Forex Calls Recap for 6/9/14

A single loser to start the week. See EURUSD section below.

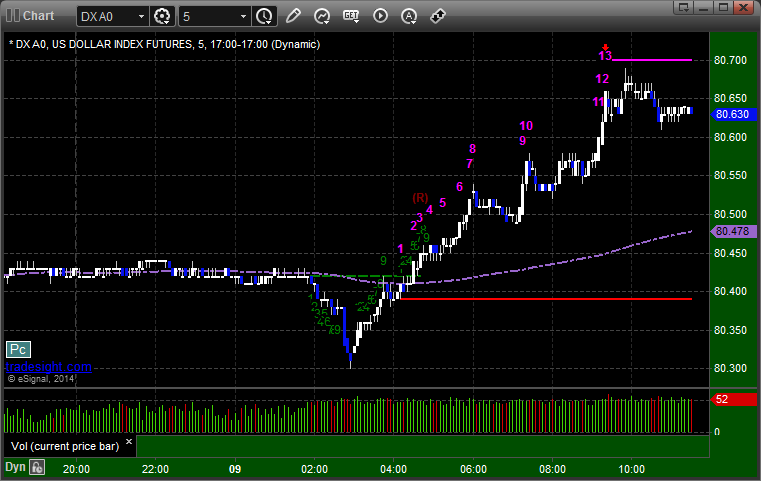

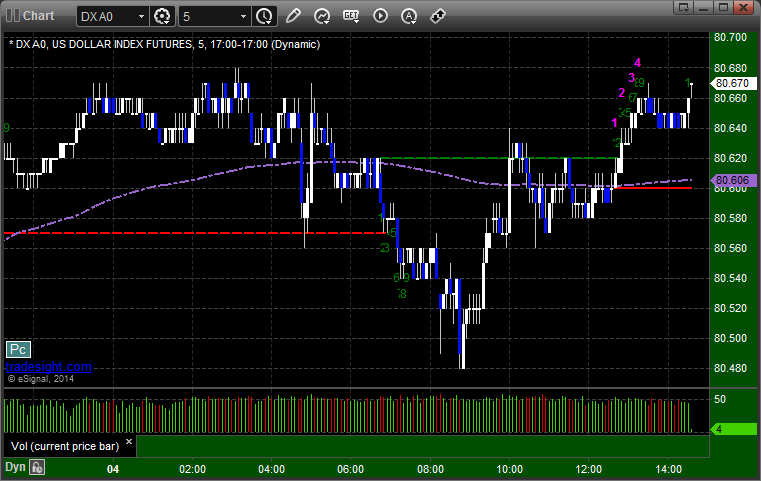

Here's a look at the US Dollar Index intraday with our market directional lines:

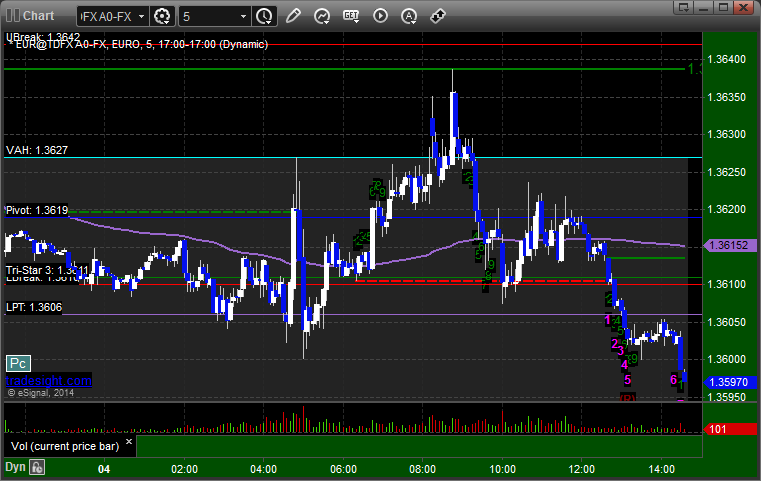

EURUSD:

Triggered long at A and stopped:

Stock Picks Recap for 6/6/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FORM and ARWR gapped over, no plays.

ELGX triggered long (with market support) and didn't do enough either way to count:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and worked enough for a partial:

His BIDU triggered long (with market support) and worked:

FSLR triggered short (without market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 6/6/14

Well, not that it was a surprise on a Friday, but a complete waste of time compared to Thursday. See the ES and NQ below.

Net ticks: -21 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

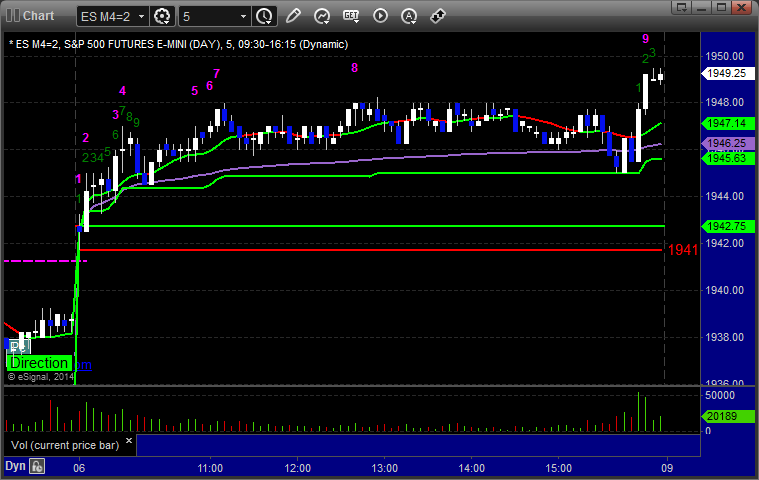

ES:

Mark's long at A at 1946.50 stopped, and he did not re-enter:

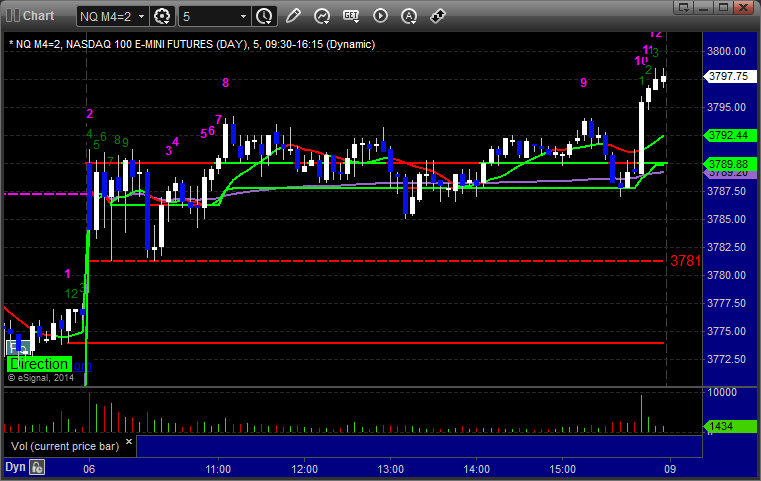

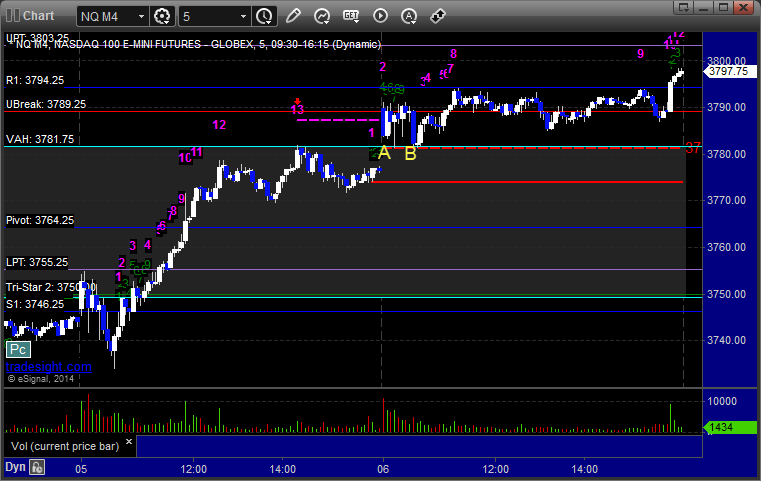

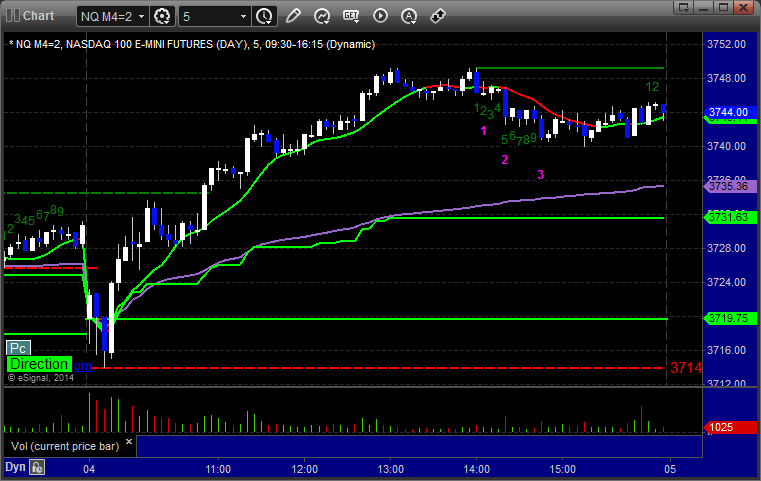

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Nice Value Area setup triggered short at A at 3781.50 and stopped, then triggered again at B and stopped again:

Forex Calls Recap for 6/6/14

A loser to close out the week, but we did start seeing some action this week, so hopefully that's a sign of things to come. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered long at A and if you didn't stop at B (which basically touched the stop level), then we stopped shortly after:

Stock Picks Recap for 6/5/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GGAL triggered long (without market support due to opening 5 minutes) and worked:

COST triggered long (without market support) early and didn't work, then I pointed out to take it later (with market support) and it worked, although I cut it off even after it took so long:

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered long (with market support) and worked great:

Rich's FAS triggered short (ETF, so no market support needed) and worked enough for a partial:

Rich's GS triggered long (with market support) and worked enough for a partial:

NTAP triggered short (without market support) and didn't work:

Rich's AMZN reversal triggered short (without market support) and worked enough for a partial:

In total, that's 3 trades triggering with market support, all 3 of them worked.

Futures Calls Recap for 6/5/14

A nice trading session with a clean trigger on the ES that ran nicely. There were other trades as well, including finally several 13 sell signals.

Net ticks: +21 ticks.

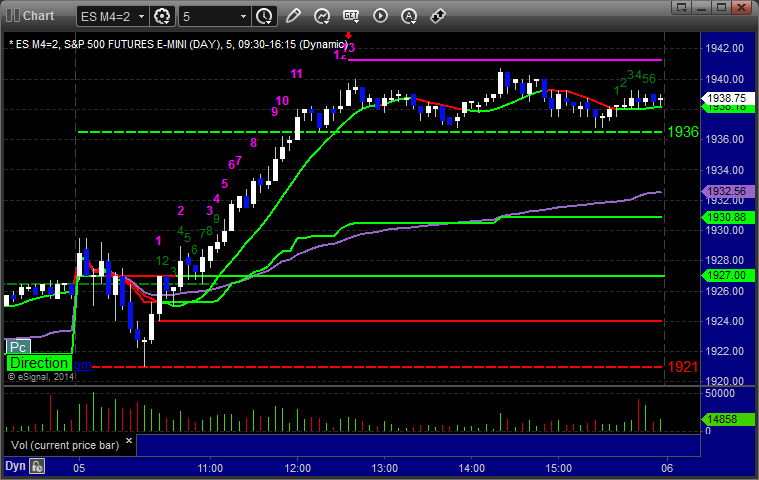

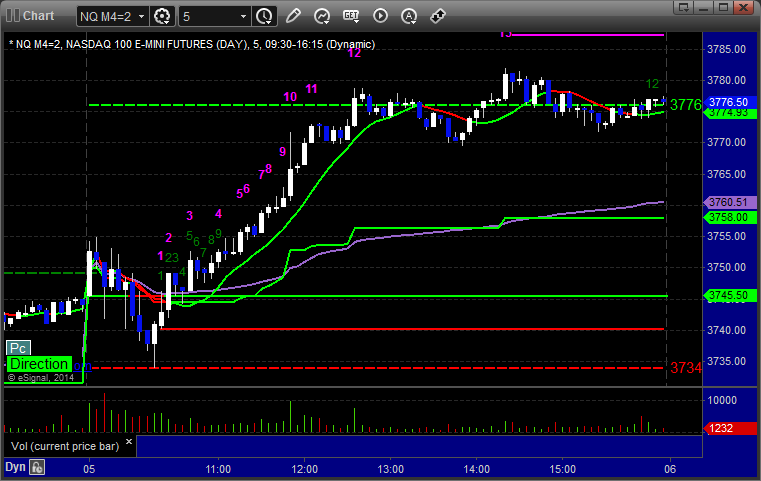

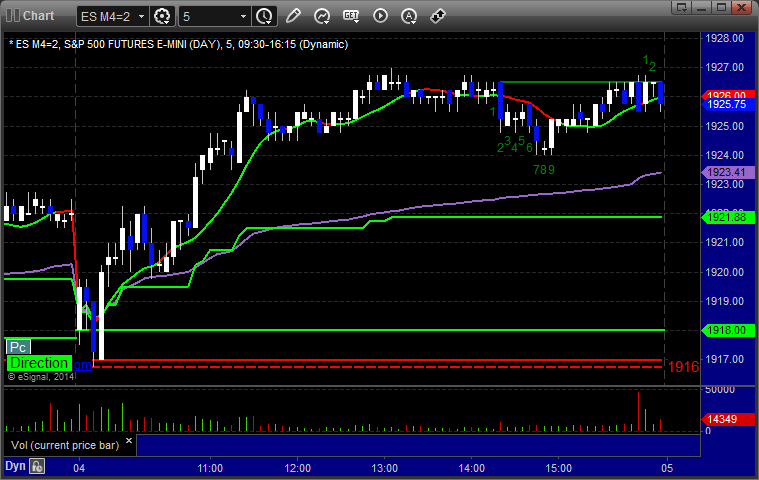

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1929.75, hit first target for 6 ticks, stopped final piece after several adjustments at B at 1936.75 for 28 ticks. Also went short on the Comber 13 at C at 1939.50, covered half at 1938.50, and put a stop over the highs which stopped at D:

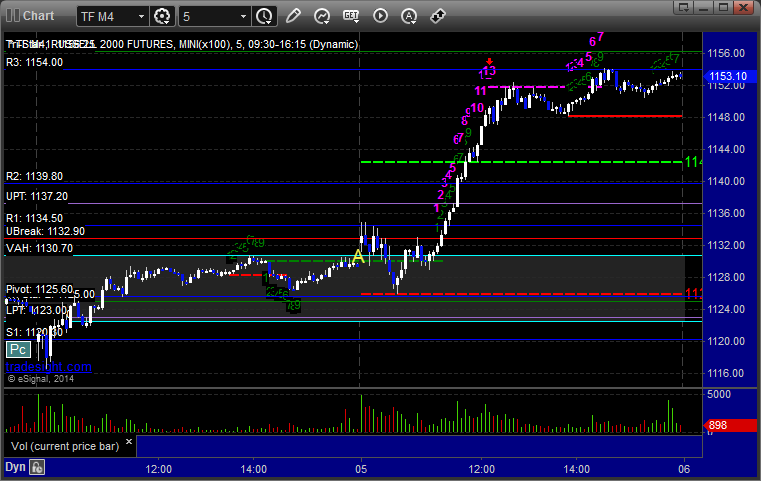

ER:

Triggered short at A at 1130.60, hit first target for 8 ticks, and stopped second half over the entry:

Forex Calls Recap for 6/5/14

A stop out and a winner still going on the GBPUSD (see that section below) as we finally got some movement in the markets.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. Triggered long at B, hit first target at C, and holding second half with a stop under D:

Stock Picks Recap for 6/4/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PXLW triggered long (with market support) and worked:

PRXL triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TIBX triggered long (without market support due to opening 5 minutes) and worked:

His AMZN triggered short (with market support) and worked for over a point:

GILD triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 6/4/14

A small winner early on a gap fill play over the Pivot on the ES (see that section below) as we encountered another dull session. NASDAQ volume closed at 1.45 billion shares.

Net ticks: +2.5 ticks.

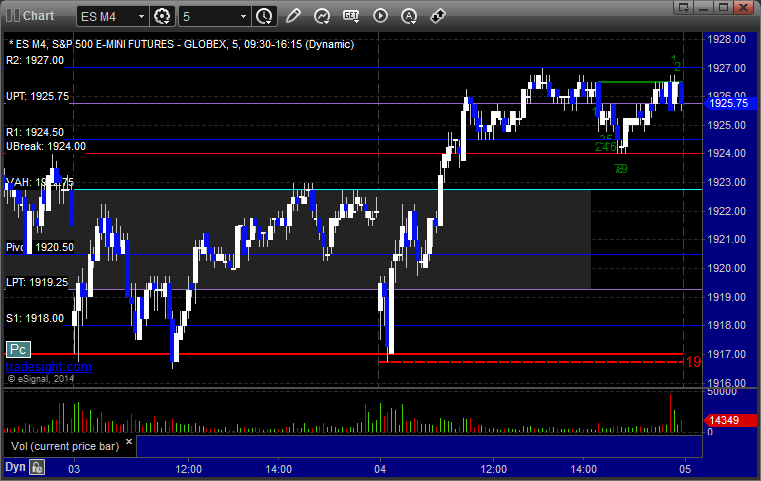

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

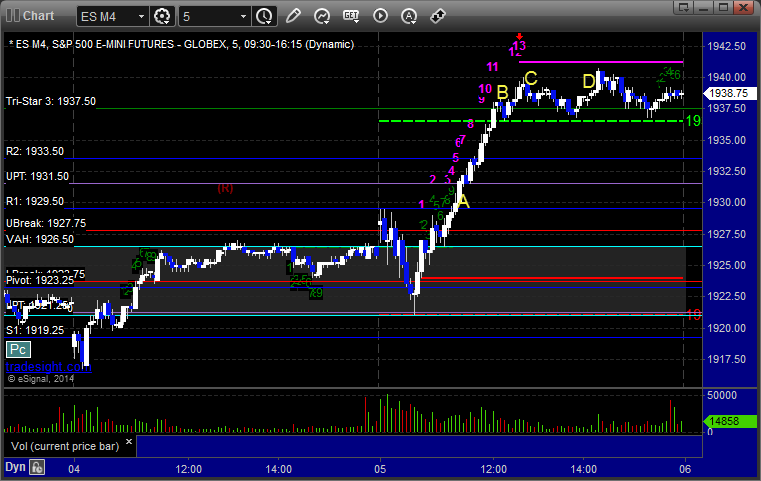

ES:

Triggered long at A at 1918.75, hit first target for 6 ticks, and stopped second half under the entry:

Forex Calls Recap for 6/4/14

No triggers again as the EURUSD stuck in a 40 pip range. Better no trigger than a stop out, though. Charts are all below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD: