Stock Picks Recap for 6/3/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SPLS triggered short (with market support) and I closed it just under the entry eventually, nothing either way:

INSM triggered short (with market support) and I closed it a couple of pennies under the trigger, so nothing either way:

ENOC triggered short (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's WYNN triggered short (without market support) and eventually worked (one of his energy plays, stop should be over the high of the opening 5-minute bar):

Mark's SNDK triggered long (with market support) and worked:

Rich's GOOG triggered short (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked. Two others were closed at the entry.

Futures Calls Recap for 6/3/14

Not enough movement with the ES trapped in a 6-point range and NASDAQ volume closing at 1.45 billion shares to make a call. The NQ's were particularly rangebound, although they did cross the Value Area early. If there was a setup, it was the ER over the opening 5-minute bar high into the Value Area.

Net ticks: +0 ticks.

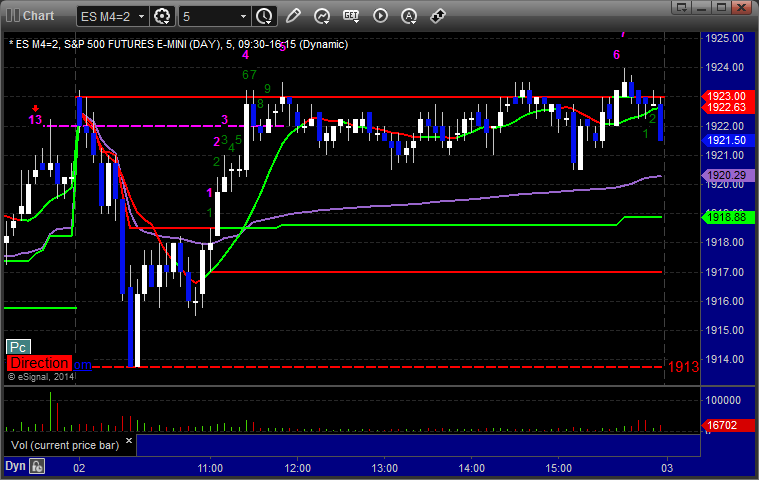

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 6/3/14

A trigger that didn't go anywhere for the session again. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, never quite hit first target, and closed at B at entry for end of session:

Stock Picks Recap for 6/2/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SWHC triggered long (with market support) and worked enough that I closed it in the last 15 minutes in the Messenger:

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered short (with market support) and worked enough for a partial:

Rich's AAPL triggered short (with market support) and didn't work (he closed it around even in the Lab):

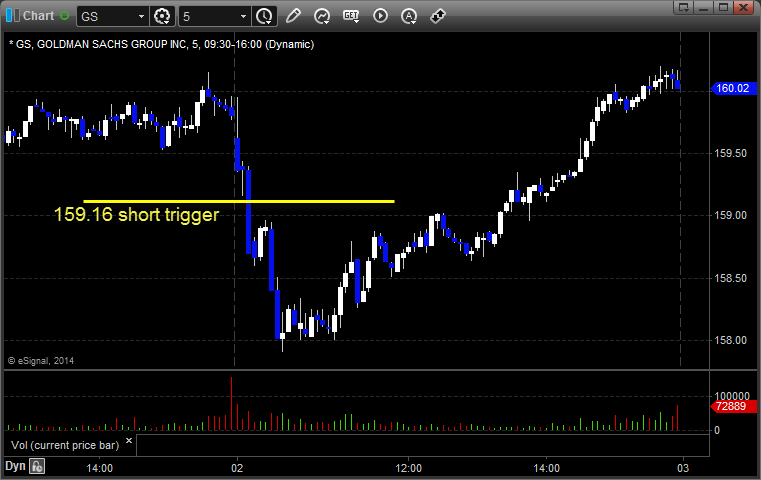

GS triggered short (with market support) and worked:

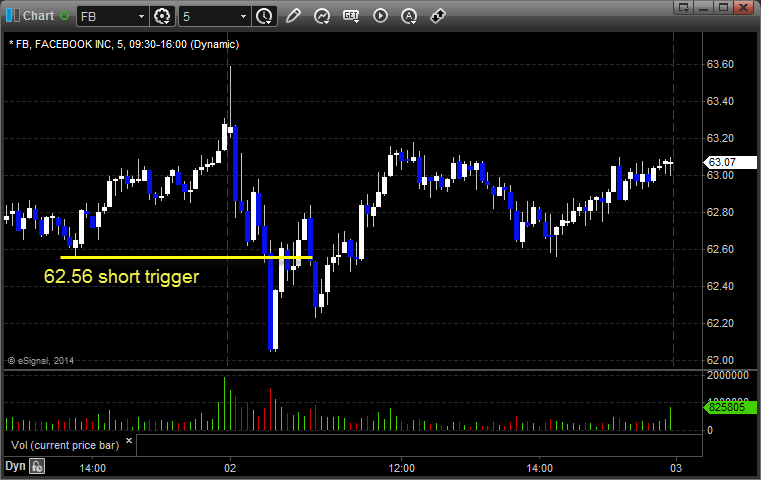

FB triggered short (with market support) and worked:

FSLR triggered short (with market support) and didn't work:

Rich's AMZN triggered short (without market support) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 6/2/14

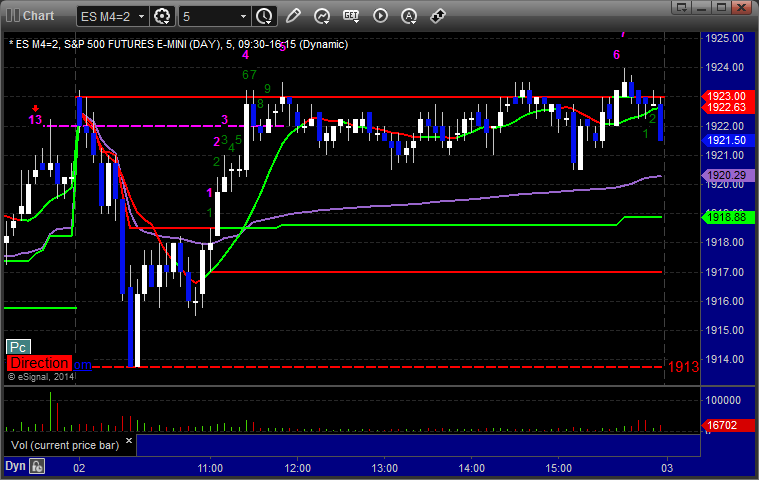

A clean trigger on the ES for the Value Area and gap fill, but also have a look at the NQ, which set the UPT from above on the opening 5 minute bar and worked great breaking under that into the gap as well. NASDAQ volume closed at 1.5 billion shares, and the markets ended basically flat for the session despite the nice opening hour.

Net ticks: +6.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

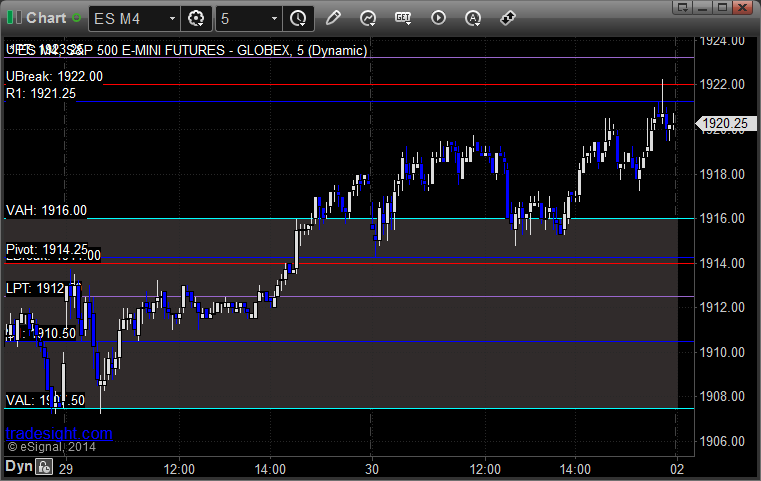

ES:

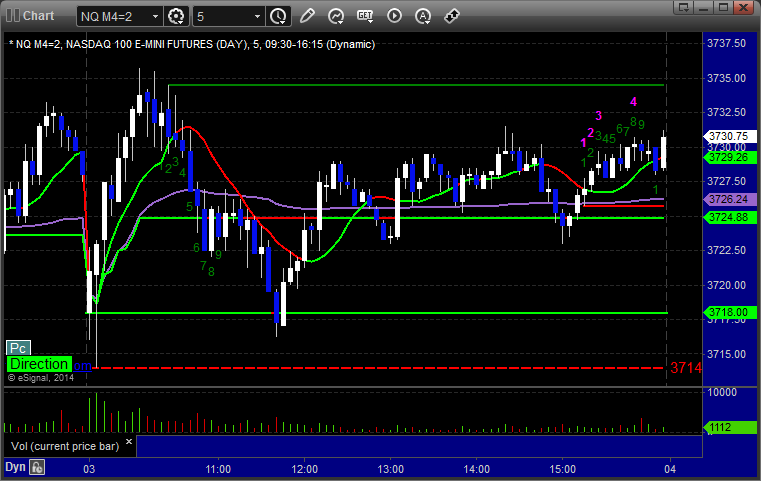

A clean trigger on the ES for the Value Area and gap fill, but also have a look at the NQ, which set the UPT from above on the opening 5 minute bar and worked great breaking under that into the gap as well. NASDAQ volume closed at 1.5 billion shares, and the markets ended basically flat for the session despite the nice opening hour.

Net ticks: +6.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Forex Calls Recap for 5/30/14

35 pips of range on the GBPUSD and not much better on the EURUSD. Good news in that environment: Nothing triggered. All charts listed below, and note the Comber 13 sell signal on the GBPUSD.

Here's a look at the US Dollar Index intraday with our market directional lines:

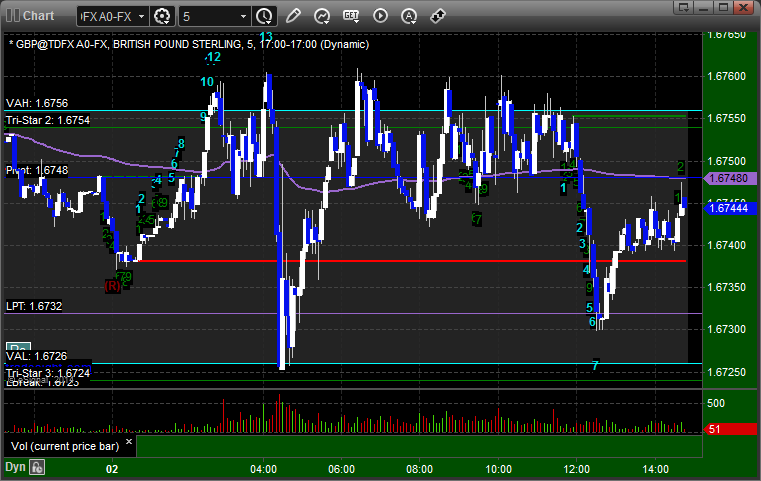

GBPUSD:

No triggers but check the 13 sell signal:

Stock Picks Recap for 5/30/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and worked enough for a partial, but not for his broader play:

In total, that's 1 trade triggering with market support, and it worked a little.

Futures Calls Recap for 5/30/14

No calls to end the month, basically as expected. The ES stuck in a 5 point range in the morning and only added 2 points in the last minutes of the session. NASDAQ volume closed at 1.6 billion shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 5/30/14

Another winner to close out the week. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

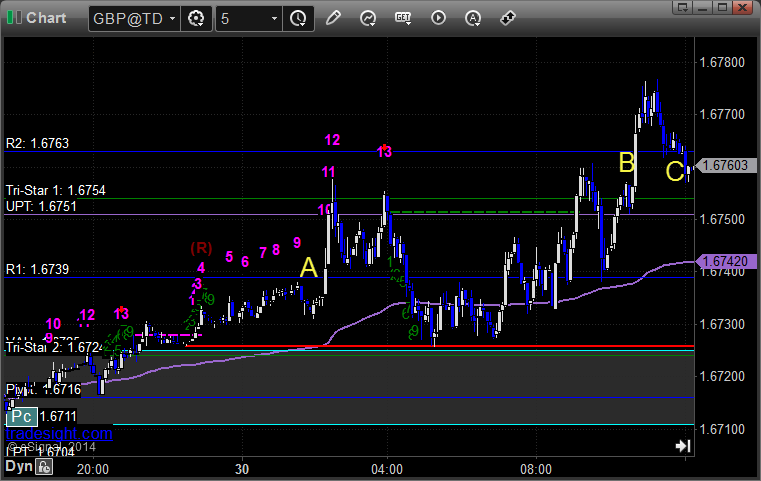

GBPUSD:

Triggered long at A, hit first target at B, closed second half at C for end of week:

Stock Picks Recap for 5/30/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IDTI and JBLU gapped over, no plays.

IRDM triggered long (with market support) and worked:

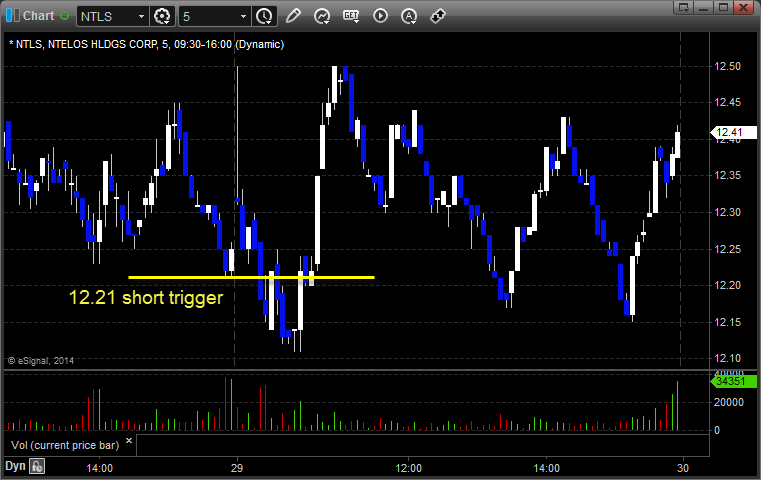

NTLS triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's BIDU triggered short (without market support) and didn't work:

AMGN triggered long (with market support) and didn't work:

Rich's CELG triggered long (with market support) and didn't work:

His CAT triggered short (with market support) and didn't work:

AMZN triggered long (with market support) and worked enough for a partial:

Rich's GLD triggered long (ETF, so no market support needed) and worked:

TWTR triggered short (without market support) and worked:

SHLD triggered long (with market support) and closed barely in the money when futures tanked, ended up working great:

In total, that's 7 trades triggering with market support, 3 of them worked, 4 did not. Strangely, it was still a good day despite a rare-sub-50% win ratio.