Forex Calls Recap for 5/23/14

A triggered that wasn't going anywhere, so I closed it late in the session, and then it magically worked to the first target. See GBPUSD below.

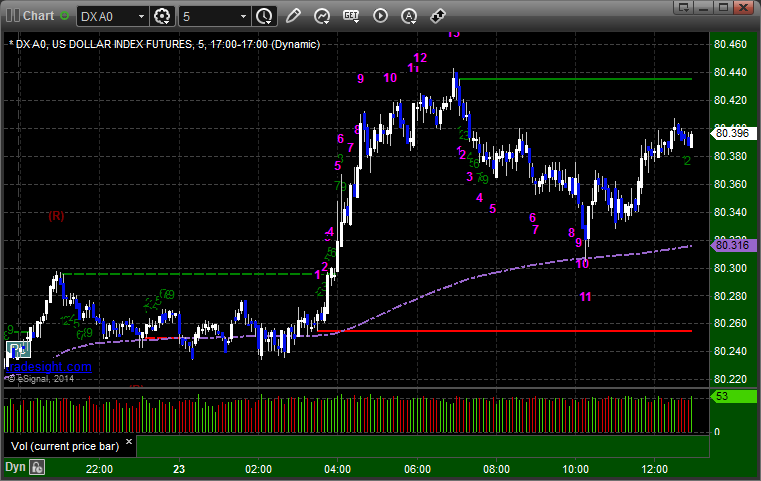

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

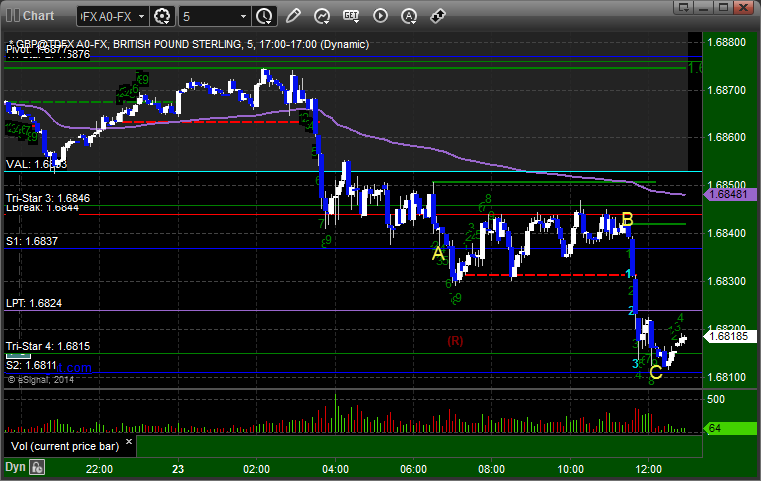

GBPUSD:

Triggered short at A, closed at B for end of week/session, and then right after, it dropped exactly to the first target at C:

Stock Picks Recap for 5/22/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MXIM triggered long (with market support) and worked, but not much (see YouTube video on this trade as well):

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered long (with market support) and worked:

GS triggered long (with market support) and worked, although I closed it even after sitting in it for a long time and going nowhere:

Rich's QIHU triggered long (with market support) and worked enough for a partial:

Rich's GLD triggered short (ETF, so no market support needed) and worked:

In total, that's 5 trades triggering with market support, all of them worked, but we closed one even (GS) and one just slightly in the money (MXIM).

Futures Calls Recap for 5/22/14

A small winner in the ES that we closed due to lack of movement, and then a loser on the ER as I typo'd the entry, unfortunately. See both sections below.

Net ticks: -3 ticks.

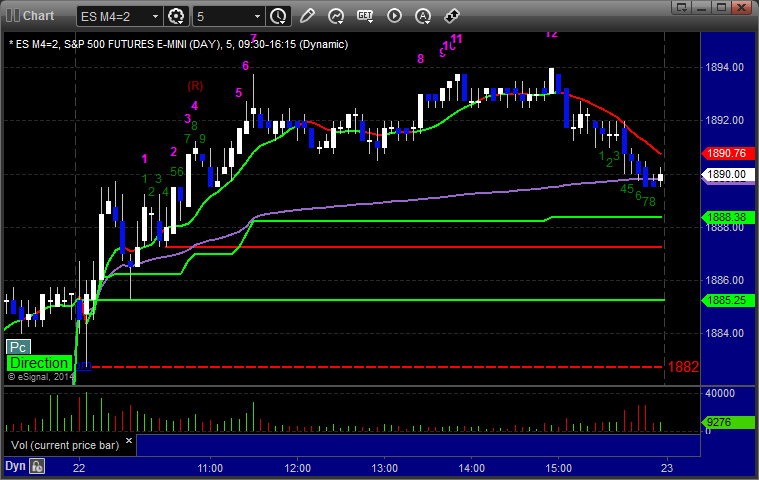

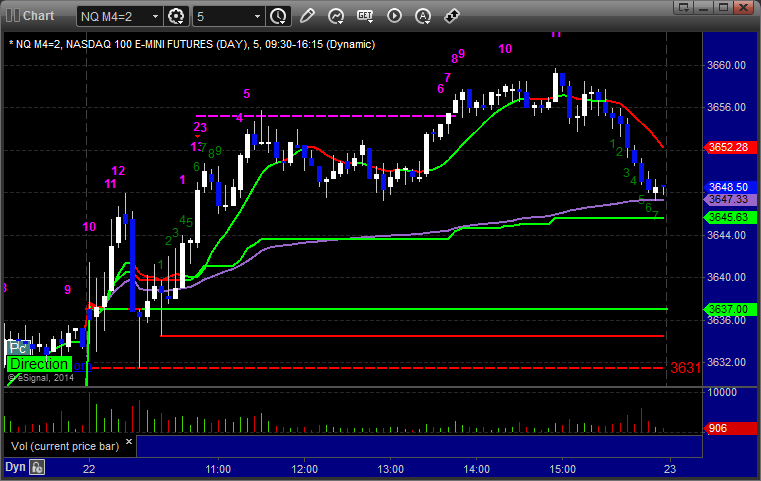

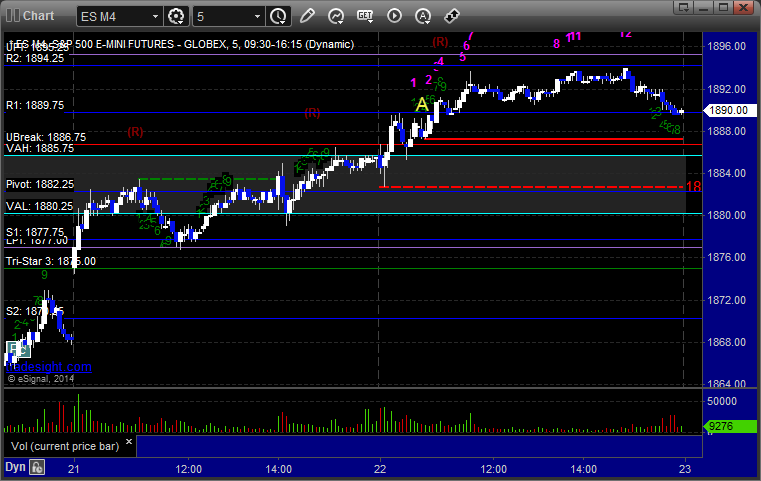

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1890.00, took forever to do anything, closed at 1891.00 for 4 ticks:

Forex Calls Recap for 5/22/14

Another winner that gave us the equivalent of hitting the first target and stopping out the second half, but instead by only getting halfway to the first target by the close. LOL. See EURUSD section below. Another narrow session.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, never hit first target, only 45 pips of range, close at B for 25 pips:

Stock Picks Recap for 5/21/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered again. This is fairly normal in a light volume market that is swaying back and forth both ways around a key number (1875 on the ES).

This was a day that we had to be very on top of taking partials because the markets had a small range to move before that ES gap filled.

From the Messenger/Tradesight_st Twitter Feed, Rich's DECK triggered short (without market support) and worked enough for a partial:

His FAS triggered long (ETF, so no market support needed) and worked enough for a partial:

BIDU triggered long (with market support) and worked:

AMZN triggered long (with market support) and worked enough for a partial as posted in the Twitter feed:

GOOG triggered long (with market support) and worked:

Rich's MYGN triggered short (without market support) and worked a little before running out of time:

In total, that's 4 trades triggering with market support, all 4 of them worked, although most just enough for a partial.

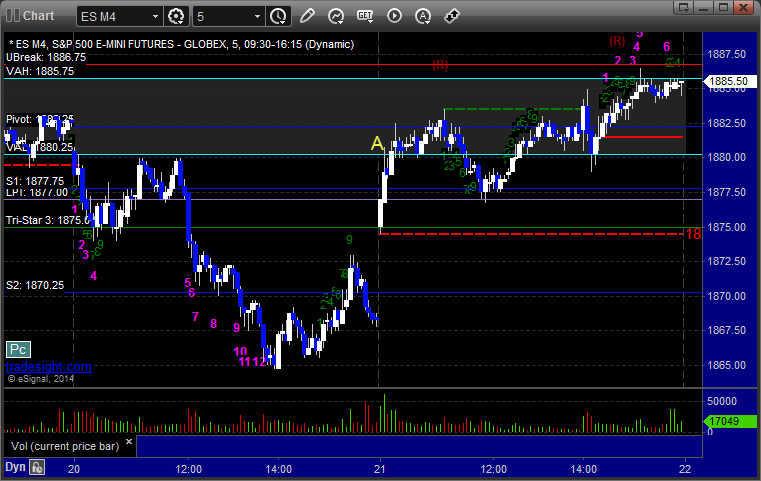

Futures Calls Recap for 5/21/14

Boy, it's so technical, it's predictable but not easy to squeeze money out of. The ES gapped up to open at 1875 (again), set the high of the prior session (remember, the gap never filled), and gave us a winner...just to the gap fill and no further. NASDAQ volume closed again at a weak 1.4 billion shares. See ES section below. Meanwhile, we had a nice Comber 13 sell signal on the NQ that worked. See that section too.

Net ticks: +2.5 ticks.

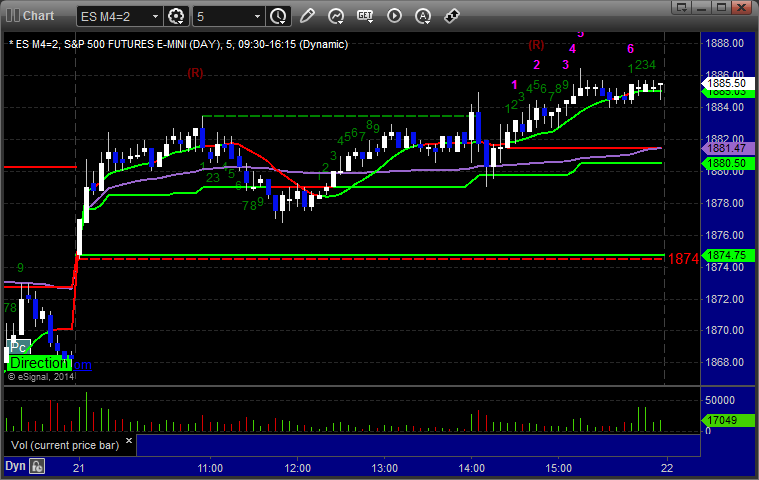

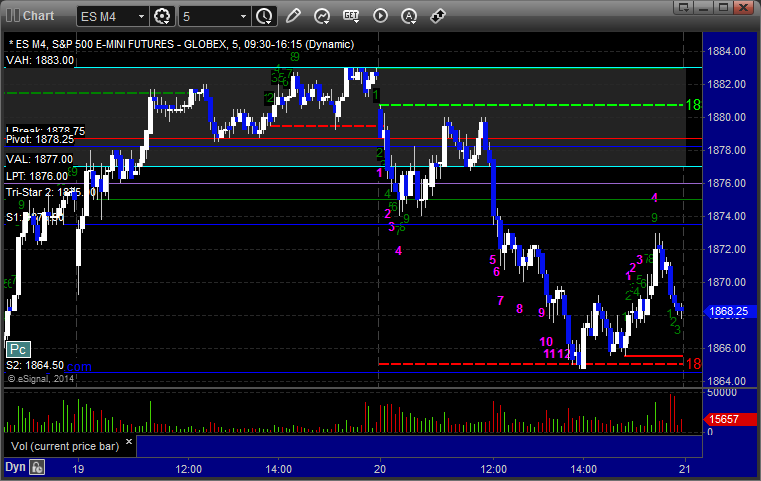

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1881.00, hit first target at 1882.50 (the gap fill from the prior session), but that was it, stopped second half under the entry:

Forex Calls Recap for 5/21/14

Another session where we triggered one way and hit the first target, but no further. See GBPUSD section below. The interesting bit is that this is the first day in a while that the GBPUSD and EURUSD traded their 6-month average daily range. There is also something to see in the USDCAD and GBPCHF charts below.

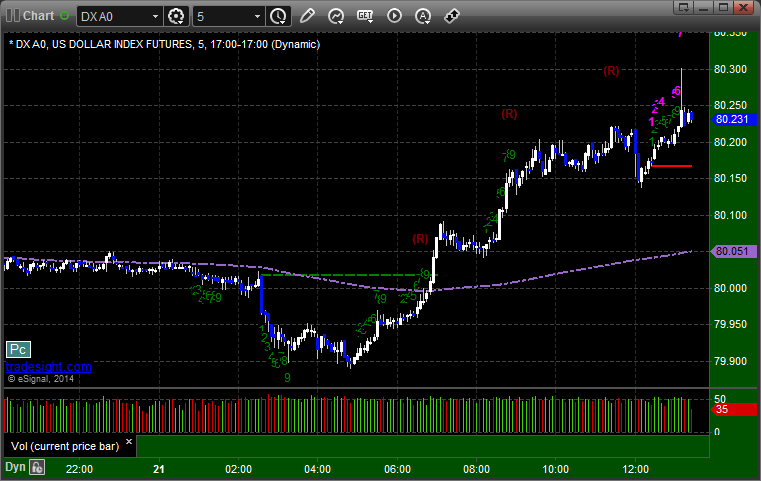

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, and closed second half under entry at C. Note the solid green and red lines measure the 6-month average daily range, and we covered it exactly:

USDCAD:

Note the Comber 13 sell signal at the high:

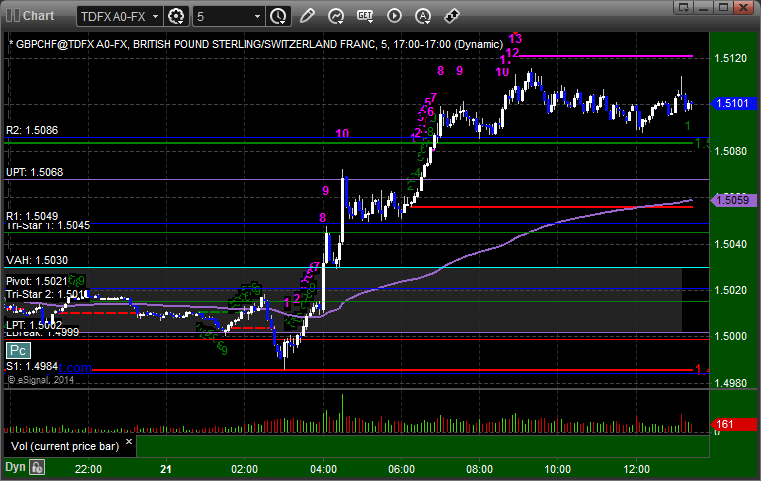

GBPCHF:

Note the Comber 13 sell signal at the high:

Stock Picks Recap for 5/20/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's CAT triggered short (with market support) and worked great:

FSLR triggered short (with market support) and didn't work:

Rich's VXX triggered long (ETF, so no market support needed) and worked enough for a partial:

His GLD triggered long (ETF, so no market support needed) and didn't work:

AAPL triggered short (with market support) and worked nicely:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 5/20/14

NQ's stopped us out twice before working a little. The first 2 hours were extremely dull on light volume, but then the market fell during lunch when a Fed member spoke about raising rates. We also had a nice 13 Comber buy signal on the ES for a pop. See those sections below.

Net ticks: -11.5 ticks.

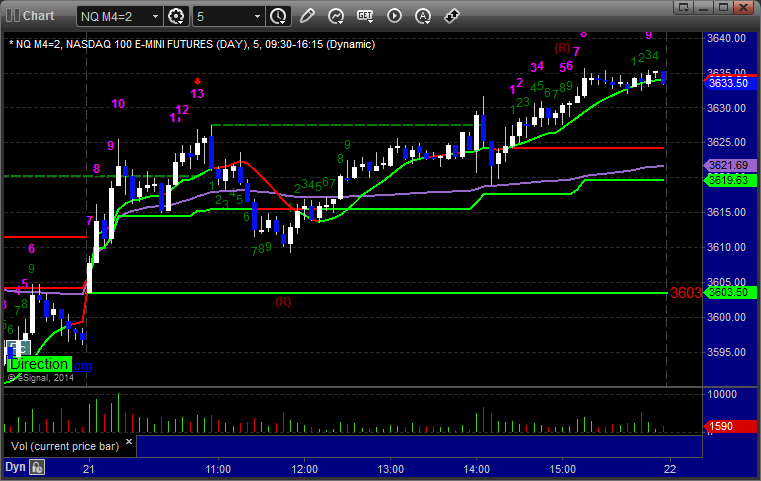

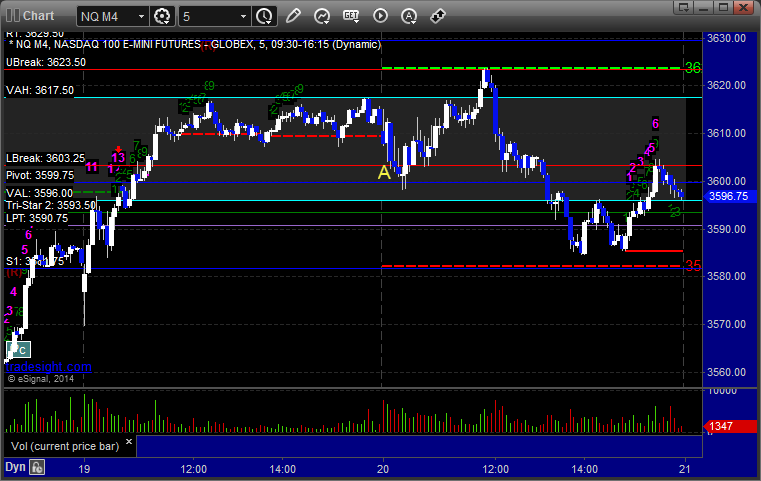

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Nice Comber 13 buy signal for a pop here:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at A at 3603.00 three times (first two were back to back sweeps). The third time worked, but only to a partial and then stopped over the entry:

Forex Calls Recap for 5/20/14

A winner in the GBPUSD for the session, although once again, it only hit the first target. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, closed second half in the morning under the entry at C: