Tradesight 2016 Forex Results

We post our daily results. You can access any of our systems through a 2-week free trial to make sure that we are honestly reporting the trades and what happened. Everything we do is archived for review and validation both publicly and privately.

Click here for the daily Forex daily recaps going back in time.

Click here for the monthly tallies of the net gains/losses and breakdown of winners and losers.

So this post is designed to easily summarize those results for 2016.

Total number of official Forex trade calls that triggered in 2016: 319

Winners: 169

Losers: 150

Winning percentage: 52.9%, which is a little light but still near our target range of 55-60%. However, our system should account for this because we keep the losers tight.

Net pip gains or losses for the year: +2940 pips.

This is just a phenomenal year. No other way to look at it. We had one negative month, and we kept our win/loss ratio close to the ideal level and kept our losers tight. This is how you trade Forex. We even benefited from Brexit with a nice winner that night. Looking forward to 2017. We will have a broader "all markets" review posted in the next week, but I just wanted to summarize the data here.

Tradesight December 2016 Stock Results

Tradesight has been providing stock calls daily since 2002. We post the results of our of our trades, winners and losers, in our reports and Market Blog every day. Some people might find it surprising to learn that while we track our Futures and Forex formal trade call results monthly, we don’t post anything beyond the trade reviews on our Stocks calls.

There is actually a very specific reason for this. I’ve never been a fan of trying to “hype” or “promote” something. Being profitable in trading is about learning what to do and getting yourself to make the right decisions. In Futures as well as in Forex, if we publish a call in advance, just about everyone should get the same fills and be able to get in and out at almost the same numbers. That isn’t always the case in stocks. It depends on how many shares you are trading and what the liquidity in the market for that stock is at the time. For that reason, I have already been hesitant to say “These are the exact results.” I would never want to try to suggest that someone would make a certain amount of dollars trading a certain number of shares or make a certain percentage. If I take a trade and sell it for a $0.30 gain, it makes a big statistical difference if someone else had to pay $0.05 more to get in and maybe got out for $0.02 less. That’s $0.23 instead of $0.30 even though the concept of the trade was fine.

However, after many requests, in October 2015, we started posting our results. You can see these monthly here.

In our system, you can basically break trades down into four categories: Big losers, small losers, small winners, and big winners.

In order to have any chance of succeeding in the markets, you have to have a system. There is no other way around it. I’ve been trading for 20 years now, and I’ve trained over 1000 people. You don’t make money if you don’t have a technically valid system for entry and exits.

Of the four categories of trades listed above, we simply don’t allow any of the first category, which is big losers. We always have a worst-case stop and we always stick to it. There should never be a scenario where you are still in a trade that is causing a significant loss if you follow our rules.

In terms of the other three categories, generally speaking, if you have about a third of your trades fall into each category, you should be making good money. In other words, if we have about 33% of our trades as small losers and 33% of trades as small winners, those basically would offset. That leaves the other 33% of so only as bigger winners, and that’s what we are here for. In our world, we count a loser as a trade that stops out (stops in our system are based on the price-level of the stock). We count a small winner as a trade that goes enough to make a partial and then either stops the second half of the trade under the entry or stops the second half of the trade slightly in the money, but no more than the partial was or so. Then the big winners are anything that keeps going beyond the partial.

So these were the results for November, which you can view here.

Tradesight Stock Results for November 2016

Number of trade calls that triggered with market support: 74

Number (and percent of total) of small losers: 17 (23.0%)

Number (and percent of total) of small winners: 33 (44.6%)

Number (and percent of total) of big winners: 24 (32.4%)

And for November?

Tradesight Stock Results for December 2016

Number of trade calls that triggered with market support: 54

Number (and percent of total) of small losers: 17 (31.4%)

Number (and percent of total) of small winners: 16 (29.6%)

Number (and percent of total) of big winners: 21 (38.8%)

Obviously, we had less trades trigger in December, especially in the last week and a half when the Holiday environment kicks in, and that's normal, but we still had about the desired win/loss ratio.

Tradesight December 2016 Futures Results

Before we get to December’s numbers, here is a short reminder of the results from November. The full report from November can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for November 2016

Number of trades: 57

Number of losers: 23

Winning percentage: 59.6%

Net ticks: +40 ticks

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Twitter feed exactly as we call them and manage them as well as the Opening Range plays under the basic strategy we teach for those in our course. We do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Twitter calls.

It is important to note that these results do not include the Tradesight Value Area or Institutional Range plays, all of which have been working quite well on their own.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for December 2016

Number of trades: 50

Number of losers: 14

Winning percentage: 72%

Net ticks: +192.5 ticks

What a great close out to 2016! The Opening Range plays alone paid the bills, including in the boring last week of the year, which saw light volume and poor stock action, but great futures trading. On to 2017...

Tradesight December 2016 Forex Results

Before we get to December’s numbers, here is a short reminder of the results from November. The full report from November can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for November 2016

Number of trades: 24

Number of losers: 8

Winning percentage: 66.7%

Worst losing streak: 2 in a row

Net pips: +305 pips

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for December 2016

Number of trades: 23

Number of losers: 9

Winning percentage: 60.9%

Worst losing streak: 2 in a row

Net pips: +265 pips

December was a strong month and didn't really slow down during the Holidays, so we got to close out the year on a high note.

Stock Picks Recap for 12/30/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, VRSN triggered short (with market support) and didn't work:

In total, that's 1 trade triggering with market support, and it didn't work.

Futures Calls Recap for 12/30/16

The markets headed lower to close the year (not a surprise as we will discuss in the preview for next week) but volume was only 1.4 billion shares, so it was mostly a drift. A piece of that volume was right at the close. Opening Range plays worked.

Net ticks: +19.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 12/30/16

A winner to close out 2016. See the EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

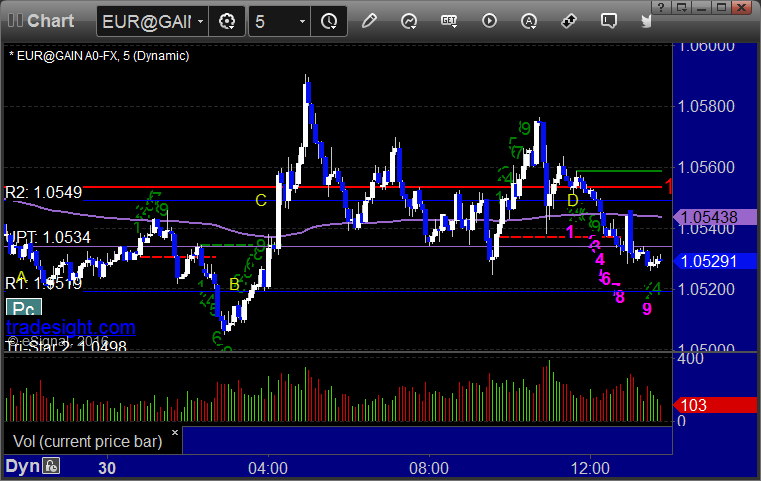

EURUSD:

Triggered long before the chart shows here, but could have taken it at A or all the way to B, hit first target at C, closed second half at D for end of week/month/year:

Stock Picks Recap for 12/29/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SSYS triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered long (with market support) and worked enough for a partial:

In total, that's 1 trade triggering with market support, and it worked.

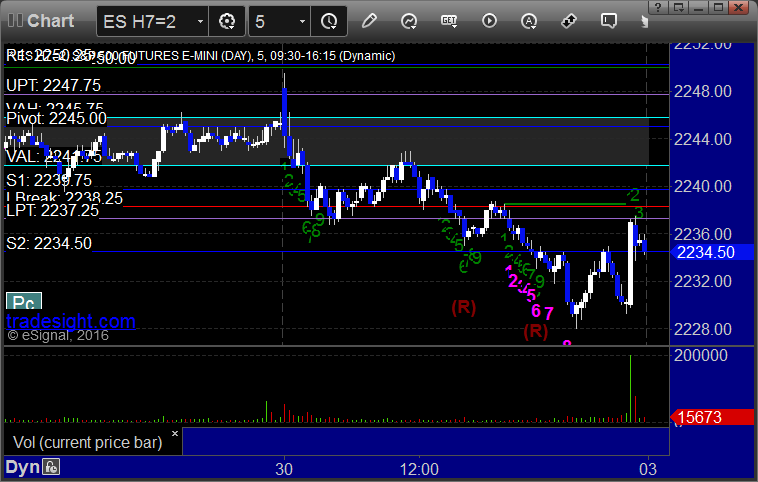

Futures Calls Recap for 12/29/16

A flat day on less volume. Opening Range plays didn't work as there was never a moment of excitement. NASDAQ volume was only 1.1 billion shares.

Net ticks: -22.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and I closed it for a 2-tick loss, triggered short at B and didn't work:

NQ Opening Range Play triggered long at A and I closed it under the midpoint, triggered short at B and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

Forex Calls Recap for 12/29/16

A dull session that literally led to a breakeven trade. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

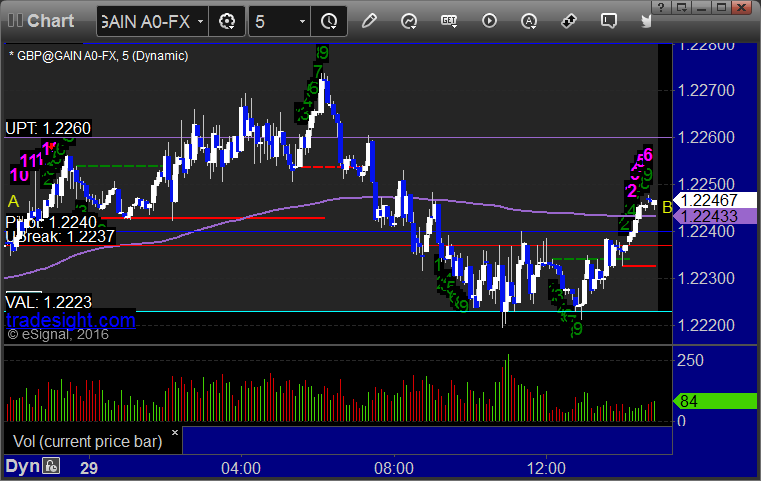

GBPUSD:

Triggered long at A, never hit first target, never broke the stop, closed at B, which was around the entry price: