Futures Calls Recap for 5/30/14

They say "never short a dull market," and this was a good example as the market was as dull as can be and finally broke out a bit after lunch. Meanwhile, we had two winners and a loser, see ES and NQ below. NASDAQ volume closed at only 1.5 billion shares.

Net ticks: +1.5 ticks.

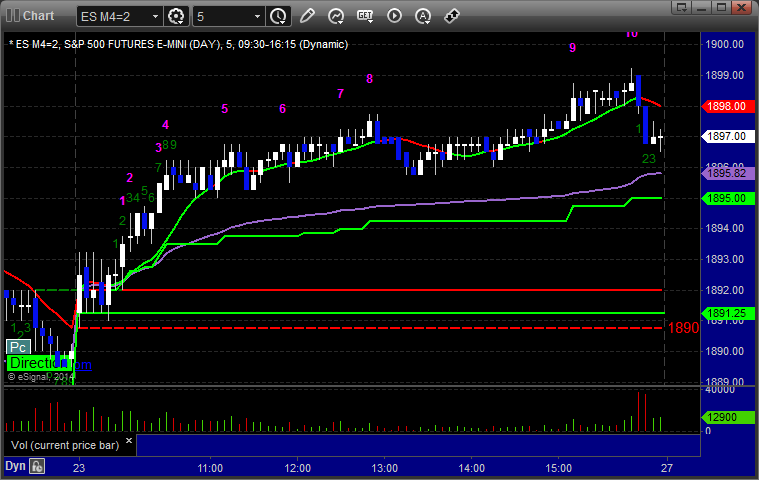

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1910.50 and stopped, then again at B, hit first target for 6 ticks, and lowered the stop twice and stopped at that same level, 6 ticks in the money:

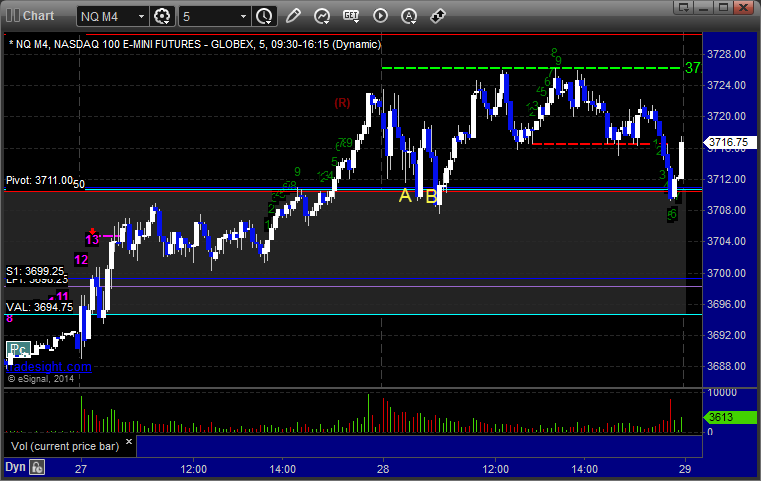

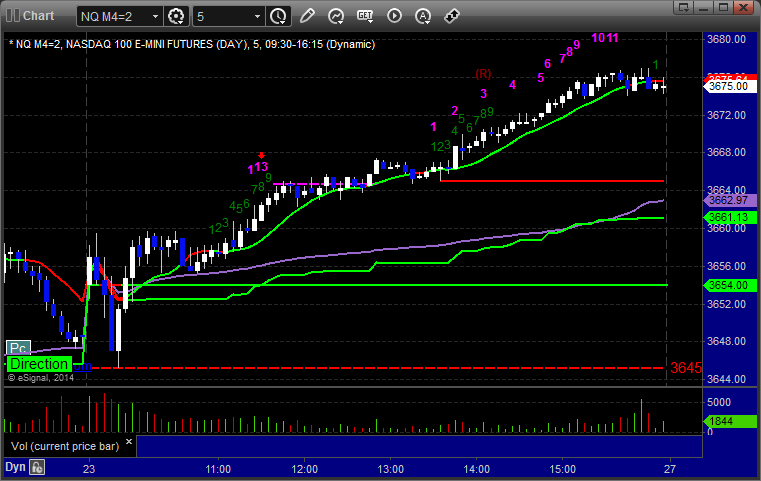

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at A at 3721.00, hit first target for 6 ticks, and stopped second half over the entry:

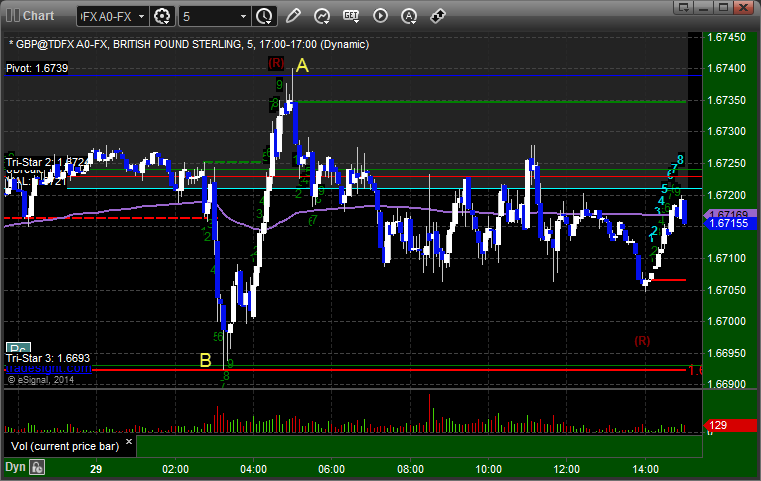

Forex Calls Recap for 5/30/14

You know you have the right technical triggers when the high and low of the session are basically your entry points. See GBPUSD below.

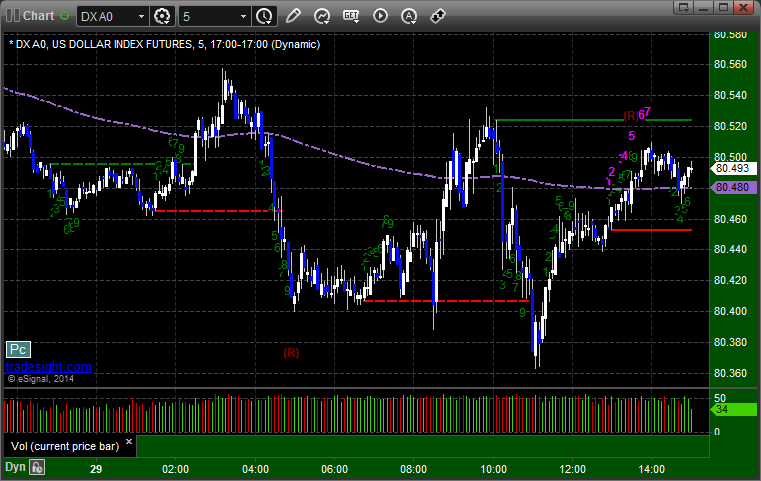

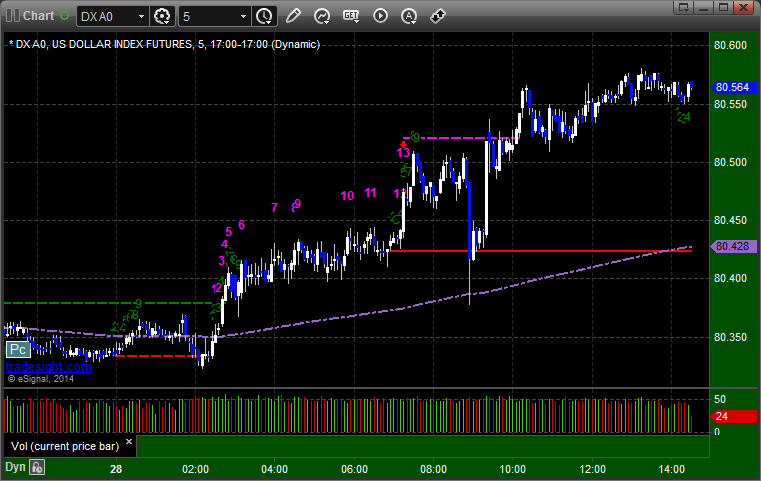

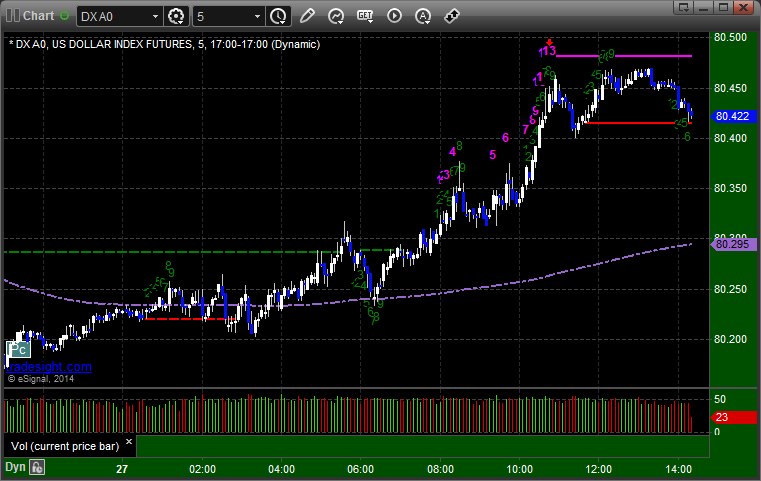

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

We were looking to go short under LBreak, which hit exactly at B and never triggered. We were looking to go long over Pivot, which hit at A, and at most 1 leg of the 3 that we use for staggered entries may have triggered and stopped:

Stock Picks Recap for 5/28/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IMOS triggered long (with market support) and didn't do enough either direction to count, closed on the trigger:

AVNR triggered long (with market support) and really didn't do enough in either direction to count:

FB triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's KORS triggered short (with market support) and worked for a couple of points:

Rich's AAPL triggered short (with market support) and didn't work:

BIDU triggered short (without market support) and worked:

SHLD triggered short (without market support) and didn't work:

Nothing else triggered.

In total, that's 3 trades triggering with market support (not counting two that never did anything), 2 of them worked, 1 did not.

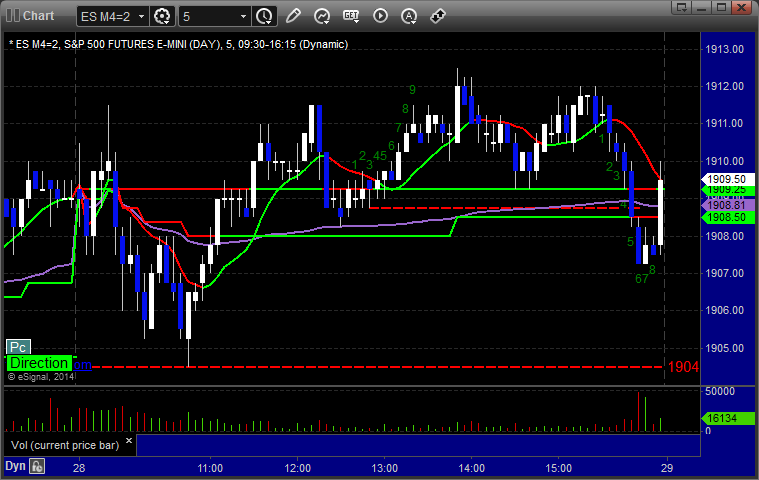

Futures Calls Recap for 5/28/14

Well, we had some extremely nice setups, and the ES short was working and looking good right when the NQ triggered, but the NQ stopped twice. See both sections below. Two other nice setups long the ER and ES were cancelled, which ended up being a good thing because they didn't go anywhere on another narrow session with no volume.

Net ticks: -11.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

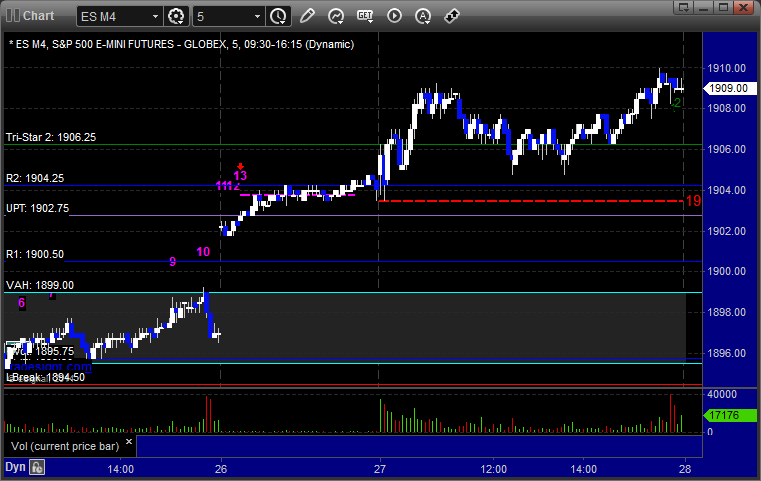

ES:

Triggered short at A, eventually hit first target at B for 6 ticks, and stopped the second half over the entry:

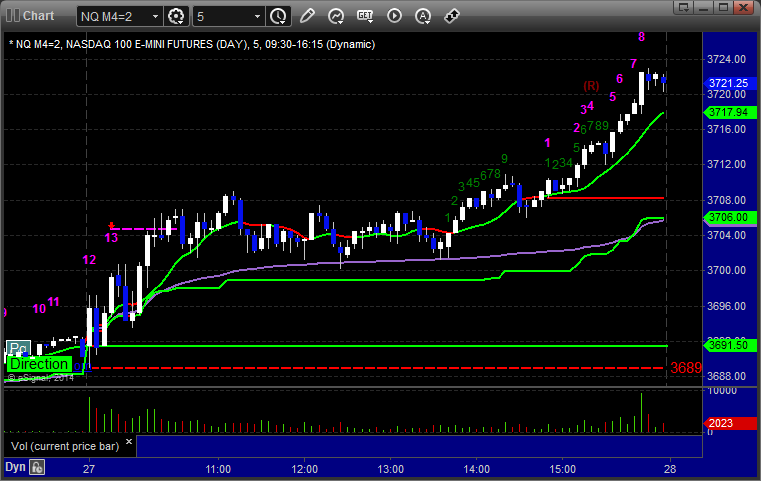

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A and stopped. This was a beautiful setup with the Break, Pivot, and VAL all lined up. Tried again at B and missed the first target by a single tick:

Forex Calls Recap for 5/28/14

One small winner that didn't hit the first target but gave us a winner for the session. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, never hit first target or stop, closed at B for end of session:

Stock Picks Recap for 5/27/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ARRS gapped to the trigger (without market support due to opening 5 minutes) at the open and worked from there is you were interested:

PDLI triggered long (with market support) and worked:

MACK gapped over, no play.

BDSI triggered long (with market support) and I ended up closing it slightly in the money after it didn't do much for a while, but really didn't do much either direction:

From the Messenger/Tradesight_st Twitter Feed, CELG triggered long (with market support) and didn't work, worked much later:

FSLR triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 5/27/14

If there was a day where I would say not one trade set up in the futures, this was it. The ES stuck in a 5-point range for the session until the last 15 minutes. NASDAQ volume was 1.6 billion shares. Gaps remain below to last Friday's close.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 5/27/14

A small winner to start the short week. I ended up closing it out because the EURUSD crossed the Value Area and didn't seem inclined to do much else. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, crossed the Value Area (shaded range) and closed at B:

Stock Picks Recap for 5/23/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no triggers, again.

From the Messenger/Tradesight_st Twitter Feed, Rich's ARUN triggered short (without market support) and worked enough only for a partial:

I put GS in the Messenger but it triggered before the call went up.

SNDK triggered long (with market support) and worked:

In total, that's 1 trades triggering with market support, and it worked a little.

Futures Calls Recap for 5/23/14

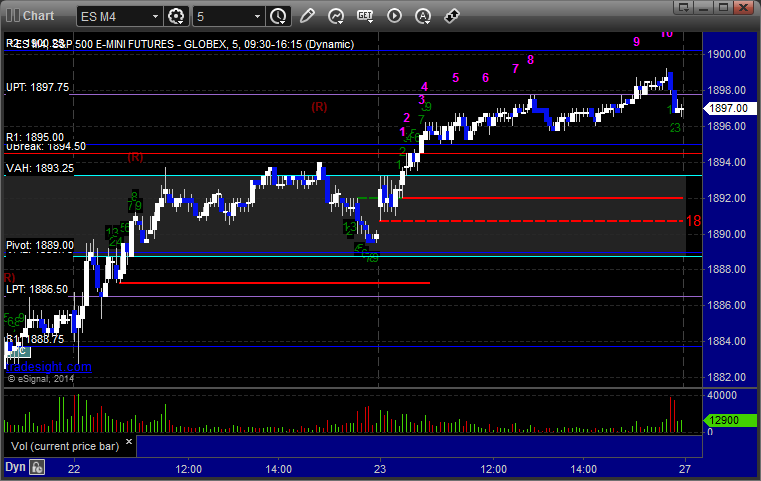

No calls for the session as action was limited on poor volume as expected. NASDAQ volume closed at 1.3 billion shares. Back to work Tuesday, have a great Memorial Day weekend. Note the ES use of the UPT.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Despite the poor action and volume, note the use of the UPT level: