Futures Calls Recap for 6/12/14

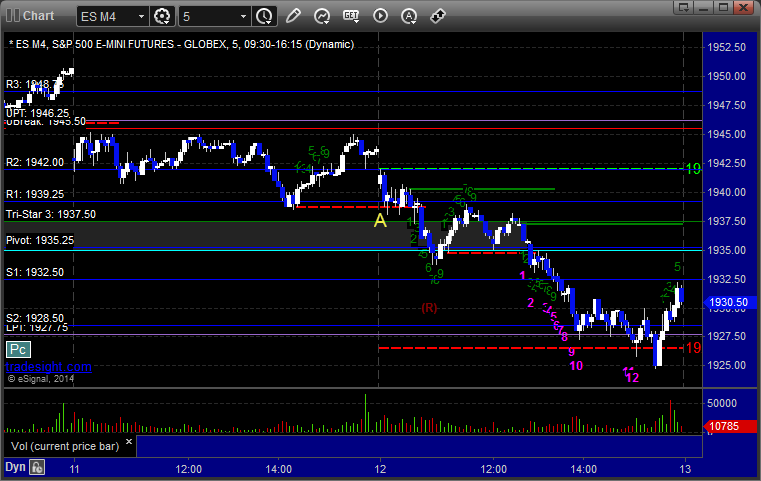

Quarterly contract roll is never a great day for technical trading in futures. One loser and I didn't bother putting it back in again. We are now on the September (U4) contracts. See ES section below.

Net ticks: -7 ticks.

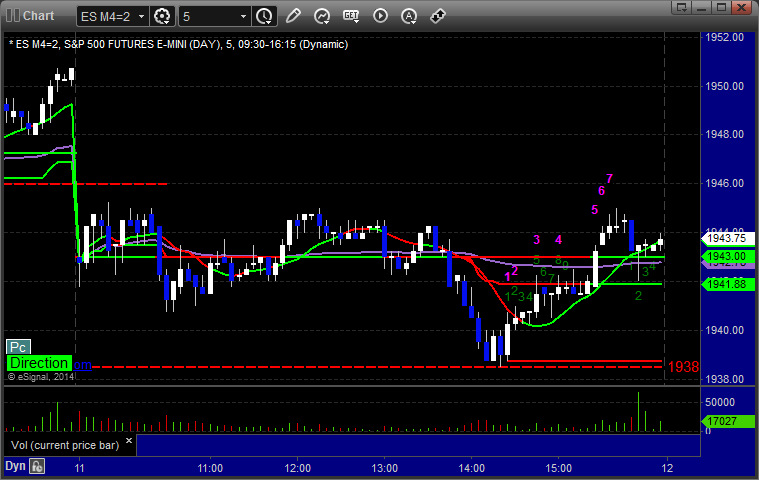

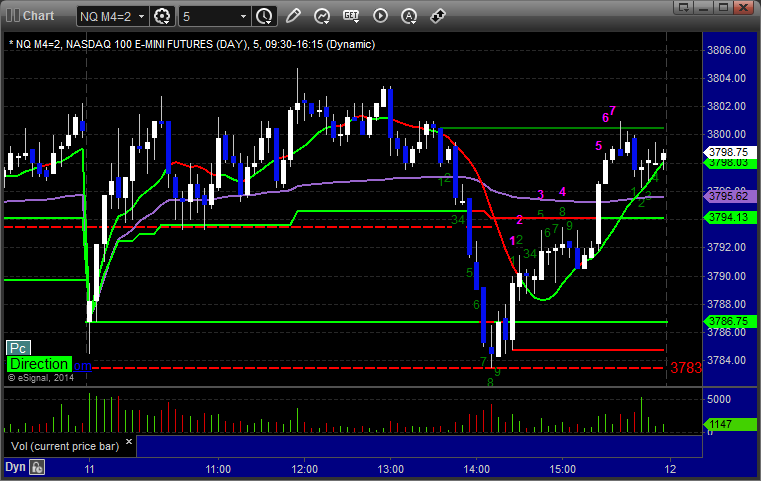

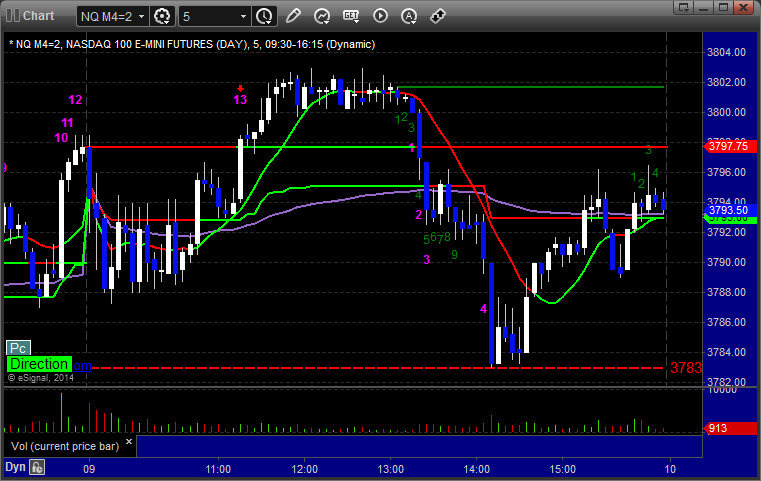

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1931.25 and stopped:

Forex Calls Recap for 6/12/14

Another winner for the session, and we closed out the second half of the prior day's trade in the money. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

We came into the session long the second half of the prior day's trade and adjusted the stop. The new call triggered long at A, hit first target at B, and we stopped the second half of that (under entry) and the second half of the prior session's trade (40 pips in the money) at C:

Stock Picks Recap for 6/11/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ATVI triggered long (without market support) and didn't work:

KLIC triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's MU triggered short (without market support) and worked enough for a partial:

His AMZN triggered long (with market support) and worked:

His VXX triggered long (ETF, so no market support needed) and worked enough for a partial:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 6/11/14

Amazingly, the ES stuck in a 5-point total range for the session, so nothing triggered. See charts below.

Net ticks: +0 ticks.

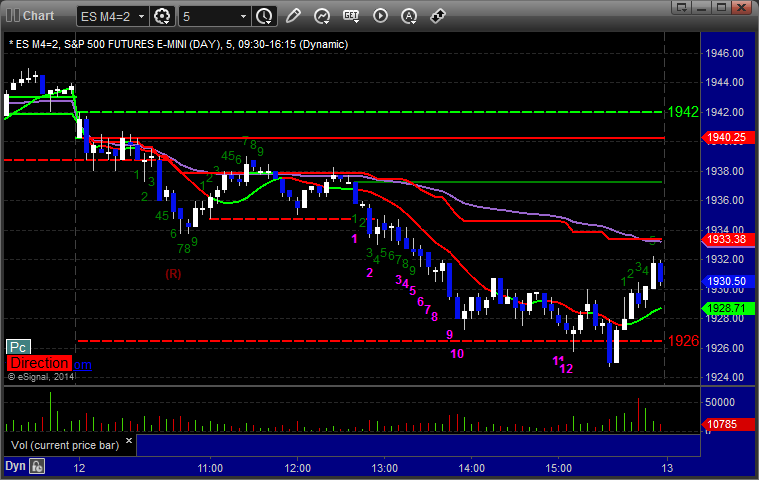

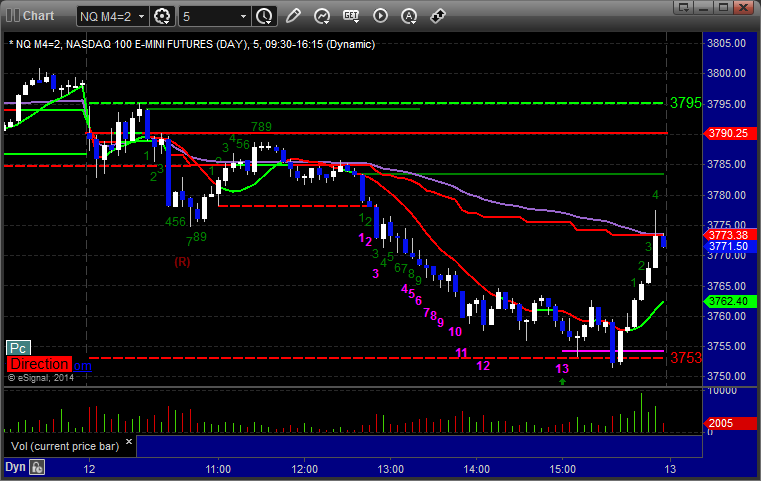

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 6/11/14

Closed out a winner in the EURUSD from the prior session, and we have a new winner going in the GBPUSD. See both sections below.

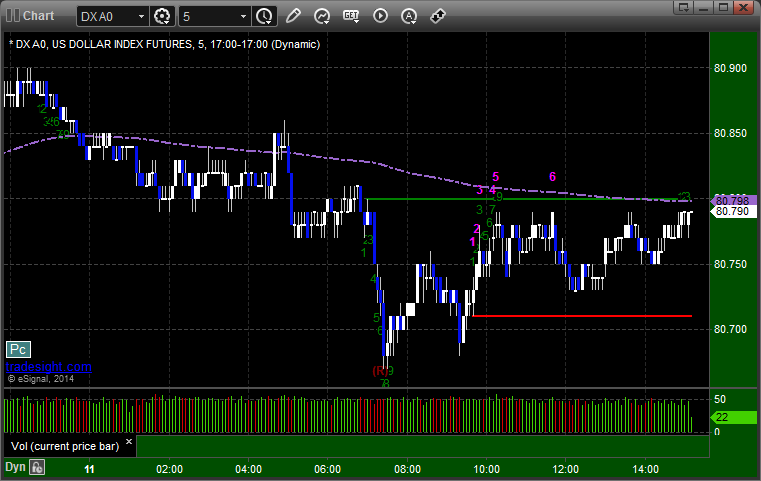

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, holding second half with a stop under the entry level:

Stock Picks Recap for 6/10/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ARCP triggered very late in the session and only had time to go five cents, so we won't count.

From the Messenger/Tradesight_st Twitter Feed, Rich's WYNN triggered short (with market support) and worked enough for a partial:

His AAPL triggered short (with market support) and worked:

His BEAV triggered short (with market support) and worked enough for a partial:

Mark's TWTR triggered long (without market support) and didn't work:

FSLR triggered short (with market support) and didn't work:

Rich's BYI triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not. Most of them were just enough for partials.

Futures Calls Recap for 6/10/14

A double sweep and a small winner in another session that spent most of the day in a 4-point ES range. NASDAQ volume closed at 1.65 billion shares.

Net ticks: -11.5 ticks.

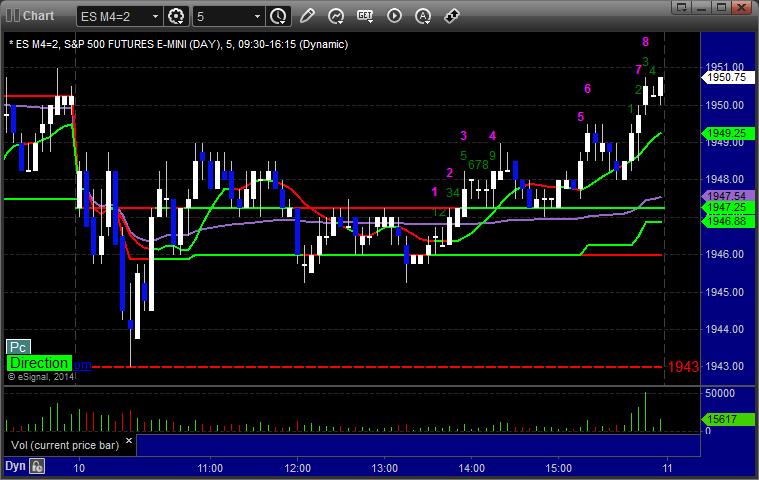

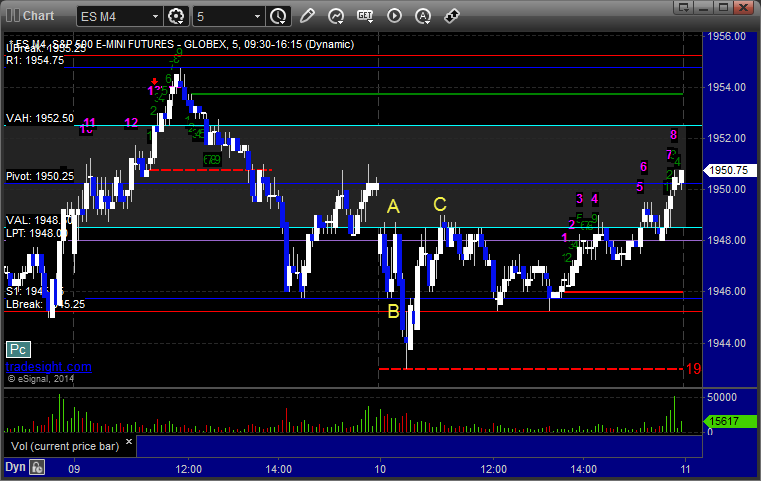

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

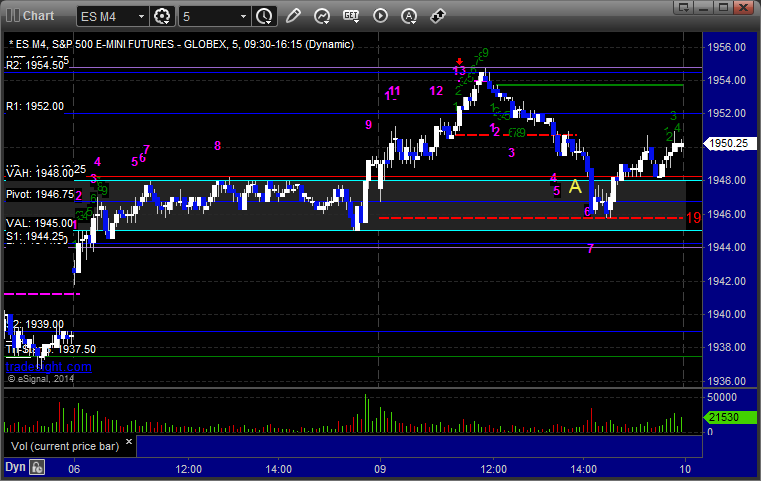

ES:

Triggered long at A at 1948.75 and stopped. Mark's call triggered short at B at 1945.00, hit first target for 6 ticks, and stopped second half over the entry. Triggered long at C at 1949.00 and stopped:

Forex Calls Recap for 6/10/14

A little bit of movement for the session, and we are left with a trade that is in the money, but we haven't taken a partial and I'm letting it ride. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

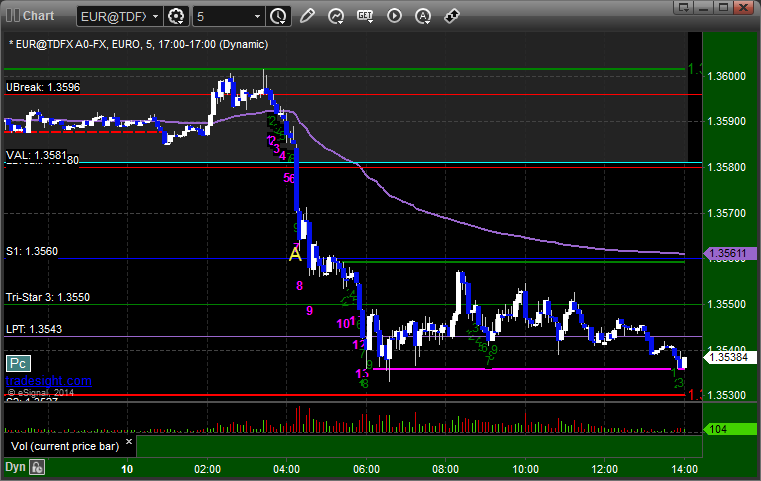

EURUSD:

Triggered short at A, never stopped or hit first target, holding with stop over entry level (S1):

Stock Picks Recap for 6/9/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MCHP triggered long (with market support) and worked:

SAVE triggered long (without market support due to opening 5 minutes) and didn't work:

CDNS triggered long (without market support due to opening 5 minutes) and didn't work:

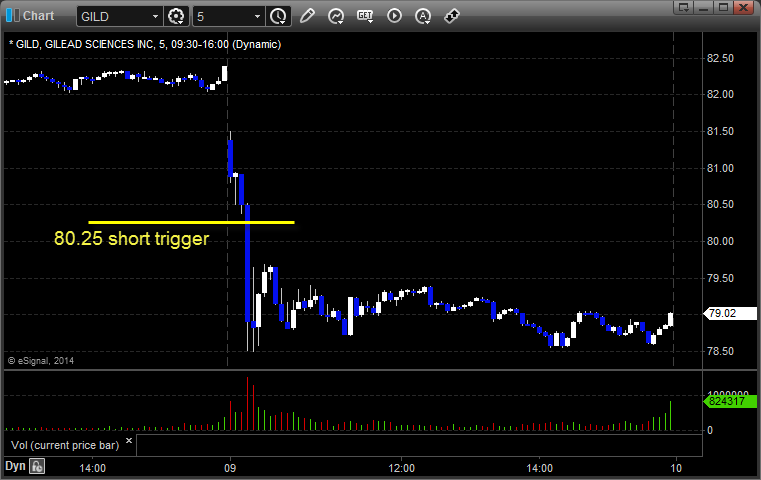

From the Messenger/Tradesight_st Twitter Feed, Rich's GILD triggered short (without market support) and worked great:

His GOOGL triggered long (with market support) and worked:

AMGN triggered short (with market support) and worked:

Mark's CTSH triggered long (with market support) and worked enough for a partial:

Rich's ICPT triggered long (with market support) and worked:

His GRFS triggered long (without market support) and worked enough for a partial late:

In total, that's 5 trades triggering with market support, all 5 of them worked.

Futures Calls Recap for 6/9/14

A small winner for another slower session.

Net ticks: +2.5 ticks.

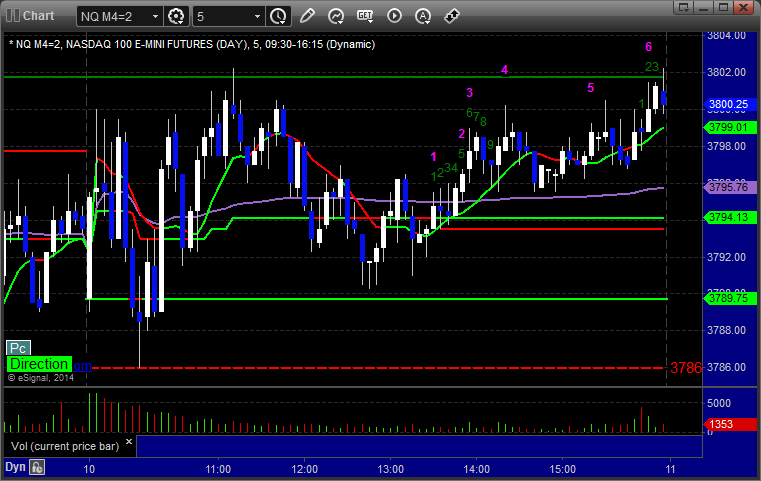

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1947.75, hit first target for 6 ticks, and stopped second half over the entry: