Tradesight Recap Report for 6/21/22

Overview

The markets gapped up and pushed higher for about 30 minutes and then that was it for the day on 4.8 billion NASDAQ shares.

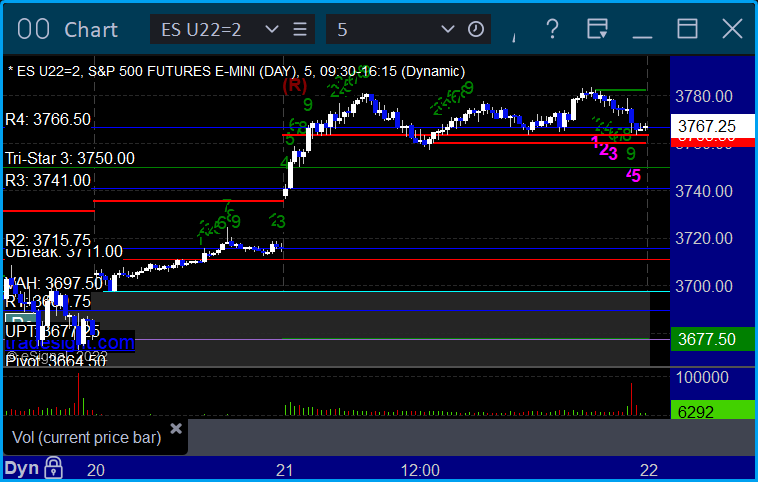

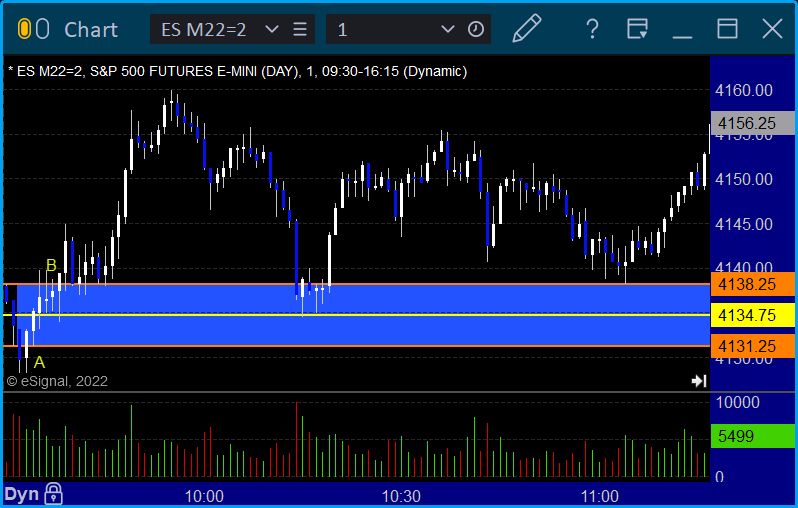

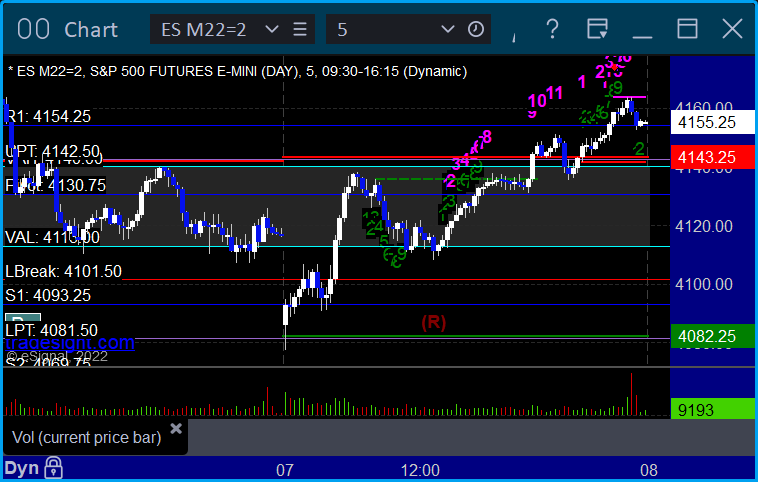

ES with Levels:

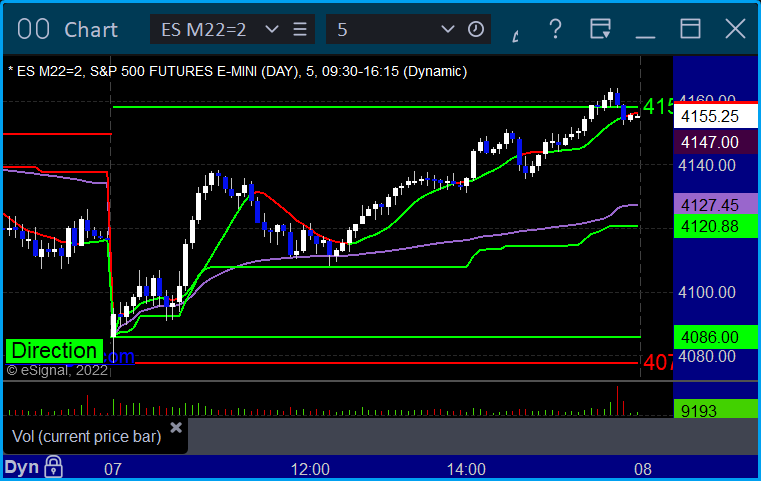

ES with Market Directional:

Futures:

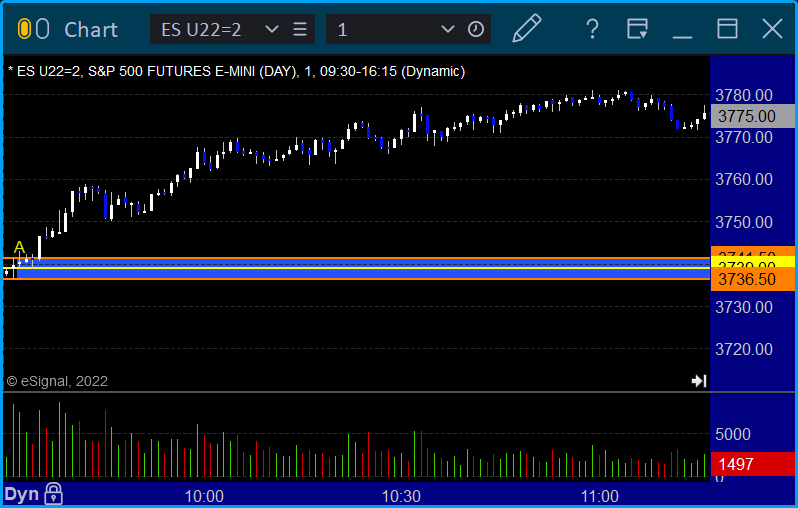

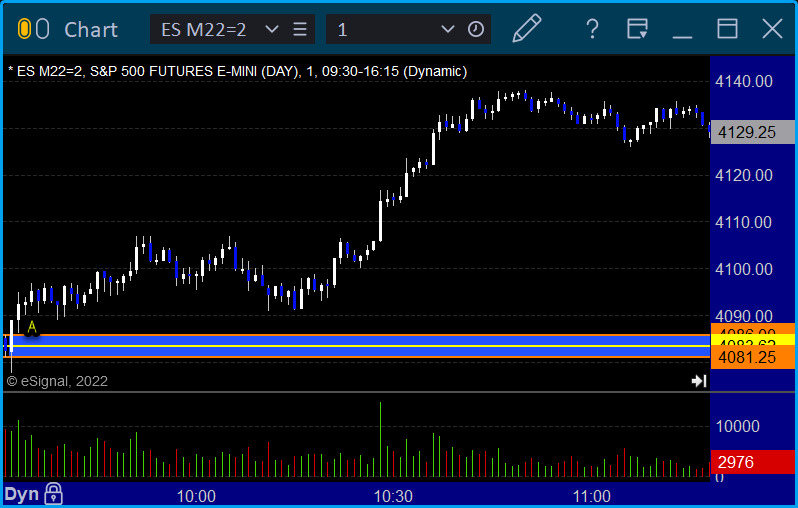

ES Opening Range Play triggered long at A but too far out of range to take:

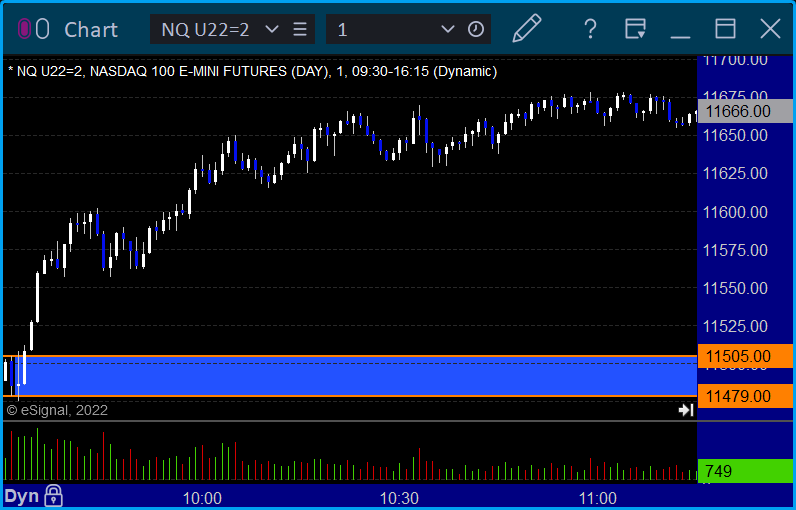

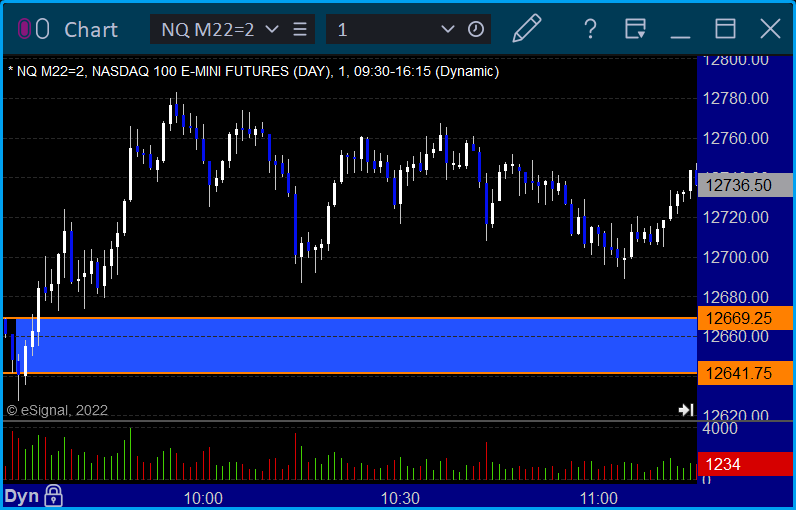

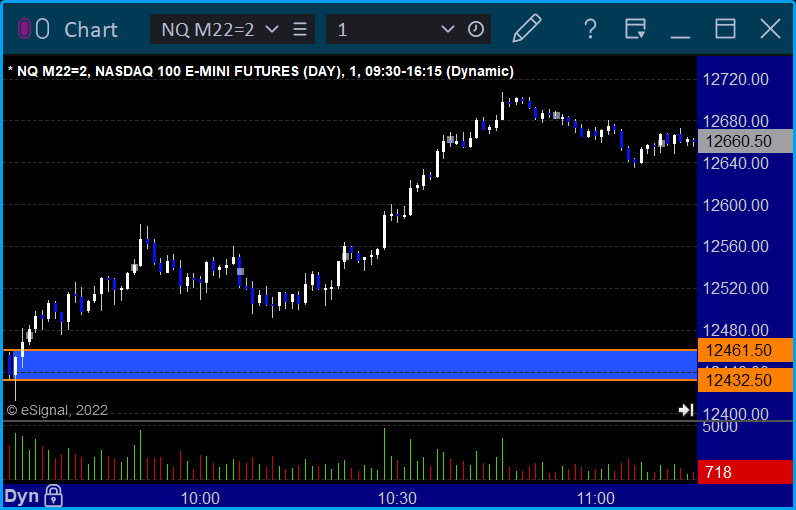

NQ Opening Range Play:

Results: +0 ticks

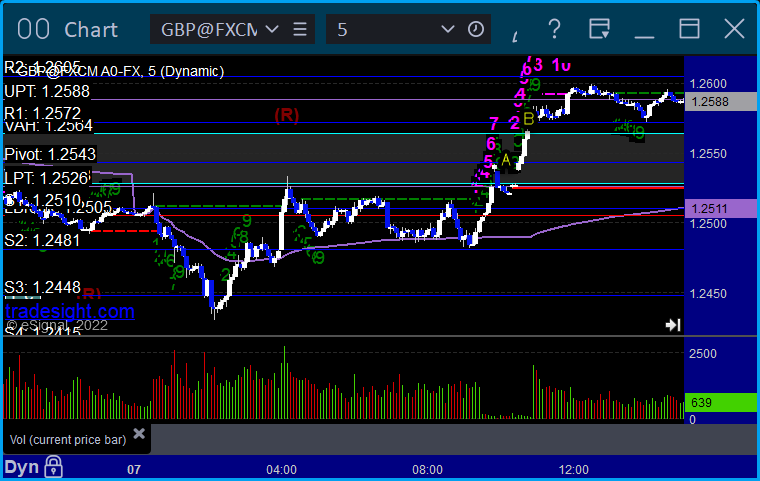

Forex:

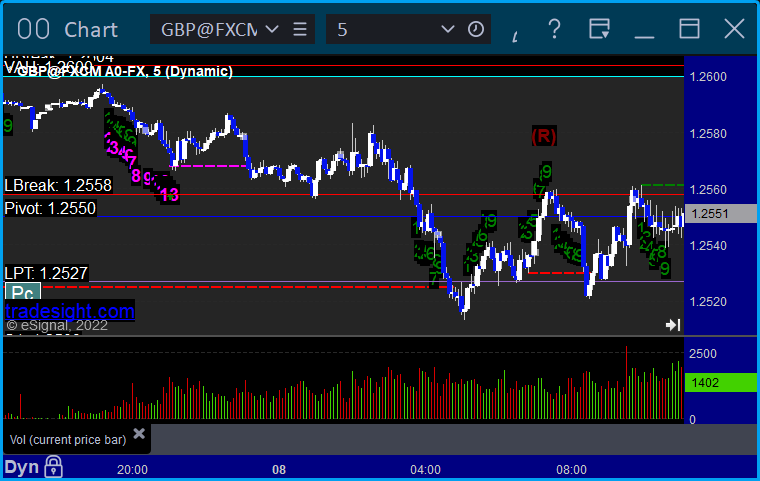

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

A decent day to start the week

From the Tradesight Plus Report, no calls.

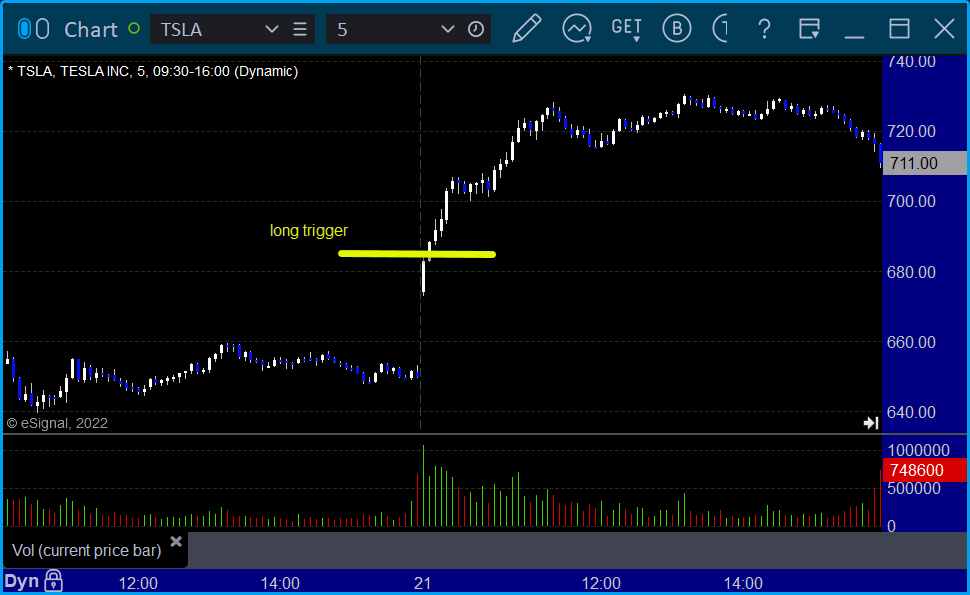

From the Tradesight Plus Twitter feed, Rich's TSLA triggered long (with market support) and worked:

EBAY triggered long (with market support) and didn't work:

Rich's META triggered long (with market support) and didn't work:

That’s 3 triggers with market support, 1 of them worked and 2 didn’t.

Tradesight Recap Report for 6/17/22

Overview

For triple expiration in June, the markets opened flat to higher, pushed up, then down, then settled into the middle of the range as is typical. The closing print on the ES at 4:15 pm EST was the midpoint exactly. NASDAQ volume was 7.4 billion shares.

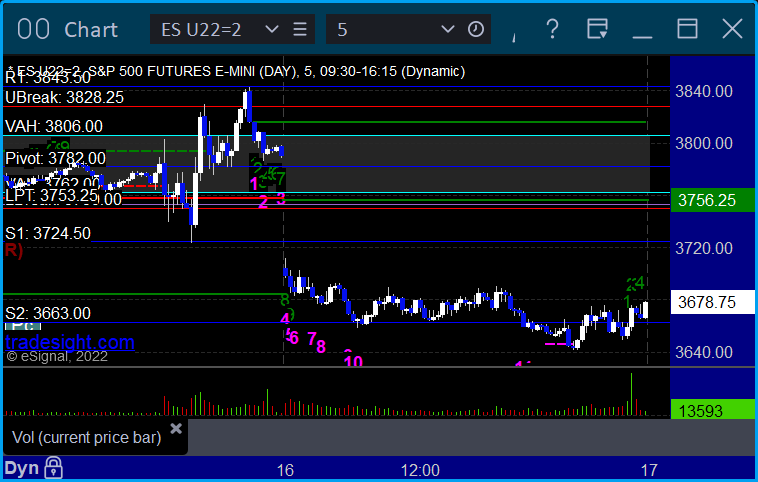

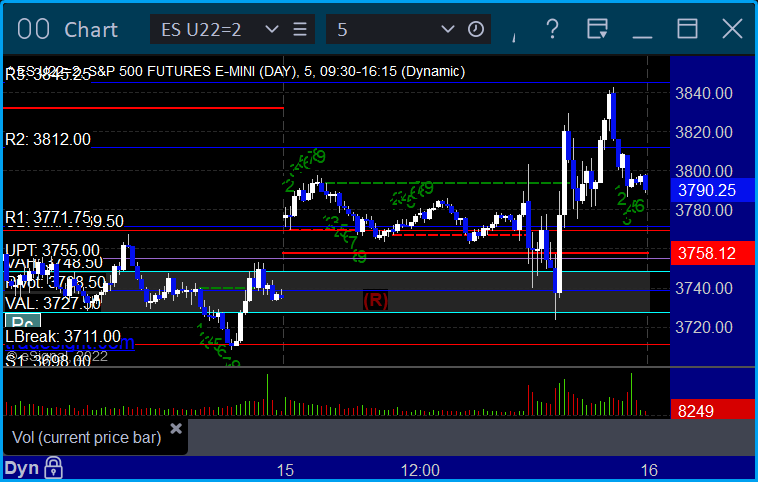

ES with Levels:

ES with Market Directional:

Futures:

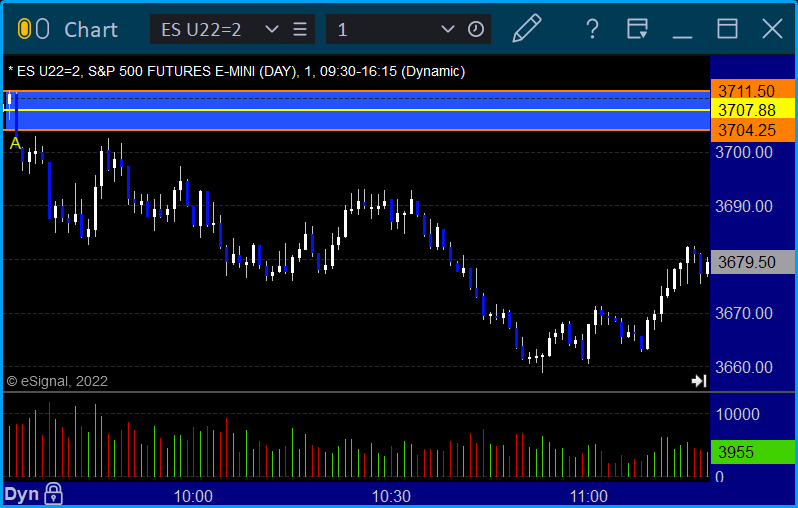

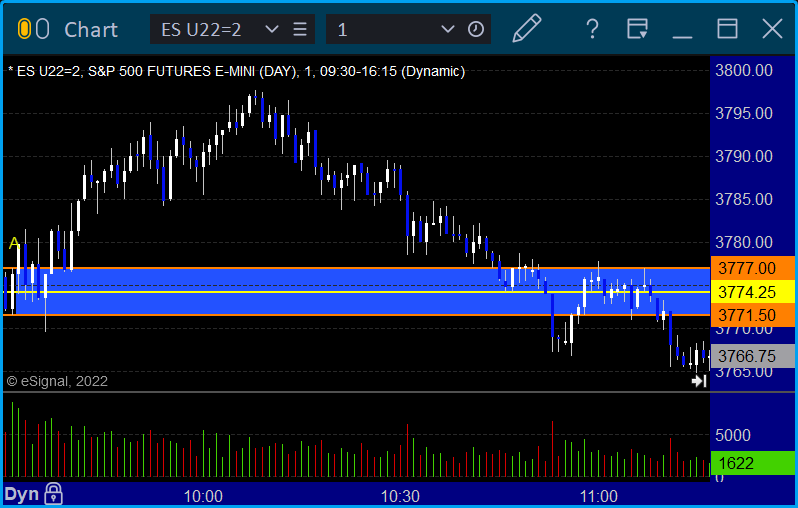

ES Opening Range Play triggered long at A and short at B, both too far out of range to take:

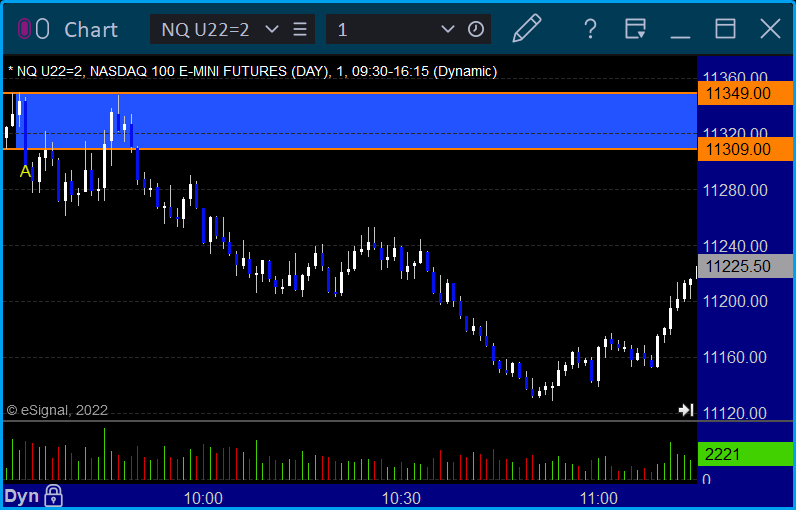

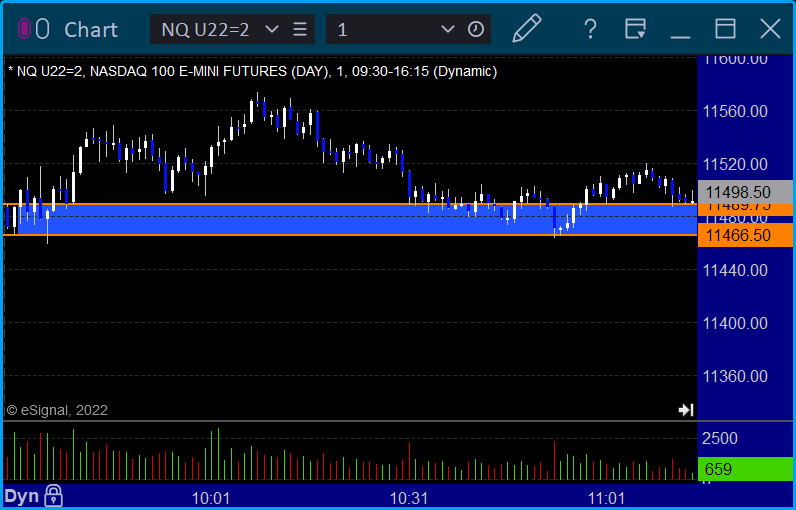

NQ Opening Range Play:

Results: +0 ticks

Forex:

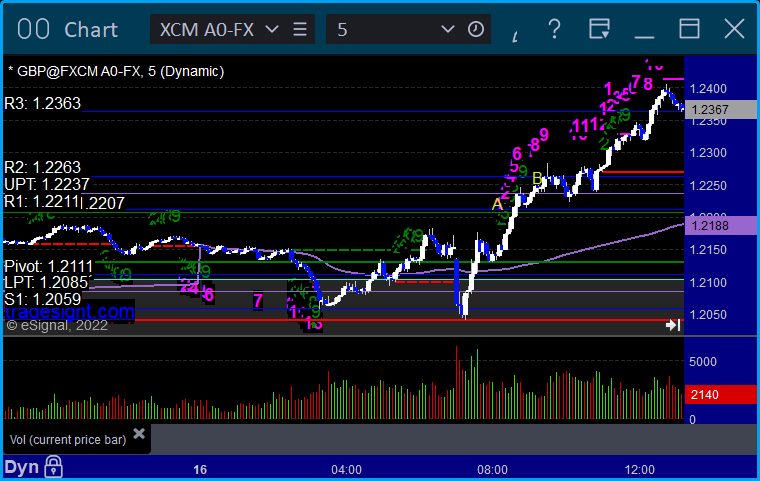

GBPUSD triggered short at A and stopped, worked later if you were around to take it again:

Results: -25 pips

Stocks:

Triple expiration is never much of a day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's FAS triggered long (ETF, so no market support needed) and worked:

His QCOM triggered short (with market support) and didn't work:

His MTCH triggered short (with market support) and didn't work:

That’s 3 triggers with market support, 1 of them worked and 2 didn’t.

Tradesight Recap Report for 6/16/22

Overview

The markets gapped down and were flat most of the day, pushed a little lower but closed just under the opening candle on 5.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD, triggered long at A, hit first target at B, still holding second half with a stop under 1.2340:

Results: Trade is not complete

Stocks:

A winner for the session but nothing else triggered as we head into triple expiration.

From the Tradesight Plus Report, no calls.

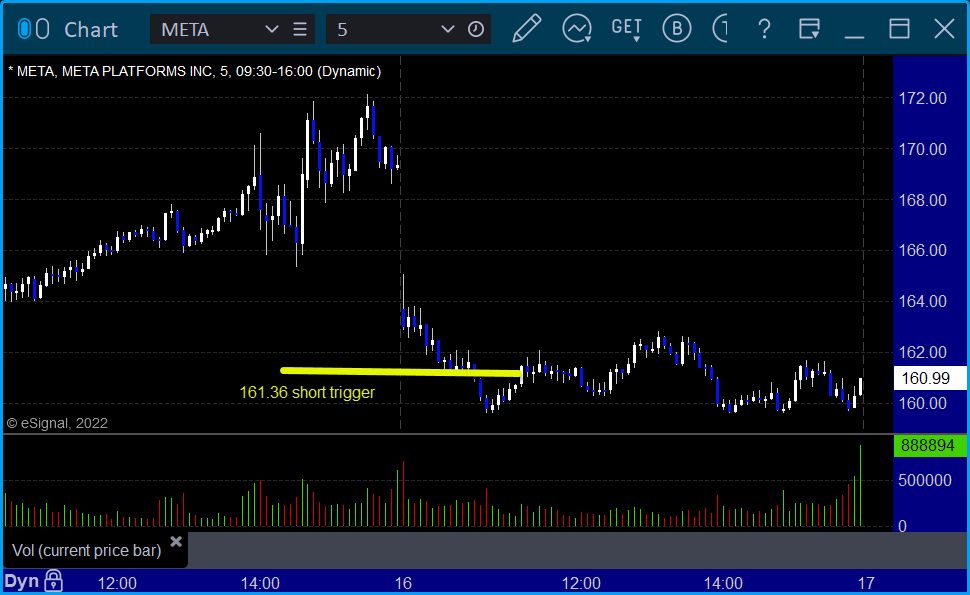

From the Tradesight Plus Twitter feed, Rich's META triggered short (with market support) and worked enough for a partial:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 6/15/22

Overview

The markets gapped up, did nothing ahead of the Fed, shook both ways on the 0.75 rate increase, filled the gap, tried to bounce, went lower, then higher, then back to where the day started, then up again, and then back on 5.3 billion NASDAQ shares. Waste of a day.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD triggered long at A, hit first target at B, stopped second half under entry:

Results: +25 pips

Stocks:

A boring day until the Fed and then a crazy day back and forth after that went nowhere.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, no real triggers. The markets were in whiplash and nothing but the Watch Ideas triggered. On to Thursday.

That’s 0 triggers with market support.

Tradesight Recap Report for 6/14/22

Overview

The markets gapped up small and filled, did nothing for most of the day, dipped late and came back to not much on 4.8 billion NASDAQ shares.

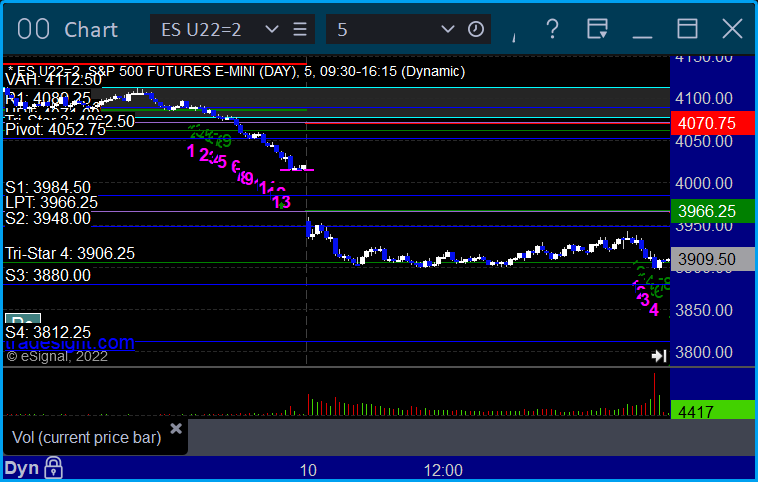

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and long at B, both too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD, no calls based on the tight levels:

Results: +0 pips

Stocks:

A boring day in the markets but another green day off of one trigger.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's SHOP triggered short (with market support) and worked enough for a partial:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 6/13/22

Overview

The markets gapped down, went lower, a bit, then came back up and closed near lows on 5.9 billion NASDAQ shares, but most of this was a gap and crypto is a mess.

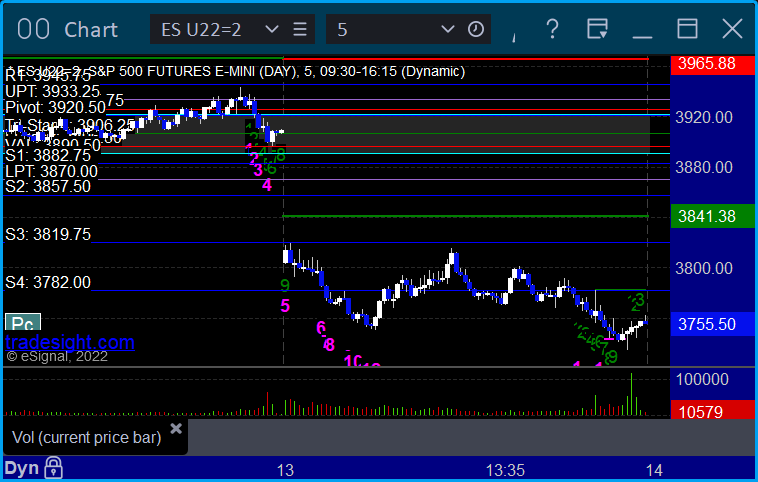

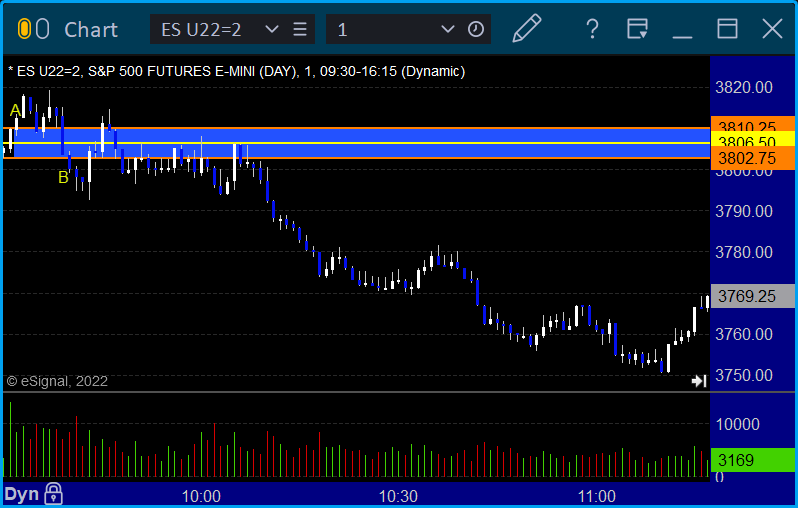

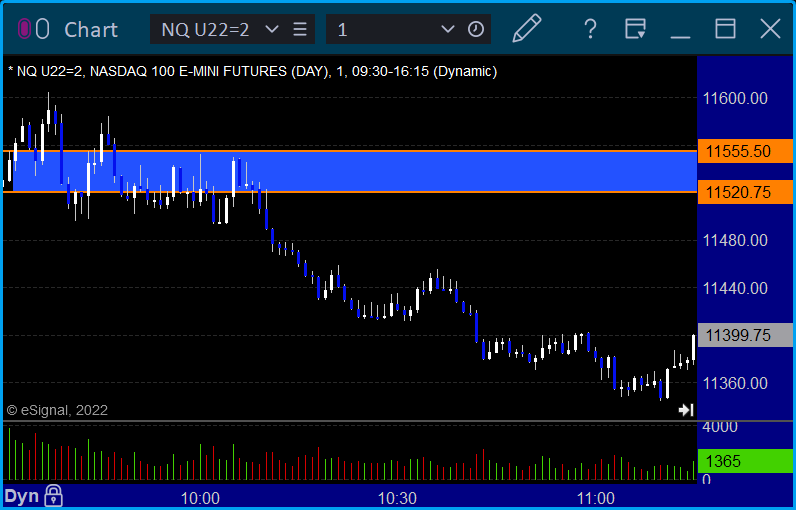

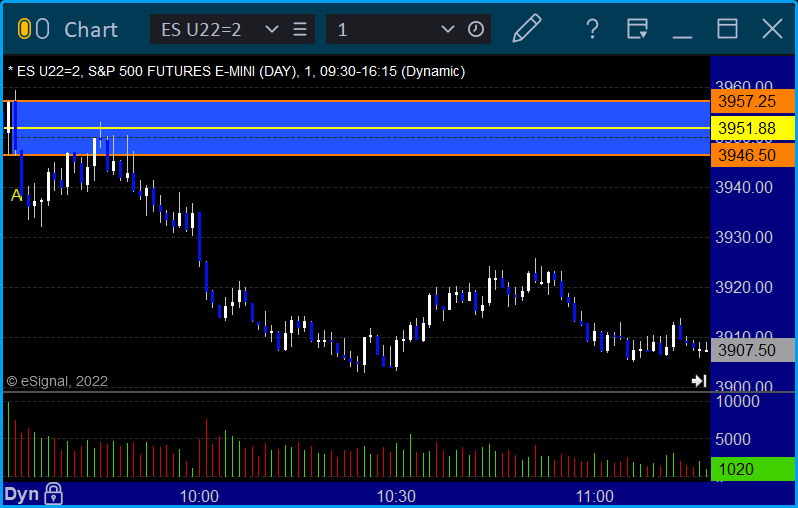

ES with Levels:

ES with Market Directional:

Futures:

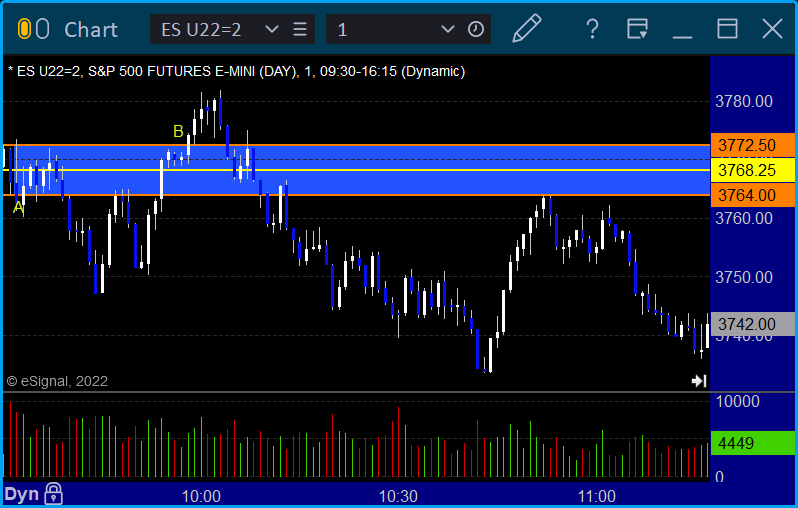

ES Opening Range Play triggered long at A and short at B, but both too far out of range to take:

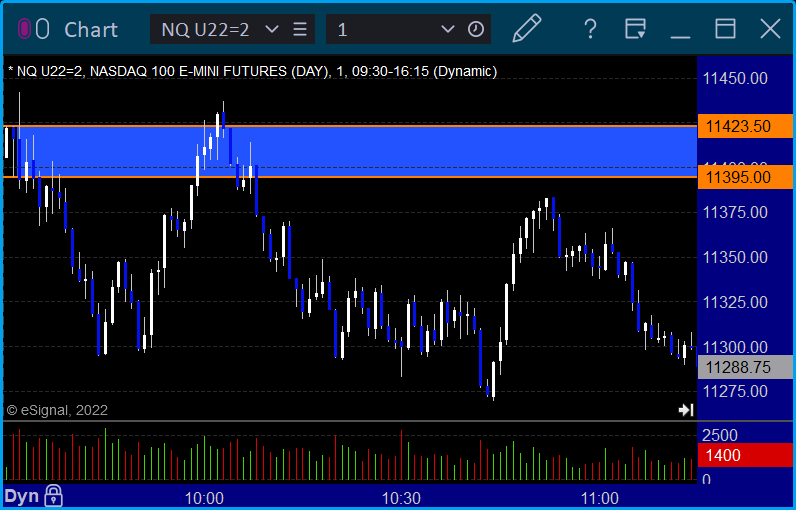

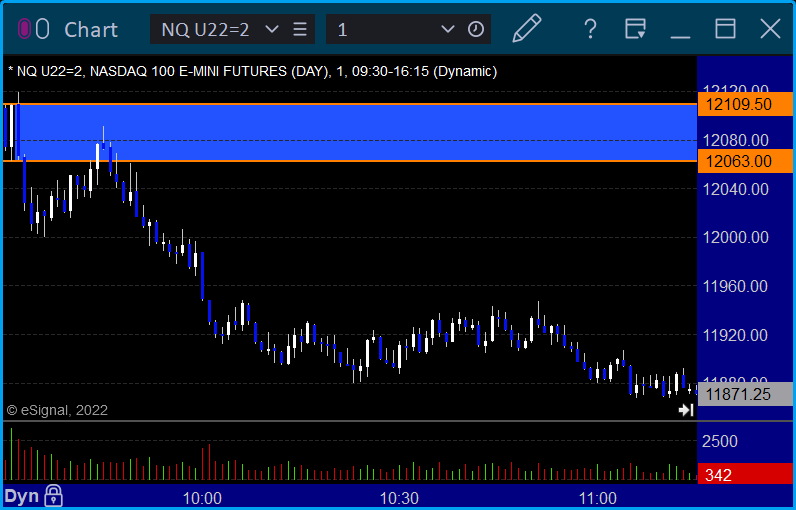

NQ Opening Range Play:

Results: +0 ticks

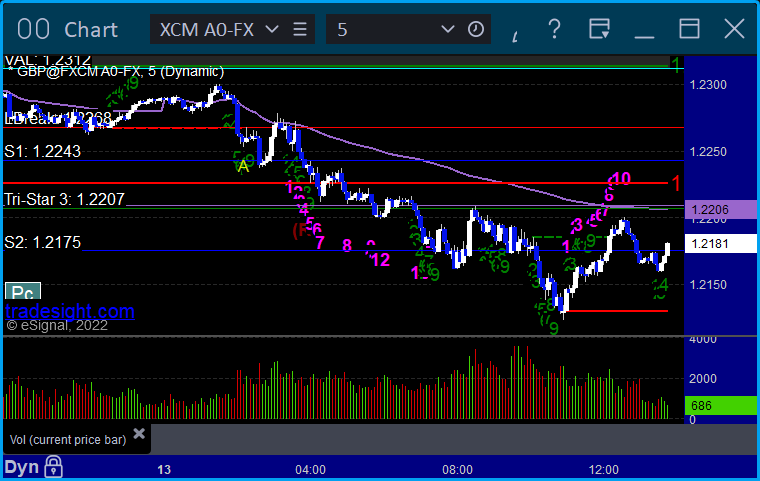

Forex:

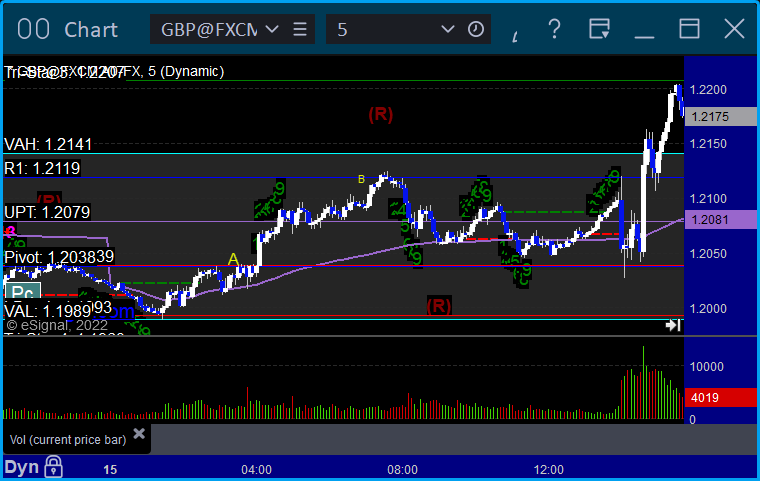

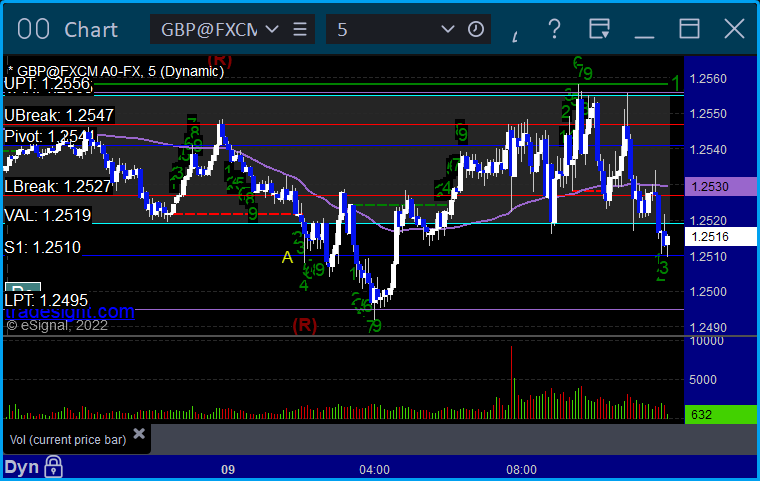

GBPUSD triggered short at A and stopped but worked later:

Results: -25 pips

Stocks:

A green day off of one nice trigger.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's ERX triggered short (ETF, so no market support needed) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 6/10/22

Overview

The market gapped down, went a little lower, but then went dead flat all day for futures contract roll on 4.2 billion NASDAQ shares.

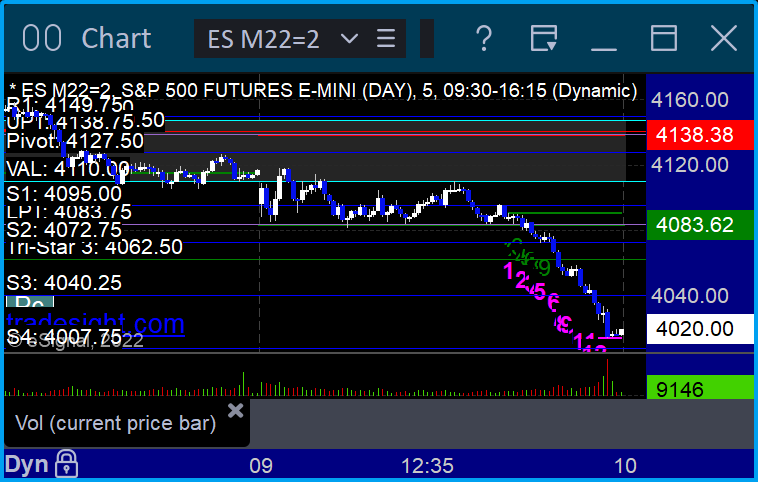

ES with Levels:

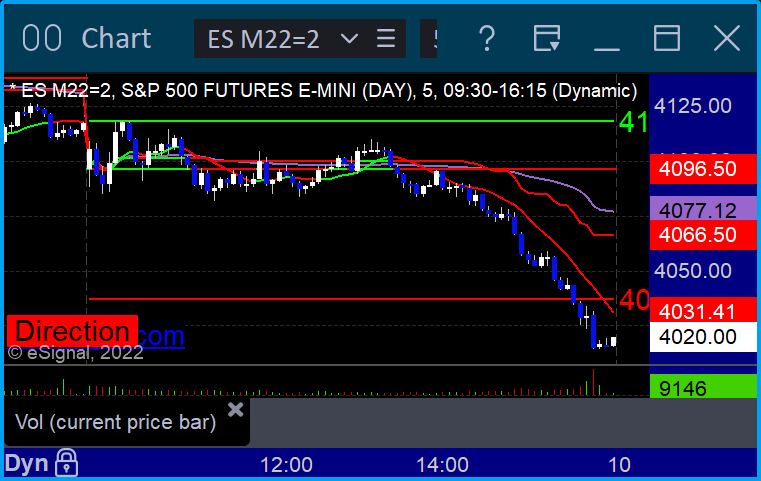

ES with Market Directional:

Futures:

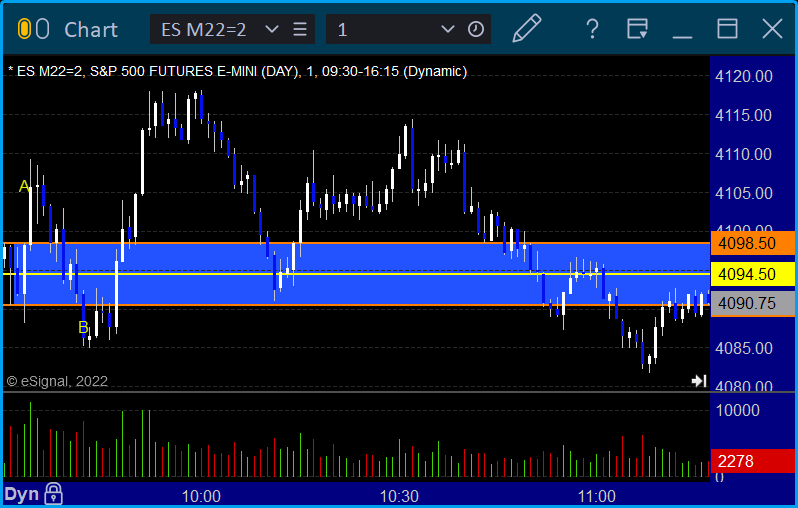

ES Opening Range Play triggered short at A but too far out of range to take:

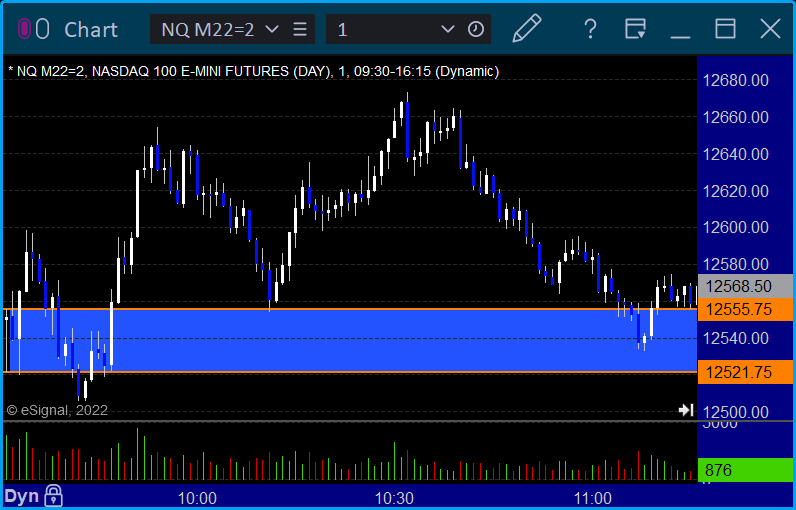

NQ Opening Range Play:

Results: +0 ticks

Forex:

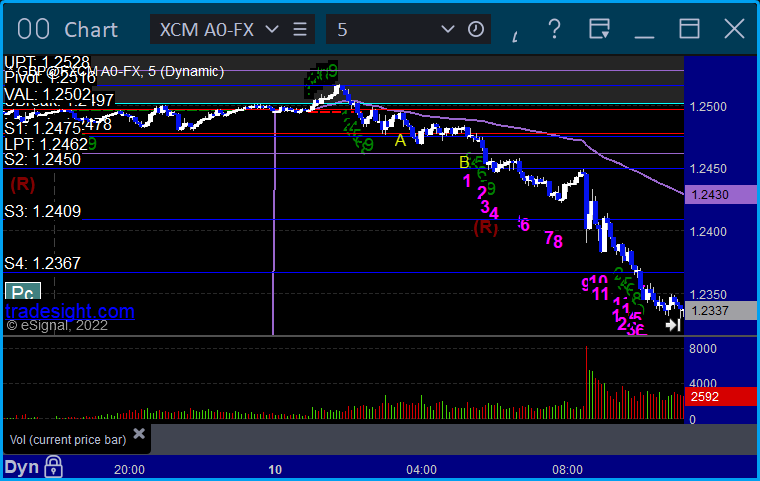

GBPUSD triggered short at A, hit first target at B, closed second half for end of week:

Results: +80 pips

Stocks:

A green day with just two triggers.

From the Tradesight Plus Report, no calls.

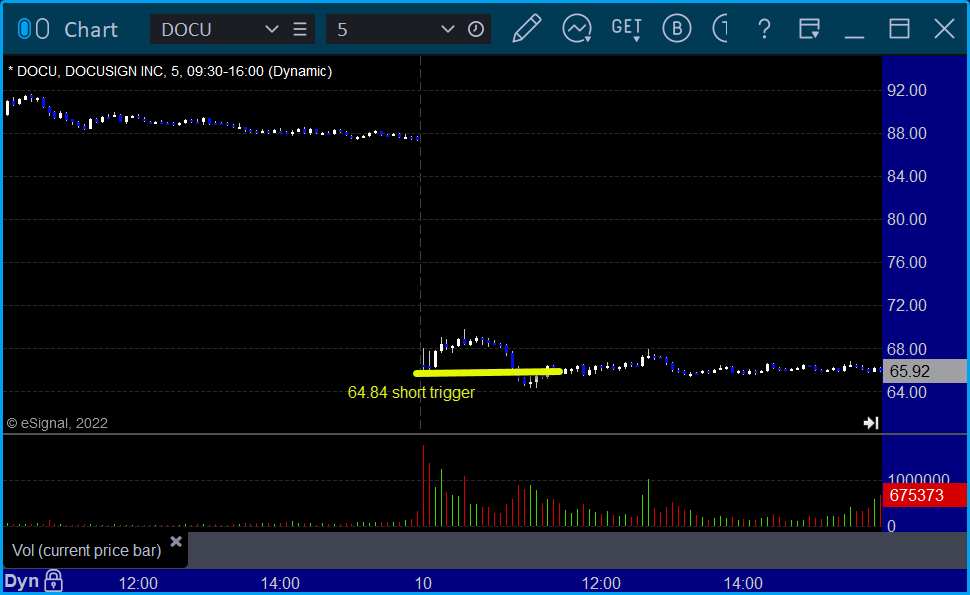

From the Tradesight Plus Twitter feed, Rich's DOCU triggered short (with market support) and worked:

His META triggered short (with market support) and worked enough for a partial:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 6/9/22

Overview

The markets gapped down a little, filled, went dead flat for hours, and then dropped in the afternoon on 4.7 billion NASDAQ shares.

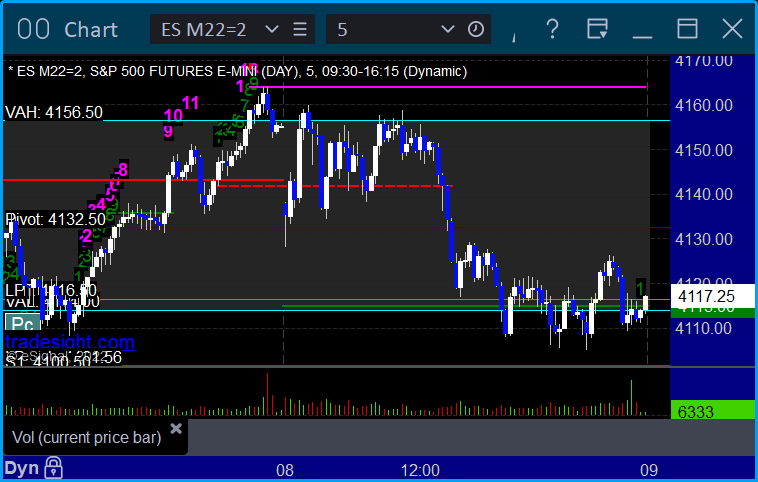

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and short at B, both too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

A green day.

From the Tradesight Plus Report, no calls.

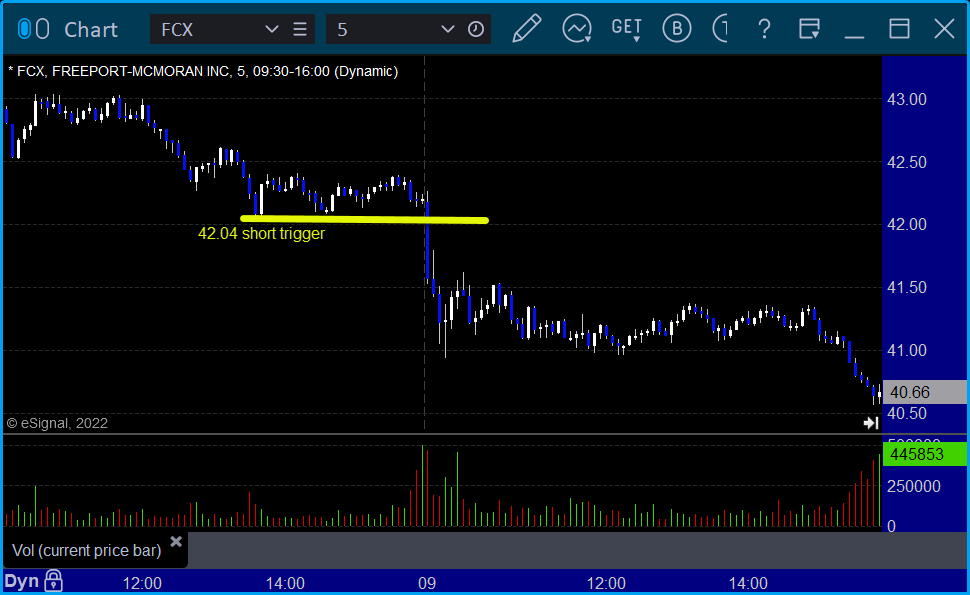

From the Tradesight Plus Twitter feed, Rich's FCX triggered short (without market support due to opening 5 minutes) and worked:

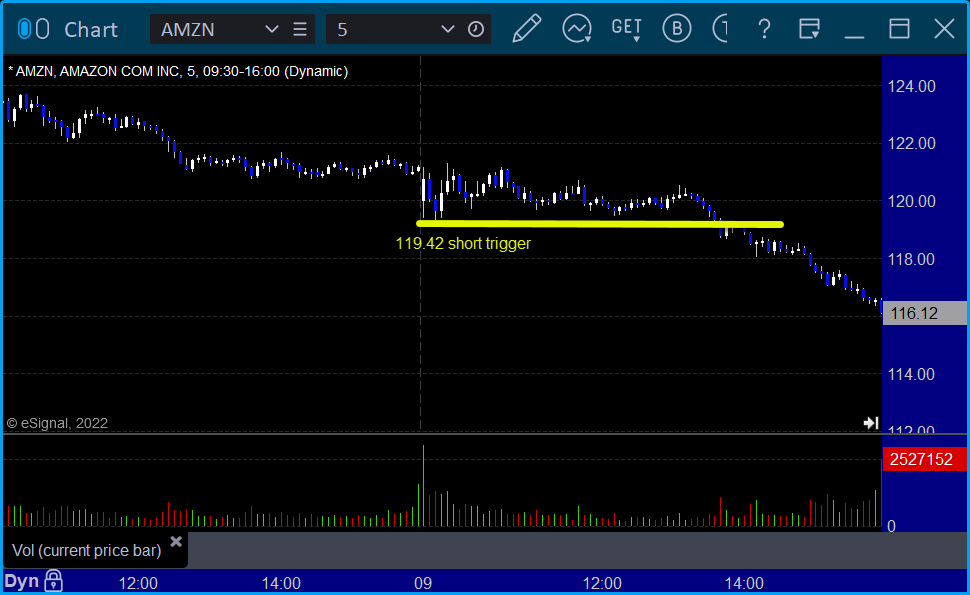

His AMZN triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 6/8/22

Overview

The markets gapped down, filled, went dead flat again for hours (still inside the range of the last two weeks), dipped over lunch a little, and that was it on 4.7 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play:

NQ Opening Range Play:

Results: ticks

Forex:

GBPUSD:

Results: pips

Stocks:

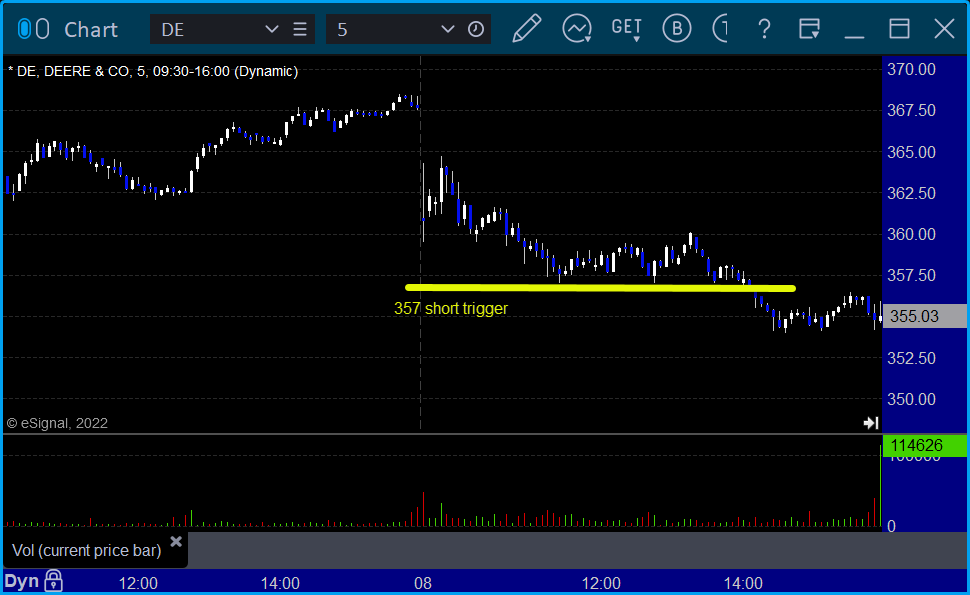

No much of a day again, just slightly green.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's MRNA gapped over, no play.

His OSTK triggered long (with market support) and didn't work:

His AMAT triggered short (with market support) and worked:

His DE triggered short (with market support) and worked a little:

That’s 3 triggers with market support, 2 of them worked and 1 didn’t.

Tradesight Recap Report for 6/7/22

Overview

The markets gapped down, filled, and then rallied after lunch on 4.3 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex

A new winner for the session

GBPUSD triggered long at A, hit first targets at B, still holding second half with a stop under R1:

Results: Trade is still going

Stocks:

Another slow day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's NOC was the only trigger and it went in the last 10 minutes of the day.

That’s 0 triggers with market support.