Futures Calls Recap for 9/29/16

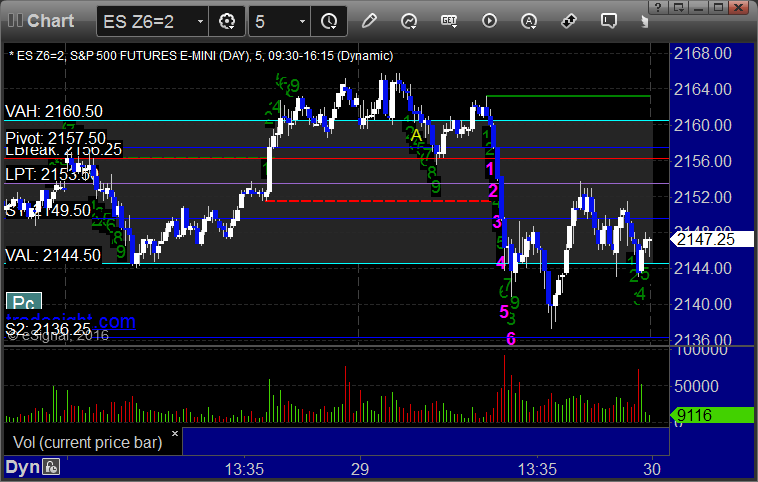

The markets opened basically flat and did nothing for the first two hours, which was expected, but then tumbled over lunch and that was the range for the day on 1.75 billion NASDAQ shares as we head into end of quarter Friday.

Net ticks: -40 ticks.

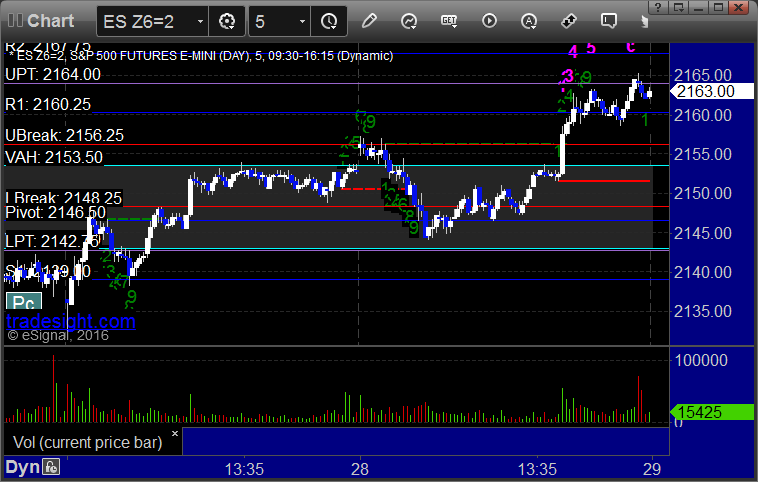

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

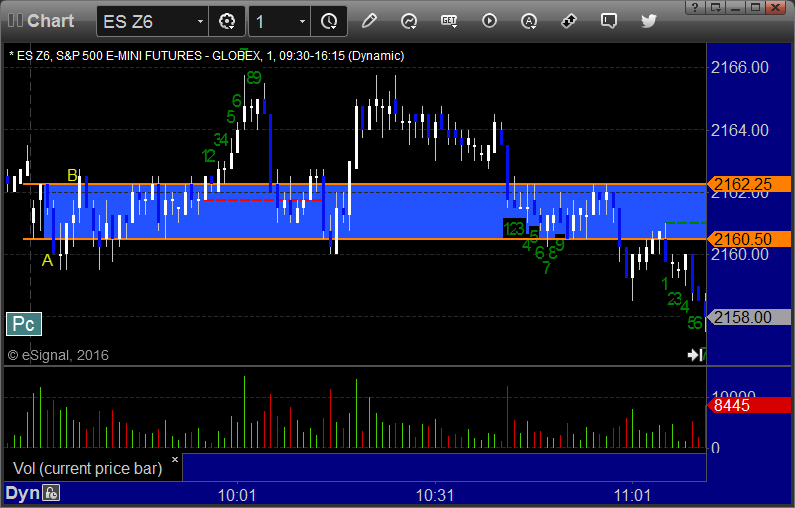

ES Opening Range Play triggered short at A and stopped, triggered long at B and stopped:

NQ Opening Range Play triggered long at A, which was valid because the ES short had stopped out and it was into the gap anyway, and stopped. Triggered short at B and stopped:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered short at A at 2159.25, stopped immediately, supposed to put that back in, triggered again, hit first target, stopped second half 6 ticks in the money:

Forex Calls Recap for 9/29/16

We remain half size and the Forex market remains really boring. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped:

Stock Picks Recap for 9/28/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AMKR triggered long (without market support) and didn't go enough in either direction to count:

EMKR triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's BABA triggered long (without market support due to opening 5 minutes) and didn't work:

His GOOGL triggered long (without market support) and worked:

His OPTT triggered long (without market support) and didn't work:

His WYNN triggered short (with market support) and worked:

Rich's ERX triggered long (ETF, so no market support needed) and worked:

Lots more calls and nothing triggered.

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 9/28/16

The markets gapped up a little and were flat for the first hour or so, then headed a bit lower after the oil data came out, and then recovered over lunch, with the NASDAQ back to its opening level for the close and the broad market slightly higher on 1.6 billion NASDAQ shares.

Net ticks: -4 ticks.

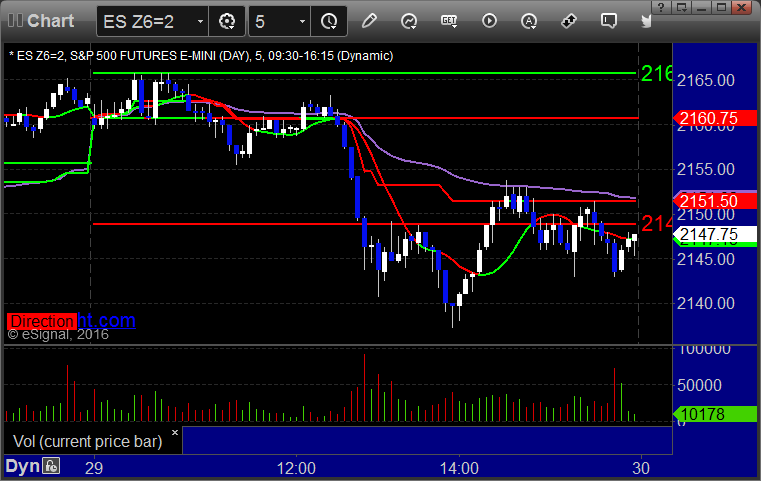

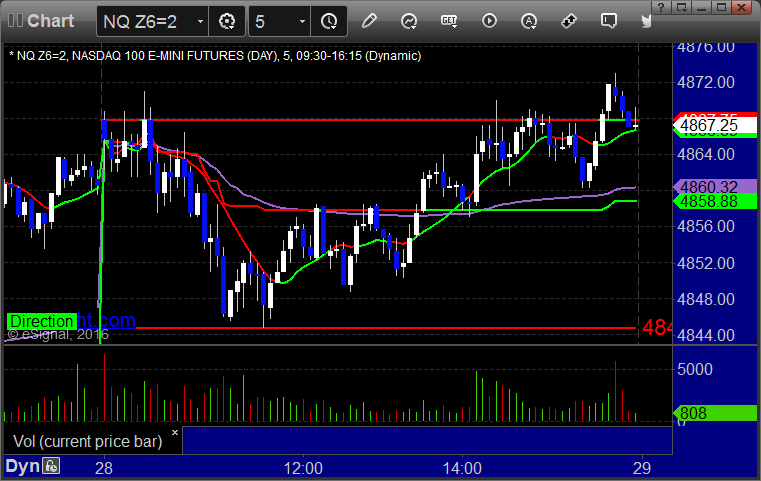

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked eventually:

NQ Opening Range Play triggered short at A and stopped. The long at B was not valid because we were still short ES and it was not in the direction of the gap:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 9/28/16

Another dull night. We stopped out of the second half of the prior day's EURUSD short and went nowhere on the GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

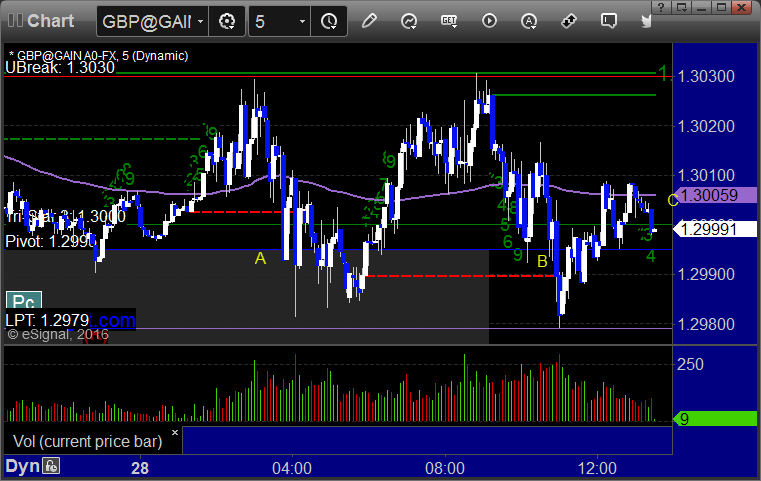

GBPUSD:

Triggered short at A overnight and stopped. Triggered short again at B and closed at C for end of day:

Stock Picks Recap for 9/27/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no triggers.

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered short (ETF, so no market support needed) and worked:

His MNK triggered short (without market support) and didn't work:

Lots of other calls but nothing triggered.

In total, that's 1 trades triggering with market support, it worked.

Futures Calls Recap for 9/27/16

The markets gapped down small and headed up, establishing the range for the day mostly by lunch and going flat in the afternoon on 1.6 billion NASDAQ shares. We had a nice day in futures. See the ES and Opening Range sections below.

Net ticks: +28 ticks.

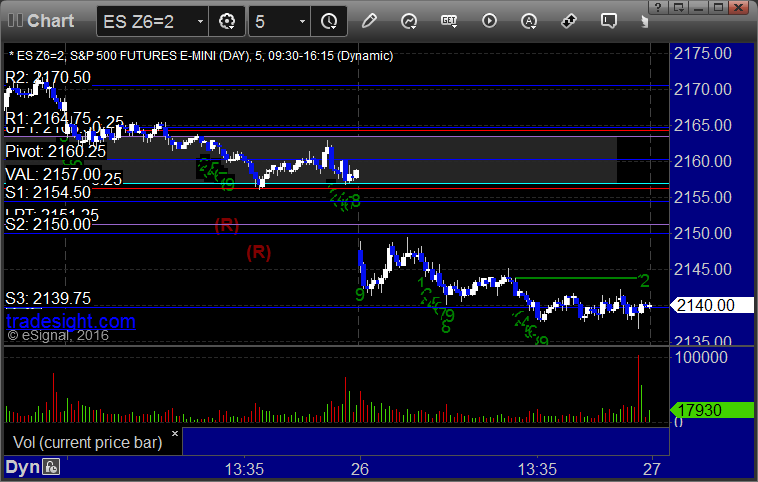

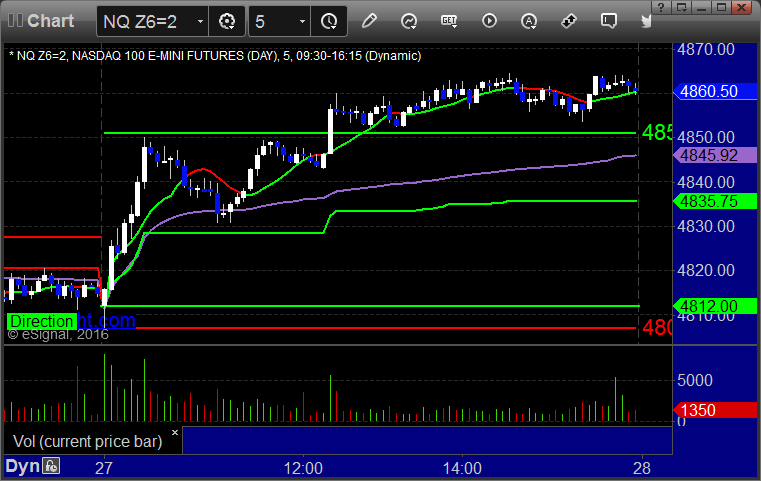

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

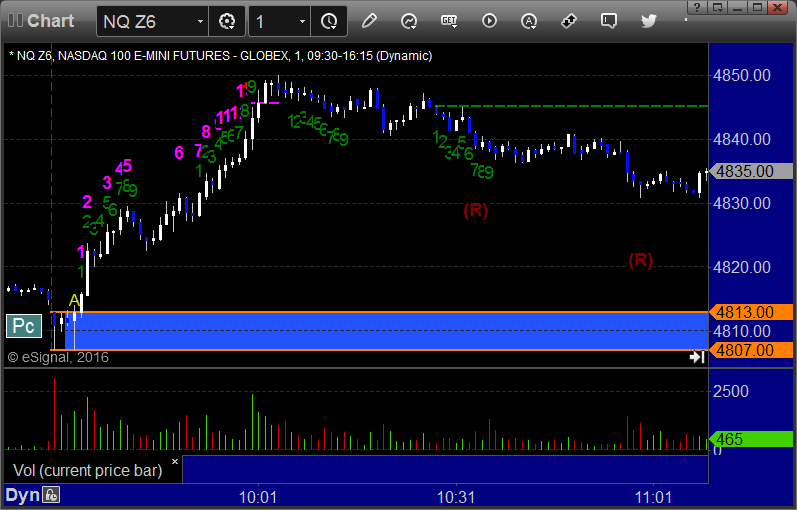

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

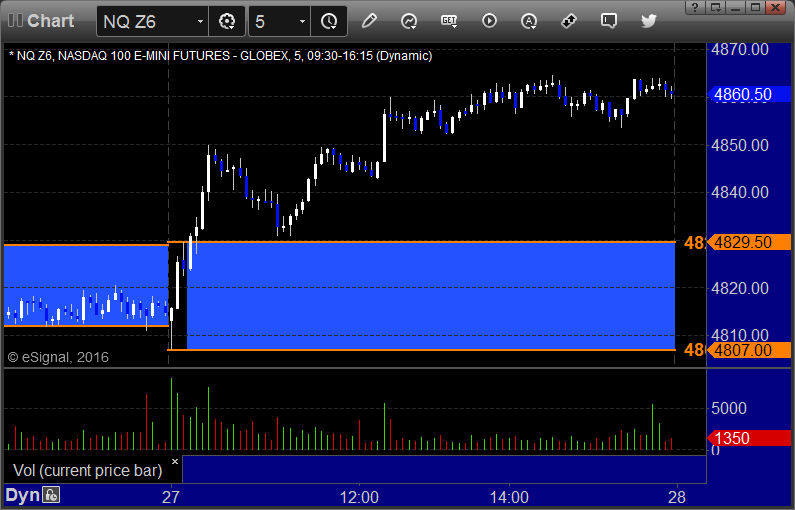

NQ Tradesight Institutional Range Play:

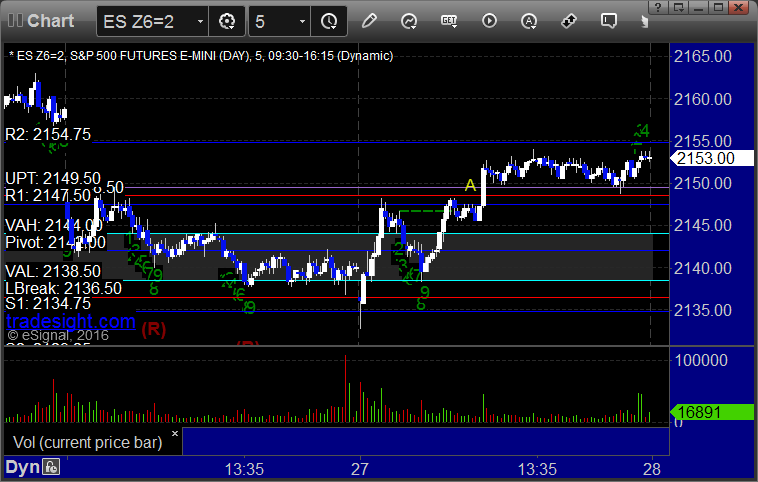

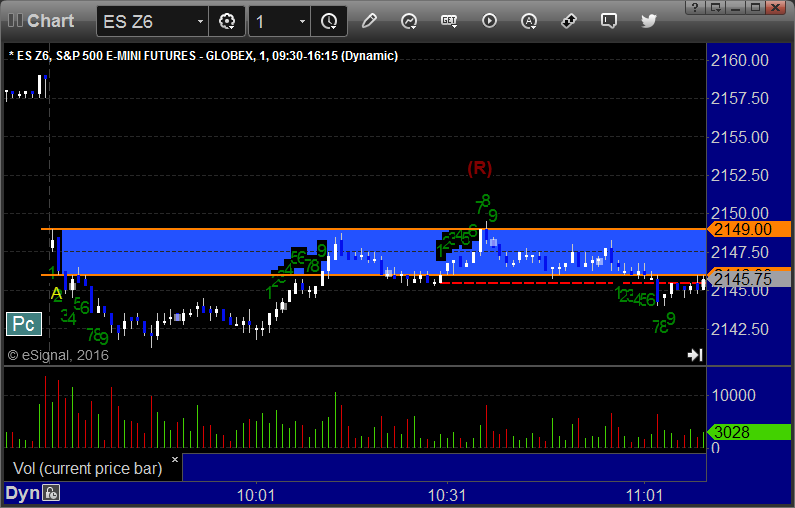

ES:

My call triggered long at A at 2149.75, hit first target for 6 ticks, and after adjusting the stop, the second half stopped 8 ticks in the money:

Forex Calls Recap for 9/27/16

A clean winner in the EURUSD after a dull overnight session (again). Still (barely) holding the second half. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

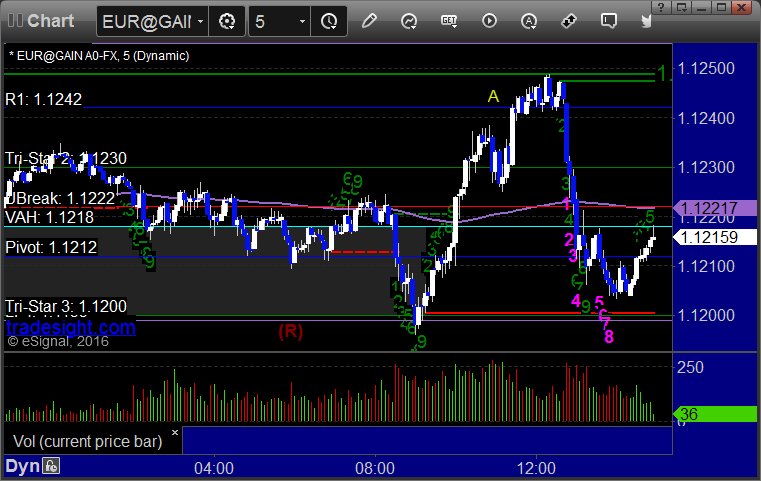

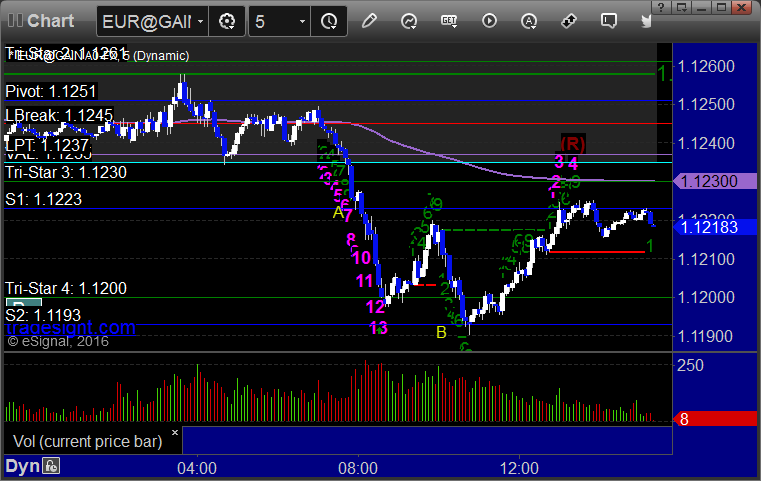

EURUSD:

Triggered short at A, note the Comber 13 bottom that caused a bounce for a bit, then hit first target at B, still holding second half with a stop a few pips over S1:

Stock Picks Recap for 9/26/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AMKR triggered long (without market support) and didn't work (was a sweep):

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and didn't work:

LULU triggered short (with market support) and didn't work:

Rich's TSLA triggered long (without market support) and didn't work:

WDC triggered long (with market support) and didn't work or took a long time to do so depending on where you put the stop:

In total, that's 3 trades triggering with market support, none of them worked, first time I remember that happening in forever.

Futures Calls Recap for 9/26/16

A fairly slow session ahead of the first Presidential Debate. The markets gapped down and established most of the range in the first 15 minutes, although we slipped a couple of points lower on the broad market over lunch and sat there for the rest of the day on 1.5 billion NASDAQ shares. See Opening Range Plays.

Net ticks: +9.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked, triggered long at B and I closed it under the midpoint with the market so dead and volume so light:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: