Stock Picks Recap for 11/30/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, URBN triggered short (without market support due to opening 5 minutes) and worked enough for a partial, but you shouldn't really have been in it moving like that in the opening 5:

From the Messenger/Tradesight_st Twitter Feed, LULU triggered long (with market support) and worked enough for a partial:

Rich's BIDU trigggered long (with market support) and didn't work:

His FEYE triggered short (with market support) and didn't go enough in either direction to count:

His PANW triggered short (with market support) and worked:

BMRN triggered short (with market support) and didn't work:

VRX triggered short (with market support) and worked great, spiked down after the entry and kept going:

Rich's AAPL triggered short (with market support) and worked:

AVGO triggered short (with market support) and worked:

AMZN triggered short (with market support) and didn't work:

In total, that's 8 trades triggering with market support, 5 of them worked, 3 did not. Some big winners.

Futures Calls Recap for 11/30/16

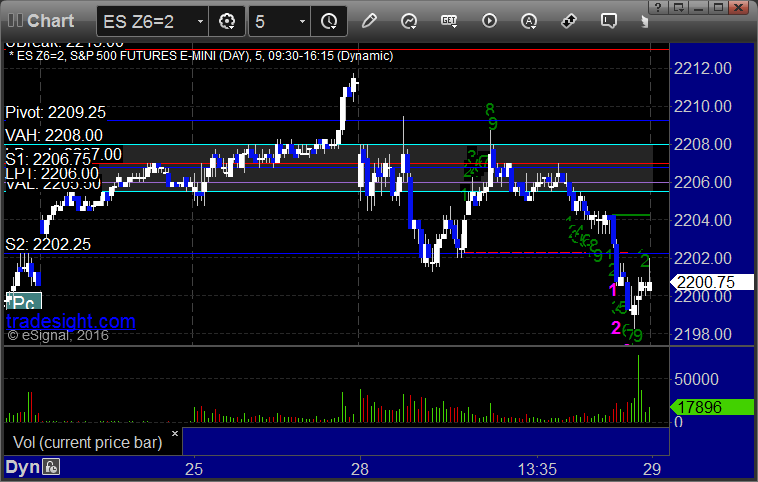

The raw numbers don't show it, but the trade that I said to go big size on in the Lab was the ES OR short, which worked. It lined up with the Value Area and was into the gap, so it was the higher probability trade. The markets gapped up and sold off, closing at lows. Perhaps the turn is finally coming. NASDAQ volume closed at 1.8 billion shares.

Net ticks: --13.5 ticks.

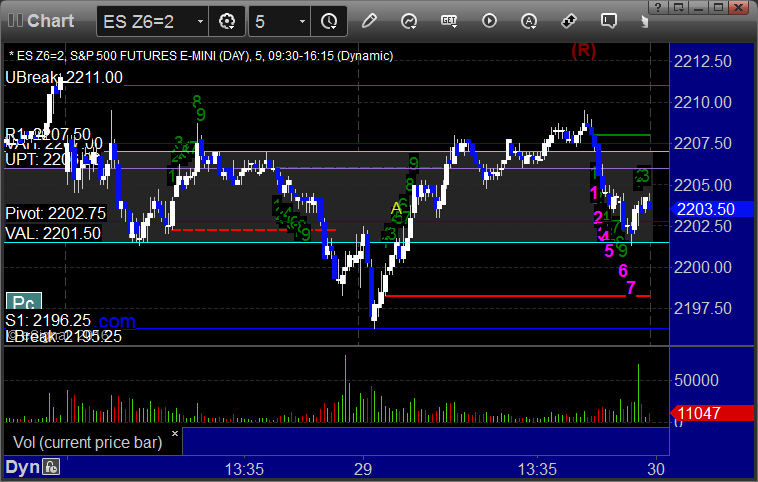

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A but shouldn't have been taken under the rules because we were short the NQ and this wasn't into the gap, and then triggered short at B and did work (this was the trade I took for big size per my comments in the Lab because it was into the gap and the NASDAQ side was weak):

NQ Opening Range Play triggered short at A and didn't work, triggered long at B and didn't work, didn't love either setup without a gap, used the midpoint as the stop:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 11/30/16

Stopped out of the second half of the prior day's trade and had a new winner. See GBPUSD section below.

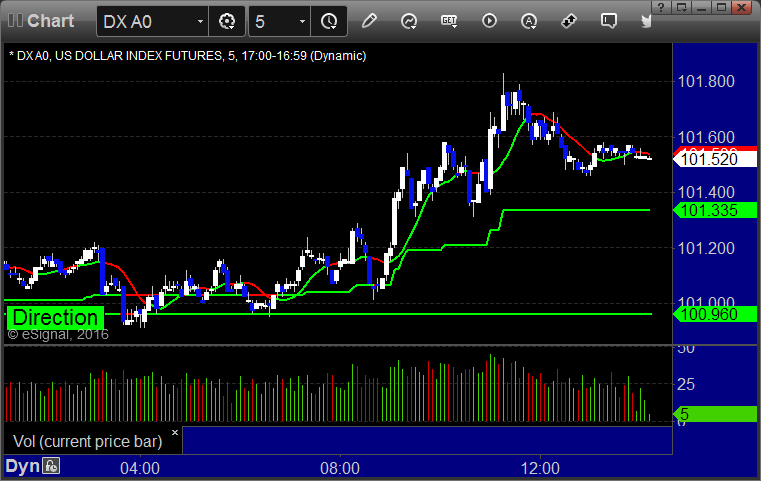

Here's a look at the US Dollar Index intraday with our market directional lines:

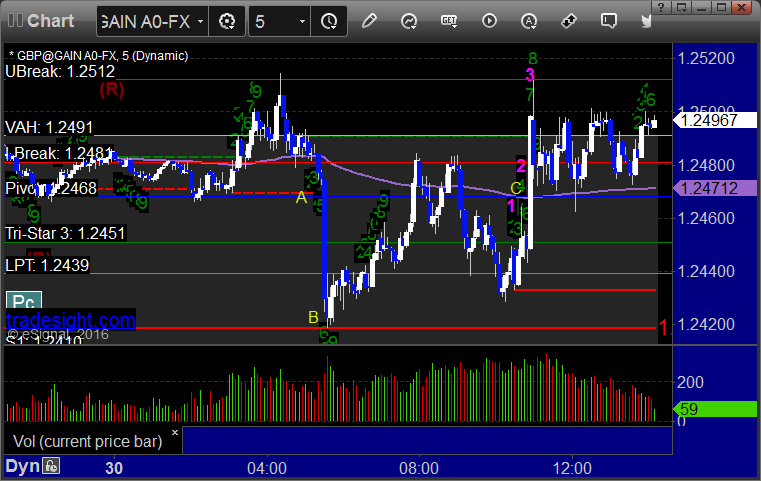

GBPUSD:

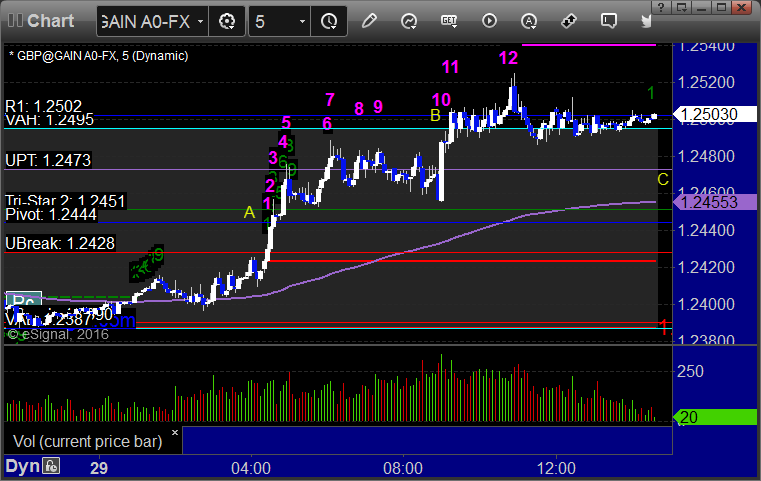

Triggered short at A, first target was 45-50 pips and hit it at B, closed second half over entry at C:

Stock Picks Recap for 11/29/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's FCX triggered short (with market support) and worked:

His MNK triggered short (with market support) and worked:

BIDU triggered long (with market support) and worked enough for a partial:

Rich's TTWO triggered long (with market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 11/29/16

A flat open and some back and forth early action before the markets finally pushed up a little on slightly improved volume of 1.6 billion NASDAQ shares. Mixed results on the Opening Ranges trades plus a profitable ES call.

Net ticks: -4.5 ticks.

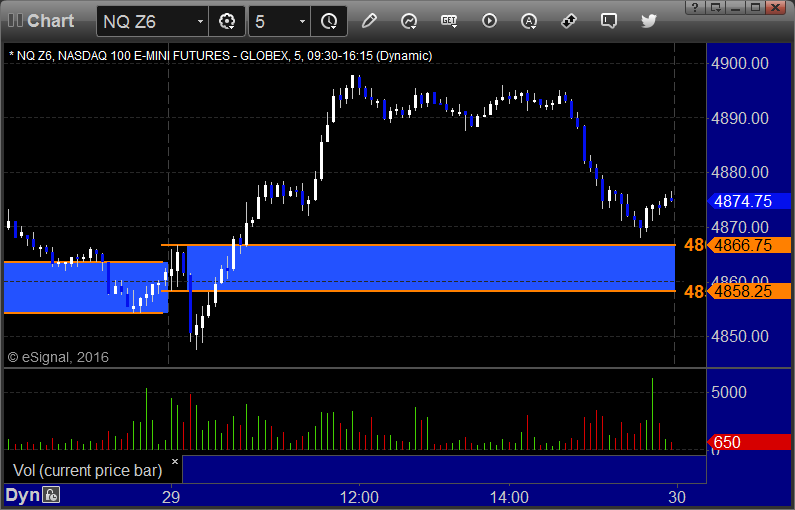

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and stopped:

NQ Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered long at A at 2203.00, hit first target for 6 ticks, and stopped second half 3 ticks in the money:

Forex Calls Recap for 11/29/16

A nice winner for the session, still going. See GBPUSD section below.

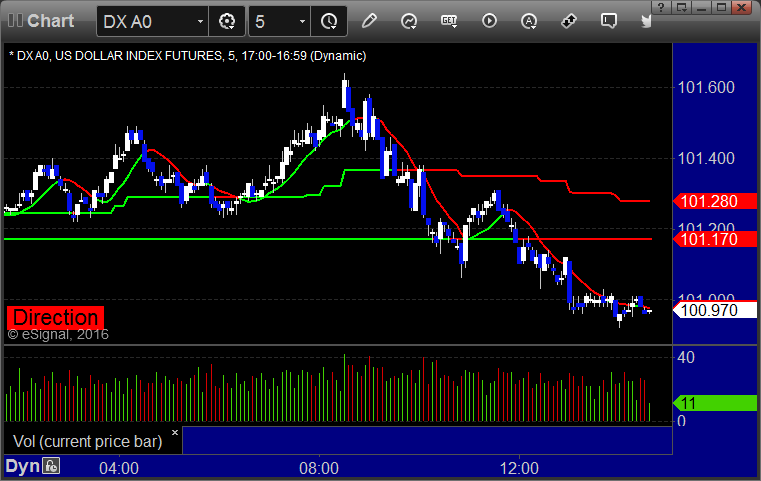

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, still holding second half with a stop under C:

Stock Picks Recap for 11/28/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, only Rich's X triggered short (with market support, late in the day) and didn't do anything:

The rest of the calls didn't trigger.

In total, that's 1 trade triggering with market support, it didn't do anything.

Futures Calls Recap for 11/28/16

A really disappointing session with no structure. We gapped down and basically gave back the small gains from Friday's half day (which happens almost every year), but it took all day. Horrible range and only 1.4 billion NASDAQ shares traded.

Net ticks: -14.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, triggered short at B and stopped:

NQ Opening Range Play triggered short at A but we don't take that because it is not into the gap (would have worked anyway) and we were long the ES at the time (it stopped a minute later, but we stick to the rules), triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 11/28/16

A winner and a loser for the session to start the week. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

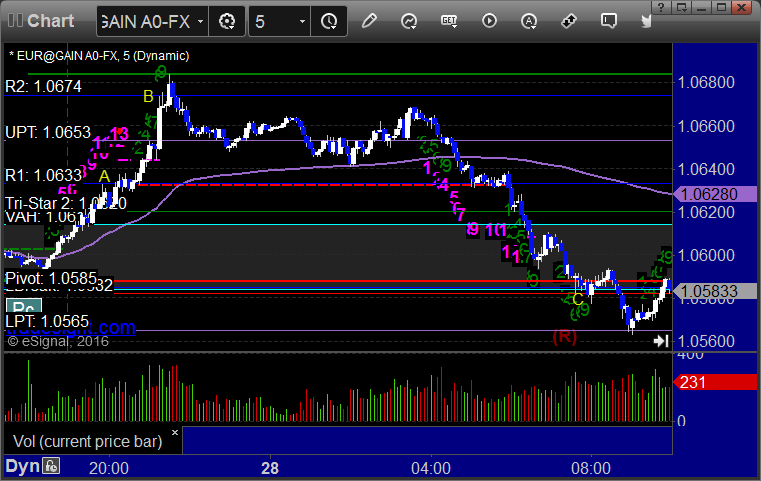

EURUSD:

Triggered long at A, hit first target at B, second half stopped. Triggered short at C and stopped:

Stock Picks Recap for 11/22/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GNTX triggered long (with market support) and didn't go enough in either direction to count:

From the Messenger/Tradesight_st Twitter Feed, Rich's FCX triggered long (without market support) and didn't do much:

GILD triggered short (with market support) and worked enough for a partial:

In total, that's 1 trade triggering with market support, and it worked a little.