Stock Picks Recap for 11/11/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls for Veteran's Day.

From the Messenger/Tradesight_st Twitter Feed, Rich's PTCT triggered short (with market support) and worked enough for a partial:

His IBB triggered long (ETF, so no market support needed) and didn't work:

TEVA triggered short (with market support) and didn't work:

Rich's BABA (Rich and I both called it within 2 minutes, I'll give it to him cause he was first) triggered short (with market support) and worked:

GILD triggered short (with market support) and worked:

Rich's AMZN triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 11/11/16

Not much action for the Veteran's Day holiday as expected, although we still traded 1.8 billion NASDAQ shares, which is big for a bank holiday. Futures were too whippy early and the Value Area plays didn't do much.

Net ticks: -14 ticks.

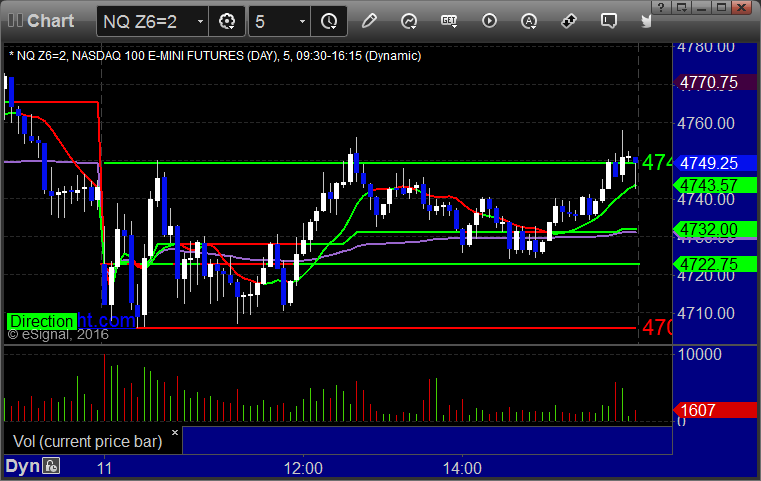

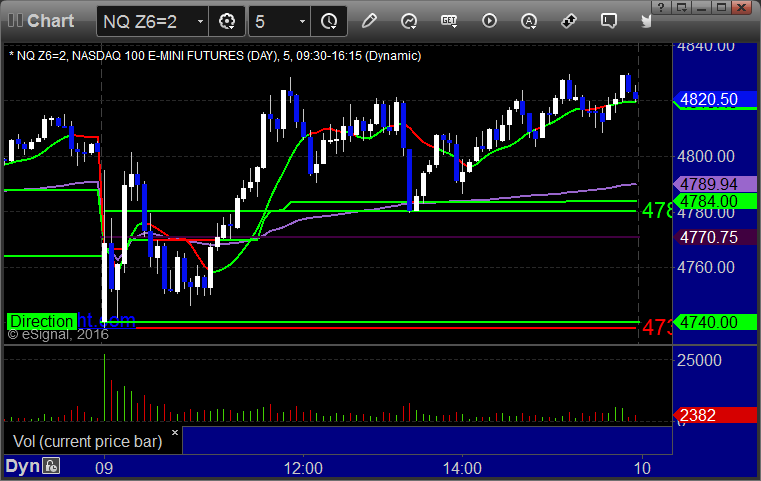

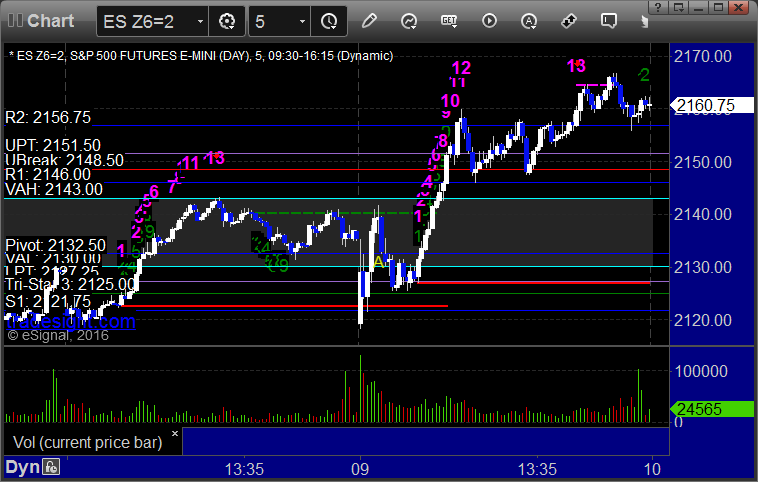

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A, used the midpoint for the stop as posted:

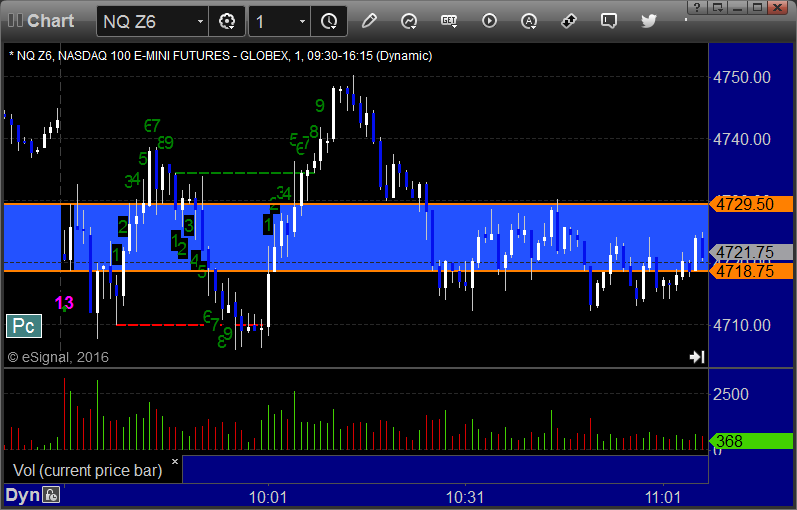

NQ Opening Range Play triggered both ways too far outside the range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 11/11/16

No calls for the Veteran's Day bank Holiday, but we did post Levels, so charts are below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Stock Picks Recap for 11/11/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SAGE triggered long (without market support due to opening 5 minutes) and worked:

UTHR opened a penny above the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's V triggered long (with market support) and didn't work:

His VRX triggered long (with market support) and worked:

SINA triggered long (with market support) and didn't work:

TSLA triggered short (with market support) and worked great:

AAPL triggered short (with market support) and worked great:

Rich's TLT triggered short (ETF, so no market support needed) and worked:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 11/10/16

The markets gapped up a little and were bifurcated immediately, with the NASDAQ holding more negative (and eventually tanking 100 points) while the broad market was a little stronger (although the S&P only closed up 4). The interesting thing is that we closed both sides near the VWAPs. NASDAQ volume is 2.7 billion shares.

Net ticks: +25 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A, but we wouldn't take that because we were short NQ and this was not into the gap, triggered short at B and worked:

NQ Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered short at A at 2166.25 and stopped. I put it back in, hit first target, closed out another 1/4 of the trade for 43 ticks, and stopped out of the final piece over the entry:

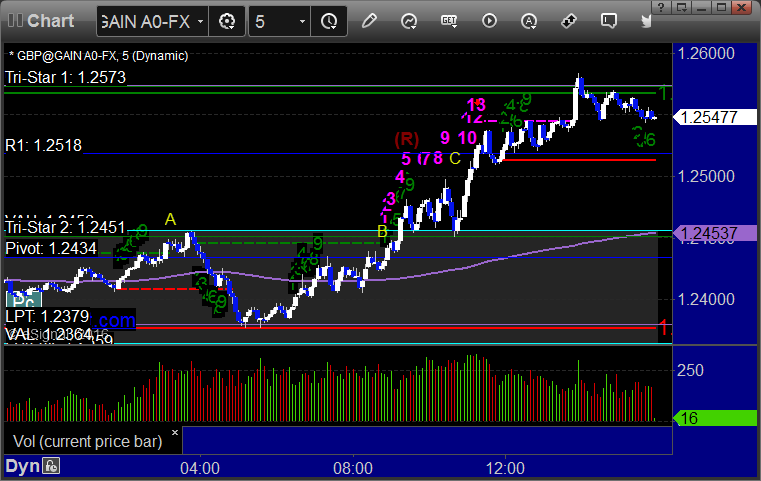

Forex Calls Recap for 11/10/16

A little movement finally in the Forex markets. A loser and a winner (still going) in the GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

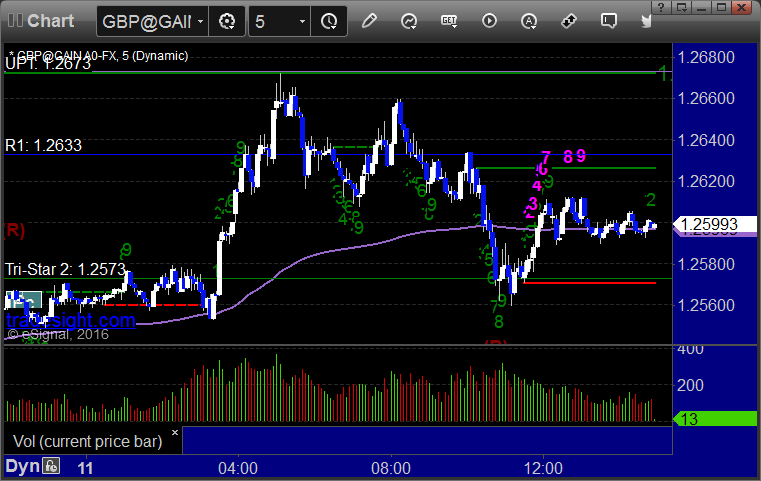

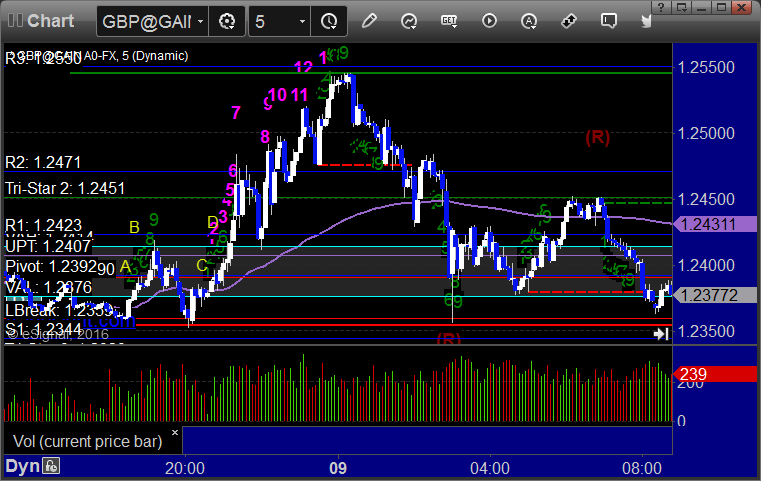

GBPUSD:

Triggered long at A and stopped. Triggered long at B, hit first target at C, still holding second half with a stop under R1:

Stock Picks Recap for 11/9/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered long (with market support) and worked enough for a partial:

Rich's ERX triggered long (ETF, so no market support needed) and worked great:

His APA triggered long (with market support) and worked great:

His IBB triggered short (ETF, so no market support needed) and worked:

NFLX triggered short (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 11/9/16

The markets gapped down and filled and were all over the map initially, but then went higher on 2.5 billion NASDAQ shares. I said not to take the Opening Range plays because the range was too wide, and it was probably smart as the ES would have worked and the NQ would have stopped. We did have another winning call.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play would have triggered at A and worked:

NQ Opening Range Play would have triggered at A and not worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered short at A at 2132.25, hit first target for ticks, stopped second half over the entry:

Forex Calls Recap for 11/9/16

A winner in the session in the GBPUSD.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A early, hit first target at B. If you didn't catch that because it was early, triggered long at C, hit first target at D and beyond, note the Comber 13 sell signal at the top:

Stock Picks Recap for 11/8/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, COMM triggered long (without market support due to opening 5 minutes) and worked:

SOHU triggered short (by a penny, without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's HTZ triggered short (without market support due to opening 5 minutes) and worked:

Rich's VRX triggered long (with market support) and worked:

His CVS triggered long (with market support) and didn't work initially, worked later:

AVGO triggered long (with market support) and didn't work:

Rich's AAPL triggered short (without market support) and worked:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.