Tradesight Plus Report for 2-2-21

Opening comments posted to YouTube. I found a few charts (all longs, no shorts), in the scans. We will work with these and call the rest via Twitter.

As usual, in order of best chart construction, starting with RVMD:

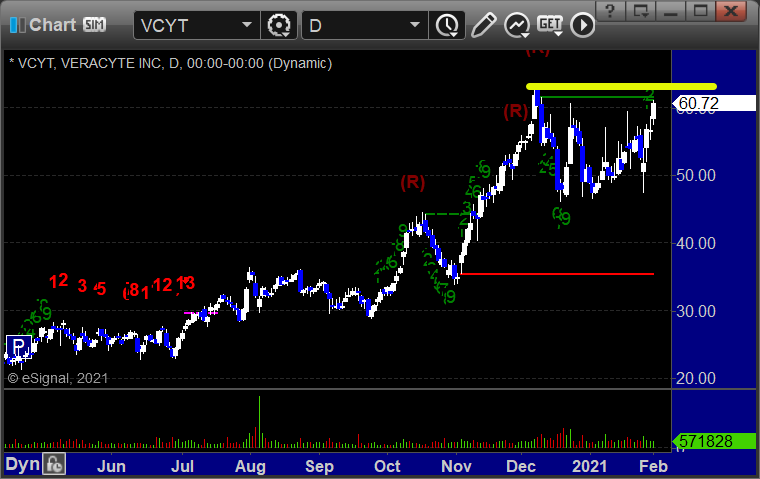

VCYT:

MGI:

VXRT:

ONEM:

Tradesight Recap Report for 2/1/21

Overview

The markets gapped up, pulled back, not much of a day, we were nowhere after two hours, then headed up over lunch, and then the rest of the day was flat on 7 billion NASDAQ shares.

Futures:

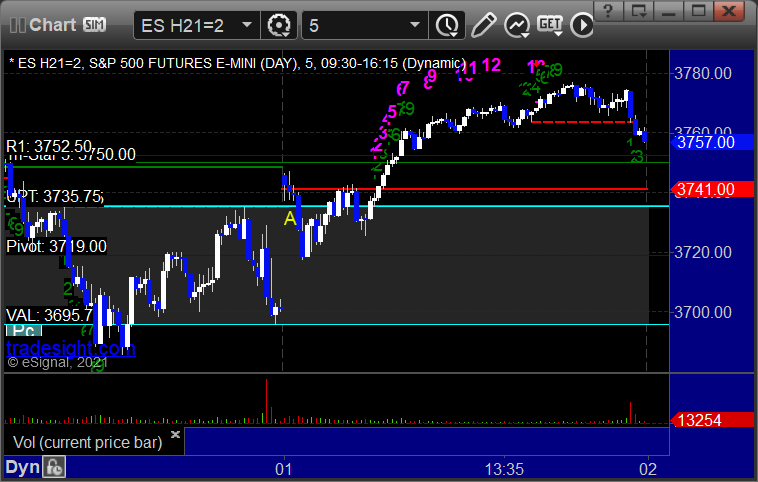

ES Opening Range Play triggered short at A and stopped over the midpoint:

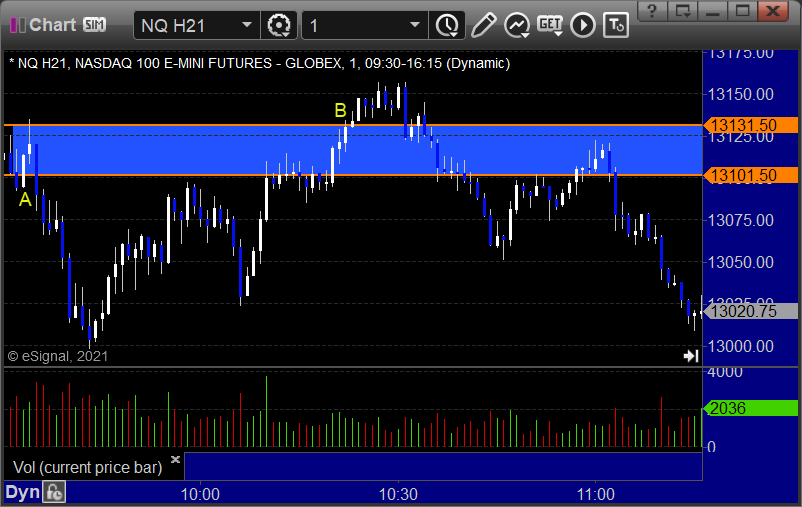

NQ Opening Range Play:

Results: -16 ticks

Forex:

Results: pips

Stocks:

GTHX gapped over, no play.

MGI triggered long (with market support), tried twice, stopped:

From the Twitter feed, Rich's NTES triggered long (with market support) and worked:

His KOSS triggered short (without market support due to opening 5 minutes) and worked:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Plus Report for 2-1-21

Opening Comments posted to YouTube. Let's hope for a week more like last Wednesday and Friday than the rest.

Only two longs found. Nothing on the short side. Is what it is.

GTHX long over 24.26:

MGI long over 8.93:

Tradesight Recap Report for 1/29/21

Overview

The markets gapped down, tried to fill, rolled, and went lower on 7.8 billion NASDAQ shares.

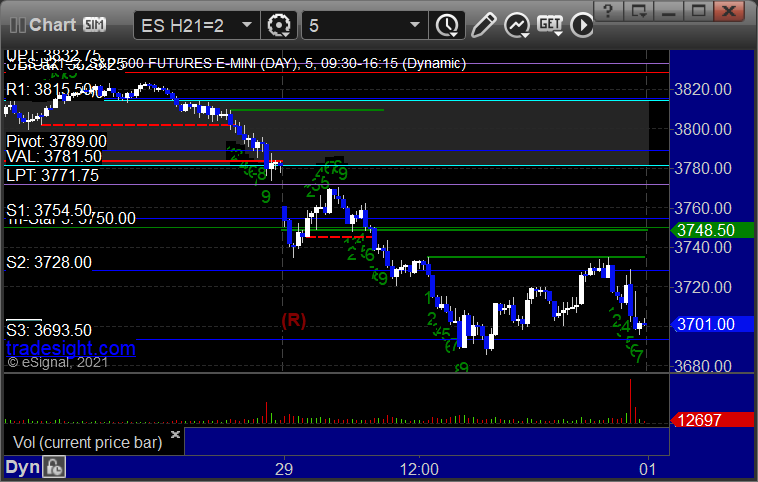

ES with Levels:

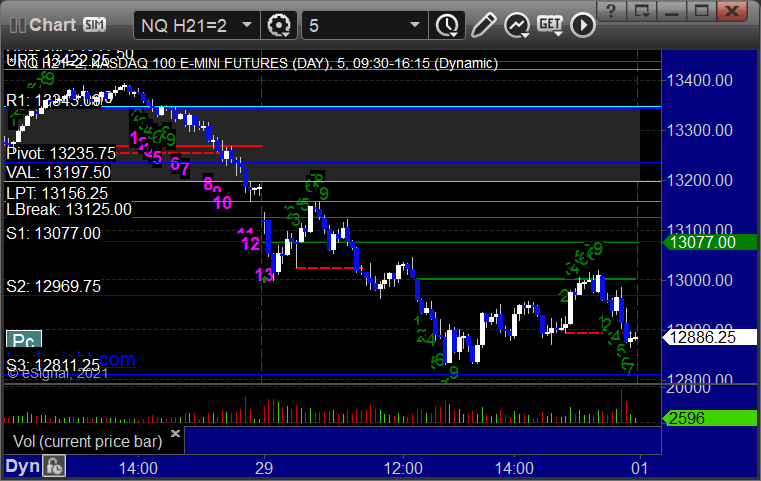

NQ with Levels:

Futures:

ES Opening Range Play triggered short at A and long at B but too far out of range to take:

NQ Opening Range Play triggered short at A and long at B but too far out of range to take:

Results: +0 ticks

Forex:

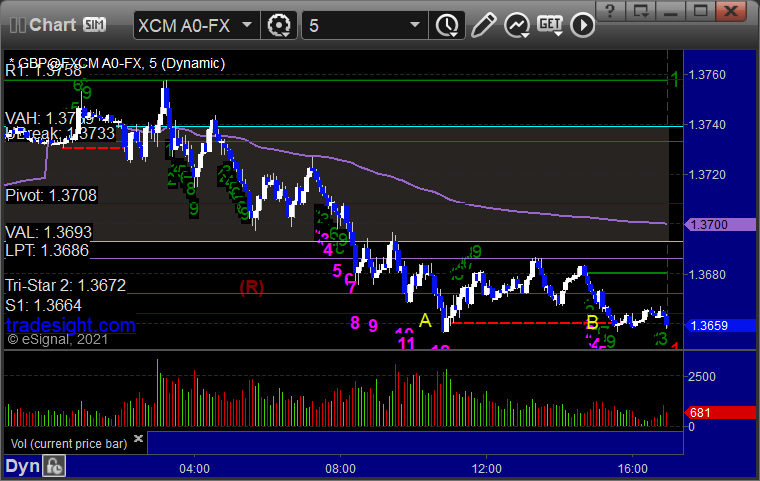

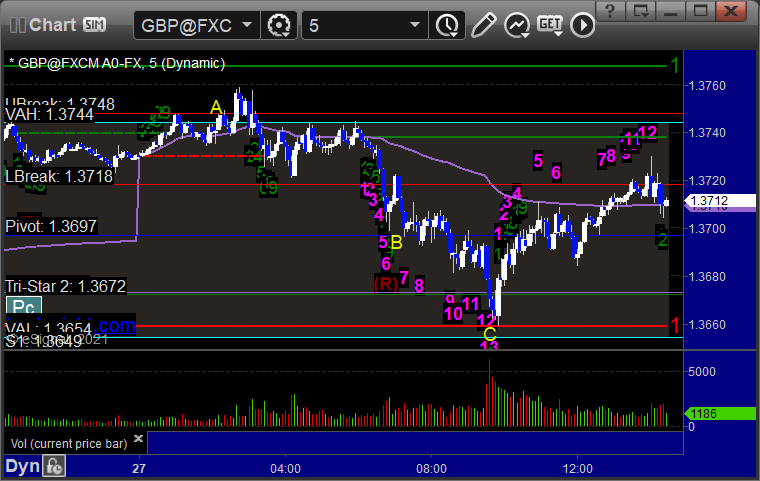

GBPUSD triggered short at A, hit first target at B, stopped second half over the entry. Triggered long at C and stopped:

Results: -10 pips

Stocks:

GS triggered short (with market support) and didn't work:

Rich's AAPL triggered short (with market support) and worked:

KLAC triggered short (with market support) and worked:

That’s 3 triggers with market support, 2 of them worked and 1 didn’t.

Tradesight Recap Report for 1/28/21

Overview

The markets gapped up, went a little higher, and closed around where they started on 10 billion NASDAQ shares.

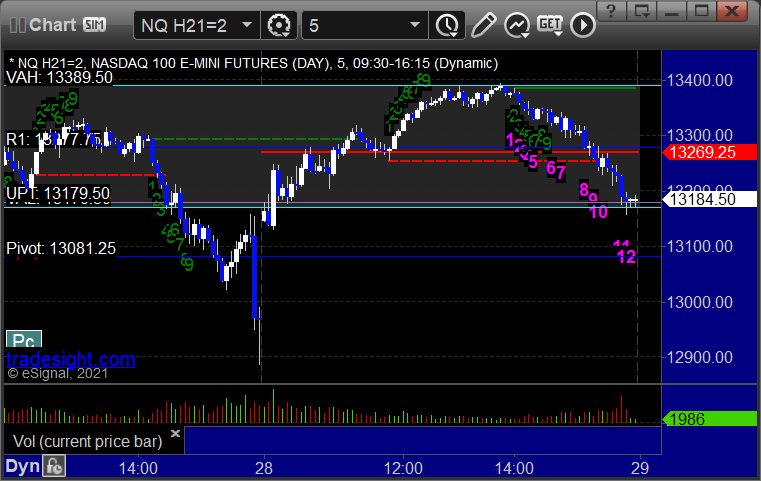

NASDAQ stayed in the Value Area exactly:

Futures:

ES Opening Range Play triggered long, but too far out of range to take:

NQ Opening Range Play triggered long, but too far out of range to take:

Results: +0 ticks

Forex:

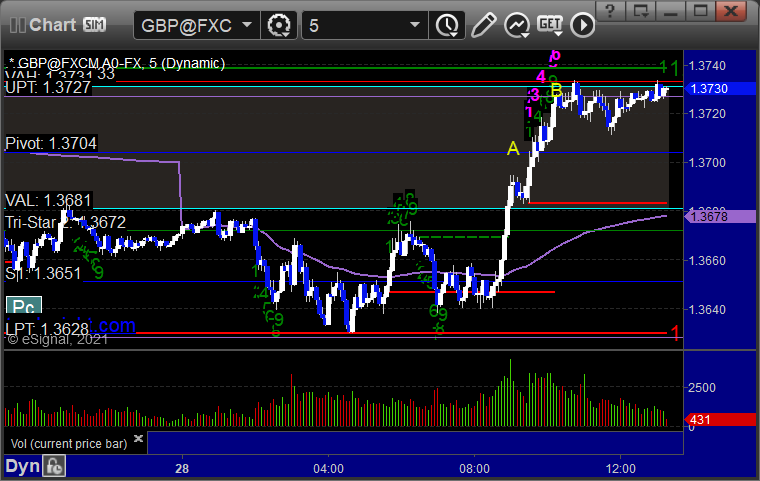

GBPUSD triggered long at A, hit first target at B, still holding second half with a stop under Pivot

Results: Not closed yet

Stocks:

Rich's FB triggered long (with market support) and worked enough for a partial:

His NVAX triggered long (with market support) and worked:

His MRNA triggered long (with market support) and worked:

His DOCU triggered long (with market support) and worked:

GS triggered long (with market support) and worked enough for a partial:

That’s 5 triggers with market support, all of them worked.

Tradesight Plus Report for 1-27-21

Opening comments posted to YouTube. Scans didn't turn up shorts like I wanted, but that's not surprising after just one day down. Here's one call and then we will do the rest in Twitter.

Longs first, only one, ANGI long over 17.05, nice long base:

Tradesight Recap Report for 1/27/21

Overview

The US Dollar got a little stronger, but not much. The stock market gapped down big, went lower early, stayed in that range until after lunch, and then dipped late on 11 billion NASDAQ shares, a record volume day.

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

NQ Opening Range Play triggered short at A but too far out of range to take:

Our ES call didn't trigger.

Results: +0 ticks

Forex:

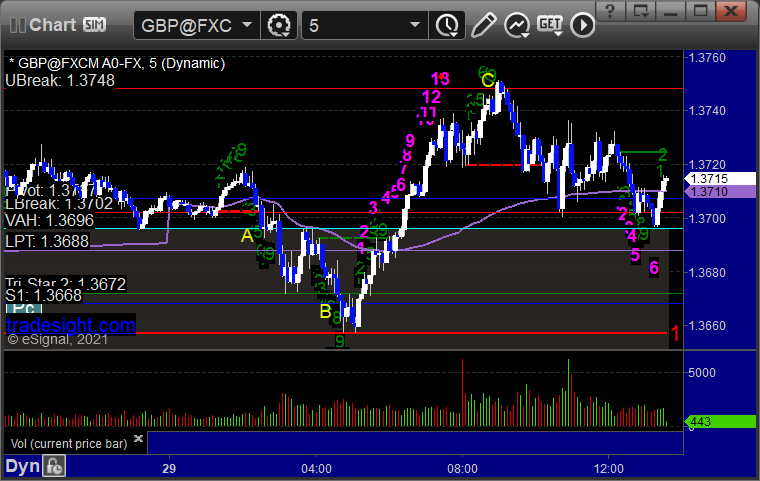

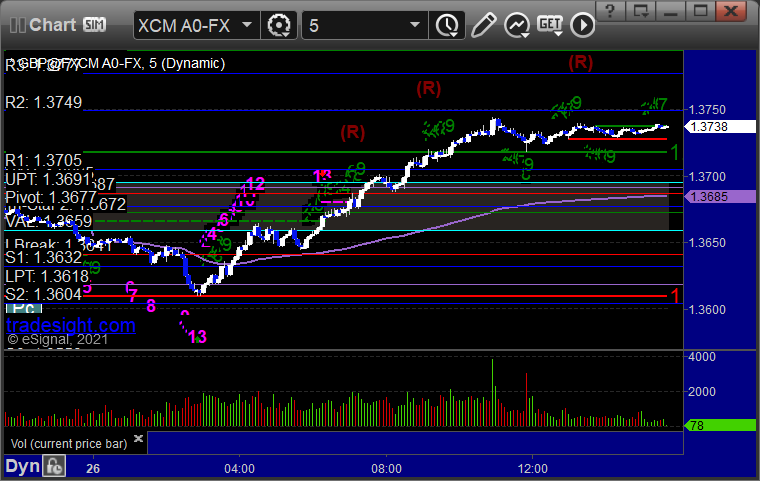

GBPUSD triggered long at A and stopped, triggered short at B, hit first target at C on a 13 buy signal, stopped second half over the entry:

Results: -10 pips

Stocks:

From the report, nothing triggered.

From Twitter, TSLA triggered short (with market support) and worked enough for a partial:

COST triggered short (without market support) and didn't work, although it triggered later with market support) and worked:

Rich's AVGO triggered short (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 1/26/21

Overview

Quite a dull day. The markets gapped up small and filled and that was it with the S&P closing down 6 and the NDX up 5 on 6.8 billion NASDAQ shares. Horrible. Look how we stuck to the VWAP:

Futures:

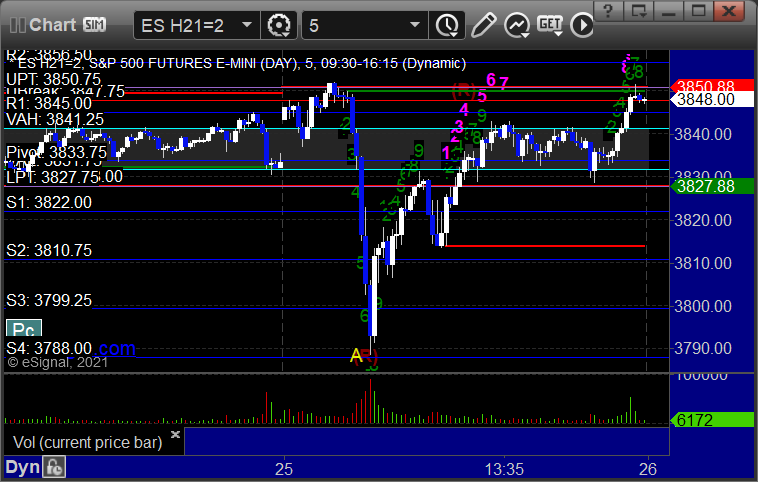

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play:

Results: +8 ticks

Forex:

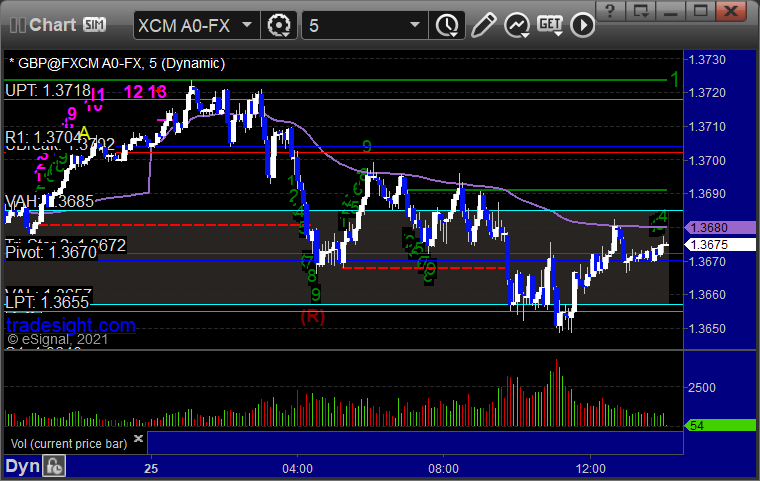

We had a loser and a winner in the GBPUSD. We triggered short at A and stopped and long at B and closed eventually for 25 pips when it never hit the first target:

Results: +0 pips

Stocks:

From the report, LNTH triggered long (without market support) and worked:

CLVS gapped over.

From the Twitter feed, Rich's RCL triggered short (with market support) and worked:

His NKLA triggered long (without market support) and worked:

QCOM triggered short (with market support) and never worked enough for a partial:

YELP triggered long (without market support) and didn't work:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Plus Report for 1-26-21

I wanted to type a reminder about how the new reports work. The Tradesight Plus Report will be posted every weekend for Monday, and then could be posted each weeknight ahead of Tuesday, Wednesday, Thursday, and Friday. If my stock scans don't turn up anything new, then no report will be posted, which means anything from the prior report that hasn't triggered will still be valid. Either way, additional calls will be made via the Twitter feed.

Every day there will be a recap report. This will include any official trades (Stocks, Futures, and Forex) that triggered, plus anything else I want to show about the market action that day or to make an educational point.

Opening comments for Tuesday are posted to YouTube. Expect some crazy market whips while the new House and Senate try to get their rules set and while the new stimulus package is being worked on. This could be very news driven.

Longs only, in order of best construction, starting with LNTH over 16.50:

CLVS over 7.97:

ARDX over 8.33:

FTEK over 7.04:

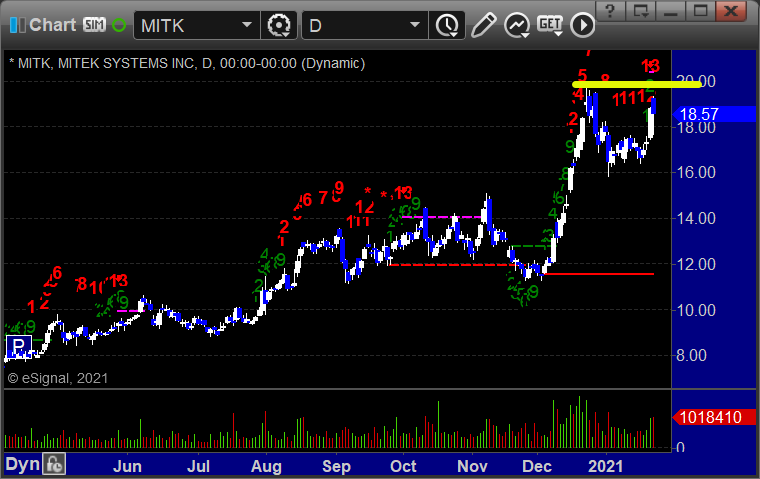

MITK over 19.88:

Tradesight Recap Report for 1/25/21

Overview

The broad market gapped up a couple of points while the NASDAQ gapped up over 100. The first hour was dead and then the markets suddenly plunged on news out of Washington. Note that the low of the drop was S4:

Sadly, that was it, and then the market just drifted back up to about even and sat there for most of the rest of the day. Even when things start to look exciting, they aren't. NASDAQ volume was 7.1 billion shares.

Futures:

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked enough for a partial:

NQ Opening Range Play only triggered long and was too wide to take:

Results: -10 ticks

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

Not much triggered, but the one that did worked.

Rich's BB triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.