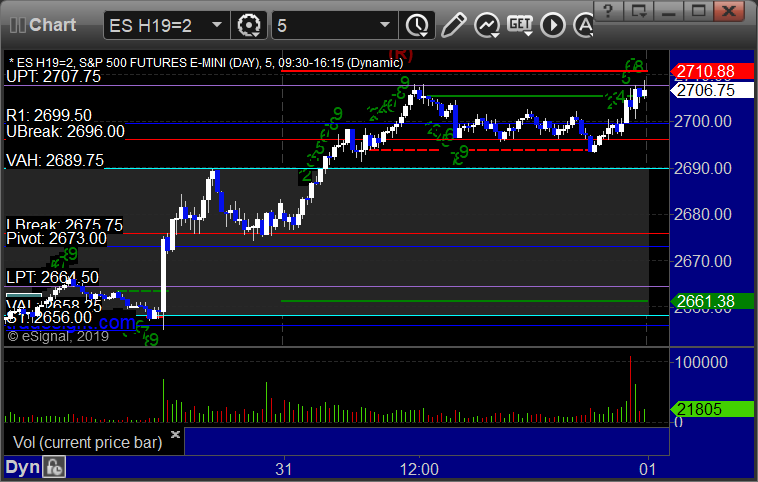

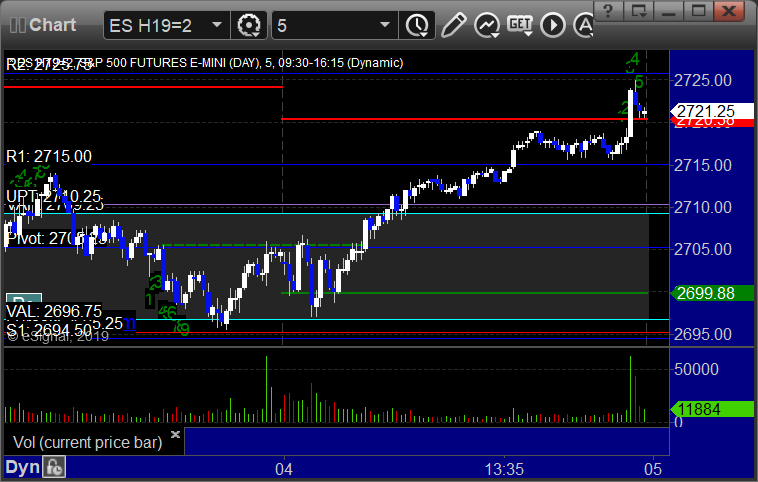

Futures Calls Recap for 2/5/19

The markets gapped up

and drifted higher early, then came back and almost filled the gap, then

tested the highs and failed late on 2.2 billion NASDAQ shares.

Net ticks: +5.5 ticks.

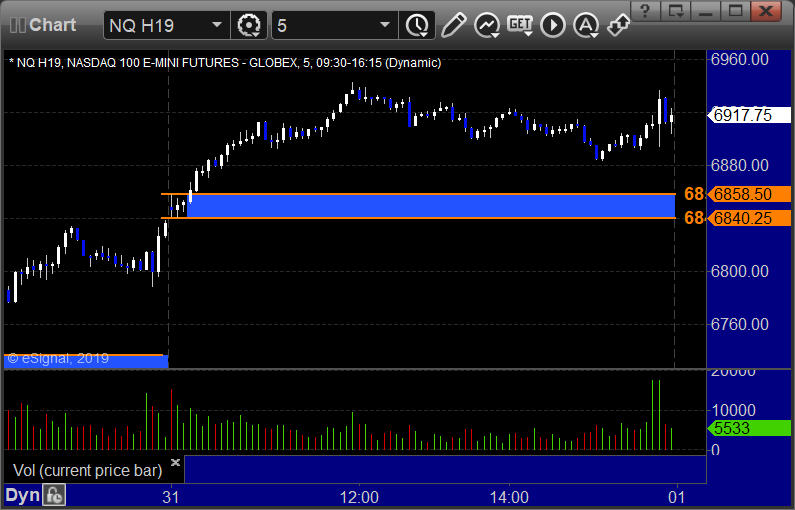

As usual, let's start by taking a look at the ES and NQ with our

market directional lines, VWAP, and Comber on the 5-minute chart from

today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

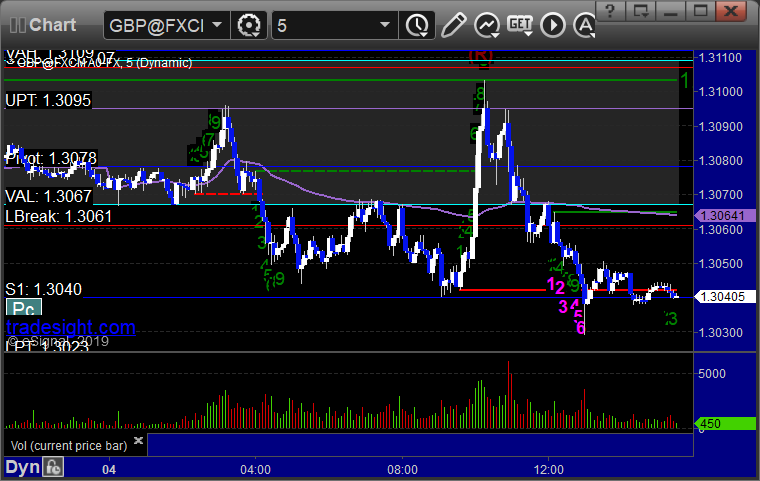

Forex Calls Recap for 2/5/19

No calls for the session

because the Levels were too tight from the prior day. We were flat

until late and then the GBPUSD moved, so we should have setups tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stock Picks Recap for 2/4/19

With each stock's recap,

we will include a (with market support) or (without market support)

tag, designating whether the trade triggered with or without market

directional support at the time. Anything in the first five minutes will

be considered WITHOUT market support because market direction cannot be

determined that early. ETF calls do not require market support, and are

thus either winners or losers.

From the report, SPLK triggered long (with market support) and worked enough for a partial:

TERP triggered long (with market support) and worked a little, nothing major:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered

short (with market support) and worked enough for a partial:

Rich's BA triggered long (with market support) and didn't work, worked later:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not, but nothing exciting at all.

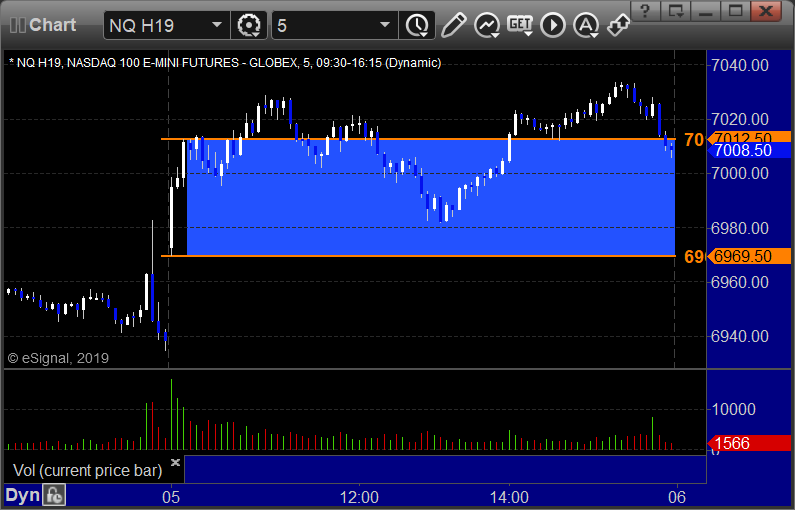

Futures Calls Recap for 2/4/19

The markets opened dead

flat and did nothing for over an hour, then started drifting higher on a

very weak 1.9 billion NASDAQ shares.

Net ticks: -18 ticks.

As usual, let's start by taking a look at the ES and NQ with our

market directional lines, VWAP, and Comber on the 5-minute chart from

today's session:

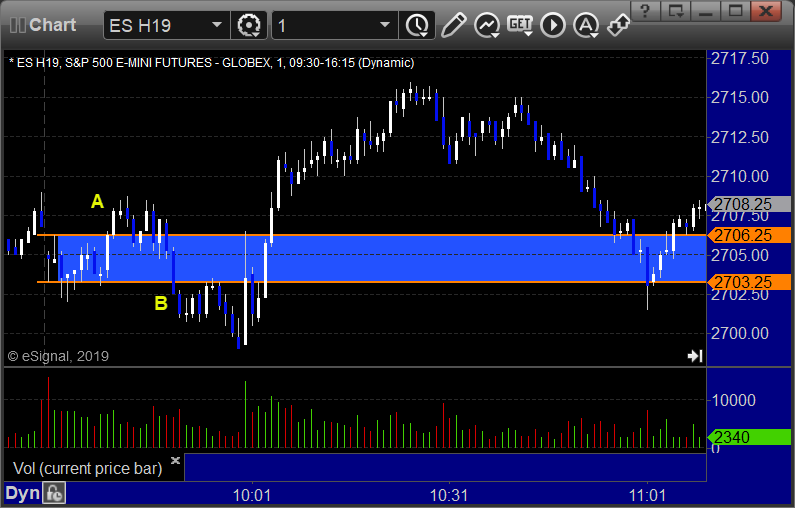

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and stopped:

NQ Opening Range Play triggered long at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

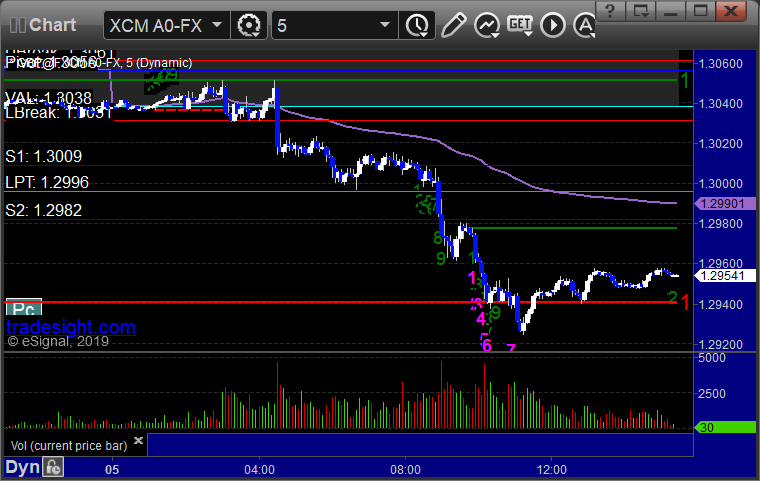

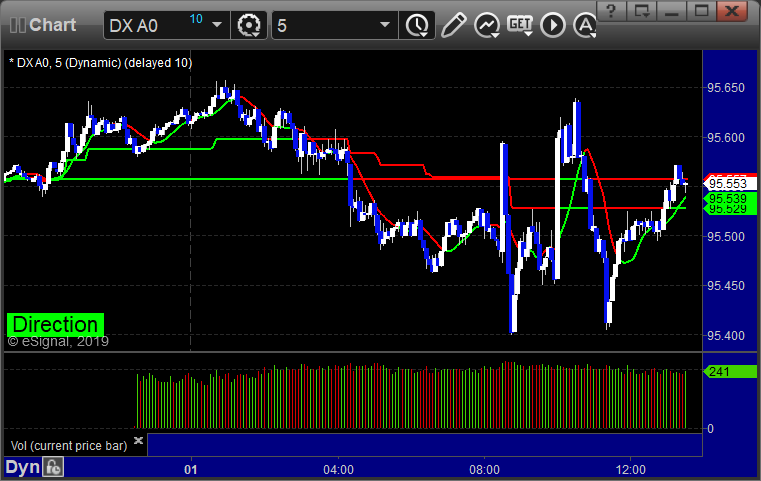

Forex Calls Recap for 2/4/19

Wow, amazing. Our short we under S1 on GBPUSD and that was the low exactly for the main session, so no triggers.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stock Picks Recap for 2/1/19

With each stock's recap,

we will include a (with market support) or (without market support)

tag, designating whether the trade triggered with or without market

directional support at the time. Anything in the first five minutes will

be considered WITHOUT market support because market direction cannot be

determined that early. ETF calls do not require market support, and are

thus either winners or losers.

From the report, FAST triggered long (with market support) and didn't work:

MEDP triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GS triggered

short (with market support) and worked a little, had to be closed at end

of day:

In total, that's 3 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 2/1/19

The markets were mixed early, then went higher, then drifted down to the close on 2.3 billion NASDAQ shares.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our

market directional lines, VWAP, and Comber on the 5-minute chart from

today's session:

ES and NQ Opening and Institutional Range PLays:

ES Opening Range Play triggered long at A and stopped under the midpoint, triggered short at B and worked enough for a partial:

NQ Opening Range Play triggered long but way too far outside the OR to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 2/1/19

Finally a trigger for the week, but it stopped out. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered long at A and stopped:

Stock Picks Recap for 1/31/19

With each stock's recap,

we will include a (with market support) or (without market support)

tag, designating whether the trade triggered with or without market

directional support at the time. Anything in the first five minutes will

be considered WITHOUT market support because market direction cannot be

determined that early. ETF calls do not require market support, and are

thus either winners or losers.

From the report, TELL triggered long (with market support) and didn't work, didn't really do much yet either way:

FIVN triggered long (without market support due to opening 5 minutes) and worked:

NSTG triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, NVDA triggered long (with market support) and worked great:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

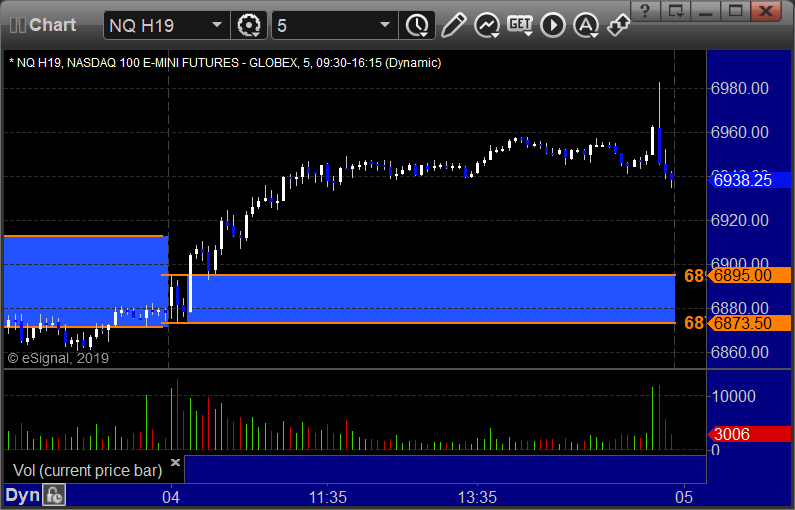

Futures Calls Recap for 1/31/19

The markets opened

fairly flat, went higher until the start of lunch, and that was the high

of the session on 2.8 billion NASDAQ shares to end January and print

the statements.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our

market directional lines, VWAP, and Comber on the 5-minute chart from

today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and worked:

NQ Opening Range Play triggered long at A and worked, but probably

just a little more out of the OR range to take under the rules for most:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: