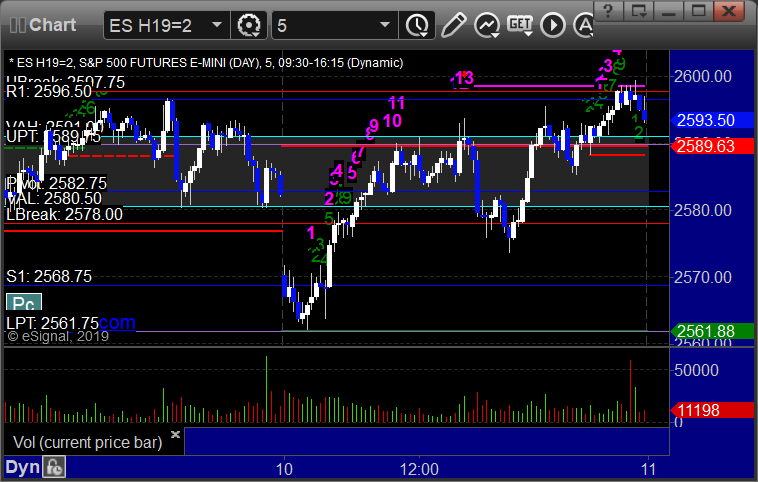

Futures Calls Recap for 10/10/19

The markets gapped down,

went lower briefly, and then headed back up, filled the gap, and closed

slightly positive on a weak 2.1 billion NASDAQ shares.

Net ticks: +4 ticks.

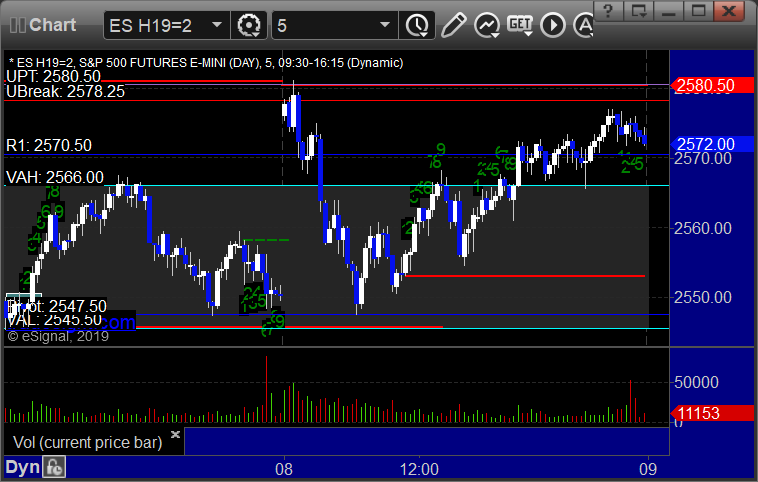

As usual, let's start by taking a look at the ES and NQ with our

market directional lines, VWAP, and Comber on the 5-minute chart from

today's session:

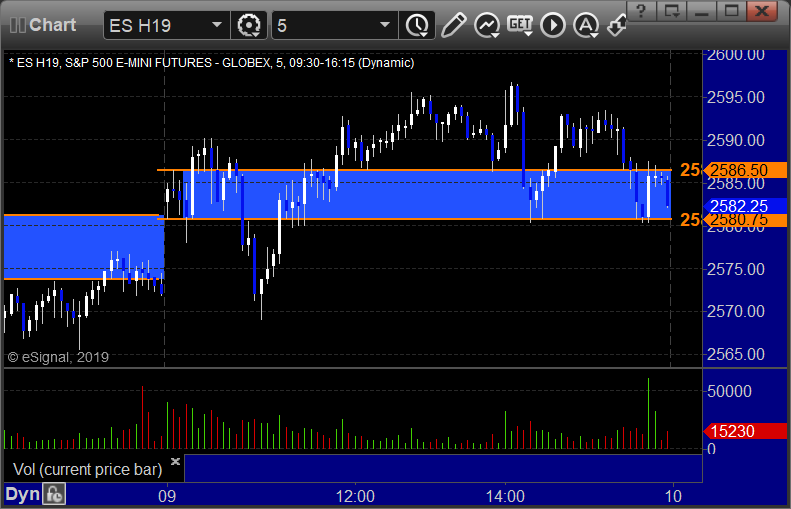

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

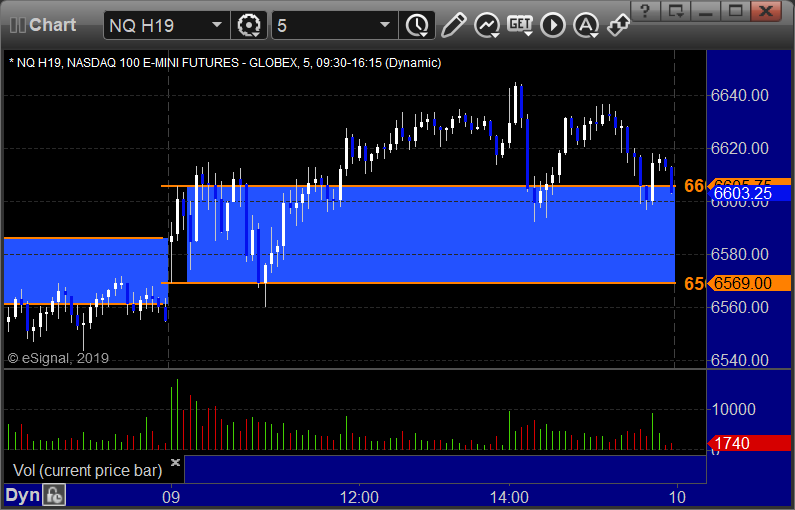

NQ Opening Range Play:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Stock Picks Recap for 10/10/19

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, QNST triggered long (with market support) and worked, but moved pretty quick, hard to get:

VCYT triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's WDC triggered long (with market support) and didn't work:

Stock Picks Recap for 10/10/19

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

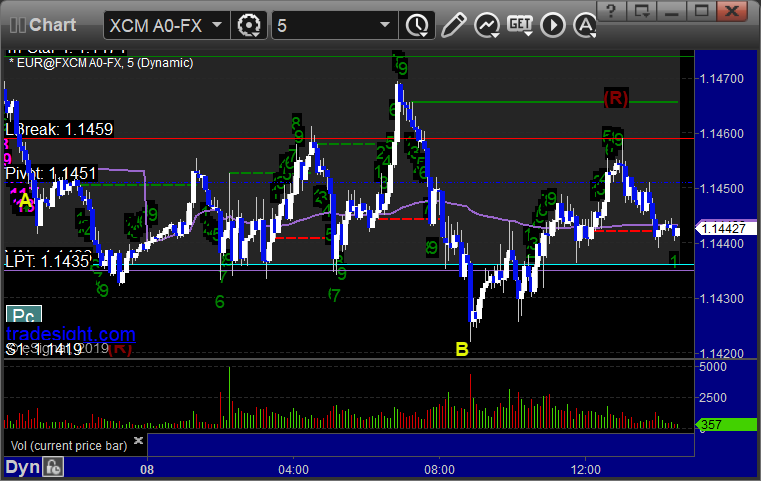

Forex Calls Recap for 10/10/19

A very flat session. No triggers. I posted an update on a pair that we didn't make a call on.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 10/9/19

With each stock's recap,

we will include a (with market support) or (without market support)

tag, designating whether the trade triggered with or without market

directional support at the time. Anything in the first five minutes will

be considered WITHOUT market support because market direction cannot be

determined that early. ETF calls do not require market support, and are

thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's TLRY triggered long (with market support) and worked:

His FB triggered long (with market support) and worked enough for a partial:

Nothing else triggered.

In total, that's 2 trades triggering with market support, both of them worked.

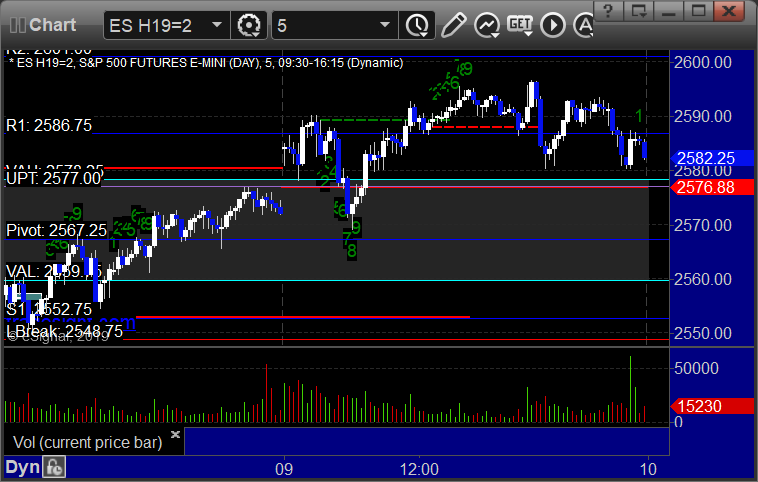

Futures Calls Recap for 10/9/19

A choppy session as the market gapped up, tried both ways, eventually filled, then headed up and made new highs over lunch, then came back to where they opened on 2.4 billion NASDAQ shares.

Net ticks: -29 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES Opening Range Play triggered short at A and stopped, triggered long at B and stopped under the midpoint:

NQ Opening Range Play triggered too far out of range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 10/9/19

Not much of a session, although the EURUSD moved. We had calls in the GBPUSD though, and one worked. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A over the Pivot and gave you hours to enter, hit first target at B, second half stopped:

Stock Picks Recap for 1/8/19

With each stock's recap,

we will include a (with market support) or (without market support)

tag, designating whether the trade triggered with or without market

directional support at the time. Anything in the first five minutes will

be considered WITHOUT market support because market direction cannot be

determined that early. ETF calls do not require market support, and are

thus either winners or losers.

From the report, DRYS and INVA gapped over, no plays.

CROX triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's WDAY triggered short (with market support) and didn't work:

His SINA triggered short (with market support) and worked enough for a partial:

FB triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.

Futures Calls Recap 1/8/19

The markets gapped up,

filled in the first two hours, then slowly made their way back up to

where they opened on 2.4 billion NASDAQ shares.

Net ticks: -14.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our

market directional lines, VWAP, and Comber on the 5-minute chart from

today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work, triggered long at B and didn't work:

NQ Opening Range Play triggered long at A and worked enough for a

partial, triggered short at B but too far out of range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 1/8/19

A dull session with a small winner. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, stopped second half over the entry:

Tradesight 2018 Stock Results

We post our daily results. You can access any of our systems through a 2-week free trial to make sure that we are honestly reporting the trades and what happened. We publish our daily results both privately and publicly for anyone to review.

Click here for the daily Stock daily recaps going back in time.

Click here for the monthly tallies of the net gains/losses and breakdown of winners and losers.

So this post is designed to easily summarize those results for 2018.

Total number of Stock trades that triggered in 2018: 645

Big Losers: None

Small Losers: 156 (24.7%)

Small Winners: 213 (33.0%)

Big Winners: 273 (42.3%)

Winning percentage: 75.3%, which is outstanding and above our target range of 60-70%.

The best part about this year is that the percentage of trades that followed through and became "big winners" instead of just partials and stall out was 42.3%. Hard to complain about that and over a 75% win ratio. We continue to offer the stock service as our flagship service for a reason.