Stock Picks Recap for 2/25/19

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CDNA triggered long (without market support due to opening 5 minutes) and didn't work:

QURE gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's WDC triggered long (with market support) and didn't work:

NVDA triggered short (without market support) and worked great:

In total, that's 1 trade triggering with market support, and it didn't work.

Futures Calls Recap for 2/25/19

The markets gapped up on news that the tariffs against China would be delayed and literally put in one of the most boring, flat days we have seen in a while. NASDAQ volume was 2.2 billion shares.

Net ticks: -20 ticks.

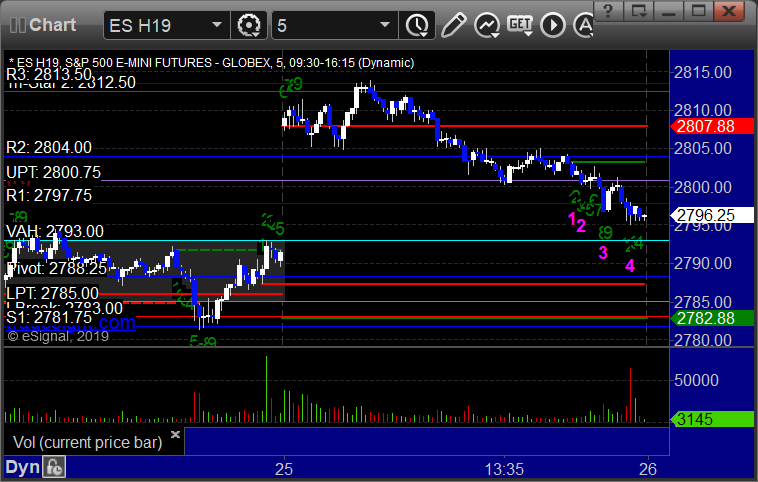

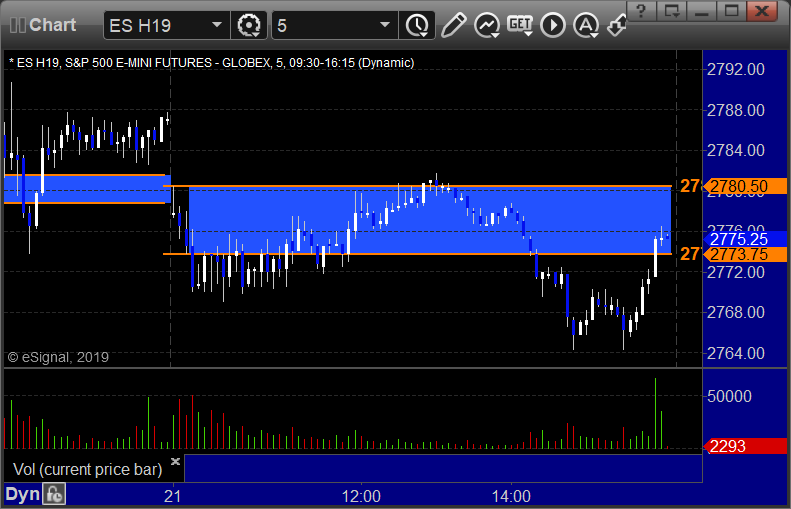

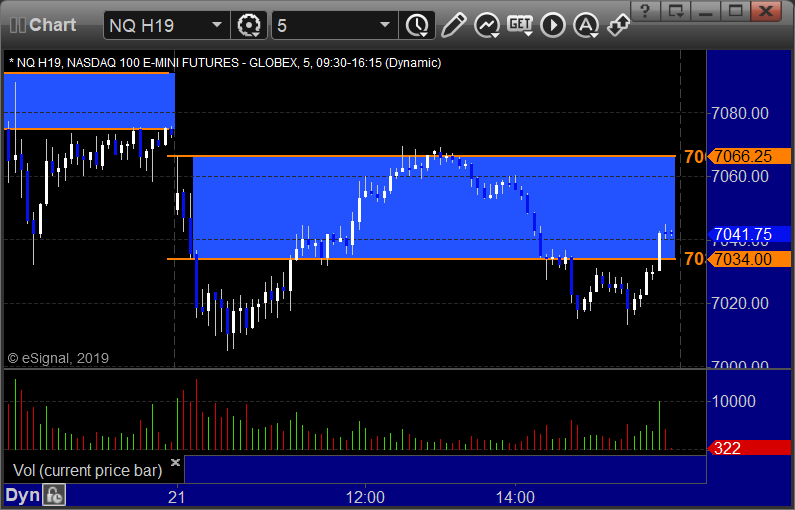

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

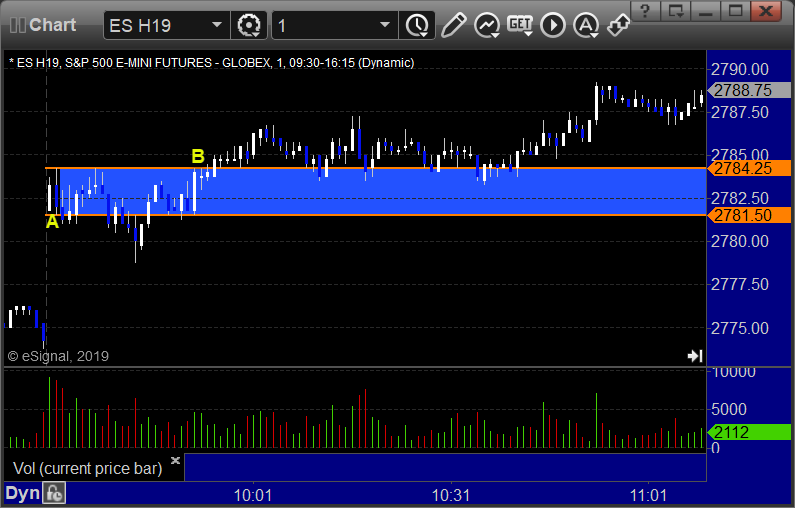

ES Opening Range Play triggered long at A and stopped, triggered short at B and stopped:

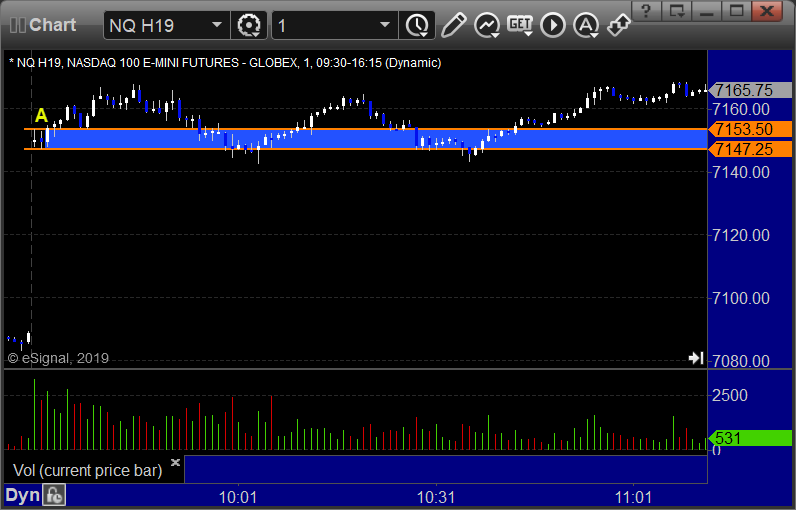

NQ Opening Range Play triggered long at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 2/25/19

Wow, once again, no triggers (GBPUSD literally hit our trigger but didn't get through). Just amazing.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stock Picks Recap for 2/22/19

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ARAY triggered long (with market support) and didn't go enough in either direction to count:

ACOR triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

TTWO triggered short (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, YELP triggered long (with market support) and worked enough for a partial:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 2/22/19

The markets gapped up, held for 30 minutes, then headed up until lunch and that was about it for the day on 2.2 billion NASDAQ shares.

Net ticks: +8 ticks.

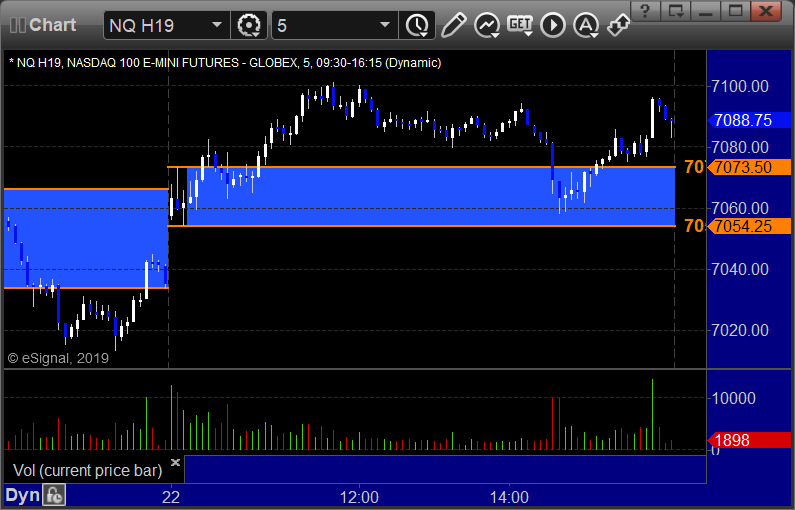

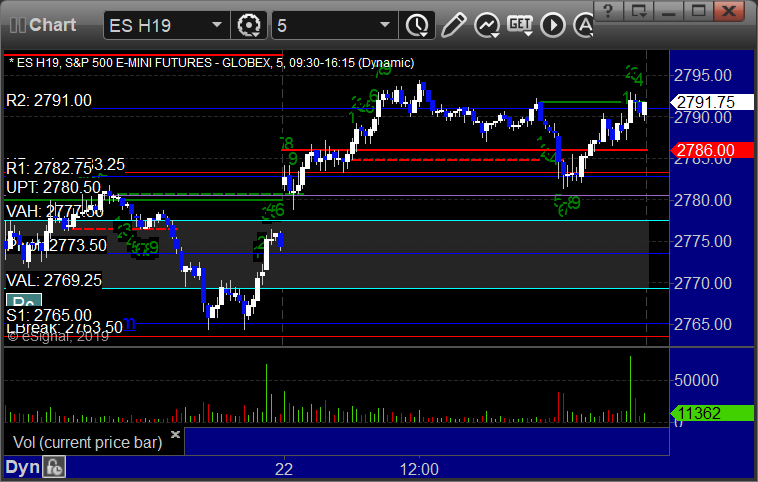

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

NQ Opening Range Play triggered long at A but we don't take it by rule because we were short ES and this was not into the gap:

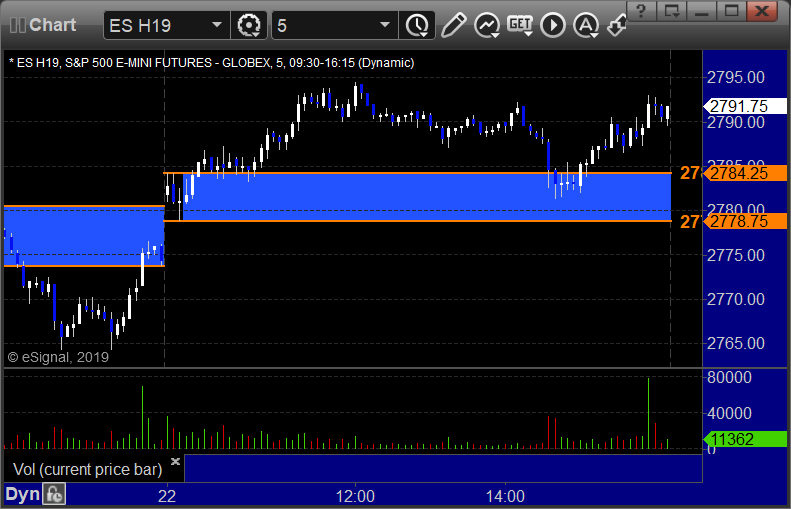

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

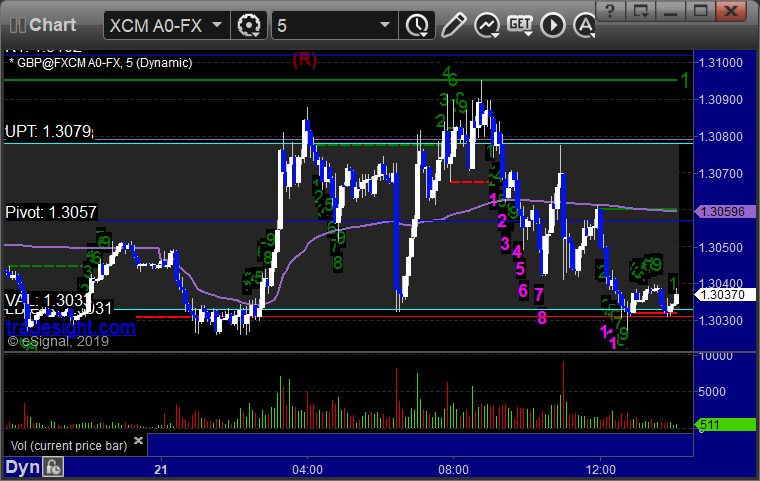

Forex Calls Recap for 2/22/19

A small loss to close out one of the slowest weeks in Forex since last summer. See GBPUSD section below.

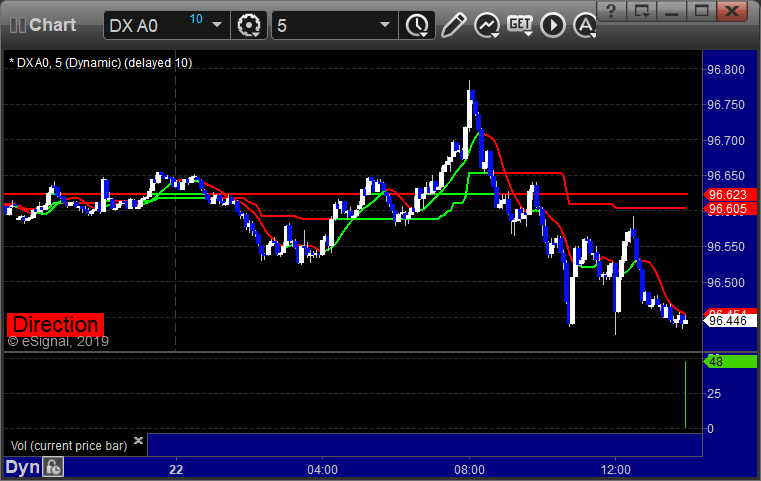

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

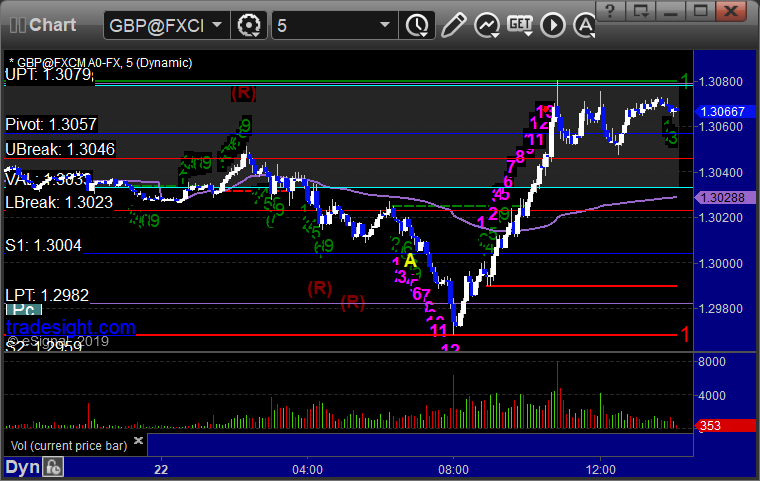

GBPUSD:

Triggered short at A, never made it to the first target, but we lowered stop to just over 1.3015:

Stock Picks Recap for 2/21/19

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ACIA triggered long (without market support due to opening 5 minutes):

From the Messenger/Tradesight_st Twitter Feed, Rich's CAT triggered long (without market support) and didn't work:

FB triggered short (with market support) and didn't quite work enough for a partial:

NVDA triggered short (with market support) and worked great:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

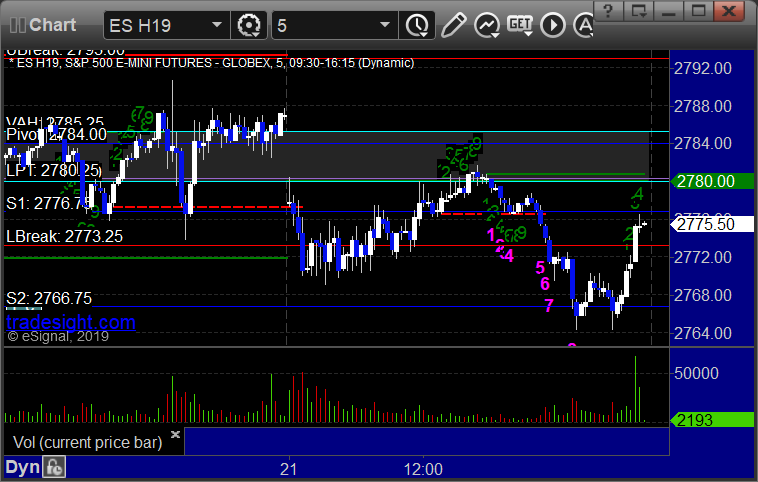

Futures Calls Recap for 2/21/19

The markets gapped down, went lower for a brief moment, flattened out for hours, curled back up a bit to the open over lunch, then rolled in the afternoon before bouncing back in the last 15 minutes on 2.1 billion NASDAQ shares.

Net ticks: +4 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered short at A but too far out of range to take (over 10 points to the midpoint):

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 2/21/19

Amazingly, again no triggers. Forex is just dead right now.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stock Picks Recap for 2/20/19

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, KNDI gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's MGLN triggered long (with market support) and didn't work:

In total, that's x trades triggering with market support, y of them worked, z did not.