Tradesight Recap Report for 2/9/21

Overview

The markets gapped down and took most of the day to fill and then that was it. We literally closed S&P down 4 and NDX down 7 even though we traded 8.7 billion NASDAQ shares. Waste of time.

Futures:

Not much to focus on here after a day that did nothing.

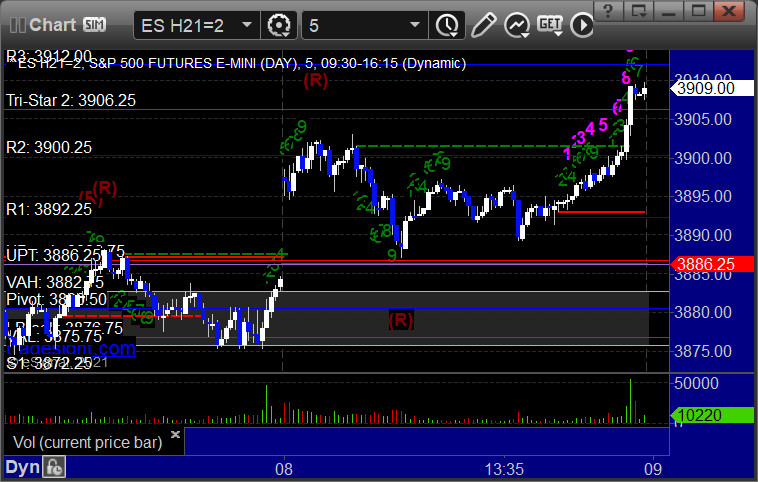

ES with Levels:

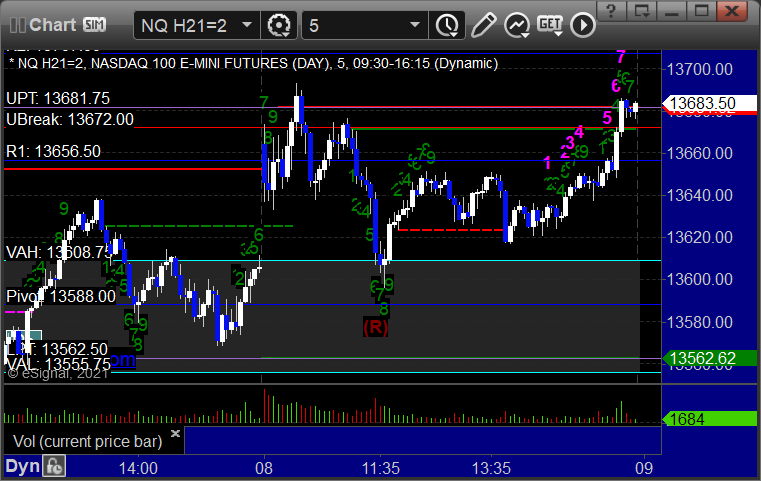

NQ with Levels:

ES Opening Range Play triggered short at A but stopped over the midpoint, triggered long at B and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: -9 ticks

Forex:

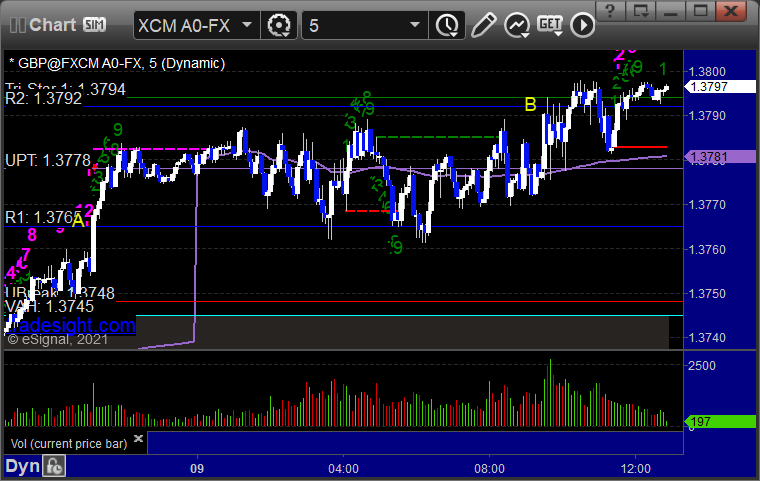

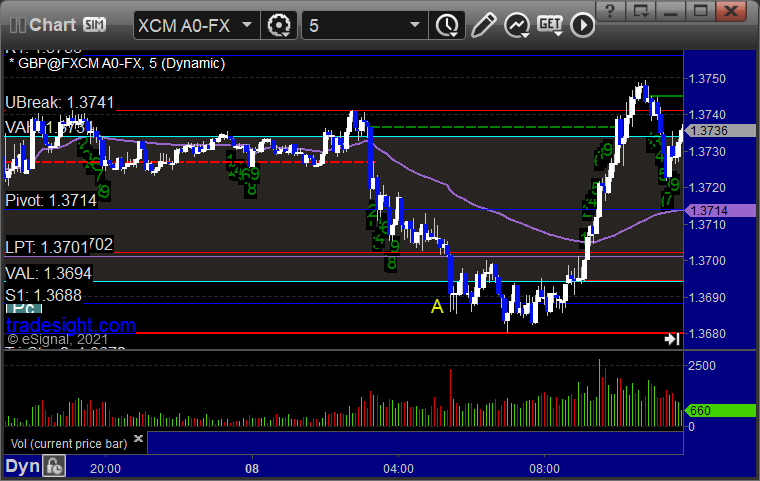

GBPUSD triggered long at A, hit first target at B, still holding second half:

Results: Trade not completed.

Stocks:

From the report, ORTX gapped over, no play.

Rich's AAPL triggered long (with market support) and didn't work:

That’s 1 trigger with market support, and it didn't work. Boring waste of a day.

Tradesight Plus Report for 2-9-21

Opening comments posted to YouTube. Not much new to say after the third highest volume day in history that literally did nothing.

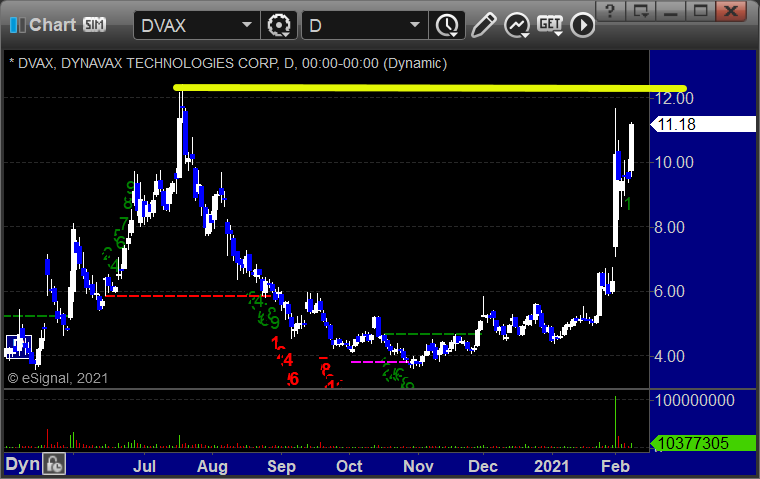

Three calls, all longs. In order of best chart construction, we start with DVAX:

REFR:

ORTX:

Tradesight Recap Report for 2/8/21

Overview

The markets gapped up and basically sat flat all day on 8.5 billion NASDAQ shares, which is a lot of volume to go nowhere until the last ten minutes.

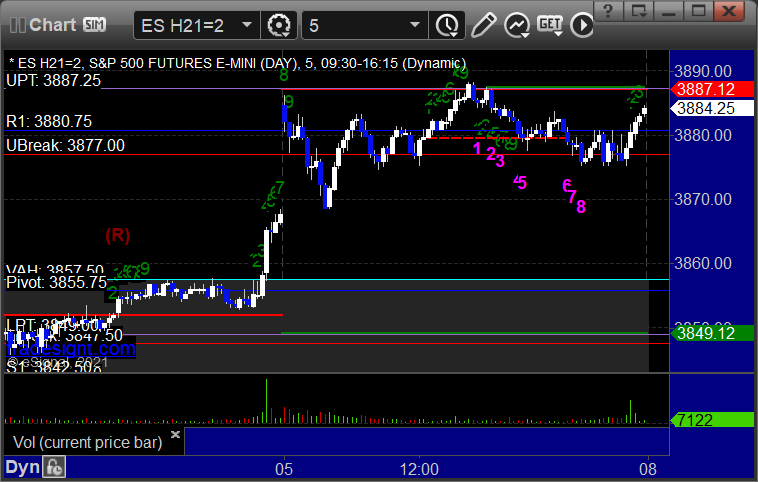

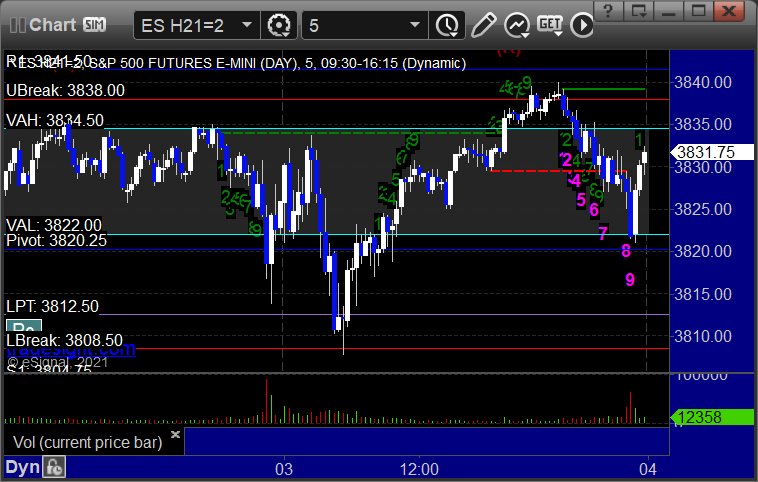

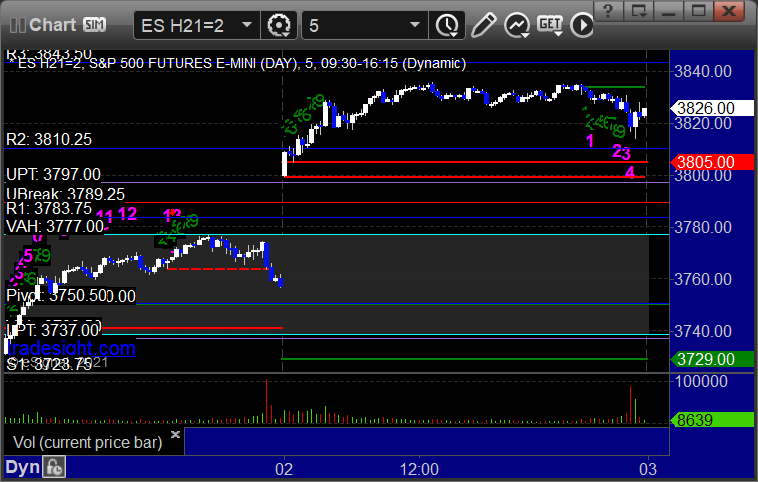

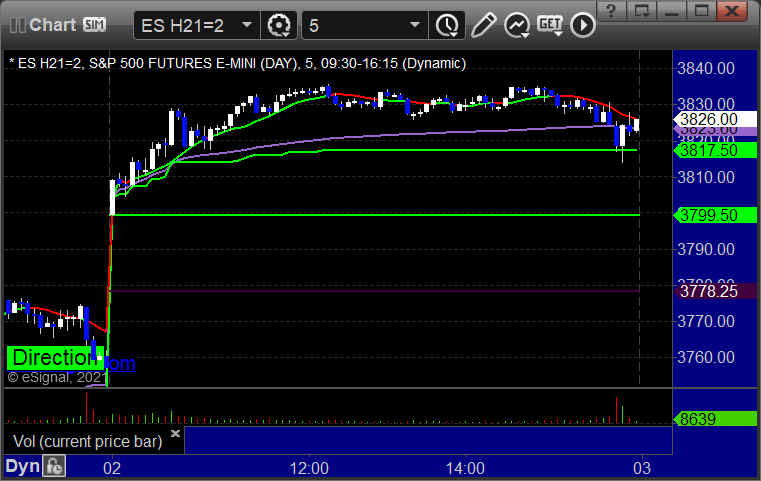

Here's the ES with Levels, note how the UBreak/UPT were the low:

