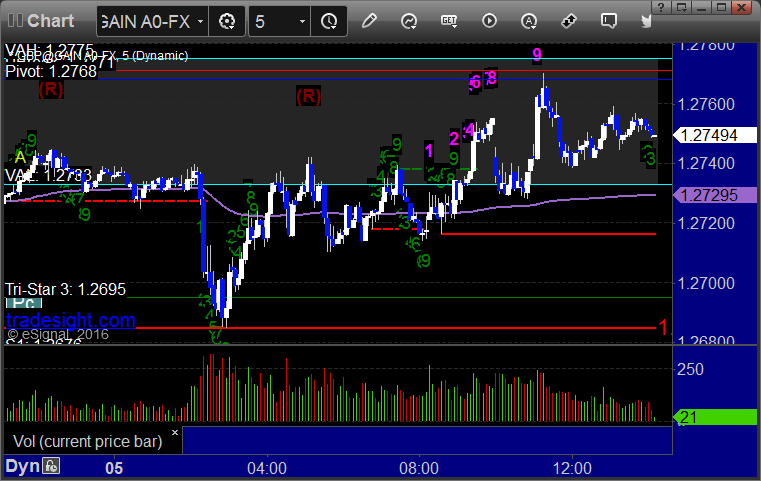

Forex Calls Recap for 10/10/16

No calls for the session with the US Bank Holiday. I'm just posting the charts here. Back to it tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 10/07/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (without market support) and didn't work:

His CLVS triggered short (with market support) and didn't work:

Mark's COST triggered short (with market support) and didn't work:

MYGN triggered long (without market support) and never went enough either way to count:

BIIB triggered short (with market support) and worked enough for a partial:

LULU triggered short (with market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

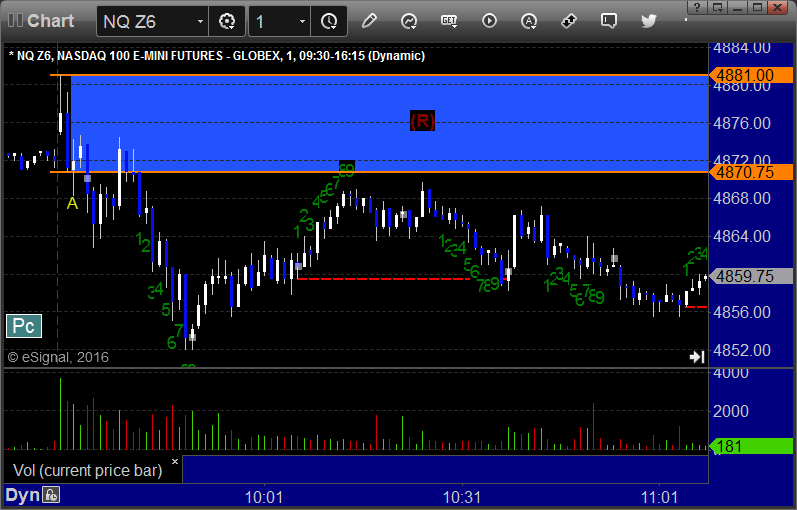

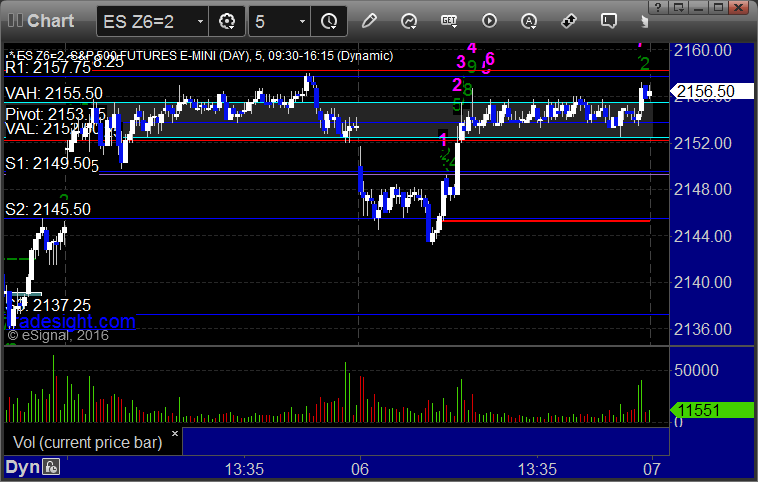

Futures Calls Recap for 10/7/16

Markets opened flat and closed down a little on not much action with the hurricane hitting the coast of Florida. NASDAQ volume was 1.5 billion at the close but stayed light all day. Monday is Columbus Day, so most banks are closed but the stock market is open and should be dead.

Net ticks: +8 ticks.

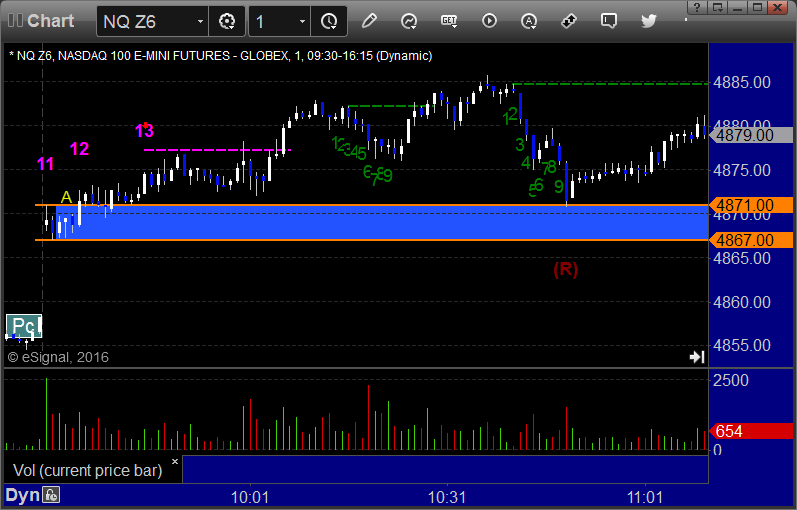

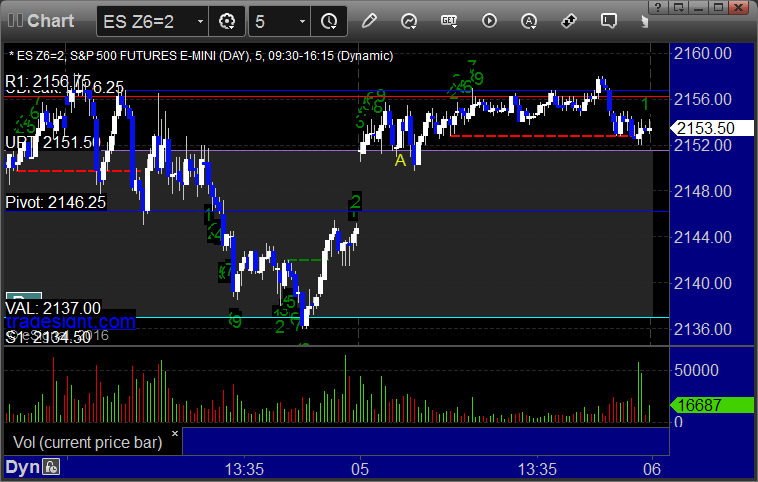

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial:

NQ Opening Range Play triggered long at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

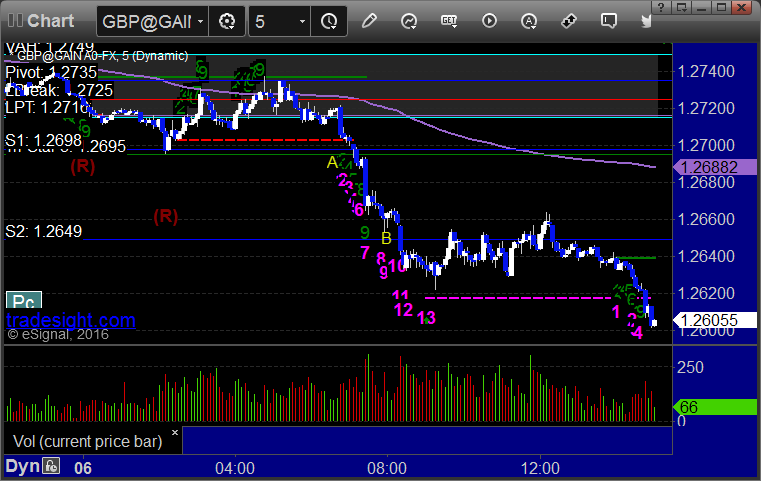

Forex Calls Recap for 10/7/16

A strange session with a huge (and mostly unexplained) spike down in the GBPUSD. If you got filled on our short call, you made a ton of money, but since it hadn't triggered until the spike, I would doubt most got a fill, unlike the original Brexit spike where we were already short when it happened. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

In theory, triggered short at A and worked huge, but since that happened on the unexplained spike, most probably didn't get a fill:

Stock Picks Recap for 10/6/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AVXS triggered long (without market support due to opening 5 minutes) and worked great:

AIRM triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TLT triggered long (ETF, so no market support needed) and worked:

VRSN triggered short (with market support) and worked:

Rich's AUPH triggered short (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

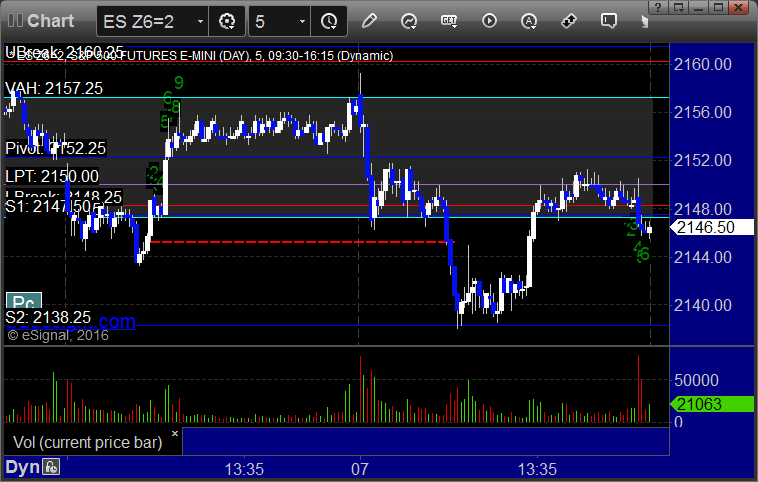

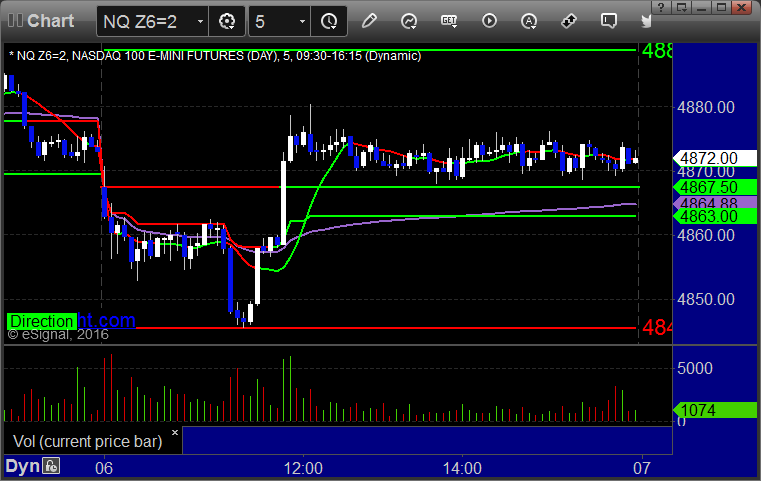

Futures Calls Recap for 10/6/16

As expected, a dead market with the hurricane approaching Florida. Markets gapped down and inched lower, giving us some profitable early trades, and then went higher on a pop ahead of lunch to exactly fill the gaps and sat dead flat the rest of the session on 1.5 billion NASDAQ shares.

Net ticks: +13 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 10/6/16

A winner for the session as the hurricane approaches Florida. Friday could be slow. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, stopped second half over S2 at same price:

Stock Picks Recap for 10/5/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, DISH triggered long (with market support) and worked enough for a partial:

MOMO triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Mark's XLNX triggered long (with market support) and didn't work:

GS triggered long (with market support) and worked:

Rich's CRM triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

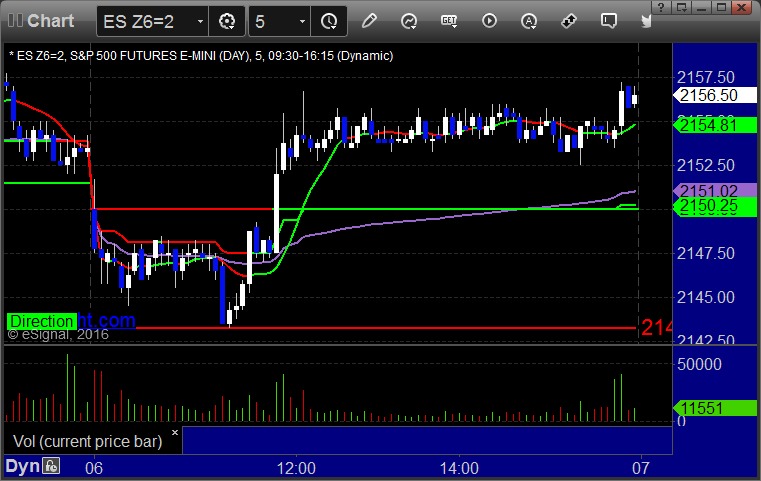

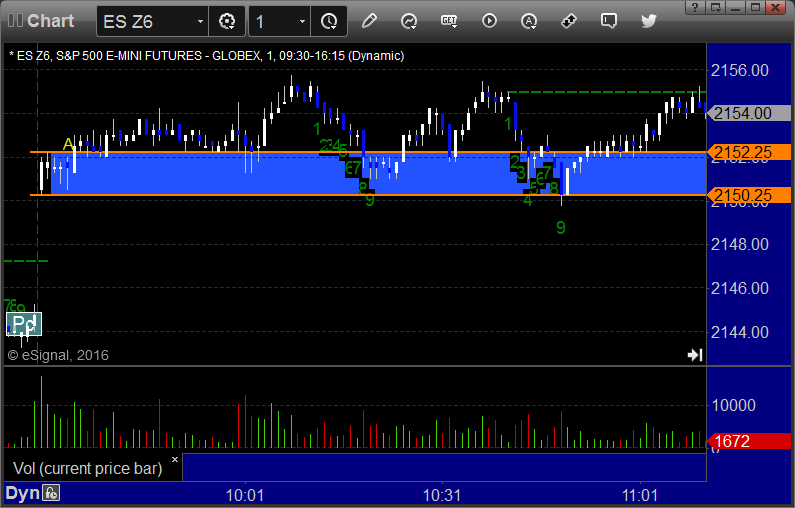

Futures Calls Recap for 10/5/16

A dull session as the hurricane closes in on Florida. Probably will remain like this for the rest of the week with so many people having other real issues to worry about. Markets gapped up and drifted higher but didn't even trade half of average daily range. NASDAQ volume was 1.6 billion shares.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and eventually worked:

NQ Opening Range Play triggered long at A and eventually worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered short at A at 2151.00, missed first target by a tick, and stopped for 7 ticks:

Forex Calls Recap for 10/5/16

We stopped out of the second half of the GBPUSD in the money from the prior session, and then had a new trade trigger. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped: