Futures Calls Recap for 9/15/16

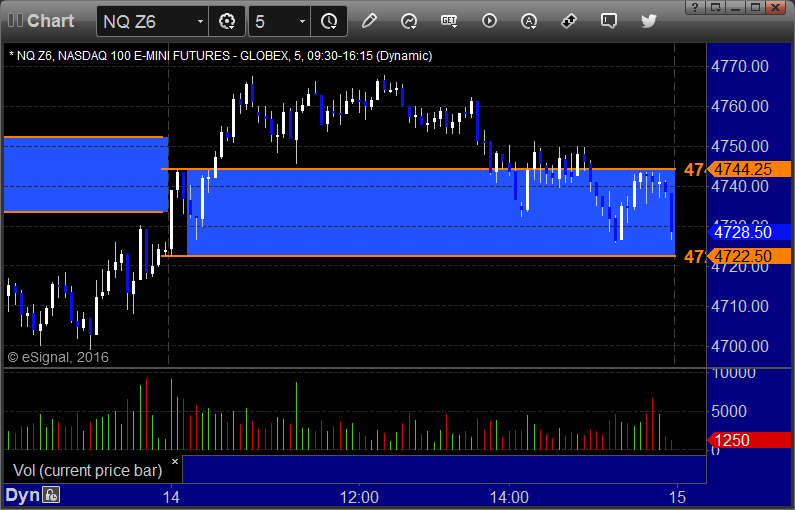

The markets gapped up small, flopped around both ways for 15 minutes, and then went higher for the session on 1.5 billion shares as volume dried up ahead of Friday's triple expiration. Opening Range plays did not work and they were wider than normal. My NQ call didn't trigger.

Net ticks: -32 ticks.

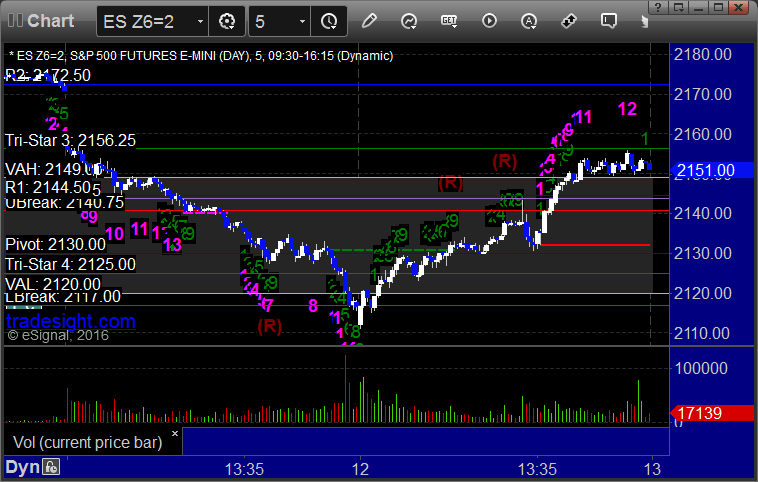

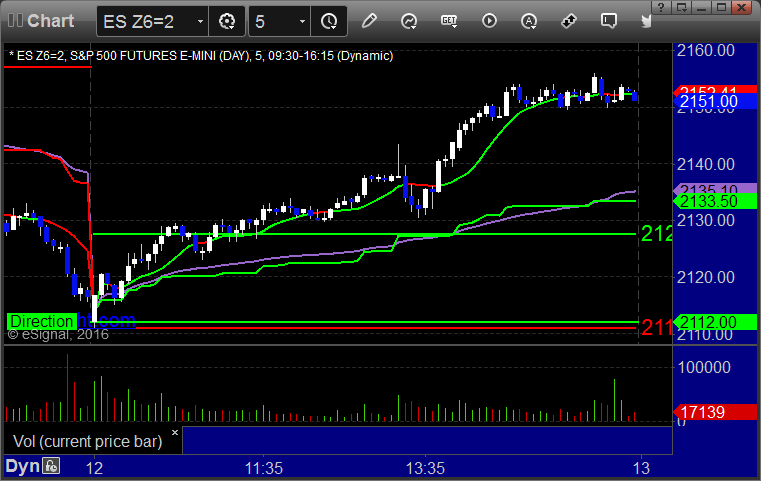

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

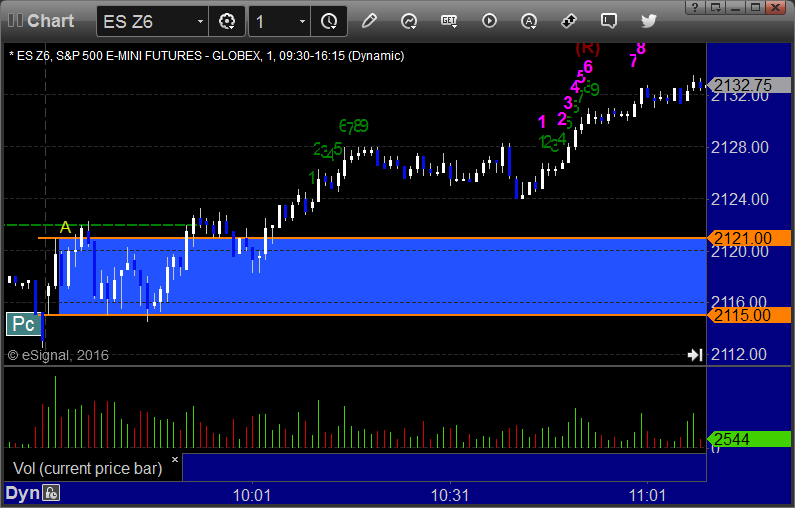

ES Opening Range Play triggered long at A and stopped, we use the midpoint when it this wide:

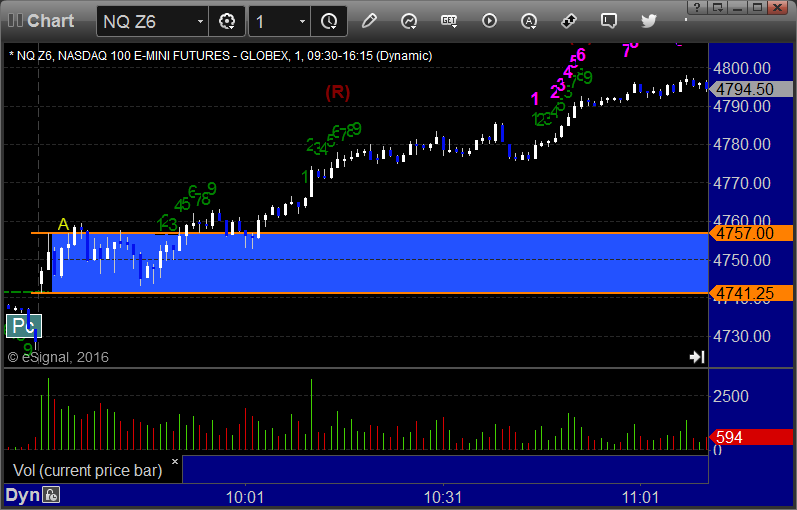

NQ Opening Range Play triggered long at A and stopped, we use the midpoint when it this wide:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

If we had paused at the UPT at A, this would have been a called setup, very nice overall:

Forex Calls Recap for 9/15/16

Wow, this has been one of the slowest weeks of the whole year as the rest of the markets have returned to being great. EURUSD was basically in a 40 pip range minus a news spike. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

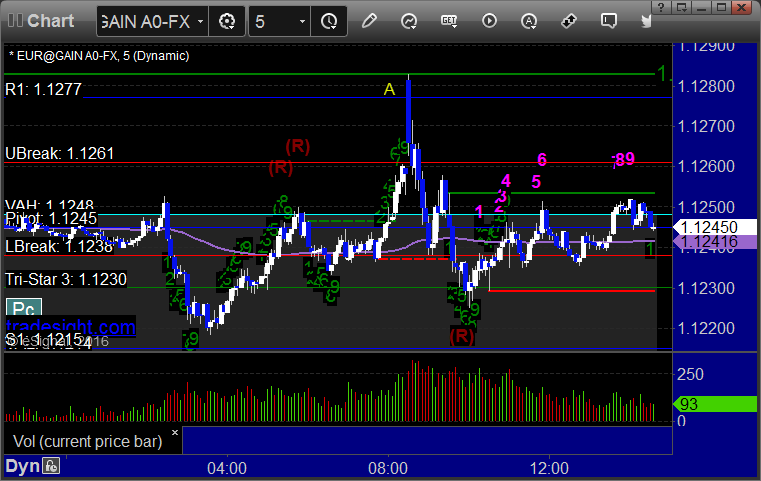

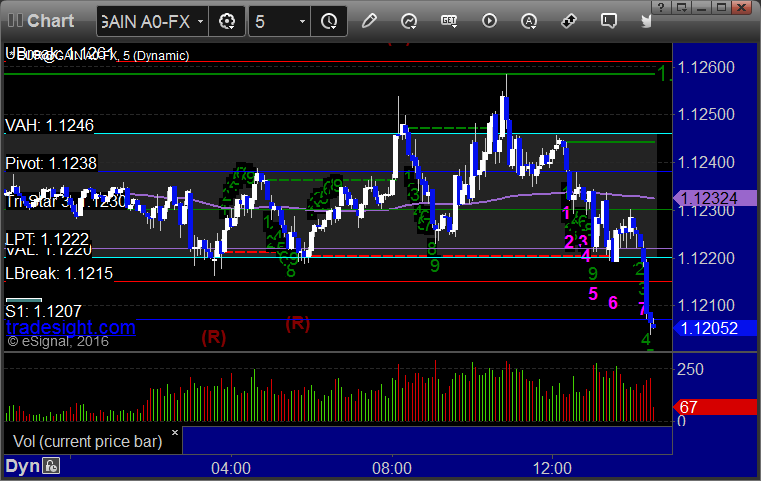

EURUSD:

A dead flat night that then triggered our long on the economic data at 8:30 am EST at A and stopped, and then we resumed being dead flat:

Stock Picks Recap for 9/14/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, WYNN triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (with market support) and worked enough for a partial:

His AMGN triggered long (with market support) and worked:

His ERX triggered short (with market support) and didn't work (worked later in the day if you wanted it):

His BABA triggered long (with market support) and worked:

His VXX triggered short (ETF, so no market support needed) and worked:

SINA triggered long (with market support) and didn't work:

There were many more calls, nothing triggered.

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Futures Calls Recap for 9/14/16

The markets opened fairly flat and wiggled both ways, then pushed higher in the morning, settled down over lunch, and the broad market swept the lows after lunch. Since the top was an hour in and volume held up a bit, it does appear that we got a slight options unravel move, which was to the downside. NASDAQ volume was 1.7 billion shares.

Net ticks: +23 ticks.

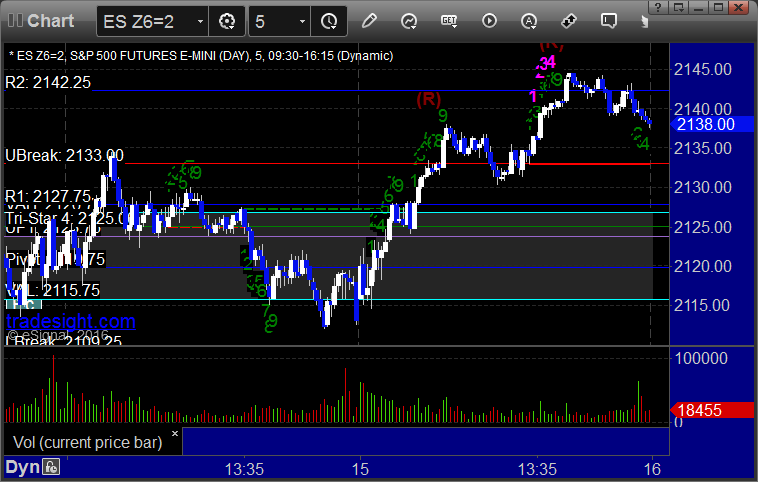

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, we used the midpoint, triggered short at B and stopped, we used the midpoint:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

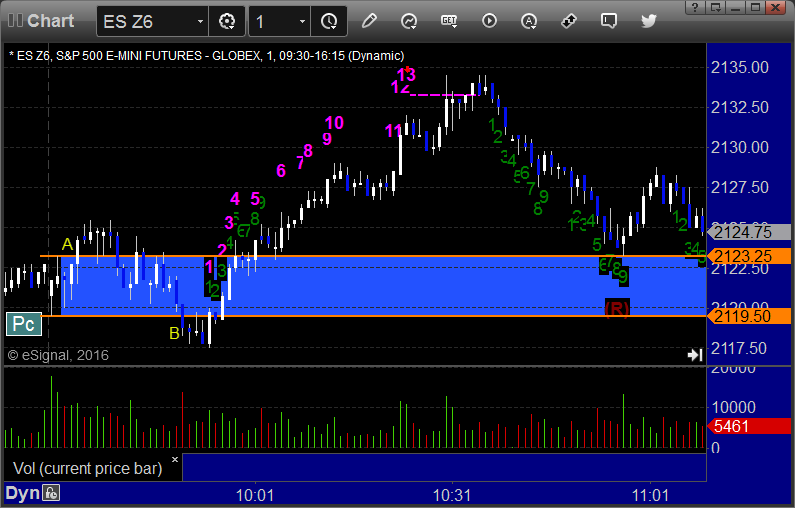

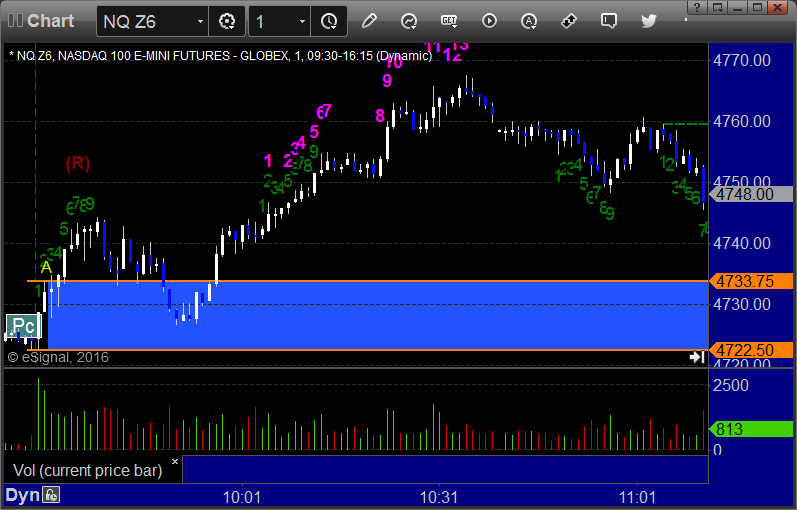

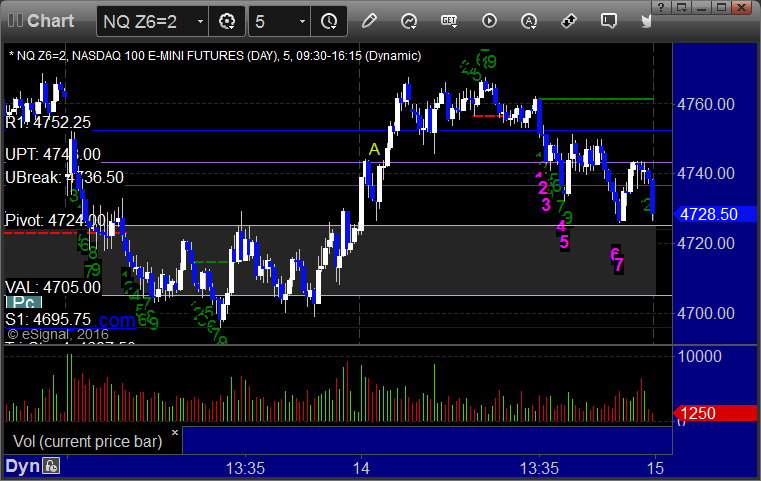

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered long at A at 4744.50, hit first target for 6 ticks, raised the stop several times, and locked in 34 ticks to the final exit:

Forex Calls Recap for 9/14/16

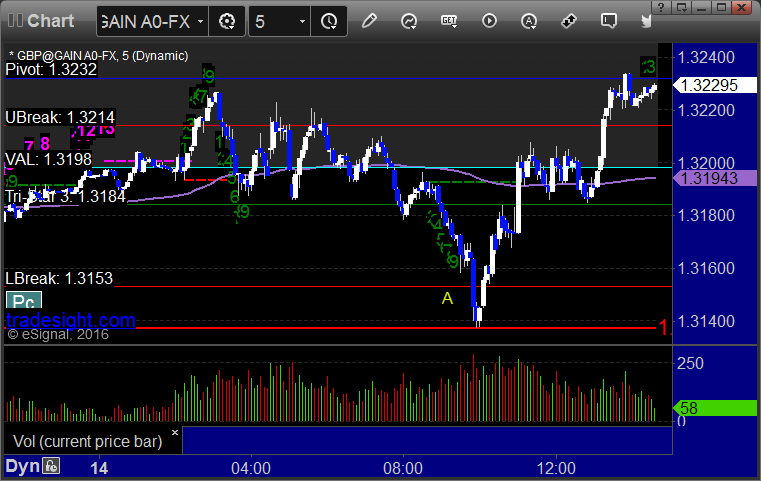

Forex remains slow. We have not yet seen the movement return here that we have in stocks and futures post-Labor Day. Therefore, we remain half size. GBPUSD was flat all night and finally triggered and stopped a trade in the US session. See that section below.

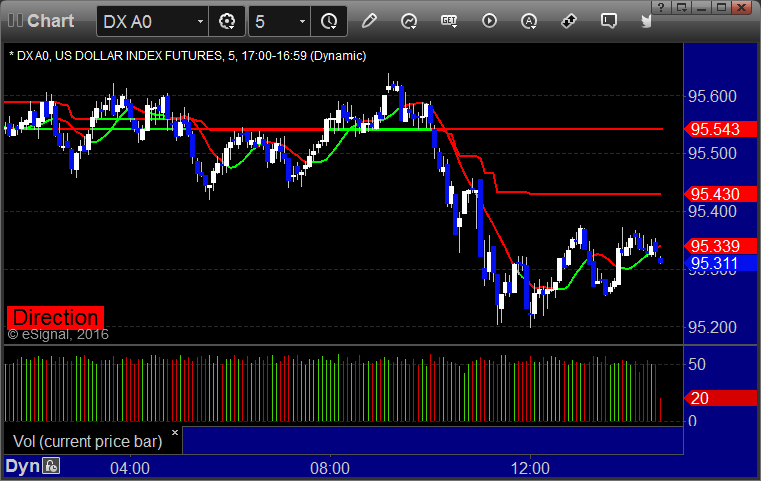

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped:

Stock Picks Recap for 9/13/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's ERX triggered short (with market support) and worked:

FB triggered short (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 9/13/16

The markets gapped down and ultimately kept going, although the trades into the gap looked better, but never triggered. Opening Range plays worked, see that section below. NASDAQ volume was 1.9 billion shares.

Net ticks: +8 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and worked:

NQ Opening Range Play triggered long at A and worked a little, triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 9/13/16

We stopped out of the second half of the prior day's trade in the money, and then we had EURUSD calls for the session but nothing triggered as it sat in a 50 pip range.

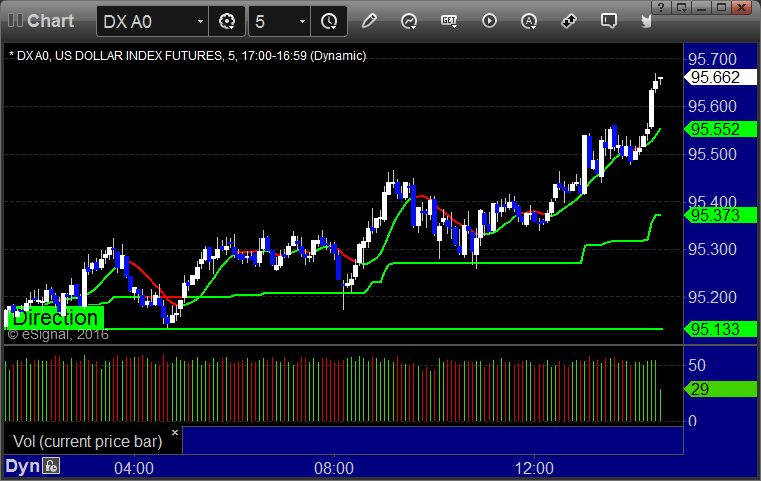

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 9/12/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MLNX triggered short (without market support) and worked:

AAPL gapped under the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's AMGN triggered long (with market support) and worked:

Mark's ILMN triggered long (with market support) and worked:

WYNN triggered long (with market support) and worked:

NFLX triggered long (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 9/12/16

The markets gapped down a little and headed up, this time reversing Friday's loss and closing exactly where we opened Friday on 1.8 billion NASDAQ shares. Nice morning for us.

Net ticks: +29 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: