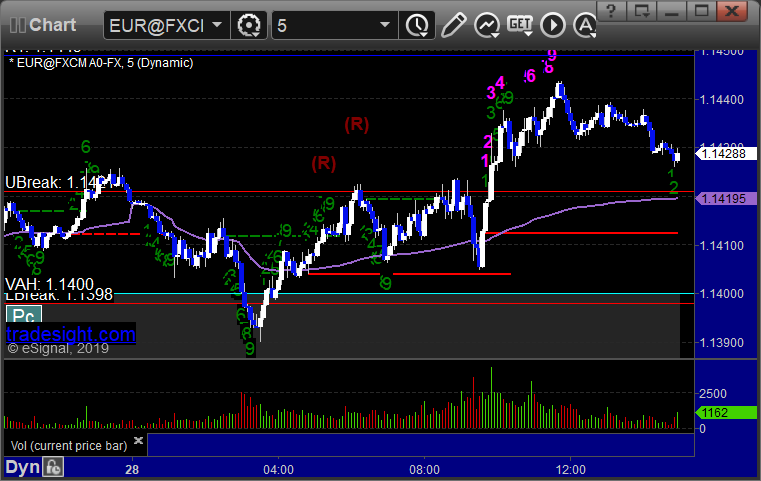

Forex Calls Recap for 1/31/19

This is truly amazing.

We had a Holiday for the first day of the week and now three days in a

row where the market stayed between our triggers for the whole session.

This has never happened since Tradesight launched Forex in 2004. See

EURUSD section below.

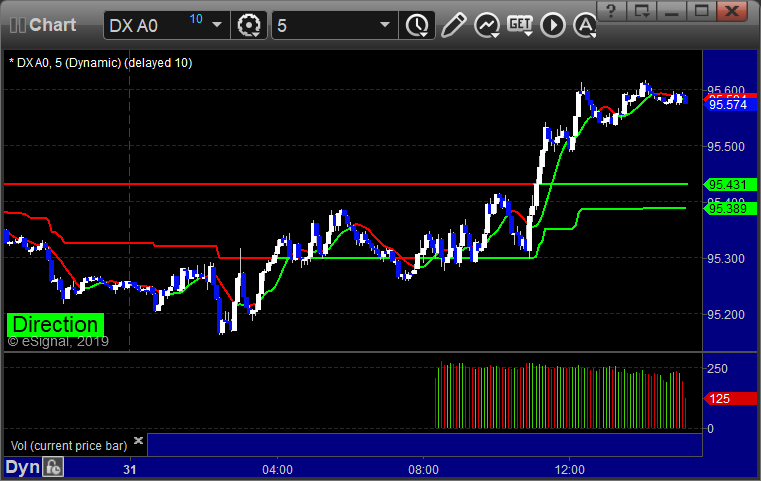

Here's a look at the US Dollar Index intraday with our market directional lines:

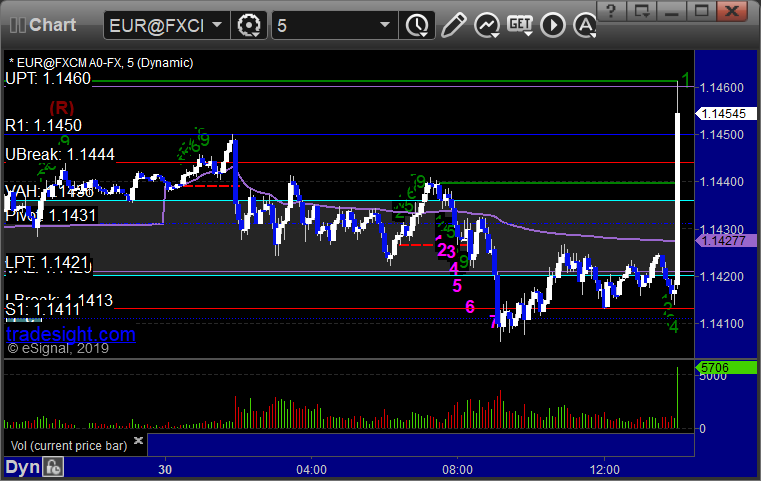

EURUSD:

Didn't trigger during times that matter. If you took the late trigger (almost noon EST) at A, it was working:

Stock Picks Recap for 1/30/19

With each stock's recap,

we will include a (with market support) or (without market support)

tag, designating whether the trade triggered with or without market

directional support at the time. Anything in the first five minutes will

be considered WITHOUT market support because market direction cannot be

determined that early. ETF calls do not require market support, and are

thus either winners or losers.

From the report, amazingly, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, FB triggered short (with market support) and didn't work:

Rich's AMZN triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

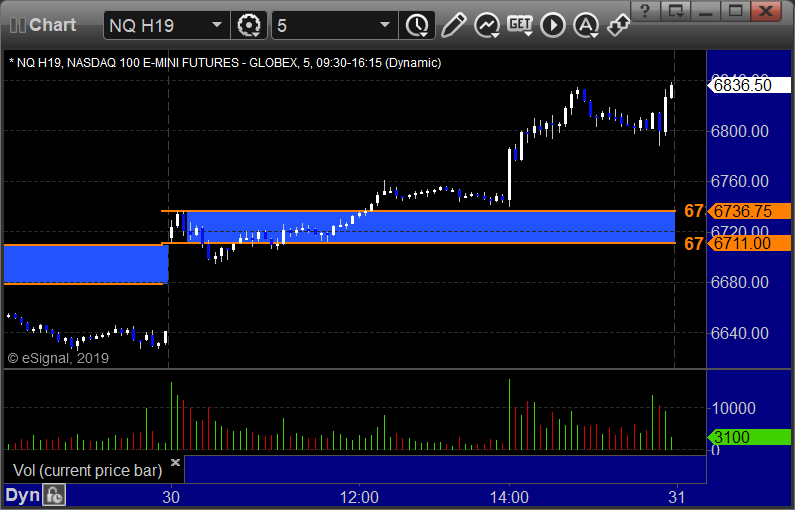

Futures Calls Recap for 1/30/19

The markets gapped up,

pulled back a bit, went higher over lunch, then spiked on the Fed

announcement and ended up closing about where that spike stopped on 2.5

billion NASDAQ shares.

Net ticks: -7.5 ticks.

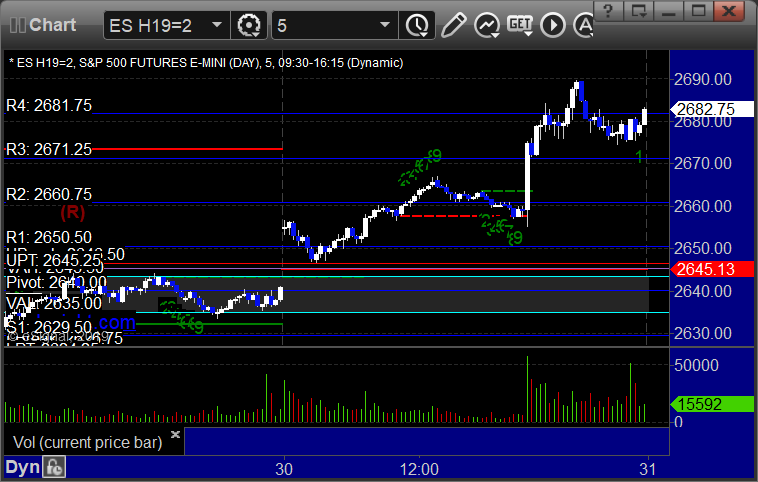

As usual, let's start by taking a look at the ES and NQ with our

market directional lines, VWAP, and Comber on the 5-minute chart from

today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and stopped:

NQ Opening Range Play triggered long at A and worked, triggered short at B and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

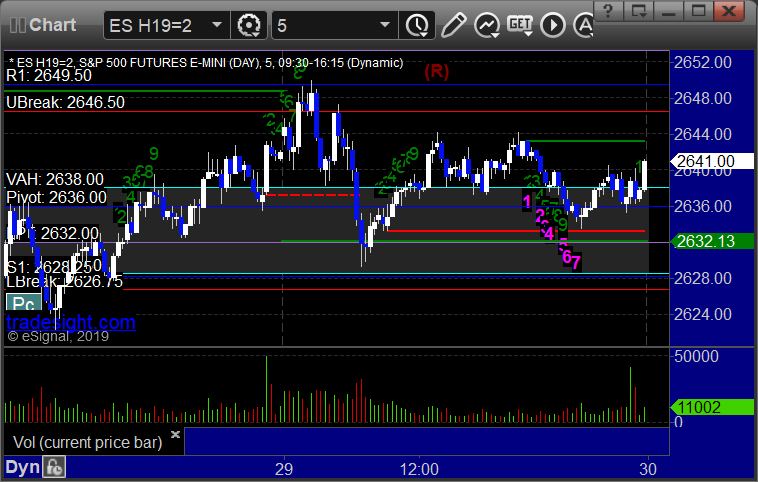

ES:

Our call triggered short at 2650.25, hit first target for 6 ticks, stopped second half over the entry:

Forex Calls Recap for 1/30/19

No triggers yet again until right at the Fed, which we don't take. Note the US Dollar spiked on the announcement.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 1/29/19

With each stock's recap,

we will include a (with market support) or (without market support)

tag, designating whether the trade triggered with or without market

directional support at the time. Anything in the first five minutes will

be considered WITHOUT market support because market direction cannot be

determined that early. ETF calls do not require market support, and are

thus either winners or losers.

From the report, ZIXI triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, ATVI triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked:

GILD triggered long (with market support) and didn't work:

TWTR triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 1/29/19

The markets gapped up

and filled quickly, then shook back and forth before dropping finally in

the morning, then came back up to the middle and sat the rest of the

session on a weak 2.0 billion NASDAQ shares. Overall, it wasn't very

exciting again.

Net ticks: +19.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our

market directional lines, VWAP, and Comber on the 5-minute chart from

today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked enough for a partial:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

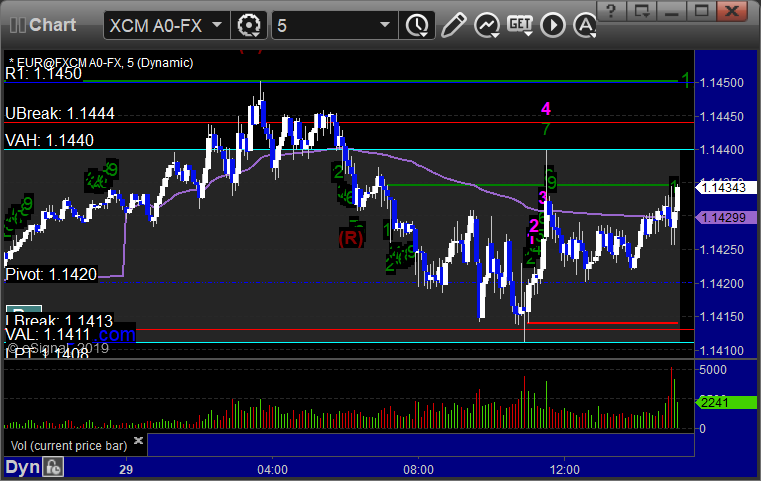

Forex Calls Recap for 1/29/19

For the second day in a row, no triggers. Very weird and unusual.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

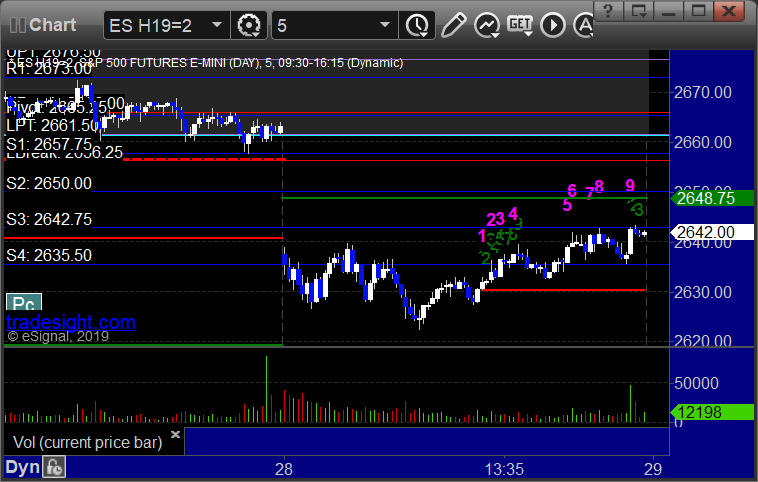

Futures Calls Recap for 1/28/19

The markets gapped down

and closed where they opened, although they did try to go lower. They

never could try higher successfully. NASDAQ volume was 2.4 billion

shares.

Net ticks: +23 ticks.

As usual, let's start by taking a look at the ES and NQ with our

market directional lines, VWAP, and Comber on the 5-minute chart from

today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 1/28/19

No triggers for the session at all. EURUSD never went under Pivot or over R1.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD: