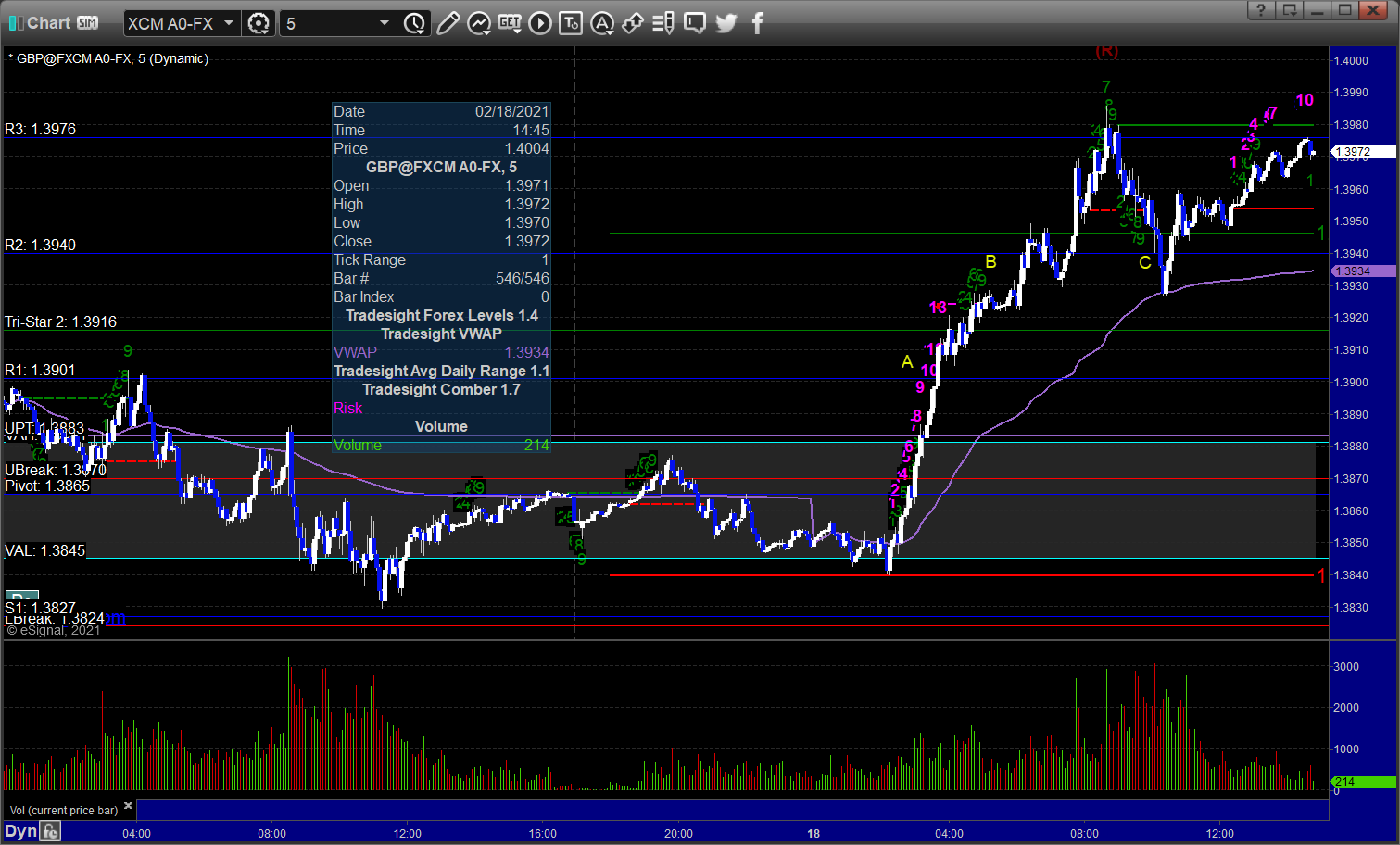

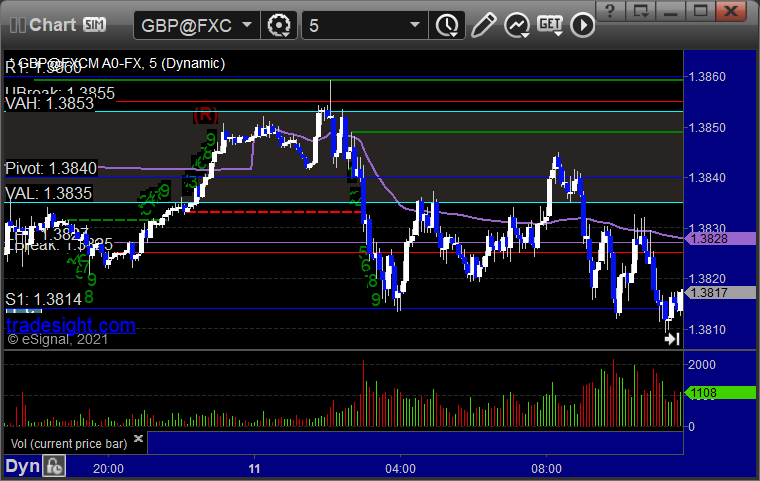

GBPUSD triggered long at A, hit first target at B, stopped second half under the R2 at C:

Results: +35 pips

Stocks:

From the report, HST triggered long (with market support) and worked:

From the Twitter feed, Rich's V triggered long (with market support) and didn't work, worked later if you took the retrigger:

His WDC triggered long (with market support) and worked:

His WFC triggered long (with market support) and worked:

His PXD triggered short (with market support) and worked:

ADBE triggered short (without market support) and didn't work, shouldn't have been taken anyway due to the spike:

Rich's AMZN triggered long (with market support) and worked:

That’s 6 triggers with market support, 5 of them worked and 1 didn’t.

Tradesight Recap Report for 2/17/21

Overview

The markets gapped down and didn't do much early, probably more negative than positive, but then things came back and the S&P closed -1 on 7.2 billion NASDAQ shares.

ES with Levels:

ES with Market Direction:

Futures:

ES Opening Range Play triggered long at A and worked, triggered short at B and worked:

NQ Opening Range Play:

Results: +26 ticks

Forex:

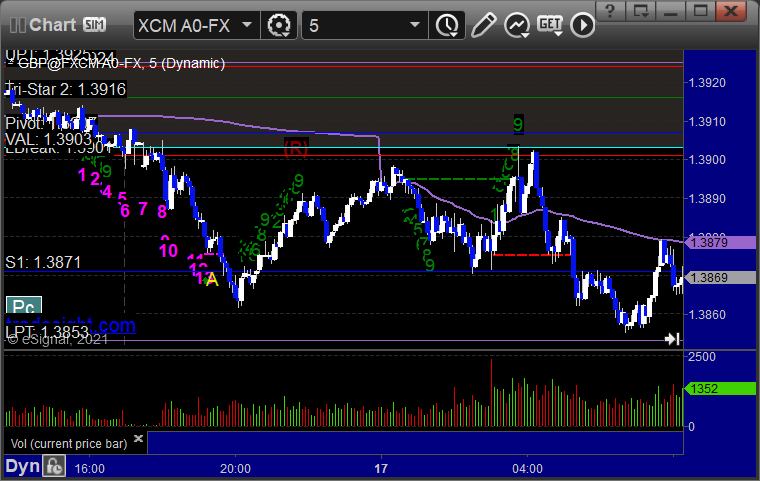

Not much action. GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Rich's PTON triggered short (without market support due to opening 5 minutes) and worked:

His ZM triggered short (without market support due to opening 5 minutes) and worked:

His BIDU triggered short (without market support due to opening 5 minutes) and worked:

PYPL triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Plus Report for 2-18-21

Two flat closes in a row doesn't typically lead to a bunch of new ideas in the scans, so I just have three long ideas.

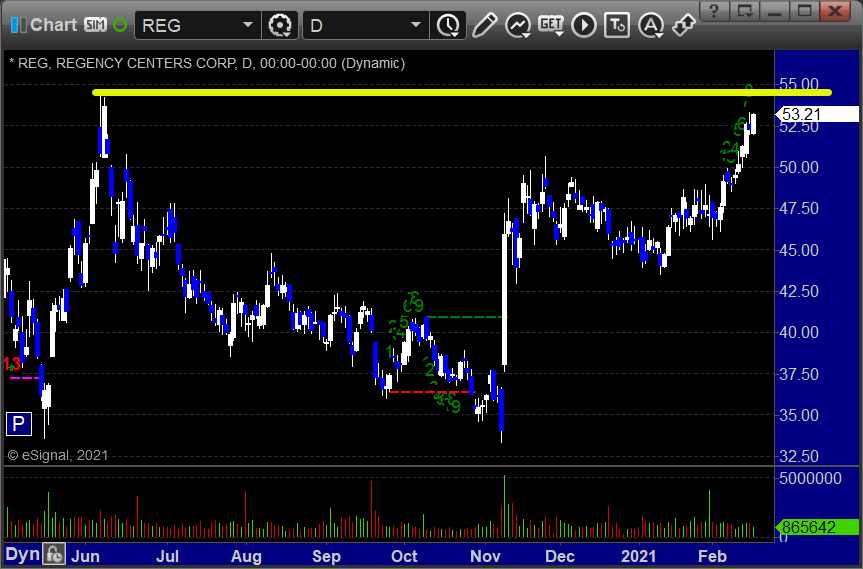

In order of best construction, starting with REG > 54.57:

ZVO > 7.34:

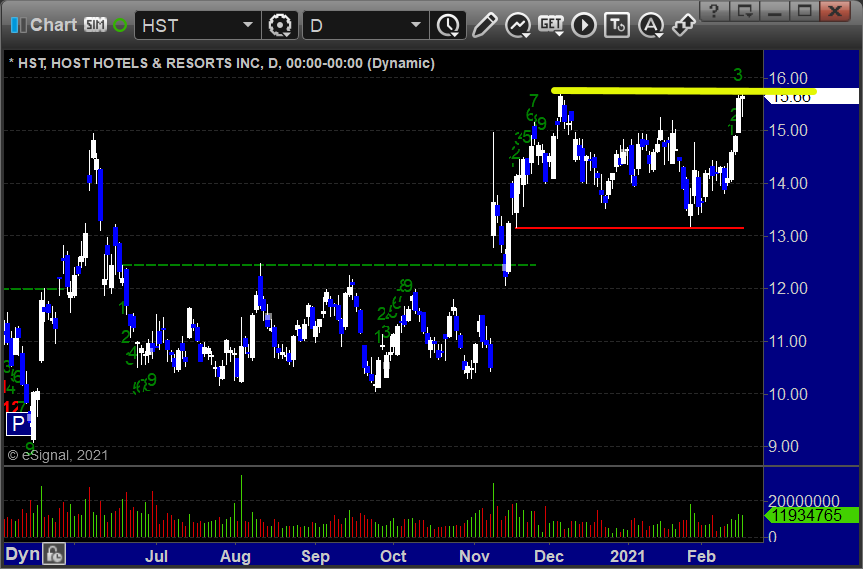

HST > 15.74:

Tradesight Recap Report for 2/16/21

Overview

The markets gapped up, didn't do anything for over an hour, finally pulled down to fill the gap and a little more, but then came back up to even for the last 4 hours and closed with the S&P down 2 on 7.7 billion NASDAQ shares.

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered short at A but too far out of range to take under the rules:

Results: +4 ticks

Forex:

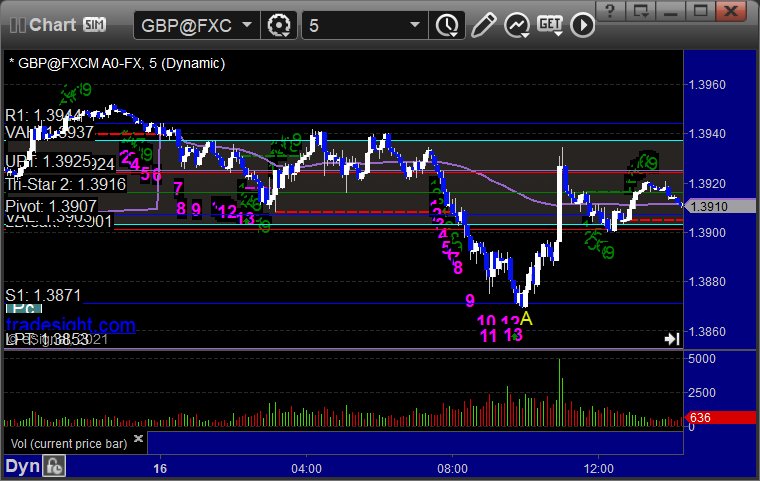

We didn't make any Forex calls for the session because the Levels were so tightly bunched from the Holiday. But, note the 13 Comber buy signal on the 5-minute GBPUSD at the lows of the main session:

Results: +0 pips

Stocks:

On the stock front, not much because it was SOOOO slow. FORM from the report gapped over, no play.

Rich's FB triggered long (with market support) and worked:

His NVDA triggered long (with market support) and worked:

That’s 2 triggers with market support, and both of them worked.

Tradesight Plus Report for 2-16-21

Ran all of my scans for the weekend. Found a few new items. Market Preview for the week is posted. Expect a slow start Tuesday after a long weekend.

Longs only, in order of best chart construction, starting with ZVO > 7.34, nice long cup breakout:

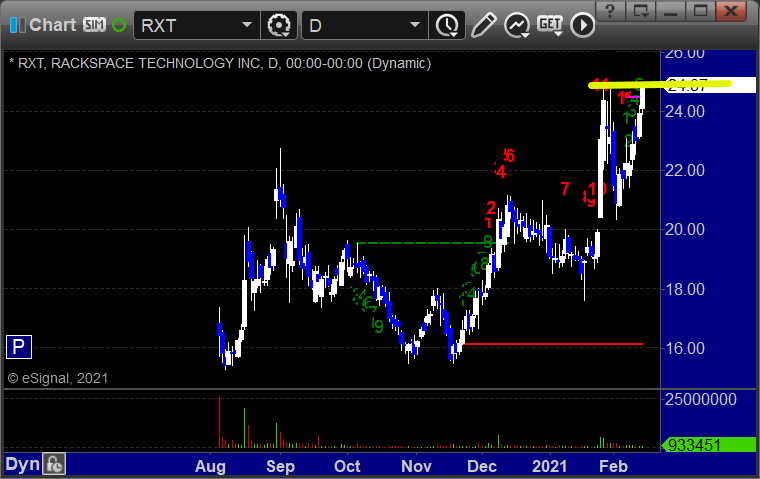

RXT > 24.92, high range base breakout but from a recent base breakout:

DVAX > 11.69, cup and handle breakout:

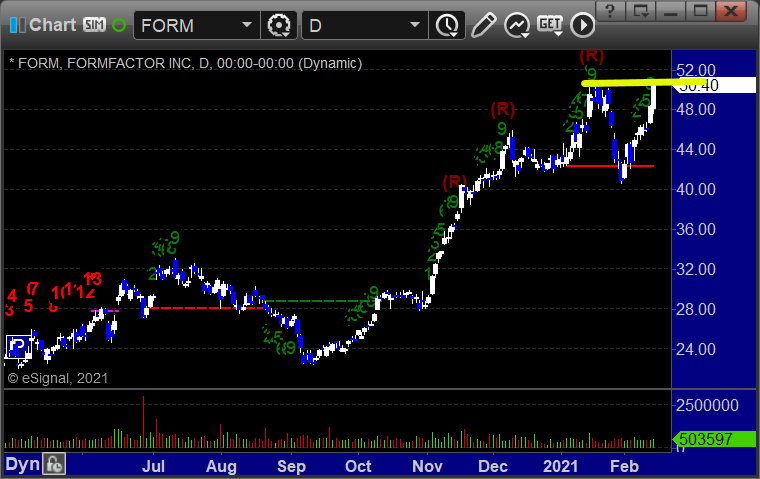

FORM > 50.57, high range base breakout:

No shorts found. We will call the rest from the tape.

Tradesight Recap Report for 2/12/21

Overview

The markets gapped down, filled, and spent most of the day dead flat until a rally with 30 minutes left. NASDAQ volume was 7.4 billion shares.

ES with Levels:

Note how the ES Institutional Range was such precise support at A and B:

Futures:

ES Opening Range Play triggered long at A which was just enough to keep the stop under the midpoint instead of the ORL, so we barely stopped out, otherwise it would have worked:

NQ Opening Range Play triggered short at A and long at B, but too far out of range to take:

Results: -14 ticks

Forex:

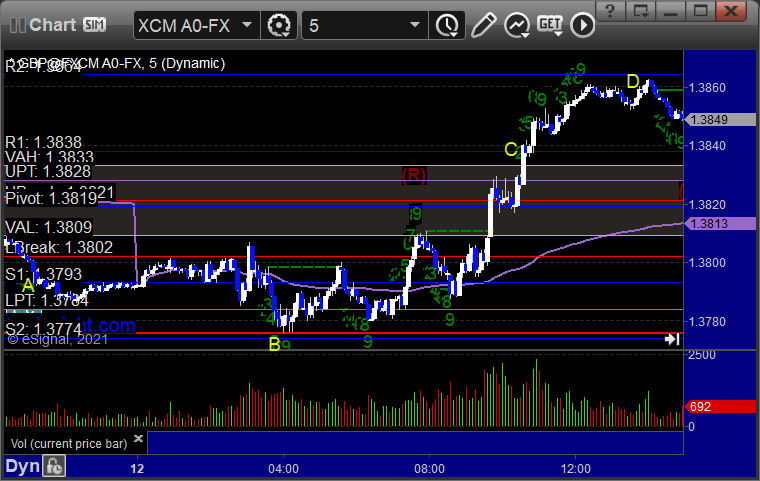

GBPUSD triggered short at A, hit first target at B, stopped second half over the entry. Triggered long at C, hit first target at D, closed in the money for end of week:

Results: +15 pips

Stocks:

Not a very interesting day, but one super nice call from Rich. AMAT triggered long (with market support) and worked nicely:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 2/11/21

Overview:

The markets gapped up a little, filled in about an hour, and then dipped over lunch before coming back for end of day at S&P plus 6 on 10 billion NASDAQ shares.

Futures:

ES Opening Range Player triggered long at A and stopped, triggered short at B but too far out of range to take:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: -16 ticks

Forex:

No calls because the Levels spacing was awful, which is weird two days in a row.

GBPUSD anyway:

Results: +0 pips

Stocks:

Nothing triggered off of the report. Bad bad. So unexciting it's awful.

Rich's ZM triggered long (with market support) and worked:

His DD triggered short (with market support) and worked a little before running out of time:

His AMZN triggered short (with market support) and didn't work, worked big later:

That’s 3 triggers with market support, 2 of them worked and 1 didn’t.

Tradesight Plus Report for 2-11-21

A few calls for Thursday even though the markets netted out nothing for Wednesday after a boring Tuesday.

All long ideas, in order of best construction generally, starting with, RIDE > 31.80, long cup breakout:

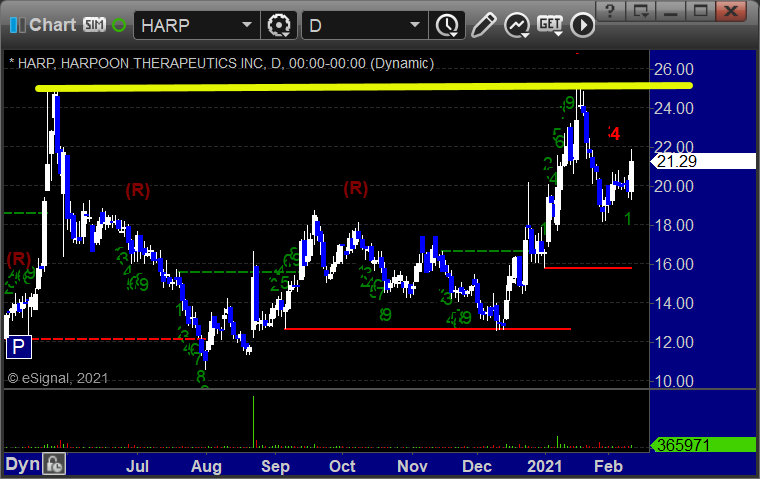

HARP > 25.23, cup and handle breakout:

REFR > 5.70, cup and handle breakout:

DVAX > 11.69, cup breakout:

Good luck.

Tradesight Recap Report for 2/10/21

Overview

The markets gapped up, drifted a little lower for an hour, plunged out of the blue without warning, and then made their way back up to even like nothing happened on 10.7 billion NASDAQ shares, the second highest NASDAQ volume day ever. Here's the ES with levels:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +4 ticks

Forex:

No calls because the Levels spacing was so horrible, but here's a look at the bad action in GBPUSD:

Results: +0 pips

Stocks:

Again, not too many triggers, really bad environment except for a few minutes that got our hopes up and then led to nothing.

NVDA triggered long (without market support) and worked enough for a partial:

Rich's RIOT triggered short (with market support) and didn't work, worked later:

That’s 1 triggers with market support, and it didn't work.