Tradesight 2018 Futures Results

We post our daily results. You can access any of our systems through a 2-week free trial to make sure that we are honestly reporting the trades and what happened. All of our results are archived both publicly and privately for review and validation.

Click here for the daily Futures daily recaps going back in time.

Click here for the monthly tallies of the net gains/losses and breakdown of winners and losers.

So this post is designed to easily summarize those results for 2018.

Total number of Futures trade calls that triggered in 2018: 638

Winners: 438

Losers: 200

Winning percentage: 68.6%, which is right in our target range of 65% for futures. However, since we only had one losing month, the returns for the year were stellar.

Net tick gains or losses for the year: +959 ticks.

Keep in mind that this doesn't count Value Area Plays, Seeker/Comber plays, and other trade types that we teach in our program. This is just the basic calls that we make the Opening Range plays, which, in the last two months of the year, the wild ranges made trading the NQ in particular really tough. Solid year in 2018 for futures.

Tradesight 2018 Forex Results

We post our daily results. You can access any of our systems through a 2-week free trial to make sure that we are honestly reporting the trades and what happened. Everything we do is archived for review and validation both publicly and privately.

Click here for the daily Forex daily recaps going back in time.

Click here for the monthly tallies of the net gains/losses and breakdown of winners and losers.

So this post is designed to easily summarize those results for 2018.

Total number of official Forex trade calls that triggered in 2018: 253

Winners: 133

Losers: 120

Winning percentage: 52.6%, which is actually slightly below our target range of 55-60%. However, our system should account for this because we keep the losers tight.

Net pip gains or losses for the year: +905 pips.

There are a few things to keep in mind here. First of all, these are just the calls we make each day (usually 2). This doesn't include the trade setups we teach in our program, such as Value Area Plays, Power Hour Plays, and Seeker/Comber reversals. This is just the easy stuff that anyone can follow. Second, the second half of the year was about as flat as can be, so the opportunities were limited. Keep in mind that while we racked up more pips in 2017, we had the Brexit move that made us almost 1000 pips in a session. Here, we had 9 winning months and 3 losing months, which is great, and the winning months were limited by the lack of movement. No complaints.

Stock Picks Recap for 1/7/19

With each stock's recap,

we will include a (with market support) or (without market support)

tag, designating whether the trade triggered with or without market

directional support at the time. Anything in the first five minutes will

be considered WITHOUT market support because market direction cannot be

determined that early. ETF calls do not require market support, and are

thus either winners or losers.

From the report, GGAL triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMGN triggered long (with market support) and worked:

His AXGN triggered short (without market support) and worked enough for a partial:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 1/7/19

The markets were flat early, drifted up after the first hour, then higher over lunch and came back on 2.5 billion NASDAQ shares.

Net ticks: +0 ticks.

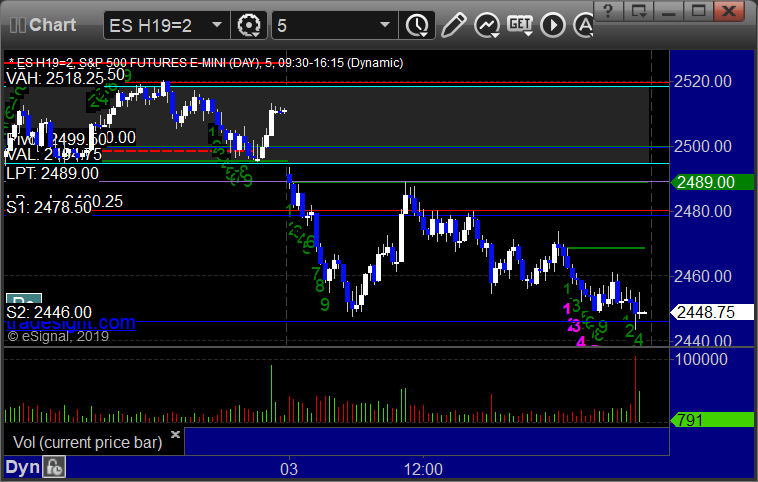

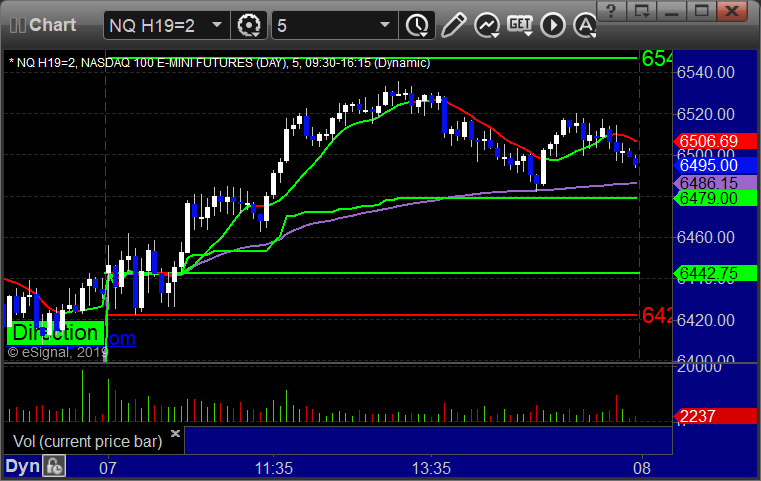

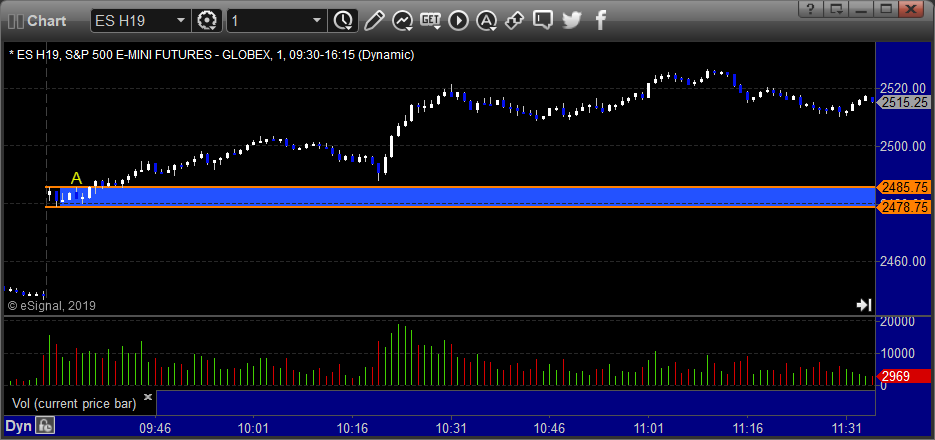

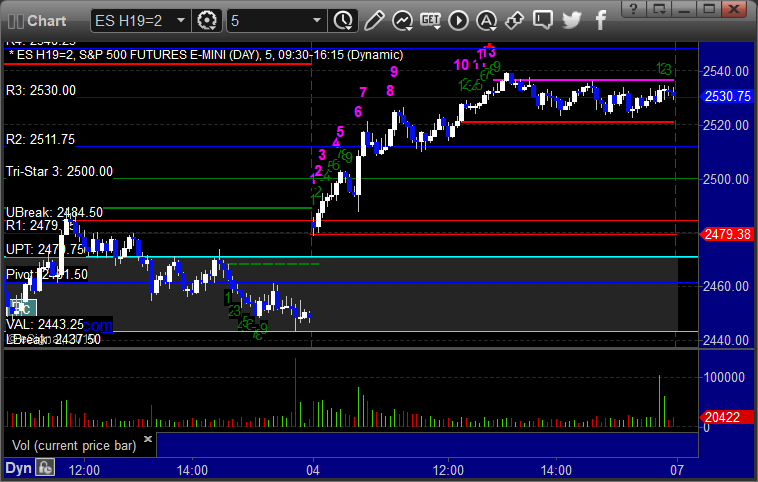

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and long at B, both too far out of range to take under the rules:

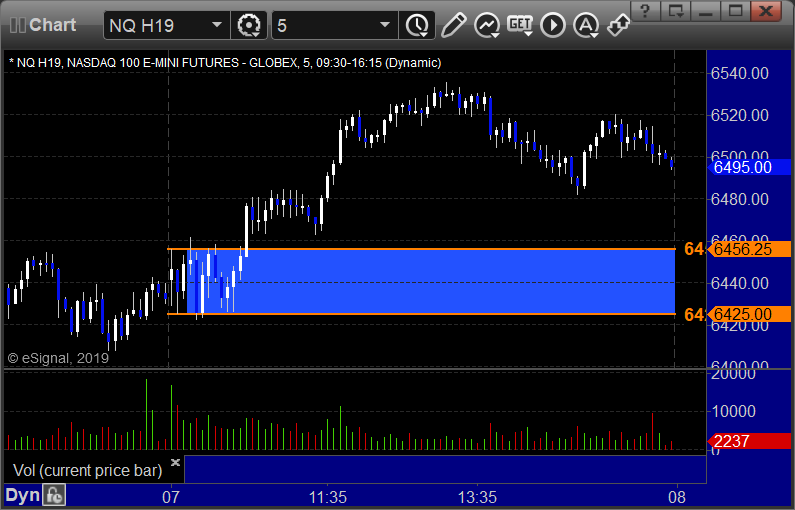

NQ Opening Range Play triggered short at A and long at B, both too far out of range to take under the rules:

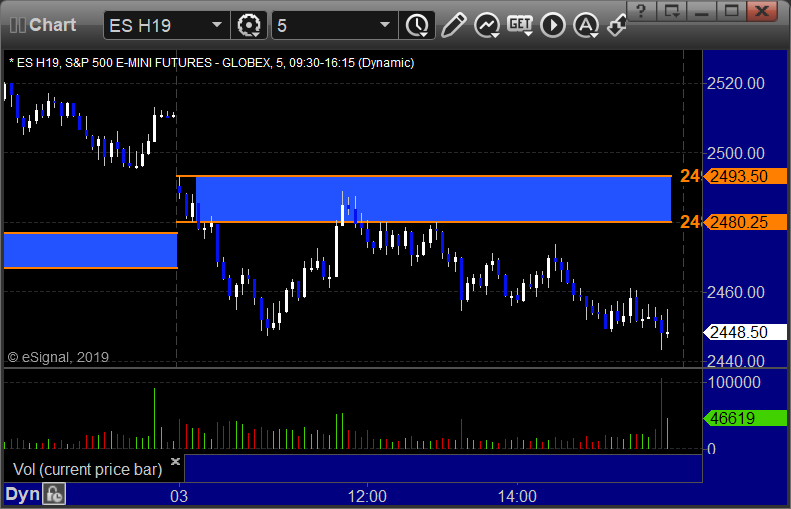

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

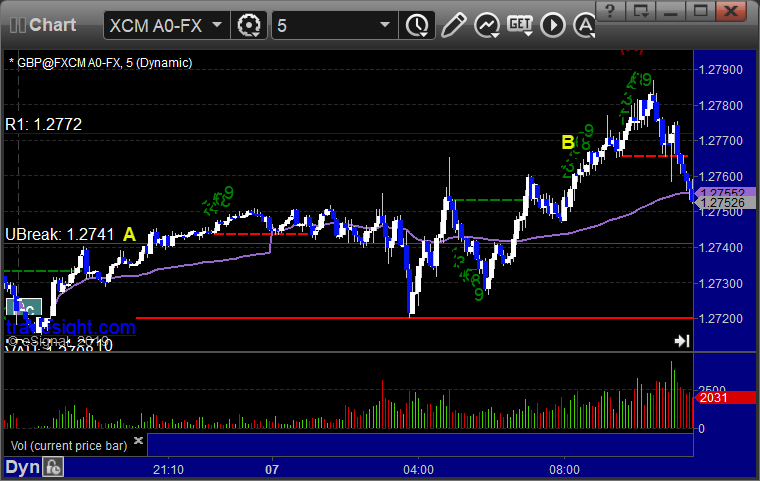

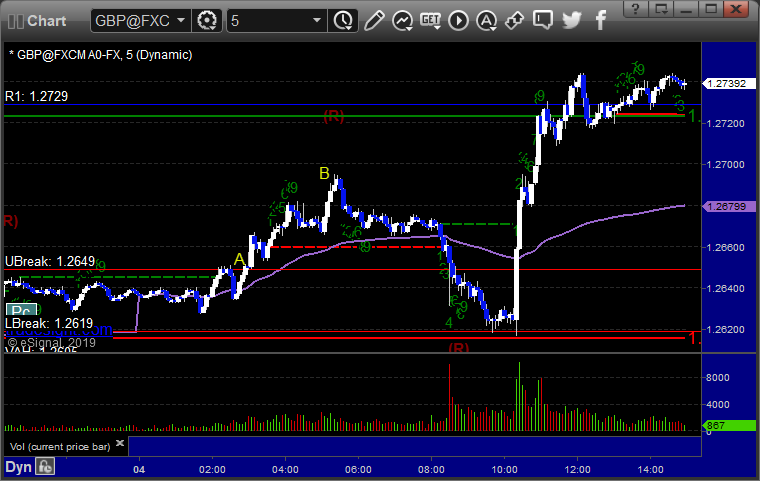

Forex Calls Recap for 1/7/19

A winner (still going) to start the week. See GBPUSD section below.

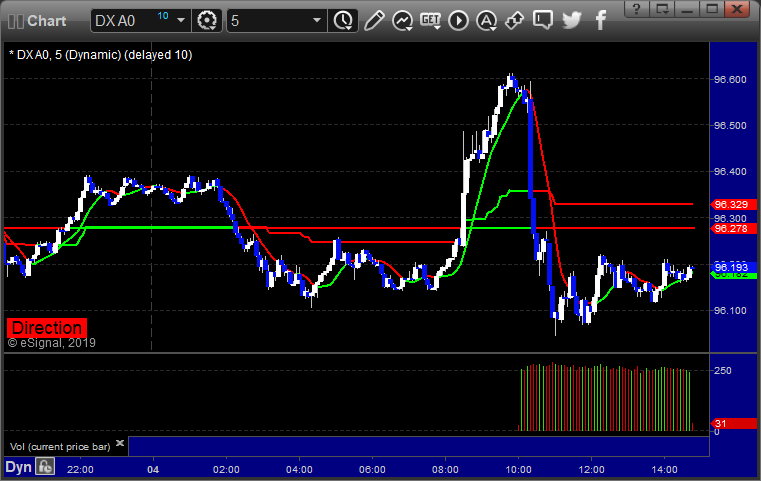

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, still holding second half with a stop under the entry:

Stock Picks Recap for 1/4/19

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's FSLR triggered long (with market support) and worked:

His TWTR triggered long (with market support) and worked:

His NFLX triggered long (with market support) and worked:

His BIIB triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all of them worked.

Futures Calls Recap for 1/4/19

The markets gapped down small and filled and sat mostly flat on 2.6 billion NASDAQ shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A but too far out of range to take:

NQ Opening Range Play triggered long at A but too far out of range to take, same with the short at B:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 1/4/19

A winner to close out the opening week of 2019. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered long at A, hit first target at B, stopped second half under the entry:

Stock Picks Recap for 1/3/19

With each stock's recap,

we will include a (with market support) or (without market support)

tag, designating whether the trade triggered with or without market

directional support at the time. Anything in the first five minutes will

be considered WITHOUT market support because market direction cannot be

determined that early. ETF calls do not require market support, and are

thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's APA triggered short (with market support) and didn't work:

His BIDU triggered short (with market support) and worked enough for a partial:

His AVGO triggered short (with market support) and worked:

His ATRA triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 1/3/19

The markets gapped down, went lower, recovered a bit, then closed at lows on 2.5 billion NASDAQ shares after the AAPL warning.

Net ticks: +11 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered long at A and short at B but both too much risk to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: