Tradesight Plus Report for 1-25-21

Opening comments for the week posted to YouTube. We have a 2-day Fed meeting, we have earnings, and we have the first look at GDP for Q4 2020. Let's hope for some better action to go with all of that.

My scans didn't turn up much, which isn't surprising with how slow Thursday and Friday were.

We have two long ideas and we will call the rest live.

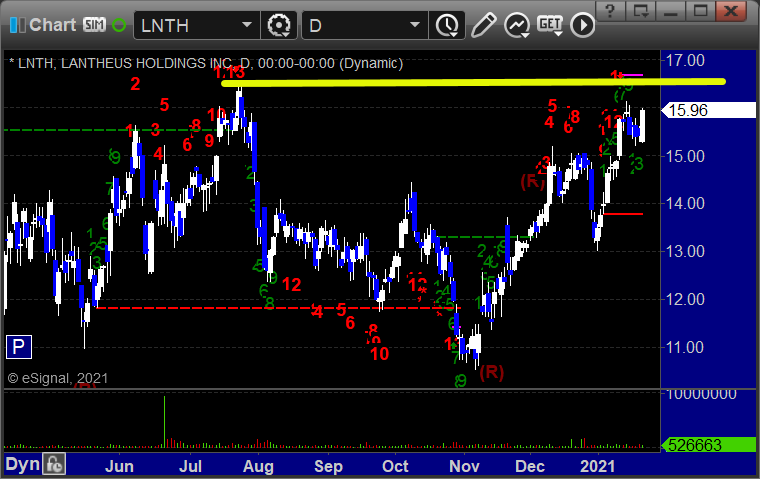

LNTH long over 16.50:

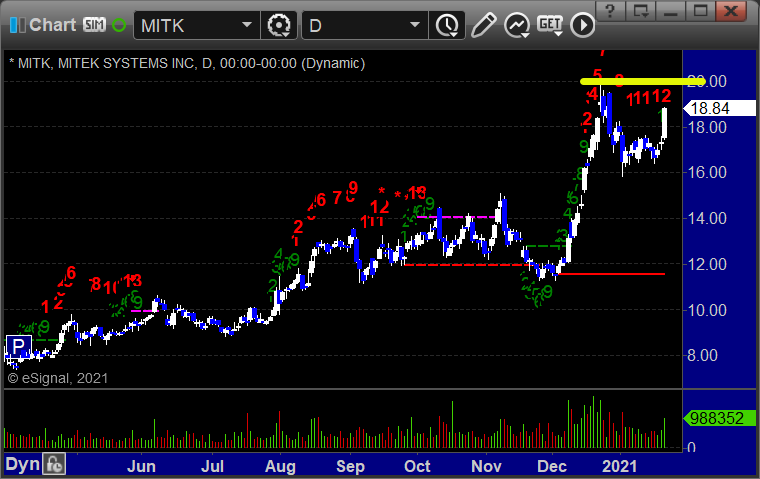

MITK long over 19.88:

All stops should be based on the Tradesight system. If you don't know how to trade, don't!

Tradesight Recap Report for 1/22/21

Overview

The markets gapped down, tried to rally, failed back to lows, then came back again in the afternoon before selling off late and settling right at the VWAPs on 5.9 billion NASDAQ shares.

Futures:

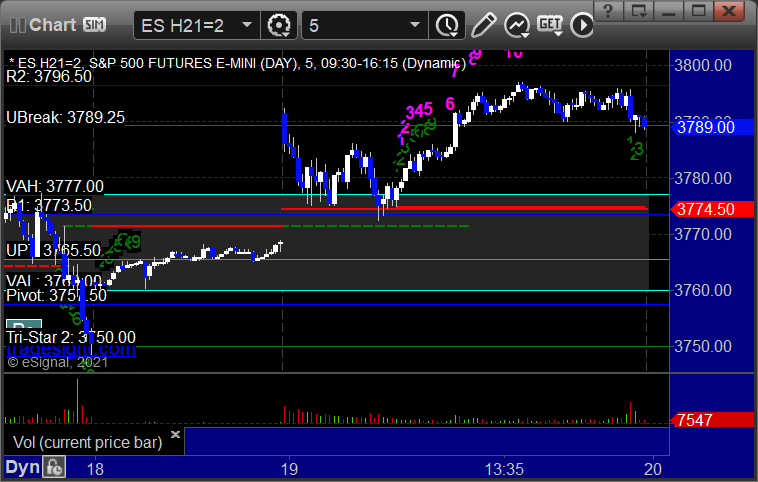

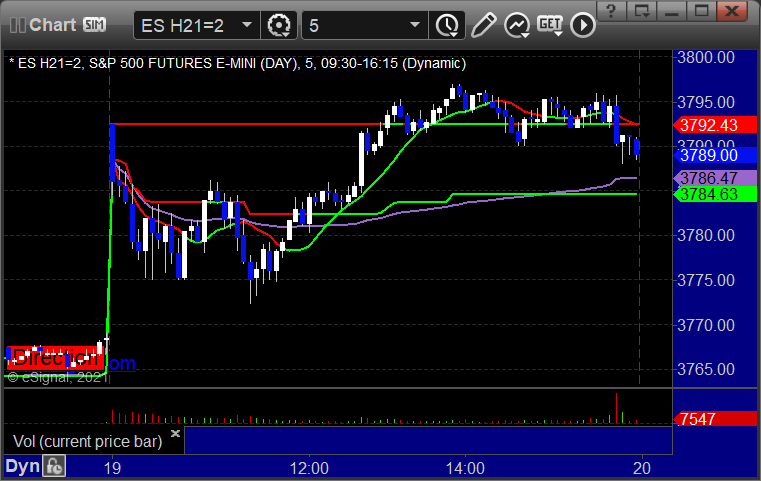

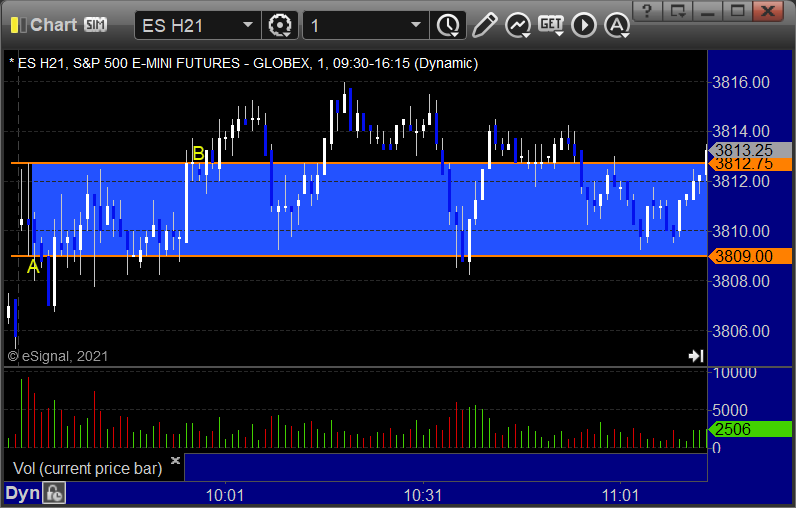

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered short at A and long at B, both too far out of range to take under the rules:

Note that after the gap down, the first stop heading up was at the LBreak/S1/Low of Previous day at A, and the second stop later was at the Pivot:

Note that we also closed on the VWAP:

Results: +11 ticks

Forex:

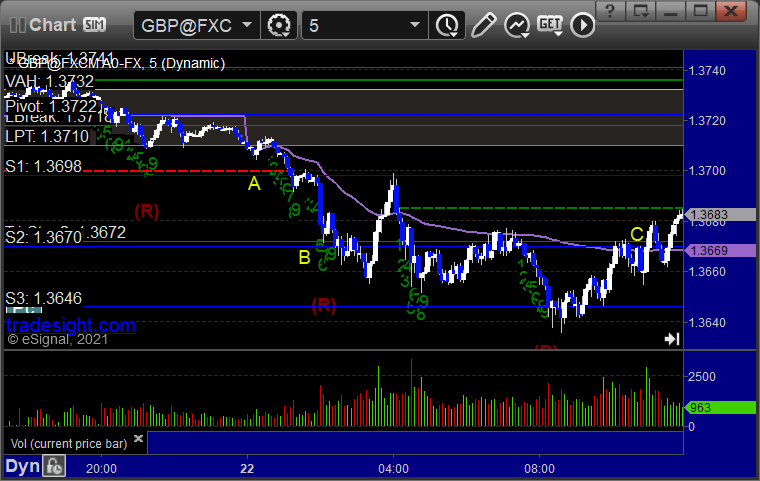

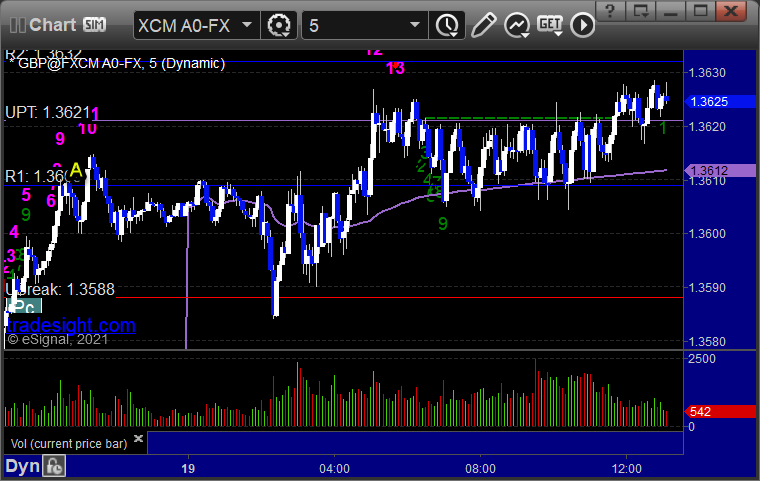

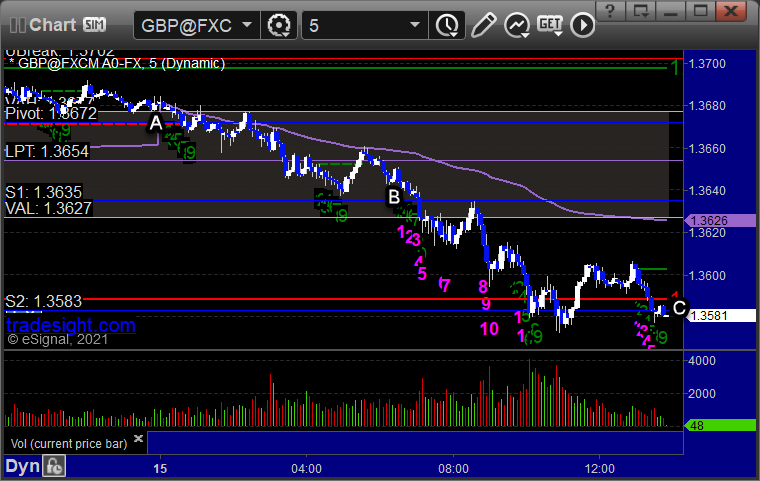

GBPUSD triggered short at A, hit first target at B, stopped second half over the trigger at C:

Results: +35 pips

Stocks:

Nothing from the report triggered.

UBER triggered short (without market support) and worked:

COST triggered long (with market support) and didn't do much:

That’s 1 trigger with market support, and it didn't work.

Tradesight Recap Report for 1/21/21

Overview

The markets gapped up tiny and filled the small gaps quickly and it was a dead flat day on 7.2 billion NASDAQ shares, which is crazy. The markets literally did nothing.

Futures:

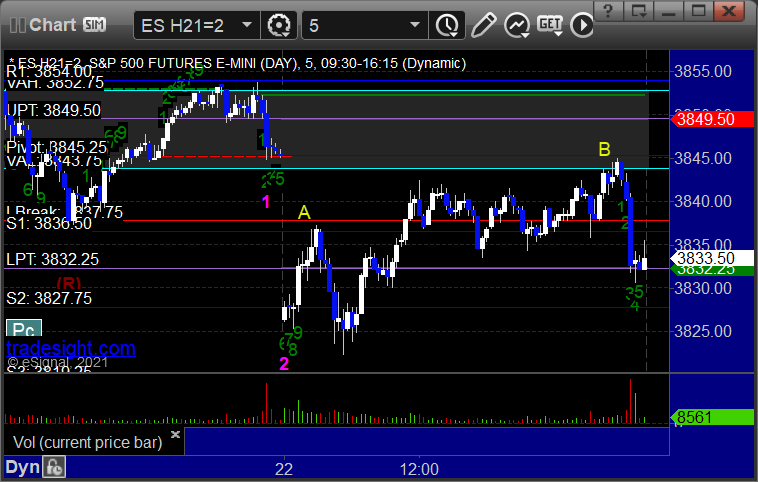

ES Opening Range Play triggered short at A and worked, triggered long at B and worked:

NQ Opening Range Play triggered both directions, but both were too far out of range to take under the risk rules:

Results: +17 ticks

Forex:

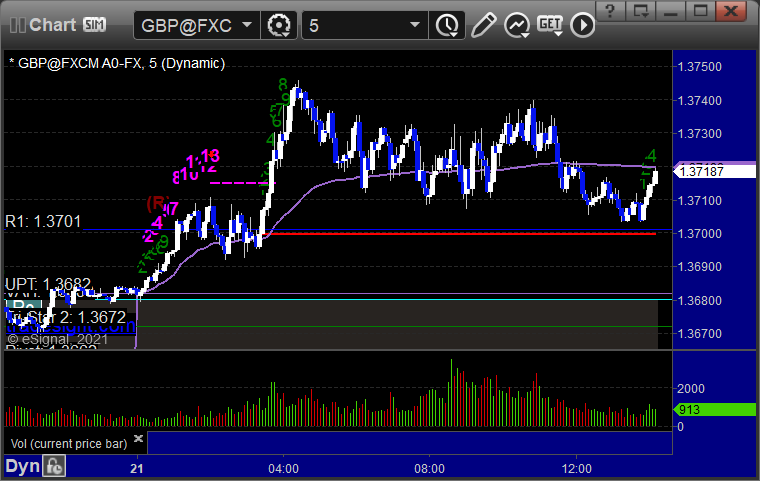

GBPUSD triggered long at A, hit first target at B, still holding second half with a stop under R1:

Results: Trade not yet completed

Results: Trade not yet completed

Stocks:

Rich’s DOCU triggered short (with market support) and worked:

His LRCX triggered short (with market support) and didn’t work:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Report for 1-21-21

Not much new came up in the scans. Opening comments posted to YouTube. Once again, as of this writing, futures are pointing to another gap up.

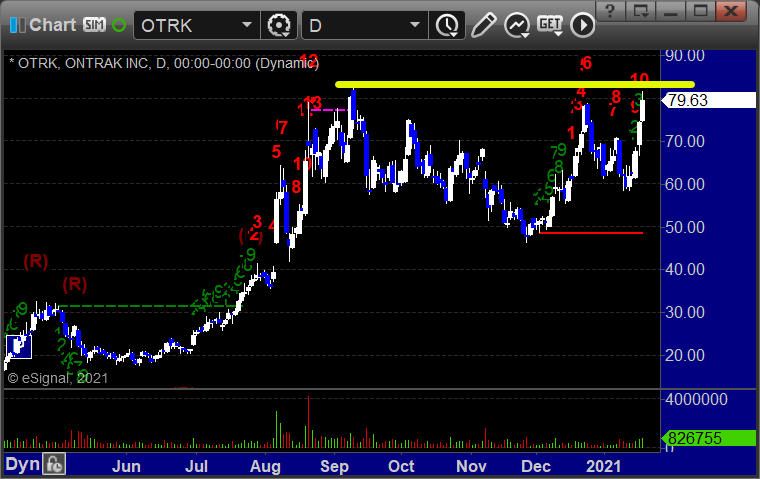

I love this OTRK long over 83.34:

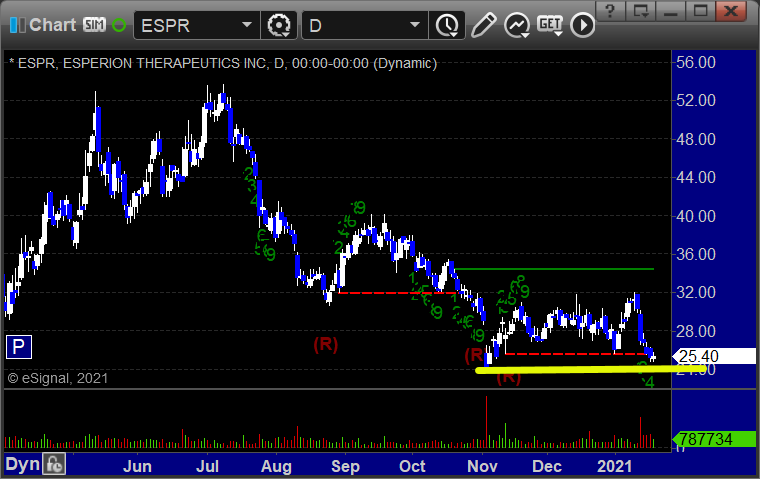

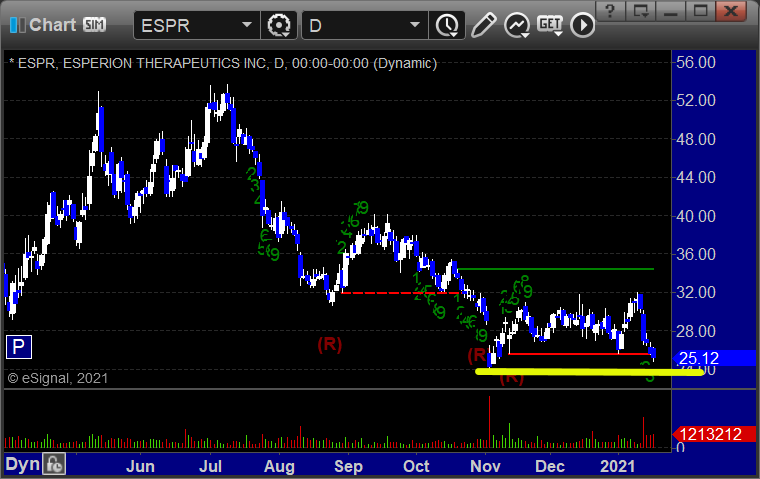

And we still like the ESPR short under 23.90:

Tradesight Recap Report for 1/20/21

Overview

Not much out of the markets, with stocks gapping up and drifting higher, but forex sitting pretty still overall. NASDAQ volume was 6.7 billion shares.

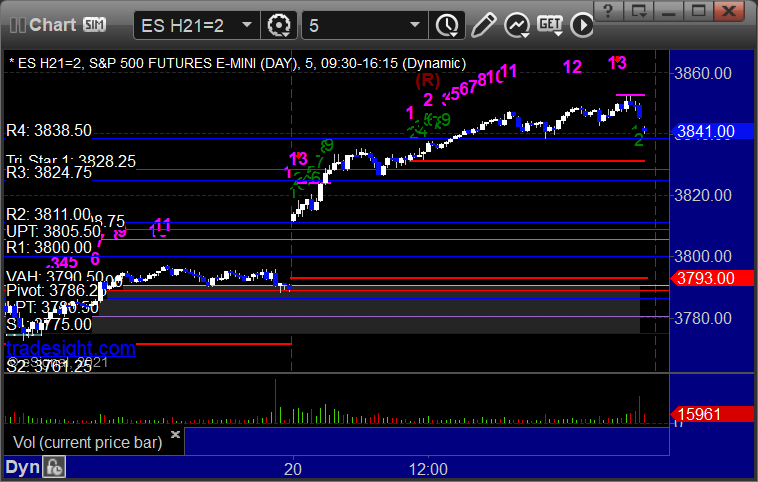

The markets gapped over most of our key levels, although we did end the day with a Comber 13 sell signal and the risk line was exactly the final high:

Futures:

ES Opening Range Play triggered long at A and stopped under the midpoint:

NQ Opening Range Play triggered long at A but too far out of range to take under the rules:

Results: -12 ticks

Forex:

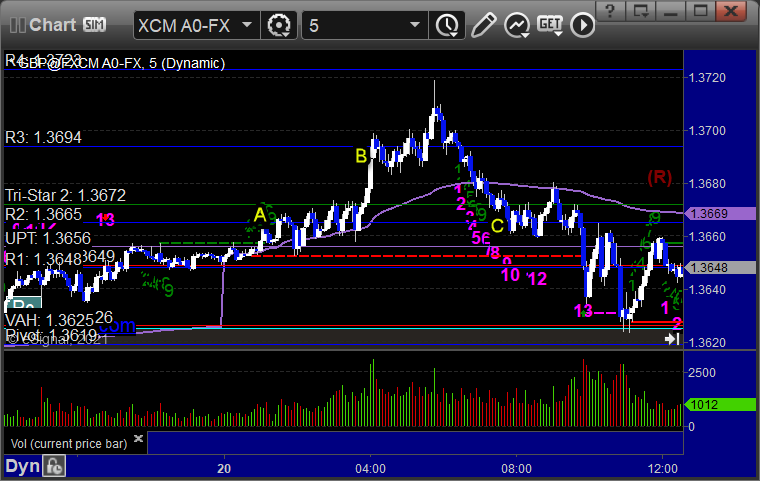

GBPUSD triggered long at A, hit first target at B, stopped out of the second half under the entry:

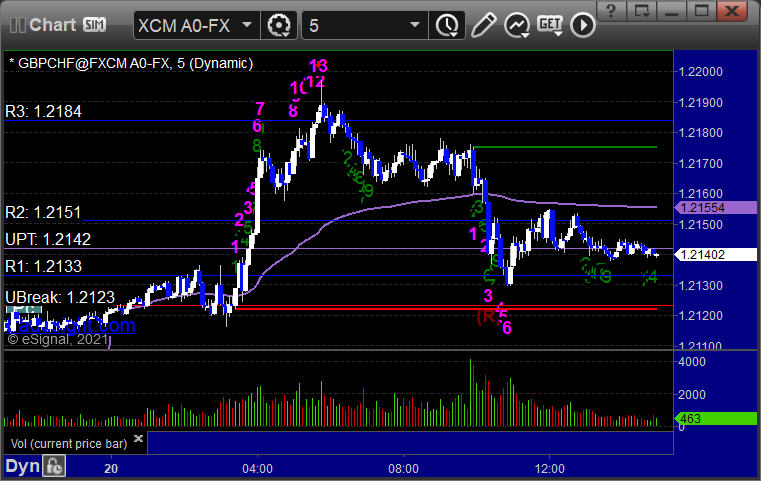

One pair that did make a move was the GBPCHF, which topped out on a Comber 13 sell signal:

Results: +15 pips

Stocks:

INSG off the report gapped over, no play.

AAPL triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Report for 1-20-21

The Market Preview is posted to YouTube. This is the second day back from options expiration, so let's hope for more excitement, but it seems like the focus will be on the Biden Inauguration.

For Stock Picks, two long ideas.

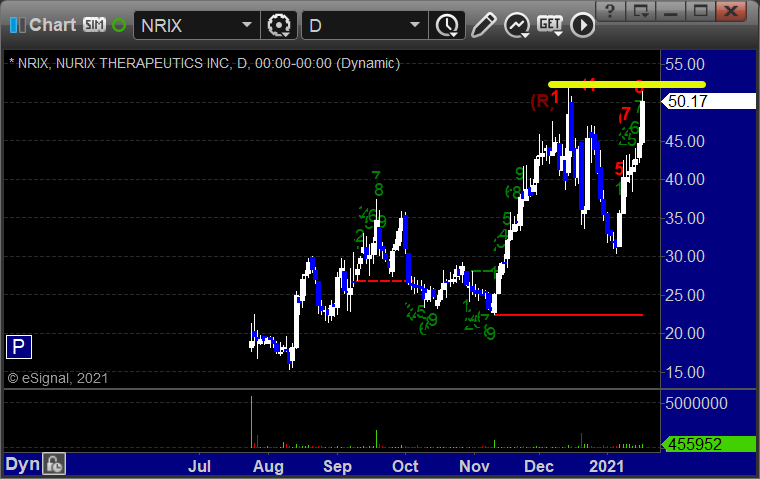

First, NRIX, a nice high range base breakout on volume:

Then INSG, a shorter high range base breakout on volume:

On the short side, just ESPR, a 6-week plus base breakdown to new lows:

These should do it, and we will call the rest from the tape in Twitter.

Tradesight Recap Report for 1/19/21

Overview-

Forex made a small move. Futures gapped down and closed a little lower on 6.4 billion NASDAQ shares for options expiration Friday. It was a dead day in the markets. Here's the ES with Levels to show you how bad it was:

Futures-

Futures-

+ 11.5 ticks

Opening Range plays, ES triggered short at A and worked:

NQ OR plays were too wide with too much risk to take at A and B:

Here's the ES with Market Directional:

Forex-

-25 pips

A loser in the GBPUSD. Triggered long at A and stopped:

Stocks-

Stocks-

On the stock side, not much to deal with.

COLL triggered long (without market support due to opening 5 minutes) and didn't work:

IDYA triggered long (with market support over 18.12) and worked:

Rich's GS triggered short (with market support) and didn't work:

That’s 2 triggers with market support, 1 of them worked and 1 didn't.

Tradesight Recap Report for 1/15/21

Overview-

Forex made a small move. Futures gapped down and closed a little lower on 6.4 billion NASDAQ shares for options expiration Friday.

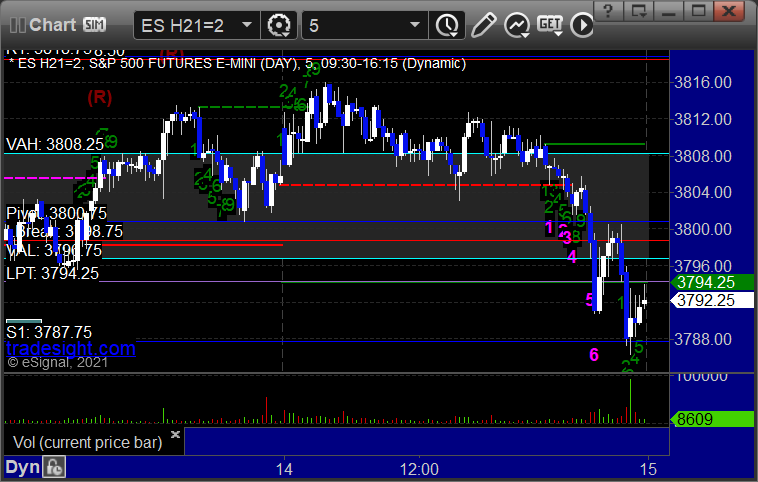

Futures-

+ 14 ticks

Opening Range plays on ES failed on the long side and worked on the short side:

NQ OR plays were too wide with too much risk to take:

NQ OR plays were too wide with too much risk to take:

Note how the Institutional Range on the ES and NQ were resistance (especially on the NQ) in the late day rally:

Note how the Institutional Range on the ES and NQ were resistance (especially on the NQ) in the late day rally:

Forex-

Forex-

+65 pips

A winner in the GBPUSD. Triggered long at A, hit first target at B, closed second half at C for end of week:

Stocks-

Stocks-

Rich’s GME triggered short (with market support) and worked:

LULU triggered short (with market support) and worked:

LULU triggered short (with market support) and worked:

Rich’s FB triggered long (without market support) and didn’t work:

Rich’s FB triggered long (without market support) and didn’t work:

That’s 2 triggers with market support, both of them worked.

That’s 2 triggers with market support, both of them worked.

Stock Picks Recap for 1/14/21

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's EOG triggered short (with market support) and didn't work:

Hiss NGA triggered short (with market support) and worked enough for a partial:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 1/14/21

The markets gapped up small, filled easily, and did nothing all day on 6.7 billion NASDAQ shares.

Net ticks: +10 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: