Tradesight Recap Report for 5/20/22

Overview

For options expiration Friday in May, the markets gapped up, filled, and dropped quite a bit lower, but then rallied late to close even on 5.2 billion NASDAQ shares.

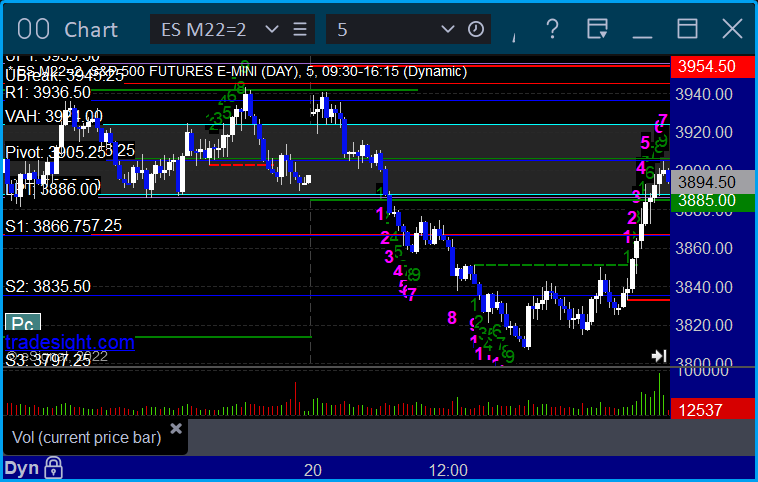

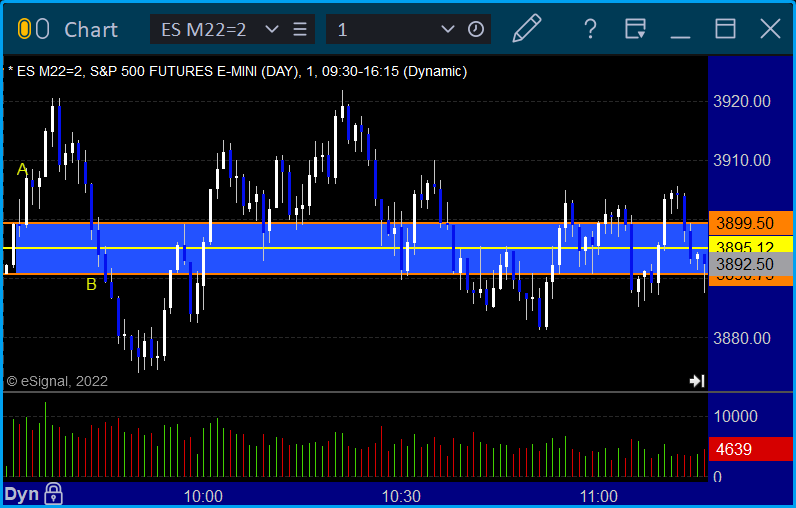

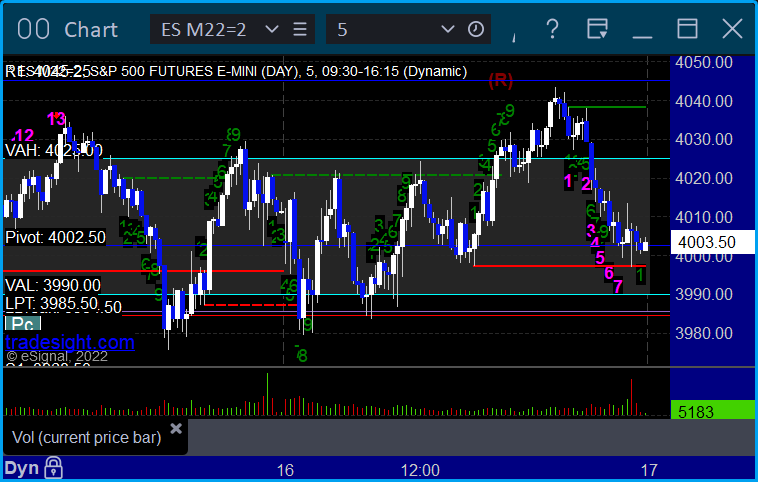

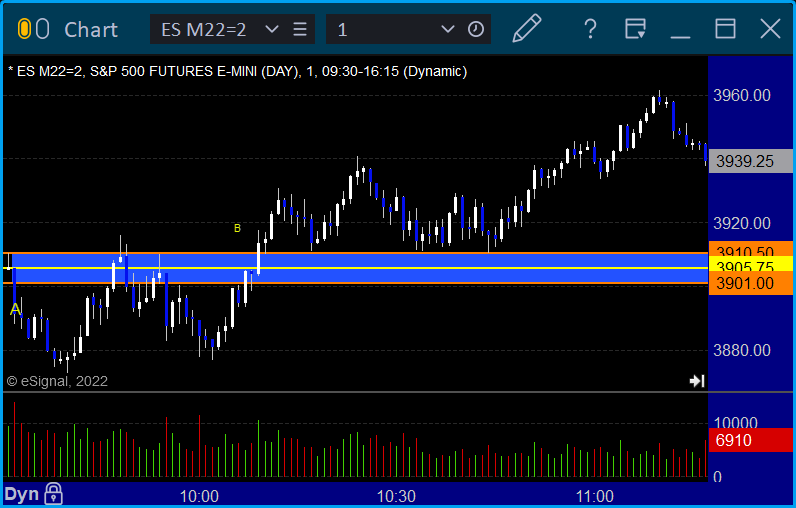

ES with Levels:

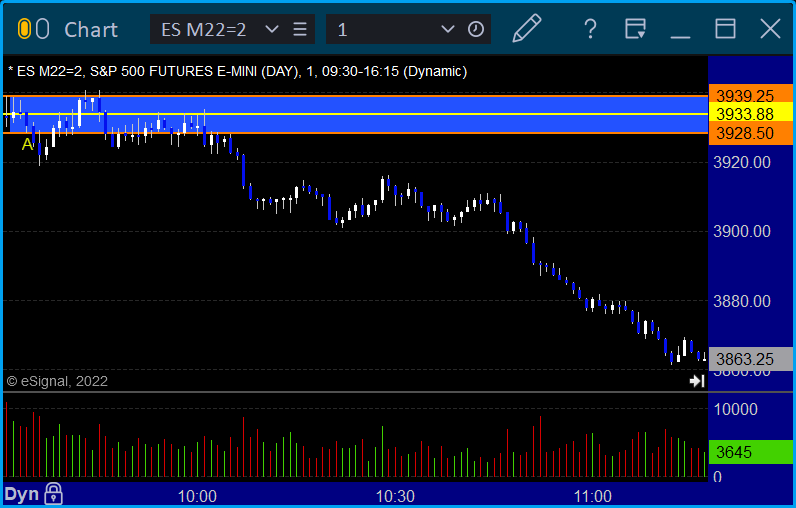

ES with Market Directional:

Futures:

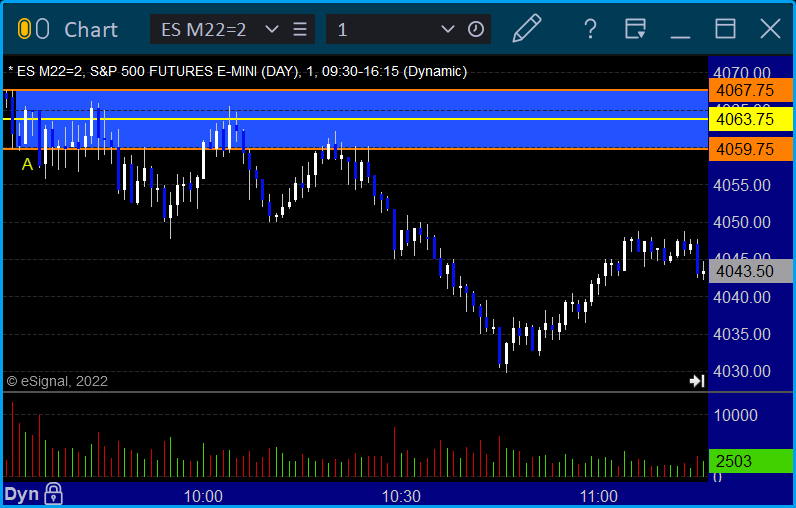

ES Opening Range Play triggered short at A but too far out of range to take:

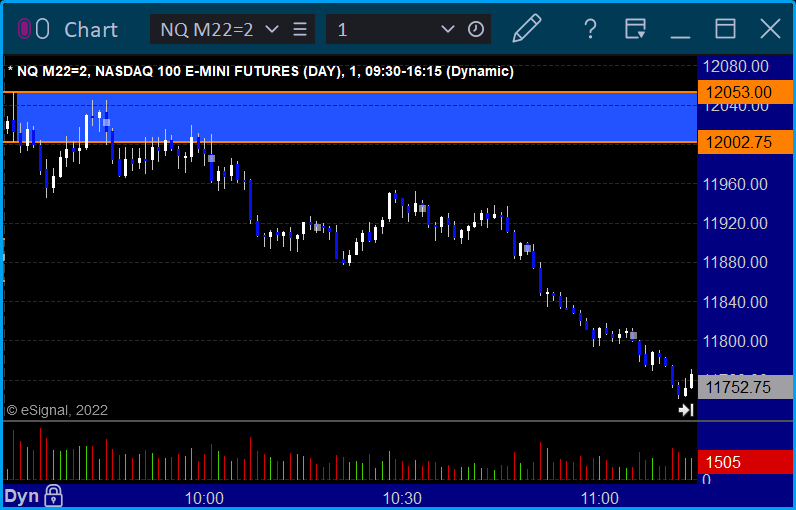

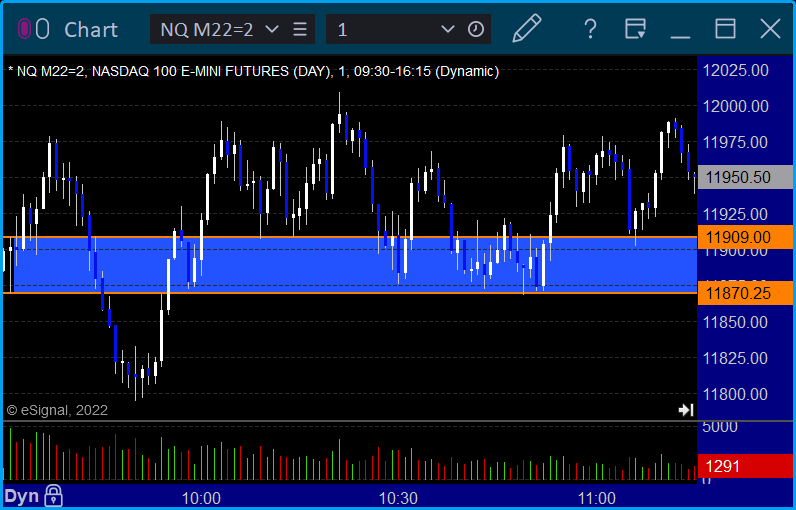

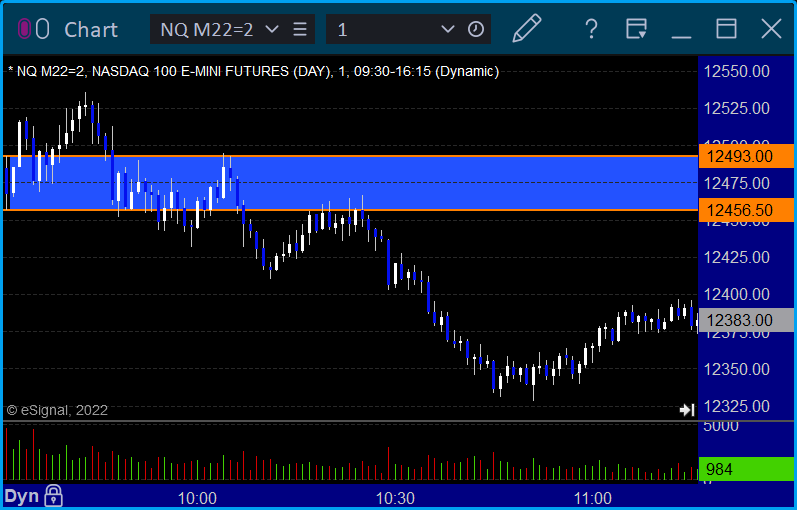

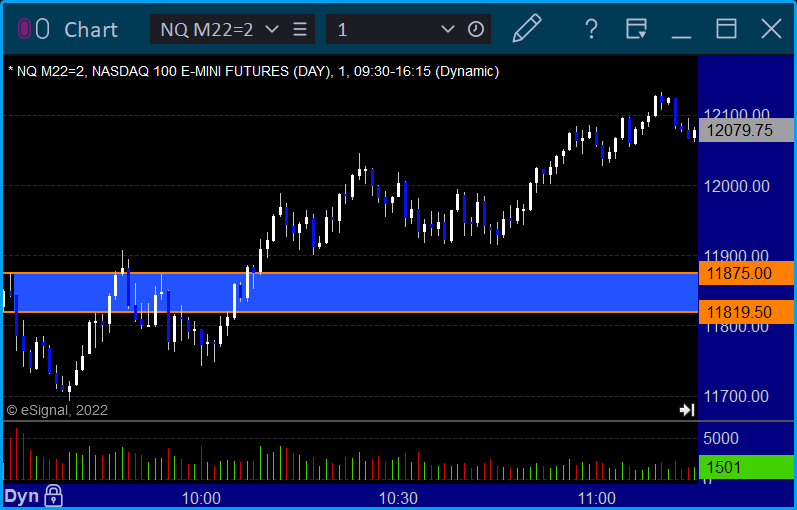

NQ Opening Range Play:

Results: +0 ticks

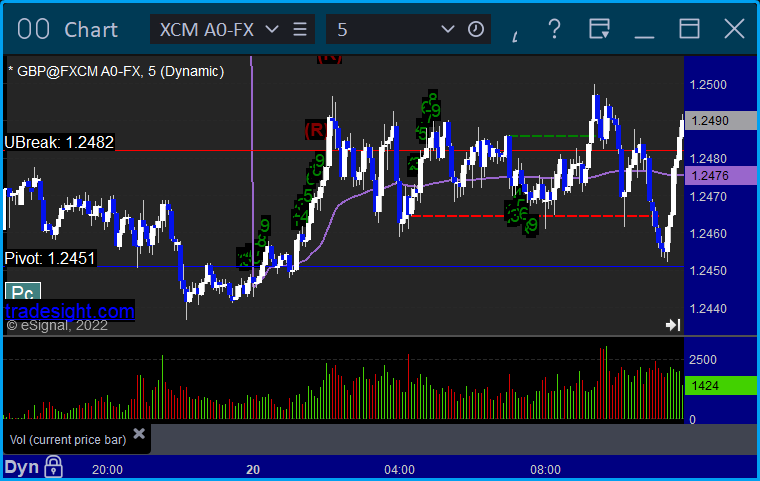

Forex:

We closed out the prior day's trade in the money, but nothing new triggered.

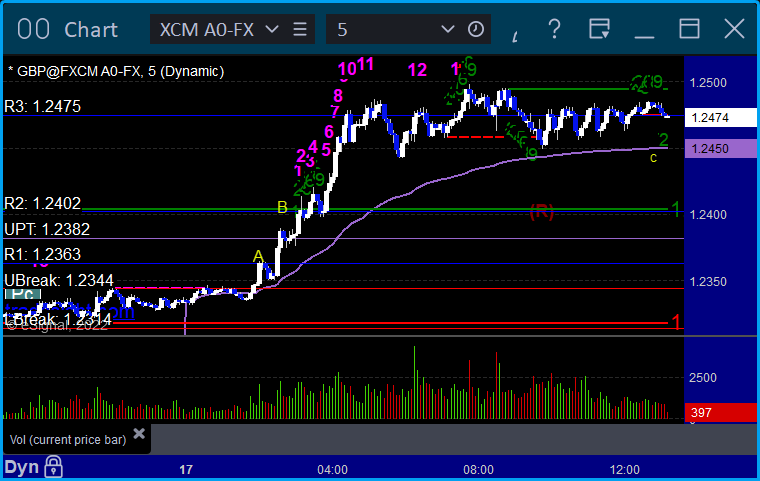

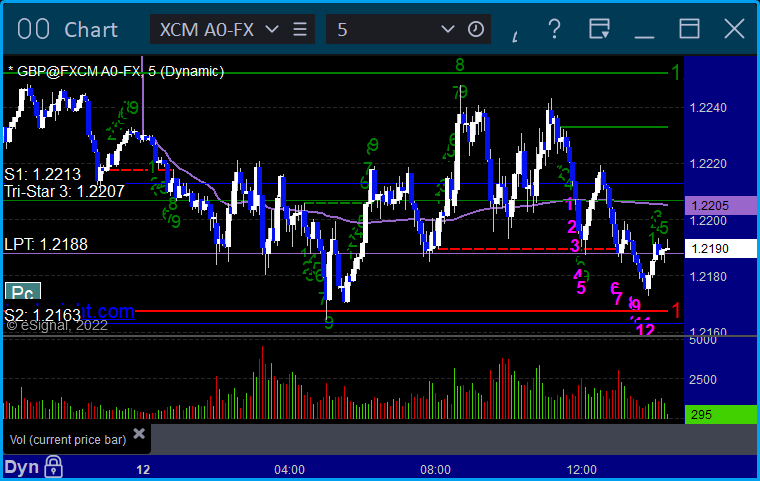

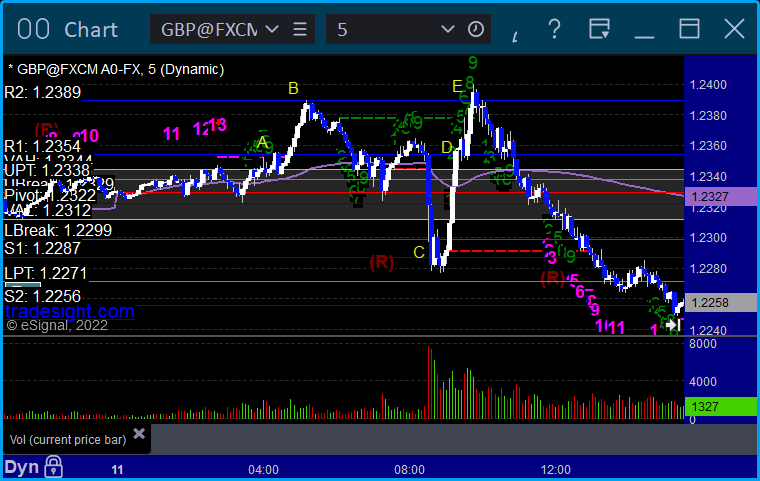

GBPUSD:

Results: +60 pips

Stocks:

The early action looked weak and looked like a typical options expiration gap fill, so we didn't make any calls. In the end, the markets closed even.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, no calls.

That’s 0 triggers with market support.

Tradesight Recap Report for 5/19/22

Overview

A dead flat day in the markets with little range on 4.8 billion NASDAQ shares.

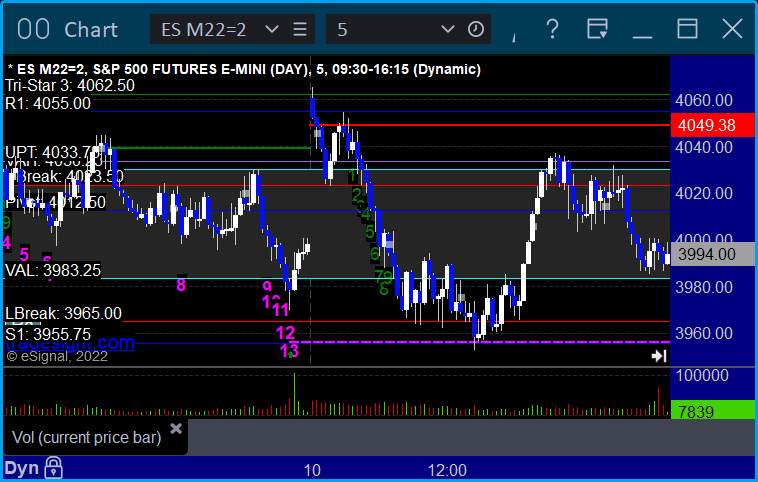

ES with Levels:

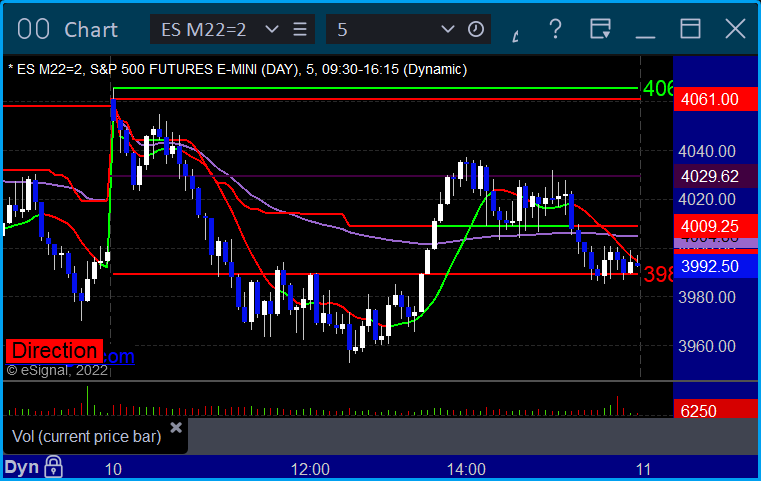

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and short at B, both too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

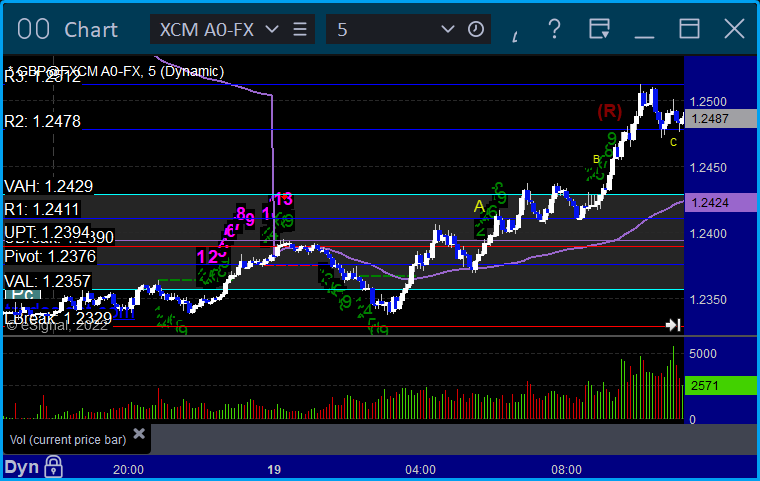

Forex:

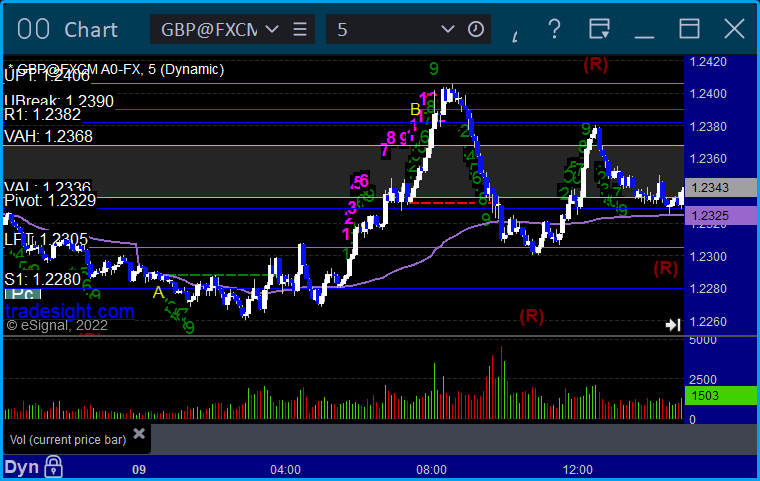

GBPUSD triggered long at A, hit first target at B, still holding second half with a stop under R2 at C:

Results: Trade still going

Stocks:

An unexciting session leads to unexciting trading.

From the Tradesight Plus Report, no calls.

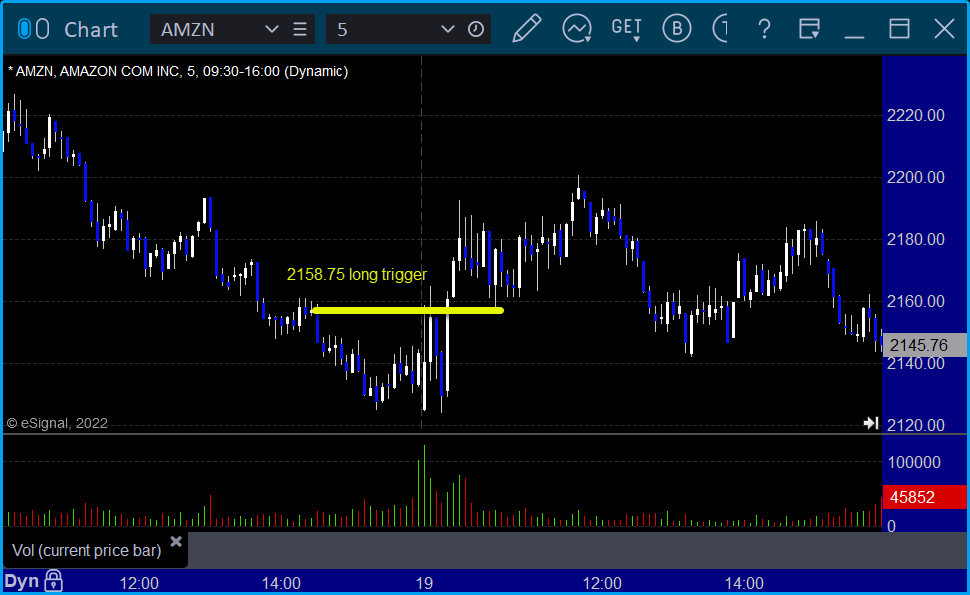

From the Tradesight Plus Twitter feed, Rich's AMZN triggered long (with market support) and didn't work:

His MRNA triggered long (with market support) and didn't work:

His AAPL triggered short (with market support) and didn't work:

That’s 3 triggers with market support, none of them worked on a dead day.

Tradesight Recap Report for 5/18/22

Overview

The markets gapped down and kept going much lower for options unraveling Wednesday even though volume was still only 4 billion NASDAQ shares.

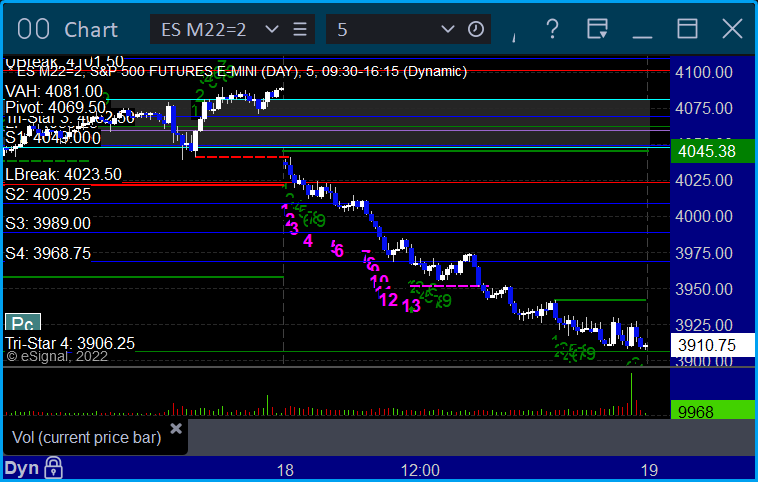

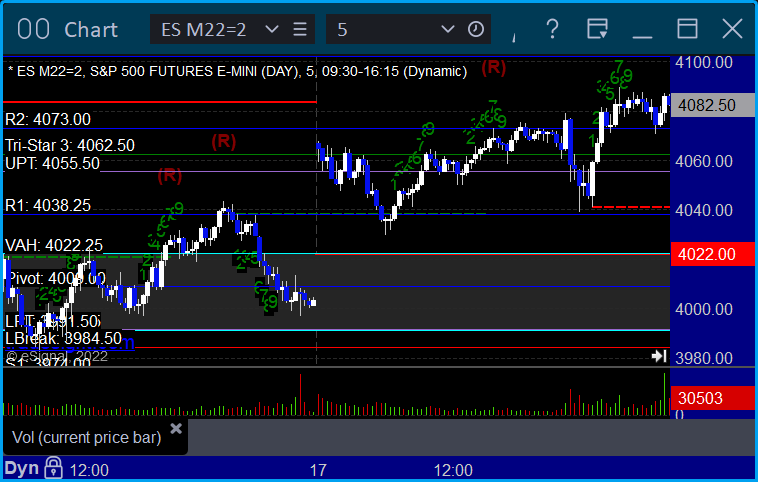

ES with Levels:

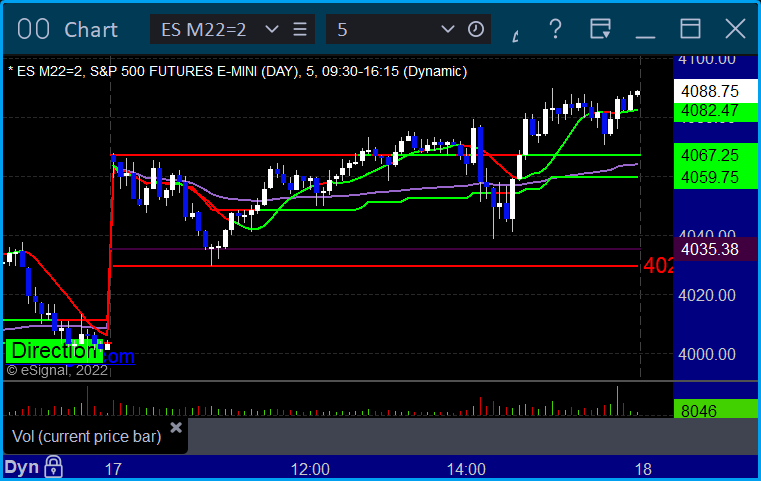

ES with Market Directional:

Futures:

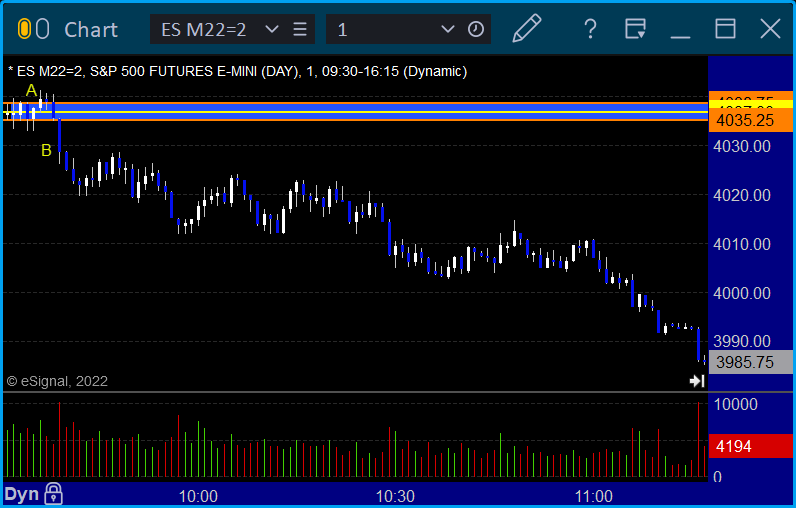

ES Opening Range Play triggered long at A and stopped, triggered short at B but too far out of range to take:

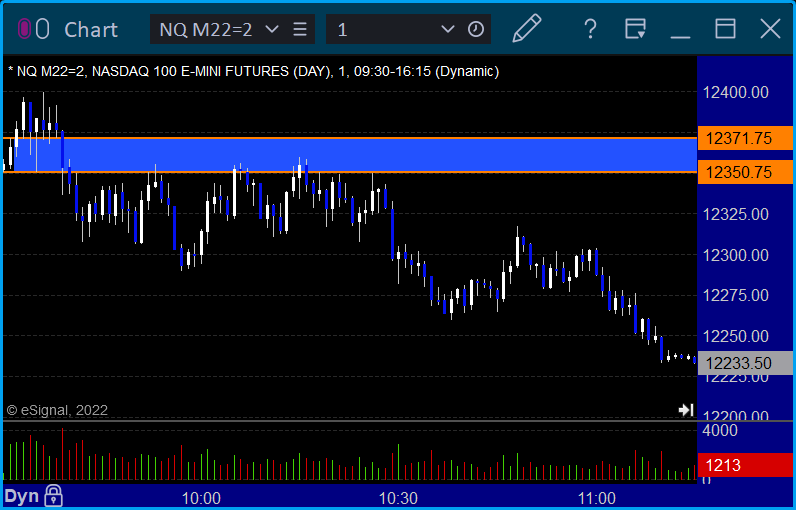

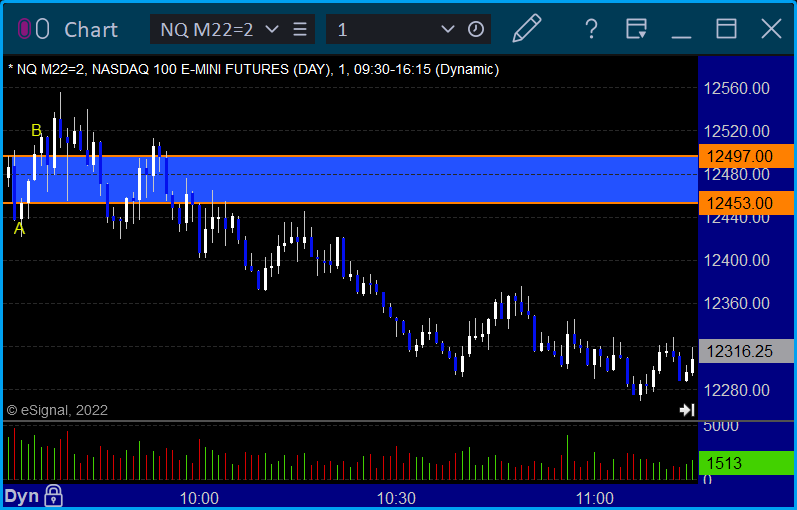

NQ Opening Range Play:

Results: -13 ticks

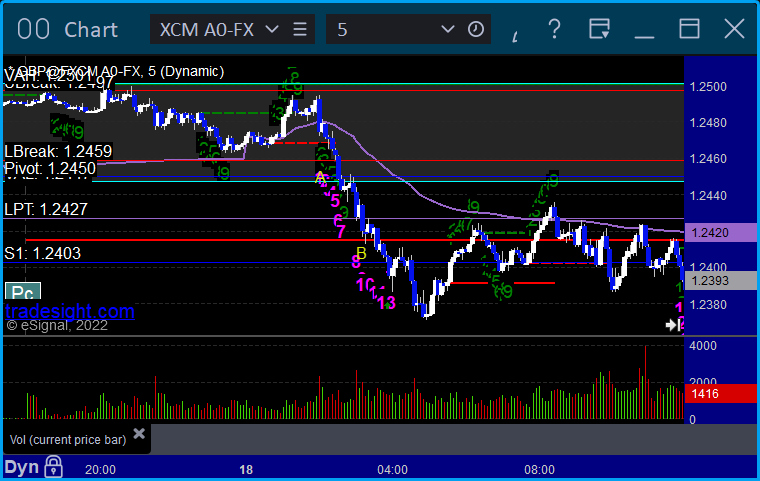

Forex stopped out of the second half of the prior day's trade and then had a new winner:

GBPUSD triggered short at A, hit first target at B, still holding second half:

Results: +40 pips from prior day's call, current day is still working

Stocks:

Another green day if you stuck with market direction.

From the Tradesight Plus Report, no calls.

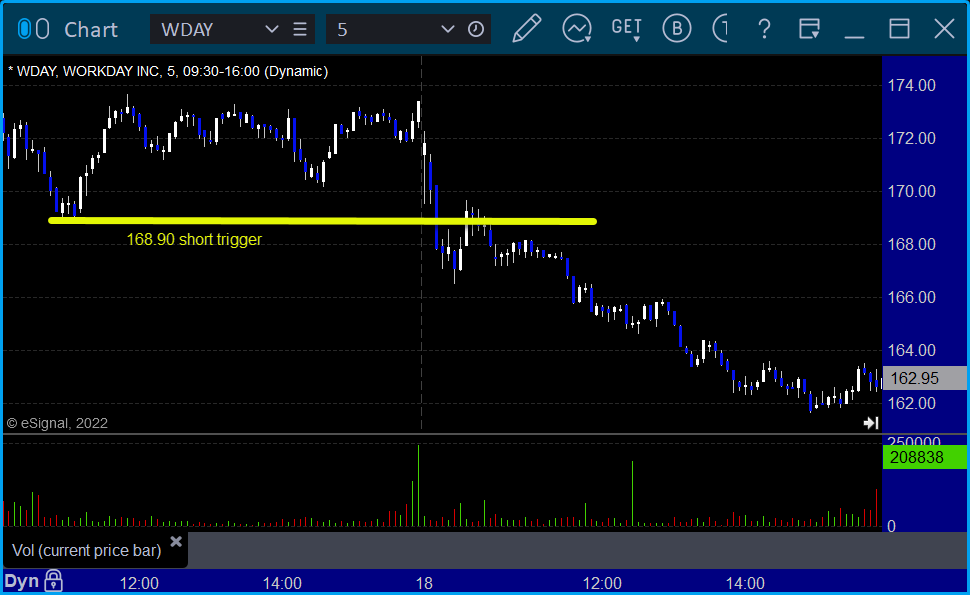

From the Tradesight Plus Twitter feed. Rich's WDAY triggered short (with market support) and worked:

His SNOW triggered short (with market support) and barely stopped before working later:

His OSTK triggered short (with market support) and worked enough for a partial:

His TTWO triggered long (without market support) and didn't work:

His SPOT triggered long (without market support) and didn't work:

That’s 3 triggers with market support, 2 of them worked and 1 did not.

Tradesight Recap Report for 5/17/22

Overview

The markets gapped up, pulled back a bit, and closed a little bit higher on 4 billion NASDAQ shares.

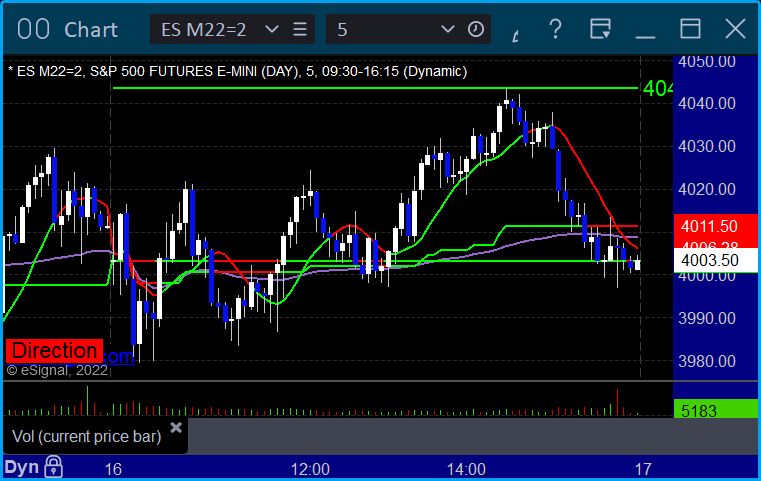

ES with Levels:

ES with Market Directional:

Futures:

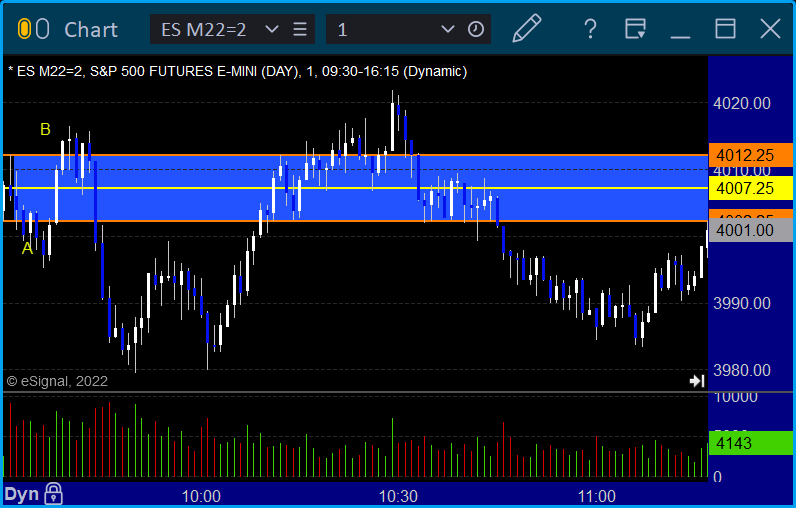

ES Opening Range Play triggered short at A but too far out of range to take:

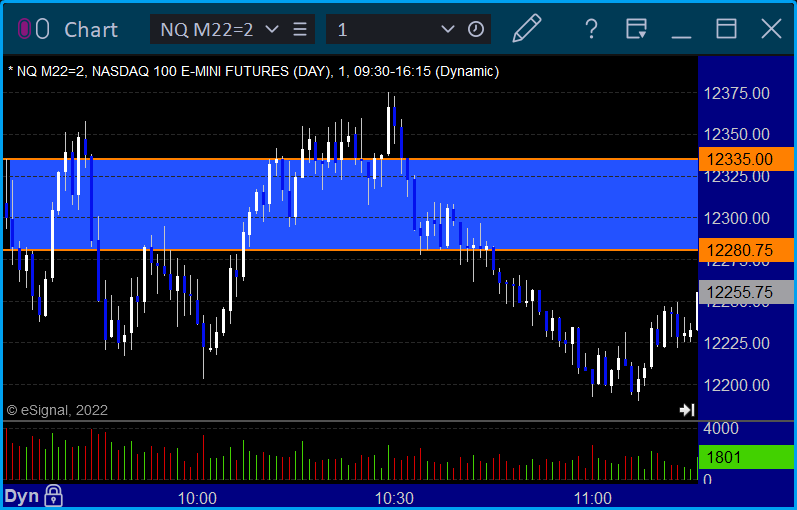

NQ Opening Range Play:

Results: +0 ticks

Forex:

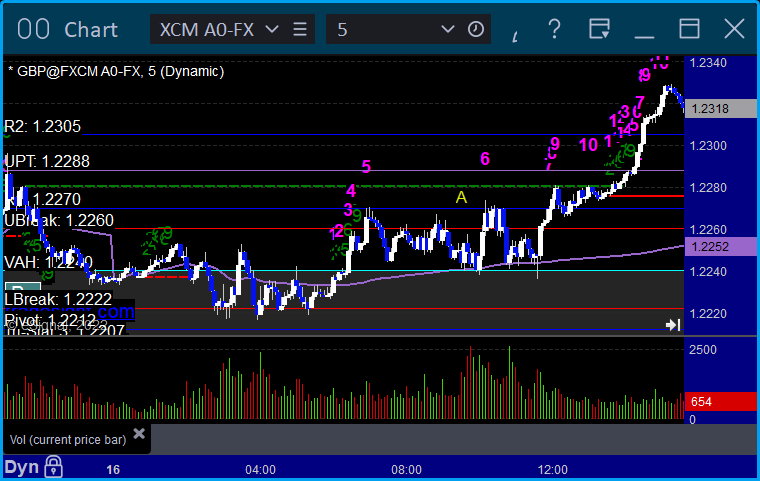

GBPUSD triggered long at A, hit first target at B, still holding second half with a stop under C::

Results: Trade still open

Stocks:

An interesting session.

From the Tradesight Plus Report, no calls.

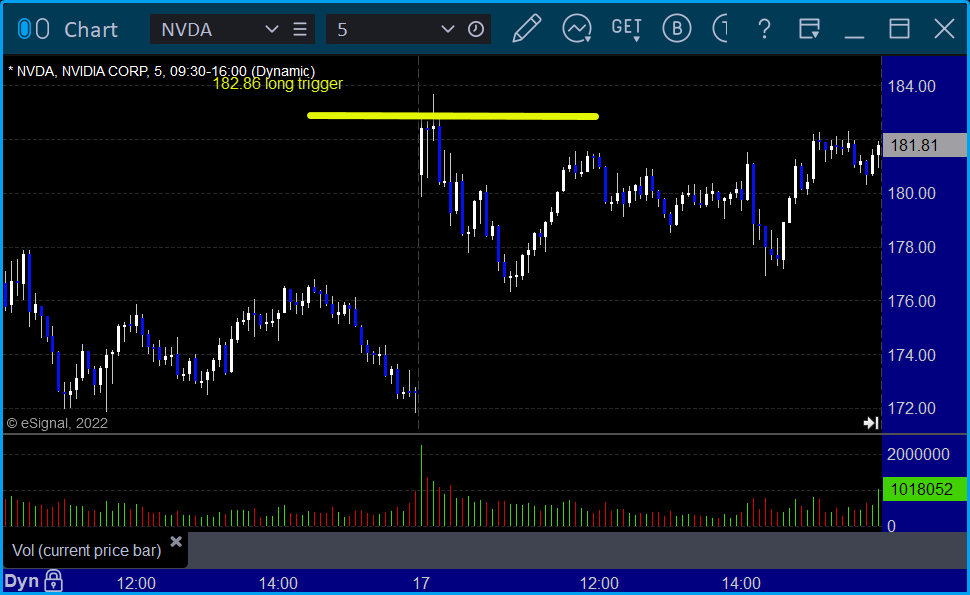

From the Tradesight Plus Twitter feed, Rich's NVDA triggered long (with market support) and didn't work:

His FB triggered long (with market support) and didn't work:

His SMH triggered long (ETF, so no market support needed) and didn't work:

That’s 3 triggers with market support, none of them worked.

Tradesight Recap Report for 5/16/22

Overview

The markets opened fairly flat and did nothing at all for the whole session on a weak 3.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

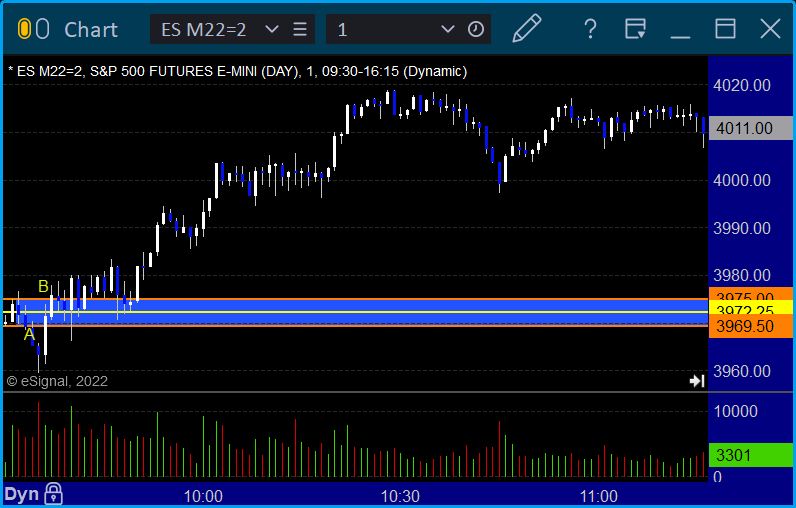

ES Opening Range Play triggered short at A and long at B, both were too far out of range to take:

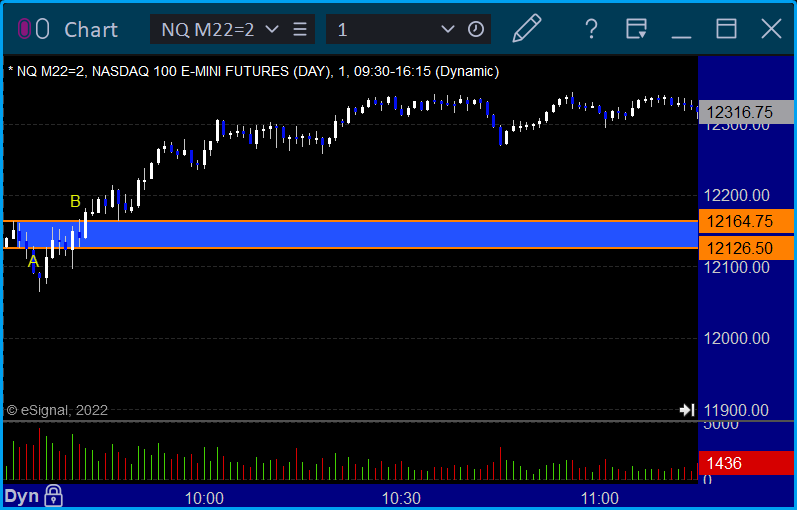

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

We made a lot of calls but most didn't trigger on a completely dead day in the markets.

From the Tradesight Plus Report, no calls.

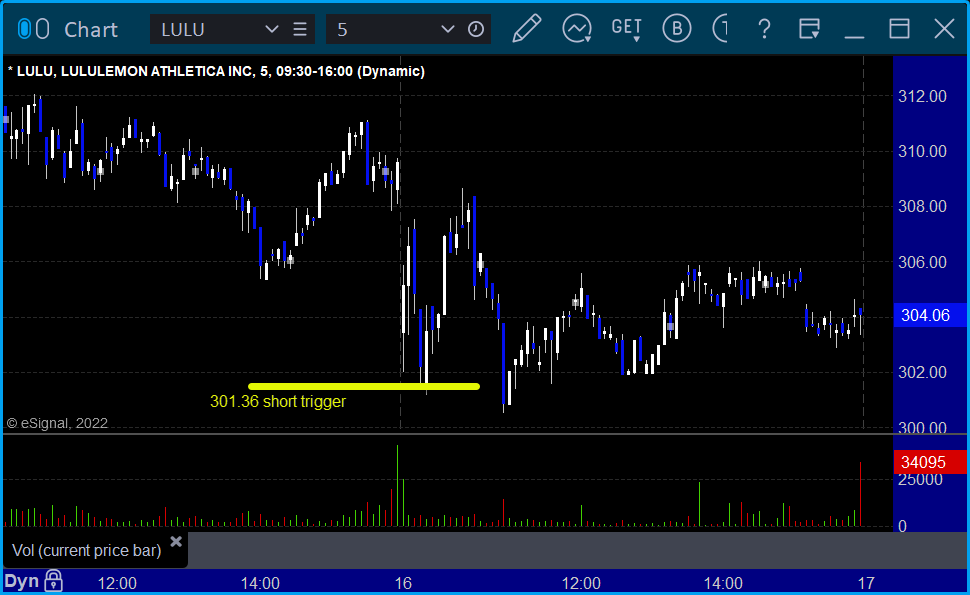

From the Tradesight Plus Twitter feed, LULU triggered short (with market support) and didn't work:

Rich's DVN triggered long (with market support) and didn't work:

That’s 2 triggers with market support, neither of them worked.

Tradesight Recap Report for 5/13/22

Overview

The markets gapped up and basically held in a narrow range on 4.8 billion NASDAQ shares.

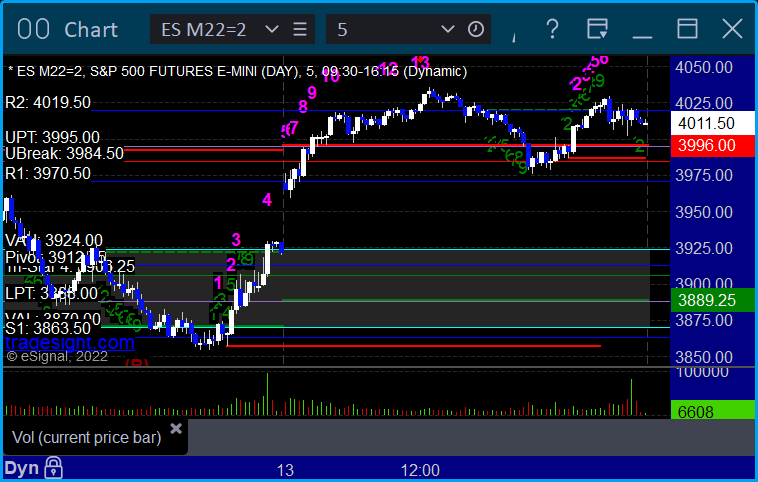

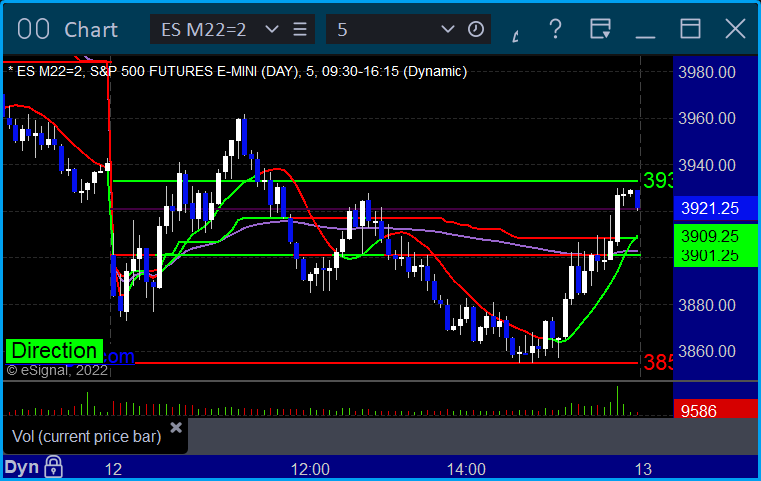

ES with Levels:

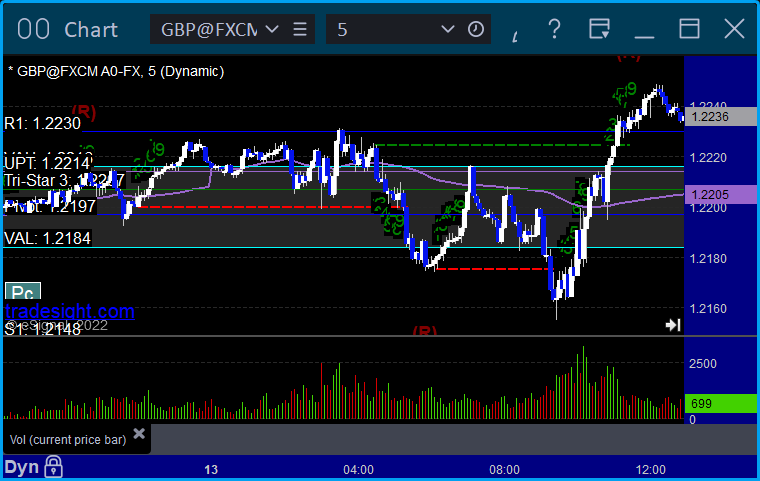

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked enough for a partial:

NQ Opening Range Play:

Results: +8 ticks

Forex:

GBPUSD, no calls:

Results: +0 pips

Stocks:

A winner on a minor day in the markets.

From the Tradesight Plus Report, no calls.

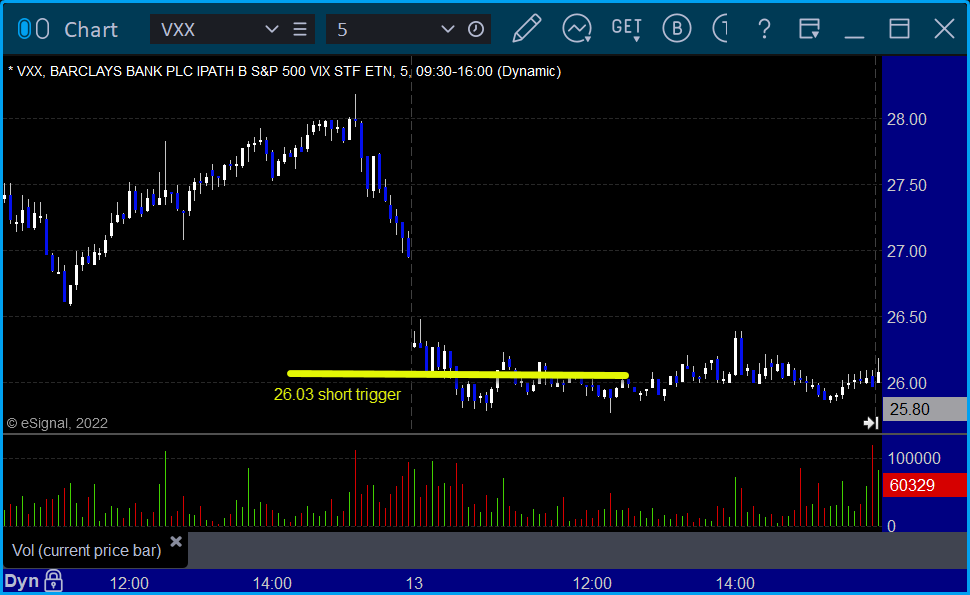

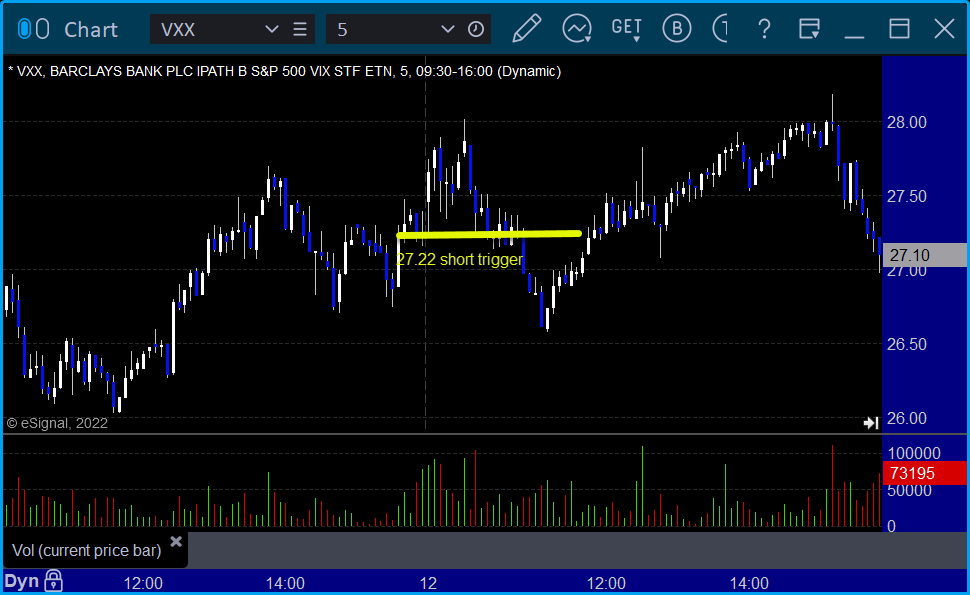

From the Tradesight Plus Twitter feed, Rich's VXX triggered short (ETF, so no market support needed) and didn't go enough either way to count:

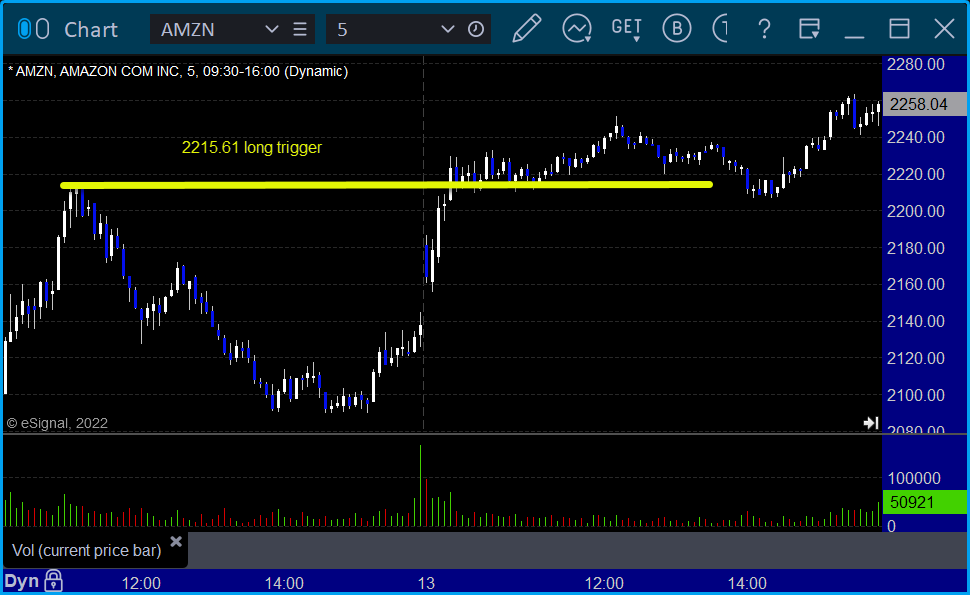

His AMZN triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 5/12/22

Overview

The markets gapped down, filled, and didn't do much else on 5.2 billion NASDAQ shares.

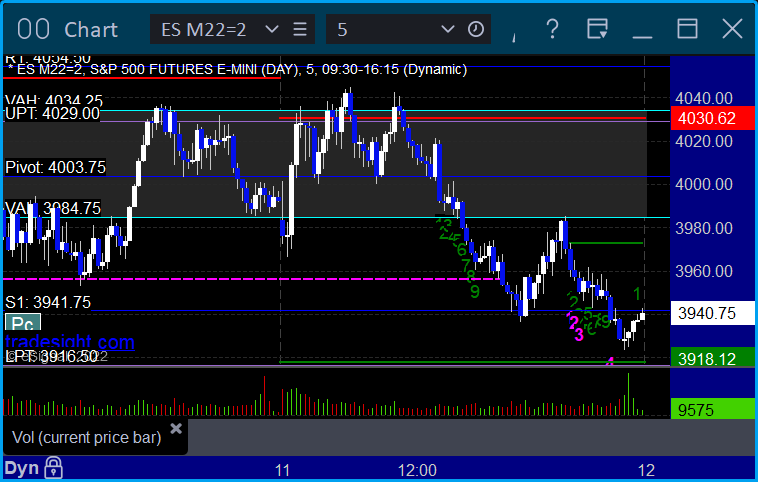

ES with Levels:

ES with Market Directional:

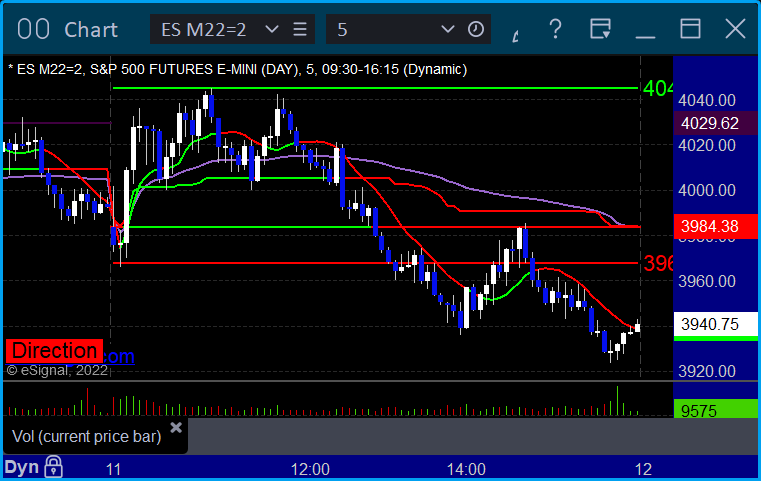

Futures:

ES Opening Range Play triggered short at A and long at B, both too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD, no triggers:

Results: +0 pips

Stocks:

Three winners for the session.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's NFLX triggered long (with market support) and worked:

His DIS triggered long (with market support) and worked enough for a partial:

His VXX triggered short (ETF, so no market support needed) and worked:

That’s 3 triggers with market support, and all of them worked.

Tradesight Recap Report for 5/11/22

Overview

The markets gapped down, went higher, then were even going into lunch and sold off in the afternoon on 6.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

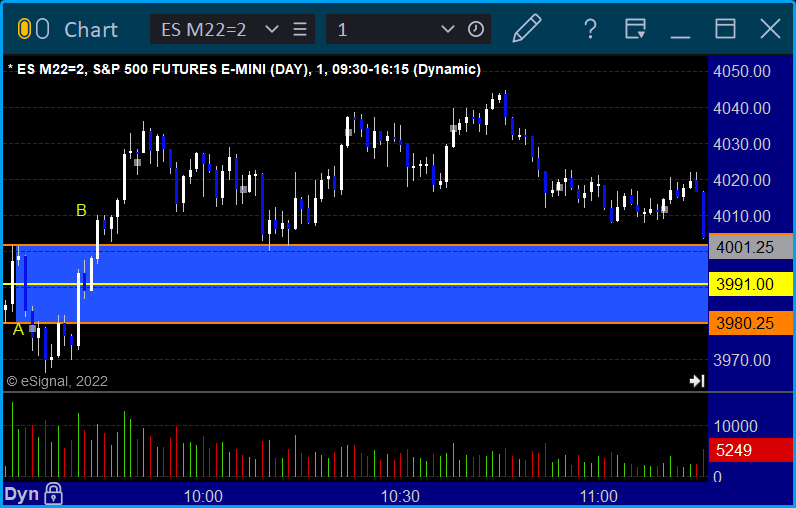

ES Opening Range Play triggered short at A and long at B, both too far out of range to take:

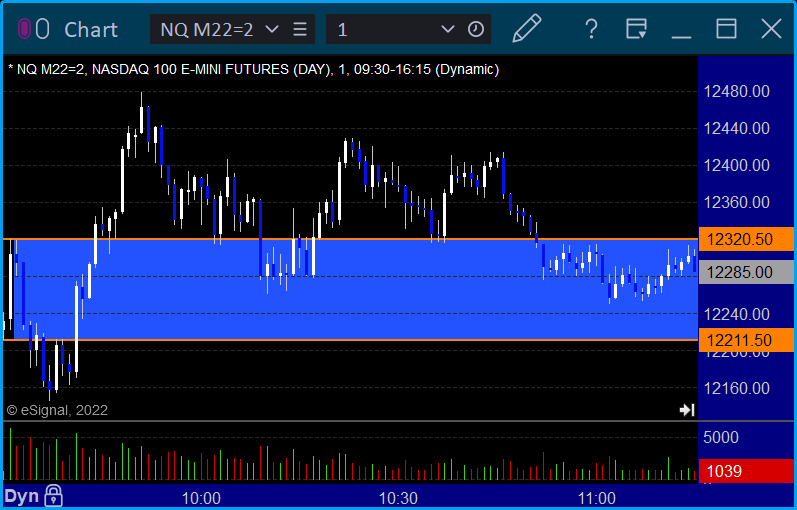

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD triggered long at A, hit first target at B, second half stopped. Triggered short at C and stopped. Triggered long at D, hit first target at E, second half stopped again:

Results: +5 pips

Stocks:

Another successful day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's AAPL triggered short (with market support) and worked:

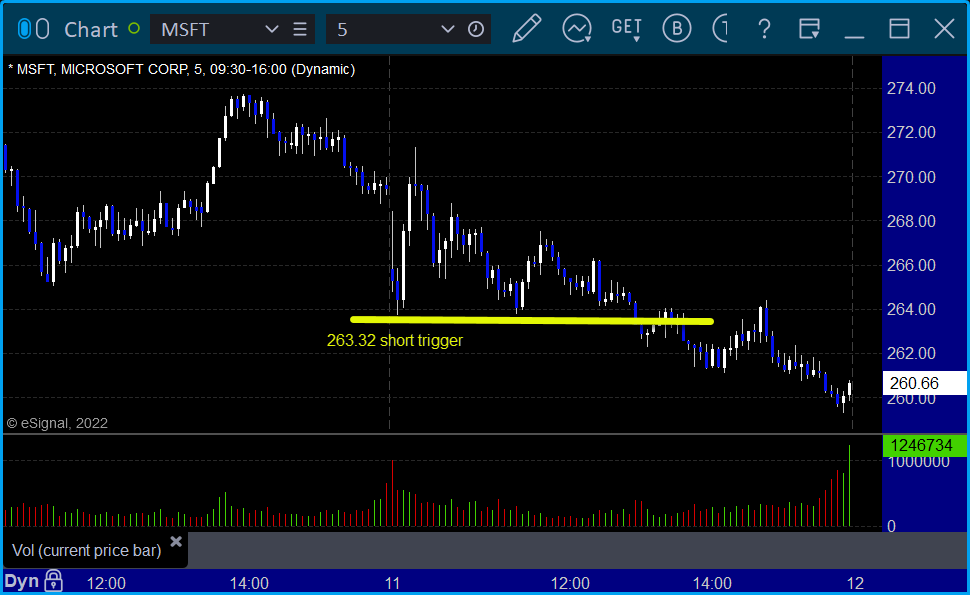

His MSFT triggered short (with market support) and worked:

His VXX triggered short (ETF, so no market support needed) and worked:

That’s 3 triggers with market support, all of them worked.

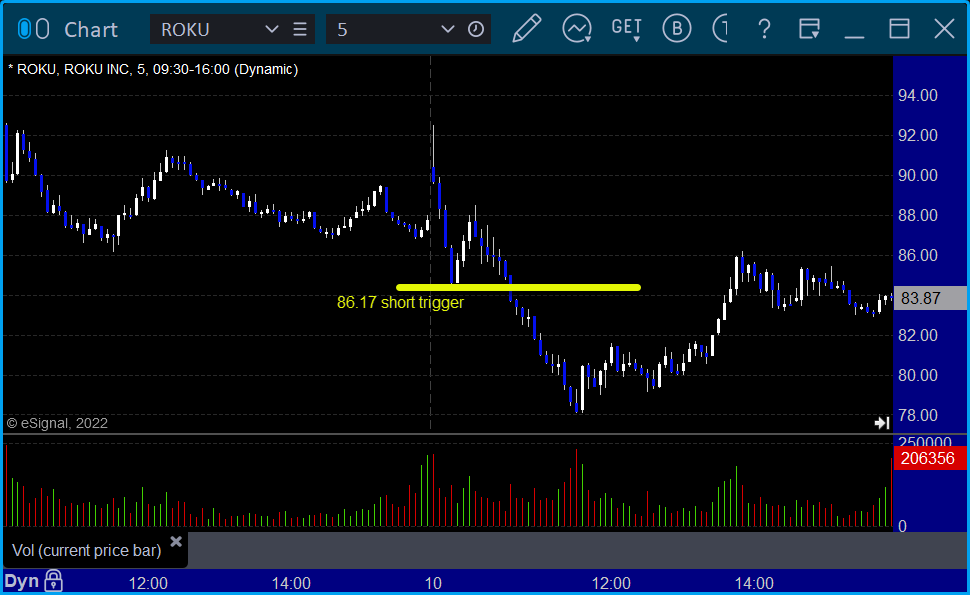

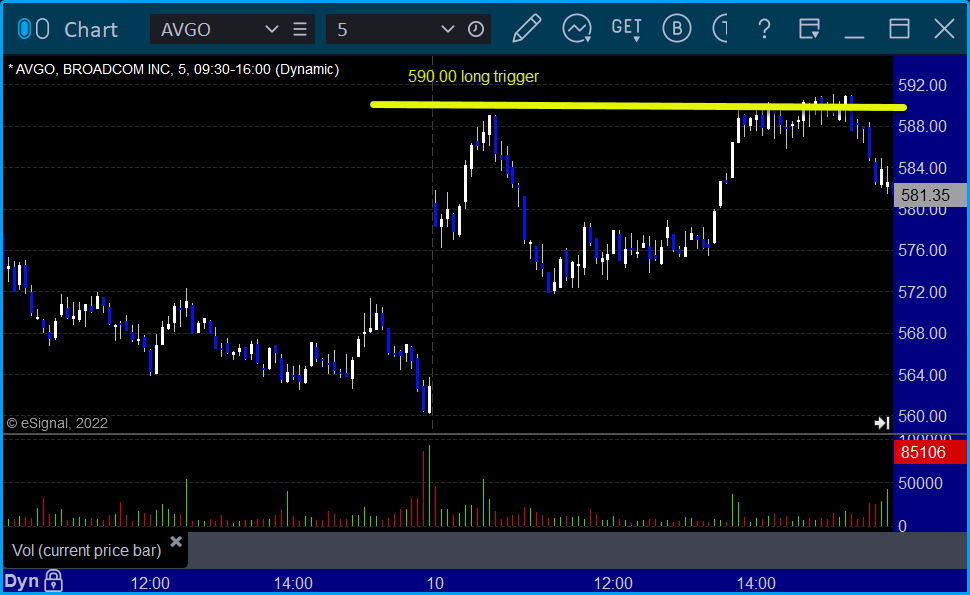

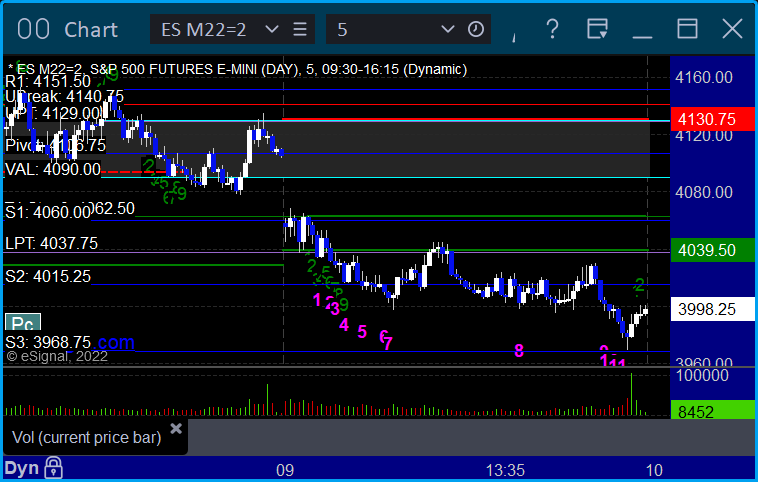

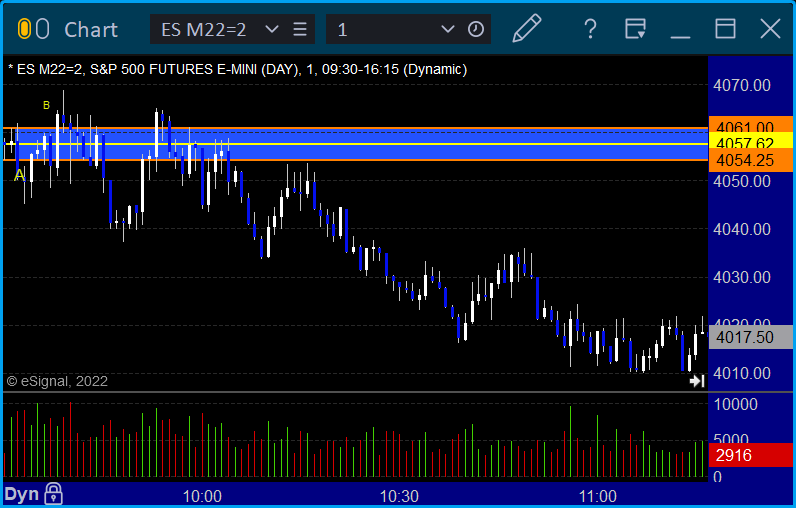

Tradesight Recap Report for 5/10/22

Overview

The markets gapped up, sold off to fill the gap, rallied again, and came back to even on 5.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +27.5 ticks

Forex:

GBPUSD, no calls, no triggers.

Results: +0 pips

Stocks:

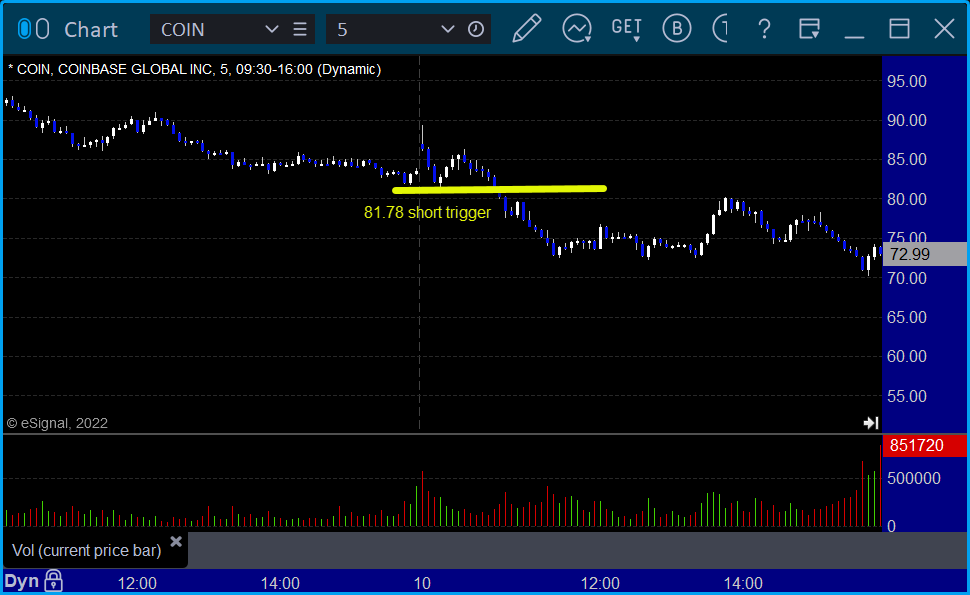

A good day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's MRNA triggered short (with market support) and worked enough for a partial:

His BNTX triggered long (without market support) and didn't work:

His COIN triggered short (with market support) and worked:

His ROKU triggered short (with market support) and worked:

His AVGO triggered long (with market support) and didn't work:

That’s 4 triggers with market support, 3 of them worked and 1 didn’t.

Tradesight Recap Report for 5/9/22

Overview

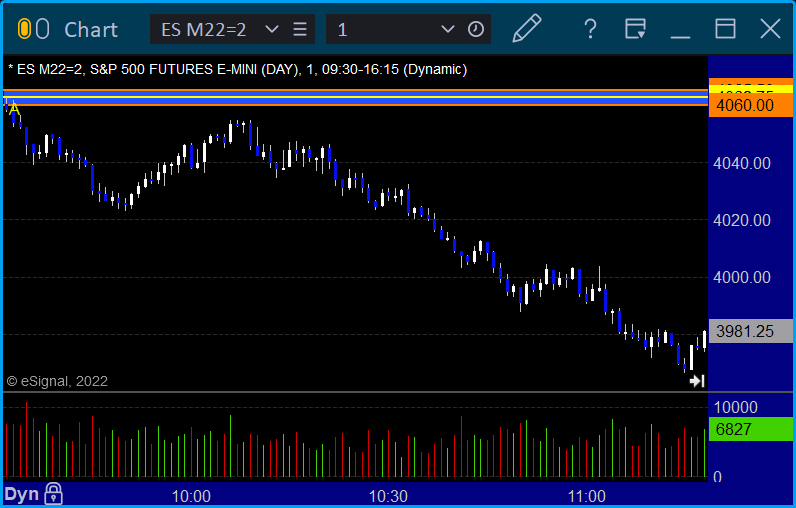

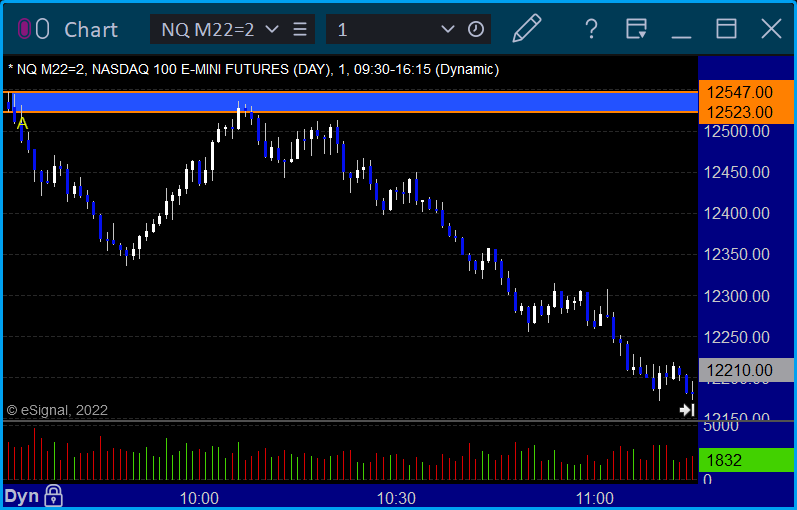

The markets gapped down and went lower with the NASDAQ being weaker on 5.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and long at B, both too far out of range to take:

NQ Opening Range Play triggered short at A and long at B, both too far out of range to take:

Results: +0 ticks

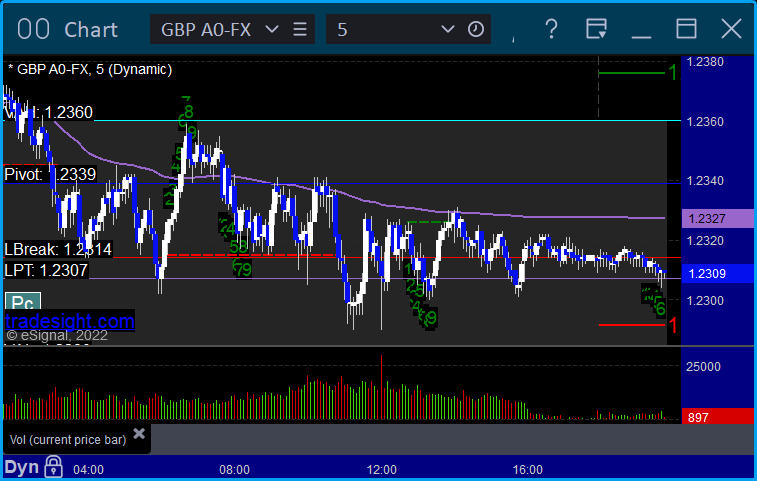

Forex:

GBPUSD triggered short at A and long at B, both stopped:

Results: -50 pips

Stocks:

Not much of a day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's AAPL triggered long (without market support) and didn't work:

His BIDU triggered short (with market support) and worked:

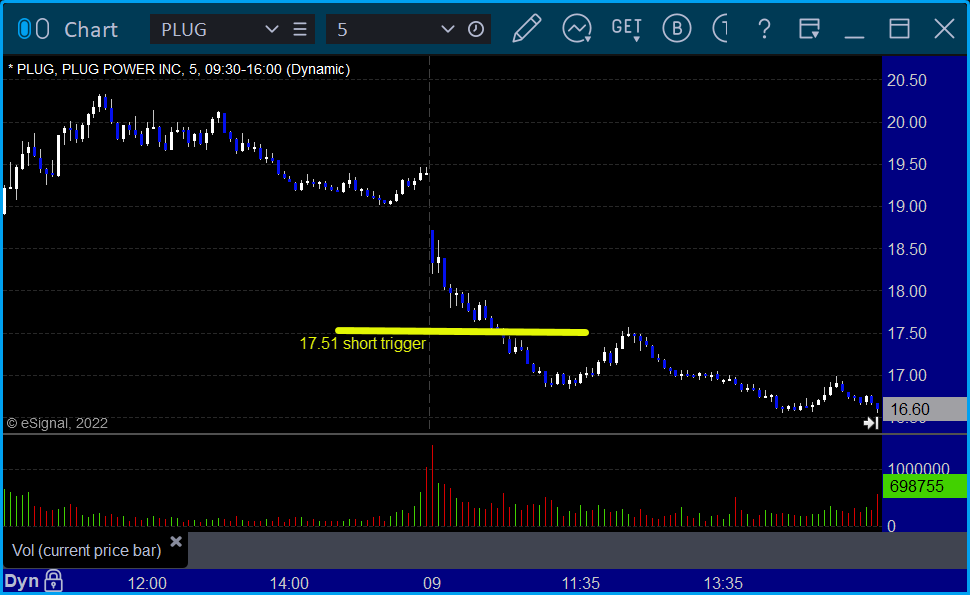

His PLUG triggered short (with market support) and worked:

His RIVN triggered short (with market support) and worked enough for a partial:

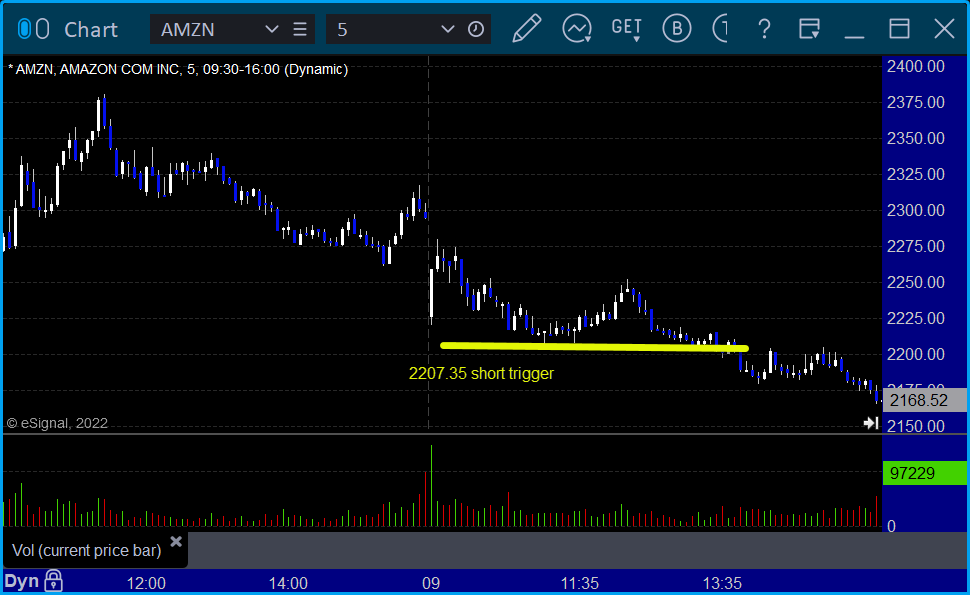

His AMZN triggered short (with market support) and worked:

That’s 4 triggers with market support, all of them worked.