Forex Calls Recap for 11/17/16

Two winners for the session, one still going. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B (was the high of the session), and closed second half under entry in the morning. Triggered short at C, didn't quite get to S2 target, so I closed half at D and moved stop over S1, still holding:

Stocks Picks Recap for 11/16/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IDTI triggered long (with market support) and ultimately worked, but may have stopped you out once first:

INSM triggered long (without market support) and didn't work:

OCUL triggered long (with market support) and worked big:

From the Messenger/Tradesight_st Twitter Feed, GS triggered short (without market support) and didn't work:

Mark's COST triggered long (with market support) and didn't work:

Rich's TWLO triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Futures Calls Recap for 11/16/16

The markets gapped down a little. The NASDAQ side filled and then held up for the session (although the last 5 hours were dead flat across the board), and the broad market never filled and sat in a 5-point range all day on 1.8 billion NASDAQ shares.

Net ticks: +27.5 ticks.

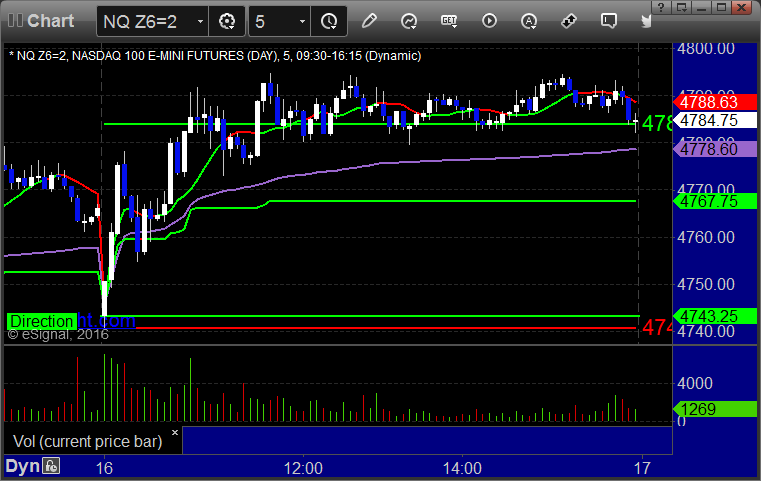

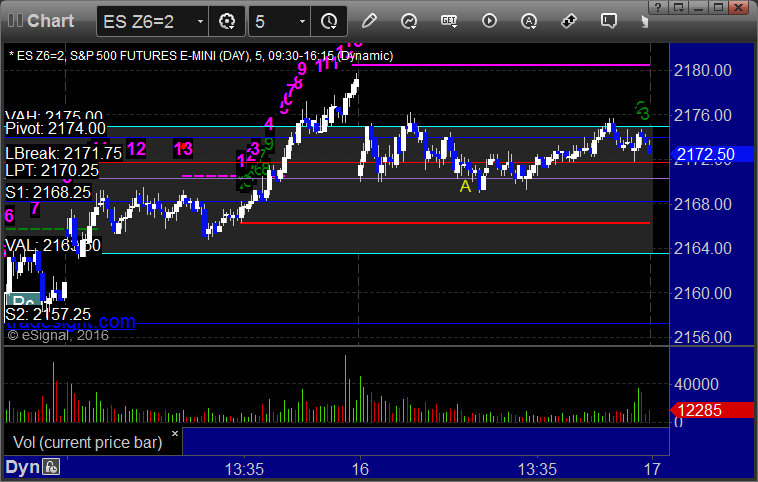

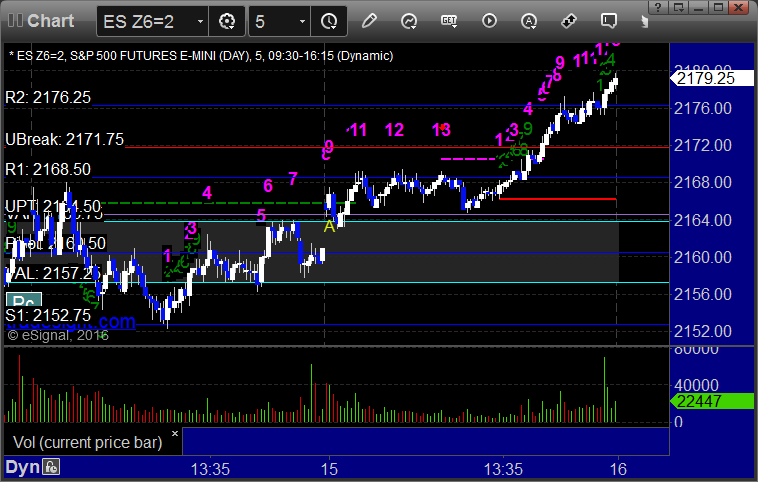

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

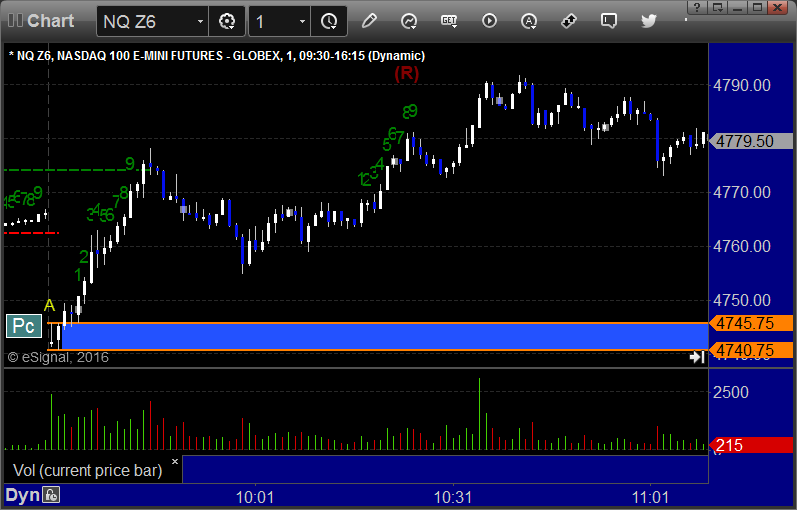

NQ Opening Range Play triggered long at A and worked huge:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered short at A at 2169.75 over lunch and stopped for 7 ticks:

Forex Calls Recap for 11/16/16

Amazingly, Forex slowed down enough that neither of our calls triggered.

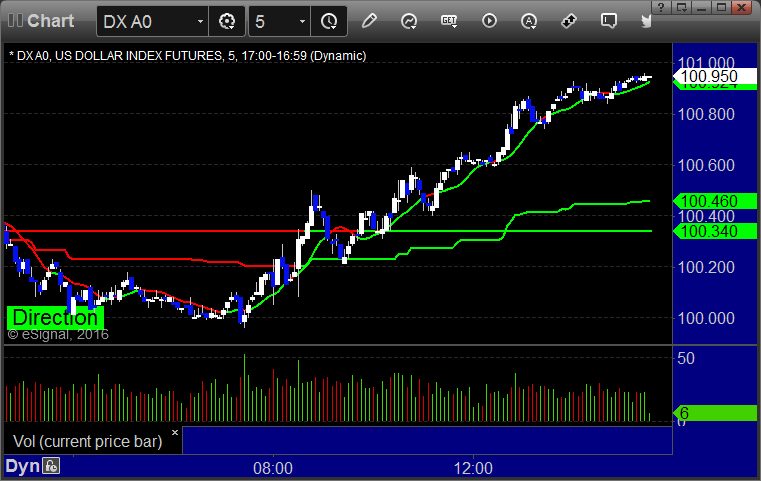

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stock Picks Recap for 11/15/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VRSN triggered short (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, AMGN triggered short (without market support) and worked:

Rich's SSYS triggered short (with market support) and worked:

His DKS triggered short (without market support) and didn't work:

His AMZN triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 11/15/16

The NASDAQ side came back a bit today but the broad market was dead until the last two hours or so. Everything closed positive on 1.9 billion NASDAQ shares, which is a big volume drop-off.

Net ticks: -19 ticks.

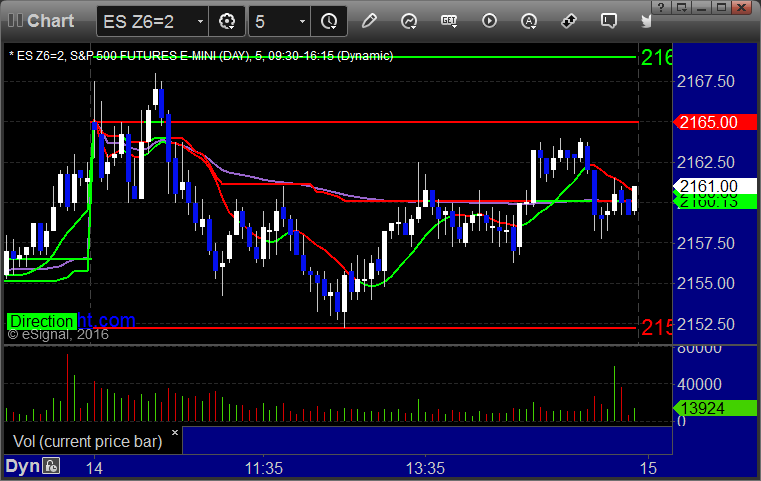

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, we used the midpoint, triggered short at B and stopped:

NQ Opening Range Play triggered long at A and would have worked, but we past on it because the trigger was 10 points above the ORH:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered short at A at 2163.50 and stopped for 7 ticks. This call basically lined up with the OR play, so whether you took this in addition or just took the OR play is your call:

Forex Calls Recap for 11/15/16

Closed out the second half of the prior day's trade in the money and then had two new winners. See EURUSD and GBPUSD sections below. Nice day to go back to full size.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, stopped second half:

Stock Picks Recap for 11/14/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, URBN triggered long (without market support due to opening 5 minutes) and worked:

PRTA triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's NSC triggered long (without market support due to opening 5 minutes) and worked:

His LNG triggered short (with market support) and worked enough for a partial:

FB triggered short (with market support) and worked:

AMGN triggered short (with market support) and worked:

Rich's AGN triggered short (with market support) and worked:

His WFC triggered short (with market support) and didn't work:

His BABA triggered short (with market support) and worked enough for a partial:

His FSLR triggered long (without market support) and worked:

His ERX triggered long (ETF, so no market support needed) and worked a little:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Futures Calls Recap for 11/14/16

The markets opened flat to a little higher, filled, and then came lower, bottoming out over lunch and then returning to the midpoint for the close on 2.1 billion NASDAQ shares.

Net ticks: +13 ticks.

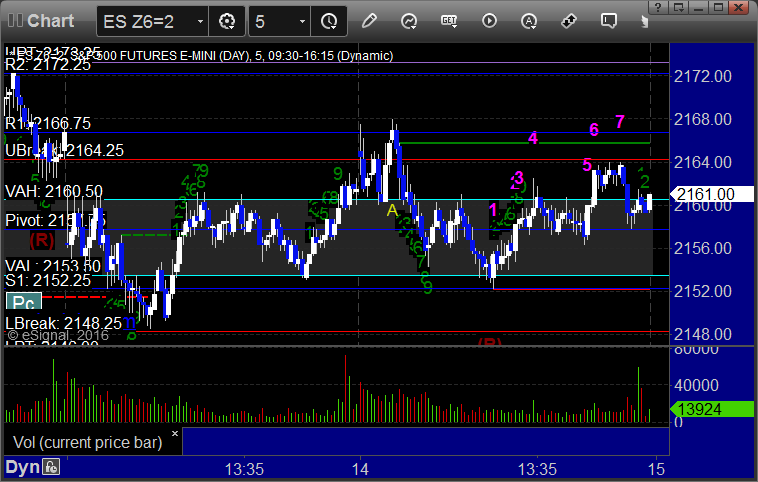

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and would have worked eventually, but the trigger was 10 points below the ORL, so we don't take it:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered short at A at 2159.75, hit first target for 6 ticks, lowered the stop and stopped out there as well on the second half:

Forex Calls Recap for 11/14/16

A nice winner to start the week as the US Dollar starts getting stronger. See the EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over 1.0760: