Forex Calls Recap for 8/7/18

A dull session with a stop out, plus we stopped out of the prior day's trade in the money. See GBPUSD below.

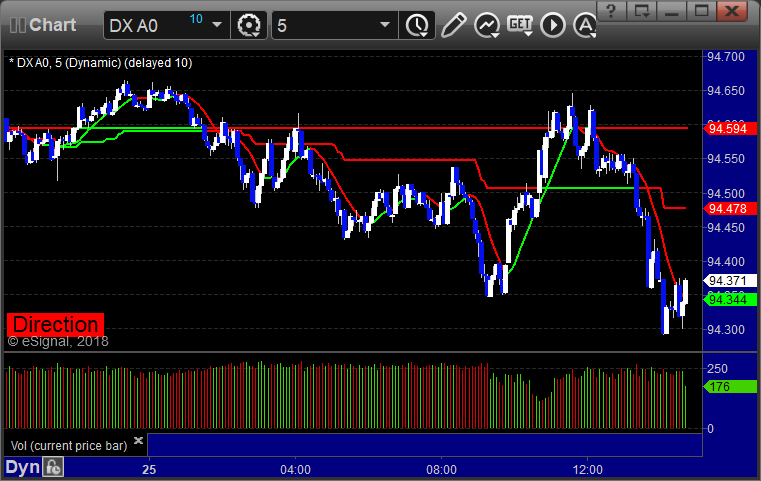

Here's a look at the US Dollar Index intraday with our market directional lines:

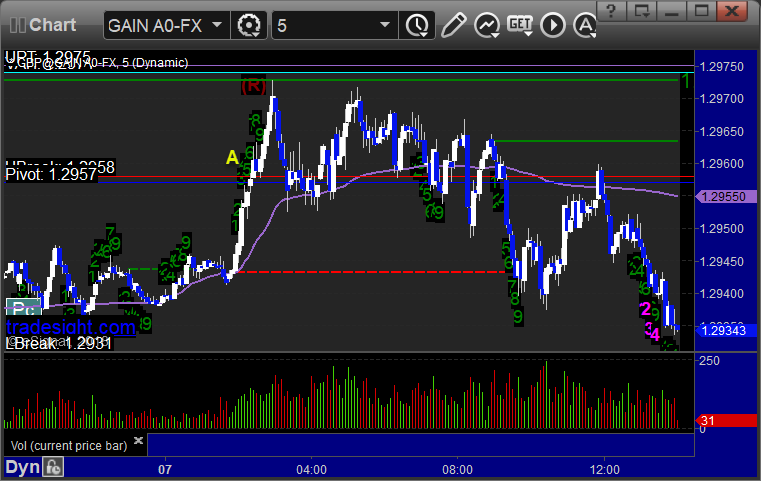

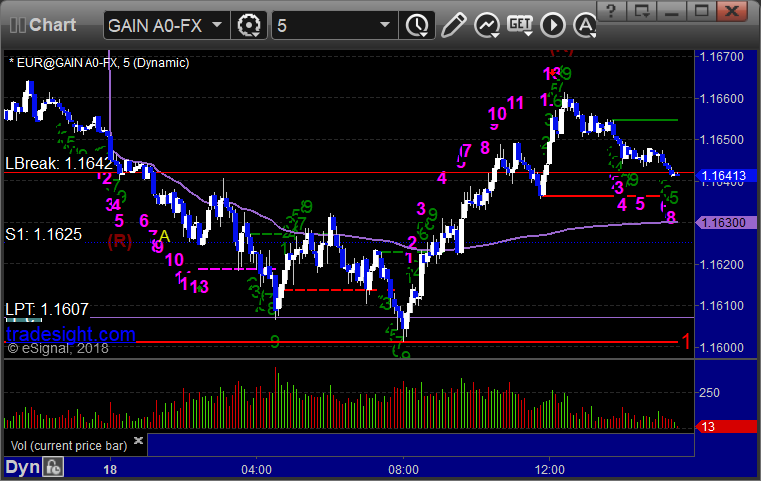

GBPUSD:

Triggered long at A and stopped:

Forex Calls Recap for 7/27/18

Again, nothing triggered for the session in a dead Friday in the summer.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

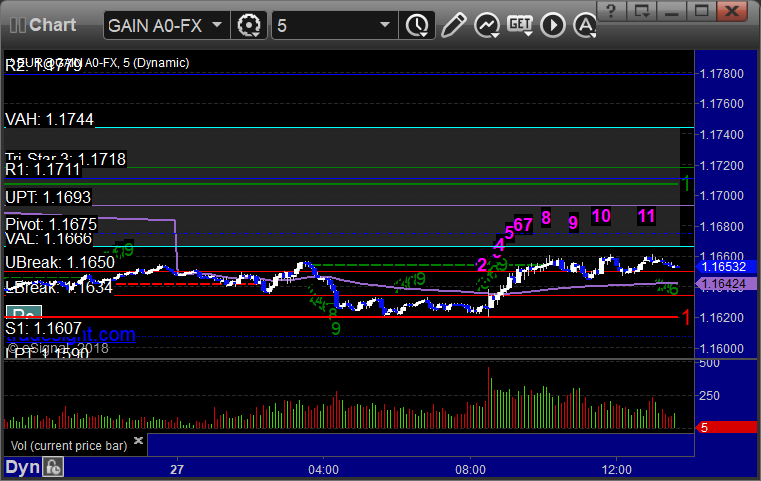

EURUSD:

Forex Calls Recap for 7/25/18

We came into the session long GBPUSD, but nothing new triggered. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

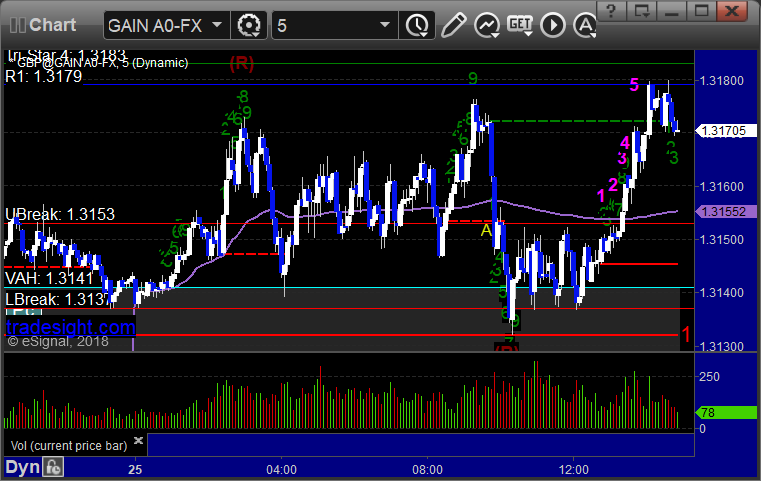

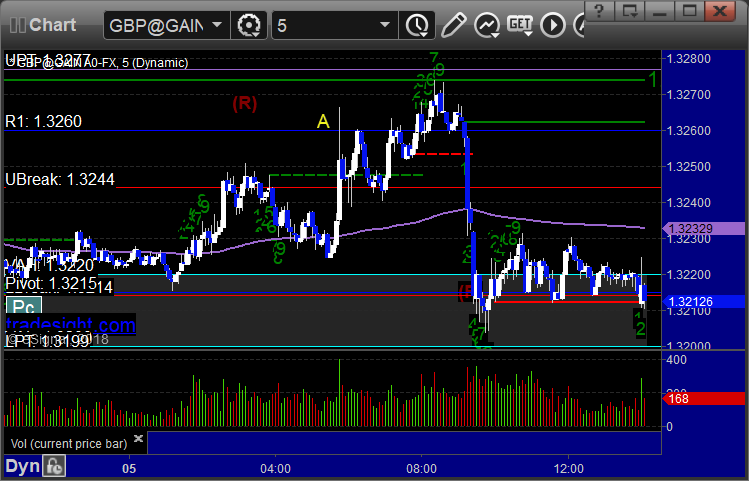

GBPUSD:

Came into the session long the second half of the GBPUSD from the prior day. No new triggers, but we raised the stop on that in the morning and stopped at A:

Forex Calls Recap for 7/18/18

A dead session again. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and stopped:

Tradesight May 2018 Forex Results

Before we get to May’s numbers, here is a short reminder of the results from April. The full report from April can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for April 2018

Number of trades: 21

Number of losers: 9

Winning percentage: 57.1%

Worst losing streak: 5 in a row

Net pips: +35 pips

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for May 2018

Number of trades: 25

Number of losers: 14

Winning percentage: 44%

Worst losing streak: 3 in a row

Net pips: -25 pips

Markets have been flat, and this pretty much shows it. Still, nice when the win ratio is only 44% (which is rare) that we only lose 25 pips. Moving forward...

Forex Calls Recap for 7/5/18

A boring session with a stop out on the GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped:

Forex Calls Recap for 4/30/18

A winner (still going) in the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

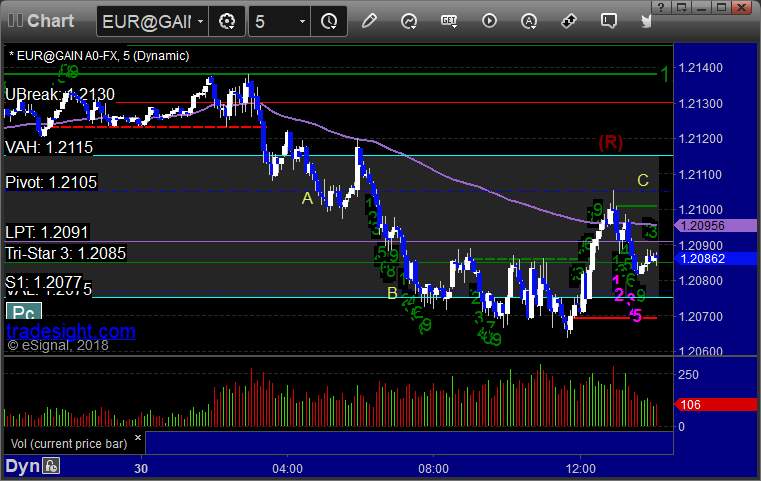

EURUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over Pivot at C:

Forex Calls Recap for 11/29/17

A double stop out, although just barely on the second one. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. Triggered long again at B, but stopped on a single candle spike at C before proceeding straight to our first target at the UPT. Oh well, it happens:

Tradesight 2016 Stock Results

We post our daily results. You can access any of our systems through a 2-week free trial to make sure that we are honestly reporting the trades and what happened. We publish our daily results both privately and publicly for anyone to review.

Click here for the daily Stock daily recaps going back in time.

Click here for the monthly tallies of the net gains/losses and breakdown of winners and losers.

So this post is designed to easily summarize those results for 2016.

Total number of Stock trades that triggered: 1038

Big Losers: None

Small Losers: 271 (26.1%)

Small Winners: 372 (35.8%)

Big Winners: 395 (38.1%)

Winning percentage: 73.9%, which is outstanding and above our target range of 60-70%.

This is just a phenomenal year. No other way to look at it. We had one negative month, and we kept our win/loss ratio close to the ideal level and kept our losers tight. This is what we do at Tradesight, and the track record has been there day-by-day.

Tradesight 2016 Futures Results

We post our daily results. You can access any of our systems through a 2-week free trial to make sure that we are honestly reporting the trades and what happened. All of our results are archived both publicly and privately for review and validation.

Click here for the daily Futures daily recaps going back in time.

Click here for the monthly tallies of the net gains/losses and breakdown of winners and losers.

So this post is designed to easily summarize those results for 2016.

Total number of Futures trade calls that triggered in 2016: 740

Winners: 467

Losers: 243

Winning percentage: 63.1%, which is a little light but still near our target range of 65% for futures. However, our system should account for this because we keep the losers tight.

Net tick gains or losses for the year: +1440.5 ticks. That means that with a $10,000 account, trading 2 contracts of all trades, you would have made over $28,000, and this scales to any trade size you want.

We had one negative month, and we kept our win/loss ratio close to the ideal level and kept our losers tight. This is what we do at Tradesight, and the track record has been there day-by-day. These results are only part of the trading system of Tradesight, but counts all of our primary trade calls and Opening Range plays. It does not include Institutional Range plays, Value Area Plays, additional setups, and the Seeker/Comber trades, all of which should only add to your results.