Here's the NQ with Levels, which did just fill the gap:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial:

NQ Opening Range Play:

Results: +4 ticks

Forex:

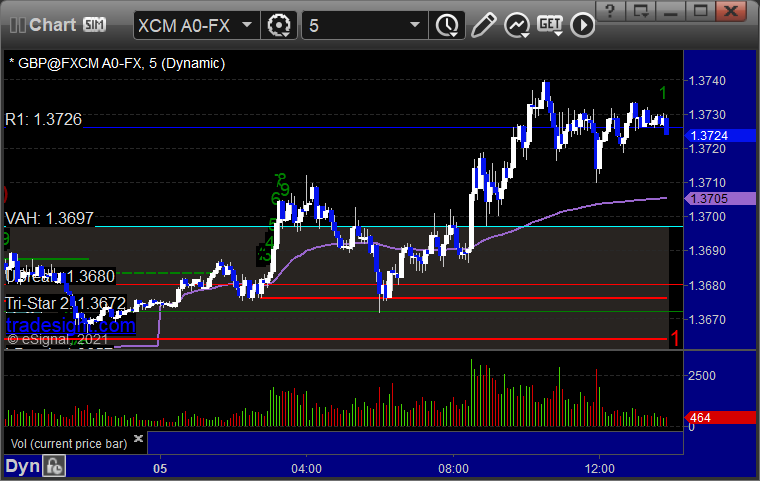

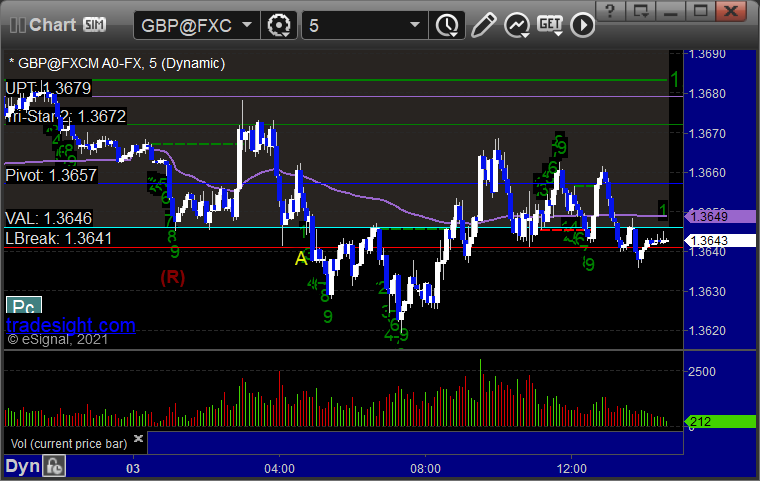

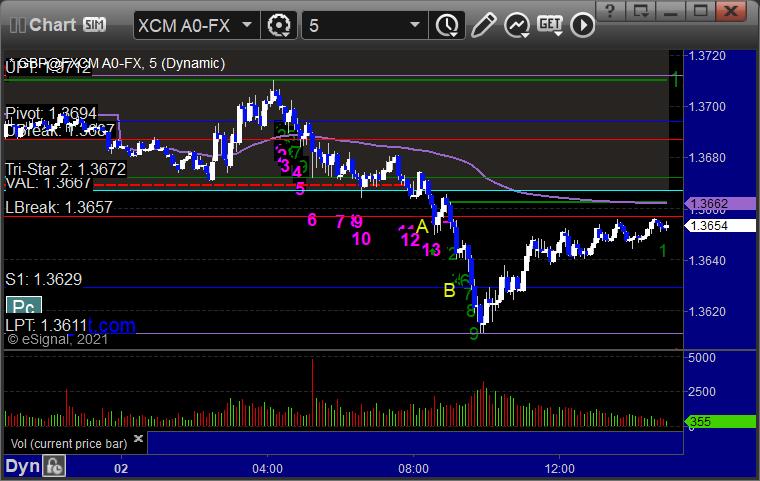

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Wasn't super exciting. From the report, CLVS triggered long (with market support) and didn't work, worked later:

YELP triggered long (with market support) and worked:

Rich's FB triggered long (with market support) and didn't work:

That’s 3 triggers with market support, 1 of them worked and 2 didn’t.

Tradesight Plus New Computer Blog

We have a lot going on with Tradesight. We are still trying to fully establish Tradesight 4.0. There is a lot of behind-the-scenes work to be done, which we are working on. Once that is done, I expect to be able to make more calls, focus on the revised course, and even do more futures and options calls. It's all coming, but there is so much going on right now that it is hard.

Every year or so, I try to send out a Blog about trading computers. This is that Blog post for the year. I'm going to explain to you what I currently have and why.

Trading is a business. If you don't treat it like that, you will never be successful. The idea is to improve and grow and become better. How do we do that?

First of all, for many of you, it requires getting extremely focused on how to trade, submitting your blotters, and becoming a more knowledgeable trader.

But as a business, our "tool" is our computer. Think of it like this. Through your broker and charting package (could be the same, could be different), you are connected to the Exchanges which provide you with executions. Without that, you are in trouble.

If you have a weak link between your keyboard and the trade destination, then you aren't treating your business as seriously as others. Don't worry about the rest. Don't worry about black boxes. You can be a better trader than a black box if you understand the markets. But none of it matters if you aren't taking your tools seriously. Think of it like this. If you were a handyman, would you be successful owning cheap tools and showing up at people's houses? I think not.

So before we get into the latest computer specs, think about this.

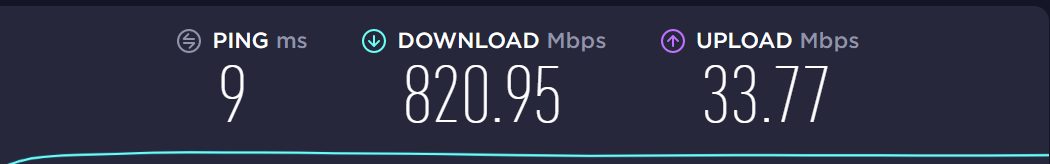

Successful trading starts with fast Internet. I have Gigabit from Cox Cable. If you have DSL or Satellite, you are already behind. Upload speeds don't matter much. You don't send much up in your trading. Download speeds and Ping matter a lot. Here's mine at home:

Now, I would agree, you might not need 820 Mbps Download. But you need something strong. 100 Mbps won't cut it. You'll be behind the next guy. THIS IS A COST OF YOUR BUSINESS. Make it right.

Inside your house, once you get the Internet to your router, then it's a matter of wired versus wi-fi. Ideally, you have a wired connection in Mbps. There's no point in your router accepting speeds like 820 Mbps and then having it only sending 100 Mbps to your computer. You want the full whack. If you can't be wired, which I get, make sure you get a full current Wi-Fi solution like Google Wi-Fi, which handles these speeds. Even if you end up with 300 Mbps, that's beyond good. 50 Mbps is not going to cut it. If you ignore these steps, then before you even buy a computer, you are going to be limiting your speed.

You need a current Windows 10 machine with at least a Solid State Hard Drive to boot it, and you need your broker and eSignal (if you use it) on that hard drive. That makes sure that you can load the platforms as fast as possible.

I'm not going to get into Macs because most financial software is Windows only (eSignal certainly is), but you can run Parallels on Mac to run Windows software. It works, but it is not ideal. We don't operate in an Apple world at this time if you want to be ahead of the curve.

On a Windows 10 machine, I current have 32 GB of high speed RAM (DDR4 2933MHz) with an AMD Ryzen 5 3600XT 6-Core chip. You can also do a 9th or 10th generation i7 Intel chip (that's what my laptop has). So if you have a Solid State Hard Drive and crazy fast RAM, that's a good step. I currently have a i7-10870H 8-core chip with 16MB Cache.

Keyboards and mice are up to you. Logitech is usually the best with their single USB nub solutions. I have a 4K video recorder with a high end microphone, but that won't affect your trading.

Next up is the video card. This is very important, because it controls how fast images shoot up to the screen.

The last piece are your video cards and monitors. I have 3 curved 32" Samsung 4k monitors powered by an NVIDIA GeForce RTX 3080 8GB GDDR6 video card. I run the three monitors via the DisplayPort option. You can even daisy chain them. It is awesome.

Getting your images up to the screen with zero latency is important or else you are seeing your charts later than everyone else.

I have USB 3.0 ports out the Wazoo, but that doesn't matter. This above is the current best practice for a trading computer. Remember, your business is based on success, and success is based on having the tools that match or beat everyone else. If any part of the scenario that I described above fails, then there will be people with an edge over you. This is what it takes in life to be a successful trader in 2021. It's the Tradesight version and review of that. Good luck.

Tradesight Plus Report for 2-8-21

Opening comments for the week are posted to YouTube.

Note that next Monday, the 15th, the markets are closed for President's Day.

That will likely lead to a slow Friday this week, but let's hope for some action before that.

Five nice patterns came up in the scans, all longs. In order of best construction, we start with REFR > 5.70, nice base:

ORTX > 7.88, almost a cup and handle, definitely a little cup on increased volume of late:

CLVS > 9.55, a bull flag/high-range base breakout:

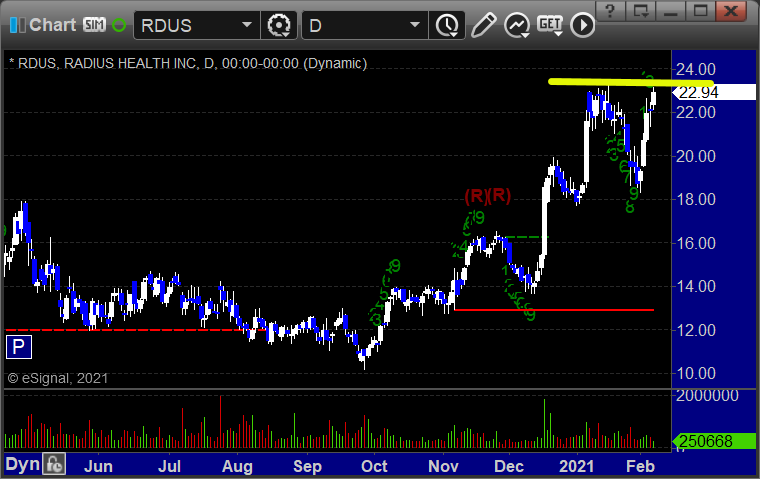

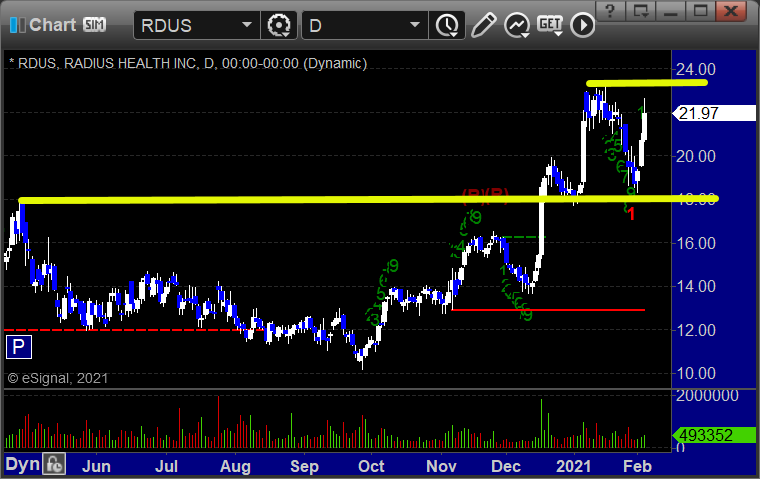

RDUS > 23.30, high-range base breakout:

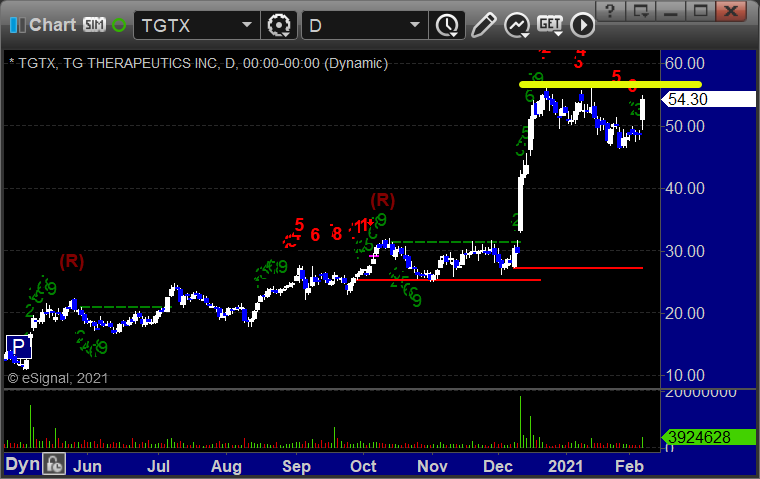

TGTX > 56.74, another high-range base breakout with volume up, but last in the list because of the one minor spike day:

Tradesight Recap Report for 2/5/21

Overview

The markets gapped up, NASDAQ filled, ES came close, and then it was just a flat day after that on 6.7 billion NASDAQ shares. ES with Levels:

Futures:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +7.5 ticks

Forex:

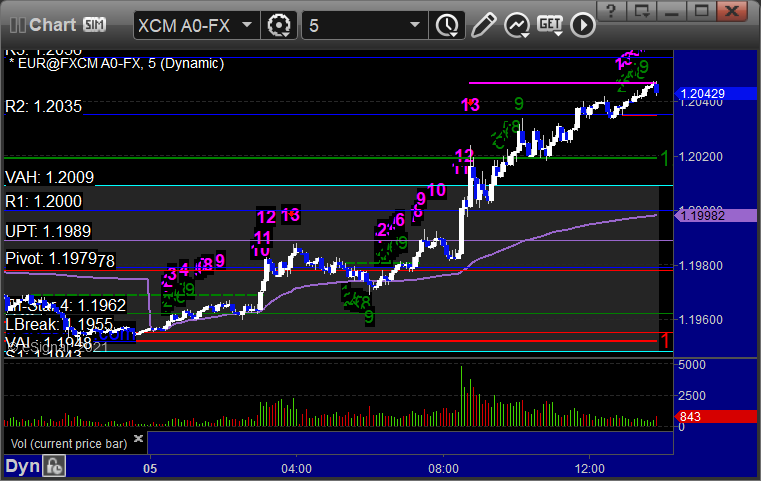

Note the EURUSD Comber 13 sell signals, both worked under the rules:

GBPUSD:

Nothing triggered:

Results: +0 pips

Stocks:

From the report, no triggers. From the Twitter feed, Rich's OSTK triggered long (without market support) and worked:

That’s 0 triggers with market support.

Tradesight Recap Report for 2/4/21

Overview

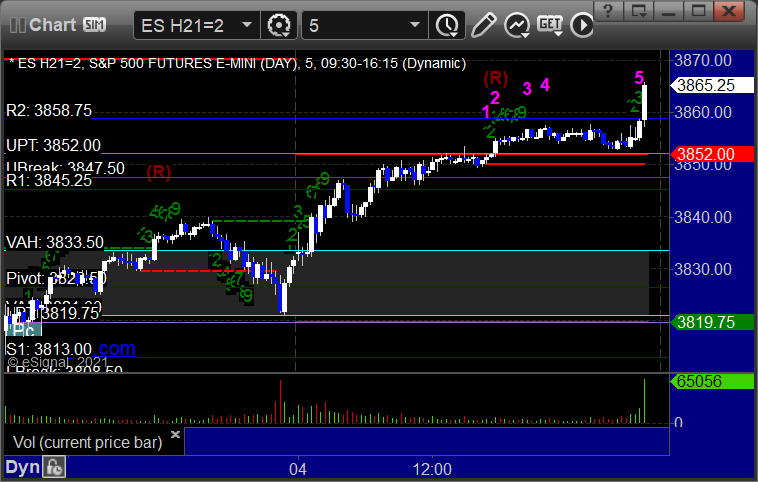

The markets gapped up small, filled, the NASDAQ was weaker earlier, and then we turned up and closed at new highs despite a fairly boring session on 7.3 billion NASDAQ shares:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play no triggers in range:

Results: +4 ticks

Forex:

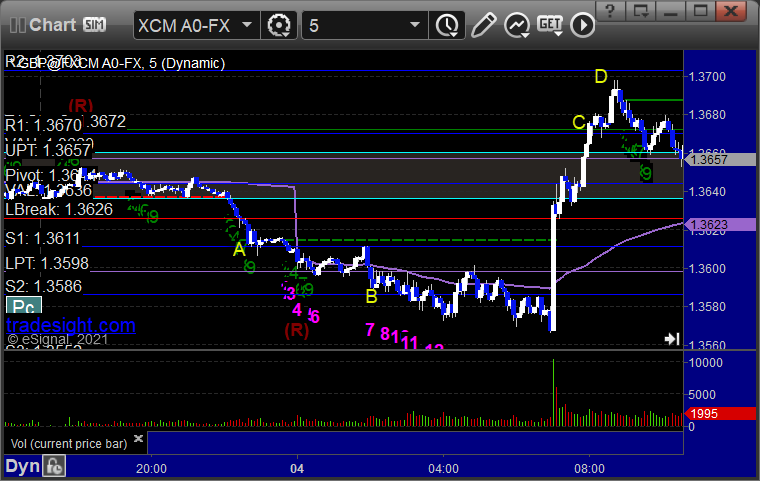

GBPUSD triggered short at A, hit first target at B, stopped second half over the entry. Triggered long at C, hit first target at D, stopped second half under the entry:

Results: +25 pips

Stocks:

A decent day.

MGI triggered long (with market support) on a news spike, which is never what we want, and stopped:

MVIS triggered long (with market support) and worked great:

From the Twitter feed, Rich's QCOM triggered short (without market support) and worked:

His AMZN triggered short (with market support) and worked:

BYND triggered short (without market support) and didn't work:

Rich's DE triggered long (with market support) and worked:

That’s 4 triggers with market support, 3 of them worked and 1 didn’t.

Tradesight Plus Report for 2-4-21

Opening comments are posted to YouTube for the rest of the week. Let's hope for some better action. I'm ready for some downside, the sell signals are in place on the daily. We have big data coming out Friday too.

No shorts found.

Longs in order of best construction, starting with MGI long over 9.07, nice cup for breakout still:

MVIS long over 9.84, nice high range base breakout:

RDUS long over 23.30, another nice high range base breakout, note the support from the last long breakout (lower yellow line):

Let's get to it. See you in the Lab.

Tradesight Recap Report for 2/3/21

Overview

Not a very interesting day. The markets gapped up small, filled, and spent most of the day flat in the Value Areas on 7 billion NASDAQ shares. Here's the ES with Levels:

Futures:

The ES Opening Range was 10 points wide, which makes it almost impossible to get a valid Opening Range trigger, so we didn't take it for once. Not much else of use happened in the futures.

ES Opening Range Play, long at A and short at B both not valid:

NQ Opening Range Play:

Results: 0 ticks

Forex:

Another dead session for Forex. GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Not much here.

From the report, TWOU triggered long (without market support) and didn't work:

From the Twitter feed, Rich's ERX triggered long (ETF, so no market support needed) and worked:

His MSFT triggered long (with market support) and worked:

His JPM triggered long (with market support) and worked:

That’s 3 triggers with market support, all of them worked.

That’s 3 triggers with market support, all of them worked.

Tradesight Recap Report for 2/2/21

Overview

The markets gapped up and went higher, although every thing after the first hour or so was very dead on 7.2 billion NASDAQ shares.

ES with Levels:

Note we closed on the VWAP:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered too far out of range to take.

Results: +11 ticks

Forex:

GBPUSD triggered short at A, hit first target at B, second half stopped over the entry after I took this screenshot:

Results: +10 pips, trade isn't closed yet

Stocks:

From the report, VCYT, VXRT, and ONEM all triggered in the opening 5 minutes, so no plays there.

Rich's PTON triggered long (with market support) and didn't work:

ADBE triggered long (with market support) and worked:

BYND triggered short (without market support) and worked:

Several other calls but none triggered.

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.