Tradesight October 2020 Futures Results

Before we get to October's numbers, here is a short reminder of the results from September. The full report from September can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for September 2020

Number of trades: 24

Number of losers: 6

Winning percentage: 75%

Net ticks: +40 ticks

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Twitter feed exactly as we call them and manage them as well as the Opening Range plays under the basic strategy we teach for those in our course. We do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Twitter calls.

It is important to note that these results do not include the Tradesight Value Area or Institutional Range plays, all of which have been working quite well on their own.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for October 2020

Number of trades: 26

Number of losers: 8

Winning percentage: 69.2%

Net ticks: +47.5 ticks

An interesting month. We had several days where the Opening Range triggered too far out of range to take. Keep in mind that we aren't tracking the Value Areas in these numbers, or the PT plays, etc.

Stock Picks Recap for 12/11/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SOHU triggered short (without market support) and did nothing either way:

From the Messenger/Tradesight_st Twitter Feed, Rich's ETSY triggered long (with market support) and worked:

His ROKU triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

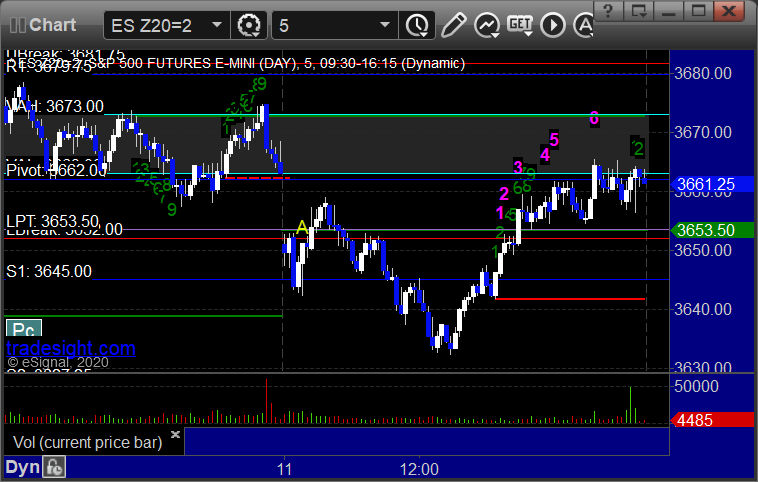

Futures Calls Recap for 12/11/20

The markets gapped down and waited until basically the end of the day to fill on 4.2 billion NASDAQ shares.

Net ticks: +12.5 ticks.

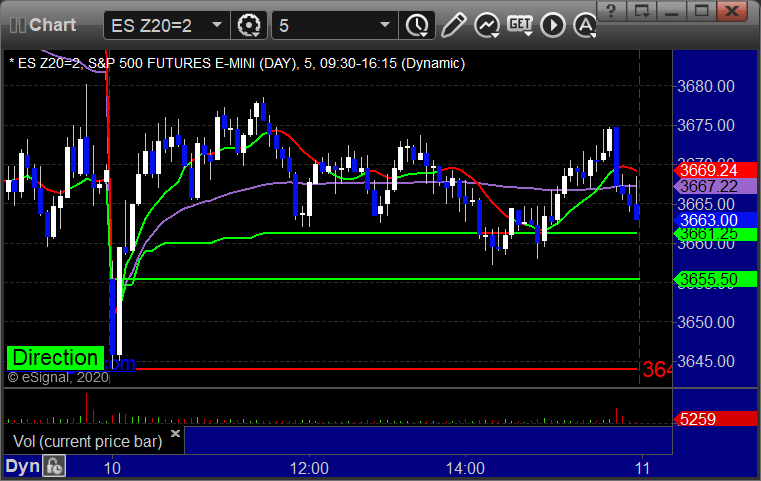

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

NQ Opening Range Play, both too far out or range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered long at A, hit first target for 8 ticks, stopped second half under the entry:

Forex Calls Recap for 12/11/20

A winner to end the week. See GBPUSD section below.

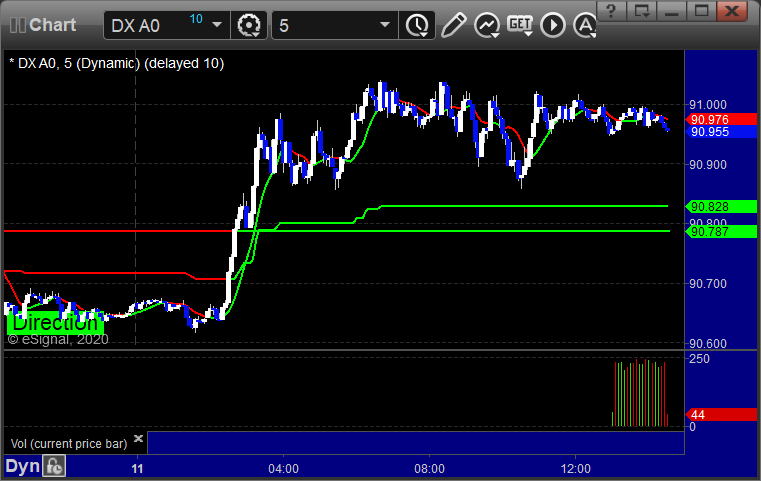

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

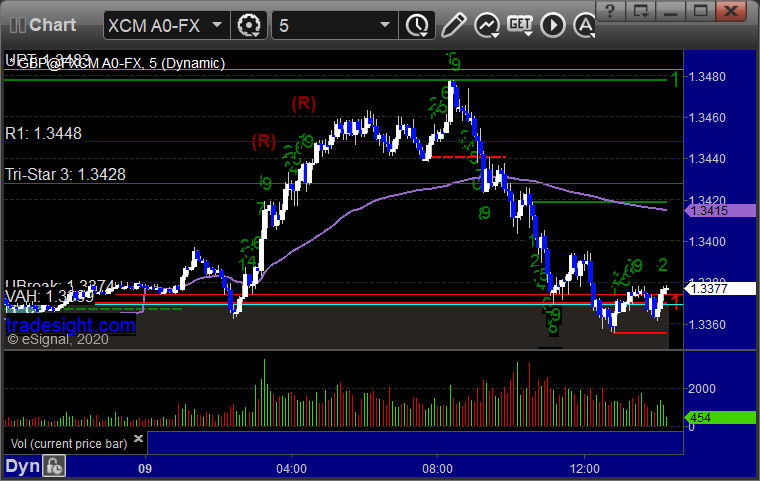

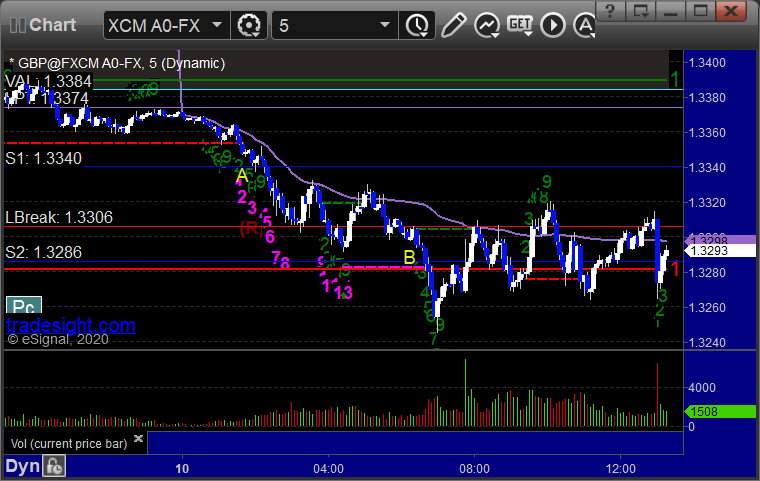

GBPUSD:

Triggered short at A, hit first target at B, second half stopped in the money at C:

Stock Picks Recap for 12/10/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, SFIX triggered long (with market support) and worked:

Rich's TSLA triggered long (without market support due to opening 5 minutes) and worked:

His NVDA triggered long (with market support) and worked:

His AAPL triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, all of them worked.

Futures Calls Recap for 12/10/20

The markets gapped down, filled the gaps, and went dead flat all day again on 4.5 billion NASDAQ shares.

Net ticks: +5.5 ticks.

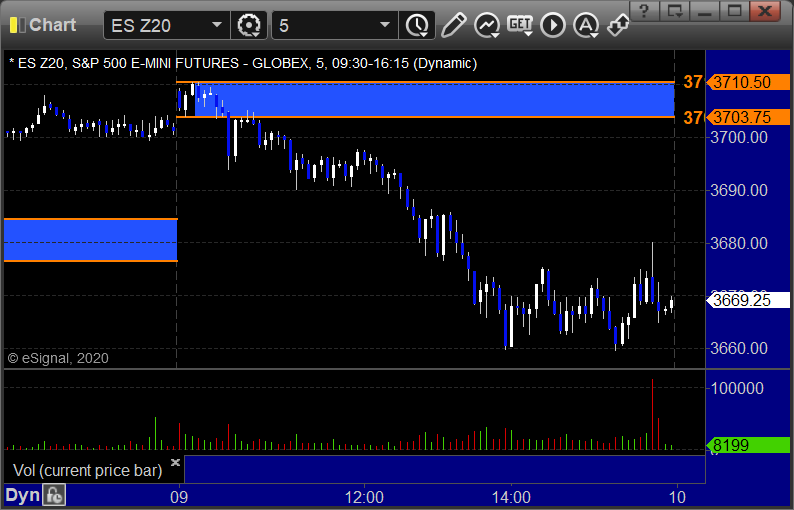

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A but too far out of range to take, triggered long at B and worked:

NQ Opening Range Play:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

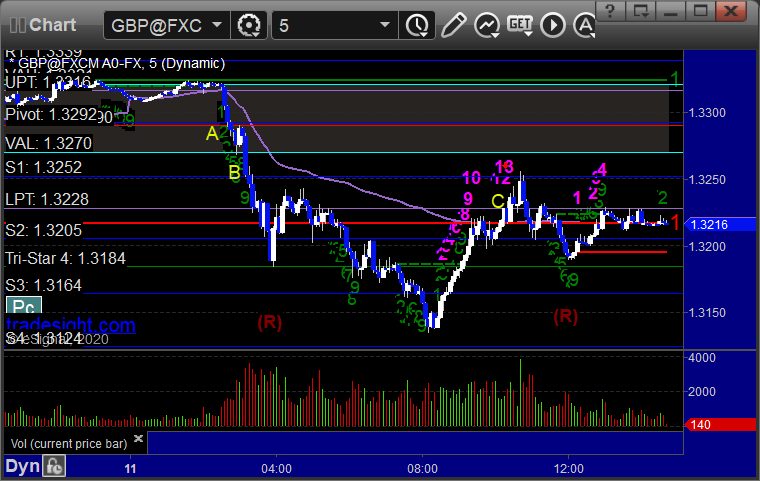

Forex Calls Recap for 12/10/20

A winner (still going) in the GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over S1:

Stock Picks Recap for 12/9/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GRPN triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's BYND triggered long (without market support) and worked enough for a partial:

ZM triggered short (with market support) and didn't work, worked later:

Rich's PDD triggered short (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

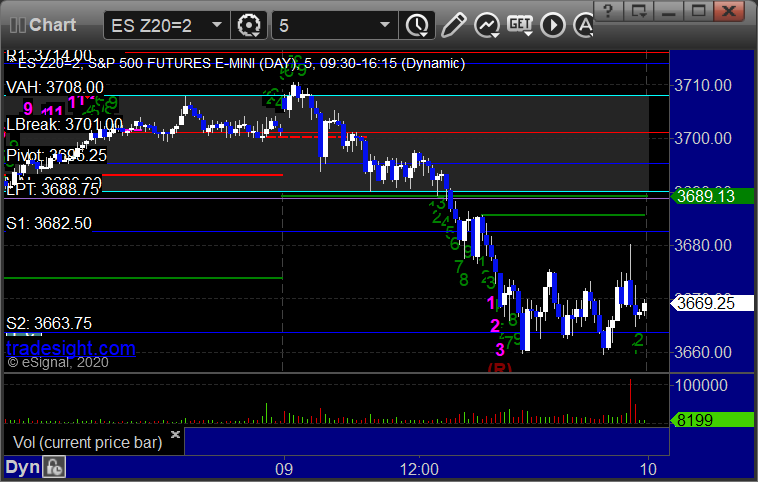

Futures Calls Recap for 12/09/20

The markets basically opened flat and did not much for 90 minutes, filled the gap, then sold off hard over lunch and then went flat for the last 2 hours on 5.1 billion NASDAQ shares.

Net ticks: -42 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and stopped:

NQ Opening Range Play triggered short at A but too far out of range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 12/09/20

No calls for the session.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD: